Market Trends

Introduction

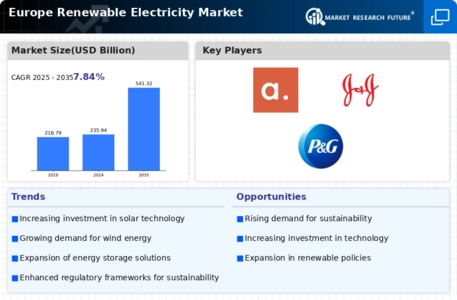

The European market for regenerative electricity is undergoing significant transformation by a confluence of macro-factors such as technological advancement, government regulation, and changing consumer behavior. The fast-paced development of new energy systems, such as storage and smart grids, is increasing the efficiency and availability of regenerative sources. Alongside this, the increasing stringency of regulations to reduce CO2 emissions is driving stakeholders to adopt and invest in sustainable practices. Also, the growing demand from consumers for regenerative energy solutions is changing the market dynamic, and companies are compelled to prioritise sustainability in their product offerings. This report provides an overview of the trends affecting the regenerative electricity market in Europe.

Top Trends

-

Increased Investment in Offshore Wind

By 2030, Europe’s offshore wind capacity is projected to reach 100 GW, driven by countries such as the United Kingdom and Germany. In the UK alone, the offshore wind industry is investing heavily, with a total of over €20 billion in new projects announced by the major companies. This growth is expected to create thousands of jobs and boost local economies. In Europe, the Green Deal also aims for a carbon-neutral Europe by 2050. Future developments could include new and improved windmills and floating offshore wind farms. -

Decentralization of Energy Production

Local energy communities are gaining in popularity. Governments are encouraging small-scale renewable energy projects, leading to a 30% increase in the capacity of distributed energy by 2022. This is a shift that gives consumers power and reduces their dependence on centralised grids. These new energy communities are bringing with them new energy management and storage solutions. These are bringing with them higher resilience for the grid and greater energy independence for communities. -

Integration of Energy Storage Solutions

Energy storage is becoming increasingly important for balancing supply and demand of electricity from the sun and the wind. In 2022, the number of battery storage systems in Europe rose by 50%, thanks to a combination of public policy and technological developments. Large operators are investing in large-scale projects to ensure grid stability. This trend is expected to help to increase the share of renewables and reduce the cost of curtailment. In the future, further developments could be aimed at improving the performance and cost of batteries. -

Electrification of Transportation

The electrification of transport is gaining ground, and the sale of electric cars in Europe will rise by seventy per cent in twenty-two. Hence the demand for electric energy. The governments are making the rules more stringent and are increasing the charging points, which thereby increases the demand for electricity. By the year twenty-thirty the big car-makers will have completely electric ranges. This development will increase the demand for electricity, and will force further investment in renewable energy. The charging technology may also be improved, as well as the vehicle-to-grid systems. -

Policy and Regulatory Support

STRONG POLICY IS REQUIRED FOR THE GROWTH OF THE MARKET FOR RENEWABLE ENERGY. The European Union’s “Five by Fifteen” package aims at a reduction of greenhouse gas emissions of at least five-fifths by 2030, and encourages the use of renewable energy. France and Spain are implementing supportive policies to encourage investment in this sector. This trend is making the investment climate more favourable for projects in the renewable energy sector. The future trend is towards stricter regulations and increased public funding for green projects. -

Corporate Power Purchase Agreements (PPAs)

The PPAs are a popular means of securing the supply of green energy. They are expected to increase by 40 percent in 2022. The main reason is the voluntary commitment of the large companies to the sustainable development. This development is providing financial security for the new renewable energy plants and reducing market volatility. Moreover, these PPAs are increasingly used to hedge against price fluctuations. In the future, it is likely that the PPAs will be more and more adapted and that they will also be used by SMEs. -

Digitalization and Smart Grids

The digital revolution is transforming the landscape of energy management. In 2022, smart grid investments in Europe reached 10 billion. They are improving the efficiency and reliability of the grid. Companies are using big data and the Internet of Things to optimize the distribution and consumption of electricity. This trend is expected to make the integration of renewable energy sources easier and improve the customer experience. Future developments may include advanced security solutions and solutions for a more efficient grid. -

Hydrogen as a Renewable Energy Carrier

In the energy transition, green hydrogen is gaining importance, with a production capacity that is expected to increase significantly by 2030. Germany, for example, is investing heavily in the hydrogen economy and is aiming to build up a 5 GW capacity in the form of an electrolysis plant by 2030. This trend is seen as a solution to reducing the emissions from the difficult-to-abate sectors. In the transport and industry sectors, hydrogen is being tested in a variety of ways. Future developments could include the reduction of the costs of hydrogen production and the expansion of its use. -

Sustainability and ESG Focus

The criteria for the environment, social and governance (ESG) are increasingly being taken into account in the investment decision in the energy sector. According to a survey, 75% of investors give priority to sustainability in their portfolios. As a result, companies are adopting ESG practices in order to attract investment and improve their reputation. This trend is driving innovation and transparency in the green electricity market. The next step could be a higher degree of reporting and higher expectations for the achievement of ESG targets. -

Emergence of Floating Solar Farms

In 2022 the floating solar system will be installed in a greater number of places. The first countries to use water to produce solar energy are the Netherlands and France. This trend has the advantage of using less land and of being more efficient because of the cooling effect. Companies are looking for alliances to develop large-scale floating solar projects. The future of this technique is to be improved and extended to different types of water.

Conclusion: Navigating Europe's Renewable Energy Landscape

The competition in the European renewable energy market is very fragmented, with both the traditional and new players fighting for a share of the market. In each region, the trends show a growing emphasis on both sustainability and flexibility, which is forcing suppliers to change their strategies and adapt to the market. The old players are using their established networks and integrating new capabilities such as automation and artificial intelligence to optimize their operations. In contrast, the new players are focusing on niche markets and sustainable practices to differentiate themselves. The ability to use artificial intelligence for predictive analysis, to automate processes and to offer flexible solutions will be the key to success as the market evolves. To stay ahead of the game, decision-makers need to focus on these capabilities.

Leave a Comment