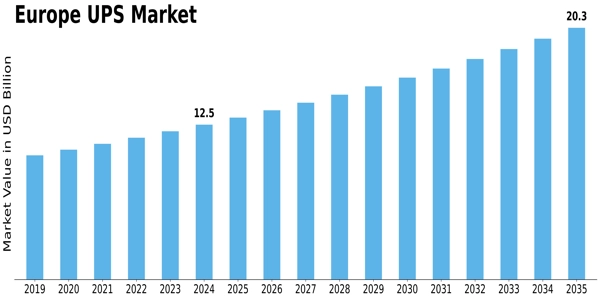

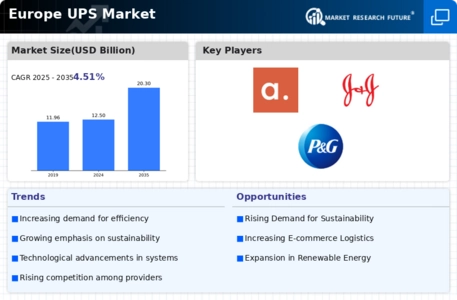

Europe Ups Size

Europe UPS Market Growth Projections and Opportunities

The Uninterruptible Power Supply (UPS) market in Europe has witnessed dynamic shifts influenced by the continent's evolving energy landscape and technological advancements. UPS systems play a critical role in ensuring a constant and reliable power supply, offering protection against power interruptions and voltage fluctuations. One of the primary factors shaping the market dynamics is the increasing reliance on digital technology and the demand for uninterrupted power in critical applications such as data centers, healthcare facilities, and industrial processes.

The heightened focus on sustainability and energy efficiency in Europe has spurred innovations in UPS technology. As part of the broader commitment to reduce energy consumption and environmental impact, the UPS market has seen a rise in the adoption of energy-efficient and eco-friendly UPS systems. Manufacturers are developing UPS solutions with advanced energy management features, such as high-efficiency modes and intelligent battery management, aligning with the European Union's energy efficiency directives and regulations.

The proliferation of e-commerce, data-driven services, and digital connectivity has fueled the demand for UPS systems in Europe. Data centers, in particular, require reliable power protection to safeguard critical operations and prevent data loss during power outages. The increasing digitization of industries and the rise of remote working have further underscored the importance of UPS solutions in ensuring continuous and uninterrupted power supply for sensitive electronic equipment.

Government initiatives and regulations in Europe have played a crucial role in shaping the UPS market dynamics. The EU's emphasis on building a resilient and sustainable energy infrastructure aligns with the need for reliable power protection. Incentives and regulations that promote energy efficiency and the use of eco-friendly technologies have influenced both end-users and manufacturers to invest in UPS solutions that meet stringent environmental standards.

The growth of the UPS market is closely linked to the expansion of renewable energy sources in Europe. The integration of solar and wind power into the energy mix introduces greater variability and intermittency, making power quality and reliability more critical. UPS systems provide an effective means of ensuring a stable power supply, protecting sensitive equipment from voltage fluctuations and sudden power interruptions. As Europe transitions to a cleaner energy grid, the UPS market is poised to play a pivotal role in maintaining power continuity.

The increasing frequency and severity of extreme weather events in Europe have heightened awareness about the vulnerability of power infrastructure. UPS systems are gaining importance in sectors such as healthcare, where the reliable operation of medical equipment is crucial during emergencies. The UPS market responds to these challenges by offering solutions with extended backup times, rapid recharge capabilities, and enhanced reliability features, ensuring continuous power availability in critical scenarios.

The rise of edge computing and the Internet of Things (IoT) has introduced new dimensions to the UPS market in Europe. Edge computing, with its decentralized model, requires reliable power protection at the network's edge, driving the demand for compact and efficient UPS solutions. Additionally, the proliferation of IoT devices necessitates UPS systems with the scalability to accommodate the increasing power demands of connected devices while maintaining uninterrupted service.

As businesses and industries increasingly prioritize resilience and business continuity, the UPS market in Europe continues to evolve. The demand for modular and scalable UPS solutions that can adapt to changing power requirements reflects the dynamic nature of the market. Manufacturers are focusing on developing UPS systems with advanced monitoring and remote management capabilities, providing end-users with real-time insights into power quality and system performance.

The market dynamics of UPS systems in Europe are shaped by a confluence of factors, including technological advancements, regulatory imperatives, and the evolving needs of a digitalized and sustainable society. The UPS market is poised for growth as it addresses the challenges posed by a changing energy landscape, ensuring the continuous and reliable delivery of power in a variety of critical applications across the continent.

Leave a Comment