-

MARKET DYNAMICS

-

\r\n4.1. Overview

-

\r\n4.2. Drivers

-

\r\n4.3. Restraints

-

\r\n4.4.

-

Opportunities

-

\r\n5. MARKET FACTOR ANALYSIS

-

\r\n5.1. Value Chain Analysis

-

\r\n5.2.

-

Porter’s Five Forces Analysis

-

\r\n5.2.1. Bargaining Power of Suppliers

-

\r\n5.2.2.

-

Bargaining Power of Buyers

-

\r\n5.2.3. Threat of New Entrants

-

\r\n5.2.4.

-

Threat of Substitutes

-

\r\n5.2.5. Intensity of Rivalry

-

\r\n5.3. COVID-19

-

Impact Analysis

-

\r\n5.3.1. Market Impact Analysis

-

\r\n5.3.2. Regional

-

Impact

-

\r\n5.3.3. Opportunity and Threat Analysis

-

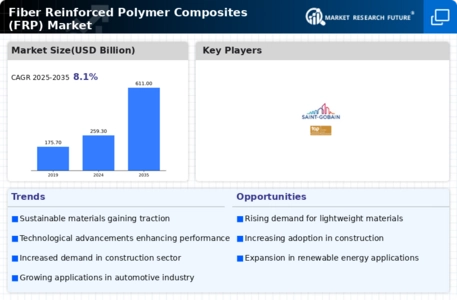

\r\n6. GLOBAL FIBER

-

REINFORCED POLYMER COMPOSITES FRP MARKET, BY PRODUCT TYPE

-

\r\n6.1. Overview

-

\r\n6.2.

-

Glass Fiber Reinforced Polymer (GFRP) Composites

-

\r\n6.3. Carbon Fiber Reinforced

-

Polymer (CFRP) Composites

-

\r\n6.4. Basalt Fiber Reinforced Polymer (BFRP)

-

Composites

-

\r\n6.5. Aramid Fiber Reinforced Polymer (AFRP) Composites

-

\r\n7.

-

GLOBAL FIBER REINFORCED POLYMER COMPOSITES FRP MARKET, BY APPLICATION

-

\r\n7.1.

-

Overview

-

\r\n7.2. Automotive

-

\r\n7.3. Construction

-

\r\n7.4. Fire

-

Fighting

-

\r\n7.5. Defence

-

\r\n7.6. Others

-

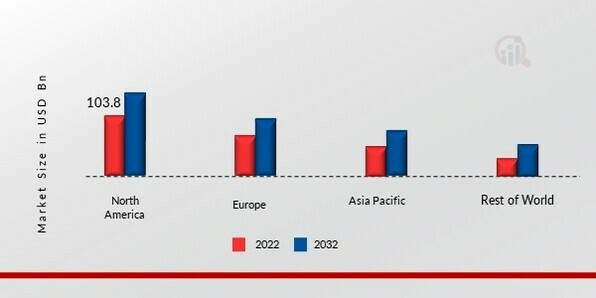

\r\n8. GLOBAL FIBER

-

REINFORCED POLYMER COMPOSITES FRP MARKET, BY REGION

-

\r\n8.1. Overview

-

\r\n8.2.

-

North America

-

\r\n8.2.1. U.S.

-

\r\n8.2.2. Canada

-

\r\n8.3. Europe

-

\r\n8.3.1.

-

Germany

-

\r\n8.3.2. France

-

\r\n8.3.3. U.K

-

\r\n8.3.4. Italy

-

\r\n8.3.5.

-

Spain

-

\r\n8.3.6. Rest of Europe

-

\r\n8.4. Asia-Pacific

-

\r\n8.4.1.

-

China

-

\r\n8.4.2. India

-

\r\n8.4.3. Japan

-

\r\n8.4.4. South Korea

-

\r\n8.4.5.

-

Australia

-

\r\n8.4.6. Rest of Asia-Pacific

-

\r\n8.5. Rest of the World

-

\r\n8.5.1.

-

Middle East

-

\r\n8.5.2. Africa

-

\r\n8.5.3. Latin America

-

\r\n9.

-

COMPETITIVE LANDSCAPE

-

\r\n9.1. Overview

-

\r\n9.2. Competitive Analysis

-

\r\n9.3.

-

Market Share Analysis

-

\r\n9.4. Major Growth Strategy in the Global Fiber reinforced

-

polymer composites frp Market,

-

\r\n9.5. Competitive Benchmarking

-

\r\n9.6.

-

Leading Players in Terms of Number of Developments in the Global Fiber reinforced

-

polymer composites frp Market,

-

\r\n9.7. Key developments and Growth Strategies

-

\r\n9.7.1.

-

New PRODUCT TYPE Launch/Application Deployment

-

\r\n9.7.2. Merger & Acquisitions

-

\r\n9.7.3.

-

Joint Ventures

-

\r\n9.8. Major Players Financial Matrix

-

\r\n9.8.1. Sales

-

& Operating Income, 2022

-

\r\n9.8.2. Major Players R&D Expenditure.

-

\r\n10. COMPANY PROFILES

-

\r\n10.1. Saint Gobain

-

\r\n10.1.1.

-

Company Overview

-

\r\n10.1.2. Financial Overview

-

\r\n10.1.3. PRODUCT

-

TYPE Offered

-

\r\n10.1.4. Key Developments

-

\r\n10.1.5. SWOT Analysis

-

\r\n10.1.6.

-

Key Strategies

-

\r\n10.2. Asahi Fiberglass

-

\r\n10.2.1. Company Overview

-

\r\n10.2.2.

-

Financial Overview

-

\r\n10.2.3. PRODUCT TYPE Offered

-

\r\n10.2.4. Key

-

Developments

-

\r\n10.2.5. SWOT Analysis

-

\r\n10.2.6. Key Strategies

-

\r\n10.3.

-

Owen Corning

-

\r\n10.3.1. Company Overview

-

\r\n10.3.2. Financial Overview

-

\r\n10.3.3.

-

PRODUCT TYPE Offered

-

\r\n10.3.4. Key Developments

-

\r\n10.3.5. SWOT Analysis

-

\r\n10.3.6.

-

Key Strategies

-

\r\n10.4. Mitsubishi Rayon Co., Ltd

-

\r\n10.4.1. Company

-

Overview

-

\r\n10.4.2. Financial Overview

-

\r\n10.4.3. PRODUCT TYPE Offered

-

\r\n10.4.4.

-

Key Developments

-

\r\n10.4.5. SWOT Analysis

-

\r\n10.4.6. Key Strategies

-

\r\n10.5.

-

B&B FRP Manufacturing Inc

-

\r\n10.5.1. Company Overview

-

\r\n10.5.2.

-

Financial Overview

-

\r\n10.5.3. PRODUCT TYPE Offered

-

\r\n10.5.4. Key

-

Developments

-

\r\n10.5.5. SWOT Analysis

-

\r\n10.5.6. Key Strategies

-

\r\n10.6.

-

American Fiberglass Rebar

-

\r\n10.6.1. Company Overview

-

\r\n10.6.2. Financial

-

Overview

-

\r\n10.6.3. PRODUCT TYPE Offered

-

\r\n10.6.4. Key Developments

-

\r\n10.6.5.

-

SWOT Analysis

-

\r\n10.6.6. Key Strategies

-

\r\n10.7. American Grating

-

\r\n10.7.1.

-

Company Overview

-

\r\n10.7.2. Financial Overview

-

\r\n10.7.3. PRODUCT

-

TYPE Offered

-

\r\n10.7.4. Key Developments

-

\r\n10.7.5. SWOT Analysis

-

\r\n10.7.6.

-

Key Strategies

-

\r\n10.8. LLC

-

\r\n10.8.1. Company Overview

-

\r\n10.8.2.

-

Financial Overview

-

\r\n10.8.3. PRODUCT TYPE Offered

-

\r\n10.8.4. Key

-

Developments

-

\r\n10.8.5. SWOT Analysis

-

\r\n10.8.6. Key Strategies

-

\r\n11.

-

APPENDIX

-

\r\n11.1. References

-

\r\n11.2. Related Reports

-

\r\n

-

\r\nLIST

-

OF TABLES

-

\r\nTABLE 1 GLOBAL FIBER REINFORCED POLYMER COMPOSITES FRP MARKET,

-

SYNOPSIS, 2025 - 2034

-

\r\nTABLE 2 GLOBAL FIBER REINFORCED POLYMER COMPOSITES

-

FRP MARKET, ESTIMATES & FORECAST, 2025 - 2034 (USD BILLION)

-

\r\nTABLE

-

GLOBAL FIBER REINFORCED POLYMER COMPOSITES FRP MARKET, BY PRODUCT TYPE, 2025 -

-

\r\nTABLE 4 GLOBAL FIBER REINFORCED POLYMER COMPOSITES

-

FRP MARKET, BY APPLICATION, 2025 - 2034 (USD BILLION)

-

\r\nTABLE 5 NORTH AMERICA

-

FIBER REINFORCED POLYMER COMPOSITES FRP MARKET, BY PRODUCT TYPE, 2025 - 2034 (USD

-

BILLION)

-

\r\nTABLE 6 NORTH AMERICA FIBER REINFORCED POLYMER COMPOSITES FRP

-

MARKET, BY APPLICATION, 2025 - 2034 (USD BILLION)

-

\r\nTABLE 7 NORTH AMERICA

-

FIBER REINFORCED POLYMER COMPOSITES FRP MARKET, BY COUNTRY, 2025 - 2034 (USD BILLION)

-

\r\nTABLE

-

U.S. FIBER REINFORCED POLYMER COMPOSITES FRP MARKET, BY PRODUCT TYPE, 2025 - 2034

-

(USD BILLION)

-

\r\nTABLE 9 U.S. FIBER REINFORCED POLYMER COMPOSITES FRP MARKET,

-

BY APPLICATION, 2025 - 2034 (USD BILLION)

-

\r\nTABLE 10 CANADA FIBER REINFORCED

-

POLYMER COMPOSITES FRP MARKET, BY PRODUCT TYPE, 2025 - 2034 (USD BILLION)

-

\r\nTABLE

-

CANADA FIBER REINFORCED POLYMER COMPOSITES FRP MARKET, BY APPLICATION, 2025 -

-

\r\nTABLE 12 EUROPE FIBER REINFORCED POLYMER COMPOSITES

-

FRP MARKET, BY PRODUCT TYPE, 2025 - 2034 (USD BILLION)

-

\r\nTABLE 13 EUROPE

-

FIBER REINFORCED POLYMER COMPOSITES FRP MARKET, BY APPLICATION, 2025 - 2034 (USD

-

BILLION)

-

\r\nTABLE 14 EUROPE FIBER REINFORCED POLYMER COMPOSITES FRP MARKET,

-

BY COUNTRY, 2025 - 2034 (USD BILLION)

-

\r\nTABLE 15 GERMANY FIBER REINFORCED

-

POLYMER COMPOSITES FRP MARKET, BY PRODUCT TYPE, 2025 - 2034 (USD BILLION)

-

\r\nTABLE

-

GERMANY FIBER REINFORCED POLYMER COMPOSITES FRP MARKET, BY APPLICATION, 2025

-

- 2034 (USD BILLION)

-

\r\nTABLE 17 FRANCE FIBER REINFORCED POLYMER COMPOSITES

-

FRP MARKET, BY PRODUCT TYPE, 2025 - 2034 (USD BILLION)

-

\r\nTABLE 18 FRANCE

-

FIBER REINFORCED POLYMER COMPOSITES FRP MARKET, BY APPLICATION, 2025 - 2034 (USD

-

BILLION)

-

\r\nTABLE 19 ITALY FIBER REINFORCED POLYMER COMPOSITES FRP MARKET,

-

BY PRODUCT TYPE, 2025 - 2034 (USD BILLION)

-

\r\nTABLE 20 ITALY FIBER REINFORCED

-

POLYMER COMPOSITES FRP MARKET, BY APPLICATION, 2025 - 2034 (USD BILLION)

-

\r\nTABLE

-

SPAIN FIBER REINFORCED POLYMER COMPOSITES FRP MARKET, BY PRODUCT TYPE, 2025 -

-

\r\nTABLE 22 SPAIN FIBER REINFORCED POLYMER COMPOSITES

-

FRP MARKET, BY APPLICATION, 2025 - 2034 (USD BILLION)

-

\r\nTABLE 23 U.K FIBER

-

REINFORCED POLYMER COMPOSITES FRP MARKET, BY PRODUCT TYPE, 2025 - 2034 (USD BILLION)

-

\r\nTABLE

-

U.K FIBER REINFORCED POLYMER COMPOSITES FRP MARKET, BY APPLICATION, 2025 - 2034

-

(USD BILLION)

-

\r\nTABLE 25 REST OF EUROPE FIBER REINFORCED POLYMER COMPOSITES

-

FRP MARKET, BY PRODUCT TYPE, 2025 - 2034 (USD BILLION)

-

\r\nTABLE 26 REST OF

-

EUROPE FIBER REINFORCED POLYMER COMPOSITES FRP MARKET, BY APPLICATION, 2025 - 2034

-

(USD BILLION)

-

\r\nTABLE 27 ASIA PACIFIC FIBER REINFORCED POLYMER COMPOSITES

-

FRP MARKET, BY PRODUCT TYPE, 2025 - 2034 (USD BILLION)

-

\r\nTABLE 28 ASIA PACIFIC

-

FIBER REINFORCED POLYMER COMPOSITES FRP MARKET, BY APPLICATION, 2025 - 2034 (USD

-

BILLION)

-

\r\nTABLE 29 ASIA PACIFIC FIBER REINFORCED POLYMER COMPOSITES FRP

-

MARKET, BY COUNTRY, 2025 - 2034 (USD BILLION)

-

\r\nTABLE 30 JAPAN FIBER REINFORCED

-

POLYMER COMPOSITES FRP MARKET, BY PRODUCT TYPE, 2025 - 2034 (USD BILLION)

-

\r\nTABLE

-

JAPAN FIBER REINFORCED POLYMER COMPOSITES FRP MARKET, BY APPLICATION, 2025 -

-

\r\nTABLE 32 CHINA FIBER REINFORCED POLYMER COMPOSITES

-

FRP MARKET, BY PRODUCT TYPE, 2025 - 2034 (USD BILLION)

-

\r\nTABLE 33 CHINA

-

FIBER REINFORCED POLYMER COMPOSITES FRP MARKET, BY APPLICATION, 2025 - 2034 (USD

-

BILLION)

-

\r\nTABLE 34 INDIA FIBER REINFORCED POLYMER COMPOSITES FRP MARKET,

-

BY PRODUCT TYPE, 2025 - 2034 (USD BILLION)

-

\r\nTABLE 35 INDIA FIBER REINFORCED

-

POLYMER COMPOSITES FRP MARKET, BY APPLICATION, 2025 - 2034 (USD BILLION)

-

\r\nTABLE

-

AUSTRALIA FIBER REINFORCED POLYMER COMPOSITES FRP MARKET, BY PRODUCT TYPE, 2025

-

- 2034 (USD BILLION)

-

\r\nTABLE 37 AUSTRALIA FIBER REINFORCED POLYMER COMPOSITES

-

FRP MARKET, BY APPLICATION, 2025 - 2034 (USD BILLION)

-

\r\nTABLE 38 SOUTH KOREA

-

FIBER REINFORCED POLYMER COMPOSITES FRP MARKET, BY PRODUCT TYPE, 2025 - 2034 (USD

-

BILLION)

-

\r\nTABLE 39 SOUTH KOREA FIBER REINFORCED POLYMER COMPOSITES FRP

-

MARKET, BY APPLICATION, 2025 - 2034 (USD BILLION)

-

\r\nTABLE 40 REST OF ASIA-PACIFIC

-

FIBER REINFORCED POLYMER COMPOSITES FRP MARKET, BY PRODUCT TYPE, 2025 - 2034 (USD

-

BILLION)

-

\r\nTABLE 41 REST OF ASIA-PACIFIC FIBER REINFORCED POLYMER COMPOSITES

-

FRP MARKET, BY APPLICATION, 2025 - 2034 (USD BILLION)

-

\r\nTABLE 42 REST OF

-

WORLD FIBER REINFORCED POLYMER COMPOSITES FRP MARKET, BY PRODUCT TYPE, 2025 - 2034

-

(USD BILLION)

-

\r\nTABLE 43 REST OF WORLD FIBER REINFORCED POLYMER COMPOSITES

-

FRP MARKET, BY APPLICATION, 2025 - 2034 (USD BILLION)

-

\r\nTABLE 44 REST OF

-

WORLD FIBER REINFORCED POLYMER COMPOSITES FRP MARKET, BY COUNTRY, 2025 - 2034 (USD

-

BILLION)

-

\r\nTABLE 45 MIDDLE EAST FIBER REINFORCED POLYMER COMPOSITES FRP

-

MARKET, BY PRODUCT TYPE, 2025 - 2034 (USD BILLION)

-

\r\nTABLE 46 MIDDLE EAST

-

FIBER REINFORCED POLYMER COMPOSITES FRP MARKET, BY APPLICATION, 2025 - 2034 (USD

-

BILLION)

-

\r\nTABLE 47 AFRICA FIBER REINFORCED POLYMER COMPOSITES FRP MARKET,

-

BY PRODUCT TYPE, 2025 - 2034 (USD BILLION)

-

\r\nTABLE 48 AFRICA FIBER REINFORCED

-

POLYMER COMPOSITES FRP MARKET, BY APPLICATION, 2025 - 2034 (USD BILLION)

-

\r\nTABLE

-

LATIN AMERICA FIBER REINFORCED POLYMER COMPOSITES FRP MARKET, BY PRODUCT TYPE,

-

\r\nTABLE 50 LATIN AMERICA FIBER REINFORCED POLYMER

-

COMPOSITES FRP MARKET, BY APPLICATION, 2025 - 2034 (USD BILLION)

-

\r\n

-

\r\nLIST

-

OF FIGURES

-

\r\nFIGURE 1 RESEARCH PROCESS

-

\r\nFIGURE 2 MARKET STRUCTURE

-

FOR THE GLOBAL FIBER REINFORCED POLYMER COMPOSITES FRP MARKET

-

\r\nFIGURE 3

-

MARKET DYNAMICS FOR THE GLOBAL FIBER REINFORCED POLYMER COMPOSITES FRP MARKET

-

\r\nFIGURE

-

GLOBAL FIBER REINFORCED POLYMER COMPOSITES FRP MARKET, SHARE (%), BY PRODUCT TYPE,

-

\r\nFIGURE 5 GLOBAL FIBER REINFORCED POLYMER COMPOSITES FRP MARKET, SHARE

-

(%), BY APPLICATION, 2022

-

\r\nFIGURE 6 GLOBAL FIBER REINFORCED POLYMER COMPOSITES

-

FRP MARKET, SHARE (%), BY REGION, 2022

-

\r\nFIGURE 7 NORTH AMERICA: FIBER REINFORCED

-

POLYMER COMPOSITES FRP MARKET, SHARE (%), BY REGION, 2022

-

\r\nFIGURE 8 EUROPE:

-

FIBER REINFORCED POLYMER COMPOSITES FRP MARKET, SHARE (%), BY REGION, 2022

-

\r\nFIGURE

-

ASIA-PACIFIC: FIBER REINFORCED POLYMER COMPOSITES FRP MARKET, SHARE (%), BY REGION,

-

\r\nFIGURE 10 REST OF THE WORLD: FIBER REINFORCED POLYMER COMPOSITES

-

FRP MARKET, SHARE (%), BY REGION, 2022

-

\r\nFIGURE 11 GLOBAL FIBER REINFORCED

-

POLYMER COMPOSITES FRP MARKET: COMPANY SHARE ANALYSIS, 2022 (%)

-

\r\nFIGURE

-

SAINT GOBAIN: FINANCIAL OVERVIEW SNAPSHOT

-

\r\nFIGURE 13 SAINT GOBAIN: SWOT

-

ANALYSIS

-

\r\nFIGURE 14 ASAHI FIBERGLASS: FINANCIAL OVERVIEW SNAPSHOT

-

\r\nFIGURE

-

ASAHI FIBERGLASS: SWOT ANALYSIS

-

\r\nFIGURE 16 OWEN CORNING: FINANCIAL OVERVIEW

-

SNAPSHOT

-

\r\nFIGURE 17 OWEN CORNING: SWOT ANALYSIS

-

\r\nFIGURE 18 MITSUBISHI

-

RAYON CO., LTD : FINANCIAL OVERVIEW SNAPSHOT

-

\r\nFIGURE 19 MITSUBISHI RAYON

-

CO., LTD : SWOT ANALYSIS

-

\r\nFIGURE 20 B&B FRP MANUFACTURING INC.: FINANCIAL

-

OVERVIEW SNAPSHOT

-

\r\nFIGURE 21 B&B FRP MANUFACTURING INC.: SWOT ANALYSIS

-

\r\nFIGURE

-

AMERICAN FIBERGLASS REBAR : FINANCIAL OVERVIEW SNAPSHOT

-

\r\nFIGURE 23 AMERICAN

-

FIBERGLASS REBAR : SWOT ANALYSIS

-

\r\nFIGURE 24 AMERICAN GRATING: FINANCIAL

-

OVERVIEW SNAPSHOT

-

\r\nFIGURE 25 AMERICAN GRATING: SWOT ANALYSIS

-

\r\nFIGURE

-

LLC: FINANCIAL OVERVIEW SNAPSHOT

-

\r\nFIGURE 27 LLC: SWOT ANALYSIS

Leave a Comment