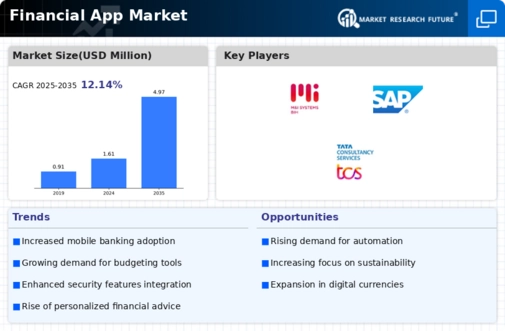

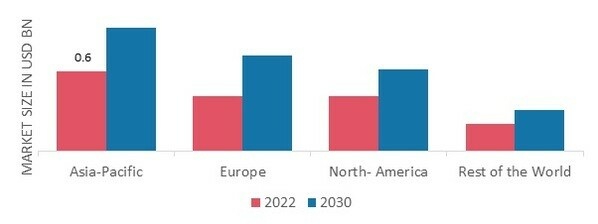

TABLE OF CONTENTS\r\n \r\n \r\n1 Executive Summary\r\n2 Scope of the Report\r\n2.1 Market Definition\r\n2.2 Scope of the Study\r\n2.2.1 Research Objectives\r\n2.2.2 Assumptions & Limitations\r\n2.3 Market Structure\r\n3 Market Research Methodology\r\n3.1 Research Process\r\n3.2 Secondary Research\r\n3.3 Primary Research\r\n3.4 Forecast Business Function\r\n4 Market Landscape\r\n4.1 Porter’s Five Forces Analysis\r\n4.1.1 Threat of New Entrants\r\n4.1.2 Bargaining power of buyers\r\n4.1.3 Threat of substitutes\r\n4.1.4 Segment rivalry\r\n4.2 Value Chain/Supply Chain of Global Financial App Market\r\n5 Industry Overview of Global Financial App Market\r\n5.1 Introduction\r\n5.2 Growth Drivers\r\n5.3 Impact analysis\r\n5.4 Market Challenges\r\n6 Market Trends\r\n6.1 Introduction\r\n6.2 Growth Trends\r\n6.3 Impact analysis\r\n7. Global Financial App Market by Software\r\n7.1 Introduction\r\n7.2 Audit, Risk & Compliance Management\r\n7.2.1 Market Estimates & Forecast, 2023-2030\r\n7.2.2 Market Estimates & Forecast by Region, 2023-2030\r\n7.3 BI & Analytics Applications\r\n7.3.1 Market Estimates & Forecast, 2023-2030\r\n7.3.2 Market Estimates & Forecast by Region, 2023-2030\r\n7.4 Customer Experience\r\n7.4.1 Market Estimates & Forecast, 2023-2030\r\n7.4.2 Market Estimates & Forecast by Region, 2023-2030\r\n8. Global Financial App Market by Service \r\n8.1 Introduction\r\n8.2. Training & Support\r\n8.2.1 Market Estimates & Forecast, 2023-2030\r\n8.2.2 Market Estimates & Forecast by Region, 2023-2030\r\n8.3 Consulting Service\r\n8.3.1 Market Estimates & Forecast, 2023-2030\r\n8.3.2 Market Estimates & Forecast by Region, 2023-2030\r\n8.3 Integration & Implementation\r\n8.3.1 Market Estimates & Forecast, 2023-2030\r\n8.3.2 Market Estimates & Forecast by Region, 2023-2030\r\n8.4 Operation & Maintenance\r\n8.4.1 Market Estimates & Forecast, 2023-2030\r\n8.4.2 Market Estimates & Forecast by Region, 2023-2030\r\n8.5 Others\r\n8.5.1 Market Estimates & Forecast, 2023-2030\r\n8.5.2 Market Estimates & Forecast by Region, 2023-2030\r\n9 Global Financial App Market by Deployment\r\n9.1 On-Premises\r\n9.1.1 Market Estimates & Forecast, 2023-2030\r\n9.1.2 Market Estimates & Forecast by Region, 2023-2030\r\n9.2 On-Cloud\r\n9.2.1 Market Estimates & Forecast, 2023-2030\r\n9.2.2 Market Estimates & Forecast by Region, 2023-2030\r\n10. Global Financial App Market by Organization size\r\n10.1 Introduction\r\n10.2 Large Enterprises\r\n10.2.1 Market Estimates & Forecast, 2023-2030\r\n10.2.2 Market Estimates & Forecast by Region, 2023-2030\r\n10.3 Small and Medium Enterprises\r\n10.3.1 Market Estimates & Forecast, 2023-2030\r\n10.3.2 Market Estimates & Forecast by Region, 2023-2030\r\n11. Global Financial App Market by End-users\r\n11.1 Introduction\r\n11.2 BFSI\r\n11.2.1 Market Estimates & Forecast, 2023-2030\r\n11.2.2 Market Estimates & Forecast by Region, 2023-2030\r\n11.3 Government \r\n11.3.1 Market Estimates & Forecast, 2023-2030\r\n11.3.2 Market Estimates & Forecast by Region, 2023-2030\r\n11.4 Retail & E-commerce \r\n11.4.1 Market Estimates & Forecast, 2023-2030\r\n11.4.2 Market Estimates & Forecast by Region, 2023-2030\r\n11.5 Others \r\n11.5.1 Market Estimates & Forecast, 2023-2030\r\n11.5.2 Market Estimates & Forecast by Region, 2023-2030\r\n12. Global Financial App Market by Region\r\n12.1 Introduction\r\n12.2 North America\r\n12.2.1 Market Estimates & Forecast, 2023-2030\r\n12.2.2 Market Estimates & Forecast by Software, 2023-2030\r\n12.2.3 Market Estimates & Forecast by Service , 2023-2030\r\n12.2.4 Market Estimates & Forecast by Deployment, 2023-2030\r\n12.2.5 Market Estimates & Forecast by Organization Size, 2023-2030\r\n12.2.6 Market Estimates & Forecast by End-User, 2023-2030\r\n12.2.7 U.S. \r\n12.2.7.1 Market Estimates & Forecast, 2023-2030\r\n12.2.7.2 Market Estimates & Forecast by Software, 2023-2030\r\n12.2.7.3 Market Estimates & Forecast by Service , 2023-2030\r\n12.2.7.4 Market Estimates & Forecast by Deployment, 2023-2030\r\n12.2.7.5 Market Estimates & Forecast by Organization Size, 2023-2030\r\n12.2.7.6 Market Estimates & Forecast by End-User, 2023-2030\r\n12.2.7 Canada\r\n12.2.7.1 Market Estimates & Forecast, 2023-2030\r\n12.2.7.2 Market Estimates & Forecast by Software, 2023-2030\r\n12.2.7.3 Market Estimates & Forecast by Service , 2023-2030\r\n12.2.7.4 Market Estimates & Forecast by Deployment, 2023-2030\r\n12.2.7.5 Market Estimates & Forecast by Organization Size, 2023-2030\r\n12.2.7.6 Market Estimates & Forecast by End-User, 2023-2030\r\n12.3 Europe\r\n12.3.1 Market Estimates & Forecast, 2023-2030\r\n12.3.2 Market Estimates & Forecast by Software, 2023-2030\r\n12.3.3 Market Estimates & Forecast by Service , 2023-2030\r\n12.3.4 Market Estimates & Forecast by Deployment, 2023-2030\r\n12.3.5 Market Estimates & Forecast by Organization Size, 2023-2030\r\n12.3.6 Market Estimates & Forecast by End-User, 2023-2030\r\n12.3.7 Germany\r\n12.3.7.1 Market Estimates & Forecast, 2023-2030\r\n12.3.7.2 Market Estimates & Forecast by Software, 2023-2030\r\n12.3.7.3 Market Estimates & Forecast by Service , 2023-2030\r\n12.3.7.4 Market Estimates & Forecast by Deployment, 2023-2030\r\n12.3.7.5 Market Estimates & Forecast by Organization Size, 2023-2030\r\n12.3.7.6 Market Estimates & Forecast by End-User, 2023-2030\r\n12.3.8. France\r\n12.3.8.1 Market Estimates & Forecast, 2023-2030\r\n12.3.8.2 Market Estimates & Forecast by Software, 2023-2030\r\n12.3.8.3Market Estimates & Forecast by Service , 2023-2030\r\n12.3.8.4 Market Estimates & Forecast by Deployment, 2023-2030\r\n12.3.8.5 Market Estimates & Forecast by Organization Size, 2023-2030\r\n12.3.8.6 Market Estimates & Forecast by End-User, 2023-2030\r\n12.3.9. U.K\r\n12.3.9.1 Market Estimates & Forecast, 2023-2030\r\n12.3.9.2 Market Estimates & Forecast by Software, 2023-2030\r\n12.3.9.3 Market Estimates & Forecast by Service , 2023-2030\r\n12.3.9.4 Market Estimates & Forecast by Deployment, 2023-2030\r\n12.3.9.5 Market Estimates & Forecast by Organization Size, 2023-2030\r\n12.3.9.6 Market Estimates & Forecast by End-User, 2023-2030\r\n12.4 Asia Pacific\r\n12.4.1 Market Estimates & Forecast, 2023-2030\r\n12.4.2 Market Estimates & Forecast by Software, 2023-2030\r\n12.4.3 Market Estimates & Forecast by Service , 2023-2030\r\n12.4.4 Market Estimates & Forecast by Deployment, 2023-2030\r\n12.4.5 Market Estimates & Forecast by Organization Size, 2023-2030\r\n12.4.6 Market Estimates & Forecast by End-User, 2023-2030\r\n12.4.7 China\r\n12.4.7.1 Market Estimates & Forecast, 2023-2030\r\n12.4.7.2 Market Estimates & Forecast by Software, 2023-2030\r\n12.4.7.3 Market Estimates & Forecast by Service , 2023-2030\r\n12.4.7.4 Market Estimates & Forecast by Deployment, 2023-2030\r\n12.4.7.5 Market Estimates & Forecast by Organization Size, 2023-2030\r\n12.4.7.6 Market Estimates & Forecast by End-User, 2023-2030\r\n12.4.8 India\r\n12.4.8.1 Market Estimates & Forecast, 2023-2030\r\n12.4.8.2 Market Estimates & Forecast by Software, 2023-2030\r\n12.4.8.3 Market Estimates & Forecast by Service , 2023-2030\r\n12.4.8.4 Market Estimates & Forecast by Deployment, 2023-2030\r\n12.4.8.5 Market Estimates & Forecast by Organization Size, 2023-2030\r\n12.4.8.6 Market Estimates & Forecast by End-User, 2023-2030\r\n12.4.9 Japan\r\n12.4.9.1 Market Estimates & Forecast, 2023-2030\r\n12.4.9.2 Market Estimates & Forecast by Software, 2023-2030\r\n12.4.9.3 Market Estimates & Forecast by Service , 2023-2030\r\n12.4.9.4Market Estimates & Forecast by Deployment, 2023-2030\r\n12.4.9.5 Market Estimates & Forecast by Organization Size, 2023-2030\r\n12.4.9.6 Market Estimates & Forecast by End-User, 2023-2030\r\n12.4.10 Rest of Asia Pacific\r\n12.4.10.1 Market Estimates & Forecast, 2023-2030\r\n12.4.10.2 Market Estimates & Forecast by Software, 2023-2030\r\n12.4.10.3 Market Estimates & Forecast by Service , 2023-2030\r\n12.4.10.4 Market Estimates & Forecast by Deployment, 2023-2030\r\n12.4.10.5 Market Estimates & Forecast by Organization Size, 2023-2030\r\n12.4.10.6 Market Estimates & Forecast by End-User, 2023-2030\r\n12.5 Rest of the World \r\n12.5.1 Market Estimates & Forecast, 2023-2030\r\n12.5.2 Market Estimates & Forecast by Software, 2023-2030\r\n12.5.3 Market Estimates & Forecast by Service , 2023-2030\r\n12.5.4 Market Estimates & Forecast by Deployment, 2023-2030\r\n12.5.5 Market Estimates & Forecast by Organization Size, 2023-2030\r\n12.5.6 Market Estimates & Forecast by End-User, 2023-2030\r\n12.5.7 The Middle East & Africa \r\n12.5.7.1 Market Estimates & Forecast, 2023-2030\r\n12.5.7.2 Market Estimates & Forecast by Software, 2023-2030\r\n12.5.7.3 Market Estimates & Forecast by Service , 2023-2030\r\n12.5.7.4 Market Estimates & Forecast by Deployment, 2023-2030\r\n12.5.7.5 Market Estimates & Forecast by Organization Size, 2023-2030\r\n12.5.7.6 Market Estimates & Forecast by End-User, 2023-2030\r\n12.5.8 Latin Countries \r\n12.5.8.1 Market Estimates & Forecast, 2023-2030\r\n12.5.8.2 Market Estimates & Forecast by Software, 2023-2030\r\n12.5.8.3 Market Estimates & Forecast by Service , 2023-2030\r\n12.5.8.4 Market Estimates & Forecast by Deployment, 2023-2030\r\n12.5.8.5 Market Estimates & Forecast by Organization Size, 2023-2030\r\n12.5.8.6 Market Estimates & Forecast by End-User, 2023-2030\r\n13. Company Landscape\r\n14. Company Profiles\r\n14.1 Accenture Plc (Ireland)\r\n14.1.1 Company Overview\r\n14 1.2 Product/Business Segment Overview\r\n14.1.3 Financial Updates\r\n14.1.4 Key Developments\r\n14.2 FIS Corporation (U.S.)\r\n14.2.1 Company Overview\r\n14.2.2 Product/Business Segment Overview\r\n14.2.3 Financial Updates\r\n14.2.4 Key Developments\r\n14.3 Fiserv Inc. (U.S.)\r\n14.3.1 Company Overview\r\n14.3.2 Product/Business Segment Overview\r\n14.3 3 Financial Updates\r\n14.3.4 Key Developments\r\n14.4 IBM Corporation (U.S.)\r\n14.4.1 Company Overview\r\n14.4.2 Product/Business Segment Overview\r\n14.4 3 Financial Updates\r\n14.4.4 Key Developments\r\n14.5 Infosys Ltd (India)\r\n14.5.1 Company Overview\r\n14.5.2 Product/Business Segment Overview\r\n14.5.3 Financial Updates\r\n14.5.4 Key Developments\r\n14.6 Misys (U.K)\r\n14.6.1 Company Overview\r\n14.6.2 Product/Business Segment Overview\r\n14.6.3 Financial Updates\r\n14.6.4 Key Developments\r\n14.7 Oracle Corporation (U.S.)\r\n14.7.1 Company Overview\r\n14.7.2 Product/Business Segment Overview\r\n14.7.3 Financial Updates\r\n14.7 4 Key Developments\r\n14.8 SAP SE (Germany)\r\n14.8.1 Company Overview\r\n14.8.2 Product/Business Segment Overview\r\n14.8 3 Financial Updates\r\n14.8.4 Key Developments\r\n14.9 TCS Ltd. (India)\r\n14.9.1 Company Overview\r\n14.9.2 Product/Business Segment Overview\r\n14.9.3 Financial Updates\r\n14.9.4 Key Developments\r\n14.10 Temenos Group AG (Switzerland)\r\n14.10.1 Company Overview\r\n14.10.2 Product/Business Segment Overview\r\n14.10.3 Financial Updates\r\n14.10.4 Key Developments\r\n15 Conclusion\r\n \r\n \r\nLIST OF TABLES\r\n \r\n \r\nTable1 World Population by Major Regions (2023 TO 2030) \r\nTable2 Global Financial App Market: By Region, 2023-2030 \r\nTable3 North America Financial App Market: By Country, 2023-2030 \r\nTable4 Europe Financial App Market: By Country, 2023-2030 \r\nTable5 Asia Pacific Financial App Market: By Country, 2023-2030 \r\nTable6 The Middle East & Africa Financial App Market: By Country, 2023-2030 \r\nTable7 Latin America Financial App Market: By Country, 2023-2030 \r\nTable8 Global Financial App by Software Market: By Regions, 2023-2030 \r\nTable9 North America Financial App by Software Market: By Country, 2023-2030 \r\nTable10 Europe Financial App by Software Market: By Country, 2023-2030 \r\nTable11 Asia Pacific Financial App by Software Market: By Country, 2023-2030\r\nTable12 The Middle East & Africa Financial App by Software Market: By Country, 2023-2030 \r\nTable13 Latin America Financial App by Software Market: By Country, 2023-2030 \r\nTable14 Global Financial App by Industry Market: By Regions, 2023-2030 \r\nTable15 North America Financial App by Industry Market: By Country, 2023-2030 \r\nTable16 Europe Financial App by Industry Market: By Country, 2023-2030 \r\nTable17 Asia Pacific Financial Appby Industry Market: By Country, 2023-2030 \r\nTable18 The Middle East & Africa Financial App by Industry Market: By Country, 2023-2030 \r\nTable19 Latin America Financial App by Industry Market: By Country, 2023-2030 \r\nTable20 North America Financial App for Industry Market: By Country, 2023-2030 \r\nTable21 Europe Financial App for Industry Market: By Country, 2023-2030 \r\nTable22 Asia Pacific Financial App for Industry Market: By Country, 2023-2030 \r\nTable23 The Middle East & Africa Financial App for Industry Market: By Country, 2023-2030 \r\nTable24 Global Software Market: By Region, 2023-2030 \r\nTable25 Global Industry Market By Region, 2023-2030 \r\nTable26 Global Industry Market By Region, 2023-2030 \r\nTable27 North America Financial App Market, By Country \r\nTable28 North America Financial App Market, By Software \r\nTable29 North America Financial App Market, By Product\r\nTable30 Europe Financial App Market, By Product\r\nTable31 Europe Financial App Market, By Software \r\nTable32 Asia Pacific Financial App Market, By Country \r\nTable33 Asia Pacific Financial App Market, By Software \r\nTable34 Asia Pacific Financial App Market, By Product\r\nTable35 The Middle East & Africa: Financial App Market, By Country \r\nTable36 The Middle East & Africa Financial App Market, By Software \r\nTable37 The Middle East & Africa Financial App Market, By Product\r\nTable38 Latin America: Financial App Market, By Country \r\nTable39 Latin America Financial App Market, By Software \r\nTable40 Latin America Financial App Market, By Product\r\n \r\nLIST OF FIGURES\r\n \r\nFIGURE 1 Global Financial App Market segmentation\r\nFIGURE 2 Forecast Methodology\r\nFIGURE 3 Porter’s Five Forces Analysis of Global Financial App Market\r\nFIGURE 4 Value Chain of Global Financial App Market\r\nFIGURE 5 Share of Global Financial App Market in 2023, by country (in %)\r\nFIGURE 6 Global Financial App Market, 2023-2030,\r\nFIGURE 7 Sub-segments of Software \r\nFIGURE 8 Global Financial App Market size by Software, 2023\r\nFIGURE 8 Share of Global Financial App Market by Software, 2023 TO 2030\r\nFIGURE 9 Global Financial App Market size by Product, 2023\r\nFIGURE 10 Share of Global Financial App Market by Product, 2023 TO 2030\r\nFIGURE 11 Global Financial App Market size by Industry, 2023\r\nFIGURE 12 Share of Global Financial App Market by Industry, 2023 TO 2030

Leave a Comment