Flat Steel Size

Market Size Snapshot

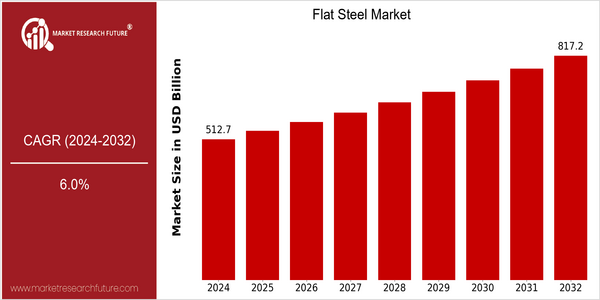

| Year | Value |

|---|---|

| 2024 | USD 512.72 Billion |

| 2032 | USD 817.2 Billion |

| CAGR (2024-2032) | 6.0 % |

Note – Market size depicts the revenue generated over the financial year

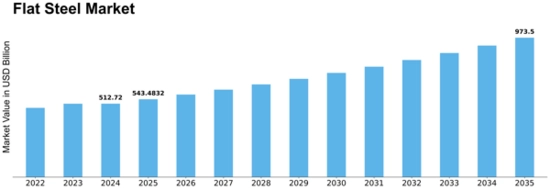

The global flat steel market is poised for significant growth, with a current market size of USD 512.72 billion in 2024, projected to reach USD 817.2 billion by 2032. This represents a robust compound annual growth rate (CAGR) of 6.0% over the forecast period. The increasing demand for flat steel products across various industries, including automotive, construction, and manufacturing, is a primary driver of this growth. As economies continue to recover and expand post-pandemic, the need for durable and versatile materials like flat steel is expected to rise, further fueling market expansion.

Technological advancements, such as the development of high-strength steel and innovations in production processes, are also contributing to the market's upward trajectory. Companies are increasingly investing in research and development to enhance product performance and sustainability. Key players in the flat steel market, such as ArcelorMittal, Tata Steel, and Nippon Steel, are actively pursuing strategic initiatives, including partnerships and investments in new technologies, to strengthen their market positions. For instance, collaborations aimed at improving recycling processes and reducing carbon footprints are becoming more prevalent, aligning with global sustainability goals and driving further demand for flat steel products.

Regional Market Size

Regional Deep Dive

The Flat Steel Market is characterized by diverse dynamics across different regions, driven by varying demand from key industries such as automotive, construction, and manufacturing. In North America, the market is influenced by a strong automotive sector and infrastructure investments, while Europe focuses on sustainability and innovation in production processes. Asia-Pacific stands out due to its rapid industrialization and urbanization, leading to increased demand for flat steel products. The Middle East and Africa are witnessing growth due to infrastructural developments, while Latin America is leveraging its natural resources to boost production capabilities. Each region presents unique opportunities and challenges shaped by economic conditions, regulatory frameworks, and cultural factors.

Europe

- The European Union's Green Deal is pushing for a significant reduction in carbon emissions, prompting flat steel manufacturers like ArcelorMittal to invest in greener production technologies, such as hydrogen-based steelmaking.

- The rise of electric vehicles in Europe is driving demand for high-strength flat steel products, with companies like Thyssenkrupp adapting their offerings to meet the evolving needs of the automotive sector.

Asia Pacific

- China remains the largest producer and consumer of flat steel, with state-owned enterprises like Baowu Steel Group leading the charge in capacity expansion and technological advancements.

- India's government initiatives, such as the National Steel Policy, aim to increase domestic production and reduce imports, fostering a competitive environment for local manufacturers.

Latin America

- Brazil's flat steel market is benefiting from increased investments in the construction sector, with companies like Gerdau expanding their production capabilities to cater to this demand.

- The region is also seeing a rise in sustainability initiatives, with local manufacturers exploring eco-friendly production methods to align with global trends.

North America

- The U.S. has seen a surge in flat steel demand due to the revival of the automotive industry, with companies like U.S. Steel and Nucor investing in advanced manufacturing technologies to enhance production efficiency.

- Recent regulatory changes, including tariffs on imported steel, have prompted domestic producers to increase capacity and innovate, leading to a more competitive market landscape.

Middle East And Africa

- The UAE is investing heavily in infrastructure projects, such as Expo 2020 in Dubai, which has increased demand for flat steel products, with companies like Emirates Steel playing a pivotal role in meeting this demand.

- Regulatory frameworks in countries like Saudi Arabia are evolving to support local manufacturing, encouraging investments in flat steel production facilities.

Did You Know?

“Did you know that flat steel products account for nearly 50% of the total steel consumption in the automotive industry, making them crucial for vehicle manufacturing?” — World Steel Association

Segmental Market Size

The Flat Steel Market segment is currently experiencing stable growth, driven by increasing demand in construction, automotive, and manufacturing industries. Key factors propelling this demand include the rising need for lightweight materials that enhance fuel efficiency in vehicles and the ongoing urbanization trends that necessitate robust infrastructure development. Additionally, regulatory policies aimed at reducing carbon emissions are pushing industries to adopt more sustainable practices, further boosting the demand for flat steel products.

Currently, the adoption of flat steel is in a mature stage, with notable leaders such as Tata Steel and ArcelorMittal implementing advanced manufacturing techniques to enhance product quality and sustainability. Primary applications include automotive body panels, construction beams, and appliances, where companies leverage flat steel for its strength and versatility. Macro trends such as the push for green building initiatives and the shift towards electric vehicles are catalyzing growth in this segment. Technologies like advanced high-strength steel (AHSS) and innovative coating methods are shaping the evolution of flat steel, ensuring it meets the demands of modern applications.

Future Outlook

The Flat Steel Market is poised for significant growth from 2024 to 2032, with a projected market value increase from $512.72 billion to $817.2 billion, reflecting a robust compound annual growth rate (CAGR) of 6.0%. This growth trajectory is underpinned by rising demand across key sectors such as automotive, construction, and manufacturing, where flat steel products are essential for structural integrity and design flexibility. As industries increasingly prioritize lightweight and high-strength materials, the penetration of advanced flat steel solutions is expected to rise, enhancing overall market dynamics.

Key technological advancements, including the development of high-strength low-alloy (HSLA) steels and innovations in coating technologies, are anticipated to drive market expansion. Additionally, supportive government policies aimed at promoting sustainable manufacturing practices and reducing carbon emissions will further bolster the adoption of flat steel products. Emerging trends such as the integration of Industry 4.0 technologies in steel production processes and the growing emphasis on recycling and circular economy principles are likely to reshape the competitive landscape, fostering a more resilient and innovative market environment. As a result, stakeholders in the flat steel market should prepare for a transformative period characterized by both challenges and opportunities, driven by evolving consumer preferences and regulatory frameworks.

Leave a Comment