Frozen Yogurt Size

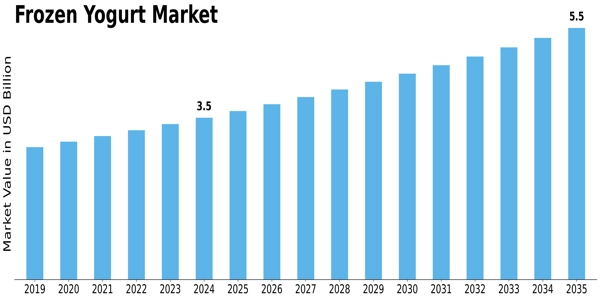

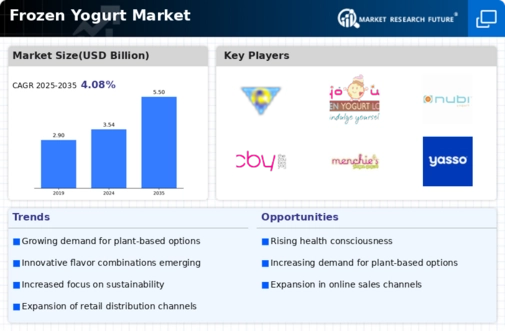

Frozen Yogurt Market Growth Projections and Opportunities

The Frozen Yogurt market is influenced by several market factors that collectively shape its growth and dynamics. One significant factor is the increasing consumer focus on healthier food choices. With a growing awareness of nutrition and wellness, consumers are seeking alternatives to traditional desserts. Frozen Yogurt, often perceived as a healthier option due to its probiotic content and lower fat levels compared to ice cream, has gained popularity. The demand for frozen yogurt aligns with the broader trend of health-conscious consumption, contributing to the market's expansion.

Changing consumer preferences and taste trends play a pivotal role in the Frozen Yogurt market. As consumers look for novel and diverse flavor experiences, frozen yogurt manufacturers continually innovate their product offerings. The market is characterized by a wide range of flavors and customizable toppings, allowing consumers to personalize their frozen yogurt experience. This focus on variety and customization caters to evolving taste preferences and keeps the market dynamic and appealing to a broad customer base.

The influence of lifestyle factors, including busy schedules and on-the-go consumption, is another significant market factor. Frozen Yogurt's convenient and portable nature makes it a popular choice for consumers looking for a quick and enjoyable treat. The availability of frozen yogurt in self-serve kiosks or specialty shops enhances its accessibility, providing consumers with a convenient and flexible option for indulgence in various settings.

Economic factors also impact the Frozen Yogurt market, influencing both consumer behavior and industry dynamics. Economic stability and disposable income levels play a role in determining consumer spending on non-essential items such as frozen desserts. Additionally, the cost of production and distribution affects the pricing of frozen yogurt products, influencing purchasing decisions and market competition.

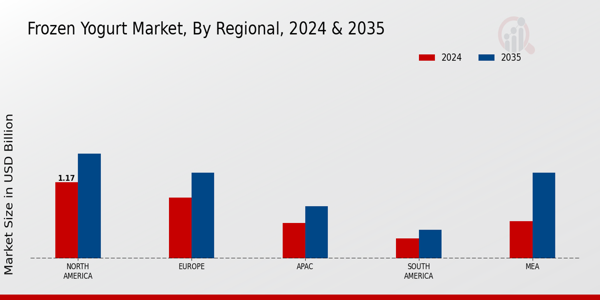

Globalization and cultural influences contribute to the diversity within the Frozen Yogurt market. As people are exposed to different culinary traditions and flavor profiles, there is a demand for unique and exotic frozen yogurt offerings. The incorporation of international flavors and ingredients reflects the globalization of food preferences, providing opportunities for market players to cater to diverse consumer tastes.

The regulatory environment is a crucial factor shaping the Frozen Yogurt market. Compliance with food safety standards, labeling requirements, and health regulations is essential for manufacturers to ensure the quality and safety of their products. Additionally, regulatory scrutiny of ingredients, including sweeteners and additives, can influence formulation choices within the industry. Adherence to these regulations not only ensures product quality but also contributes to consumer trust and confidence.

Technological advancements and innovations in the food industry impact the Frozen Yogurt market. Manufacturers invest in research and development to improve product formulations, enhance texture, and extend shelf life. Advancements in freezing technologies and equipment contribute to the production efficiency of frozen yogurt, allowing for the creation of smoother and creamier textures that meet consumer expectations.

Competitive factors are significant in shaping the Frozen Yogurt market landscape. The industry features a diverse range of players, including large frozen dessert chains, independent frozen yogurt shops, and private label offerings. Market leaders often differentiate themselves through branding, marketing strategies, and product innovations. Smaller players may focus on niche markets, unique flavors, or specialty frozen yogurt formulations to carve out their market share.

Environmental and sustainability considerations are gaining importance in the Frozen Yogurt market. With an increasing emphasis on eco-friendly practices, consumers and industry players are seeking sustainable packaging options and responsibly sourced ingredients. Companies that adopt environmentally conscious practices and communicate their commitment to sustainability may gain a competitive advantage in the market.

Leave a Comment