Market Share

Gene Therapy Market Share Analysis

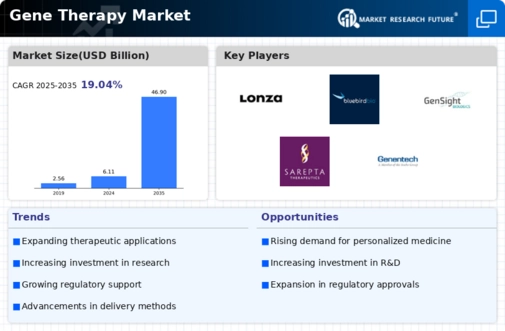

In the rapidly growing Gene Therapy Market, companies use several methods to gain market share and meet the complex therapeutic needs of genetically ill patients. Methods like separation via beneficial growth are necessary. Companies invest much in gene therapies with enhanced targeting, viability, and side effects. These companies want to survive in a competitive industry by selling cutting-edge gadgets for treating genetic diseases to medical professionals.

Gene Therapy Market cost management is crucial. Some groups provide affordable gene therapy without sacrificing quality. This strategy is important as patients and medical care providers seek financially viable ways to access cutting-edge genetic medicines. Companies become cost-effective gene therapy suppliers by optimizing manufacturing processes, negotiating reasonable pricing with providers, and implementing efficient distribution channels, making these life-changing drugs more accessible to unlucky patients.

Gene Therapy Market vital linkages and coordinated efforts are normal. Biotechnology companies often collaborate with academic research foundations, clinical centers, and patient support groups to enhance gene therapy outcomes. Building relationships with key medical services participants helps organizations learn about patient populations, access specialized skills, and successfully integrate their therapies into clinical practice.

Marketing and automation are growing in the Gene Therapy Market. To reach medical professionals, patients, and guardians easily, organizations promote user-friendly websites, digital marketing, and virtual entertainment. Giving educational resources, sharing examples of overcoming adversity, and raising concerns about gene therapy's potential outcomes and challenges online increases awareness and helps organizations connect with their target audience and understand these innovative medicines.

The biotechnology industry, particularly the Gene Therapy Market, requires administrative consistency and safety. Organizations invest in administrative approvals, clinical preliminaries, and meeting the highest safety and efficacy standards. Administrative consistency assures medical professionals and patients that gene therapy undergo extensive research and meet quality standards.

Innovative work is essential to Gene Therapy Market positioning methods. Companies invest in novel therapeutic targets, sign growth, and gene therapy delivery methods. This commitment to innovation ensures that companies stay at the forefront of gene therapy and positions them as leaders in providing exceptional genetic disease treatments.

Leave a Comment