-

Executive Summary

-

Market Introduction

-

Definition 16

-

Scope of the Study 16

-

List of Assumptions 16

-

Market Structure 17

-

Key Takeaways 17

-

Key Buying Criteria 18

-

Research Methodology

-

Research Process 20

-

Primary Research 20

-

Secondary Research 21

-

Market Size Estimation 22

-

Forecast Model 23

-

Market Dynamics

-

Introduction 25

-

Drivers 25

- Growing Green Building Concept 25

- Managing the Cost of Green Buildings 26

- Higher Rents and Values 26

- Impact on Workplace Productivity and Health 26

- Drivers Impact Analysis 27

-

Restraints 27

- Delays in obtaining certification and permits 27

- Restraints Impact Analysis 27

-

Opportunity 28

- Sustainability in Emerging Economies & the Developing World 28

-

Market Factor Analysis

-

Supply Chain Analysis 30

- Material acquisition 30

- Components Design 30

- Construction/retrofitting 30

- Facilities management 31

-

Porter’s Five Forces Model 31

- Threat of New Entrants 31

- Bargaining Power of Suppliers 31

- Bargaining Power of Buyers 32

- Threat of Substitutes 32

- Intensity of Rivalry 32

-

Policy Initiatives for Green Building in India 32

-

Tax Incentives for Green Buildings 33

- Government of India 33

- State Government/Local Bodies 33

- Financial Institutions 33

-

Global Green Building Market, By Product

-

Overview 35

- Exterior Products 35

- Interior Products 35

-

Global Green Building Market, By Application

-

Overview 38

- Residential 38

- Non-Residential 38

-

Global Green Building Market, By Region

-

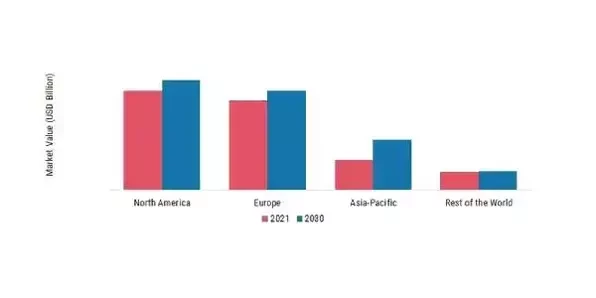

Introduction 41

-

North America 43

- U.S. 44

- Canada 45

- Mexico 46

-

Europe 47

- Germany 48

- U.K. 49

- Norway 50

- Poland 50

- France 51

- Rest of Europe 52

-

Asia Pacific 53

- China 55

- Japan 55

- India 56

- South Korea 57

- Australia 58

- Singapore 58

- Hong Kong 59

- Rest of Asia Pacific 60

-

Middle East & Africa 61

- Middle East 62

- Africa 62

-

Competitive Landscape

-

Company Profiles

-

E. I. du Pont de Nemours and Company 67

- Company Overview 67

- Financial Overview 67

- Products Offerings 68

- Key Strategy 68

- SWOT Analysis 68

-

Saint Global S.A. 69

- Company Overview 69

- Financial Overview 69

- Products Offerings 70

- Key Strategy 70

- SWOT Analysis 71

-

Wienerberger AG 72

- Company Overview 72

- Financial Overview 72

- Products Offerings 72

- Key Strategy 72

- SWOT Analysis 73

-

SGS 74

- Company Overview 74

- Financial Overview 74

- Products Offerings 74

- Key Strategy 74

- SWOT Analysis 75

-

Kingspan Group Plc. 76

- Company Overview 76

- Financial Overview 76

- Products Offerings 77

- Key Strategy 77

- SWOT Analysis 77

-

Bauder 78

- Company Overview 78

- Financial Overview 78

- Products Offerings 78

- Key Strategy 78

-

NATiVE 79

- Company Overview 79

- Financial Overview 79

- Products Offerings 79

- Key Strategy 80

-

Green Building Store 81

- Company Overview 81

- Financial Overview 81

- Products Offerings 81

- Key Strategy 81

-

Ginkgo Sustainability Inc. 82

- Company Overview 82

- Financial Overview 82

- Products Offerings 82

- Key Strategy 82

-

Green Build Products (I) Pvt Ltd 83

- Company Overview 83

- Financial Overview 83

- Products Offerings 83

- Key Strategy 83

-

Conclusion

-

Key Findings 85

- Key Companies to Watch 85

- Prediction 85

-

Appendix

-

List of Tables

-

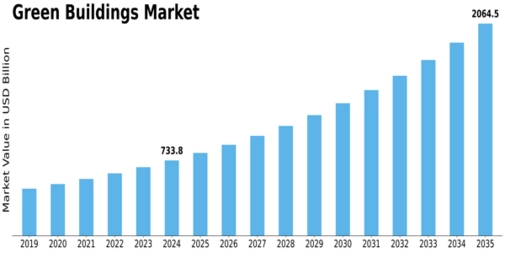

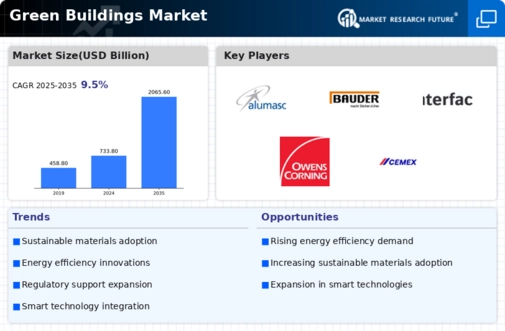

MARKET SYNOPSIS 14

-

LIST OF ASSUMPTIONS 16

-

GLOBAL GREEN BUILDING MARKET SIZE, BY PRODUCT, 2020-2027 (USD MILLION) 36

-

GLOBAL GREEN BUILDING MARKET, BY APPLICATION, 2020-2027 (USD MILLION) 39

-

GLOBAL GREEN BUILDING MARKET, BY REGION, 2020-2027 (USD MILLION) 42

-

NORTH AMERICA: GREEN BUILDING MARKET, BY COUNTRY, 2020-2027 (USD MILLION) 43

-

NORTH AMERICA: GREEN BUILDING MARKET, BY PRODUCT, 2020-2027 (USD MILLION) 43

-

NORTH AMERICA: GREEN BUILDING MARKET, BY APPLICATION, 2020-2027 (USD MILLION) 44

-

U.S.: GREEN BUILDING MARKET, BY PRODUCT, 2020-2027 (USD MILLION) 44

-

U.S.: GREEN BUILDING MARKET, BY APPLICATION, 2020-2027 (USD MILLION) 44

-

CANADA: GREEN BUILDING MARKET, BY PRODUCT, 2020-2027 (USD MILLION) 45

-

CANADA: GREEN BUILDING MARKET, BY APPLICATION, 2020-2027 (USD MILLION) 45

-

MEXICO: GREEN BUILDING MARKET, BY PRODUCT, 2020-2027 (USD MILLION) 46

-

MEXICO: GREEN BUILDING MARKET, BY APPLICATION, 2020-2027, (USD MILLION) 46

-

EUROPE: GREEN BUILDING MARKET, BY COUNTRY, 2020-2027 (USD MILLION) 47

-

EUROPE: GREEN BUILDING MARKET, BY PRODUCT, 2020-2027 (USD MILLION) 48

-

EUROPE: GREEN BUILDING MARKET, BY APPLICATION, 2020-2027 (USD MILLION) 48

-

GERMANY: GREEN BUILDING MARKET, BY PRODUCT, 2020-2027 (USD MILLION) 48

-

GERMANY: GREEN BUILDING MARKET, BY APPLICATION, 2020-2027 (USD MILLION) 49

-

U.K.: GREEN BUILDING MARKET, BY PRODUCT, 2020-2027 (USD MILLION) 49

-

U.K.: GREEN BUILDING MARKET, BY APPLICATION, 2020-2027 (USD MILLION) 49

-

NORWAY: GREEN BUILDING MARKET, BY PRODUCT, 2020-2027 (USD MILLION) 50

-

NORWAY: GREEN BUILDING MARKET, BY APPLICATION, 2020-2027 (USD MILLION) 50

-

POLAND: GREEN BUILDING MARKET, BY PRODUCT, 2020-2027 (USD MILLION) 51

-

POLAND: GREEN BUILDING MARKET, BY APPLICATION, 2020-2027 (USD MILLION) 51

-

FRANCE: GREEN BUILDING MARKET, BY PRODUCT, 2020-2027 (USD MILLION) 51

-

FRANCE: GREEN BUILDING MARKET, BY APPLICATION, 2020-2027 (USD MILLION) 52

-

REST OF EUROPE: GREEN BUILDING MARKET, BY PRODUCT, 2020-2027 (USD MILLION) 52

-

REST OF EUROPE: GREEN BUILDING MARKET, BY APPLICATION, 2020-2027 (USD MILLION) 52

-

ASIA PACIFIC: GREEN BUILDING MARKET, BY COUNTRY, 2020-2027 (USD MILLION) 53

-

ASIA PACIFIC: GREEN BUILDING MARKET, BY PRODUCT, 2020-2027 (USD MILLION) 54

-

ASIA PACIFIC: GREEN BUILDING MARKET, BY APPLICATION, 2020-2027 (USD MILLION) 54

-

CHINA: GREEN BUILDING MARKET, BY PRODUCT, 2020-2027 (USD MILLION) 55

-

CHINA: GREEN BUILDING MARKET, BY APPLICATION, 2020-2027 (USD MILLION) 55

-

JAPAN: GREEN BUILDING MARKET, BY PRODUCT, 2020-2027 (USD MILLION) 56

-

JAPAN: GREEN BUILDING MARKET, BY APPLICATION, 2020-2027 (USD MILLION) 56

-

INDIA: GREEN BUILDING MARKET, BY PRODUCT, 2020-2027 (USD MILLION) 56

-

INDIA: GREEN BUILDING MARKET, BY APPLICATION, 2020-2027 (USD MILLION) 57

-

SOUTH KOREA: GREEN BUILDING MARKET, BY PRODUCT, 2020-2027 (USD MILLION) 57

-

SOUTH KOREA: GREEN BUILDING MARKET, BY APPLICATION, 2020-2027 (USD MILLION) 57

-

AUSTRALIA: GREEN BUILDING MARKET, BY PRODUCT, 2020-2027 (USD MILLION) 58

-

AUSTRALIA: GREEN BUILDING MARKET, BY APPLICATION, 2020-2027 (USD MILLION) 58

-

SINGAPORE: GREEN BUILDING MARKET, BY PRODUCT, 2020-2027 (USD MILLION) 59

-

SINGAPORE: GREEN BUILDING MARKET, BY APPLICATION, 2020-2027 (USD MILLION) 59

-

HONG KONG: GREEN BUILDING MARKET, BY PRODUCT, 2020-2027 (USD MILLION) 59

-

HONG KONG: GREEN BUILDING MARKET, BY APPLICATION, 2020-2027 (USD MILLION) 60

-

REST OF APAC: GREEN BUILDING MARKET, BY PRODUCT, 2020-2027 (USD MILLION) 60

-

REST OF APAC: GREEN BUILDING MARKET, BY APPLICATION, 2020-2027 (USD MILLION) 60

-

MIDDLE EAST & AFRICA: GREEN BUILDING MARKET, BY REGION, 2020-2027 (USD MILLION) 61

-

MIDDLE EAST & AFRICA: GREEN BUILDING MARKET, BY PRODUCT, 2020-2027 (USD MILLION) 61

-

MIDDLE EAST & AFRICA: GREEN BUILDING MARKET, BY APPLICATION, 2020-2027 (USD MILLION) 61

-

MIDDLE EAST: GREEN BUILDING MARKET, BY PRODUCT, 2020-2027 (USD MILLION) 62

-

MIDDLE EAST: GREEN BUILDING MARKET, BY APPLICATION, 2020-2027 (USD MILLION) 62

-

AFRICA: GREEN BUILDING MARKET, BY PRODUCT, 2020-2027 (USD MILLION) 63

-

AFRICA: GREEN BUILDING MARKET, BY APPLICATION, 2020-2027 (USD MILLION) 63

-

-

List of Figures

-

GLOBAL GREEN BUILDING: MARKET STRUCTURE 17

-

KEY TAKEAWAYS OF THE GREEN BUILDING 17

-

KEY BUYING CRITERIA OF GREEN BUILDINGS MARKET 18

-

RESEARCH PROCESS OF MRFR 20

-

TOP DOWN & BOTTOM UP APPROACH 23

-

DROC ANALYSIS OF GLOBAL GREEN BUILDING MARKET 25

-

DRIVERS IMPACT ANALYSIS: GLOBAL GREEN BUILDING 27

-

RESTRAINTS IMPACT ANALYSIS: GREEN BUILDING MARKET 27

-

SUPPLY CHAIN: GREEN BUILDING 30

-

PORTER'S FIVE FORCES ANALYSIS OF THE GLOBAL GREEN BUILDING MARKET 31

-

GLOBAL GREEN BUILDING MARKET SHARE, BY PRODUCT, 2020(%) 35

-

GLOBAL GREEN BUILDING MARKET SHARE, BY APPLICATION, 2020(%) 38

-

GLOBAL GREEN BUILDING MARKET SHARE, BY REGION, 2020(%) 41

-

NORTH AMERICA: GREEN BUILDING MARKET SHARE, BY COUNTRY, 2020(%) 43

-

EUROPE: GREEN BUILDING MARKET SHARE, BY COUNTRY, 2020(%) 47

-

ASIA PACIFIC: GREEN BUILDING MARKET, BY COUNTRY, 2020(%) 53

-

ASIA PACIFIC: GREEN BUILDING MARKET SHARE, BY PRODUCT, 2020(%) 54

-

MARKET SHARE ANALYSIS: 2020(%) 65

-

"

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Leave a Comment