-

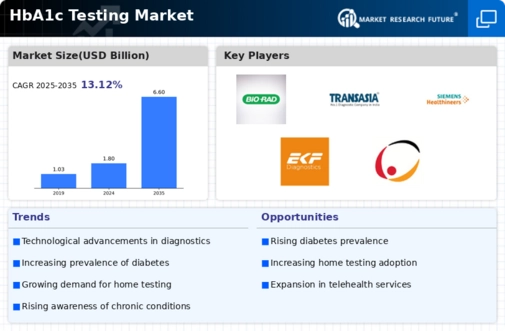

MARKET SYNOPSIS 14

-

MARKET ATTRACTIVENESS ANALYSIS 15

-

GLOBAL HBA1C TESTING MARKET, BY PRODUCT 16

-

GLOBAL HBA1C TESTING MARKET, BY TECHNOLOGY 17

-

GLOBAL HBA1C TESTING MARKET, BY END USER 18

-

Market Introduction

-

DEFINITION 19

-

SCOPE OF THE STUDY 19

-

RESEARCH OBJECTIVE 19

-

MARKET STRUCTURE 20

-

ASSUMPTIONS & LIMITATIONS 20

-

Research Methodology

-

DATA MINING 21

-

SECONDARY RESEARCH 22

-

PRIMARY RESEARCH 23

-

BREAKDOWN OF PRIMARY RESPONDENTS 24

-

FORECASTING TECHNIQUES 25

-

RESEARCH METHODOLOGY FOR MARKET SIZE ESTIMATION 26

- BOTTOM-UP APPROACH 27

- TOP-DOWN APPROACH 27

-

DATA TRIANGULATION 28

-

VALIDATION 28

-

MARKET DYNAMICS

-

OVERVIEW 29

-

DRIVERS 30

- RISING PREVALENCE OF DIABETES 30

- INCREASING INITIATIVES BY KEY PLAYERS 30

- GROWING NUMBER OF RESEARCH ORGANIZATIONS AND ASSOCIATIONS FOR DIABETES 30

- INCREASING GERIATRIC POPULATION AND THE INFLUENCE OF SEDENTARY LIFESTYLE AND UNHEALTHY DIET 30

-

RESTRAINTS 32

- LIMITED INDICATIONS OF HBA1C TESTS 32

- STRINGENT REIMBURSEMENT POLICIES IN DEVELOPING COUNTRIES 32

-

OPPORTUNITIES 33

- INCREASING APPROVALS AND PRODUCT LAUNCHES 33

- INCORPORATION OF VARIOUS TECHNOLOGIES IN HBA1C TESTING INSTRUMENTS 33

-

MARKET FACTOR ANALYSIS

-

PORTER’S FIVE FORCES MODEL 34

- THREAT OF NEW ENTRANTS 34

- BARGAINING POWER OF SUPPLIERS 35

- THREAT OF SUBSTITUTES 35

- BARGAINING POWER OF BUYERS 35

- INTENSITY OF RIVALRY 35

-

VALUE CHAIN ANALYSIS 36

- R&D AND DESIGNING 37

- MANUFACTURING 37

- DISTRIBUTION 37

- MARKETING & SALES 37

- POST-SALES MONITORING 37

-

HBA1C TESTING MARKET, BY PRODUCT

-

OVERVIEW 38

-

REAGENTS & KITS 39

-

INSTRUMENTS 40

- BENCH-TOP DEVICE 41

- HANDHELD DEVICE 42

-

HBA1C TESTING MARKET, BY TECHNOLOGY

-

OVERVIEW 43

-

ION-EXCHANGE HPLC 44

-

ENZYMATIC ASSAY 45

-

TURBIDIMETRIC INHIBITION IMMUNOASSAY (TINIA) 46

-

OTHERS 46

-

HBA1C TESTING MARKET, BY END USER

-

OVERVIEW 47

-

HOSPITALS AND CLINICS 48

-

DIAGNOSTIC LABORATORIES 49

-

OTHERS 49

-

GLOBAL HBA1C TESTING MARKET, BY REGION

-

OVERVIEW 50

-

AMERICAS 52

-

HBA1C TESTING MARKET, BY PRODUCT

-

HBA1C TESTING MARKET, BY TECHNOLOGY

-

HBA1C TESTING MARKET, BY END USER

-

OVERVIEW 52

-

NORTH AMERICA 55

-

HBA1C TESTING MARKET, BY PRODUCT

-

HBA1C TESTING MARKET, BY TECHNOLOGY

-

HBA1C TESTING MARKET, BY END USER

-

US 58

-

HBA1C TESTING MARKET, BY PRODUCT

-

HBA1C TESTING MARKET, BY TECHNOLOGY

-

HBA1C TESTING MARKET, BY END USER

-

CANADA 60

-

HBA1C TESTING MARKET, BY PRODUCT

-

HBA1C TESTING MARKET, BY TECHNOLOGY

-

HBA1C TESTING MARKET, BY END USER

-

LATIN AMERICA 62

-

HBA1C TESTING MARKET, BY PRODUCT

-

HBA1C TESTING MARKET, BY TECHNOLOGY

-

HBA1C TESTING MARKET, BY END USER

-

EUROPE 64

-

HBA1C TESTING MARKET, BY PRODUCT

-

HBA1C TESTING MARKET, BY TECHNOLOGY

-

HBA1C TESTING MARKET, BY END USER

-

OVERVIEW 64

-

WESTERN EUROPE 67

-

HBA1C TESTING MARKET, BY PRODUCT

-

HBA1C TESTING MARKET, BY TECHNOLOGY

-

HBA1C TESTING MARKET, BY END USER

-

UK 70

-

HBA1C TESTING MARKET, BY PRODUCT

-

HBA1C TESTING MARKET, BY TECHNOLOGY

-

HBA1C TESTING MARKET, BY END USER

-

GERMANY 72

-

HBA1C TESTING MARKET, BY PRODUCT

-

HBA1C TESTING MARKET, BY TECHNOLOGY

-

HBA1C TESTING MARKET, BY END USER

-

FRANCE 74

-

HBA1C TESTING MARKET, BY PRODUCT

-

HBA1C TESTING MARKET, BY TECHNOLOGY

-

HBA1C TESTING MARKET, BY END USER

-

ITALY 76

-

HBA1C TESTING MARKET, BY PRODUCT

-

HBA1C TESTING MARKET, BY TECHNOLOGY

-

HBA1C TESTING MARKET, BY END USER

-

SPAIN 78

-

HBA1C TESTING MARKET, BY PRODUCT

-

HBA1C TESTING MARKET, BY TECHNOLOGY

-

HBA1C TESTING MARKET, BY END USER

-

REST OF WESTERN EUROPE 80

-

HBA1C TESTING MARKET, BY PRODUCT

-

HBA1C TESTING MARKET, BY TECHNOLOGY

-

HBA1C TESTING MARKET, BY END USER

-

EASTERN EUROPE 82

-

HBA1C TESTING MARKET, BY PRODUCT

-

HBA1C TESTING MARKET, BY TECHNOLOGY

-

HBA1C TESTING MARKET, BY END USER

-

ASIA-PACIFIC 84

-

HBA1C TESTING MARKET, BY PRODUCT

-

HBA1C TESTING MARKET, BY TECHNOLOGY

-

HBA1C TESTING MARKET, BY END USER

-

OVERVIEW 84

-

CHINA 87

-

HBA1C TESTING MARKET, BY PRODUCT

-

HBA1C TESTING MARKET, BY TECHNOLOGY

-

HBA1C TESTING MARKET, BY END USER

-

INDIA 89

-

HBA1C TESTING MARKET, BY PRODUCT

-

HBA1C TESTING MARKET, BY TECHNOLOGY

-

HBA1C TESTING MARKET, BY END USER

-

JAPAN 91

-

HBA1C TESTING MARKET, BY PRODUCT

-

HBA1C TESTING MARKET, BY TECHNOLOGY

-

HBA1C TESTING MARKET, BY END USER

-

SOUTH KOREA 93

-

HBA1C TESTING MARKET, BY PRODUCT

-

HBA1C TESTING MARKET, BY TECHNOLOGY

-

HBA1C TESTING MARKET, BY END USER

-

AUSTRALIA 95

-

HBA1C TESTING MARKET, BY PRODUCT

-

HBA1C TESTING MARKET, BY TECHNOLOGY

-

HBA1C TESTING MARKET, BY END USER

-

REST OF ASIA-PACIFIC 97

-

HBA1C TESTING MARKET, BY PRODUCT

-

HBA1C TESTING MARKET, BY TECHNOLOGY

-

HBA1C TESTING MARKET, BY END USER

-

MIDDLE EAST & AFRICA 99

-

HBA1C TESTING MARKET, BY PRODUCT

-

HBA1C TESTING MARKET, BY TECHNOLOGY

-

HBA1C TESTING MARKET, BY END USER

-

OVERVIEW 99

-

MIDDLE EAST 102

-

HBA1C TESTING MARKET, BY PRODUCT

-

HBA1C TESTING MARKET, BY TECHNOLOGY

-

HBA1C TESTING MARKET, BY END USER

-

AFRICA 104

-

HBA1C TESTING MARKET, BY PRODUCT

-

HBA1C TESTING MARKET, BY TECHNOLOGY

-

HBA1C TESTING MARKET, BY END USER

-

COMPETITIVE LANDSCAPE

-

OVERVIEW 106

-

COMPANY SHARE ANALYSIS, 2020 (%) 106

-

COMPANY PROFILES

-

ABBOTT LABORATORIES 108

- COMPANY OVERVIEW 108

- FINANCIAL OVERVIEW 108

- PRODUCTS/SERVICES OFFERED 109

- ABBOTT LABORATORIES: KEY DEVELOPMENTS 109

- SWOT ANALYSIS 109

- KEY STRATEGIES 110

-

BIO-RAD LABORATORIES, INC. 111

- COMPANY OVERVIEW 111

- FINANCIAL OVERVIEW 111

- PRODUCTS/SERVICES OFFERED 112

- KEY DEVELOPMENTS 112

- SWOT ANALYSIS 113

- KEY STRATEGIES 113

-

DANAHER CORPORATION 114

- COMPANY OVERVIEW 114

- FINANCIAL OVERVIEW 114

- PRODUCTS/SERVICES OFFERED 115

- KEY DEVELOPMENTS 115

- SWOT ANALYSIS 115

- KEY STRATEGIES 115

-

F. HOFFMANN-LA ROCHE LTD 116

- COMPANY OVERVIEW 116

- FINANCIAL OVERVIEW 116

- PRODUCTS/SERVICES OFFERED 117

- KEY DEVELOPMENTS 117

- SWOT ANALYSIS 117

- KEY STRATEGIES 118

-

SIEMENS HEALTHINEERS 119

- COMPANY OVERVIEW 119

- FINANCIAL OVERVIEW 119

- PRODUCTS/SERVICES OFFERED 120

- KEY DEVELOPMENTS 120

- SWOT ANALYSIS 120

- KEY STRATEGIES 121

-

EKF DIAGNOSTICS 122

- COMPANY OVERVIEW 122

- FINANCIAL OVERVIEW 122

- PRODUCTS/SERVICES OFFERED 123

- KEY DEVELOPMENTS 123

- SWOT ANALYSIS 123

- KEY STRATEGIES 124

-

-

ARKRAY, INC. 125

- COMPANY OVERVIEW 125

- ARKRAY, INC.: FINANCIAL OVERVIEW 125

- PRODUCTS/SERVICES OFFERED 125

- KEY DEVELOPMENTS 125

- SWOT ANALYSIS 126

- KEY STRATEGIES 126

-

TRINITY BIOTECH PLC. 127

- COMPANY OVERVIEW 127

- FINANCIAL OVERVIEW 127

- PRODUCTS/SERVICES OFFERED 128

- KEY DEVELOPMENTS 128

- SWOT ANALYSIS 128

- KEY STRATEGIES 128

-

PTS DIAGNOSTICS 129

- COMPANY OVERVIEW 129

- FINANCIAL OVERVIEW 129

- PRODUCTS/SERVICES OFFERED 129

- KEY DEVELOPMENTS 129

- SWOT ANALYSIS 130

- KEY STRATEGIES 130

-

DIASYS DIAGNOSTIC SYSTEMS GMBH 131

- COMPANY OVERVIEW 131

- FINANCIAL OVERVIEW 131

- PRODUCTS/SERVICES OFFERED 131

- KEY DEVELOPMENTS 131

- SWOT ANALYSIS 132

- KEY STRATEGIES 132

-

APPENDIX

-

REFERENCES 133

-

RELATED REPORTS 133

-

List of Tables

-

LIST OF ASSUMPTIONS 20

-

PRIMARY INTERVIEWS AND INFORMATION GATHERING PROCESS 24

-

GLOBAL HBA1C TESTING MARKET, BY PRODUCT, 2020–2027 (USD MILLION) 39

-

GLOBAL HBA1C TESTING MARKET FOR INSTRUMENTS, BY REGION, 2020–2027 (USD MILLION) 40

-

GLOBAL HBA1C TESTING MARKET FOR INSTRUMENTS, BY TYPE, 2020–2027 (USD MILLION) 40

-

GLOBAL HBA1C TESTING MARKET FOR INSTRUMENTS, BY REGION, 2020–2027 (USD MILLION) 41

-

GLOBAL HBA1C TESTING MARKET FOR BENCH-TOP DEVICE, BY REGION, 2020–2027 (USD MILLION) 41

-

GLOBAL HBA1C TESTING MARKET FOR HANDHELD DEVICE, BY REGION, 2020–2027 (USD MILLION) 42

-

GLOBAL HBA1C TESTING MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION) 44

-

GLOBAL HBA1C TESTING MARKET FOR ION-EXCHANGE HPLC, BY REGION, 2020–2027 (USD MILLION) 45

-

GLOBAL HBA1C TESTING MARKET FOR ENZYMATIC ASSAY, BY REGION, 2020–2027 (USD MILLION) 45

-

GLOBAL HBA1C TESTING MARKET FOR TURBIDIMETRIC INHIBITION IMMUNOASSAY (TINIA), BY REGION,

-

GLOBAL HBA1C TESTING MARKET, BY END USER, 2020–2027 (USD MILLION) 48

-

GLOBAL HBA1C TESTING MARKET FOR HOSPITALS AND CLINICS, BY REGION, 2020–2027 (USD MILLION) 48

-

GLOBAL HBA1C TESTING MARKET FOR DIAGNOSTIC LABORATORIES, BY REGION, 2020–2027 (USD MILLION) 49

-

GLOBAL HBA1C TESTING MARKET, BY REGION, 2020–2027 (USD MILLION) 51

-

AMERICAS: HBA1C TESTING MARKET, BY REGION, 2020–2027 (USD MILLION) 53

-

AMERICAS: HBA1C TESTING MARKET, BY PRODUCT, 2020–2027 (USD MILLION) 53

-

AMERICAS: HBA1C TESTING MARKET FOR INSTRUMENTS, BY TYPE, 2020–2027 (USD MILLION) 53

-

AMERICAS: HBA1C TESTING MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION) 54

-

AMERICAS: HBA1C TESTING MARKET, BY END USER, 2020–2027 (USD MILLION) 54

-

NORTH AMERICA: HBA1C TESTING MARKET, BY COUNTRY, 2020–2027 (USD MILLION) 55

-

NORTH AMERICA: HBA1C TESTING MARKET, BY PRODUCT, 2020–2027 (USD MILLION) 56

-

NORTH AMERICA: HBA1C TESTING MARKET FOR INSTRUMENTS, BY TYPE, 2020–2027 (USD MILLION) 56

-

NORTH AMERICA: HBA1C TESTING MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION) 57

-

NORTH AMERICA: HBA1C TESTING MARKET, BY END USER, 2020–2027 (USD MILLION) 57

-

US: HBA1C TESTING MARKET, BY PRODUCT, 2020–2027 (USD MILLION) 58

-

US: HBA1C TESTING MARKET FOR INSTRUMENTS, BY TYPE, 2020–2027 (USD MILLION) 58

-

US: HBA1C TESTING MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION) 59

-

US: HBA1C TESTING MARKET, BY END USER, 2020–2027 (USD MILLION) 59

-

CANADA: HBA1C TESTING MARKET, BY PRODUCT, 2020–2027 (USD MILLION) 60

-

CANADA: HBA1C TESTING MARKET FOR INSTRUMENTS, BY TYPE, 2020–2027 (USD MILLION) 60

-

CANADA: HBA1C TESTING MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION) 61

-

CANADA: HBA1C TESTING MARKET, BY END USER, 2020–2027 (USD MILLION) 61

-

LATIN AMERICA: HBA1C TESTING MARKET, BY PRODUCT, 2020–2027 (USD MILLION) 62

-

LATIN AMERICA: HBA1C TESTING MARKET FOR INSTRUMENTS, BY TYPE, 2020–2027 (USD MILLION) 62

-

LATIN AMERICA: HBA1C TESTING MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION) 63

-

LATIN AMERICA: HBA1C TESTING MARKET, BY END USER, 2020–2027 (USD MILLION) 63

-

EUROPE: HBA1C TESTING MARKET, BY REGION, 2020–2027 (USD MILLION) 64

-

EUROPE: HBA1C TESTING MARKET, BY PRODUCT, 2020–2027 (USD MILLION) 65

-

EUROPE: HBA1C TESTING MARKET FOR INSTRUMENTS, BY TYPE, 2020–2027 (USD MILLION) 65

-

EUROPE: HBA1C TESTING MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION) 66

-

EUROPE: HBA1C TESTING MARKET, BY END USER, 2020–2027 (USD MILLION) 66

-

WESTERN EUROPE: HBA1C TESTING MARKET, BY COUNTRY, 2020–2027 (USD MILLION) 67

-

WESTERN EUROPE: HBA1C TESTING MARKET, BY PRODUCT, 2020–2027 (USD MILLION) 68

-

WESTERN EUROPE: HBA1C TESTING MARKET FOR INSTRUMENTS, BY TYPE, 2020–2027 (USD MILLION) 68

-

WESTERN EUROPE: HBA1C TESTING MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION) 69

-

WESTERN EUROPE: HBA1C TESTING MARKET, BY END USER, 2020–2027 (USD MILLION) 69

-

UK: HBA1C TESTING MARKET, BY PRODUCT, 2020–2027 (USD MILLION) 70

-

UK: HBA1C TESTING MARKET FOR INSTRUMENTS, BY TYPE, 2020–2027 (USD MILLION) 70

-

UK: HBA1C TESTING MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION) 71

-

UK: HBA1C TESTING MARKET, BY END USER, 2020–2027 (USD MILLION) 71

-

GERMANY: HBA1C TESTING MARKET, BY PRODUCT, 2020–2027 (USD MILLION) 72

-

GERMANY: HBA1C TESTING MARKET FOR INSTRUMENTS, BY TYPE, 2020–2027 (USD MILLION) 72

-

GERMANY: HBA1C TESTING MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION) 73

-

GERMANY: HBA1C TESTING MARKET, BY END USER, 2020–2027 (USD MILLION) 73

-

FRANCE: HBA1C TESTING MARKET, BY PRODUCT, 2020–2027 (USD MILLION) 74

-

FRANCE: HBA1C TESTING MARKET FOR INSTRUMENTS, BY TYPE, 2020–2027 (USD MILLION) 74

-

FRANCE: HBA1C TESTING MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION) 75

-

FRANCE: HBA1C TESTING MARKET, BY END USER, 2020–2027 (USD MILLION) 75

-

ITALY: HBA1C TESTING MARKET, BY PRODUCT, 2020–2027 (USD MILLION) 76

-

ITALY: HBA1C TESTING MARKET FOR INSTRUMENTS, BY TYPE, 2020–2027 (USD MILLION) 76

-

ITALY: HBA1C TESTING MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION) 77

-

ITALY: HBA1C TESTING MARKET, BY END USER, 2020–2027 (USD MILLION) 77

-

SPAIN: HBA1C TESTING MARKET, BY PRODUCT, 2020–2027 (USD MILLION) 78

-

SPAIN: HBA1C TESTING MARKET FOR INSTRUMENTS, BY TYPE, 2020–2027 (USD MILLION) 78

-

SPAIN: HBA1C TESTING MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION) 79

-

SPAIN: HBA1C TESTING MARKET, BY END USER, 2020–2027 (USD MILLION) 79

-

REST OF WESTERN EUROPE: HBA1C TESTING MARKET, BY PRODUCT, 2020–2027 (USD MILLION) 80

-

REST OF WESTERN EUROPE: HBA1C TESTING MARKET FOR INSTRUMENTS, BY TYPE, 2020–2027 (USD MILLION) 80

-

REST OF WESTERN EUROPE: HBA1C TESTING MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION) 81

-

REST OF WESTERN EUROPE: HBA1C TESTING MARKET, BY END USER, 2020–2027 (USD MILLION) 81

-

EASTERN EUROPE: HBA1C TESTING MARKET, BY PRODUCT, 2020–2027 (USD MILLION) 82

-

EASTERN EUROPE: HBA1C TESTING MARKET FOR INSTRUMENTS, BY TYPE, 2020–2027 (USD MILLION) 82

-

EASTERN EUROPE: HBA1C TESTING MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION) 83

-

EASTERN EUROPE: HBA1C TESTING MARKET, BY END USER, 2020–2027 (USD MILLION) 83

-

ASIA-PACIFIC: HBA1C TESTING MARKET, BY COUNTRY,2020–2027 (USD MILLION) 84

-

ASIA-PACIFIC: HBA1C TESTING MARKET, BY PRODUCT, 2020–2027 (USD MILLION) 85

-

ASIA-PACIFIC: HBA1C TESTING MARKET FOR INSTRUMENTS, BY TYPE, 2020–2027 (USD MILLION) 85

-

ASIA-PACIFIC: HBA1C TESTING MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION) 86

-

ASIA-PACIFIC: HBA1C TESTING MARKET, BY END USER, 2020–2027 (USD MILLION) 86

-

CHINA: HBA1C TESTING MARKET, BY PRODUCT, 2020–2027 (USD MILLION) 87

-

CHINA: HBA1C TESTING MARKET FOR INSTRUMENTS, BY TYPE, 2020–2027 (USD MILLION) 87

-

CHINA: HBA1C TESTING MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION) 88

-

CHINA: HBA1C TESTING MARKET, BY END USER, 2020–2027 (USD MILLION) 88

-

INDIA: HBA1C TESTING MARKET, BY PRODUCT, 2020–2027 (USD MILLION) 89

-

INDIA: HBA1C TESTING MARKET FOR INSTRUMENTS, BY TYPE, 2020–2027 (USD MILLION) 89

-

INDIA: HBA1C TESTING MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION) 90

-

INDIA: HBA1C TESTING MARKET, BY END USER, 2020–2027 (USD MILLION) 90

-

JAPAN: HBA1C TESTING MARKET, BY PRODUCT, 2020–2027 (USD MILLION) 91

-

JAPAN: HBA1C TESTING MARKET FOR INSTRUMENTS, BY TYPE, 2020–2027 (USD MILLION) 91

-

JAPAN: HBA1C TESTING MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION) 92

-

JAPAN: HBA1C TESTING MARKET, BY END USER, 2020–2027 (USD MILLION) 92

-

SOUTH KOREA: HBA1C TESTING MARKET, BY PRODUCT, 2020–2027 (USD MILLION) 93

-

SOUTH KOREA: HBA1C TESTING MARKET FOR INSTRUMENTS, BY TYPE, 2020–2027 (USD MILLION) 93

-

SOUTH KOREA: HBA1C TESTING MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION) 94

-

SOUTH KOREA: HBA1C TESTING MARKET, BY END USER, 2020–2027 (USD MILLION) 94

-

AUSTRALIA: HBA1C TESTING MARKET, BY PRODUCT, 2020–2027 (USD MILLION) 95

-

AUSTRALIA: HBA1C TESTING MARKET FOR INSTRUMENTS, BY TYPE, 2020–2027 (USD MILLION) 95

-

AUSTRALIA: HBA1C TESTING MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION) 96

-

AUSTRALIA: HBA1C TESTING MARKET, BY END USER, 2020–2027 (USD MILLION) 96

-

REST OF ASIA-PACIFIC: HBA1C TESTING MARKET, BY PRODUCT, 2020–2027 (USD MILLION) 97

-

REST OF ASIA-PACIFIC: HBA1C TESTING MARKET FOR INSTRUMENTS, BY TYPE, 2020–2027 (USD MILLION) 97

-

REST OF ASIA-PACIFIC: HBA1C TESTING MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION) 98

-

REST OF ASIA-PACIFIC: HBA1C TESTING MARKET, BY END USER, 2020–2027 (USD MILLION) 98

-

MIDDLE EAST & AFRICA: HBA1C TESTING MARKET, BY REGION,2020–2027 (USD MILLION) 99

-

MIDDLE EAST & AFRICA: HBA1C TESTING MARKET, BY PRODUCT, 2020–2027 (USD MILLION) 100

-

MIDDLE EAST & AFRICA: HBA1C TESTING MARKET FOR INSTRUMENTS, BY TYPE, 2020–2027 (USD MILLION) 100

-

MIDDLE EAST & AFRICA: HBA1C TESTING MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION) 101

-

MIDDLE EAST & AFRICA: HBA1C TESTING MARKET, BY END USER, 2020–2027 (USD MILLION) 101

-

MIDDLE EAST: HBA1C TESTING MARKET, BY PRODUCT, 2020–2027 (USD MILLION) 102

-

MIDDLE EAST: HBA1C TESTING MARKET FOR INSTRUMENTS, BY TYPE, 2020–2027 (USD MILLION) 102

-

MIDDLE EAST: HBA1C TESTING MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION) 103

-

MIDDLE EAST: HBA1C TESTING MARKET, BY END USER, 2020–2027 (USD MILLION) 103

-

AFRICA: HBA1C TESTING MARKET, BY PRODUCT, 2020–2027 (USD MILLION) 104

-

AFRICA: HBA1C TESTING MARKET FOR INSTRUMENTS, BY TYPE, 2020–2027 (USD MILLION) 104

-

AFRICA: HBA1C TESTING MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION) 105

-

AFRICA: HBA1C TESTING MARKET, BY END USER, 2020–2027 (USD MILLION) 105

-

ABBOTT LABORATORIES: PRODUCTS/SERVICES OFFERED 109

-

ABBOTT LABORATORIES: KEY DEVELOPMENTS 109

-

BIO-RAD LABORATORIES INC.: PRODUCTS/SERVICES OFFERED 112

-

BIO-RAD LABORATORIES, INC.: KEY DEVELOPMENTS 112

-

DANAHER CORPORATION: PRODUCTS/SERVICES OFFERED 115

-

DANAHER CORPORATION: KEY DEVELOPMENTS 115

-

F. HOFFMANN-LA ROCHE LTD: PRODUCTS/SERVICES OFFERED 117

-

F. HOFFMANN-LA ROCHE LTD: KEY DEVELOPMENTS 117

-

SIEMENS HEALTHINEERS: PRODUCTS/SERVICES OFFERED 120

-

SIEMENS HEALTHINEERS: KEY DEVELOPMENTS 120

-

EKF DIAGNOSTICS PRODUCTS/SERVICES OFFERED 123

-

EKF DIAGNOSTICS KEY DEVELOPMENTS 123

-

ARKRAY, INC.: PRODUCTS/SERVICES OFFERED 125

-

ARKRAY, INC.: KEY DEVELOPMENTS 125

-

TRINITY BIOTECH PLC.: PRODUCTS/SERVICES OFFERED 128

-

PTS DIAGNOSTICS: PRODUCTS/SERVICES OFFERED 129

-

DIASYS DIAGNOSTIC SYSTEMS GMBH: PRODUCTS/SERVICES OFFERED 131

-

List of Figures

-

MARKET SYNOPSIS 14

-

MARKET ATTRACTIVENESS ANALYSIS (2020) 15

-

GLOBAL HBA1C TESTING MARKET ANALYSIS, BY PRODUCT 16

-

GLOBAL HBA1C TESTING MARKET ANALYSIS, BY TECHNOLOGY 17

-

GLOBAL HBA1C TESTING MARKET ANALYSIS, BY END USER 18

-

GLOBAL HBA1C TESTING MARKET: STRUCTURE 20

-

BOTTOM-UP AND TOP-DOWN APPROACHES 26

-

MARKET DYNAMICS: ANALYSIS OF THE GLOBAL HBA1C TESTING MARKET 29

-

DRIVERS IMPACT ANALYSIS 31

-

RESTRAINT IMPACT ANALYSIS 32

-

PORTER’S FIVE FORCES ANALYSIS: GLOBAL HBA1C TESTING MARKET 34

-

VALUE CHAIN ANALYSIS OF THE GLOBAL HBA1C TESTING MARKET 36

-

GLOBAL HBA1C TESTING MARKET SHARE, BY PRODUCT, 2020 (%) 38

-

GLOBAL HBA1C TESTING MARKET, BY PRODUCT, 2020 & 2027 (USD MILLION) 38

-

GLOBAL HBA1C TESTING MARKET SHARE, BY TECHNOLOGY, 2020 (%) 43

-

GLOBAL HBA1C TESTING MARKET, BY TECHNOLOGY, 2020 & 2027 (USD MILLION) 43

-

GLOBAL HBA1C TESTING MARKET SHARE, BY END USER, 2020 (%) 47

-

GLOBAL HBA1C TESTING MARKET, BY END USER, 2020 & 2027 (USD MILLION) 47

-

GLOBAL HBA1C TESTING MARKET SHARE, BY REGION, 2020 (%) 50

-

GLOBAL HBA1C TESTING MARKET, BY REGION, 2020 AND 2027 (USD MILLION) 50

-

AMERICAS: HBA1C TESTING MARKET SHARE, BY REGION, 2020 (%) 52

-

NORTH AMERICA: HBA1C TESTING MARKET SHARE, BY COUNTRY, 2020 (%) 55

-

EUROPE: HBA1C TESTING MARKET SHARE, BY REGION, 2020 (%) 64

-

WESTERN EUROPE: HBA1C TESTING MARKET SHARE, BY COUNTRY, 2020 (%) 67

-

ASIA-PACIFIC: HBA1C TESTING MARKET SHARE, BY COUNTRY, 2020 (%) 84

-

MIDDLE EAST & AFRICA: HBA1C TESTING MARKET SHARE, BY REGION, 2020 (%) 99

-

GLOBAL HBA1C TESTING MARKET, MAJOR PLAYER MARKET SHARE ANALYSIS 2020 (%) 106

-

INDIA HBA1C TESTING MARKET, MAJOR PLAYER MARKET SHARE ANALYSIS 2020 (%) 107

-

ABBOTT LABORATORIES: FINANCIAL OVERVIEW SNAPSHOT 108

-

ABBOTT LABORATORIES: SWOT ANALYSIS 109

-

BIO-RAD LABORATORIES, INC.: FINANCIAL OVERVIEW SNAPSHOT 111

-

BIO-RAD LABORATORIES INC: SWOT ANALYSIS 113

-

DANAHER CORPORATION: FINANCIAL OVERVIEW SNAPSHOT 114

-

DANAHER CORPORATION: SWOT ANALYSIS 115

-

F. HOFFMANN-LA ROCHE LTD: FINANCIAL OVERVIEW SNAPSHOT 116

-

F. HOFFMANN-LA ROCHE LTD: SWOT ANALYSIS 117

-

SIEMENS: FINANCIAL OVERVIEW SNAPSHOT 119

-

SIEMENS HEALTHINEERS: SWOT ANALYSIS 120

-

EKF DIAGNOSTICS: FINANCIAL OVERVIEW SNAPSHOT 122

-

EKF DIAGNOSTICS: SWOT ANALYSIS 123

-

ARKRAY, INC.: SWOT ANALYSIS 126

-

TRINITY BIOTECH PLC.: FINANCIAL OVERVIEW SNAPSHOT 127

-

TRINITY BIOTECH PLC.: SWOT ANALYSIS 128

-

PTS DIAGNOSTICS: SWOT ANALYSIS 130

-

DIASYS DIAGNOSTIC SYSTEMS GMBH: SWOT ANALYSIS 132'

Leave a Comment