Market Share

Healthcare Security Systems Market Share Analysis

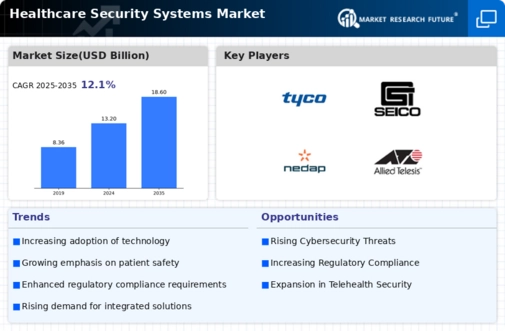

Establishing a strong market share position in the Healthcare Security Systems Market begins with the integration of advanced technologies. Companies should invest in incorporating cutting-edge technologies such as artificial intelligence (AI), machine learning, and biometrics into their security systems. These technologies enhance threat detection, improve response times, and provide a robust defense against evolving security challenges in healthcare settings. The completeness of the cybersecurity solutions is essential. In order to protect healthcare data against cyber threats, organizations must institute end-to-end cybersecurity mechanisms. This encompasses encryption protocols, firewalls, intrusion detection systems and routine security audits. Also, a comprehensive approach to cybersecurity establishes trust within healthcare organizations establishing the company as reliable security partner. Customization of healthcare environments is crucial. The security systems should be configured in accordance with the requirements and infrastructure of healthcare settings, which need to suit companies. This includes taking into account special issues in providing security for medical devices, patient records and other sensitive data; the solutions must integrate smoothly with current workflows used by healthcare providers. Interoperability with health information systems is a strategic move. Corporations need to build security systems that work interoperatively with electronic health records (EHR) and other healthcare information repositories. Integrated systems streamline the processes of security measures and allow to monitor threats in real time through the entire healthcare network. Proving mastery in regulatory compliance is a must. Corporations should pay close attention to the healthcare security laws, either in their own country or at large like Health Insurance Portability and Accountability Act (HIPAA) in USA or General Data Protection Regulation(GDRP). The fact that security systems follow these regulations makes certain credibility and trust of healthcare providers. Comprehensive incident response and recovery plans are vital. Companies should provide security solutions that not only prevent the occurrence of security incidents but also contain detailed procedures for mitigating and remedying potential breaches. Incident management that takes a broad approach minimizes the effect security incidents have on healthcare operations. Developing interfaces for medical personnel that are user-friendly is essential. The user interfaces of security systems should be easy for healthcare professionals to operate. Training programs and support services may further contribute to the development of user proficiency, ensuring that security measures are smoothly integrated into everyday activities carried out by healthcare personnel without interfering with them. Biometric access controls are strategic. Business entities ought to implement biometric authentication mechanisms that include fingerprint or retina scan systems for access control measures in hospitals. Biometrics offer an extra protective layer, allowing only authorized staff members to enter the restricted zones and gain access to confidential data. Delivering powerful cloud security solutions is mandated. Since cloud-based technologies are gaining more popularity in the health care industry, companies should develop security solutions that would protect data stored on clouds. This comprises of encryption during transmission, secured cloud storage system and continuous surveillance for possible weakness.

Leave a Comment