Market Analysis

In-depth Analysis of Heavy-duty Tire Market Industry Landscape

The Heavy-duty Tire Market is subject to various market factors that collectively influence its dynamics. A primary driver in this market is the growth of industries relying on heavy-duty vehicles, such as construction, mining, agriculture, and logistics. The demand for heavy-duty tires is closely linked to the expansion and development of these sectors. As construction projects surge and agricultural activities increase, the need for durable and robust tires for heavy-duty vehicles rises, driving the market forward.

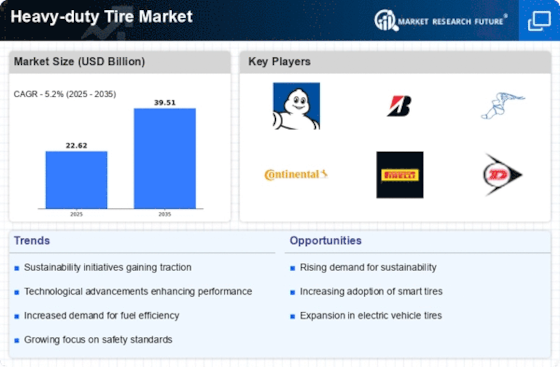

Technological advancements play a crucial role in shaping the Heavy-duty Tire Market. Manufacturers are continually investing in research and development to enhance tire performance, durability, and efficiency. Innovations such as advanced tread designs, improved rubber compounds, and the incorporation of smart tire technologies contribute to the overall evolution of heavy-duty tires. These technological advancements not only meet industry requirements but also address environmental concerns, focusing on fuel efficiency and sustainability.

Government regulations and standards in the transportation and industrial sectors significantly impact the Heavy-duty Tire Market. Regulations related to vehicle safety, emission standards, and load-carrying capacities influence the design and specifications of heavy-duty tires. Manufacturers must comply with these standards, leading to the development of tires that meet regulatory requirements while ensuring optimal performance and safety for heavy-duty vehicles.

The global economic landscape plays a vital role in the Heavy-duty Tire Market. Economic conditions affect industries that heavily rely on heavy-duty vehicles, influencing their investments in new equipment and maintenance. During periods of economic growth, industries expand their operations, leading to increased demand for heavy-duty tires. Conversely, economic downturns may result in reduced capital expenditure by industries, impacting the market negatively.

Consumer preferences and industry trends contribute significantly to the dynamics of the Heavy-duty Tire Market. End-users, including fleet operators and vehicle owners, prioritize factors such as fuel efficiency, tread life, and overall performance when selecting heavy-duty tires. Moreover, there is a growing trend towards eco-friendly and sustainable tire options, reflecting the broader shift towards environmental consciousness within the automotive industry.

Supply chain dynamics are critical factors influencing the Heavy-duty Tire Market. The availability of raw materials, manufacturing processes, and distribution networks impact the overall production and delivery of heavy-duty tires. Fluctuations in raw material prices, geopolitical events affecting the supply chain, and disruptions like the COVID-19 pandemic underscore the vulnerability of the heavy-duty tire market to external factors.

Competitive forces within the tire industry contribute to the market dynamics of heavy-duty tires. The presence of multiple tire manufacturers competing for market share results in continuous innovation and product development. Companies engage in research and development to introduce advanced tire technologies, gain a competitive edge, and cater to the diverse needs of heavy-duty vehicle operators.

Global environmental concerns and sustainability efforts have a growing influence on the Heavy-duty Tire Market. As industries increasingly adopt eco-friendly practices, there is a demand for tires that contribute to fuel efficiency, reduce emissions, and have a longer lifespan. Manufacturers are responding by developing tires with improved rolling resistance, lower environmental impact, and longer tread life, aligning with the broader goals of sustainability.

The aftermarket segment is another significant factor in the Heavy-duty Tire Market. As heavy-duty vehicles age, the need for replacement tires and maintenance services grows. Manufacturers and retailers often tailor their products to meet the specific requirements of the aftermarket, creating a secondary market that contributes to the overall dynamics of heavy-duty tire sales.

In conclusion, the Heavy-duty Tire Market is influenced by a combination of factors, including industry growth, technological advancements, government regulations, economic conditions, consumer preferences, supply chain dynamics, competition, environmental considerations, and the aftermarket. The interplay of these elements shapes the market landscape, driving tire manufacturers to innovate and adapt to meet the evolving needs of industries relying on heavy-duty vehicles.

Leave a Comment