High Density Interconnect PCB Market Trends

High Density Interconnect PCB Market Research Report Information By Interconnection Layers (1 Layer (1+N+1) HDI, 2 or more layers (2+N+2) HDI, and All Layers HDI), Application (into Consumer Electronics, Automotive, Military and Defense, Healthcare, Industrial/ Manufacturing, and Others), and By Region (North America, Europe, Asia-Pacific, Middle East & Africa, and South America) - Forecast...

Market Summary

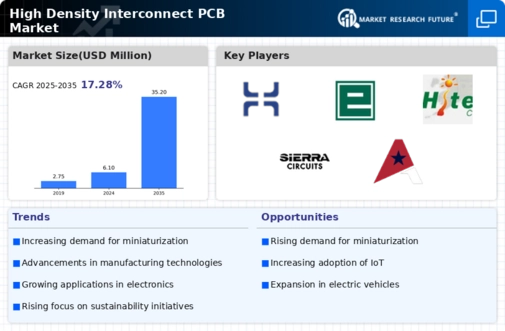

As per Market Research Future Analysis, the Global High Density Interconnect (HDI) PCB Market was valued at USD 6096.32 Million in 2024 and is projected to grow to USD 35205.74 Million by 2035, reflecting a CAGR of 17.28% from 2025 to 2035. The demand for HDI PCBs is driven by their advantages in high-tech applications, particularly in the healthcare and automotive sectors. The COVID-19 pandemic has further accelerated the demand for HDI PCBs in medical devices. Key technologies such as 5G are also creating growth opportunities for PCB manufacturers, necessitating advancements in R&D and production capabilities.

Key Market Trends & Highlights

The HDI PCB market is witnessing significant growth due to technological advancements and increasing applications across various sectors.

- Market Size in 2024: USD 6096.32 Million

- Projected Market Size by 2035: USD 35205.74 Million

- CAGR from 2025 to 2035: 17.28%

- Rising demand in healthcare applications, including medical imaging systems and devices.

Market Size & Forecast

| 2024 Market Size | USD 6096.32 Million |

| 2035 Market Size | USD 35205.74 Million |

| CAGR (2024-2035) | 17.28% |

| Largest Regional Market Share in 2024 | Asia-Pacific. |

Major Players

Compeq Manufacturing Co. Ltd., AT & S Austria Technologie & Systemtechnik Aktiengesellschaft, Unimicron, Tripod Technology, Zhen Ding Tech. Group Technology Holding Limited.

Market Trends

The ongoing evolution of technology and the increasing demand for miniaturization in electronic devices appear to be driving the growth of the High Density Interconnect PCB market, suggesting a robust future for advanced circuit board solutions.

U.S. Department of Commerce

High Density Interconnect PCB Market Market Drivers

Market Growth Projections

The Global High Density Interconnect PCB Market Industry is poised for remarkable growth, with projections indicating a rise from 6.1 USD Billion in 2024 to an impressive 35.2 USD Billion by 2035. This trajectory reflects the increasing reliance on high-density interconnect technologies across various sectors, including telecommunications, automotive, and consumer electronics. The anticipated compound annual growth rate of 17.28% from 2025 to 2035 underscores the industry's potential for expansion. As businesses and consumers alike seek more efficient and compact electronic solutions, the demand for high-density interconnect PCBs is likely to escalate, driving innovation and investment in this critical sector.

Advancements in Technology

Technological advancements play a crucial role in shaping the Global High Density Interconnect PCB Market Industry. Innovations in materials, such as high-frequency laminates and advanced substrate technologies, enable the production of PCBs that support faster signal transmission and improved thermal management. These advancements are particularly relevant in sectors like automotive and aerospace, where reliability and performance are critical. As the industry evolves, the integration of smart technologies and IoT devices further propels the demand for high-density interconnect solutions. The market is expected to witness a compound annual growth rate of 17.28% from 2025 to 2035, indicating a robust trajectory driven by these technological enhancements.

Surge in Consumer Electronics

The consumer electronics sector is a primary driver of the Global High Density Interconnect PCB Market Industry, as the proliferation of smart devices continues unabated. Products such as tablets, wearables, and smart home devices necessitate PCBs that can deliver high performance in compact designs. This demand is reflected in the market's anticipated growth, with a valuation of 6.1 USD Billion expected in 2024. The trend towards smart technology adoption, coupled with consumer preferences for multifunctional devices, propels manufacturers to innovate and enhance PCB capabilities. As a result, the industry is likely to see sustained growth as it adapts to the evolving landscape of consumer electronics.

Growth in Automotive Electronics

The automotive sector significantly influences the Global High Density Interconnect PCB Market Industry, driven by the increasing complexity of electronic systems in vehicles. Modern automobiles incorporate advanced driver-assistance systems, infotainment, and connectivity features, all of which require sophisticated PCB solutions. As electric vehicles gain traction, the demand for high-density interconnect PCBs is expected to rise, given their ability to support the intricate electronic architectures of these vehicles. The market's expansion is further underscored by projections indicating a growth to 35.2 USD Billion by 2035, highlighting the automotive industry's pivotal role in shaping future PCB requirements.

Rising Demand for Miniaturization

The Global High Density Interconnect PCB Market Industry experiences a notable surge in demand for miniaturization across various sectors, particularly in consumer electronics and telecommunications. As devices become increasingly compact, the need for PCBs that can accommodate higher component densities without compromising performance becomes paramount. This trend is exemplified by the smartphone industry, where manufacturers continuously strive to integrate more features into smaller form factors. The market is projected to reach 6.1 USD Billion in 2024, reflecting the industry's adaptation to these evolving consumer preferences. The push for miniaturization is likely to drive innovation in PCB design and manufacturing processes.

Emerging Markets and Global Expansion

Emerging markets present substantial opportunities for the Global High Density Interconnect PCB Market Industry, as economic development fosters increased demand for electronic products. Countries in Asia-Pacific and Latin America are witnessing rapid urbanization and rising disposable incomes, leading to greater consumption of consumer electronics and automotive technologies. This trend is likely to drive the need for high-density interconnect solutions, as manufacturers seek to establish a foothold in these burgeoning markets. The anticipated growth trajectory, with a CAGR of 17.28% from 2025 to 2035, suggests that the industry will continue to expand its global presence, adapting to the unique demands of diverse markets.

Market Segment Insights

High Density Interconnect PCB Interconnection layer Insights

By Interconnection Layers, the High Density Interconnect (HDI) PCB market has been categorized as 1 Layer (1+N+1) HDI, 2 or more layers (2+N+2) HDI, and All Layers HDI. During the projected period, the demand for All Layers HDI segment is expected to grow rapidly.

FIGURE 2: HIGH DENSITY INTERCONNECT PCB MARKET SIZE (USD MN) BY INTERCONNECTION LAYER 2022 VS 2032

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

High Density Interconnect PCB Application Insights

Based on Application, the High Density Interconnect (HDI) PCB market has been segmented into Consumer Electronics, Automotive, Military and Defense, Healthcare, Industrial/ Manufacturing, and Others. During the projected period, the automotive segment is expected to rise rapidly.

FIGURE 2: HIGH DENSITY INTERCONNECT PCB MARKET SIZE (USD MN) BY APPLICATION 2022 VS 2032

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Get more detailed insights about High Density Interconnect PCB Market Research Report – Forecast 2032

Regional Insights

Geographically, the market is segmented into North America, Europe, Asia-Pacific, Middle East and Africa and South America region.

Asia Pacific is expected to have a significant share of the High Density Interconnect PCB Market during the projected period.

The increasing use of printed circuit boards in the electronics, aerospace, IT & telecom, industrial, and automotive industries is driving market expansion in terms of value sales. Growing demand for technology, greater investment in R&D by enterprises in countries such as China and Japan, and government backing are some of the drivers driving market expansion. Continuous efforts in printed circuit board R&D to investigate prospective applications in different end use sectors are expected to drive market growth during the projected period.

Growing demand for printed circuit boards as a result of increased use of sophisticated devices is expected to drive market expansion during the forecast period. China, for example, has a complicated industrial chain that includes copper foil, glass fibre, resin, copper-clad laminates, and PCBs as its final component. The market has expanded even more as Western countries' desire for Asian consumer electronics has soared.

The increased usage of home appliances is also a consequence of the region's expanding disposable income in countries such as China, India, and other South-East Asian countries, which is expected to boost the local market throughout the projection period.

FIGURE 3: HIGH DENSITY INTERCONNECT PCB MARKET SIZE (USD MILLION) BY REGION 2022 VS 2032 Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Key Players and Competitive Insights

The Global High Density Interconnect (HDI) PCB Market is witnessed significant growth over the forecast period due to increasing benefits of High density interconnect technology, and rising demand of HDI PCBs in Complex electronic devices. There are several domestic, regional, and global players operating in the High Density Interconnect (HDI) PCB market who continuously strive to gain a significant share of the overall market. During the study, MRFR has analyzed some of the major players in the global High Density Interconnect (HDI) PCB market who have contributed to the market growth. Among these, Compeq Manufacturing Co.

Ltd., AT & S Austria Technologie & Systemtechnik Aktiengesellschaft, Unimicron, Tripod Technology, and Zhen Ding Tech. Group Technology Holding Limited are among the top 5 players in the global High Density Interconnect (HDI) PCB market. These players focus on expanding and enhancing their product portfolio and services to remain competitive and increase their customer base. Additionally, these players are focusing on partnerships & collaborations to expand their business and customer base to enhance their market position.

June 2022: NCAB acquired 100 percent of the shares in Kestrel International Circuits Ltd from the Merlin PCB Group Ltd. Kestrel is known as a leading source for a wide range of high-quality PCBs and the very highest levels of service for its customers in the Aerospace, Automotive, Medical, Broadcasting, Telecommunications, Industrial and Commercial markets. Kestrel will be included in NCAB Group UK, a division of the NCAB Group's section Europe. Synergies are anticipated in logistics, suppliers, payment terms, and factory management.

Key Companies in the High Density Interconnect PCB Market market include

Industry Developments

July 2022: Meiko has acquired NEC Embedded Products, Ltd., Ltd. Meiko Electronics will purchase 403,800 equity shares of NEC Embedded Products, Ltd. as part of the deal. NEC Embedded Products, Ltd. reported sales of $14.03 billion, net assets of $3.61 billion, total assets of $9.98 billion, and an operating loss of 184 million for the year ended March 31, 2022.

September 2021: NCAB Group acquired RedBoard Circuits, LLC, in the USA. RedBoard Circuits will contribute to NCAB Group's objective to take on a leading position in the U.S PCB market.

December 2021: NCAB Group acquired 100 percent of the shares in META Leiterplatten GmbH & CO. KG based in Villingen-Schwenningen in southern Germany. The company provides customers with PCB solutions in the HMLV (High-Mix-Low-Volume) segment, mainly in the industrial, consumer, and medical sectors. Their suppliers are located in China and Taiwan. This enhances the customer base in China and Taiwan.

Future Outlook

High Density Interconnect PCB Market Future Outlook

The High Density Interconnect PCB Market is poised for robust growth, driven by technological advancements and increasing demand, with a projected 17.28% CAGR from 2025 to 2035.

New opportunities lie in:

- Develop advanced materials for enhanced thermal management in HDI PCBs.

- Invest in automation technologies for efficient PCB manufacturing processes.

- Expand into emerging markets with tailored HDI PCB solutions for local industries.

By 2035, the High Density Interconnect PCB Market is expected to achieve substantial growth, reflecting evolving technological needs.

Market Segmentation

High Density Interconnect PCB Regional Outlook

- US

- Canada

- Mexico

High Density Interconnect PCB Application Outlook

- Consumer Electronics

- Automotive

- Military and Defense

- Healthcare

- Industrial/ Manufacturing

- Others

High Density Interconnect PCB Interconnection Layers Outlook

- 1 Layer (1+N+1) HDI

- 2 or more layers (2+N+2) HDI

- All Layers HDI

Report Scope

| Report Attribute/Metric | Details |

| Market Size 2024 | USD 6096.3156 Million |

| Market Size 2035 | 35205.74 |

| Compound Annual Growth Rate (CAGR) | 17.28% (2025 - 2035) |

| Base Year | 2024 |

| Forecast Period | 2025 - 2035 |

| Historical Data | 2018-2022 |

| Forecast Units | Value (USD Million) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | Interconnection Layers and Application |

| Geographies Covered | North America, Europe, Asia Pacific, Middle East & Africa, and South America |

| Countries Covered | The U.S, Canada, Mexico, Germany, France, UK, China, Japan, India, Australia, South Korea, UAE, and Brazil |

| Key Companies Profiled | Unimicron, Epec, LLC, TTM Technologies Inc., RayMing Technology, HiTech Circuits, NCAB Group Corporation, Millennium Circuits Limited, Tripod Technology, Zhen Ding Tech. Group Technology Holding Limited, AKM Meadville, Meiko Electronics Co., Ltd., Sierra Circuits Inc., Compeq Manufacturing Co., Ltd, AT & S (Austria Technologie & Systemtechnik Aktiengesellschaft), Advanced Circuits, and DAP Coroporation. |

| Key Market Opportunities | Technological advancement in HDI PCB 5G technology as a growth opportunity for PCB designers Rising demand for consumer electronics |

| Key Market Dynamics | Increasing benefits of high density interconnect technology Rising demand of HDI PCBs in complex electronic devices Growing demand for circuit miniaturization |

| Market Size 2025 | 7149.88 |

Market Highlights

Author

Latest Comments

This is a great article! Really helped me understand the topic better.

Thanks for sharing this. I’ve bookmarked it for later reference.

FAQs

What is the market size for 2032, for the High Density Interconnect PCB Market?

High Density Interconnect PCB Market is Projected to Reach USD 21,823.6 Million in 2032

What is the growth rate of the High Density Interconnect PCB market?

The global market is projected to grow at a CAGR of 17.28% during the forecast period, 2024-2032.

Which region held the largest market share in the High Density Interconnect PCB market?

From 2024 to 2032, Asia Pacific has the potential to achieve the top position in the global market.

Who are the prominent players in the High Density Interconnect PCB market?

Unimicron, Epec, LLC, TTM Technologies Inc., RayMing Technology, HiTech Circuits, NCAB Group Corporation, Millennium Circuits Limited, Tripod Technology, Zhen Ding Tech. Group Technology Holding Limited, AKM Meadville, Meiko Electronics Co., Ltd., Sierra Circuits Inc., Compeq Manufacturing Co., Ltd, AT & S (Austria Technologie & Systemtechnik Aktiengesellschaft), Advanced Circuits, and DAP Coroporation.

-

Table of Contents

-

Executive Summary

-

Market Attractiveness Analysis

- Global High Density Interconnect PCB Market, by Interconnection Layers

- Global High Density Interconnect PCB Market, by Application

- Global High Density Interconnect PCB Market, by Region

-

Market Attractiveness Analysis

-

Market Introduction

- Definition

- Scope of the Study

- Market Structure

- Key Buying Criteria

- Macro Factor Indicator Analysis

-

Research Methodology

- Research Process

- Primary Research

- Secondary Research

- Market Size Estimation

- Forecast Model

- List of Assumptions

-

MARKET DYNAMICS

- Introduction

-

Drivers

- Increasing benefits of high density interconnect technology

- Rising demand of HDI PCBs in complex electronic devices

- Growing demand for circuit miniaturization

- Drivers Impact Analysis

-

Challenges

- Introducing HDI technology in PCB for space application

- 5G technology related PCB design challenges

- Challenges faced in any-layer interconnection high density (ALV HDI) in mass productions

- Restraints Impact Analysis

-

Opportunities

- Technological advancement in HDI PCB

- 5G technology as a growth opportunity for PCB designers

- Rising demand for consumer electronics

-

Impact of COVID-19

- Impact On Semiconductor Industry

- Impact On the medical electronic Industry

- Impact On global PCB supply chain

- Rising need for digitalization of the supply chain

-

MARKET FACTOR ANALYSIS

- Value Chain Analysis/Supply Chain Analysis

- Porter’s Five Forces Model

- Bargaining Power of Suppliers

- Bargaining Power of Buyers

- Threat of New Entrants

- Threat of Substitutes

- Intensity of Rivalry

-

GLOBAL HIGH DENSITY INTERCONNECT PCB MARKET, BY INTERCONNECTION LAYERS

- Introduction

- 1 Layer (1+N+1) HDI

- 2 or more layers (2+N+2) HDI

- All Layers HDI

-

GLOBAL HIGH DENSITY INTERCONNECT PCB MARKET, BY APPLICATION

- Introduction

- Consumer Electronics

- Automotive

- Military and Defense

- Healthcare

- Industrial/ Manufacturing

- Others

-

GLOBAL HIGH DENSITY INTERCONNECT PCB MARKET SIZE ESTIMATION & FORECAST, BY REGION

- Introduction

-

North America

- Market Estimates & Forecast, by Country, 2024 - 2032

- Market Estimates & Forecast, by Interconnection Layers, 2024 - 2032

- Market Estimates & Forecast, by Application, 2024 - 2032

- US

- Market Estimates & Forecast, by Interconnection Layers, 2024 - 2032

- Market Estimates & Forecast, by Application, 2024 - 2032

- Canada

- Market Estimates & Forecast, by Interconnection Layers, 2024 - 2032

- Market Estimates & Forecast, by Application, 2024 - 2032

- Mexico

- Market Estimates & Forecast, by Interconnection Layers, 2024 - 2032

- Market Estimates & Forecast, by Application, 2024 - 2032

-

Europe

- Market Estimates & Forecast, by Country, 2024 - 2032

- Market Estimates & Forecast, by Interconnection Layers, 2024 - 2032

- Market Estimates & Forecast, by Application, 2024 - 2032

- UK

- Germany

- France

- Rest of Europe

-

Asia-Pacific

- Market Estimates & Forecast, by Country, 2024 - 2032

- Market Estimates & Forecast, by Interconnection Layers, 2024 - 2032

- Market Estimates & Forecast, by Application, 2024 - 2032

- China

- Japan

- India

- Rest of Asia-Pacific

-

Middle East & Africa

- Market Estimates & Forecast, by Interconnection Layers, 2024 - 2032

- Market Estimates & Forecast, by Application, 2024 - 2032

-

South America

- Market Estimates & Forecast, by Interconnection Layers, 2024 - 2032

- Market Estimates & Forecast, by Application, 2024 - 2032

-

Competitive Landscape

- Introduction

- Key Developments & Growth Strategies

- Competitor Benchmarking

- Vendor Share Analysis, 2021(% Share)

-

COMPANY PROFILES

-

Unimicron, Epec, LLC

- Company Overview

- Financial Overview

- Solution/Services Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

TTM Technologies Inc.

- Company Overview

- Financial Overview

- Solution/Services Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

RayMing Technology

- Company Overview

- Financial Overview

- Solution/Services Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

HiTech Circuits

- Company Overview

- Financial Overview

- Solution/Services Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

NCAB Group Corporation

- Company Overview

- Financial Overview

- Solution/Services Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Millennium Circuits Limited

- Company Overview

- Financial Overview

- Solution/Services Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Tripod Technology

- Company Overview

- Financial Overview

- Solution/Services Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Zhen Ding Tech. Group Technology Holding Limited

- Company Overview

- Financial Overview

- Solution/Services Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

AKM Meadville

- Company Overview

- Financial Overview

- Solution/Services Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Meiko Electronics Co., Ltd.

- Company Overview

- Financial Overview

- Solution/Services Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Sierra Circuits Inc.

- Company Overview

- Financial Overview

- Solution/Services Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Compeq Manufacturing Co., Ltd.

- Company Overview

- Financial Overview

- Solution/Services Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

AT & S (Austria Technologie & Systemtechnik Aktiengesellschaft)

- Company Overview

- Financial Overview

- Solution/Services Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Advanced Circuits

- Company Overview

- Financial Overview

- Solution/Services Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

DAP Corporation

- Company Overview

- Financial Overview

- Solution/Services Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Unimicron, Epec, LLC

-

NOTE:

-

This table of content is tentative and subject to change as the research progresses.

-

In section 12, only the top 10 companies will be profiled. Each company will be profiled based on the Market Overview, Financials, Service Portfolio, Business Strategies, and Recent Developments parameters.

-

The companies are selected based on two broad criteria¬– strength of Type portfolio and excellence in business strategies.

-

Key parameters considered for evaluating strength of the vendor’s Type portfolio are industry experience, Type capabilities/features, innovations/R&D investment, flexibility to customize the Type, ability to integrate with other systems, pre- and post-sale services, and customer ratings/feedback.

-

Key parameters considered for evaluating a vendor’s excellence in business strategy are its market share, global presence, customer base, partner ecosystem (Provider alliances/resellers/distributors), acquisitions, and marketing strategies/investments.

-

The financial details of the company cannot be provided if the information is not available in the public domain and or from reliable sources.

-

List of Tables and Figures

- LIST OF TABLES

- TABLE 1 MARKET SYNOPSIS 17

- TABLE 2 GLOBAL HIGH DENSITY INTERCONNECT (HDI) PCB MARKET, BY INTERCONNECTION LAYERS, 2024 - 2032 (USD MILLION) 41

- TABLE 3 GLOBAL HIGH DENSITY INTERCONNECT (HDI) PCB MARKET, BY APPLICATION, 2024 - 2032 (USD MILLION) 43

- TABLE 4 GLOBAL HIGH DENSITY INTERCONNECT (HDI) PCB MARKET, BY REGION, 2024 - 2032 (USD MILLION) 46

- TABLE 5 NORTH AMERICA HIGH DENSITY INTERCONNECT (HDI) PCB MARKET, BY COUNTRY, 2024 - 2032 (USD MILLION) 48

- TABLE 6 NORTH AMERICA HIGH DENSITY INTERCONNECT (HDI) PCB MARKET, BY INTERCONNECTION LAYERS, 2024 - 2032 (USD MILLION) 49

- TABLE 7 NORTH AMERICA HIGH DENSITY INTERCONNECT (HDI) PCB MARKET, BY APPLICATION, 2024 - 2032 (USD MILLION) 49

- TABLE 8 US HIGH DENSITY INTERCONNECT (HDI) PCB MARKET, BY INTERCONNECTION LAYERS, 2024 - 2032 (USD MILLION) 50

- TABLE 9 US HIGH DENSITY INTERCONNECT (HDI) PCB MARKET, BY APPLICATION, 2024 - 2032 (USD MILLION) 50

- TABLE 10 CANADA HIGH DENSITY INTERCONNECT (HDI) PCB MARKET, BY INTERCONNECTION LAYERS, 2024 - 2032 (USD MILLION) 50

- TABLE 11 CANADA HIGH DENSITY INTERCONNECT (HDI) PCB MARKET, BY APPLICATION, 2024 - 2032 (USD MILLION) 51

- TABLE 12 MEXICO HIGH DENSITY INTERCONNECT (HDI) PCB MARKET, BY INTERCONNECTION LAYERS, 2024 - 2032 (USD MILLION) 51

- TABLE 13 MEXICO HIGH DENSITY INTERCONNECT (HDI) PCB MARKET, BY APPLICATION, 2024 - 2032 (USD MILLION) 51

- TABLE 14 EUROPE HIGH DENSITY INTERCONNECT (HDI) PCB MARKET, BY COUNTRY, 2024 - 2032 (USD MILLION) 55

- TABLE 15 EUROPE HIGH DENSITY INTERCONNECT (HDI) PCB MARKET, BY INTERCONNECTION LAYERS, 2024 - 2032 (USD MILLION) 55

- TABLE 16 EUROPE HIGH DENSITY INTERCONNECT (HDI) PCB MARKET, BY APPLICATION, 2024 - 2032 (USD MILLION) 56

- TABLE 17 GERMANY HIGH DENSITY INTERCONNECT (HDI) PCB MARKET, BY INTERCONNECTION LAYERS, 2024 - 2032 (USD MILLION) 57

- TABLE 18 GERMANY HIGH DENSITY INTERCONNECT (HDI) PCB MARKET, BY APPLICATION, 2024 - 2032 (USD MILLION) 57

- TABLE 19 FRANCE HIGH DENSITY INTERCONNECT (HDI) PCB MARKET, BY INTERCONNECTION LAYERS, 2024 - 2032 (USD MILLION) 57

- TABLE 20 FRANCE HIGH DENSITY INTERCONNECT (HDI) PCB MARKET, BY APPLICATION, 2024 - 2032 (USD MILLION) 58

- TABLE 21 UK HIGH DENSITY INTERCONNECT (HDI) PCB MARKET, BY INTERCONNECTION LAYERS, 2024 - 2032 (USD MILLION) 58

- TABLE 22 UK HIGH DENSITY INTERCONNECT (HDI) PCB MARKET, BY APPLICATION, 2024 - 2032 (USD MILLION) 58

- TABLE 23 REST OF EUROPE HIGH DENSITY INTERCONNECT (HDI) PCB MARKET, BY INTERCONNECTION LAYERS, 2024 - 2032 (USD MILLION) 59

- TABLE 24 REST OF EUROPE HIGH DENSITY INTERCONNECT (HDI) PCB MARKET, BY APPLICATION, 2024 - 2032 (USD MILLION) 59

- TABLE 25 ASIA-PACIFIC HIGH DENSITY INTERCONNECT (HDI) PCB MARKET, BY COUNTRY, 2024 - 2032 (USD MILLION) 61

- TABLE 26 ASIA-PACIFIC HIGH DENSITY INTERCONNECT (HDI) PCB MARKET, BY INTERCONNECTION LAYERS, 2024 - 2032 (USD MILLION) 62

- TABLE 27 ASIA-PACIFIC HIGH DENSITY INTERCONNECT (HDI) PCB MARKET, BY APPLICATION, 2024 - 2032 (USD MILLION) 62

- TABLE 28 CHINA HIGH DENSITY INTERCONNECT (HDI) PCB MARKET, BY INTERCONNECTION LAYERS, 2024 - 2032 (USD MILLION) 63

- TABLE 29 CHINA HIGH DENSITY INTERCONNECT (HDI) PCB MARKET, BY APPLICATION, 2024 - 2032 (USD MILLION) 63

- TABLE 30 JAPAN HIGH DENSITY INTERCONNECT (HDI) PCB MARKET, BY INTERCONNECTION LAYERS, 2024 - 2032 (USD MILLION) 63

- TABLE 31 JAPAN HIGH DENSITY INTERCONNECT (HDI) PCB MARKET, BY APPLICATION, 2024 - 2032 (USD MILLION) 64

- TABLE 32 INDIA HIGH DENSITY INTERCONNECT (HDI) PCB MARKET, BY INTERCONNECTION LAYERS, 2024 - 2032 (USD MILLION) 64

- TABLE 33 INDIA HIGH DENSITY INTERCONNECT (HDI) PCB MARKET, BY APPLICATION, 2024 - 2032 (USD MILLION) 64

- TABLE 34 REST OF ASIA-PACIFIC HIGH DENSITY INTERCONNECT (HDI) PCB MARKET, BY INTERCONNECTION LAYERS, 2024 - 2032 (USD MILLION) 65

- TABLE 35 REST OF ASIA-PACIFIC HIGH DENSITY INTERCONNECT (HDI) PCB MARKET, BY APPLICATION, 2024 - 2032 (USD MILLION) 65

- TABLE 36 REST OF THE WORLD HIGH DENSITY INTERCONNECT (HDI) PCB MARKET, BY COUNTRY, 2024 - 2032 (USD MILLION) 67

- TABLE 37 REST OF THE WORLD HIGH DENSITY INTERCONNECT (HDI) PCB MARKET, BY INTERCONNECTION LAYERS, 2024 - 2032 (USD MILLION) 67

- TABLE 38 REST OF THE WORLD HIGH DENSITY INTERCONNECT (HDI) PCB MARKET, BY APPLICATION, 2024 - 2032 (USD MILLION) 68

- TABLE 39 MIDDLE EAST & AFRICA HIGH DENSITY INTERCONNECT (HDI) PCB MARKET, BY INTERCONNECTION LAYERS, 2024 - 2032 (USD MILLION) 69

- TABLE 40 MIDDLE EAST & AFRICA HIGH DENSITY INTERCONNECT (HDI) PCB MARKET, BY APPLICATION, 2024 - 2032 (USD MILLION) 69

- TABLE 41 SOUTH AMERICA HIGH DENSITY INTERCONNECT (HDI) PCB MARKET, BY INTERCONNECTION LAYERS, 2024 - 2032 (USD MILLION) 69

- TABLE 42 SOUTH AMERICA HIGH DENSITY INTERCONNECT (HDI) PCB MARKET, BY APPLICATION, 2024 - 2032 (USD MILLION) 70

- TABLE 43 BUSINESS EXPANSIONS/ACQUISITIONS 73

- TABLE 44 UNIMICRON: PRODUCTS/SOLUTIONS/SERVICES OFFERED 77

- TABLE 45 EPEC, LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED 78

- TABLE 46 EPEC, LLC: KEY DEVELOPMENTS 78

- TABLE 47 TTM TECHNOLOGIES INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED 81

- TABLE 48 RAYMING TECHNOLOGY: PRODUCTS/SOLUTIONS/SERVICES OFFERED 83

- TABLE 49 HITECH CIRCUITS: PRODUCTS/SOLUTIONS/SERVICES OFFERED 84

- TABLE 50 NCAB GROUP CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED 86

- TABLE 51 NCAB GROUP CORPORATION: KEY DEVELOPMENTS 86

- TABLE 52 MILENNIUM CIRCUITS LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED 89

- TABLE 53 TRIPOD TECHNOLOGY: PRODUCTS/SOLUTIONS/SERVICES OFFERED 90

- TABLE 54 ZHEN DING TECH. GROUP TECHNOLOGY HOLDING LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED 93

- TABLE 55 AKM MEADVILLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED 96

- TABLE 56 MEIKO ELECTRONICS CO., LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED 99

- TABLE 57 MEIKO ELECTRONICS CO., LTD: KEY DEVELOPMENTS 100

- TABLE 58 SIERRA CIRCUITS INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED 102

- TABLE 59 COMPEQ MANUFACTURING CO. LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED 104

- TABLE 60 AT & S AUSTRIA TECHNOLOGIE & SYSTEMTECHNIK AKTIENGESELLSCHAFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED 106

- TABLE 61 ADVANCED CIRCUIT.: PRODUCTS/SOLUTIONS/SERVICES OFFERED 108

- TABLE 62 DAP CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED 109 LIST OF FIGURES

- FIGURE 1 MARKET ATTRACTIVENESS ANALYSIS: GLOBAL HIGH DENSITY INTERCONNECT (HDI) PCB MARKET 18

- FIGURE 2 GLOBAL HIGH DENSITY INTERCONNECT (HDI) PCB MARKET: MARKET STRUCTURE 20

- FIGURE 3 BOTTOM-UP AND TOP-DOWN APPROACHES 25

- FIGURE 4 MARKET DYNAMIC ANALYSIS OF THE GLOBAL HIGH DENSITY INTERCONNECT (HDI) PCB MARKET 28

- FIGURE 5 DRIVER IMPACT ANALYSIS 30

- FIGURE 6 GLOBAL HIGH DENSITY INTERCONNECT (HDI) PCB MARKET: SUPPLY CHAIN ANALYSIS 36

- FIGURE 7 PORTER''S FIVE FORCES ANALYSIS OF THE HIGH DENSITY INTERCONNECT (HDI) PCB MARKET 38

- FIGURE 8 GLOBAL HIGH DENSITY INTERCONNECT (HDI) PCB MARKET, BY INTERCONNECTION LAYERS, 2022 (% SHARE) 40

- FIGURE 9 GLOBAL HIGH DENSITY INTERCONNECT (HDI) PCB MARKET, BY INTERCONNECTION LAYERS, 2024 VS 2032 (USD MILLION) 40

- FIGURE 10 GLOBAL HIGH DENSITY INTERCONNECT (HDI) PCB MARKET, BY APPLICATION, 2022 (% SHARE) 42

- FIGURE 11 GLOBAL HIGH DENSITY INTERCONNECT (HDI) PCB MARKET, BY APPLICATION, 2024 VS 2032 (USD MILLION) 42

- FIGURE 12 GLOBAL HIGH DENSITY INTERCONNECT (HDI) PCB MARKET, BY REGION, 2022 (% SHARE) 45

- FIGURE 13 GLOBAL HIGH DENSITY INTERCONNECT (HDI) PCB MARKET, BY REGION, 2024 VS 2032 (USD MILLION) 45

- FIGURE 14 NORTH AMERICA HIGH DENSITY INTERCONNECT (HDI) PCB MARKET, BY COUNTRY, 2022 (% SHARE) 47

- FIGURE 15 NORTH AMERICA HIGH DENSITY INTERCONNECT (HDI) PCB MARKET, BY COUNTRY, 2024 VS 2032 (USD MILLION) 48

- FIGURE 16 NORTH AMERICA HIGH DENSITY INTERCONNECT (HDI) PCB MARKET, BY INTERCONNECTION LAYERS, 2024 - 2032 (USD MILLION) 48

- FIGURE 17 NORTH AMERICA HIGH DENSITY INTERCONNECT (HDI) PCB MARKET, BY APPLICATION, 2024 - 2032 (USD MILLION) 49

- FIGURE 18 EUROPE HIGH DENSITY INTERCONNECT (HDI) PCB MARKET, BY COUNTRY, 2022 (% SHARE) 53

- FIGURE 19 EUROPE HIGH DENSITY INTERCONNECT (HDI) PCB MARKET, BY COUNTRY, 2024 VS 2032 (USD MILLION) 53

- FIGURE 20 EUROPE HIGH DENSITY INTERCONNECT (HDI) PCB MARKET, BY INTERCONNECTION LAYERS, 2024 - 2032 (USD MILLION) 55

- FIGURE 21 EUROPE HIGH DENSITY INTERCONNECT (HDI) PCB MARKET, BY APPLICATION, 2024 - 2032 (USD MILLION) 56

- FIGURE 22 ASIA-PACIFIC HIGH DENSITY INTERCONNECT (HDI) PCB MARKET, BY COUNTRY, 2022 (% SHARE) 60

- FIGURE 23 ASIA-PACIFIC HIGH DENSITY INTERCONNECT (HDI) PCB MARKET, BY COUNTRY, 2024 VS 2032 (USD MILLION) 61

- FIGURE 24 ASIA-PACIFIC HIGH DENSITY INTERCONNECT (HDI) PCB MARKET, BY INTERCONNECTION LAYERS, 2024 - 2032 (USD MILLION) 61

- FIGURE 25 ASIA-PACIFIC HIGH DENSITY INTERCONNECT (HDI) PCB MARKET, BY APPLICATION, 2024 - 2032 (USD MILLION) 62

- FIGURE 26 REST OF THE WORLD HIGH DENSITY INTERCONNECT (HDI) PCB MARKET, BY COUNTRY, 2022 (% SHARE) 66

- FIGURE 27 REST OF THE WORLD HIGH DENSITY INTERCONNECT (HDI) PCB MARKET, BY COUNTRY, 2024 VS 2032 (USD MILLION) 66

- FIGURE 28 REST OF THE WORLD HIGH DENSITY INTERCONNECT (HDI) PCB MARKET, BY INTERCONNECTION LAYERS, 2024 - 2032 (USD MILLION) 67

- FIGURE 29 REST OF THE WORLD HIGH DENSITY INTERCONNECT (HDI) PCB MARKET, BY APPLICATION, 2024 - 2032 (USD MILLION) 68

- FIGURE 30 GLOBAL HIGH DENSITY INTERCONNECT (HDI) PCB MARKET: COMPETITIVE BENCHMARKING 72

- FIGURE 31 VENDOR SHARE ANALYSIS, 2021 (%) 73

- FIGURE 32 UNIMICRON: FINANCIAL OVERVIEW SNAPSHOT 76

- FIGURE 33 UNIMICRON: SWOT ANALYSIS 77

- FIGURE 34 EPEC, LLC: SWOT ANALYSIS 79

- FIGURE 35 TTM TECHNOLOGIES INC.: FINANCIAL OVERVIEW SNAPSHOT 81

- FIGURE 36 TTM TECHNOLOGIES INC.: SWOT ANALYSIS 82

- FIGURE 37 NCAB GROUP CORPORATION: FINANCIAL OVERVIEW SNAPSHOT 85

- FIGURE 38 NCAB GROUP CORPORATION: SWOT ANALYSIS 88

- FIGURE 39 TRIPOD TECHNOLOGY: FINANCIAL OVERVIEW SNAPSHOT 90

- FIGURE 40 TRIPOD TECHNOLOGY: SWOT ANALYSIS 91

- FIGURE 41 ZHEN DING TECH. GROUP TECHNOLOGY HOLDING LIMITED: FINANCIAL OVERVIEW SNAPSHOT 92

- FIGURE 42 ZHEN DING TECH. GROUP TECHNOLOGY HOLDING LIMITED: SWOT ANALYSIS 93

- FIGURE 43 AKM MEADVILLE (AKM INDUSTRIAL COMPANY LIMITED): FINANCIAL OVERVIEW SNAPSHOT 95

- FIGURE 44 AKM MEADVILLE: SWOT ANALYSIS 97

- FIGURE 45 MEIKO ELECTRONICS CO., LTD.: FINANCIAL OVERVIEW SNAPSHOT 99

- FIGURE 46 MEIKO ELECTRONICS CO., LTD: SWOT ANALYSIS 100

- FIGURE 47 COMPEQ MANUFACTURING CO., LTD: FINANCIAL OVERVIEW SNAPSHOT 103

- FIGURE 48 COMPEQ MANUFACTURING CO. LTD.: SWOT ANALYSIS 104

- FIGURE 49 AT & S (AUSTRIA TECHNOLOGIE & SYSTEMTECHNIK AKTIENGESELLSCHAFT): FINANCIAL OVERVIEW SNAPSHOT 105

- FIGURE 50 AT & S (AUSTRIA TECHNOLOGIE & SYSTEMTECHNIK AKTIENGESELLSCHAFT): SWOT ANALYSIS 107

High Density Interconnect PCB Market Segmentation

Global High Density Interconnect PCB, By Interconnection Layers Outlook (USD Million, 2018-2032)

- 1 Layer (1+N+1) HDI

- 2 or more layers (2+N+2) HDI

- All Layers HDI

Global High Density Interconnect PCB, By Application Outlook (USD Million, 2018-2032)

- Consumer Electronics

- Automotive

- Military and Defense

- Healthcare

- Industrial/ Manufacturing

- Others

Global High Density Interconnect PCB Regional Outlook (USD Million, 2018-2032)

North America Outlook (USD Million, 2018-2032)

North America High Density Interconnect PCB, By Interconnection Layers Outlook (USD Million, 2018-2032)

- Layer (1+N+1) HDI

- 2 or more layers (2+N+2) HDI

- All Layers HDI

North America High Density Interconnect PCB, By Application (USD Million, 2018-2032)

- Consumer Electronics

- Automotive

- Military and Defense

- Healthcare

- Industrial/ Manufacturing

- Others

US Outlook (USD Million, 2018-2032)

US High Density Interconnect PCB, By Interconnection Layers Outlook (USD Million, 2018-2032)

- Layer (1+N+1) HDI

- 2 or more layers (2+N+2) HDI

- All Layers HDI

US High Density Interconnect PCB, By Application (USD Million, 2018-2032)

- Consumer Electronics

- Automotive

- Military and Defense

- Healthcare

- Industrial/ Manufacturing

- Others

Canada Outlook (USD Million, 2018-2032)

Canada High Density Interconnect PCB, By Interconnection Layers Outlook (USD Million, 2018-2032)

- Layer (1+N+1) HDI

- 2 or more layers (2+N+2) HDI

- All Layers HDI

Canada High Density Interconnect PCB, By Application (USD Million, 2018-2032)

- Consumer Electronics

- Automotive

- Military and Defense

- Healthcare

- Industrial/ Manufacturing

- Others

Mexico Outlook (USD Million, 2018-2032)

Mexico High Density Interconnect PCB, By Interconnection Layers Outlook (USD Million, 2018-2032)

- Layer (1+N+1) HDI

- 2 or more layers (2+N+2) HDI

- All Layers HDI

Mexico High Density Interconnect PCB, By Application (USD Million, 2018-2032)

- Consumer Electronics

- Automotive

- Military and Defense

- Healthcare

- Industrial/ Manufacturing

- Others

Europe Outlook (USD Million, 2018-2032)

Europe High Density Interconnect PCB, By Interconnection Layers Outlook (USD Million, 2018-2032)

- Layer (1+N+1) HDI

- 2 or more layers (2+N+2) HDI

- All Layers HDI

Europe High Density Interconnect PCB, By Application (USD Million, 2018-2032)

- Consumer Electronics

- Automotive

- Military and Defense

- Healthcare

- Industrial/ Manufacturing

- Others

Germany Outlook (USD Million, 2018-2032)

Germany High Density Interconnect PCB, By Interconnection Layers Outlook (USD Million, 2018-2032)

- Layer (1+N+1) HDI

- 2 or more layers (2+N+2) HDI

- All Layers HDI

Germany High Density Interconnect PCB, By Application (USD Million, 2018-2032)

- Consumer Electronics

- Automotive

- Military and Defense

- Healthcare

- Industrial/ Manufacturing

- Others

France Outlook (USD Million, 2018-2032)

France High Density Interconnect PCB, By Interconnection Layers Outlook (USD Million, 2018-2032)

- Layer (1+N+1) HDI

- 2 or more layers (2+N+2) HDI

- All Layers HDI

France High Density Interconnect PCB, By Application (USD Million, 2018-2032)

- Consumer Electronics

- Automotive

- Military and Defense

- Healthcare

- Industrial/ Manufacturing

- Others

UK Outlook (USD Million, 2018-2032)

UK High Density Interconnect PCB, By Interconnection Layers Outlook (USD Million, 2018-2032)

- Layer (1+N+1) HDI

- 2 or more layers (2+N+2) HDI

- All Layers HDI

UK High Density Interconnect PCB, By Application (USD Million, 2018-2032)

- Consumer Electronics

- Automotive

- Military and Defense

- Healthcare

- Industrial/ Manufacturing

- Others

Rest of Europe Outlook (USD Million, 2018-2032)

Rest of Europe High Density Interconnect PCB, By Interconnection Layers Outlook (USD Million, 2018-2032)

- Layer (1+N+1) HDI

- 2 or more layers (2+N+2) HDI

- All Layers HDI

Rest of Europe High Density Interconnect PCB, By Application (USD Million, 2018-2032)

- Consumer Electronics

- Automotive

- Military and Defense

- Healthcare

- Industrial/ Manufacturing

- Others

Asia-Pacific Outlook (USD Million, 2018-2032)

Asia-Pacific High Density Interconnect PCB, By Interconnection Layers Outlook (USD Million, 2018-2032)

- Layer (1+N+1) HDI

- 2 or more layers (2+N+2) HDI

- All Layers HDI

Asia-Pacific High Density Interconnect PCB, By Application (USD Million, 2018-2032)

- Consumer Electronics

- Automotive

- Military and Defense

- Healthcare

- Industrial/ Manufacturing

- Others

China Outlook (USD Million, 2018-2032)

China High Density Interconnect PCB, By Interconnection Layers Outlook (USD Million, 2018-2032)

- Layer (1+N+1) HDI

- 2 or more layers (2+N+2) HDI

- All Layers HDI

China High Density Interconnect PCB, By Application (USD Million, 2018-2032)

- Consumer Electronics

- Automotive

- Military and Defense

- Healthcare

- Industrial/ Manufacturing

- Others

India Outlook (USD Million, 2018-2032)

India High Density Interconnect PCB, By Interconnection Layers Outlook (USD Million, 2018-2032)

- Layer (1+N+1) HDI

- 2 or more layers (2+N+2) HDI

- All Layers HDI

India High Density Interconnect PCB, By Application (USD Million, 2018-2032)

- Consumer Electronics

- Automotive

- Military and Defense

- Healthcare

- Industrial/ Manufacturing

- Others

Japan Outlook (USD Million, 2018-2032)

Japan High Density Interconnect PCB, By Interconnection Layers Outlook (USD Million, 2018-2032)

- Layer (1+N+1) HDI

- 2 or more layers (2+N+2) HDI

- All Layers HDI

Japan High Density Interconnect PCB, By Application (USD Million, 2018-2032)

- Consumer Electronics

- Automotive

- Military and Defense

- Healthcare

- Industrial/ Manufacturing

- Others

Rest of Asia-Pacific Outlook (USD Million, 2018-2032)

Rest of Asia-Pacific High Density Interconnect PCB, By Interconnection Layers Outlook (USD Million, 2018-2032)

- Layer (1+N+1) HDI

- 2 or more layers (2+N+2) HDI

- All Layers HDI

Rest of Asia-Pacific High Density Interconnect PCB, By Application (USD Million, 2018-2032)

- Consumer Electronics

- Automotive

- Military and Defense

- Healthcare

- Industrial/ Manufacturing

- Others

Rest of the World Outlook (USD Million, 2018-2032)

Rest of the World High Density Interconnect PCB, By Interconnection Layers Outlook (USD Million, 2018-2032)

- Layer (1+N+1) HDI

- 2 or more layers (2+N+2) HDI

- All Layers HDI

Rest of the World High Density Interconnect PCB, By Application (USD Million, 2018-2032)

- Consumer Electronics

- Automotive

- Military and Defense

- Healthcare

- Industrial/ Manufacturing

- Others

Middle East & Africa Outlook (USD Million, 2018-2032)

Middle East & Africa High Density Interconnect PCB, By Interconnection Layers Outlook (USD Million, 2018-2032)

- Layer (1+N+1) HDI

- 2 or more layers (2+N+2) HDI

- All Layers HDI

Middle East & Africa High Density Interconnect PCB, By Application (USD Million, 2018-2032)

- Consumer Electronics

- Automotive

- Military and Defense

- Healthcare

- Industrial/ Manufacturing

- Others

South America Outlook (USD Million, 2018-2032)

South America High Density Interconnect PCB, By Interconnection Layers Outlook (USD Million, 2018-2032)

- Layer (1+N+1) HDI

- 2 or more layers (2+N+2) HDI

- All Layers HDI

South America High Density Interconnect PCB, By Application (USD Million, 2018-2032)

- Consumer Electronics

- Automotive

- Military and Defense

- Healthcare

- Industrial/ Manufacturing

- Others

Free Sample Request

Kindly complete the form below to receive a free sample of this Report

Customer Strories

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

Leave a Comment