-

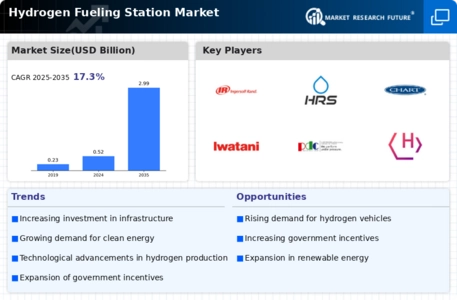

EXECUTIVE SUMMARY

-

MARKET

-

Definition

-

Scope of the Study

- Assumptions

- Limitations

-

Overview

-

Data Mining

-

Primary Research

- Primary

- Breakdown of Primary

-

Forecasting Model

-

Market Size

- Bottom-Up Approach

- Top-Down

-

Data Triangulation

-

Validation

-

Overview

-

Drivers

-

Opportunities

-

MARKET FACTOR ANALYSIS

-

Porter’s Five Forces Analysis

- Bargaining Power of Buyers

- Threat of Substitutes

-

COVID-19 Impact Analysis

- Regional Impact

-

GLOBAL HYDROGEN FUELING STATION

-

Overview

-

Small Stations

-

Large Stations

-

GLOBAL HYDROGEN

-

Overview

-

On-site

-

GLOBAL HYDROGEN FUELING STATION

-

Overview

-

High Pressure

-

GLOBAL HYDROGEN FUELING STATION MARKET, BY STATION

-

Overview

-

Fixed Hydrogen Stations

-

GLOBAL HYDROGEN FUELING STATION MARKET,

-

Overview

-

Engineering Procurement

-

Components

-

GLOBAL HYDROGEN

-

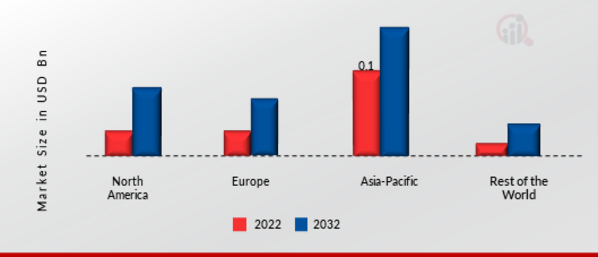

Overview

- U.S.

- Canada

- Germany

- France

- Italy

- Spain

-

Asia-Pacific

- China

- Japan

- South Korea

- Rest of Asia-Pacific

-

Rest of

- Middle East

- Africa

-

COMPETITIVE LANDSCAPE

-

Overview

-

Market Share Analysis

-

Leading Players in Terms of Number

- New Station Size Launch/Supply

- Merger & Acquisitions

-

Major Players Financial Matrix

- Major Players R&D Expenditure.

-

COMPANY PROFILES

-

AUTONAVI

- Financial Overview

- Key Developments

- Key Strategies

-

Baidu

- Financial Overview

- Key Developments

- Key Strategies

-

Civil Maps

- Financial Overview

- Key Developments

- Key Strategies

-

DeepMap

- Financial Overview

- Key Developments

- Key Strategies

-

Dynamic Map

- Company Overview

- Financial

- Station Sizes Offered

- Key Developments

- Key Strategies

-

ESRI

- Financial Overview

- Key Developments

- Key Strategies

-

HERE Technologies

- Financial Overview

- Key Developments

- Key Strategies

-

Mapbox

- Financial Overview

- Key Developments

- Key Strategies

-

Momenta

- Financial Overview

- Key Developments

- Key Strategies

-

NavInfo

- Financial Overview

- Key Developments

- Key Strategies

-

Navmii

- Financial Overview

- Key Developments

- Key Strategies

-

NVIDIA

- Company Overview

- Financial

- Station Sizes Offered

- Key

- SWOT Analysis

- Key Strategies

- Company Overview

- Station Sizes Offered

- SWOT Analysis

- Key

-

TomTom International BV

- Company

- Financial Overview

- Station

- Key Developments

- SWOT

- Key Strategies

-

Waymo LLC

- Financial Overview

- Key Developments

- Key Strategies

-

Woven Planet

- Company Overview

- Financial

- Station Sizes Offered

- Key

- SWOT Analysis

- Key Strategies

- Company Overview

- Station Sizes Offered

- SWOT Analysis

- Key

-

APPENDIX

-

References

-

GLOBAL HYDROGEN FUELING STATION MARKET, SYNOPSIS, 2024-2032

-

GLOBAL HYDROGEN FUELING STATION MARKET, ESTIMATES & FORECAST, 2024-2032 (USD

-

GLOBAL HYDROGEN FUELING STATION MARKET, BY STATION TYPE, 2024-2032 (USD BILLION)

-

GLOBAL HYDROGEN FUELING STATION MARKET, BY SOLUTION, 2024-2032 (USD BILLION)

-

NORTH AMERICA HYDROGEN FUELING STATION MARKET, BY STATION SIZE, 2024-2032 (USD

-

NORTH AMERICA HYDROGEN FUELING STATION MARKET, BY STATION TYPE, 2024-2032 (USD

-

U.S. HYDROGEN FUELING STATION MARKET, BY STATION SIZE, 2024-2032 (USD BILLION)

-

U.S. HYDROGEN FUELING STATION MARKET, BY SUPPLY TYPE, 2024-2032 (USD BILLION)

-

U.S. HYDROGEN FUELING STATION MARKET, BY PRESSURE, 2024-2032 (USD BILLION)

-

U.S. HYDROGEN FUELING STATION MARKET, BY STATION TYPE, 2024-2032 (USD BILLION)

-

U.S. HYDROGEN FUELING STATION MARKET, BY SOLUTION, 2024-2032 (USD BILLION)

-

CANADA HYDROGEN FUELING STATION MARKET, BY STATION SIZE, 2024-2032 (USD BILLION)

-

CANADA HYDROGEN FUELING STATION MARKET, BY SUPPLY TYPE, 2024-2032 (USD BILLION)

-

CANADA HYDROGEN FUELING STATION MARKET, BY PRESSURE, 2024-2032 (USD BILLION)

-

CANADA HYDROGEN FUELING STATION MARKET, BY STATION TYPE, 2024-2032 (USD BILLION)

-

CANADA HYDROGEN FUELING STATION MARKET, BY SOLUTION, 2024-2032 (USD BILLION)

-

EUROPE HYDROGEN FUELING STATION MARKET, BY STATION SIZE, 2024-2032 (USD BILLION)

-

EUROPE HYDROGEN FUELING STATION MARKET, BY SUPPLY TYPE, 2024-2032 (USD BILLION)

-

EUROPE HYDROGEN FUELING STATION MARKET, BY PRESSURE, 2024-2032 (USD BILLION)

-

EUROPE HYDROGEN FUELING STATION MARKET, BY STATION TYPE, 2024-2032 (USD BILLION)

-

EUROPE HYDROGEN FUELING STATION MARKET, BY SOLUTION, 2024-2032 (USD BILLION)

-

EUROPE HYDROGEN FUELING STATION MARKET, BY COUNTRY, 2024-2032 (USD BILLION)

-

GERMANY HYDROGEN FUELING STATION MARKET, BY STATION SIZE, 2024-2032 (USD BILLION)

-

GERMANY HYDROGEN FUELING STATION MARKET, BY SUPPLY TYPE, 2024-2032 (USD BILLION)

-

GERMANY HYDROGEN FUELING STATION MARKET, BY PRESSURE, 2024-2032 (USD BILLION)

-

GERMANY HYDROGEN FUELING STATION MARKET, BY STATION TYPE, 2024-2032 (USD BILLION)

-

GERMANY HYDROGEN FUELING STATION MARKET, BY SOLUTION, 2024-2032 (USD BILLION)

-

FRANCE HYDROGEN FUELING STATION MARKET, BY STATION SIZE, 2024-2032 (USD BILLION)

-

FRANCE HYDROGEN FUELING STATION MARKET, BY SUPPLY TYPE, 2024-2032 (USD BILLION)

-

FRANCE HYDROGEN FUELING STATION MARKET, BY PRESSURE, 2024-2032 (USD BILLION)

-

FRANCE HYDROGEN FUELING STATION MARKET, BY STATION TYPE, 2024-2032 (USD BILLION)

-

FRANCE HYDROGEN FUELING STATION MARKET, BY SOLUTION, 2024-2032 (USD BILLION)

-

U.K HYDROGEN FUELING STATION MARKET, BY STATION SIZE, 2024-2032 (USD BILLION)

-

U.K HYDROGEN FUELING STATION MARKET, BY SUPPLY TYPE, 2024-2032 (USD BILLION)

-

U.K HYDROGEN FUELING STATION MARKET, BY PRESSURE, 2024-2032 (USD BILLION)

-

U.K HYDROGEN FUELING STATION MARKET, BY STATION TYPE, 2024-2032 (USD BILLION)

-

U.K HYDROGEN FUELING STATION MARKET, BY SOLUTION, 2024-2032 (USD BILLION)

-

ITALY HYDROGEN FUELING STATION MARKET, BY STATION SIZE, 2024-2032 (USD BILLION)

-

ITALY HYDROGEN FUELING STATION MARKET, BY SUPPLY TYPE, 2024-2032 (USD BILLION)

-

ITALY HYDROGEN FUELING STATION MARKET, BY PRESSURE, 2024-2032 (USD BILLION)

-

ITALY HYDROGEN FUELING STATION MARKET, BY STATION TYPE, 2024-2032 (USD BILLION)

-

ITALY HYDROGEN FUELING STATION MARKET, BY SOLUTION, 2024-2032 (USD BILLION)

-

SPAIN HYDROGEN FUELING STATION MARKET, BY STATION SIZE, 2024-2032 (USD BILLION)

-

SPAIN HYDROGEN FUELING STATION MARKET, BY SUPPLY TYPE, 2024-2032 (USD BILLION)

-

SPAIN HYDROGEN FUELING STATION MARKET, BY PRESSURE, 2024-2032 (USD BILLION)

-

SPAIN HYDROGEN FUELING STATION MARKET, BY STATION TYPE, 2024-2032 (USD BILLION)

-

SPAIN HYDROGEN FUELING STATION MARKET, BY SOLUTION, 2024-2032 (USD BILLION)

-

REST OF EUROPE HYDROGEN FUELING STATION MARKET, BY STATION SIZE, 2024-2032 (USD

-

REST OF EUROPE HYDROGEN FUELING STATION MARKET, BY STATION TYPE, 2024-2032 (USD

-

ASIA PACIFIC HYDROGEN FUELING STATION MARKET, BY SUPPLY TYPE, 2024-2032 (USD

-

ASIA PACIFIC HYDROGEN FUELING STATION MARKET, BY COUNTRY, 2024-2032 (USD BILLION)

-

CHINA HYDROGEN FUELING STATION MARKET, BY STATION SIZE, 2024-2032 (USD BILLION)

-

CHINA HYDROGEN FUELING STATION MARKET, BY SUPPLY TYPE, 2024-2032 (USD BILLION)

-

CHINA HYDROGEN FUELING STATION MARKET, BY PRESSURE, 2024-2032 (USD BILLION)

-

CHINA HYDROGEN FUELING STATION MARKET, BY STATION TYPE, 2024-2032 (USD BILLION)

-

CHINA HYDROGEN FUELING STATION MARKET, BY SOLUTION, 2024-2032 (USD BILLION)

-

JAPAN HYDROGEN FUELING STATION MARKET, BY STATION SIZE, 2024-2032 (USD BILLION)

-

JAPAN HYDROGEN FUELING STATION MARKET, BY SUPPLY TYPE, 2024-2032 (USD BILLION)

-

JAPAN HYDROGEN FUELING STATION MARKET, BY PRESSURE, 2024-2032 (USD BILLION)

-

JAPAN HYDROGEN FUELING STATION MARKET, BY STATION TYPE, 2024-2032 (USD BILLION)

-

JAPAN HYDROGEN FUELING STATION MARKET, BY SOLUTION, 2024-2032 (USD BILLION)

-

INDIA HYDROGEN FUELING STATION MARKET, BY STATION SIZE, 2024-2032 (USD BILLION)

-

INDIA HYDROGEN FUELING STATION MARKET, BY SUPPLY TYPE, 2024-2032 (USD BILLION)

-

INDIA HYDROGEN FUELING STATION MARKET, BY PRESSURE, 2024-2032 (USD BILLION)

-

INDIA HYDROGEN FUELING STATION MARKET, BY STATION TYPE, 2024-2032 (USD BILLION)

-

INDIA HYDROGEN FUELING STATION MARKET, BY SOLUTION, 2024-2032 (USD BILLION)

-

SOUTH KOREA HYDROGEN FUELING STATION MARKET, BY STATION SIZE, 2024-2032 (USD

-

SOUTH KOREA HYDROGEN FUELING STATION MARKET, BY STATION TYPE, 2024-2032 (USD

-

AUSTRALIA HYDROGEN FUELING STATION MARKET, BY PRESSURE, 2024-2032 (USD BILLION)

-

AUSTRALIA HYDROGEN FUELING STATION MARKET, BY STATION TYPE, 2024-2032 (USD BILLION)

-

AUSTRALIA HYDROGEN FUELING STATION MARKET, BY SOLUTION, 2024-2032 (USD BILLION)

-

REST OF ASIA PACIFIC HYDROGEN FUELING STATION MARKET, BY STATION SIZE, 2024-2032

-

REST OF ASIA PACIFIC HYDROGEN FUELING STATION MARKET, BY STATION TYPE, 2024-2032

-

REST OF THE WORLD HYDROGEN FUELING STATION MARKET, BY SUPPLY TYPE, 2024-2032

-

REST OF THE WORLD HYDROGEN FUELING STATION MARKET, BY SOLUTION, 2024-2032 (USD

-

MIDDLE EAST HYDROGEN FUELING STATION MARKET, BY SUPPLY TYPE, 2024-2032 (USD

-

AFRICA HYDROGEN FUELING STATION MARKET, BY STATION SIZE, 2024-2032 (USD BILLION)

-

AFRICA HYDROGEN FUELING STATION MARKET, BY SUPPLY TYPE, 2024-2032 (USD BILLION)

-

AFRICA HYDROGEN FUELING STATION MARKET, BY PRESSURE, 2024-2032 (USD BILLION)

-

AFRICA HYDROGEN FUELING STATION MARKET, BY STATION TYPE, 2024-2032 (USD BILLION)

-

AFRICA HYDROGEN FUELING STATION MARKET, BY SOLUTION, 2024-2032 (USD BILLION)

-

LATIN AMERICA HYDROGEN FUELING STATION MARKET, BY STATION SIZE, 2024-2032 (USD

-

LATIN AMERICA HYDROGEN FUELING STATION MARKET, BY STATION TYPE, 2024-2032 (USD

-

GLOBAL HYDROGEN FUELING STATION MARKET, SHARE (%), BY STATION SIZE, 2022

-

GLOBAL HYDROGEN FUELING STATION MARKET, SHARE (%), BY SUPPLY TYPE, 2022

-

GLOBAL HYDROGEN FUELING STATION MARKET, SHARE (%), BY PRESSURE, 2022

-

GLOBAL HYDROGEN FUELING STATION MARKET, SHARE (%), BY STATION TYPE, 2022

-

GLOBAL HYDROGEN FUELING STATION MARKET, SHARE (%), BY SOLUTION, 2022

-

GLOBAL HYDROGEN FUELING STATION MARKET, SHARE (%), BY REGION, 2022

-

NORTH AMERICA: HYDROGEN FUELING STATION MARKET, SHARE (%), BY REGION, 2022

-

EUROPE: HYDROGEN FUELING STATION MARKET, SHARE (%), BY REGION, 2022

-

ASIA-PACIFIC: HYDROGEN FUELING STATION MARKET, SHARE (%), BY REGION, 2022

-

REST OF THE WORLD: HYDROGEN FUELING STATION MARKET, SHARE (%), BY REGION, 2022

-

GLOBAL HYDROGEN FUELING STATION MARKET: COMPANY SHARE ANALYSIS, 2022 (%)

-

AUTONAVI: FINANCIAL OVERVIEW SNAPSHOT

-

BAIDU: SWOT ANALYSIS

-

CIVIL MAPS: SWOT ANALYSIS

-

ESRI: SWOT ANALYSIS

-

MAPBOX: FINANCIAL OVERVIEW SNAPSHOT

-

MOMENTA: FINANCIAL OVERVIEW SNAPSHOT

-

NAVINFO: FINANCIAL OVERVIEW SNAPSHOT

-

NAVMII: FINANCIAL OVERVIEW SNAPSHOT

-

NVIDIA CORPORATION: FINANCIAL OVERVIEW SNAPSHOT

-

WAYMO LLC: FINANCIAL OVERVIEW SNAPSHOT

-

ZENRIN CO., LTD.: FINANCIAL OVERVIEW SNAPSHOT

Leave a Comment