Hydrogenated Nitrile Butadiene Rubber Market Analysis

Hydrogenated Nitrile Butadiene Rubber (HNBR) Market Research Report Information By Product (HNBR Solid [Belts & Cables, Seals & O-Rings, Hoses, Adhesives & Sealants, Foamed Products and others], HNBR Latex [Gloves, Non-Woven Fabric, Films & Coating, Paper Saturation] and others), By End-Use Industry (Automotive, Machinery, Oil & Gas, Medical, Construction, Others) - Forecast...

Market Summary

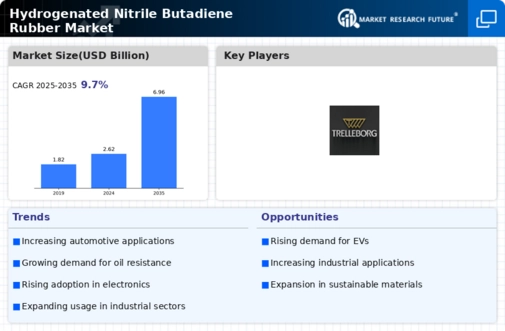

As per Market Research Future Analysis, the Global Hydrogenated Nitrile Butadiene Rubber (HNBR) Market is projected to grow at a CAGR of 9.7%, reaching USD 21.3 Billion by 2030. The primary driver for this growth is the increased consumption of HNBR in industrial and medical gloves. The automotive sector leads the end-use industries, accounting for 52% of the market share in 2018, driven by the demand for belts, seals, and hoses. The Asia-Pacific region dominated the market with a 42% share in 2018, and is expected to maintain the highest CAGR of 9.30% by 2025. However, the market faces challenges such as high manufacturing costs and potential health impacts from COVID-19, which temporarily affected production activities.

Key Market Trends & Highlights

Key trends influencing the HNBR market include rising demand across various sectors and significant R&D investments.

- HNBR consumption in industrial and medical gloves is a primary growth driver.

- The automotive sector accounted for 52% of the market share in 2018.

- Asia-Pacific held the largest market share of 42% in 2018, with a projected CAGR of 9.30% by 2025.

- High manufacturing costs are a significant restraint on market growth.

Market Size & Forecast

| Current Market Size | USD 21.3 Billion by 2030 |

| CAGR | 9.7% |

| Largest Regional Market Share in 2018 | Asia-Pacific (42%) |

| Automotive Sector Market Share in 2018 | 52% |

Major Players

Arlanxeo (The Netherlands), Zeon Corporation (US), Polycomp (The Netherlands), Eriks NV (The Netherlands), Rahco Rubber, Inc. (US), Mantaline (US), Trelleborg Sealing Solutions (US), MCM SpA (Italy)

Market Trends

The demand for hydrogenated nitrile butadiene rubber is anticipated to rise as industries increasingly prioritize materials that offer enhanced durability and resistance to harsh environments.

U.S. Department of Energy

Hydrogenated Nitrile Butadiene Rubber Market Market Drivers

Expansion in Emerging Markets

The Global Hydrogenated Nitrile Butadiene Rubber Market Industry is witnessing expansion in emerging markets, where industrialization and urbanization are accelerating. Countries in Asia-Pacific and Latin America are increasingly adopting hydrogenated nitrile butadiene rubber due to its superior properties and versatility across multiple applications. The growing automotive and oil and gas sectors in these regions are particularly driving demand. As these markets develop, the industry is poised for substantial growth, contributing to the overall market value projected to reach 6.96 USD Billion by 2035.

Market Trends and Projections

Growth in Oil and Gas Applications

The Global Hydrogenated Nitrile Butadiene Rubber Market Industry is significantly influenced by the growth in oil and gas applications. This material is favored for its excellent resistance to oil, making it ideal for seals and gaskets used in drilling and extraction processes. As global energy demands rise, the oil and gas sector is expected to expand, thereby increasing the consumption of hydrogenated nitrile butadiene rubber. The industry's projected growth to 6.96 USD Billion by 2035 indicates a robust market potential, driven by the need for durable and reliable materials in challenging environments.

Increasing Focus on Sustainability

The Global Hydrogenated Nitrile Butadiene Rubber Market Industry is increasingly shaped by a focus on sustainability and eco-friendly materials. Manufacturers are exploring bio-based alternatives and recycling methods to reduce environmental impact. This shift is driven by regulatory pressures and consumer preferences for sustainable products. As industries strive to meet sustainability goals, the demand for hydrogenated nitrile butadiene rubber, which can be produced with lower environmental footprints, is expected to rise. This trend may further propel the market's growth, aligning with global efforts to promote sustainable practices across various sectors.

Rising Demand from Automotive Sector

The Global Hydrogenated Nitrile Butadiene Rubber Market Industry experiences a notable surge in demand from the automotive sector, primarily due to the increasing need for high-performance materials that can withstand extreme temperatures and harsh environments. Hydrogenated nitrile butadiene rubber is utilized in various automotive components, including seals, gaskets, and hoses, which require superior resistance to oils and fuels. As the automotive industry continues to evolve, with a projected market value of 2.62 USD Billion in 2024, the adoption of hydrogenated nitrile butadiene rubber is likely to expand significantly, contributing to the overall growth of the industry.

Technological Advancements in Manufacturing

Technological advancements in the manufacturing processes of hydrogenated nitrile butadiene rubber are enhancing the efficiency and quality of production. Innovations such as improved polymerization techniques and better compounding methods are enabling manufacturers to produce higher-grade materials that meet stringent industry standards. This evolution not only boosts the performance characteristics of hydrogenated nitrile butadiene rubber but also reduces production costs, making it more accessible to various industries. As a result, the Global Hydrogenated Nitrile Butadiene Rubber Market Industry is likely to witness a compound annual growth rate of 9.3% from 2025 to 2035, reflecting the positive impact of these advancements.

Market Segment Insights

Regional Insights

Key Companies in the Hydrogenated Nitrile Butadiene Rubber Market market include

Industry Developments

September 2020: In deep blue and red, Apple launched two new braided Solo Loop Apple Watch Bands. "A patent application from Apple was published by the US Patent & Trademark Office covering the production of this new band, which Apple describes as "Stretchable recycled yarn interwoven with silicone threads, made of different elastic materials, including hydrogenated nitrile butadiene rubber, designed for ultra comfort without buckles or clasps.

July 2020: Arlanxeo held a 24-hour synthetic rubber multimedia scientific marathon, featuring "world-class" lectures with more than 2,000 professionals participating. EPDM crosslinking chemistry and Arlanxeo's Therban HT, a plastic re-enforced hydrogenated nitrile butadiene rubber (HNBR) with enhanced high-temperature properties, were addressed in some of the main fields.

Future Outlook

Hydrogenated Nitrile Butadiene Rubber Market Future Outlook

The Hydrogenated Nitrile Butadiene Rubber Market is projected to grow at a 9.3% CAGR from 2024 to 2035, driven by rising demand in automotive and industrial applications.

New opportunities lie in:

- Develop eco-friendly hydrogenated nitrile butadiene rubber formulations to meet sustainability goals.

- Expand production capabilities in emerging markets to capture growing regional demand.

- Invest in R&D for high-performance applications in aerospace and medical sectors.

By 2035, the market is expected to achieve substantial growth, reflecting robust demand and innovation.

Market Segmentation

Report Overview

- HNBR Solid

- HNBR Latex

- Others

- Automotive

- Machinery

- Oil & Gas

- Medical

- Construction

- Others

Report Scope

| Report Attribute/Metric | Details |

| Market Size | USD 21.3 billion 2030 |

| CAGR | 9.7% (2021–2030) |

| Base Year | 2021 |

| Forecast Period | 2021–2030 |

| Historical Data | 2020 |

| Forecast Units | Value (USD Billion) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | Product and End-Use |

| Geographies Covered | North America, Europe, Asia-Pacific, and Rest of the World (RoW) |

| Key Vendors | Arlanxeo (The Netherlands), Zeon Corporation (US), Polycomp (The Netherlands), Eriks NV (The Netherlands), Rahco Rubber, Inc. (US), Mantaline (US), Trelleborg Sealing Solutions (US), MCM SpA (Italy) |

| Key Market Opportunities | Growing R&D Investments to Create Growth Avenues for Market Players |

| Key Market Drivers | Growing Adoption from Oil & Gas Sector to Drive Market Growth |

Market Highlights

Author

Latest Comments

This is a great article! Really helped me understand the topic better.

Thanks for sharing this. I’ve bookmarked it for later reference.

FAQs

At what CAGR is the hydrogenated nitrile butadiene rubber market expected to grow over the forecast period?

The hydrogenated nitrile butadiene rubber market is predicted to grow at a 9.7% CAGR between 2021-2030.

What will be the possible market valuation of the hydrogenated nitrile butadiene rubber market?

The global hydrogenated nitrile butadiene rubber market is predicted to touch USD 21.3 billion by 2030.

Which region will spearhead the hydrogenated nitrile butadiene rubber market?

Asia Pacific is predicted to spearhead the hydrogenated nitrile butadiene rubber market.

Which end use industry will dominate the hydrogenated nitrile butadiene rubber market?

The automotive industry will dominate the hydrogenated nitrile butadiene rubber market.

Which factors may limit the will dominate the hydrogenated nitrile butadiene rubber market growth?

High manufacturing cost and raw material price may limit the market growth.

-

Report Prologue

-

Market Introduction

- Market Definition 24

-

Scope of the Study 24

- Research Objectives 24

- List Of Assumptions 25

- Market Structure 26

-

Market Insights

- Key Takeaways 28

-

Research Methodology

- Research Process 33

- Primary Research 34

- Secondary Research 35

- Market Size Estimation 35

- Forecast Model 36

-

Market Dynamics

- Introduction 38

-

Drivers 39

- Growing Use In Manufacturing Industrial And Medical Gloves 39

- High Demand In Automobiles And Machinery 40

- Surging Demand For HNBR In Oil & Gas Industry 40

-

Restraint 41

- Relatively High Cost Of HNBR 41

-

Opportunity 42

- Development Of Innovative Grades Of HNBR For The Automotive Industry 42

-

Challenge 42

- Fluctuating Prices In The Global Elastomers Market 42

-

Market Factor Analysis

-

Supply Chain Analysis 44

- Raw Material Suppliers 44

- HNBR Manufacturers 44

- Distribution Channel 45

- End-Use Industry 45

-

Porter’s Five Force Analysis 45

- Threat Of New Entrants 45

- Threat Of Rivalry 46

- Threat Of Substitutes 46

- Bargaining Power Of Suppliers 46

- Bargaining Power Of Buyers 46

-

Supply Chain Analysis 44

-

Global Hydrogenated Nitrile Butadiene Rubber (HNBR) Market, By Product

- Introduction 48

-

HNBR Solid 50

- HNBR Solid, By Application 51

-

HNBR Latex 59

- HNBR Latex, By Application 60

- Others 67

-

Global Hydrogenated Nitrile Butadiene Rubber (HNBR) Market, By End-Use Industry

- Introduction 70

- Automotive 72

- Machinery 73

- Oil & Gas 74

- Medical 75

- Construction 76

- Others 78

-

Global Hydrogenated Nitrile Butadiene Rubber (HNBR) Market, By Region

- Introduction 81

-

North America 83

- U.S. 87

- Canada 91

-

Europe 95

- Germany 99

- UK 103

- Russia 107

- France 110

- Spain 114

- Italy 118

- Poland 122

- Rest Of Europe 126

-

Asia Pacific 130

- China 135

- Japan 139

- India 143

- Australia & New Zealand 147

- Indonesia 151

- South Korea 155

- Thailand 159

- Rest Of Asia-Pacific 163

-

Latin America 167

- Mexico 172

- Brazil 175

- Argentina 179

- Rest Of Latin America 183

-

Middle East & Africa 187

- Turkey 192

- UAE 195

- Saudi Arabia 199

- Rest Of Middle East & Africa 203

-

Competitive Landscape

- Introduction 209

- Market Strategy Analysis 209

-

Company Profiles

-

Arlanxeo 212

- Company Overview 212

- Financial Overview 212

- Products Offered 212

- Key Developments 213

- SWOT Analysis 213

- Key Strategy 213

-

Zeon Corporation 214

- Company Overview 214

- Financial Overview 214

- Products Offered 215

- Key Developments 215

- SWOT Analysis 216

- Key Strategy 216

-

AirBoss Of America Corp. 217

- Company Overview 217

- Financial Overview 217

- Products Offered 217

- Key Developments 218

- SWOT Analysis 218

- Key Strategy 218

-

Precision Associates, Inc. 219

- Company Overview 219

- Financial Overview 219

- Products Offered 219

- Key Developments 219

- SWOT Analysis 219

- Key Strategy 219

-

Arlanxeo 212

-

-

Polycomp 220

- Company Overview 220

- Financial Overview 220

- Products Offered 220

- Key Developments 220

- SWOT Analysis 220

- Key Strategy 220

-

ERIKS NV 221

- Company Overview 221

- Financial Overview 221

- Products Offered 221

- Key Developments 221

- SWOT Analysis 221

- Key Strategy 221

-

Rahco Rubber, Inc. 222

- Company Overview 222

- Financial Overview 222

- Products Offered 222

- Key Developments 222

- SWOT Analysis 222

- Key Strategy 222

-

Mantaline 223

- Company Overview 223

- Financial Overview 223

- Products Offered 223

- Key Developments 223

- SWOT Analysis 223

- Key Strategy 223

-

Trelleborg Sealing Solutions 224

- Company Overview 224

- Financial Overview 224

- Products Offered 224

- Key Developments 225

- SWOT Analysis 225

- Key Strategy 225

-

MCM S.P.A. 226

- Company Overview 226

- Financial Overview 226

- Products Offered 226

- Key Developments 226

- SWOT Analysis 226

- Key Strategy 226

-

Polycomp 220

-

Conclusion

-

List of Tables and Figures

- 13 List Of Tables

- TABLE 1 MARKET SYNOPSIS 22

- TABLE 2 LIST OF ASSUMPTIONS 25

- TABLE 3 GLOBAL HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY PRODUCT, 2020-2027 (USD MILLION) 48

- TABLE 4 GLOBAL HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY PRODUCT, 2020-2027 (KILO TONS) 49

- TABLE 5 GLOBAL HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET FOR HNBR SOLID, BY REGION, 2020-2027 (USD MILLION) 50

- TABLE 6 GLOBAL HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET FOR HNBR SOLID, BY REGION, 2020-2027 (KILO TONS) 50

- TABLE 7 GLOBAL HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR), BY SOLID APPLICATION, 2020-2027 (USD MILLION) 51

- TABLE 8 GLOBAL HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY SOLID APPLICATION, 2020-2027 (KILO TONS) 52

- TABLE 9 GLOBAL HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET FOR BELTS AND CABLES, BY REGION, 2020-2027 (USD MILLION) 53

- TABLE 10 GLOBAL HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET FOR BELTS AND CABLES, BY REGION, 2020-2027 (KILO TONS) 53

- TABLE 11 GLOBAL HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET FOR SEALS & O-RINGS, BY REGION, 2020-2027 (USD MILLION) 54

- TABLE 12 GLOBAL HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET FOR SEALS & O-RINGS, BY REGION, 2020-2027 (KILO TONS) 55

- TABLE 13 GLOBAL HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET FOR HOSES, BY REGION, 2020-2027 (USD MILLION) 55

- TABLE 14 GLOBAL HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET FOR HOSES, BY REGION, 2020-2027 (KILO TONS) 56

- TABLE 15 GLOBAL HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET FOR ADHESIVES & SEALANTS, BY REGION, 2020-2027 (USD MILLION) 56

- TABLE 16 GLOBAL HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET FOR ADHESIVES & SEALANTS, BY REGION, 2020-2027 (KILO TONS) 57

- TABLE 17 GLOBAL HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET FOR FOAMED PRODUCTS, BY REGION, 2020-2027 (USD MILLION) 57

- TABLE 18 GLOBAL HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET FOR FOAMED PRODUCTS, BY REGION, 2020-2027 (KILO TONS) 58

- TABLE 19 GLOBAL HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET FOR OTHERS, BY REGION, 2020-2027 (USD MILLION) 58

- TABLE 20 GLOBAL HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET FOR OTHERS, BY REGION, 2020-2027 (KILO TONS) 59

- TABLE 21 GLOBAL HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET FOR HNBR LATEX, BY REGION, 2020-2027 (USD MILLION) 59

- TABLE 22 GLOBAL HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET FOR HNBR LATEX, BY REGION, 2020-2027 (KILO TONS) 60

- TABLE 23 GLOBAL HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR), BY LATEX APPLICATION, 2020-2027 (USD MILLION) 61

- TABLE 24 GLOBAL HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, LATEX APPLICATION, 2020-2027 (KILO TONS) 62

- TABLE 25 GLOBAL HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET FOR GLOVES, BY REGION, 2020-2027 (USD MILLION) 63

- TABLE 26 GLOBAL HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET FOR GLOVES, BY REGION, 2020-2027 (KILO TONS) 63

- TABLE 27 GLOBAL HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR)MARKET FOR NON-WOVEN FABRIC, BY REGION, 2020-2027 (USD MILLION) 64

- TABLE 28 GLOBAL HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET FOR NON-WOVEN FABRIC, BY REGION, 2020-2027 (KILO TONS) 65

- TABLE 29 GLOBAL HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET FOR FILMS AND COATING, BY REGION, 2020-2027 (USD MILLION) 65

- TABLE 30 GLOBAL HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR)MARKET FOR FILMS AND COATING, BY REGION, 2020-2027 (KILO TONS) 66

- TABLE 31 GLOBAL HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET FOR PAPER SATURATION, BY REGION, 2020-2027 (USD MILLION) 66

- TABLE 32 GLOBAL HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR)MARKET FOR PAPER SATURATION, BY REGION, 2020-2027 (KILO TONS) 67

- TABLE 33 GLOBAL HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET FOR OTHERS, BY REGION, 2020-2027 (USD MILLION) 67

- TABLE 34 GLOBAL HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET FOR OTHERS, BY REGION, 2020-2027 (KILO TONS) 68

- TABLE 35 GLOBAL HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR), BY END-USE INDUSTRY, 2020-2027 (USD MILLION) 70

- TABLE 36 GLOBAL HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY END-USE INDUSTRY, 2020-2027 (KILO TONS) 71

- TABLE 37 GLOBAL HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET FOR AUTOMOTIVE, BY REGION, 2020-2027 (KILO TONS) 72

- TABLE 38 GLOBAL HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET FOR MACHINERY, BY REGION, 2020-2027 (USD MILLION) 73

- TABLE 39 GLOBAL HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET FOR MACHINERY, BY REGION, 2020-2027 (KILO TONS) 74

- TABLE 40 GLOBAL HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET FOR OIL & GAS, BY REGION, 2020-2027 (USD MILLION) 74

- TABLE 41 GLOBAL HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET FOR OIL & GAS, BY REGION, 2020-2027 (KILO TONS) 75

- TABLE 42 GLOBAL HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET FOR MEDICAL, BY REGION, 2020-2027 (KILO TONS) 76

- TABLE 43 GLOBAL HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET FOR CONSTRUCTION, BY REGION, 2020-2027 (USD MILLION) 77

- TABLE 44 GLOBAL HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET FOR CONSTRUCTION, BY REGION, 2020-2027 (KILO TONS) 77

- TABLE 45 GLOBAL HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET FOR OTHERS, BY REGION, 2020-2027 (USD MILLION) 78

- TABLE 46 GLOBAL HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET FOR OTHERS, BY REGION, 2020-2027 (KILO TONS) 79

- TABLE 47 GLOBAL HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY REGION, 2020-2027 (USD MILLION) 81

- TABLE 48 GLOBAL HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY REGION, 2020-2027 (KILO TONS) 82

- TABLE 49 NORTH AMERICA HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY COUNTRY, 2020-2027 (USD MILLION) 83

- TABLE 50 NORTH AMERICA HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY COUNTRY, 2020-2027 (KILO TONS) 83

- TABLE 51 NORTH AMERICA HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY PRODUCT, 2020-2027 (USD MILLION) 83

- TABLE 52 NORTH AMERICA HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY PRODUCT, 2020-2027 (KILO TONS) 84

- TABLE 53 NORTH AMERICA HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY SOLID APPLICATION, 2020-2027 (USD MILLION) 84

- TABLE 54 NORTH AMERICA HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY SOLID APPLICATION, 2020-2027 (KILO TONS) 85

- TABLE 55 NORTH AMERICA HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY LATEX APPLICATION, 2020-2027 (USD MILLION) 85

- TABLE 56 NORTH AMERICA HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY LATEX APPLICATION, 2020-2027 (KILO TONS) 86

- TABLE 57 NORTH AMERICA HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY END-USE INDUSTRY, 2020-2027 (USD MILLION) 86

- TABLE 58 NORTH AMERICA HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY END-USE INDUSTRY, 2020-2027 (KILO TONS) 87

- TABLE 59 U.S. HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY PRODUCT, 2020-2027 (USD MILLION) 87

- TABLE 60 U.S. HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY PRODUCT, 2020-2027 (KILO TONS) 88

- TABLE 61 U.S. HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY SOLID APPLICATION, 2020-2027 (USD MILLION) 88

- TABLE 62 U.S. HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY SOLID APPLICATION, 2020-2027 (KILO TONS) 89

- TABLE 63 U.S. HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY LATEX APPLICATION, 2020-2027 (USD MILLION) 89

- TABLE 64 U.S. HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY LATEX APPLICATION, 2020-2027 (KILO TONS) 90

- TABLE 65 U.S. HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY END-USE INDUSTRY, 2020-2027 (USD MILLION) 90

- TABLE 66 U.S. HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY END-USE INDUSTRY, 2020-2027 (KILO TONS) 91

- TABLE 67 CANADA HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY PRODUCT, 2020-2027 (USD MILLION) 91

- TABLE 68 CANADA HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY PRODUCT, 2020-2027 (KILO TONS) 91

- TABLE 69 CANADA HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY SOLID APPLICATION, 2020-2027 (USD MILLION) 92

- TABLE 70 CANADA HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY SOLID APPLICATION, 2020-2027 (KILO TONS) 92

- TABLE 71 CANADA HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY LATEX APPLICATION, 2020-2027 (USD MILLION) 93

- TABLE 72 CANADA HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY LATEX APPLICATION, 2020-2027 (KILO TONS) 93

- TABLE 73 CANADA HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY END-USE INDUSTRY, 2020-2027 (USD MILLION) 94

- TABLE 74 CANADA HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY END-USE INDUSTRY, 2020-2027 (KILO TONS) 94

- TABLE 75 EUROPE HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY COUNTRY, 2020-2027 (USD MILLION) 95

- TABLE 76 EUROPE HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY COUNTRY, 2020-2027 (KILO TONS) 95

- TABLE 77 EUROPE HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY PRODUCT, 2020-2027 (USD MILLION) 96

- TABLE 78 EUROPE HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY PRODUCT, 2020-2027 (KILO TONS) 96

- TABLE 79 EUROPE HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY SOLID APPLICATION, 2020-2027 (USD MILLION) 96

- TABLE 80 EUROPE HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY SOLID APPLICATION, 2020-2027 (KILO TONS) 97

- TABLE 81 EUROPE HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY LATEX APPLICATION, 2020-2027 (USD MILLION) 97

- TABLE 82 EUROPE HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY LATEX APPLICATION, 2020-2027 (KILO TONS) 98

- TABLE 83 EUROPE HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY END-USE INDUSTRY, 2020-2027 (USD MILLION) 98

- TABLE 84 EUROPE HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY END-USE INDUSTRY, 2020-2027 (KILO TONS) 99

- TABLE 85 GERMANY HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY PRODUCT, 2020-2027 (USD MILLION) 99

- TABLE 86 GERMANY HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY PRODUCT, 2020-2027 (KILO TONS) 100

- TABLE 87 GERMANY HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY SOLID APPLICATION, 2020-2027 (USD MILLION) 100

- TABLE 88 GERMANY HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY SOLID APPLICATION, 2020-2027 (KILO TONS) 101

- TABLE 89 GERMANY HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY LATEX APPLICATION, 2020-2027 (USD MILLION) 101

- TABLE 90 GERMANY HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY LATEX APPLICATION, 2020-2027 (KILO TONS) 102

- TABLE 91 GERMANY HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY END-USE INDUSTRY, 2020-2027 (USD MILLION) 102

- TABLE 92 GERMANY HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY END-USE INDUSTRY, 2020-2027 (KILO TONS) 103

- TABLE 93 UK HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY PRODUCT, 2020-2027 (USD MILLION) 103

- TABLE 94 UK HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY PRODUCT, 2020-2027 (KILO TONS) 103

- TABLE 95 UK HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY SOLID APPLICATION, 2020-2027 (USD MILLION) 104

- TABLE 96 UK HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY SOLID APPLICATION, 2020-2027 (KILO TONS) 104

- TABLE 97 UK HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY LATEX APPLICATION, 2020-2027 (USD MILLION) 105

- TABLE 98 UK HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY LATEX APPLICATION, 2020-2027 (KILO TONS) 105

- TABLE 99 UK HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY END-USE INDUSTRY, 2020-2027 (USD MILLION) 106

- TABLE 100 UK HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY END-USE INDUSTRY, 2020-2027 (KILO TONS) 106

- TABLE 101 RUSSIA HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY PRODUCT, 2020-2027 (USD MILLION) 107

- TABLE 102 RUSSIA HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY PRODUCT, 2020-2027 (KILO TONS) 107

- TABLE 103 RUSSIA HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY SOLID APPLICATION, 2020-2027 (USD MILLION) 107

- TABLE 104 RUSSIA HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY SOLID APPLICATION, 2020-2027 (KILO TONS) 108

- TABLE 105 RUSSIA HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY LATEX APPLICATION, 2020-2027 (USD MILLION) 108

- TABLE 106 RUSSIA HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY LATEX APPLICATION, 2020-2027 (KILO TONS) 109

- TABLE 107 RUSSIA HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY END-USE INDUSTRY, 2020-2027 (USD MILLION) 109

- TABLE 108 RUSSIA HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY END-USE INDUSTRY, 2020-2027 (KILO TONS) 110

- TABLE 109 FRANCE HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY PRODUCT, 2020-2027 (USD MILLION) 110

- TABLE 110 FRANCE HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY PRODUCT, 2020-2027 (KILO TONS) 111

- TABLE 111 FRANCE HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY SOLID APPLICATION, 2020-2027 (USD MILLION) 111

- TABLE 112 FRANCE HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY SOLID APPLICATION, 2020-2027 (KILO TONS) 112

- TABLE 113 FRANCE HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY LATEX APPLICATION, 2020-2027 (USD MILLION) 112

- TABLE 114 FRANCE HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY LATEX APPLICATION, 2020-2027 (KILO TONS) 113

- TABLE 115 FRANCE HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY END-USE INDUSTRY, 2020-2027 (USD MILLION) 113

- TABLE 116 FRANCE HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY END-USE INDUSTRY, 2020-2027 (KILO TONS) 114

- TABLE 117 SPAIN HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY PRODUCT, 2020-2027 (USD MILLION) 114

- TABLE 118 SPAIN HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY PRODUCT, 2020-2027 (KILO TONS) 115

- TABLE 119 SPAIN HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY SOLID APPLICATION, 2020-2027 (USD MILLION) 115

- TABLE 120 SPAIN HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY SOLID APPLICATION, 2020-2027 (KILO TONS) 116

- TABLE 121 SPAIN HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY LATEX APPLICATION, 2020-2027 (USD MILLION) 116

- TABLE 122 SPAIN HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY LATEX APPLICATION, 2020-2027 (KILO TONS) 117

- TABLE 123 SPAIN HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY END-USE INDUSTRY, 2020-2027 (USD MILLION) 117

- TABLE 124 SPAIN HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY END-USE INDUSTRY, 2020-2027 (KILO TONS) 118

- TABLE 125 ITALY HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY PRODUCT, 2020-2027 (USD MILLION) 118

- TABLE 126 ITALY HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY PRODUCT, 2020-2027 (KILO TONS) 119

- TABLE 127 ITALY HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY SOLID APPLICATION, 2020-2027 (USD MILLION) 119

- TABLE 128 ITALY HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY SOLID APPLICATION, 2020-2027 (KILO TONS) 120

- TABLE 129 ITALY HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY LATEX APPLICATION, 2020-2027 (USD MILLION) 120

- TABLE 130 ITALY HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY LATEX APPLICATION, 2020-2027 (KILO TONS) 121

- TABLE 131 ITALY HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY END-USE INDUSTRY, 2020-2027 (USD MILLION) 121

- TABLE 132 ITALY HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY END-USE INDUSTRY, 2020-2027 (KILO TONS) 122

- TABLE 133 POLAND HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY PRODUCT, 2020-2027 (USD MILLION) 122

- TABLE 134 POLAND HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY PRODUCT, 2020-2027 (KILO TONS) 123

- TABLE 135 POLAND HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY SOLID APPLICATION, 2020-2027 (USD MILLION) 123

- TABLE 136 POLAND HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY SOLID APPLICATION, 2020-2027 (KILO TONS) 124

- TABLE 137 POLAND HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY LATEX APPLICATION, 2020-2027 (USD MILLION) 124

- TABLE 138 POLAND HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY LATEX APPLICATION, 2020-2027 (KILO TONS) 125

- TABLE 139 POLAND HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY END-USE INDUSTRY, 2020-2027 (USD MILLION) 125

- TABLE 140 POLAND HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY END-USE INDUSTRY, 2020-2027 (KILO TONS) 126

- TABLE 141 REST OF EUROPE HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY PRODUCT, 2020-2027 (USD MILLION) 126

- TABLE 142 REST OF EUROPE HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY PRODUCT, 2020-2027 (KILO TONS) 127

- TABLE 143 REST OF EUROPE HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY SOLID APPLICATION, 2020-2027 (USD MILLION) 127

- TABLE 144 REST OF EUROPE HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY SOLID APPLICATION, 2020-2027 (KILO TONS) 128

- TABLE 145 REST OF EUROPE HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY LATEX APPLICATION, 2020-2027 (USD MILLION) 128

- TABLE 146 REST OF EUROPE HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY LATEX APPLICATION, 2020-2027 (KILO TONS) 129

- TABLE 147 REST OF EUROPE HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY END-USE INDUSTRY, 2020-2027 (USD MILLION) 129

- TABLE 148 REST OF EUROPE HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY END-USE INDUSTRY, 2020-2027 (KILO TONS) 130

- TABLE 149 ASIA PACIFIC HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY COUNTRY, 2020-2027 (USD MILLION) 130

- TABLE 150 ASIA PACIFIC HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY COUNTRY, 2020-2027 (KILO TONS) 131

- TABLE 151 ASIA PACIFIC HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY PRODUCT, 2020-2027 (USD MILLION) 131

- TABLE 152 ASIA PACIFIC HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY PRODUCT, 2020-2027 (KILO TONS) 132

- TABLE 153 ASIA PACIFIC HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY SOLID APPLICATION, 2020-2027 (USD MILLION) 132

- TABLE 154 ASIA PACIFIC HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY SOLID APPLICATION, 2020-2027 (KILO TONS) 133

- TABLE 155 ASIA PACIFIC HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY LATEX APPLICATION, 2020-2027 (USD MILLION) 133

- TABLE 156 ASIA PACIFIC HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY LATEX APPLICATION, 2020-2027 (KILO TONS) 134

- TABLE 157 ASIA PACIFIC HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY END-USE INDUSTRY, 2020-2027 (USD MILLION) 134

- TABLE 158 ASIA PACIFIC HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY END-USE INDUSTRY, 2020-2027 (KILO TONS) 135

- TABLE 159 CHINA HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY PRODUCT, 2020-2027 (USD MILLION) 135

- TABLE 160 CHINA HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY PRODUCT, 2020-2027 (KILO TONS) 136

- TABLE 161 CHINA HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY SOLID APPLICATION, 2020-2027 (USD MILLION) 136

- TABLE 162 CHINA HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY SOLID APPLICATION, 2020-2027 (KILO TONS) 137

- TABLE 163 CHINA HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY LATEX APPLICATION, 2020-2027 (USD MILLION) 137

- TABLE 164 CHINA HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY LATEX APPLICATION, 2020-2027 (KILO TONS) 138

- TABLE 165 CHINA HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY END-USE INDUSTRY, 2020-2027 (USD MILLION) 138

- TABLE 166 CHINA HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY END-USE INDUSTRY, 2020-2027 (KILO TONS) 139

- TABLE 167 JAPAN HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY PRODUCT, 2020-2027 (USD MILLION) 139

- TABLE 168 JAPAN HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY PRODUCT, 2020-2027 (KILO TONS) 140

- TABLE 169 JAPAN HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY SOLID APPLICATION, 2020-2027 (USD MILLION) 140

- TABLE 170 JAPAN HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY SOLID APPLICATION, 2020-2027 (KILO TONS) 141

- TABLE 171 JAPAN HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY LATEX APPLICATION, 2020-2027 (USD MILLION) 141

- TABLE 172 JAPAN HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY LATEX APPLICATION, 2020-2027 (KILO TONS) 142

- TABLE 173 JAPAN HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY END-USE INDUSTRY, 2020-2027 (USD MILLION) 142

- TABLE 174 JAPAN HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY END-USE INDUSTRY, 2020-2027 (KILO TONS) 143

- TABLE 175 INDIA HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY PRODUCT, 2020-2027 (USD MILLION) 143

- TABLE 176 INDIA HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY PRODUCT, 2020-2027 (KILO TONS) 144

- TABLE 177 INDIA HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY SOLID APPLICATION, 2020-2027 (USD MILLION) 144

- TABLE 178 INDIA HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY SOLID APPLICATION, 2020-2027 (KILO TONS) 145

- TABLE 179 INDIA HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY LATEX APPLICATION, 2020-2027 (USD MILLION) 145

- TABLE 180 INDIA HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY LATEX APPLICATION, 2020-2027 (KILO TONS) 146

- TABLE 181 INDIA HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY END-USE INDUSTRY, 2020-2027 (USD MILLION) 146

- TABLE 182 INDIA HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY END-USE INDUSTRY, 2020-2027 (KILO TONS) 147

- TABLE 183 AUSTRALIA & NEW ZEALAND HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY PRODUCT, 2020-2027 (USD MILLION) 147

- TABLE 184 AUSTRALIA & NEW ZEALAND HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY PRODUCT, 2020-2027 (KILO TONS) 148

- TABLE 185 AUSTRALIA & NEW ZEALAND HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY SOLID APPLICATION, 2020-2027 (USD MILLION) 148

- TABLE 186 AUSTRALIA & NEW ZEALAND HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY SOLID APPLICATION, 2020-2027 (KILO TONS) 149

- TABLE 187 AUSTRALIA & NEW ZEALAND HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY LATEX APPLICATION, 2020-2027 (USD MILLION) 149

- TABLE 188 AUSTRALIA & NEW ZEALAND HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY LATEX APPLICATION, 2020-2027 (KILO TONS) 150

- TABLE 189 AUSTRALIA & NEW ZEALAND HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY END-USE INDUSTRY, 2020-2027 (USD MILLION) 150

- TABLE 190 AUSTRALIA & NEW ZEALAND HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY END-USE INDUSTRY, 2020-2027 (KILO TONS) 151

- TABLE 191 INDONESIA HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY PRODUCT, 2020-2027 (USD MILLION) 151

- TABLE 192 INDONESIA HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY PRODUCT, 2020-2027 (KILO TONS) 152

- TABLE 193 INDONESIA HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY SOLID APPLICATION, 2020-2027 (USD MILLION) 152

- TABLE 194 INDONESIA HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY SOLID APPLICATION, 2020-2027 (KILO TONS) 153

- TABLE 195 INDONESIA HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY LATEX APPLICATION, 2020-2027 (USD MILLION) 153

- TABLE 196 INDONESIA HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY LATEX APPLICATION, 2020-2027 (KILO TONS) 154

- TABLE 197 INDONESIA HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY END-USE INDUSTRY, 2020-2027 (USD MILLION) 154

- TABLE 198 INDONESIA HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY END-USE INDUSTRY, 2020-2027 (KILO TONS) 155

- TABLE 199 SOUTH KOREA HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY PRODUCT, 2020-2027 (USD MILLION) 155

- TABLE 200 SOUTH KOREA HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY PRODUCT, 2020-2027 (KILO TONS) 156

- TABLE 201 SOUTH KOREA HYDROGENATED NITRILE BUTADIENE RUBBER (HNBR) MARKET, BY SOLID APPLICATION,

Hydrogenated Nitrile Butadiene Rubber (HNBR) Market Segmentation

Market Segmentation Overview

- Detailed segmentation data will be available in the full report

- Comprehensive analysis by multiple parameters

- Regional and country-level breakdowns

- Market size forecasts by segment

Free Sample Request

Kindly complete the form below to receive a free sample of this Report

Customer Strories

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

Leave a Comment