Industrial Thermopile Sensors Market Share

Industrial Thermopile Sensors Market Research Report Information By Type (Thermopile Infrared Sensors And Thermopile Laser Sensors), By Application (Automobile Industry, Medical Industry, Defense Industry) And By Region (North America, Europe, Asia-Pacific, And Rest Of The World) –Market Forecast Till 2035

Market Summary

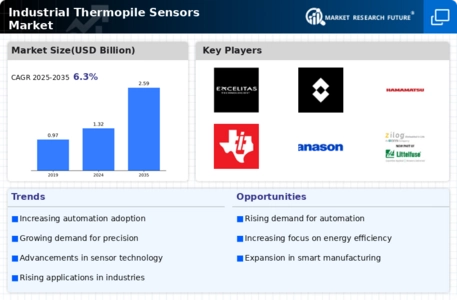

The Global Industrial Thermopile Sensors Market is projected to grow from 1.32 USD Billion in 2024 to 2.59 USD Billion by 2035.

Key Market Trends & Highlights

Industrial Thermopile Sensors Key Trends and Highlights

- The market is expected to experience a compound annual growth rate (CAGR) of 6.33% from 2025 to 2035.

- By 2035, the market valuation is anticipated to reach 2.59 USD Billion, indicating robust growth.

- in 2024, the market is valued at 1.32 USD Billion, reflecting a strong foundation for future expansion.

- Growing adoption of advanced temperature sensing technologies due to increasing industrial automation is a major market driver.

Market Size & Forecast

| 2024 Market Size | 1.32 (USD Billion) |

| 2035 Market Size | 2.59 (USD Billion) |

| CAGR (2025-2035) | 6.32% |

| Largest Regional Market Share in 2024 | latin_america) |

Major Players

Excelitas Technologies, Fuji Ceramics Corporation, Ampheonl Advance Sensors, Flir Systems, Heimann Sensor GmbH, Nippon Ceramic, Hamamatsu Photonic, Texas Instruments, Panasonic, GE, Zilog, InfraTec, TE Connectivity, Murata, Winsensor

Market Trends

Rising Demand for Non-Contact Temperature Measurement Drives Market Growth

Market CAGR for industrial thermopile sensors is being driven by the rising demand for non-contact temperature measurement. The increased need for non-contact temperature measurement across numerous industries is driving the market growth. Industrial uses for these sensors include process control, HVAC systems, and automotive, aerospace, and medical equipment. The ability of thermopile sensors to measure temperature reliably without physical contact makes them extremely useful for monitoring and managing temperature in difficult conditions.

The growing emphasis on energy conservation and compliance with safety requirements has hastened the adoption of thermopile sensors. These sensors provide for exact temperature monitoring, which assists enterprises in optimizing energy use and preventing overheating or temperature changes.

In addition, technological developments have resulted in the development of smaller, more cost-effective thermopile sensors, making them more accessible to a broader range of sectors. The incorporation of wireless connectivity and Internet of Things capabilities in thermopile sensors has also opened up new possibilities for real-time monitoring and remote temperature management.

This occurred in warehouses when the Internet of Robotic Things (IoRT) expanded in popularity. The use of IoT technology in the manufacturing industry is becoming increasingly important as part of the digital transformation. According to the industry report "The State of Industrial Internet of Things 2020" by the technology firm PTC, IIoT technology is now used primarily in manufacturing plants. Due to the continuous and dependable operation of sensors, assets in heavy-industrial processes have generated critical daily KPIs. Manufacturers keep a tight check on asset availability as well as their manufacturing processes.

Industrial networking with IIoT platforms for a variety of use cases, roles, and applications connects legacy machinery common in these complex industries.

AR (Augmented Reality) provided a new lens for observing this real-time data in-situ for numerous application cases, increasing front-line worker productivity. According to the State of Augmented Reality 2020 research, AR in industrial arenas was ranked first, with 20% of AR respondents in industrial items, 9% in automotive, and 7% in electronics and high-tech.

The increasing demand for non-contact temperature measurement solutions across various industrial applications appears to be driving the growth of the global industrial thermopile sensors market.

U.S. Department of Energy

Industrial Thermopile Sensors Market Market Drivers

Rising Demand for Non-Contact Temperature Measurement

The Global Industrial Thermopile Sensors Market Industry experiences a notable increase in demand for non-contact temperature measurement solutions. Industries such as manufacturing, automotive, and food processing are increasingly adopting thermopile sensors due to their ability to provide accurate temperature readings without direct contact. This trend is driven by the need for enhanced safety and efficiency in production processes. As a result, the market is projected to reach 1.32 USD Billion in 2024, reflecting a growing reliance on advanced sensing technologies. The shift towards automation and smart manufacturing further propels the adoption of thermopile sensors, indicating a robust future for the Global Industrial Thermopile Sensors Market Industry.

Market Segment Insights

Industrial Thermopile Sensors Type Insights

The Industrial Thermopile Sensors Market segmentation, based on type includes thermopile infrared sensors and thermopile laser sensors. The thermopile infrared sensors segment is the market's largest shareholder. These sensors are widely utilized in a variety of applications such as temperature measurement, gas analysis, and thermal imaging. Their non-contact nature and ability to detect infrared radiation make them ideal for industrial and consumer electronics applications. Thermopile infrared sensors have achieved substantial traction in areas such as automotive, aerospace, and healthcare, adding to their dominant market dominance.

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Industrial Thermopile Sensors Application Insights

The Industrial Thermopile Sensors Market segmentation, based on application, includes automobile industry, medical industry, and defense industry. The medical industry is the fastest expanding area of the Industrial Thermopile Sensors market. Because of their uses in temperature monitoring, medical imaging, and non-contact temperature measurement, thermopile sensors are in high demand in the medical industry. The increased emphasis on healthcare, as well as improvements in medical technology, is driving the use of thermopile sensors in a variety of medical devices and equipment.

Get more detailed insights about Industrial Thermopile Sensors Market Research Report — Global Forecast till 2034

Regional Insights

By region, the study provides the market insights into North America, Europe, Asia-Pacific and Rest of the World. North America dominates the Industrial Thermopile Sensors Market due to the significant presence of key industry players and technological advances. The presence of numerous prominent thermopile sensor manufacturers and suppliers in the region helps to the region's market dominance. Furthermore, North America has a well-established infrastructure as well as a high rate of technological adoption in industries such as automotive, aerospace, and medical devices.

Further, the major countries studied in the market report are The US, Canada, German, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure2: INDUSTRIAL THERMOPILE SENSORS MARKET SHARE BY REGION 2022 (USD Billion)

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Europe Industrial Thermopile Sensors Market accounts for the second-largest market share due to its powerful manufacturing sector and emphasis on energy efficiency. Further, the German Industrial Thermopile Sensors Market held the largest market share, and the UK Industrial Thermopile Sensors Market was the fastest growing market in the European region

The Asia-Pacific Industrial Thermopile Sensors Market is expected to grow at the fastest CAGR from 2023 to 2032. This is due to its increasing industrial sector and rapid technical improvements. Moreover, China’s Industrial Thermopile Sensors Market held the largest market share, and the Indian Industrial Thermopile Sensors Market was the fastest growing market in the Asia-Pacific region.

Key Players and Competitive Insights

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the Industrial Thermopile Sensors Market, grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, Industrial Thermopile Sensors industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the global Industrial Thermopile Sensors industry to benefit clients and increase the market sector. In recent years, the Industrial Thermopile Sensors industry has offered some of the most significant advantages to medicine. Major players in the Industrial Thermopile Sensors Market, including Excelitas Technologies, Fuji Ceramics Corporation, Ampheonl Advance Sensors, Flir Systems, Heimann Sensor GmbH and others, are attempting to increase market demand by investing in research and development operations.

Texas Instruments Incorporated (TI) is an American technology corporation based in Dallas, Texas, that designs and manufactures semiconductors and different integrated circuits for sale to electronics designers and manufacturers worldwide. It is one among the top ten semiconductor firms in the world in terms of sales volume. The company's primary concentration is on analogue chips and embedded processors, which account for more than 80% of its revenue. In March 2022, Texas Instruments will discuss critical power-management design issues for electric vehicles and industrial systems at APEC 2022.

Power designers will benefit from new technologies, demonstrations, and industry presentations that will help them reduce EMI and noise while enhancing power density and dependability.

TE Connectivity is a technology business based in the United States and Switzerland that designs and manufactures connectors and sensors for a variety of industries, including automotive, industrial equipment, data communication systems, aerospace, defence, medical, oil and gas, consumer electronics, and energy. TE Connectivity employs 89,000 people worldwide, including over 8,000 engineers. Customers are served in roughly 140 countries. In April 2022, TE Connectivity purchased 17 businesses and invested in two more. The transactions cost the company more than $ 3.08 billion. TE Connectivity has invested in Sensors, Cardiac and Vascular Disorders, Micro Electro Mechanical Systems, and other fields.

Key Companies in the Industrial Thermopile Sensors Market market include

Industry Developments

May 2022,Honeywell has won 11 product design accolades, including the Red Dot and iF Design accolades, two of the industry's most prestigious and well-known award programs. These product-specific awards recognize Honeywell's ongoing commitment to providing a best-in-class user experience that promotes workplace and worker safety via innovation, functionality, and design durability.

April 2022,Spectris Plc has agreed to sell Omega Engineering's process measurement and control instruments in the United States to private equity firm Arcline Investment Management for $525 million in cash. According to a statement made by Spectris on Tuesday, Omega Engineering is valued at roughly 20.4 times its adjusted profits before interest, taxes, depreciation, and amortization for 2021. Arcline will integrate Omega Engineering with Dwyer Group, a sensor maker it purchased last year, according to the announcement.

Future Outlook

Industrial Thermopile Sensors Market Future Outlook

The Industrial Thermopile Sensors Market is projected to grow at a 6.32% CAGR from 2025 to 2035, driven by advancements in automation, energy efficiency demands, and increasing industrial applications.

New opportunities lie in:

- Develop smart thermopile sensors for IoT applications to enhance data collection.

- Invest in R&D for high-temperature sensors to cater to specialized industries.

- Expand into emerging markets with tailored solutions for local industries.

By 2035, the market is expected to exhibit robust growth, solidifying its role in industrial automation.

Market Segmentation

Industrial Thermopile Sensors Regional Outlook

- US

- Canada

Industrial Thermopile Sensors Market Type Outlook

- Thermopile Infrared Sensors

- Thermopile Laser Sensors

Industrial Thermopile Sensors Market Application Outlook

- Automobile Industry

- Medical Industry

- Defense Industry

Report Scope

| Report Attribute/Metric | Details |

| Market Size 2024 | USD 1.32 Billion |

| Market Size 2025 | USD 1.41 Billion |

| Market Size 2035 | 2.59 (Value (USD Billion)) |

| Compound Annual Growth Rate (CAGR) | 6.32% (2025 - 2035) |

| Base Year | 2024 |

| Market Forecast Period | 2025 - 2035 |

| Historical Data | 2020- 2023 |

| Market Forecast Units | Value (USD Billion) |

| Report Coverage | Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | Type, Application and Region |

| Geographies Covered | North America, Europe, Asia Pacific, and the Rest of the World |

| Countries Covered | The US, Canada, German, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

| Key Companies Profiled | Excelitas Technologies, Fuji Ceramics Corporation, Ampheonl Advance Sensors, Flir Systems, Heimann Sensor GmbH, Nippon Ceramic, Hamamatsu Photonic, Texas Instruments, Panasonic, GE, Zilog, InfraTec, TE Connectivity, Murata, Winsensor. |

| Key Market Opportunities | Advancements in automation technology |

| Key Market Dynamics | The growing need for precise temperature measurement and control in various industries. |

Market Highlights

Author

Latest Comments

This is a great article! Really helped me understand the topic better.

Thanks for sharing this. I’ve bookmarked it for later reference.

FAQs

How much is the Industrial Thermopile Sensors Market?

The Industrial Thermopile Sensors Market size was valued at USD 1.32 Billion in 2024.

What is the growth rate of the Industrial Thermopile Sensors Market?

The global market is projected to grow at a CAGR of 6.3% during the forecast period, 2025-2034.

Which region held the largest market share in the Industrial Thermopile Sensors Market?

North America had the largest share in the global market

Who are the key players in the Industrial Thermopile Sensors Market?

The key players in the market are Excelitas Technologies, Fuji Ceramics Corporation, Ampheonl Advance Sensors, Flir Systems, Heimann Sensor GmbH.

Which type led the Industrial Thermopile Sensors Market?

The thermopile infrared sensors category dominated the market in 2022.

Which application had the fastest growing segment in the Industrial Thermopile Sensors Market?

The medical industry had the largest share in the global market.

-

Table of Contents

-

Executive Summary

-

Market Introduction

- Definition

-

Scope of the Study

- Research Objective

- Assumptions

- Limitations

-

Research Methodology

- Overview

- Data Mining

- Secondary Research

-

Primary Research

- Primary Interviews and Information Gathering Process

- Breakdown of Primary Respondents

- Forecasting Model

-

Market Size Estimation

- Bottom-up Approach

- Top-Down Approach

- Data Triangulation

- Validation

-

MARKET DYNAMICS

- Overview

- Drivers

- Restraints

- Opportunities

-

MARKET FACTOR ANALYSIS

- Value Chain Analysis

-

Porter’s Five Forces Analysis

- Bargaining Power of Suppliers

- Bargaining Power of Buyers

- Threat of New Entrants

- Threat of Substitutes

- Intensity of Rivalry

-

COVID-19 Impact Analysis

- Market Impact Analysis

- Regional Impact

- Opportunity and Threat Analysis

-

GLOBAL INDUSTRIAL THERMOPILE SENSORS MARKET,BY TYPE

- Overview

- Thermopile Infrared Sensors

- Thermopile Laser Sensors

-

GLOBAL INDUSTRIAL THERMOPILE SENSORS MARKET,BY APPLICATION

- Overview

- Automobile Industry

- Medical Industry

- Defense Industry

-

GLOBAL INDUSTRIAL THERMOPILE SENSORS MARKET, BY REGION

- Overview

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

-

Asia-Pacific

- China

- India

- Japan

- South Korea

- Australia

- Rest of Asia-Pacific

-

Rest of the World

- Middle East

- Africa

- Latin America

-

Competitive Landscape

- Overview

- Competitive Analysis

- Market Share Analysis

- Major Growth Strategy in the Global Industrial Thermopile Sensors Market,

- Competitive Benchmarking

- Leading Players in Terms of Number of Developments in the Global Industrial Thermopile Sensors Market,

-

Key developments and Growth Strategies

- New ProductLaunch/Service Deployment

- Merger &Acquisitions

- Joint Ventures

-

Major Players Financial Matrix

- Sales & Operating Income,2022

- Major Players R&D Expenditure.2022

-

COMPANY PROFILES

-

Excelitas Technologies

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Fuji Ceramics Corporation

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Ampheonl Advance Sensors

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Flir Systems

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Heimann Sensor GmbH

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Nippon Ceramic

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Hamamatsu Photonic

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

TEXAS INSTRUMENTS

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Panasonic

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Zilog

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

InfraTec

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

TE Connectivity

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Murata

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Winsensor

- Company Overview

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Excelitas Technologies

-

APPENDIX

- References

- Related Reports

-

-

List of Tables and Figures

- LIST OF TABLES

- TABLE 1 GLOBAL INDUSTRIAL THERMOPILE SENSORS MARKET, SYNOPSIS, 2020-2034

- TABLE 2 GLOBAL INDUSTRIAL THERMOPILE SENSORS MARKET, ESTIMATES &FORECAST, 2020-2034 (USD BILLION)

- TABLE 3 GLOBAL INDUSTRIAL THERMOPILE SENSORS MARKET,BY TYPE, 2020-2034(USD BILLION)

- TABLE 4 GLOBAL INDUSTRIAL THERMOPILE SENSORS MARKET,BY APPLICATION, 2020-2034(USD BILLION)

- TABLE 5 NORTH AMERICA: INDUSTRIAL THERMOPILE SENSORS MARKET,BY TYPE, 2020-2034(USD BILLION)

- TABLE 6 NORTH AMERICA: INDUSTRIAL THERMOPILE SENSORS MARKET,BY APPLICATION, 2020-2034(USD BILLION)

- TABLE 7 US: INDUSTRIAL THERMOPILE SENSORS MARKET,BY TYPE, 2020-2034(USD BILLION)

- TABLE 8 US: INDUSTRIAL THERMOPILE SENSORS MARKET,BY APPLICATION, 2020-2034(USD BILLION)

- TABLE 9 CANADA: INDUSTRIAL THERMOPILE SENSORS MARKET,BY TYPE, 2020-2034(USD BILLION)

- TABLE 10 CANADA: INDUSTRIAL THERMOPILE SENSORS MARKET,BY APPLICATION, 2020-2034(USD BILLION)

- TABLE 1 EUROPE: INDUSTRIAL THERMOPILE SENSORS MARKET,BY TYPE, 2020-2034(USD BILLION)

- TABLE 2 EUROPE: INDUSTRIAL THERMOPILE SENSORS MARKET, BY APPLICATION, 2020-2034(USD BILLION)

- TABLE 3 GERMANY: INDUSTRIAL THERMOPILE SENSORS MARKET,BY TYPE,2020-2034(USD BILLION)

- TABLE 4 GERMANY: INDUSTRIAL THERMOPILE SENSORS MARKET, BY APPLICATION, 2020-2034(USD BILLION)

- TABLE 5 FRANCE: INDUSTRIAL THERMOPILE SENSORS MARKET,BY TYPE, 2020-2034(USD BILLION)

- TABLE 6 FRANCE: INDUSTRIAL THERMOPILE SENSORS MARKET, BY APPLICATION, 2020-2034(USD BILLION)

- TABLE 7 ITALY: INDUSTRIAL THERMOPILE SENSORS MARKET,BY TYPE, 2020-2034(USD BILLION)

- TABLE 8 ITALY: INDUSTRIAL THERMOPILE SENSORS MARKET, BY APPLICATION, 2020-2034(USD BILLION)

- TABLE 9 SPAIN: INDUSTRIAL THERMOPILE SENSORS MARKET,BY TYPE, 2020-2034(USD BILLION)

- TABLE 10 SPAIN: INDUSTRIAL THERMOPILE SENSORS MARKET, BY APPLICATION, 2020-2034(USD BILLION)

- TABLE 11 UK: INDUSTRIAL THERMOPILE SENSORS MARKET,BY TYPE, 2020-2034(USD BILLION)

- TABLE 12 UK: INDUSTRIAL THERMOPILE SENSORS MARKET, BY APPLICATION, 2020-2034(USD BILLION)

- TABLE 13 REST OF EUROPE: INDUSTRIAL THERMOPILE SENSORS MARKET,BY TYPE, 2020-2034(USD BILLION)

- TABLE 14 REST OF EUROPE: INDUSTRIAL THERMOPILE SENSORS MARKET, BY APPLICATION, 2020-2034(USD BILLION)

- TABLE 15 ASIA-PACIFIC: INDUSTRIAL THERMOPILE SENSORS MARKET,BY TYPE, 2020-2034(USD BILLION)

- TABLE 16 ASIA-PACIFIC: INDUSTRIAL THERMOPILE SENSORS MARKET, BY APPLICATION, 2020-2034(USD BILLION)

- TABLE 17 JAPAN: INDUSTRIAL THERMOPILE SENSORS MARKET,BY TYPE, 2020-2034(USD BILLION)

- TABLE 18 JAPAN: INDUSTRIAL THERMOPILE SENSORS MARKET, BY APPLICATION, 2020-2034(USD BILLION)

- TABLE 19 CHINA: INDUSTRIAL THERMOPILE SENSORS MARKET,BY TYPE, 2020-2034(USD BILLION)

- TABLE 20 CHINA: INDUSTRIAL THERMOPILE SENSORS MARKET, BY APPLICATION, 2020-2034(USD BILLION)

- TABLE 21 INDIA: INDUSTRIAL THERMOPILE SENSORS MARKET,BY TYPE, 2020-2034(USD BILLION)

- TABLE 22 INDIA: INDUSTRIAL THERMOPILE SENSORS MARKET, BY APPLICATION, 2020-2034(USD BILLION)

- TABLE 23 AUSTRALIA: INDUSTRIAL THERMOPILE SENSORS MARKET,BY TYPE, 2020-2034(USD BILLION)

- TABLE 24 AUSTRALIA: INDUSTRIAL THERMOPILE SENSORS MARKET, BY APPLICATION, 2020-2034(USD BILLION)

- TABLE 25 SOUTH KOREA: INDUSTRIAL THERMOPILE SENSORS MARKET,BY TYPE, 2020-2034(USD BILLION)

- TABLE 26 SOUTH KOREA: INDUSTRIAL THERMOPILE SENSORS MARKET, BY APPLICATION, 2020-2034(USD BILLION)

- TABLE 27 REST OF ASIA-PACIFIC: INDUSTRIAL THERMOPILE SENSORS MARKET,BY TYPE, 2020-2034(USD BILLION)

- TABLE 28 REST OF ASIA-PACIFIC: INDUSTRIAL THERMOPILE SENSORS MARKET, BY APPLICATION, 2020-2034(USD BILLION)

- TABLE 29 REST OF THE WORLD: INDUSTRIAL THERMOPILE SENSORS MARKET,BY TYPE, 2020-2034(USD BILLION)

- TABLE 30 REST OF THE WORLD: INDUSTRIAL THERMOPILE SENSORS MARKET, BY APPLICATION, 2020-2034(USD BILLION)

- TABLE 31 MIDDLE EAST: INDUSTRIAL THERMOPILE SENSORS MARKET,BY TYPE, 2020-2034(USD BILLION)

- TABLE 32 MIDDLE EAST: INDUSTRIAL THERMOPILE SENSORS MARKET, BY APPLICATION, 2020-2034(USD BILLION)

- TABLE 33 AFRICA: INDUSTRIAL THERMOPILE SENSORS MARKET,BY TYPE, 2020-2034(USD BILLION)

- TABLE 34 AFRICA: INDUSTRIAL THERMOPILE SENSORS MARKET, BY APPLICATION, 2020-2034(USD BILLION)

- TABLE 35 LATIN AMERICA: INDUSTRIAL THERMOPILE SENSORS MARKET,BY TYPE, 2020-2034(USD BILLION)

- TABLE 36 LATIN AMERICA: INDUSTRIAL THERMOPILE SENSORS MARKET, BY APPLICATION, 2020-2034(USD BILLION) LIST OF FIGURES

- FIGURE 1 RESEARCH PROCESS

- FIGURE 2 MARKET STRUCTURE FOR THE GLOBAL INDUSTRIAL THERMOPILE SENSORS MARKET

- FIGURE 3 MARKET DYNAMICS FOR THE GLOBAL INDUSTRIAL THERMOPILE SENSORS MARKET

- FIGURE 4 GLOBAL INDUSTRIAL THERMOPILE SENSORS MARKET, SHARE (%), BY TYPE, 2022

- FIGURE 5 GLOBAL INDUSTRIAL THERMOPILE SENSORS MARKET, SHARE (%), BY APPLICATION, 2022

- FIGURE 6 GLOBAL INDUSTRIAL THERMOPILE SENSORS MARKET, SHARE (%), BY REGION, 2022

- FIGURE 7 NORTH AMERICA: INDUSTRIAL THERMOPILE SENSORS MARKET, SHARE (%), BY REGION, 2022

- FIGURE 8 EUROPE: INDUSTRIAL THERMOPILE SENSORS MARKET, SHARE (%), BY REGION, 2022

- FIGURE 9 ASIA-PACIFIC: INDUSTRIAL THERMOPILE SENSORS MARKET, SHARE (%), BY REGION, 2022

- FIGURE 10 REST OF THE WORLD: INDUSTRIAL THERMOPILE SENSORS MARKET, SHARE (%), BY REGION, 2022

- FIGURE 11 GLOBAL INDUSTRIAL THERMOPILE SENSORS MARKET: COMPANY SHARE ANALYSIS, 2022 (%)

- FIGURE 12 EXCELITAS TECHNOLOGIES: FINANCIAL OVERVIEW SNAPSHOT

- FIGURE 13 EXCELITAS TECHNOLOGIES: SWOT ANALYSIS

- FIGURE 14 FUJI CERAMICS CORPORATION:FINANCIAL OVERVIEW SNAPSHOT

- FIGURE 15 FUJI CERAMICS CORPORATION:SWOT ANALYSIS

- FIGURE 16 AMPHEONL ADVANCE SENSORS:FINANCIAL OVERVIEW SNAPSHOT

- FIGURE 17 AMPHEONL ADVANCE SENSORS:SWOT ANALYSIS

- FIGURE 18 FLIR SYSTEMS: FINANCIAL OVERVIEW SNAPSHOT

- FIGURE 19 FLIR SYSTEMS:SWOT ANALYSIS

- FIGURE 20 HEIMANN SENSOR GMBH.:FINANCIAL OVERVIEW SNAPSHOT

- FIGURE 21 HEIMANN SENSOR GMBH.:SWOT ANALYSIS

- FIGURE 22 NIPPON CERAMIC:FINANCIAL OVERVIEW SNAPSHOT

- FIGURE 23 NIPPON CERAMIC:SWOT ANALYSIS

- FIGURE 24 HAMAMATSU PHOTONIC: FINANCIAL OVERVIEW SNAPSHOT

- FIGURE 25 HAMAMATSU PHOTONIC: SWOT ANALYSIS

- FIGURE 26 TEXAS INSTRUMENTS: FINANCIAL OVERVIEW SNAPSHOT

- FIGURE 27 TEXAS INSTRUMENTS: SWOT ANALYSIS

- FIGURE 28 PANASONIC: FINANCIAL OVERVIEW SNAPSHOT

- FIGURE 29 PANASONIC: SWOT ANALYSIS

- FIGURE 30 GE:FINANCIAL OVERVIEW SNAPSHOT

- FIGURE 31 GE:SWOT ANALYSIS

- FIGURE 32 ZILOG:FINANCIAL OVERVIEW SNAPSHOT

- FIGURE 33 ZILOG:SWOT ANALYSIS

- FIGURE 34 INFRATEC:FINANCIAL OVERVIEW SNAPSHOT

- FIGURE 35 INFRATEC:SWOT ANALYSIS

- FIGURE 36 TE CONNECTIVITY:FINANCIAL OVERVIEW SNAPSHOT

- FIGURE 37 TE CONNECTIVITY:SWOT ANALYSIS

- FIGURE 38 MURATA:FINANCIAL OVERVIEW SNAPSHOT

- FIGURE 39 MURATA:SWOT ANALYSIS

- FIGURE 40 WINSENSOR:FINANCIAL OVERVIEW SNAPSHOT

- FIGURE 41 WINSENSOR:SWOT ANALYSIS

Industrial Thermopile Sensors Market Segmentation

Industrial Thermopile Sensors Market Type Outlook (USD Billion, 2020-2034)

- Thermopile Infrared Sensors

- Thermopile Laser Sensors

Industrial Thermopile Sensors Market Application Outlook (USD Billion, 2020-2034)

- Automobile Industry

- Medical Industry

- Defense Industry

Industrial Thermopile Sensors Market Regional Outlook (USD Billion, 2020-2034)

- North AmericaOutlook (USD Billion, 2020-2034)

- North America Industrial Thermopile Sensors Market by Type

- Thermopile Infrared Sensors

- Thermopile Laser Sensors

- North America Industrial Thermopile Sensors Market by Application

- Automobile Industry

- Medical Industry

- Defense Industry

- USOutlook (USD Billion, 2020-2034)

- US Industrial Thermopile Sensors Market by Type

- Thermopile Infrared Sensors

- Thermopile Laser Sensors

- US Industrial Thermopile Sensors Market by Application

- Automobile Industry

- Medical Industry

- Defense Industry

- CANADAOutlook (USD Billion, 2020-2034)

- CANADA Industrial Thermopile Sensors Market by Type

- Thermopile Infrared Sensors

- Thermopile Laser Sensors

- CANADA Industrial Thermopile Sensors Market by Application

- Automobile Industry

- Medical Industry

- Defense Industry

- EuropeOutlook (USD Billion, 2020-2034)

- Europe Industrial Thermopile Sensors Market by Type

- Thermopile Infrared Sensors

- Thermopile Laser Sensors

- EuropeIndustrial Thermopile Sensors Market by Application

- Automobile Industry

- Medical Industry

- Defense Industry

- GermanyOutlook (USD Billion, 2020-2034)

- Germany Industrial Thermopile Sensors Market by Type

- Thermopile Infrared Sensors

- Thermopile Laser Sensors

- GermanyIndustrial Thermopile Sensors Market by Application

- Automobile Industry

- Medical Industry

- Defense Industry

- FranceOutlook (USD Billion, 2020-2034)

- France Industrial Thermopile Sensors Market by Type

- Thermopile Infrared Sensors

- Thermopile Laser Sensors

- FranceIndustrial Thermopile Sensors Market by Application

- Automobile Industry

- Medical Industry

- Defense Industry

- UKOutlook (USD Billion, 2020-2034)

- UK Industrial Thermopile Sensors Market by Type

- Thermopile Infrared Sensors

- Thermopile Laser Sensors

- UKIndustrial Thermopile Sensors Market by Application

- Automobile Industry

- Medical Industry

- Defense Industry

- ITALYOutlook (USD Billion, 2020-2034)

- ITALY Industrial Thermopile Sensors Market by Type

- Thermopile Infrared Sensors

- Thermopile Laser Sensors

- ITALYIndustrial Thermopile Sensors Market by Application

- Automobile Industry

- Medical Industry

- Defense Industry

- SPAINOutlook (USD Billion, 2020-2034)

- Spain Industrial Thermopile Sensors Market by Type

- Thermopile Infrared Sensors

- Thermopile Laser Sensors

- SpainIndustrial Thermopile Sensors Market by Application

- Automobile Industry

- Medical Industry

- Defense Industry

- Rest Of EuropeOutlook (USD Billion, 2020-2034)

- Rest Of Europe Industrial Thermopile Sensors Market by Type

- Thermopile Infrared Sensors

- Thermopile Laser Sensors

- REST OF EUROPEIndustrial Thermopile Sensors Market by Application

- Automobile Industry

- Medical Industry

- Defense Industry e

- Asia-PacificOutlook (USD Billion, 2020-2034)

- Asia-Pacific Industrial Thermopile Sensors Market by Type

- Thermopile Infrared Sensors

- Thermopile Laser Sensors

- Asia-PacificIndustrial Thermopile Sensors Market by Application

- Automobile Industry

- Medical Industry

- Defense Industry

- ChinaOutlook (USD Billion, 2020-2034)

- China Industrial Thermopile Sensors Market by Type

- Thermopile Infrared Sensors

- Thermopile Laser Sensors

- ChinaIndustrial Thermopile Sensors Market by Application

- Automobile Industry

- Medical Industry

- Defense Industry

- JapanOutlook (USD Billion, 2020-2034)

- Japan Industrial Thermopile Sensors Market by Type

- Thermopile Infrared Sensors

- Thermopile Laser Sensors

- JapanIndustrial Thermopile Sensors Market by Application

- Automobile Industry

- Medical Industry

- Defense Industry

- India Outlook (USD Billion, 2020-2034)

- India Industrial Thermopile Sensors Market by Type

- Thermopile Infrared Sensors

- Thermopile Laser Sensors

- IndiaIndustrial Thermopile Sensors Market by Application

- Automobile Industry

- Medical Industry

- Defense Industry

- AustraliaOutlook (USD Billion, 2020-2034)

- Australia Industrial Thermopile Sensors Market by Type

- Thermopile Infrared Sensors

- Thermopile Laser Sensors

- AustraliaIndustrial Thermopile Sensors Market by Application

- Automobile Industry

- Medical Industry

- Defense Industry

- Rest of Asia-PacificOutlook (USD Billion, 2020-2034)

- Rest of Asia-Pacific Industrial Thermopile Sensors Market by Type

- Thermopile Infrared Sensors

- Thermopile Laser Sensors

- Rest of Asia-PacificIndustrial Thermopile Sensors Market by Application

- Automobile Industry

- Medical Industry

- Defense Industry

- Rest of the WorldOutlook (USD Billion, 2020-2034)

- Rest of the World Industrial Thermopile Sensors Market by Type

- Thermopile Infrared Sensors

- Thermopile Laser Sensors

- Rest of the WorldIndustrial Thermopile Sensors Market by Application

- Automobile Industry

- Medical Industry

- Defense Industry

- Middle EastOutlook (USD Billion, 2020-2034)

- Middle East Industrial Thermopile Sensors Market by Type

- Thermopile Infrared Sensors

- Thermopile Laser Sensors

- Middle EastIndustrial Thermopile Sensors Market by Application

- Automobile Industry

- Medical Industry

- Defense Industry

- AfricaOutlook (USD Billion, 2020-2034)

- Africa Industrial Thermopile Sensors Market by Type

- Thermopile Infrared Sensors

- Thermopile Laser Sensors

- Africa Industrial Thermopile Sensors Market by Application

- Automobile Industry

- Medical Industry

- Defense Industry

- Latin AmericaOutlook (USD Billion, 2020-2034)

- Latin America Industrial Thermopile Sensors Market by Type

- Thermopile Infrared Sensors

- Thermopile Laser Sensors

- Latin AmericaIndustrial Thermopile Sensors Market by Application

- Automobile Industry

- Medical Industry

- Defense Industry

Free Sample Request

Kindly complete the form below to receive a free sample of this Report

Customer Strories

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

Leave a Comment