-

MARKET INTRODUCTION

-

INTRODUCTION

-

SCOPE OF STUDY

- RESEARCH OBJECTIVE

- ASSUMPTIONS

- LIMITATIONS

-

MARKET STRUCTURE

-

RESEARCH METHODOLOGY

-

RESEARCH TYPE

-

PRIMARY RESEARCH

-

SECONDARY RESEARCH

-

FORECAST MODEL

- MARKET DATA COLLECTION, ANALYSIS & FORECAST

- MARKET SIZE ESTIMATION

-

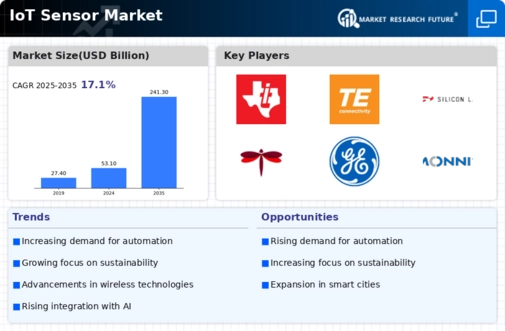

MARKET DYNAMICS

-

INTRODUCTION

-

MARKET DRIVERS

-

MARKET CHALLENGES

-

MARKET OPPORTUNITIES

-

MARKET RESTRAINTS

-

EXECUTIVE SUMMARY

-

MARKET FACTOR ANALYSIS

-

PORTER’S FIVE FORCES ANALYSIS

-

SUPPLY CHAIN ANALYSIS

-

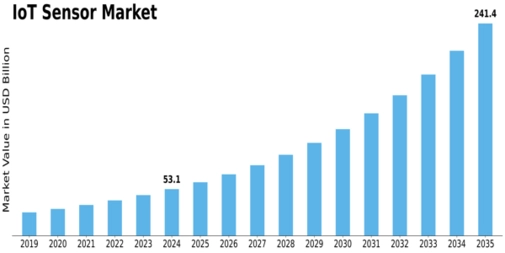

IOT SENSOR MARKET, BY SEGMENTS

-

INTRODUCTION

-

MARKET STATISTICS

- BY COMPONENT

- BY TYPE

- BY NETWORK TECHNOLOGY

- BY VERTICAL

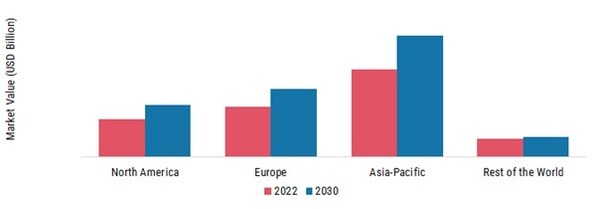

- BY REGION

-

COMPETITIVE ANALYSIS

-

MARKET SHARE ANALYSIS

-

COMPANY PROFILES

- TEXAS INSTRUMENTS INCORPORATED (U.S.)

- STMICROELECTRONICS N.V. (SWITZERLAND)

- TE CONNECTIVITY LTD. (U.S.)

- INFINEON TECHNOLOGIES AG (GERMANY)

- ANALOG DEVICES, INC. (U.S.)

- BROADCOM LIMITED (U.S.)

- ROBERT BOSCH GMBH (GERMANY)

- JOHNSON CONTROLS INTERNATIONAL PLC (IRELAND)

- SONY CORPORATION (JAPAN)

- HONEYWELL INTERNATIONAL, INC. (U.S.)

- OTHERS

-

LIST OF TABLES

-

IOT SENSOR MARKET, BY COMPONENT

-

IOT SENSOR MARKET, BY TYPE

-

IOT SENSOR MARKET, BY NETWORK TECHNOLOGY

-

IOT SENSOR MARKET, BY VERTICAL

-

IOT SENSOR MARKET, BY REGIONS

-

NORTH AMERICA IOT SENSOR MARKET, BY COMPONENT

-

NORTH AMERICA IOT SENSOR MARKET, BY TYPE

-

NORTH AMERICA IOT SENSOR MARKET, BY NETWORK TECHNOLOGY

-

NORTH AMERICA IOT SENSOR MARKET, BY VERTICAL

-

U.S. IOT SENSOR MARKET, BY COMPONENT

-

U.S. IOT SENSOR MARKET, BY TYPE

-

U.S. IOT SENSOR MARKET, BY NETWORK TECHNOLOGY

-

U.S. IOT SENSOR MARKET, BY VERTICAL

-

CANADA IOT SENSOR MARKET, BY COMPONENT

-

CANADA IOT SENSOR MARKET, BY TYPE

-

CANADA IOT SENSOR MARKET, BY NETWORK TECHNOLOGY

-

CANADA IOT SENSOR MARKET, BY VERTICAL

-

EUROPE IOT SENSOR MARKET, BY COMPONENT

-

EUROPE IOT SENSOR MARKET, BY TYPE

-

EUROPE IOT SENSOR MARKET, BY NETWORK TECHNOLOGY

-

EUROPE IOT SENSOR MARKET, BY VERTICAL

-

U.K. IOT SENSOR MARKET, BY COMPONENT

-

U.K. IOT SENSOR MARKET, BY TYPE

-

U.K. IOT SENSOR MARKET, BY NETWORK TECHNOLOGY

-

U.K. IOT SENSOR MARKET, BY VERTICAL

-

GERMANY IOT SENSOR MARKET, BY COMPONENT

-

GERMANY IOT SENSOR MARKET, BY TYPE

-

GERMANY IOT SENSOR MARKET, BY NETWORK TECHNOLOGY

-

GERMANY IOT SENSOR MARKET, BY VERTICAL

-

FRANCE IOT SENSOR MARKET, BY COMPONENT

-

FRANCE IOT SENSOR MARKET, BY TYPE

-

FRANCE IOT SENSOR MARKET, BY NETWORK TECHNOLOGY

-

FRANCE IOT SENSOR MARKET, BY VERTICAL

-

ITALY IOT SENSOR MARKET, BY COMPONENT

-

ITALY IOT SENSOR MARKET, BY TYPE

-

ITALY IOT SENSOR MARKET, BY NETWORK TECHNOLOGY

-

ITALY IOT SENSOR MARKET, BY VERTICAL

-

REST OF EUROPE IOT SENSOR MARKET, BY COMPONENT

-

REST OF EUROPE IOT SENSOR MARKET, BY TYPE

-

REST OF EUROPE IOT SENSOR MARKET, BY NETWORK TECHNOLOGY

-

REST OF EUROPE IOT SENSOR MARKET, BY VERTICAL

-

ASIA-PACIFIC IOT SENSOR MARKET, BY COMPONENT

-

ASIA-PACIFIC IOT SENSOR MARKET, BY TYPE

-

ASIA-PACIFIC IOT SENSOR MARKET, BY NETWORK TECHNOLOGY

-

ASIA-PACIFIC IOT SENSOR MARKET, BY VERTICAL

-

CHINA IOT SENSOR MARKET, BY COMPONENT

-

CHINA IOT SENSOR MARKET, BY TYPE

-

CHINA IOT SENSOR MARKET, BY NETWORK TECHNOLOGY

-

CHINA IOT SENSOR MARKET, BY VERTICAL

-

JAPAN IOT SENSOR MARKET, BY COMPONENT

-

JAPAN IOT SENSOR MARKET, BY TYPE

-

JAPAN IOT SENSOR MARKET, BY NETWORK TECHNOLOGY

-

JAPAN IOT SENSOR MARKET, BY VERTICAL

-

SOUTH KOREA IOT SENSOR MARKET, BY COMPONENT

-

SOUTH KOREA IOT SENSOR MARKET, BY TYPE

-

SOUTH KOREA IOT SENSOR MARKET, BY NETWORK TECHNOLOGY

-

SOUTH KOREA IOT SENSOR MARKET, BY VERTICAL

-

INDIA IOT SENSOR MARKET, BY COMPONENT

-

INDIA IOT SENSOR MARKET, BY TYPE

-

INDIA IOT SENSOR MARKET, BY NETWORK TECHNOLOGY

-

INDIA IOT SENSOR MARKET, BY VERTICAL

-

REST OF ASIA-PACIFIC IOT SENSOR MARKET, BY COMPONENT

-

REST OF ASIA-PACIFIC IOT SENSOR MARKET, BY TYPE

-

REST OF ASIA-PACIFIC IOT SENSOR MARKET, BY NETWORK TECHNOLOGY

-

REST OF ASIA-PACIFIC IOT SENSOR MARKET, BY VERTICAL

-

REST OF THE WORLD IOT SENSOR MARKET, BY COMPONENT

-

REST OF THE WORLD IOT SENSOR MARKET, BY TYPE

-

REST OF THE WORLD IOT SENSOR MARKET, BY NETWORK TECHNOLOGY

-

REST OF THE WORLD IOT SENSOR MARKET, BY VERTICAL

-

-

LIST OF FIGURES

-

RESEARCH TYPE

-

IOT SENSOR MARKET, BY COMPONENT (%)

-

IOT SENSOR MARKET, BY TYPE (%)

-

IOT SENSOR MARKET, BY NETWORK TECHNOLOGY (%)

-

IOT SENSOR MARKET, BY VERTICAL (%)

-

IOT SENSOR MARKET, BY REGIONS (%)

-

NORTH AMERICA IOT SENSOR MARKET, BY COMPONENT (%)

-

NORTH AMERICA IOT SENSOR MARKET, BY TYPE (%)

-

NORTH AMERICA IOT SENSOR MARKET, BY NETWORK TECHNOLOGY (%)

-

NORTH AMERICA IOT SENSOR MARKET, BY VERTICAL (%)

-

U.S. IOT SENSOR MARKET, BY COMPONENT (%)

-

U.S. IOT SENSOR MARKET, BY TYPE (%)

-

U.S. IOT SENSOR MARKET, BY NETWORK TECHNOLOGY (%)

-

U.S. IOT SENSOR MARKET, BY VERTICAL (%)

-

CANADA IOT SENSOR MARKET, BY COMPONENT (%)

-

CANADA IOT SENSOR MARKET, BY TYPE (%)

-

CANADA IOT SENSOR MARKET, BY NETWORK TECHNOLOGY (%)

-

CANADA IOT SENSOR MARKET, BY VERTICAL (%)

-

EUROPE IOT SENSOR MARKET, BY COMPONENT (%)

-

EUROPE IOT SENSOR MARKET, BY TYPE (%)

-

EUROPE IOT SENSOR MARKET, BY NETWORK TECHNOLOGY (%)

-

EUROPE IOT SENSOR MARKET, BY VERTICAL (%)

-

U.K. IOT SENSOR MARKET, BY COMPONENT (%)

-

U.K. IOT SENSOR MARKET, BY TYPE (%)

-

U.K. IOT SENSOR MARKET, BY NETWORK TECHNOLOGY (%)

-

U.K. IOT SENSOR MARKET, BY VERTICAL (%)

-

GERMANY IOT SENSOR MARKET, BY COMPONENT (%)

-

GERMANY IOT SENSOR MARKET, BY TYPE (%)

-

GERMANY IOT SENSOR MARKET, BY NETWORK TECHNOLOGY (%)

-

GERMANY IOT SENSOR MARKET, BY VERTICAL (%)

-

FRANCE IOT SENSOR MARKET, BY COMPONENT (%)

-

FRANCE IOT SENSOR MARKET, BY TYPE (%)

-

FRANCE IOT SENSOR MARKET, BY NETWORK TECHNOLOGY (%)

-

FRANCE IOT SENSOR MARKET, BY VERTICAL (%)

-

ITALY IOT SENSOR MARKET, BY COMPONENT (%)

-

ITALY IOT SENSOR MARKET, BY TYPE (%)

-

ITALY IOT SENSOR MARKET, BY NETWORK TECHNOLOGY (%)

-

ITALY IOT SENSOR MARKET, BY VERTICAL (%)

-

REST OF EUROPE IOT SENSOR MARKET, BY COMPONENT (%)

-

REST OF EUROPE IOT SENSOR MARKET, BY TYPE (%)

-

REST OF EUROPE IOT SENSOR MARKET, BY NETWORK TECHNOLOGY (%)

-

REST OF EUROPE IOT SENSOR MARKET, BY VERTICAL (%)

-

ASIA-PACIFIC IOT SENSOR MARKET, BY COMPONENT (%)

-

ASIA-PACIFIC IOT SENSOR MARKET, BY TYPE (%)

-

ASIA-PACIFIC IOT SENSOR MARKET, BY NETWORK TECHNOLOGY (%)

-

ASIA-PACIFIC IOT SENSOR MARKET, BY VERTICAL (%)

-

CHINA IOT SENSOR MARKET, BY COMPONENT (%)

-

CHINA IOT SENSOR MARKET, BY TYPE (%)

-

CHINA IOT SENSOR MARKET, BY NETWORK TECHNOLOGY (%)

-

CHINA IOT SENSOR MARKET, BY VERTICAL (%)

-

JAPAN IOT SENSOR MARKET, BY COMPONENT (%)

-

JAPAN IOT SENSOR MARKET, BY TYPE (%)

-

JAPAN IOT SENSOR MARKET, BY NETWORK TECHNOLOGY (%)

-

JAPAN IOT SENSOR MARKET, BY VERTICAL (%)

-

SOUTH KOREA IOT SENSOR MARKET, BY COMPONENT (%)

-

SOUTH KOREA IOT SENSOR MARKET, BY TYPE (%)

-

SOUTH KOREA IOT SENSOR MARKET, BY NETWORK TECHNOLOGY (%)

-

SOUTH KOREA IOT SENSOR MARKET, BY VERTICAL (%)

-

INDIA IOT SENSOR MARKET, BY COMPONENT (%)

-

INDIA IOT SENSOR MARKET, BY TYPE (%)

-

INDIA IOT SENSOR MARKET, BY NETWORK TECHNOLOGY (%)

-

INDIA IOT SENSOR MARKET, BY VERTICAL (%)

-

REST OF ASIA-PACIFIC IOT SENSOR MARKET, BY COMPONENT (%)

-

REST OF ASIA-PACIFIC IOT SENSOR MARKET, BY TYPE (%)

-

REST OF ASIA-PACIFIC IOT SENSOR MARKET, BY NETWORK TECHNOLOGY (%)

-

REST OF ASIA-PACIFIC IOT SENSOR MARKET, BY VERTICAL (%)

-

REST OF THE WORLD IOT SENSOR MARKET, BY COMPONENT (%)

-

REST OF THE WORLD IOT SENSOR MARKET, BY TYPE (%)

-

REST OF THE WORLD IOT SENSOR MARKET, BY NETWORK TECHNOLOGY (%)

-

REST OF THE WORLD IOT SENSOR MARKET, BY VERTICAL (%)

-

"

Leave a Comment