-

EXECUTIVE SUMMARY

-

MARKET ATTRACTIVENESS ANALYSIS

- GLOBAL IRON ORE MARKET, BY PRODUCT TYPE

- GLOBAL IRON ORE MARKET, BY FORM

- GLOBAL IRON ORE MARKET, BY END-USE INDUSTRY

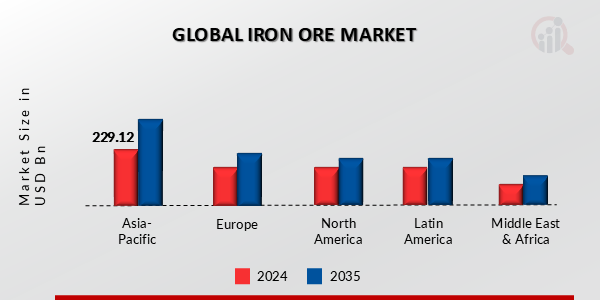

- GLOBAL IRON ORE MARKET, BY REGION

-

MARKET INTRODUCTION

-

DEFINITION

-

SCOPE OF THE STUDY

-

MARKET STRUCTURE

-

RESEARCH METHODOLOGY

-

RESEARCH PROCESS

-

PRIMARY RESEARCH

-

SECONDARY RESEARCH

-

MARKET SIZE ESTIMATION

-

TOP-DOWN AND BOTTOM-UP APPROACHES

-

FORECAST MODEL

-

LIST OF ASSUMPTIONS & LIMITATIONS

-

MARKET DYNAMICS

-

INTRODUCTION

-

DRIVERS

- HEALTHY GROWTH OF THE CONSTRUCTION INDUSTRY

- GROWING USE OF STEEL IN THE AUTOMOTIVE AND TRANSPORTATION INDUSTRIES

-

RESTRAINTS

- STRINGENT GOVERNMENT REGULATIONS ON MINING ACTIVITIES

-

OPPORTUNITIES

- INCREASING ADOPTION OF IRON OXIDE PIGMENTS IN VARIOUS APPLICATIONS

-

CHALLENGES

- INCREASING EMPHASIS ON STEEL RECYCLING

-

MARKET FACTOR ANALYSIS

-

SUPPLY CHAIN ANALYSIS

- IRON ORE PROCESSING & PRODUCERS

- DISTRIBUTION & SALES CHANNEL

- END-USE INDUSTRY

-

PORTER’S FIVE FORCES ANALYSIS

- THREAT OF NEW ENTRANTS

- BARGAINING POWER OF SUPPLIERS

- THREAT OF SUBSTITUTES

- BARGAINING POWER OF BUYERS

- INTENSITY OF RIVALRY

-

PRICING OVERVIEW, BY REGION (USD/TON)

-

IMPACT OF COVID-19 OUTBREAK ON THE GLOBAL IRON ORE MARKET

- OVERVIEW OF SUPPLY SCENARIO

- IMPACT ON IRON ORE SUPPLIERS AND MANUFACTURERS

- IMPACT ON IRON ORE END USERS

-

GLOBAL IRON ORE MARKET, BY PRODUCT TYPE

-

OVERVIEW

- IRON ORE: MARKET ESTIMATES & FORECAST BY PRODUCT TYPE, 2019–2030

- IRON ORE: MARKET ESTIMATES & FORECAST BY PRODUCT TYPE, 2019–2030

-

HEMATITE

- HEMATITE: MARKET ESTIMATES & FORECAST BY REGION,2019–2030

-

MAGNETITE

- MAGNETITE: MARKET ESTIMATES & FORECAST BY REGION,2019–2030

-

LIMONITE

- LIMONITE: MARKET ESTIMATES & FORECAST BY REGION,2019–2030

-

SIDERITE

- SIDERITE: MARKET ESTIMATES & FORECAST BY REGION,2019–2030

-

OTHERS

- OTHERS: MARKET ESTIMATES & FORECAST BY REGION,2019–2030

-

GLOBAL IRON ORE MARKET, BY FORM

-

OVERVIEW

- IRON ORE: MARKET ESTIMATES & FORECAST BY FORM, 2019–2030

- IRON ORE: MARKET ESTIMATES & FORECAST BY FORM, 2019–2030

-

SINTER FINES

- SINTER FINES: MARKET ESTIMATES & FORECAST BY REGION,2019–2030

-

LUMPS

- LUMPS: MARKET ESTIMATES & FORECAST BY REGION,2019–2030

-

PELLETS

- PELLETS: MARKET ESTIMATES & FORECAST BY REGION,2019–2030

-

OTHERS

- OTHERS: MARKET ESTIMATES & FORECAST BY REGION,2019–2030

-

GLOBAL IRON ORE MARKET, BY END-USE INDUSTRY

-

OVERVIEW

- IRON ORE: MARKET ESTIMATES & FORECAST BY END-USE INDUSTRY, 2019–2030

- IRON ORE: MARKET ESTIMATES & FORECAST BY END-USE INDUSTRY, 2019–2030

-

STEEL MANUFACTURING

- STEEL MANUFACTURING: MARKET ESTIMATES & FORECAST BY REGION,2019–2030

-

OTHERS

- OTHERS: MARKET ESTIMATES & FORECAST BY REGION,2019–2030

-

GLOBAL IRON ORE MARKET, BY REGION

-

OVERVIEW

-

NORTH AMERICA

- US

- CANADA

-

EUROPE

- GERMANY

- UK

- FRANCE

- SPAIN

- ITALY

- RUSSIA

- BELGIUM

- POLAND

- NETHERLANDS

- REST OF EUROPE

-

ASIA-PACIFIC

- CHINA

- JAPAN

- INDIA

- AUSTRALIA & NEW ZEALAND

- INDONESIA

- SOUTH KOREA

- REST OF ASIA-PACIFIC

-

LATIN AMERICA

- BRAZIL

- MEXICO

- ARGENTINA

- REST OF LATIN AMERICA

-

MIDDLE EAST & AFRICA

- SAUDI ARABIA

- IRAN

- ISRAEL

- TURKEY

- SOUTH AFRICA

- UAE

- REST OF THE MIDDLE EAST & AFRICA

-

COMPETITIVE LANDSCAPE

-

INTRODUCTION

-

MARKET STRATEGY ANALYSIS

-

KEY DEVELOPMENTS & GROWTH STRATEGIES

-

COMPETITIVE BENCHMARKING

-

COMPANY PROFILES

-

VALE S.A.

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

RIO TINTO

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

BHP

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENT

- SWOT ANALYSIS

- KEY STRATEGIES

-

FORTESCUE METALS GROUP LTD

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

ANSTEEL GROUP CORPORATION LIMITED

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

ARCELORMITTAL

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

METALLOINVEST MC LLC

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

LKAB

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- SWOT ANALYSIS

- KEY STRATEGIES

-

CLEVELAND-CLIFFS INC.

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENT

- SWOT ANALYSIS

- KEY STRATEGIES

-

HBIS GROUP

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

ANGLO AMERICAN PLC

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENT

- SWOT ANALYSIS

- KEY STRATEGIES

-

EVRAZ PLC

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

APPENDIX

-

REFERENCES

-

RELATED REPORTS

-

-

LIST OF TABLES

-

LIST OF ASSUMPTIONS & LIMITATIONS

-

PRICING OVERVIEW, BY REGION (USD/TON)

-

PRICING OVERVIEW, BY REGION (USD/TON)

-

IRON ORE MARKET ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019–2030 (USD MILLION)

-

IRON ORE MARKET ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019–2030 (MILLION TONS)

-

HEMATITE MARKET ESTIMATES & FORECAST, BY REGION, 2019–2030 (USD MILLION)

-

HEMATITE MARKET ESTIMATES & FORECAST, BY REGION, 2019–2030 (MILLION TONS)

-

MAGNETITE MARKET ESTIMATES & FORECAST, BY REGION, 2019–2030 (USD MILLION)

-

MAGNETITE MARKET ESTIMATES & FORECAST, BY REGION, 2019–2030 (MILLION TONS)

-

LIMONITE MARKET ESTIMATES & FORECAST, BY REGION, 2019–2030 (USD MILLION)

-

LIMONITE MARKET ESTIMATES & FORECAST, BY REGION, 2019–2030 (MILLION TONS)

-

SIDERITE MARKET ESTIMATES & FORECAST, BY REGION, 2019–2030 (USD MILLION)

-

SIDERITE MARKET ESTIMATES & FORECAST, BY REGION, 2019–2030 (MILLION TONS)

-

OTHERS MARKET ESTIMATES & FORECAST, BY REGION, 2019–2030 (USD MILLION)

-

OTHERS MARKET ESTIMATES & FORECAST, BY REGION, 2019–2030 (MILLION TONS)

-

IRON ORE MARKET ESTIMATES & FORECAST, BY FORM, 2019–2030 (USD MILLION)

-

IRON ORE MARKET ESTIMATES & FORECAST, BY FORM, 2019–2030 (MILLION TONS)

-

SINTER FINES MARKET ESTIMATES & FORECAST, BY REGION, 2019–2030 (USD MILLION)

-

SINTER FINES MARKET ESTIMATES & FORECAST, BY REGION, 2019–2030 (MILLION TONS)

-

LUMPS MARKET ESTIMATES & FORECAST, BY REGION, 2019–2030 (USD MILLION)

-

LUMPS MARKET ESTIMATES & FORECAST, BY REGION, 2019–2030 (MILLION TONS)

-

PELLETS MARKET ESTIMATES & FORECAST, BY REGION, 2019–2030 (USD MILLION)

-

PELLETS MARKET ESTIMATES & FORECAST, BY REGION, 2019–2030 (MILLION TONS)

-

OTHERS MARKET ESTIMATES & FORECAST, BY REGION, 2019–2030 (USD MILLION)

-

OTHERS MARKET ESTIMATES & FORECAST, BY REGION, 2019–2030 (MILLION TONS)

-

IRON ORE MARKET ESTIMATES & FORECAST, BY END-USE INDUSTRY, 2019–2030 (USD MILLION)

-

IRON ORE MARKET ESTIMATES & FORECAST, BY END-USE INDUSTRY, 2019–2030 (MILLION TONS)

-

STEEL MANUFACTURING MARKET ESTIMATES & FORECAST, BY REGION, 2019–2030 (USD MILLION)

-

STEEL MANUFACTURING MARKET ESTIMATES & FORECAST, BY REGION, 2019–2030 (MILLION TONS)

-

IRON ORE MARKET ESTIMATES & FORECAST, BY STEEL MANUFACTURING, 2019–2030 (USD MILLION)

-

IRON ORE MARKET ESTIMATES & FORECAST, BY STEEL MANUFACTURING, 2019–2030 (MILLION TONS)

-

OTHERS MARKET ESTIMATES & FORECAST, BY REGION, 2019–2030 (USD MILLION)

-

OTHERS MARKET ESTIMATES & FORECAST, BY REGION, 2019–2030 (MILLION TONS)

-

GLOBAL IRON ORE MARKET, BY REGION, 2019–2030 (USD MILLION)

-

GLOBAL IRON ORE MARKET, BY REGION, 2019–2030 (MILLION TONS)

-

NORTH AMERICA: IRON ORE MARKET, BY COUNTRY, 2019–2030 (USD MILLION)

-

NORTH AMERICA: IRON ORE MARKET, BY COUNTRY, 2019–2030 (MILLION TONS)

-

NORTH AMERICA: IRON ORE MARKET, BY PRODUCT TYPE, 2019–2030 (USD MILLION)

-

NORTH AMERICA: IRON ORE MARKET, BY PRODUCT TYPE, 2019–2030 (MILLION TONS)

-

NORTH AMERICA: IRON ORE MARKET, BY FORM, 2019–2030 (USD MILLION)

-

NORTH AMERICA: IRON ORE MARKET, BY FORM, 2019–2030 (MILLION TONS)

-

NORTH AMERICA: IRON ORE MARKET, BY END-USE INDUSTRY, 2019–2030 (USD MILLION)

-

NORTH AMERICA: IRON ORE MARKET, BY END-USE INDUSTRY, 2019–2030 (MILLION TONS)

-

NORTH AMERICA: IRON ORE MARKET, BY STEEL MANUFACTURING, 2019–2030 (USD MILLION)

-

NORTH AMERICA: IRON ORE MARKET, BY STEEL MANUFACTURING, 2019–2030 (MILLION TONS)

-

US: IRON ORE MARKET, BY PRODUCT TYPE, 2019–2030 (USD MILLION)

-

US: IRON ORE MARKET, BY PRODUCT TYPE, 2019–2030 (MILLION TONS)

-

US: IRON ORE MARKET, BY FORM, 2019–2030 (USD MILLION)

-

US: IRON ORE MARKET, BY FORM, 2019–2030 (MILLION TONS)

-

US: IRON ORE MARKET, BY END-USE INDUSTRY, 2019–2030 (USD MILLION)

-

US: IRON ORE MARKET, BY END-USE INDUSTRY, 2019–2030 (MILLION TONS)

-

US: IRON ORE MARKET, BY STEEL MANUFACTURING, 2019–2030 (USD MILLION)

-

US: IRON ORE MARKET, BY STEEL MANUFACTURING, 2019–2030 (MILLION TONS)

-

CANADA: IRON ORE MARKET, BY PRODUCT TYPE, 2019–2030 (USD MILLION)

-

CANADA: IRON ORE MARKET, BY PRODUCT TYPE, 2019–2030 (MILLION TONS)

-

CANADA: IRON ORE MARKET, BY FORM, 2019–2030 (USD MILLION)

-

CANADA: IRON ORE MARKET, BY FORM, 2019–2030 (MILLION TONS)

-

CANADA: IRON ORE MARKET, BY END-USE INDUSTRY, 2019–2030 (USD MILLION)

-

CANADA: IRON ORE MARKET, BY END-USE INDUSTRY, 2019–2030 (MILLION TONS)

-

CANADA: IRON ORE MARKET, BY STEEL MANUFACTURING, 2019–2030 (USD MILLION)

-

CANADA: IRON ORE MARKET, BY STEEL MANUFACTURING, 2019–2030 (MILLION TONS)

-

EUROPE: IRON ORE MARKET, BY COUNTRY, 2019–2030 (USD MILLION)

-

EUROPE: IRON ORE MARKET, BY COUNTRY, 2019–2030 (MILLION TONS)

-

EUROPE: IRON ORE MARKET, BY PRODUCT TYPE, 2019–2030 (USD MILLION)

-

EUROPE: IRON ORE MARKET, BY PRODUCT TYPE, 2019–2030 (MILLION TONS)

-

EUROPE: IRON ORE MARKET, BY FORM, 2019–2030 (USD MILLION)

-

EUROPE: IRON ORE MARKET, BY FORM, 2019–2030 (MILLION TONS)

-

EUROPE: IRON ORE MARKET, BY END-USE INDUSTRY, 2019–2030 (USD MILLION)

-

EUROPE: IRON ORE MARKET, BY END-USE INDUSTRY, 2019–2030 (MILLION TONS)

-

EUROPE: IRON ORE MARKET, BY STEEL MANUFACTURING, 2019–2030 (USD MILLION)

-

EUROPE: IRON ORE MARKET, BY STEEL MANUFACTURING, 2019–2030 (MILLION TONS)

-

GERMANY: IRON ORE MARKET, BY PRODUCT TYPE, 2019–2030 (USD MILLION)

-

GERMANY: IRON ORE MARKET, BY PRODUCT TYPE, 2019–2030 (MILLION TONS)

-

GERMANY: IRON ORE MARKET, BY FORM, 2019–2030 (USD MILLION)

-

GERMANY: IRON ORE MARKET, BY FORM, 2019–2030 (MILLION TONS)

-

GERMANY: IRON ORE MARKET, BY END-USE INDUSTRY, 2019–2030 (USD MILLION)

-

GERMANY: IRON ORE MARKET, BY END-USE INDUSTRY, 2019–2030 (MILLION TONS)

-

GERMANY: IRON ORE MARKET, BY STEEL MANUFACTURING, 2019–2030 (USD MILLION)

-

GERMANY: IRON ORE MARKET, BY STEEL MANUFACTURING, 2019–2030 (MILLION TONS)

-

UK: IRON ORE MARKET, BY PRODUCT TYPE, 2019–2030 (USD MILLION)

-

UK: IRON ORE MARKET, BY PRODUCT TYPE, 2019–2030 (MILLION TONS)

-

UK: IRON ORE MARKET, BY FORM, 2019–2030 (USD MILLION)

-

UK: IRON ORE MARKET, BY FORM, 2019–2030 (MILLION TONS)

-

UK: IRON ORE MARKET, BY END-USE INDUSTRY, 2019–2030 (USD MILLION)

-

UK: IRON ORE MARKET, BY END-USE INDUSTRY, 2019–2030 (MILLION TONS)

-

UK: IRON ORE MARKET, BY STEEL MANUFACTURING, 2019–2030 (USD MILLION)

-

UK: IRON ORE MARKET, BY STEEL MANUFACTURING, 2019–2030 (MILLION TONS)

-

FRANCE: IRON ORE MARKET, BY PRODUCT TYPE, 2019–2030 (USD MILLION)

-

FRANCE: IRON ORE MARKET, BY PRODUCT TYPE, 2019–2030 (MILLION TONS)

-

FRANCE: IRON ORE MARKET, BY FORM, 2019–2030 (USD MILLION)

-

FRANCE: IRON ORE MARKET, BY FORM, 2019–2030 (MILLION TONS)

-

FRANCE: IRON ORE MARKET, BY END-USE INDUSTRY, 2019–2030 (USD MILLION)

-

FRANCE: IRON ORE MARKET, BY END-USE INDUSTRY, 2019–2030 (MILLION TONS)

-

FRANCE: IRON ORE MARKET, BY STEEL MANUFACTURING, 2019–2030 (USD MILLION)

-

FRANCE: IRON ORE MARKET, BY STEEL MANUFACTURING, 2019–2030 (MILLION TONS)

-

SPAIN: IRON ORE MARKET, BY PRODUCT TYPE, 2019–2030 (USD MILLION)

-

SPAIN: IRON ORE MARKET, BY PRODUCT TYPE, 2019–2030 (MILLION TONS)

-

SPAIN: IRON ORE MARKET, BY FORM, 2019–2030 (USD MILLION)

-

SPAIN: IRON ORE MARKET, BY FORM, 2019–2030 (MILLION TONS)

-

SPAIN: IRON ORE MARKET, BY END-USE INDUSTRY, 2019–2030 (USD MILLION)

-

SPAIN: IRON ORE MARKET, BY END-USE INDUSTRY, 2019–2030 (MILLION TONS)

-

SPAIN: IRON ORE MARKET, BY STEEL MANUFACTURING, 2019–2030 (USD MILLION)

-

SPAIN: IRON ORE MARKET, BY STEEL MANUFACTURING, 2019–2030 (MILLION TONS)

-

ITALY: IRON ORE MARKET, BY PRODUCT TYPE, 2019–2030 (USD MILLION)

-

ITALY: IRON ORE MARKET, BY PRODUCT TYPE, 2019–2030 (MILLION TONS)

-

ITALY: IRON ORE MARKET, BY FORM, 2019–2030 (USD MILLION)

-

ITALY: IRON ORE MARKET, BY FORM, 2019–2030 (MILLION TONS)

-

ITALY: IRON ORE MARKET, BY END-USE INDUSTRY, 2019–2030 (USD MILLION)

-

ITALY: IRON ORE MARKET, BY END-USE INDUSTRY, 2019–2030 (MILLION TONS)

-

ITALY: IRON ORE MARKET, BY STEEL MANUFACTURING, 2019–2030 (USD MILLION)

-

ITALY: IRON ORE MARKET, BY STEEL MANUFACTURING, 2019–2030 (MILLION TONS)

-

RUSSIA: IRON ORE MARKET, BY PRODUCT TYPE, 2019–2030 (USD MILLION)

-

RUSSIA: IRON ORE MARKET, BY PRODUCT TYPE, 2019–2030 (MILLION TONS)

-

RUSSIA: IRON ORE MARKET, BY FORM, 2019–2030 (USD MILLION)

-

RUSSIA: IRON ORE MARKET, BY FORM, 2019–2030 (MILLION TONS)

-

RUSSIA: IRON ORE MARKET, BY END-USE INDUSTRY, 2019–2030 (USD MILLION)

-

RUSSIA: IRON ORE MARKET, BY END-USE INDUSTRY, 2019–2030 (MILLION TONS)

-

RUSSIA: IRON ORE MARKET, BY STEEL MANUFACTURING, 2019–2030 (USD MILLION)

-

RUSSIA: IRON ORE MARKET, BY STEEL MANUFACTURING, 2019–2030 (MILLION TONS)

-

BELGIUM: IRON ORE MARKET, BY PRODUCT TYPE, 2019–2030 (USD MILLION)

-

BELGIUM: IRON ORE MARKET, BY PRODUCT TYPE, 2019–2030 (MILLION TONS)

-

BELGIUM: IRON ORE MARKET, BY FORM, 2019–2030 (USD MILLION)

-

BELGIUM: IRON ORE MARKET, BY FORM, 2019–2030 (MILLION TONS)

-

BELGIUM: IRON ORE MARKET, BY END-USE INDUSTRY, 2019–2030 (USD MILLION)

-

BELGIUM: IRON ORE MARKET, BY END-USE INDUSTRY, 2019–2030 (MILLION TONS)

-

BELGIUM: IRON ORE MARKET, BY STEEL MANUFACTURING, 2019–2030 (USD MILLION)

-

BELGIUM: IRON ORE MARKET, BY STEEL MANUFACTURING, 2019–2030 (MILLION TONS)

-

POLAND: IRON ORE MARKET, BY PRODUCT TYPE, 2019–2030 (USD MILLION)

-

POLAND: IRON ORE MARKET, BY PRODUCT TYPE, 2019–2030 (MILLION TONS)

-

POLAND: IRON ORE MARKET, BY FORM, 2019–2030 (USD MILLION)

-

POLAND: IRON ORE MARKET, BY FORM, 2019–2030 (MILLION TONS)

-

POLAND: IRON ORE MARKET, BY END-USE INDUSTRY, 2019–2030 (USD MILLION)

-

POLAND: IRON ORE MARKET, BY END-USE INDUSTRY, 2019–2030 (MILLION TONS)

-

POLAND: IRON ORE MARKET, BY STEEL MANUFACTURING, 2019–2030 (USD MILLION)

-

POLAND: IRON ORE MARKET, BY STEEL MANUFACTURING, 2019–2030 (MILLION TONS)

-

NETHERLANDS: IRON ORE MARKET, BY PRODUCT TYPE, 2019–2030 (USD MILLION)

-

NETHERLANDS: IRON ORE MARKET, BY PRODUCT TYPE, 2019–2030 (MILLION TONS)

-

NETHERLANDS: IRON ORE MARKET, BY FORM, 2019–2030 (USD MILLION)

-

NETHERLANDS: IRON ORE MARKET, BY FORM, 2019–2030 (MILLION TONS)

-

NETHERLANDS: IRON ORE MARKET, BY END-USE INDUSTRY, 2019–2030 (USD MILLION)

-

NETHERLANDS: IRON ORE MARKET, BY END-USE INDUSTRY, 2019–2030 (MILLION TONS)

-

NETHERLANDS: IRON ORE MARKET, BY STEEL MANUFACTURING, 2019–2030 (USD MILLION)

-

NETHERLANDS: IRON ORE MARKET, BY STEEL MANUFACTURING, 2019–2030 (MILLION TONS)

-

REST OF EUROPE: IRON ORE MARKET, BY PRODUCT TYPE, 2019–2030 (USD MILLION)

-

REST OF EUROPE: IRON ORE MARKET, BY PRODUCT TYPE, 2019–2030 (MILLION TONS)

-

REST OF EUROPE: IRON ORE MARKET, BY FORM, 2019–2030 (USD MILLION)

-

REST OF EUROPE: IRON ORE MARKET, BY FORM, 2019–2030 (MILLION TONS)

-

REST OF EUROPE: IRON ORE MARKET, BY END-USE INDUSTRY, 2019–2030 (USD MILLION)

-

REST OF EUROPE: IRON ORE MARKET, BY END-USE INDUSTRY, 2019–2030 (MILLION TONS)

-

REST OF EUROPE: IRON ORE MARKET, BY STEEL MANUFACTURING, 2019–2030 (USD MILLION)

-

REST OF EUROPE: IRON ORE MARKET, BY STEEL MANUFACTURING, 2019–2030 (MILLION TONS)

-

ASIA-PACIFIC: IRON ORE MARKET, BY COUNTRY, 2019–2030 (USD MILLION)

-

ASIA-PACIFIC: IRON ORE MARKET, BY COUNTRY, 2019–2030 (MILLION TONS)

-

ASIA-PACIFIC: IRON ORE MARKET, BY PRODUCT TYPE, 2019–2030 (USD MILLION)

-

ASIA-PACIFIC: IRON ORE MARKET, BY PRODUCT TYPE, 2019–2030 (MILLION TONS)

-

ASIA-PACIFIC: IRON ORE MARKET, BY FORM, 2019–2030 (USD MILLION)

-

ASIA-PACIFIC: IRON ORE MARKET, BY FORM, 2019–2030 (MILLION TONS)

-

ASIA-PACIFIC: IRON ORE MARKET, BY END-USE INDUSTRY, 2019–2030 (USD MILLION)

-

ASIA-PACIFIC: IRON ORE MARKET, BY END-USE INDUSTRY, 2019–2030 (MILLION TONS)

-

ASIA-PACIFIC: IRON ORE MARKET, BY STEEL MANUFACTURING, 2019–2030 (USD MILLION)

-

ASIA-PACIFIC: IRON ORE MARKET, BY STEEL MANUFACTURING, 2019–2030 (MILLION TONS)

-

CHINA: IRON ORE MARKET, BY PRODUCT TYPE, 2019–2030 (USD MILLION)

-

CHINA: IRON ORE MARKET, BY PRODUCT TYPE, 2019–2030 (MILLION TONS)

-

CHINA: IRON ORE MARKET, BY FORM, 2019–2030 (USD MILLION)

-

CHINA: IRON ORE MARKET, BY FORM, 2019–2030 (MILLION TONS)

-

CHINA: IRON ORE MARKET, BY END-USE INDUSTRY, 2019–2030 (USD MILLION)

-

CHINA: IRON ORE MARKET, BY END-USE INDUSTRY, 2019–2030 (MILLION TONS)

-

CHINA: IRON ORE MARKET, BY STEEL MANUFACTURING, 2019–2030 (USD MILLION)

-

CHINA: IRON ORE MARKET, BY STEEL MANUFACTURING, 2019–2030 (MILLION TONS)

-

JAPAN: IRON ORE MARKET, BY PRODUCT TYPE, 2019–2030 (USD MILLION)

-

JAPAN: IRON ORE MARKET, BY PRODUCT TYPE, 2019–2030 (MILLION TONS)

-

JAPAN: IRON ORE MARKET, BY FORM, 2019–2030 (USD MILLION)

-

JAPAN: IRON ORE MARKET, BY FORM, 2019–2030 (MILLION TONS)

-

JAPAN: IRON ORE MARKET, BY END-USE INDUSTRY, 2019–2030 (USD MILLION)

-

JAPAN: IRON ORE MARKET, BY END-USE INDUSTRY, 2019–2030 (MILLION TONS)

-

JAPAN: IRON ORE MARKET, BY STEEL MANUFACTURING, 2019–2030 (USD MILLION)

-

JAPAN: IRON ORE MARKET, BY STEEL MANUFACTURING, 2019–2030 (MILLION TONS)

-

INDIA: IRON ORE MARKET, BY PRODUCT TYPE, 2019–2030 (USD MILLION)

-

INDIA: IRON ORE MARKET, BY PRODUCT TYPE, 2019–2030 (MILLION TONS)

-

INDIA: IRON ORE MARKET, BY FORM, 2019–2030 (USD MILLION)

-

INDIA: IRON ORE MARKET, BY FORM, 2019–2030 (MILLION TONS)

-

INDIA: IRON ORE MARKET, BY END-USE INDUSTRY, 2019–2030 (USD MILLION)

-

INDIA: IRON ORE MARKET, BY END-USE INDUSTRY, 2019–2030 (MILLION TONS)

-

INDIA: IRON ORE MARKET, BY STEEL MANUFACTURING, 2019–2030 (USD MILLION)

-

INDIA: IRON ORE MARKET, BY STEEL MANUFACTURING, 2019–2030 (MILLION TONS)

-

AUSTRALIA & NEW ZEALAND: IRON ORE MARKET, BY PRODUCT TYPE, 2019–2030 (USD MILLION)

-

AUSTRALIA & NEW ZEALAND: IRON ORE MARKET, BY PRODUCT TYPE, 2019–2030 (MILLION TONS)

-

AUSTRALIA & NEW ZEALAND: IRON ORE MARKET, BY FORM, 2019–2030 (USD MILLION)

-

AUSTRALIA & NEW ZEALAND: IRON ORE MARKET, BY FORM, 2019–2030 (MILLION TONS)

-

AUSTRALIA & NEW ZEALAND: IRON ORE MARKET, BY END-USE INDUSTRY, 2019–2030 (USD MILLION)

-

AUSTRALIA & NEW ZEALAND: IRON ORE MARKET, BY END-USE INDUSTRY, 2019–2030 (MILLION TONS)

-

AUSTRALIA & NEW ZEALAND: IRON ORE MARKET, BY STEEL MANUFACTURING, 2019–2030 (USD MILLION)

-

AUSTRALIA & NEW ZEALAND: IRON ORE MARKET, BY STEEL MANUFACTURING, 2019–2030 (MILLION TONS)

-

INDONESIA: IRON ORE MARKET, BY PRODUCT TYPE, 2019–2030 (USD MILLION)

-

INDONESIA: IRON ORE MARKET, BY PRODUCT TYPE, 2019–2030 (MILLION TONS)

-

INDONESIA: IRON ORE MARKET, BY FORM, 2019–2030 (USD MILLION)

-

INDONESIA: IRON ORE MARKET, BY FORM, 2019–2030 (MILLION TONS)

-

INDONESIA: IRON ORE MARKET, BY END-USE INDUSTRY, 2019–2030 (USD MILLION)

-

INDONESIA: IRON ORE MARKET, BY END-USE INDUSTRY, 2019–2030 (MILLION TONS)

-

INDONESIA: IRON ORE MARKET, BY STEEL MANUFACTURING, 2019–2030 (USD MILLION)

-

INDONESIA: IRON ORE MARKET, BY STEEL MANUFACTURING, 2019–2030 (MILLION TONS)

-

SOUTH KOREA: IRON ORE MARKET, BY PRODUCT TYPE, 2019–2030 (USD MILLION)

-

SOUTH KOREA: IRON ORE MARKET, BY PRODUCT TYPE, 2019–2030 (MILLION TONS)

-

SOUTH KOREA: IRON ORE MARKET, BY FORM, 2019–2030 (USD MILLION)

-

SOUTH KOREA: IRON ORE MARKET, BY FORM, 2019–2030 (MILLION TONS)

-

SOUTH KOREA: IRON ORE MARKET, BY END-USE INDUSTRY, 2019–2030 (USD MILLION)

-

SOUTH KOREA: IRON ORE MARKET, BY END-USE INDUSTRY, 2019–2030 (MILLION TONS)

-

SOUTH KOREA: IRON ORE MARKET, BY STEEL MANUFACTURING, 2019–2030 (USD MILLION)

-

SOUTH KOREA: IRON ORE MARKET, BY STEEL MANUFACTURING, 2019–2030 (MILLION TONS)

-

REST OF ASIA-PACIFIC: IRON ORE MARKET, BY PRODUCT TYPE, 2019–2030 (USD MILLION)

-

REST OF ASIA-PACIFIC: IRON ORE MARKET, BY PRODUCT TYPE, 2019–2030 (MILLION TONS)

-

REST OF ASIA-PACIFIC: IRON ORE MARKET, BY FORM, 2019–2030 (USD MILLION)

-

REST OF ASIA-PACIFIC: IRON ORE MARKET, BY FORM, 2019–2030 (MILLION TONS)

-

REST OF ASIA-PACIFIC: IRON ORE MARKET, BY END-USE INDUSTRY, 2019–2030 (USD MILLION)

-

REST OF ASIA-PACIFIC: IRON ORE MARKET, BY END-USE INDUSTRY, 2019–2030 (MILLION TONS)

-

REST OF ASIA-PACIFIC: IRON ORE MARKET, BY STEEL MANUFACTURING, 2019–2030 (USD MILLION)

-

REST OF ASIA-PACIFIC: IRON ORE MARKET, BY STEEL MANUFACTURING, 2019–2030 (MILLION TONS)

-

LATIN AMERICA: IRON ORE MARKET, BY COUNTRY, 2019–2030 (USD MILLION)

-

LATIN AMERICA: IRON ORE MARKET, BY COUNTRY, 2019–2030 (MILLION TONS)

-

LATIN AMERICA: IRON ORE MARKET, BY PRODUCT TYPE, 2019–2030 (USD MILLION)

-

LATIN AMERICA: IRON ORE MARKET, BY PRODUCT TYPE, 2019–2030 (MILLION TONS)

-

LATIN AMERICA: IRON ORE MARKET, BY FORM, 2019–2030 (USD MILLION)

-

LATIN AMERICA: IRON ORE MARKET, BY FORM, 2019–2030 (MILLION TONS)

-

LATIN AMERICA: IRON ORE MARKET, BY END-USE INDUSTRY, 2019–2030 (USD MILLION)

-

LATIN AMERICA: IRON ORE MARKET, BY END-USE INDUSTRY, 2019–2030 (MILLION TONS)

-

LATIN AMERICA: IRON ORE MARKET, BY STEEL MANUFACTURING, 2019–2030 (USD MILLION)

-

LATIN AMERICA: IRON ORE MARKET, BY STEEL MANUFACTURING, 2019–2030 (MILLION TONS)

-

BRAZIL: IRON ORE MARKET, BY PRODUCT TYPE, 2019–2030 (USD MILLION)

-

BRAZIL: IRON ORE MARKET, BY PRODUCT TYPE, 2019–2030 (MILLION TONS)

-

BRAZIL: IRON ORE MARKET, BY FORM, 2019–2030 (USD MILLION)

-

BRAZIL: IRON ORE MARKET, BY FORM, 2019–2030 (MILLION TONS)

-

BRAZIL: IRON ORE MARKET, BY END-USE INDUSTRY, 2019–2030 (USD MILLION)

-

BRAZIL: IRON ORE MARKET, BY END-USE INDUSTRY, 2019–2030 (MILLION TONS)

-

BRAZIL: IRON ORE MARKET, BY STEEL MANUFACTURING, 2019–2030 (USD MILLION)

-

BRAZIL: IRON ORE MARKET, BY STEEL MANUFACTURING, 2019–2030 (MILLION TONS)

-

MEXICO: IRON ORE MARKET, BY PRODUCT TYPE, 2019–2030 (USD MILLION)

-

MEXICO: IRON ORE MARKET, BY PRODUCT TYPE, 2019–2030 (MILLION TONS)

-

MEXICO: IRON ORE MARKET, BY FORM, 2019–2030 (USD MILLION)

-

MEXICO: IRON ORE MARKET, BY FORM, 2019–2030 (MILLION TONS)

-

MEXICO: IRON ORE MARKET, BY END-USE INDUSTRY, 2019–2030 (USD MILLION)

-

MEXICO: IRON ORE MARKET, BY END-USE INDUSTRY, 2019–2030 (MILLION TONS)

-

MEXICO: IRON ORE MARKET, BY STEEL MANUFACTURING, 2019–2030 (USD MILLION)

-

MEXICO: IRON ORE MARKET, BY STEEL MANUFACTURING, 2019–2030 (MILLION TONS)

-

ARGENTINA: IRON ORE MARKET, BY PRODUCT TYPE, 2019–2030 (USD MILLION)

-

ARGENTINA: IRON ORE MARKET, BY PRODUCT TYPE, 2019–2030 (MILLION TONS)

-

ARGENTINA: IRON ORE MARKET, BY FORM, 2019–2030 (USD MILLION)

-

ARGENTINA: IRON ORE MARKET, BY FORM, 2019–2030 (MILLION TONS)

-

ARGENTINA: IRON ORE MARKET, BY END-USE INDUSTRY, 2019–2030 (USD MILLION)

-

ARGENTINA: IRON ORE MARKET, BY END-USE INDUSTRY, 2019–2030 (MILLION TONS)

-

ARGENTINA: IRON ORE MARKET, BY STEEL MANUFACTURING, 2019–2030 (USD MILLION)

-

ARGENTINA: IRON ORE MARKET, BY STEEL MANUFACTURING, 2019–2030 (MILLION TONS)

-

REST OF LATIN AMERICA: IRON ORE MARKET, BY PRODUCT TYPE, 2019–2030 (USD MILLION)

-

REST OF LATIN AMERICA: IRON ORE MARKET, BY PRODUCT TYPE, 2019–2030 (MILLION TONS)

-

REST OF LATIN AMERICA: IRON ORE MARKET, BY FORM, 2019–2030 (USD MILLION)

-

REST OF LATIN AMERICA: IRON ORE MARKET, BY FORM, 2019–2030 (MILLION TONS)

-

REST OF LATIN AMERICA: IRON ORE MARKET, BY END-USE INDUSTRY, 2019–2030 (USD MILLION)

-

REST OF LATIN AMERICA: IRON ORE MARKET, BY END-USE INDUSTRY, 2019–2030 (MILLION TONS)

-

REST OF LATIN AMERICA: IRON ORE MARKET, BY STEEL MANUFACTURING, 2019–2030 (USD MILLION)

-

REST OF LATIN AMERICA: IRON ORE MARKET, BY STEEL MANUFACTURING, 2019–2030 (MILLION TONS)

-

MIDDLE EAST & AFRICA: IRON ORE MARKET, BY COUNTRY, 2019–2030 (USD MILLION)

-

MIDDLE EAST & AFRICA: IRON ORE MARKET, BY COUNTRY, 2019–2030 (MILLION TONS)

-

MIDDLE EAST & AFRICA: IRON ORE MARKET, BY PRODUCT TYPE, 2019–2030 (USD MILLION)

-

MIDDLE EAST & AFRICA: IRON ORE MARKET, BY PRODUCT TYPE, 2019–2030 (MILLION TONS)

-

MIDDLE EAST & AFRICA: IRON ORE MARKET, BY FORM, 2019–2030 (USD MILLION)

-

MIDDLE EAST & AFRICA: IRON ORE MARKET, BY FORM, 2019–2030 (MILLION TONS)

-

MIDDLE EAST & AFRICA: IRON ORE MARKET, BY END-USE INDUSTRY, 2019–2030 (USD MILLION)

-

MIDDLE EAST & AFRICA: IRON ORE MARKET, BY END-USE INDUSTRY, 2019–2030 (MILLION TONS)

-

MIDDLE EAST & AFRICA: IRON ORE MARKET, BY STEEL MANUFACTURING, 2019–2030 (USD MILLION)

-

MIDDLE EAST & AFRICA: IRON ORE MARKET, BY STEEL MANUFACTURING, 2019–2030 (MILLION TONS)

-

SAUDI ARABIA: IRON ORE MARKET, BY PRODUCT TYPE, 2019–2030 (USD MILLION)

-

SAUDI ARABIA: IRON ORE MARKET, BY PRODUCT TYPE, 2019–2030 (MILLION TONS)

-

SAUDI ARABIA: IRON ORE MARKET, BY FORM, 2019–2030 (USD MILLION)

-

SAUDI ARABIA: IRON ORE MARKET, BY FORM, 2019–2030 (MILLION TONS)

-

SAUDI ARABIA: IRON ORE MARKET, BY END-USE INDUSTRY, 2019–2030 (USD MILLION)

-

SAUDI ARABIA: IRON ORE MARKET, BY END-USE INDUSTRY, 2019–2030 (MILLION TONS)

-

SAUDI ARABIA: IRON ORE MARKET, BY STEEL MANUFACTURING, 2019–2030 (USD MILLION)

-

SAUDI ARABIA: IRON ORE MARKET, BY STEEL MANUFACTURING, 2019–2030 (MILLION TONS)

-

IRAN: IRON ORE MARKET, BY PRODUCT TYPE, 2019–2030 (USD MILLION)

-

IRAN: IRON ORE MARKET, BY PRODUCT TYPE, 2019–2030 (MILLION TONS)

-

IRAN: IRON ORE MARKET, BY FORM, 2019–2030 (USD MILLION)

-

IRAN: IRON ORE MARKET, BY FORM, 2019–2030 (MILLION TONS)

-

IRAN: IRON ORE MARKET, BY END-USE INDUSTRY, 2019–2030 (USD MILLION)

-

IRAN: IRON ORE MARKET, BY END-USE INDUSTRY, 2019–2030 (MILLION TONS)

-

IRAN: IRON ORE MARKET, BY STEEL MANUFACTURING, 2019–2030 (USD MILLION)

-

IRAN: IRON ORE MARKET, BY STEEL MANUFACTURING, 2019–2030 (MILLION TONS)

-

ISRAEL: IRON ORE MARKET, BY PRODUCT TYPE, 2019–2030 (USD MILLION)

-

ISRAEL: IRON ORE MARKET, BY PRODUCT TYPE, 2019–2030 (MILLION TONS)

-

ISRAEL: IRON ORE MARKET, BY FORM, 2019–2030 (USD MILLION)

-

ISRAEL: IRON ORE MARKET, BY FORM, 2019–2030 (MILLION TONS)

-

ISRAEL: IRON ORE MARKET, BY END-USE INDUSTRY, 2019–2030 (USD MILLION)

-

ISRAEL: IRON ORE MARKET, BY END-USE INDUSTRY, 2019–2030 (MILLION TONS)

-

ISRAEL: IRON ORE MARKET, BY STEEL MANUFACTURING, 2019–2030 (USD MILLION)

-

ISRAEL: IRON ORE MARKET, BY STEEL MANUFACTURING, 2019–2030 (MILLION TONS)

-

TURKEY: IRON ORE MARKET, BY PRODUCT TYPE, 2019–2030 (USD MILLION)

-

TURKEY: IRON ORE MARKET, BY PRODUCT TYPE, 2019–2030 (MILLION TONS)

-

TURKEY: IRON ORE MARKET, BY FORM, 2019–2030 (USD MILLION)

-

TURKEY: IRON ORE MARKET, BY FORM, 2019–2030 (MILLION TONS)

-

TURKEY: IRON ORE MARKET, BY END-USE INDUSTRY, 2019–2030 (USD MILLION)

-

TURKEY: IRON ORE MARKET, BY END-USE INDUSTRY, 2019–2030 (MILLION TONS)

-

TURKEY: IRON ORE MARKET, BY STEEL MANUFACTURING, 2019–2030 (USD MILLION)

-

TURKEY: IRON ORE MARKET, BY STEEL MANUFACTURING, 2019–2030 (MILLION TONS)

-

SOUTH AFRICA: IRON ORE MARKET, BY PRODUCT TYPE, 2019–2030 (USD MILLION)

-

SOUTH AFRICA: IRON ORE MARKET, BY PRODUCT TYPE, 2019–2030 (MILLION TONS)

-

SOUTH AFRICA: IRON ORE MARKET, BY FORM, 2019–2030 (USD MILLION)

-

SOUTH AFRICA: IRON ORE MARKET, BY FORM, 2019–2030 (MILLION TONS)

-

SOUTH AFRICA: IRON ORE MARKET, BY END-USE INDUSTRY, 2019–2030 (USD MILLION)

-

SOUTH AFRICA: IRON ORE MARKET, BY END-USE INDUSTRY, 2019–2030 (MILLION TONS)

-

SOUTH AFRICA: IRON ORE MARKET, BY STEEL MANUFACTURING, 2019–2030 (USD MILLION)

-

SOUTH AFRICA: IRON ORE MARKET, BY STEEL MANUFACTURING, 2019–2030 (MILLION TONS)

-

UAE: IRON ORE MARKET, BY PRODUCT TYPE, 2019–2030 (USD MILLION)

-

UAE: IRON ORE MARKET, BY PRODUCT TYPE, 2019–2030 (MILLION TONS)

-

UAE: IRON ORE MARKET, BY FORM, 2019–2030 (USD MILLION)

-

UAE: IRON ORE MARKET, BY FORM, 2019–2030 (MILLION TONS)

-

UAE: IRON ORE MARKET, BY END-USE INDUSTRY, 2019–2030 (USD MILLION)

-

UAE: IRON ORE MARKET, BY END-USE INDUSTRY, 2019–2030 (MILLION TONS)

-

UAE: IRON ORE MARKET, BY STEEL MANUFACTURING, 2019–2030 (USD MILLION)

-

UAE: IRON ORE MARKET, BY STEEL MANUFACTURING, 2019–2030 (MILLION TONS)

-

REST OF THE MIDDLE EAST & AFRICA: IRON ORE MARKET, BY PRODUCT TYPE, 2019–2030 (USD MILLION)

-

REST OF THE MIDDLE EAST & AFRICA: IRON ORE MARKET, BY PRODUCT TYPE, 2019–2030 (MILLION TONS)

-

REST OF THE MIDDLE EAST & AFRICA: IRON ORE MARKET, BY FORM, 2019–2030 (USD MILLION)

-

REST OF THE MIDDLE EAST & AFRICA: IRON ORE MARKET, BY FORM, 2019–2030 (MILLION TONS)

-

REST OF THE MIDDLE EAST & AFRICA: IRON ORE MARKET, BY END-USE INDUSTRY, 2019–2030 (USD MILLION)

-

REST OF THE MIDDLE EAST & AFRICA: IRON ORE MARKET, BY END-USE INDUSTRY, 2019–2030 (MILLION TONS)

-

REST OF THE MIDDLE EAST & AFRICA: IRON ORE MARKET, BY STEEL MANUFACTURING, 2019–2030 (USD MILLION)

-

REST OF THE MIDDLE EAST & AFRICA: IRON ORE MARKET, BY STEEL MANUFACTURING, 2019–2030 (MILLION TONS)

-

KEY DEVELOPMENTS & GROWTH STRATEGIES

-

VALE S.A.: PRODUCTS OFFERED

-

RIO TINTO: PRODUCTS OFFERED

-

RIO TINTO: KEY DEVELOPMENTS

-

BHP: PRODUCTS OFFERED

-

BHP: KEY DEVELOPMENTS

-

FORTESCUE METALS GROUP LTD: PRODUCTS OFFERED

-

FORTESCUE METALS GROUP LTD.: KEY DEVELOPMENTS

-

ANSTEEL GROUP CORPORATION LIMITED: PRODUCTS OFFERED

-

ARCELORMITTAL: PRODUCTS OFFERED

-

ARCELORMITTAL: KEY DEVELOPMENTS

-

METALLOINVEST MC LLC: PRODUCTS OFFERED

-

METALLOINVEST MC LLC: KEY DEVELOPMENTS

-

LKAB: PRODUCTS OFFERED

-

LKAB: KEY DEVELOPMENTS

-

CLEVELAND-CLIFFS INC.: PRODUCTS OFFERED

-

CLEVELAND-CLIFFS INC.: KEY DEVELOPMENTS

-

HBIS GROUP: PRODUCTS OFFERED

-

HBIS GROUP: KEY DEVELOPMENTS

-

ANGLO AMERICAN PLC: PRODUCTS OFFERED

-

EVRAZ PLC: PRODUCTS OFFERED

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

\r\n

-

LIST OF FIGURES

-

MARKET SYNOPSIS

-

MARKET ATTRACTIVENESS ANALYSIS: GLOBAL IRON ORE MARKET, 2020

-

GLOBAL IRON ORE MARKET ANALYSIS BY PRODUCT TYPE

-

GLOBAL IRON ORE MARKET ANALYSIS BY FORM

-

GLOBAL IRON ORE MARKET ANALYSIS BY END-USE INDUSTRY

-

GLOBAL IRON ORE MARKET ANALYSIS BY REGION

-

GLOBAL IRON ORE MARKET: MARKET STRUCTURE

-

RESEARCH PROCESS OF MRFR

-

MARKET DYNAMICS OVERVIEW

-

COUNTRY-WISE TOP 10 AUTOMOTIVE PRODUCERS, 2020

-

GLOBAL ELECTRIC VEHICLE GROWTH IN MILLIONS

-

DRIVERS IMPACT ANALYSIS

-

RESTRAINTS IMPACT ANALYSIS

-

SUPPLY CHAIN ANALYSIS FOR THE GLOBAL IRON ORE MARKET

-

TOP 5 IRON ORE PRODUCING COUNTRIES, 2020

-

FLOW CHART FOR IRON ORE BENEFICIATION

-

PORTER'S FIVE FORCES ANALYSIS OF THE GLOBAL IRON ORE MARKET

-

GLOBAL IRON ORE MARKET, BY PRODUCT TYPE, 2019 TO 2030 (USD MILLION)

-

GLOBAL IRON ORE MARKET, BY PRODUCT TYPE, 2019 TO 2030 (MILLION TONS)

-

GLOBAL IRON ORE MARKET, BY FORM, 2019 TO 2030 (USD MILLION)

-

GLOBAL IRON ORE MARKET, BY FORM, 2019 TO 2030 (MILLION TONS)

-

GLOBAL IRON ORE MARKET, BY END-USE INDUSTRY, 2019 TO 2030 (USD MILLION)

-

GLOBAL IRON ORE MARKET, BY END-USE INDUSTRY, 2019 TO 2030 (MILLION TONS)

-

GLOBAL IRON ORE MARKET, BY REGION, 2019–2030 (USD MILLION)

-

GLOBAL IRON ORE MARKET, BY REGION, 2019–2030 (MILLION TONS)

-

NORTH AMERICA: IRON ORE MARKET SHARE, BY COUNTRY, 2020 (% SHARE)

-

EUROPE: IRON ORE MARKET SHARE, BY COUNTRY, 2020 (% SHARE)

-

ASIA-PACIFIC: IRON ORE MARKET SHARE, BY COUNTRY, 2020 (% SHARE)

-

LATIN AMERICA: IRON ORE MARKET SHARE, BY COUNTRY, 2020 (% SHARE)

-

MIDDLE EAST & AFRICA: IRON ORE MARKET SHARE, BY COUNTRY, 2020 (% SHARE)

-

STRATEGIC ANALYSIS, KEY DEVELOPMENTS

-

COMPETITIVE BENCHMARKING

-

VALE S.A.: FINANCIAL OVERVIEW SNAPSHOT

-

VALE S.A.: SWOT ANALYSIS

-

RIO TINTO: FINANCIAL OVERVIEW SNAPSHOT

-

RIO TINTO: SWOT ANALYSIS

-

BHP: FINANCIAL OVERVIEW SNAPSHOT

-

BHP: SWOT ANALYSIS

-

FORTESCUE METALS GROUP LTD: FINANCIAL OVERVIEW SNAPSHOT

-

FORTESCUE METALS GROUP LTD: SWOT ANALYSIS

-

ANSTEEL GROUP CORPORATION LIMITED: FINANCIAL OVERVIEW SNAPSHOT

-

ANSTEEL GROUP CORPORATION LIMITED: SWOT ANALYSIS

-

ARCELORMITTAL: FINANCIAL OVERVIEW SNAPSHOT

-

ARCELORMITTAL: SWOT ANALYSIS

-

METALLOINVEST MC LLC: FINANCIAL OVERVIEW SNAPSHOT

-

METALLOINVEST MC LLC: SWOT ANALYSIS

-

LKAB: FINANCIAL OVERVIEW SNAPSHOT

-

LKAB: SWOT ANALYSIS

-

CLEVELAND-CLIFFS INC.: FINANCIAL OVERVIEW SNAPSHOT

-

CLEVELAND-CLIFFS INC.: SWOT ANALYSIS

-

HBIS GROUP: SWOT ANALYSIS

-

ANGLO AMERICAN PLC: FINANCIAL OVERVIEW SNAPSHOT

-

ANGLO AMERICAN PLC: SWOT ANALYSIS

-

EVRAZ PLC: FINANCIAL OVERVIEW SNAPSHOT

-

EVRAZ PLC: SWOT ANALYSIS

-

\r\n

-

"

Leave a Comment