-

Report Prologue

-

Market Definition

-

Definition

-

13

-

Scope Of The Study 13

-

Research Objectives 13

-

Assumptions 14

-

Limitations 14

-

Markets

-

Structure 14

-

Research Methodology

-

Research Process 16

-

Primary Research 17

-

Secondary Research 17

-

3.4

-

Market Size Estimation 18

-

Forecast Model 19

-

Market Dynamics

-

Drivers 20

- Emergence Of Electric Vehicles. 20

- Growing Demand For Li-Ion Batteries. 21

- Increasing Glass

-

And Ceramic Production. 21

-

Restraints 22

- High Initial

- Lack Of Professionals In Lithium Extraction Activities.

-

Investments. 22

-

22

-

Opportunities 23

- High Adaptability Of Electric

- Emerging Application Of Lithium Derivatives In Aluminium

-

Vehicles. 23

-

Smelting 24

-

Trends 24

- Growing Demand For Lithium-Ion

-

Batteries In Grid Connected Storage. 25

-

Market Factor Analysis

-

Supply Chain Analysis 26

- Raw Lithium Mining 26

- End Users 27

-

5.1.2

-

Lithium Process Manufacturing I.E. Lithium Derivatives Producers 26

-

5.1.3

-

Distributers 27

-

Porter’s 5 Forces

- Intensity Of Rivalry (HIGH) 28

- Threat

- Threat Of Substitute (HIGH) 28

- Bargaining Power Of Supplier (LOW) 29

- Bargaining Of Power

-

Analysis 27

-

Of New Entrants (MEDIUM) 28

-

Of Buyers (HIGH) 29

-

Global Lithium Derivatives Market, By Type

-

Introduction 30

-

Lithium Carbonate 32

-

Lithium

-

Hydroxide 33

-

Lithium Concentrated 35

-

Lithium Metal

-

36

-

Butyl Lithium 37

-

Lithium Chloride 38

-

6.8

-

Others 39

-

Global Lithium Derivatives Market, By Application

-

Introduction 41

-

Batteries 44

-

Glass & Ceramic

-

45

-

Lubricating Greases 46

-

Metallurgic 47

-

Air Treatment 48

-

Aluminum Smelting 49

-

Polymer

-

50

-

Others 51

-

Global Lithium Derivative Market, By Region

-

Introduction 52

-

North America 54

-

Europe

-

63

-

Asia Pacific 90

-

Latin America 110

-

8.6

-

Middle East & Africa 124

-

Competitive Landscape

-

Introduction

-

141

-

Market Share Analysis 141

-

Key Developments 142

-

Company Profile

-

Albemarle Corporation 143

- Product/Business Segment Overview 143

- Financials 144

- Key Developments 144

- Company Overview 145

- Product/Business

- Financial 146

- Key Developments

-

10.1.1

-

Company Overview 143

-

10.2

-

SQM 145

-

Segment Overview 145

-

146

-

FMC Corporation. 147

- Company Overview 147

- Product/Business Segment Overview 148

- Financials

- Key Developments 149

-

149

-

Tianqi Lithium Industries

- Company Overview 150

- Product/Business

- Financials 151

- Key Developments

-

Inc. 150

-

Segment Overview 150

-

151

-

Ganfeng Lithium Co Ltd 152

- Company Profile

- Product/Business Segment Overview 152

- Financial

- Key Developments 153

-

152

-

152

-

General Lithium (Haimen)

- Company Overview 154

- Product/Business

- Financials 154

- Key Developments

-

Corporation 154

-

Segment Overview 154

-

154

-

ZHONGHE CO., LTD 155

- Company Overview 155

- Product/Business Segment Overview 155

- Key Developments

-

155

-

Conclusion

-

List Of Tables

-

GLOBAL LITHIUM DERIVATIVES MARKET, BY TYPE 2023-2032(USD MILLION) 31

-

GLOBAL LITHIUM DERIVATIVES MARKET, BY TYPE 2023-2032(THOUSAND TONS)

-

32

-

GLOBAL LITHIUM CARBONATE MARKET FOR LITHUM DERIVATIVES, BY

-

REGION, 2023-2032(USD MILLION) 32

-

GLOBAL LITHIUM CARBONATE MARKET

-

FOR LITHUM DERIVATIVE, BY REGION, 2023-2032(THOUSAND TONS) 33

-

TABLE 5

-

GLOBAL LITHIUM HYDROXIDE MARKET FOR LITHUM DERIVATIVES, BY REGION, 2023-2032(USD

-

MILLION) 33

-

GLOBAL LITHIUM HYDROXIDE MARKET FOR LITHUM DERIVATIVE,

-

BY REGION, 2023-2032(THOUSAND TONS) 35

-

GLOBAL LITHIUM CONCENTRATED

-

MARKET FOR LITHUM DERIVATIVES, BY REGION, 2023-2032(USD MILLION) 35

-

TABLE

-

GLOBAL LITHIUM CONCENTRATED MARKET FOR LITHUM DERIVATIVES, BY REGION, 2023-2032(THOUSAND

-

TONS) 36

-

GLOBAL LITHIUM METAL MARKET FOR LITHUM DERIVATIVES,

-

BY REGION, 2023-2032(USD MILLION) 36

-

GLOBAL LITHIUM METAL MARKET

-

FOR LITHUM DERIVATIVES, BY REGION, 2023-2032(THOUSAND TONS) 37

-

TABLE

-

GLOBAL BUTYL LITHIUM MARKET FOR LITHUM DERIVATIVES, BY REGION, 2023-2032(USD

-

MILLION) 37

-

GLOBAL BUTYL LITHIUM MARKET FOR LITHUM DERIVATIVES,

-

BY REGION, 2023-2032(THOUSAND TONS) 38

-

GLOBAL LITHIUM CHLORIDE

-

MARKET FOR LITHUM DERIVATIVES, BY REGION, 2023-2032(USD MILLION) 38

-

TABLE

-

GLOBAL LITHIUM CHLORIDE MARKET FOR LITHUM DERIVATIVES, BY REGION, 2023-2032(THOUSAND

-

TONS) 39

-

GLOBAL OTHERS DERIVATIVE MARKET FOR LITHUM DERIVATIVES,

-

BY REGION, 2023-2032(USD MILLION) 39

-

GLOBAL LITHIUM CHLORIDE

-

MARKET FOR LITHUM DERIVATIVES, BY REGION, 2023-2032(THOUSAND TONS) 40

-

TABLE

-

LOBAL LITHIUM DERIVATIVE MARKET, BY APPLICATION, 2023-2032(USD MILLION) 42

-

GLOBAL LITHIUM DERIVATIVE MARKET, BY APPLICATION, 2023-2032(THOUSAND

-

TONS) 43

-

GLOBAL BATTERIES MARKET FOR LITHIIUM DERIVATIVES 2023-2032(USD

-

MILLION) 44

-

GLOBAL BATTERIES MARKET FOR LITHIIUM DERIVATIVES

-

GLOBAL GLASS & CERAMIC MARKET

-

FOR LITHIIUM DERIVATIVES 2023-2032(USD MILLION) 45

-

GLOBAL GLASS

-

& CERAMIC MARKET FOR LITHIIUM DERIVATIVES 2023-2032(THOUSAND TONS) 45

-

GLOBAL LUBRATING GREASES MARKET FOR LITHIIUM DERIVATIVES 2023-2032(USD

-

MILLION) 46

-

GLOBAL LUBRATING GREASES MARKET FOR LITHIIUM DERIVATIVES

-

GLOBAL METALLURGIC MARKET FOR LITHIIUM

-

DERIVATIVES 2023-2032(USD MILLION) 47

-

GLOBAL METALLURGIC MARKET

-

FOR LITHIIUM DERIVATIVES 2023-2032(THOUSAND TONS) 47

-

GLOBAL

-

AIR TREATMENT MARKET FOR LITHIIUM DERIVATIVES 2023-2032(USD MILLION) 48

-

GLOBAL AIR TREATMENT MARKET FOR LITHIIUM DERIVATIVES 2023-2032(THOUSAND

-

TONS) 48

-

GLOBAL ALLUMINIUM SMELTING MARKET FOR LITHIIUM DERIVATIVES

-

GLOBAL ALLUMINIUM SMELTING MARKET

-

FOR LITHIIUM DERIVATIVES 2023-2032(THOUSAND TONS) 49

-

GLOBAL

-

POLYMER MARKET FOR LITHIIUM DERIVATIVES 2023-2032(USD MILLION) 50

-

TABLE

-

GLOBAL POLYMER MARKET FOR LITHIIUM DERIVATIVES 2023-2032(THOUSAND TONS) 50

-

GLOBAL OTHERS MARKET FOR LITHIIUM DERIVATIVES 2023-2032(USD MILLION)

-

51

-

GLOBAL OTHERS MARKET FOR LITHIIUM DERIVATIVES 2023-2032(THOUSAND

-

TONS) 51

-

GLOBAL LITHIUM DERIVATIVES MARKET, BY REGION, 2023-2032(USD

-

MILLION) 53

-

GLOBAL LITHIUM DERIVATIVES MARKET, BY REGION, 2023-2032(THOUSAND

-

TONS) 53

-

NORTH AMERICA LITHUM DRIVATIVES MARKET, BY TYPE, 2023-2032(USD

-

MILLION) 55

-

NORTH AMERICA LITHUM DRIVATIVES MARKET, BY TYPE,

-

U.S. LITHIUM DERIVATIVES MARKET,

-

BY TYPE 2023-2032(USD MILLION) 58

-

U.S. LITHIUM DERIVATIVES MARKET,

-

BY TYPE 2023-2032(THOUSAND TONS) 58

-

U.S. LITHIUM DERIVATIVES

-

MARKET, BY APPLICATION, 2023-2032(USD MILLION) 59

-

U.S. LITHIUM

-

DERIVATIVES MARKET, BY APPLICATION, 2023-2032(THOUSAND TONS) 60

-

TABLE

-

CANADA LITHIUM DERIVATIVES MARKET, BY TYPE 2023-2032(USD MILLION) 60

-

CANADA LITHIUM DERIVATIVES MARKET, BY TYPE 2023-2032(THOUSAND TONS) 61

-

CANADA LITHIUM DERIVATIVES MARKET, BY APPLICATION, 2023-2032(USD

-

MILLION) 61

-

CANADA LITHIUM DERIVATIVES MARKET, BY APPLICATION,

-

EUROPE LITHIUM DERIVATIVES MARKET,

-

BY COUNTRY, 2023-2032(USD MILLION) 63

-

EUROPE LITHIUM DERIVATIVES

-

MARKET, BY COUNTRY, 2023-2032(THOUSAND TONS) 64

-

EUROPE LITHIUM

-

DERIVATIVES MARKET, BY TYPE, 2023-2032(USD MILLION) 65

-

EUROPE

-

LITHIUM DERIVATIVES MARKET, BY TYPE, 2023-2032(THOUSAND TONS) 66

-

TABLE

-

EUROPE LITHIUM DERIVATIVES MARKET, BY APPLICATION, 2023-2032(USD MILLION) 67

-

EUROPE LITHIUM DERIVATIVES MARKET, BY APPLICATION, 2023-2032(THOUSAND

-

TONS) 68

-

GERMANY LITHIUM DERIVATIVES MARKET, BY TYPE, 2023-2032(USD

-

MILLION) 68

-

GERMANY LITHIUM DERIVATIVES MARKET, BY TYPE, 2023-2032(THOUSAND

-

TONS) 69

-

GERMANY LITHIUM DERIVATIVES MARKET, BY APPLICATION,

-

GERMANY LITHIUM DERIVATIVES MARKET,

-

BY APPLICATION, 2023-2032(THOUSAND TONS) 71

-

UK LITHIUM DERIVATIVES

-

MARKET, BY TYPE, 2023-2032(USD MILLION) 72

-

UK LITHIUM DERIVATIVES

-

MARKET, BY TYPE, 2023-2032(THOUSAND TONS) 72

-

UK LITHIUM DERIVATIVES

-

MARKET, BY APPLICATION, 2023-2032(USD MILLION) 73

-

UK LITHIUM

-

DERIVATIVES MARKET, BY APPLICATION, 2023-2032(THOUSAND TONS) 74

-

TABLE

-

RUSSIA LITHIUM DERIVATIVES MARKET, BY TYPE, 2023-2032(USD MILLION) 74

-

RUSSIA LITHIUM DERIVATIVES MARKET, BY TYPE, 2023-2032(THOUSAND TONS)

-

75

-

RUSSIA LITHIUM DERIVATIVES MARKET, BY APPLICATION, 2023-2032(USD

-

MILLION) 76

-

RUSSIA LITHIUM DERIVATIVES MARKET, BY APPLICATION,

-

FRANCE LITHIUM DERIVATIVES MARKET,

-

BY TYPE, 2023-2032(USD MILLION) 78

-

FRANCE LITHIUM DERIVATIVES

-

MARKET, BY TYPE, 2023-2032(THOUSAND TONS) 78

-

FRANCE LITHIUM

-

DERIVATIVES MARKET, BY APPLICATION, 2023-2032(USD MILLION) 79

-

TABLE 68

-

FRANCE LITHIUM DERIVATIVES MARKET, BY APPLICATION, 2023-2032(THOUSAND TONS) 80

-

ITALY LITHIUM DERIVATIVES MARKET, BY TYPE, 2023-2032(USD MILLION)

-

81

-

ITALY LITHIUM DERIVATIVES MARKET, BY TYPE, 2023-2032(THOUSAND

-

TONS) 81

-

ITALY LITHIUM DERIVATIVES MARKET, BY APPLICATION, 2023-2032(USD

-

MILLION) 82

-

ITALY LITHIUM DERIVATIVES MARKET, BY APPLICATION,

-

SPAIN LITHIUM DERIVATIVES MARKET,

-

BY TYPE, 2023-2032(USD MILLION) 84

-

SPAIN LITHIUM DERIVATIVES

-

MARKET, BY TYPE, 2023-2032(THOUSAND TONS) 84

-

SPAIN LITHIUM DERIVATIVES

-

MARKET, BY APPLICATION, 2023-2032(USD MILLION) 85

-

SPAIN LITHIUM

-

DERIVATIVES MARKET, BY APPLICATION, 2023-2032(THOUSAND TONS) 86

-

TABLE

-

REST OF THE EUROPE LITHIUM DERIVATIVES MARKET, BY TYPE, 2023-2032(USD MILLION)

-

87

-

REST OF THE EUROPE LITHIUM DERIVATIVES MARKET, BY TYPE, 2023-2032(THOUSAND

-

TONS) 87

-

REST OF THE EUROPE LITHIUM DERIVATIVES MARKET, BY APPLICATION,

-

REST OF THE EUROPE LITHIUM DERIVATIVES

-

MARKET, BY APPLICATION, 2023-2032(THOUSAND TONS) 89

-

ASIA PACIFIC

-

LITHIUM DERIVATIVE MARKET BY COUNTRY 2023-2032(USD MILLION) 90

-

TABLE

-

ASIA PACIFIC LITHIUM DERIVATIVE MARKET BY COUNTRY 2023-2032(THIUSAND TONS) 90

-

ASIA PACIFIC LITHIUM DERIVATIVE MARKET, BY TYPE, 2023-2032(USD

-

MILLION) 91

-

ASIA PACIFIC LITHIUM DERIVATIVE MARKET, BY TYPE,

-

ASIA PACIFIC LITHIUM DERIVATIVE

-

MARKET, BY APPLICATION, 2023-2032(USD MILLION) 93

-

ASIA PACIFIC

-

LITHIUM DERIVATIVE MARKET, BY APPLICATION, 2023-2032(THIUSAND TONS) 94

-

CHINA LITHIUM DERIVATIVE MARKET, BY TYPE, 2023-2032(USD MILLION) 95

-

CHINA LITHIUM DERIVATIVE MARKET, BY TYPE, 2023-2032(THIUSAND TONS)

-

95

-

CHINA LITHIUM DERIVATIVE MARKET, BY APPLICATION, 2023-2032(USD

-

MILLION) 96

-

CHINA LITHIUM DERIVATIVE MARKET, BY APPLICATION,

-

JAPAN LITHIUM DERIVATIVE MARKET,

-

BY TYPE, 2023-2032(USD MILLION) 98

-

JAPAN LITHIUM DERIVATIVE

-

MARKET, BY TYPE, 2023-2032(THIUSAND TONS) 98

-

JAPAN LITHIUM DERIVATIVE

-

MARKET, BY APPLICATION, 2023-2032(USD MILLION) 99

-

JAPAN LITHIUM

-

DERIVATIVE MARKET, BY APPLICATION, 2023-2032(THIUSAND TONS) 100

-

TABLE

-

INDIA LITHIUM DERIVATIVE MARKET, BY TYPE, 2023-2032(USD MILLION) 101

-

INDIA LITHIUM DERIVATIVE MARKET, BY TYPE, 2023-2032(THIUSAND TONS) 101

-

INDIA LITHIUM DERIVATIVE MARKET, BY APPLICATION, 2023-2032(USD

-

MILLION) 102

-

INDIA LITHIUM DERIVATIVE MARKET, BY APPLICATION,

-

SOUTH KOREA LITHIUM DERIVATIVE

-

MARKET, BY TYPE, 2023-2032(USD MILLION) 104

-

SOUTH KOREA LITHIUM

-

DERIVATIVE MARKET, BY TYPE, 2023-2032(THIUSAND TONS) 104

-

SOUTH

-

KOREA LITHIUM DERIVATIVE MARKET, BY APPLICATION, 2023-2032(USD MILLION) 105

-

SOUTH KOREA LITHIUM DERIVATIVE MARKET, BY APPLICATION, 2023-2032(THIUSAND

-

TONS) 106

-

REST OF THE ASIA PACIFIC LITHIUM DERIVATIVE MARKET,

-

BY TYPE, 2023-2032(USD MILLION) 107

-

REST OF THE ASIA PACIFIC

-

LITHIUM DERIVATIVE MARKET, BY TYPE, 2023-2032(THIUSAND TONS) 107

-

TABLE

-

REST OF THE ASIA PACIFIC LITHIUM DERIVATIVE MARKET, BY APPLICATION, 2023-2032(USD

-

MILLION) 108

-

REST OF THE ASIA PACIFIC LITHIUM DERIVATIVE MARKET,

-

BY APPLICATION, 2023-2032(THOUSAND TONS) 109

-

LATIN AMERICA

-

LITHIUM DERIVATIVE MARKET BY COUNTRY 2023-2032(USD MILLION) 110

-

TABLE

-

LATIN AMERICA LITHIUM DERIVATIVE MARKET BY COUNTRY 2023-2032(THOUSAND TONS)

-

110

-

LATIN AMERICA LITHIUM DERIVATIVE MARKET, BY TYPE, 2023-2032(USD

-

MILLION) 111

-

LATIN AMERICA LITHIUM DERIVATIVE MARKET, BY TYPE,

-

LATIN AMERICA LITHIUM DERIVATIVE

-

MARKET, BY APPLICATION, 2023-2032(USD MILLION) 112

-

LATIN AMERICA

-

LITHIUM DERIVATIVE MARKET, BY APPLICATION, 2023-2032(THOUSAND TONS) 113

-

BRAZIL LITHIUM DERIVATIVE MARKET, BY TYPE, 2023-2032(USD MILLION) 114

-

BRAZIL LITHIUM DERIVATIVE MARKET, BY TYPE, 2023-2032(THOUSAND

-

TONS) 114

-

BRAZIL LITHIUM DERIVATIVE MARKET, BY APPLICATION,

-

BRAZIL LITHIUM DERIVATIVE MARKET,

-

BY APPLICATION, 2023-2032(THOUSAND TONS) 116

-

ARGENTINA LITHIUM

-

DERIVATIVE MARKET, BY TYPE, 2023-2032(USD MILLION) 117

-

ARGENTINA

-

LITHIUM DERIVATIVE MARKET, BY TYPE, 2023-2032(THOUSAND TONS) 117

-

TABLE

-

ARGENTINA LITHIUM DERIVATIVE MARKET, BY APPLICATION, 2023-2032(USD MILLION)

-

118

-

ARGENTINA LITHIUM DERIVATIVE MARKET, BY APPLICATION, 2023-2032(THOUSAND

-

TONS) 119

-

REST OF THE LATIN AMERICA LITHIUM DERIVATIVE MARKET,

-

BY TYPE, 2023-2032(USD MILLION) 120

-

REST OF THE LATIN AMERICA

-

LITHIUM DERIVATIVE MARKET BY TYPE, 2023-2032(THOUSAND TONS) 121

-

TABLE

-

REST OF THE LATIN AMERICA LITHIUM DERIVATIVE MARKET, BY APPLICATION, 2023-2032(USD

-

MILLION) 122

-

REST OF THE LATIN AMERICA LITHIUM DERIVATIVE MARKET,

-

BY APPLICATION, 2023-2032(THOUSAND TONS) 123

-

MIDDLE EAST &

-

AFRICA LITHIUM DERIVATIVE MARKET BY COUNTRY 2023-2032(USD MILLION) 124

-

MIDDLE EAST & AFRICA LITHIUM DERIVATIVE MARKET BY COUNTRY 2023-2032(THOUSAND

-

TONS) 124

-

MIDDLE EAST & AFRICA LITHIUM DERIVATIVE MARKET,

-

BY TYPE, 2023-2032(USD MILLION) 125

-

MIDDLE EAST & AFRICA

-

LITHIUM DERIVATIVE MARKET, BY TYPE, 2023-2032(THOUSAND TONS) 125

-

TABLE

-

MIDDLE EAST & AFRICA LITHIUM DERIVATIVE MARKET, BY APPLICATION, 2023-2032(USD

-

MILLION) 126

-

MIDDLE EAST & AFRICA LITHIUM DERIVATIVE MARKET,

-

BY APPLICATION, 2023-2032(THOUSAND TONS) 127

-

TURKEY LITHIUM

-

DERIVATIVE MARKET, BY TYPE, 2023-2032(USD MILLION) 128

-

TURKEY

-

LITHIUM DERIVATIVE MARKET, BY TYPE, 2023-2032(THOUSAND TONS) 128

-

TABLE

-

TURKEY LITHIUM DERIVATIVE MARKET, BY APPLICATION, 2023-2032(USD MILLION) 129

-

TURKEY LITHIUM DERIVATIVE MARKET, BY APPLICATION, 2023-2032(THOUSAND

-

TONS) 130

-

UAE LITHIUM DERIVATIVE MARKET, BY TYPE, 2023-2032(USD

-

MILLION) 131

-

UAE LITHIUM DERIVATIVE MARKET, BY TYPE, 2023-2032(THOUSAND

-

TONS) 131

-

UAE LITHIUM DERIVATIVE MARKET, BY APPLICATION, 2023-2032(USD

-

MILLION) 132

-

UAE LITHIUM DERIVATIVE MARKET, BY APPLICATION,

-

SAUDI ARABIA LITHIUM DERIVATIVE

-

MARKET, BY TYPE, 2023-2032(USD MILLION) 134

-

SAUDI ARABIA LITHIUM

-

DERIVATIVE MARKET, BY TYPE, 2023-2032(THOUSAND TONS) 134

-

SAUDI

-

ARABIA LITHIUM DERIVATIVE MARKET, BY APPLICATION, 2023-2032(USD MILLION) 135

-

SAUDI ARABIA LITHIUM DERIVATIVE MARKET, BY APPLICATIONS 2023-2032(THOUSAND

-

TONS) 136

-

REST OF THE MIDDLE EAST & AFRICA LITHIUM DERIVATIVE

-

MARKET BY TYPE, 2023-2032(USD MILLION) 137

-

REST OF THE MIDDLE

-

EAST & AFRICA LITHIUM DERIVATIVE MARKET, BY TYPE, 2023-2032(THOUSAND TONS) 138

-

REST OF THE MIDDLE EAST & AFRICA LITHIUM DERIVATIVE MARKET,

-

BY APPLICATION 2023-2032(USD MILLION) 139

-

REST OF THE MIDDLE

-

EAST & AFRICA LITHIUM DERIVATIVE MARKET, BY APPLICATION, 2023-2032(THOUSAND

-

TONS) 140

-

List Of Figures

-

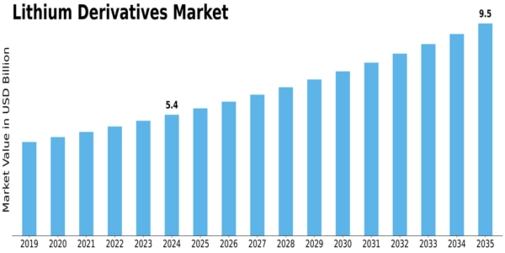

GLOBAL LITHIUM DERIVATIVES

-

MARKET OUTLOOK (2018-2025) 12

-

MRFR RESEARCH PROCESS 16

-

TOP DOWN & BOTTOM DOWN APPROACH 18

-

GROWTH DRIVER

-

IMPACT ANALYSIS 20

-

RESTRAINTS IMPACT ANALYSIS 22

-

FIGURE

-

OPPORTUNITIES IMPACT ANALYSIS 23

-

TRENDS IMPACT ANALYSIS 24

-

GLOBAL LITHIUM DERIVATIVES MARKET, BY TYPE 2023-2032(USD MILLION)

-

30

-

GLOBAL LITHIUM DERIVATIVES MARKET, BY TYPE 2023-2032(THOUSAND

-

TONS) 31

-

GLOBAL LITHIUM DERIVATIVE MARKET, BY APPLICATION,

-

GLOBAL LITHIUM DERIVATIVE MARKET,

-

BY APPLICATION, 2023-2032(THOUSAND TONS) 42

-

GLOBAL LITHIUM

-

DERIVATIVES MARKET, BY REGION 2023 (%) 52

-

NORTH AMERICA LITHUM

-

DRIVATIVES MARKET BY COUNTRY 2023-2032(USD MILLION) 54

-

NORTH

-

AMERICA LITHUM DRIVATIVES MARKET BY COUNTRY 2023-2032(THOUSAND TONS) 54

-

NORTH AMERICA LITHUM DRIVATIVES MARKET, BY APPLICATION, 2023-2032(USD

-

MILLION) 56

-

NORTH AMERICA LITHUM DRIVATIVES MARKET, BY APPLICATION,

-

GLOBAL MARKET SHARE ANALYSIS, BY

-

KEY PLAYERS 141

-

ALBEMARLE: RECENT FINANCIALS 144

-

FIGURE

-

SQM: RECENT FINANCIALS 146

-

SICHUAN TIANQI LITHIUM INDUSTRIES

-

INC. : RECENT FINANCIALS 151

-

JIANGXI GANFENG LITHIUM CO LTD

-

: RECENT FINANCIALS 152

Leave a Comment