Market Share

Introduction: Navigating the Competitive Landscape of Low-Intensity Sweeteners

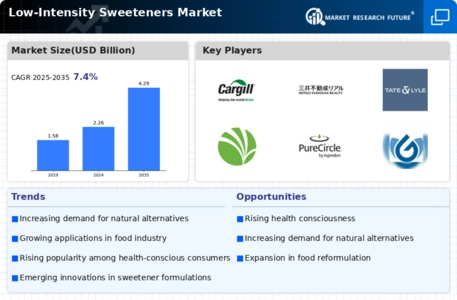

The low intensity sweeteners market is going through a transformational phase driven by the rapidly evolving technology, changing consumer preferences, and stringent regulatory framework. The key players, which include established manufacturers, new entrants, and suppliers, are striving to gain market leadership by deploying artificial intelligence and automation to enhance product development and consumer engagement. Major players are focusing on clean label offerings and sustainable sourcing with a notable shift towards plant-based alternatives to cater to the health-conscious consumer trend. The integration of IoT in their value chains is further helping the key players to collect real-time data, which is further aiding the players in devising customer-centric strategies. As the regional dynamics are shifting, mainly in North America and Asia-Pacific, the key players are strategically deploying their resources to seize the emerging opportunities and remain agile in the market, which is expected to be highly disrupted and characterized by a high growth potential through 2025.

Competitive Positioning

Full-Suite Integrators

These vendors offer comprehensive solutions across the low-intensity sweeteners spectrum, from production to application.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Cargill Inc. (US) | Diverse product portfolio and global reach | Sweeteners and food ingredients | North America, Europe, Asia |

| Ingredion (US) | Strong innovation in ingredient solutions | Food and beverage ingredients | North America, Latin America, Asia |

| Tate and Lyle (UK) | Expertise in health and wellness solutions | Food ingredients and sweeteners | Europe, North America, Asia |

Specialized Technology Vendors

These players focus on specific technologies or products within the low-intensity sweeteners market, often leading in innovation.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Roquette Freres SA (France) | Strong R&D capabilities in plant-based solutions | Natural sweeteners and food ingredients | Europe, Asia, Americas |

| E.l. Du Pont de Nemours and Company (US) | Advanced biotechnological processes | Food ingredients and sweeteners | Global |

| NutraSweet Company (US) | Pioneers in aspartame production | Artificial sweeteners | North America, Asia |

| Matsutani Chemical Industry Co. Ltd. (Japan) | Specialization in high-quality sweeteners | Maltitol and other sweeteners | Asia, North America |

| Purecircle (Malaysia) | Leader in stevia-based sweeteners | Natural sweeteners | Global |

Infrastructure & Equipment Providers

These vendors supply the necessary equipment and infrastructure for the production and processing of low-intensity sweeteners.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Mitsui (Japan) | Strong supply chain and logistics | Chemical and food processing | Asia, North America |

| Food Chem International Corporation (Japan) | Expertise in food additives and ingredients | Food processing solutions | Asia, Europe |

| Gulshan Polyols Limited (India) | Cost-effective production capabilities | Sweeteners and food ingredients | India, Asia |

| JK Sucralose Inc. (India) | Focus on sucralose production | Artificial sweeteners | India, Asia |

| EcogreenOleochemicals (Singapore) | Sustainable production methods | Oleochemicals and sweeteners | Asia, Europe |

| ZuChem Inc. (US) | Innovative carbohydrate chemistry | Specialty sweeteners | North America, Europe |

Regional Players

These vendors are primarily focused on specific regional markets, providing tailored solutions to local demands.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Südzucker AG (Germany) | Strong presence in European markets | Sugar and sweeteners | Europe |

Emerging Players & Regional Champions

- SweetLeaf (USA): Specializes in stevia-based sweeteners, recently secured a partnership with a major beverage manufacturer to develop low-calorie drinks, complementing established vendors by offering a natural alternative to synthetic sweeteners.

- PureCircle (Malaysia): Focuses on innovative stevia extraction methods, recently launched a new line of organic stevia products, challenging established vendors by emphasizing sustainability and organic certification.

- Nutraceutical Corporation (USA): Offers a range of low-intensity sweeteners derived from monk fruit, recently expanded distribution in the health food sector, complementing traditional sweetener suppliers by targeting health-conscious consumers.

- Tate & Lyle (UK): Known for their low-calorie sweetener solutions, recently entered into a collaboration with a global snack brand to reduce sugar content, positioning themselves as a challenger to traditional sugar suppliers.

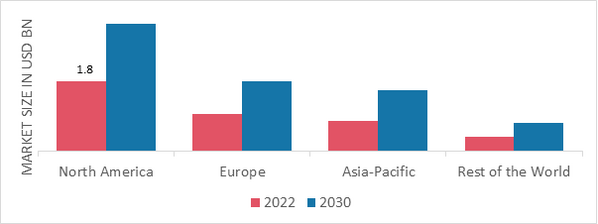

Regional Trends: In 2024, the use of low-intensity sweeteners will increase significantly in North America and Europe, resulting from growing health consciousness and government regulation to reduce sugar consumption. Asia-Pacific is a significant market, mainly due to the increasing demand for natural sweeteners, especially in China and India. In terms of technology, specialization is moving towards new extraction methods and organic certifications, which will make the product more attractive to consumers.

Collaborations & M&A Movements

- Cargill and PureCircle entered a partnership to develop new stevia-based sweeteners aimed at expanding their product offerings in the health-conscious consumer segment, enhancing their competitive positioning in the low-intensity sweeteners market.

- Nutraceutical Corporation acquired the natural sweetener brand, SweetLeaf, to diversify its product portfolio and strengthen its market share in the growing demand for natural low-calorie sweeteners.

- Tate & Lyle and DSM announced a collaboration to innovate and commercialize new low-calorie sweetening solutions, aiming to leverage their combined expertise to capture a larger share of the health and wellness market.

Competitive Summary Table

| Capability | Leading Players | Remarks |

|---|---|---|

| Product Innovation | Cargill, Tate & Lyle | Cargill has introduced a new line of monk fruit sweeteners that cater to health-conscious consumers, while Tate & Lyle focuses on developing stevia-based products with improved taste profiles, showcasing their commitment to innovation. |

| Sustainability Practices | Nutraceutical Corporation, PureCircle | Nutraceutical Corporation emphasizes sustainable sourcing of sweeteners, utilizing eco-friendly farming practices. PureCircle has made strides in producing stevia through sustainable agricultural methods, enhancing their brand reputation. |

| Regulatory Compliance | DuPont, ADM | DuPont has developed a rigorous compliance system to navigate the world’s sweetener regulations and ensure product safety and market access. ADM has successfully established the Generally Recognized as Safe (GRAS) status for its sweetener products, which facilitates market entry. |

| Consumer Education and Marketing | SweetLeaf, Wholesome Sweeteners | SweetLeaf has launched educational campaigns to inform consumers about the benefits of low-intensity sweeteners, while Wholesome Sweeteners focuses on transparency in ingredient sourcing, enhancing consumer trust. |

| Distribution Network | BASF, Kerry Group | BASF leverages its extensive global distribution network to ensure product availability across various markets, while Kerry Group has established partnerships with major retailers to enhance product reach. |

Conclusion: Navigating the Low-Intensity Sweeteners Landscape

The competition in the low-intensity sweeteners market is extremely fragmented, with both established and new entrants vying for a larger share of the market. North America and Europe are increasingly turning towards natural sweeteners, while the Asia-Pacific region is witnessing a surge in demand for low-calorie, low-intensity sweeteners. Strategically, vendors need to focus on deploying artificial intelligence (AI) for consumer insights, automation for efficient production, and sustainable practices to meet evolving regulatory standards and consumer preferences. In addition, they must be able to quickly respond to changing market trends. Companies that are able to successfully integrate these capabilities will likely emerge as the market leaders.

Leave a Comment