Lysine Size

Market Size Snapshot

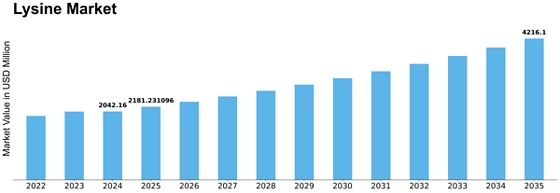

| Year | Value |

|---|---|

| 2024 | USD 2042.16 Billion |

| 2032 | USD 3459.81 Billion |

| CAGR (2024-2032) | 6.81 % |

Note – Market size depicts the revenue generated over the financial year

The lysine market is set to grow at a CAGR of 7.7 % from 2024 to 2032, with the market value set to reach $2,042.1 million in 2024 and $3,458.9 million in 2032. This growth rate reflects a CAGR of 6.81% for the forecast period. The lysine market is mainly driven by the essential role of lysine in animal nutrition and the increasing consumption of meat and meat products. The growing trend towards a high-protein diet and the growing aquaculture industry are also driving the market for lysine as a feed additive. The development of new fermentation processes and the use of genetically modified organisms (GMOs) to produce lysine also play an important role in increasing the efficiency and reducing the cost of lysine production. The lysine market is highly concentrated and dominated by a small number of large companies. These companies, such as CJ Cheil Jedang, Archer Daniels Midland, and Evonik Industries, are investing in research and development to develop new products and increase market share. These companies are also responding to the growing concern for the environment, as well as increasing the demand for lysine.

Regional Market Size

Regional Deep Dive

The lysine market is growing rapidly in several regions, driven by the increasing demand for animal feed, especially in the poultry and pig industries. The market is characterized by a shift towards more sustainable and efficient production methods, and by innovations in fermentation technology. The growing demand for high-quality, natural protein sources and the tightening regulations are also influencing the market. The market is highly competitive, and companies are investing heavily in research and development to enhance their product portfolios.

Europe

- In Europe, the demand for non-GMO and organic Lysine is on the rise, driven by consumer preferences for clean-label products, with companies like Evonik Industries leading the charge in developing innovative, sustainable solutions.

- The European Union's stringent regulations on animal welfare and feed quality are pushing manufacturers to enhance their product offerings, which is expected to lead to increased investments in sustainable production practices.

Asia Pacific

- The Asia-Pacific region is experiencing rapid growth in the Lysine market, particularly in countries like China and India, where rising meat consumption is driving demand for high-quality animal feed.

- Local companies, such as COFCO Biochemical and Ajinomoto, are expanding their production capacities to meet the increasing demand, while also focusing on sustainable practices to align with global trends.

Latin America

- Latin America is seeing a surge in the demand for Lysine, particularly in Brazil and Argentina, where the poultry and swine industries are expanding rapidly, driven by both domestic consumption and export opportunities.

- Key players like DSM and BASF are actively investing in the region, focusing on developing tailored solutions that meet the specific needs of local farmers and align with sustainability goals.

North America

- The North American Lysine market is witnessing significant advancements in fermentation technology, with companies like Archer Daniels Midland (ADM) investing heavily in R&D to improve production efficiency and reduce costs.

- Regulatory changes, particularly in the U.S. regarding animal feed additives, are shaping the market landscape, as the FDA continues to emphasize safety and efficacy, prompting manufacturers to adapt their formulations accordingly.

Middle East And Africa

- In the Middle East and Africa, the Lysine market is influenced by the growing livestock sector, with countries like South Africa and Egypt investing in modernizing their agricultural practices to improve feed efficiency.

- Government initiatives aimed at enhancing food security and self-sufficiency in animal protein production are expected to boost the demand for Lysine, as local producers seek to improve the nutritional quality of their feed.

Did You Know?

“Did you know that Lysine is considered an essential amino acid for humans and animals, meaning it must be obtained through diet, as the body cannot synthesize it?” — World Health Organization (WHO)

Segmental Market Size

The lysine market is currently booming, mainly as a result of the rising demand for high-protein foods and the expansion of the animal-feed industry. The population growth, the need for efficient and economical food sources, and the regulations promoting animal health and nutrition are the key factors driving the lysine market. Also, technological developments have enhanced the efficiency of the lysine fermentation process, which further supports the market’s stability. The lysine market is now dominated by ADM and Ajinomoto, the two leading companies. Lysine is used primarily in poultry, swine, and fish feeds, where it plays a critical role in improving the animals’ growth and feed efficiency. The emergence of sustainable development and the growing popularity of vegetarianism are other factors boosting the lysine market. Also, new biotechnology and fermentation methods are transforming the market, enabling more sustainable and cost-effective production of lysine.

Future Outlook

Lysine, a derivative of the essential amino acid, lysine, is a growth market with a CAGR of 6.81% between 2024 and 2032. This growth is mainly due to the increasing demand for high-protein feeds, especially in the livestock and aquaculture industries. Lysine is an essential nutrient for animals. Lysine is used in the manufacture of feedstuffs, mainly in the poultry and aquaculture industries. In the coming years, as the world population increases and the demand for meat rises, especially in emerging economies, the need for efficient feed formulations to increase the growth and feed conversion rate of livestock will further boost the market. By 2032, the use of lysine in animal feed is expected to account for over 70% of the feed market, indicating its importance in sustainable livestock production. Also, the development of microbial fermentation and genetic engineering will increase the efficiency of lysine production and reduce costs and the environment impact. Also, the government’s support of sustainable agricultural practices will promote the use of lysine in feed formulations. The growing trend for vegetarianism and the corresponding demand for alternative sources of protein may also open up new opportunities for lysine applications outside of animal feeds, such as in human nutrition and dietary supplements. Lysine is a key player in the global agricultural industry.

Leave a Comment