Medical Adhesives Size

Medical Adhesives Market Growth Projections and Opportunities

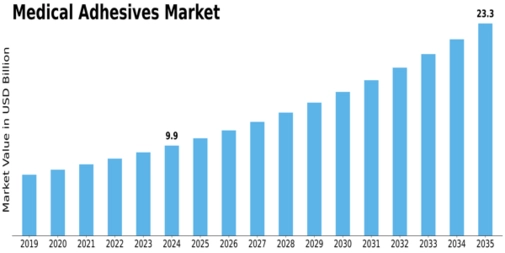

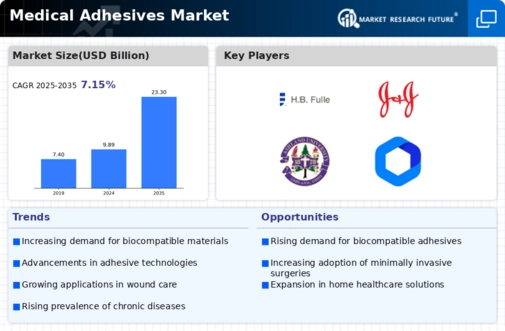

The Medical Adhesives Market Size was valued at USD 9.1 Billion in 2022. The Medical Adhesives market industry is projected to grow from USD 9.58 Billion in 2023 to USD 16.48 Billion by 2030, exhibiting a compound annual growth rate (CAGR) of 7.15%

Increasing Demand for Minimally Invasive Procedures: The growing preference for minimally invasive surgical procedures drives the demand for medical adhesives, which are used for wound closure, tissue bonding, and sealing. As patients seek faster recovery times and reduced scarring, healthcare providers increasingly rely on medical adhesives for less invasive treatment options, influencing market growth.

Advancements in Medical Technology: Technological advancements in medical devices and surgical techniques drive innovation in medical adhesives. Integration of advanced materials, such as cyanoacrylates, polyurethanes, and hydrogels, enhances the performance, biocompatibility, and versatility of medical adhesives, shaping market trends and adoption rates.

Aging Population and Chronic Diseases: The aging population and the prevalence of chronic diseases contribute to the growing demand for medical adhesives in wound care and tissue repair applications. As the elderly population increases and chronic diseases become more prevalent, the need for advanced wound closure and tissue bonding solutions grows, driving market demand.

Regulatory Compliance and Quality Standards: Adherence to regulatory requirements, such as FDA (Food and Drug Administration) approvals, CE (Conformité Européenne) marking, and ISO (International Organization for Standardization) certifications, is essential for manufacturers of medical adhesives to ensure product safety and efficacy. Compliance with regulatory standards influences market competitiveness and customer trust.

Shift towards Ambulatory Care Settings: The shift towards ambulatory care settings, such as outpatient clinics and ambulatory surgery centers, drives the demand for medical adhesives for use in minor surgeries and wound care procedures. As healthcare delivery models evolve and patients seek convenient and cost-effective treatment options, the demand for medical adhesives in ambulatory care settings increases, influencing market dynamics.

Emerging Applications in Medical Devices: Medical adhesives find applications in various medical devices, including wearable sensors, drug delivery systems, and diagnostic devices. The integration of medical adhesives with advanced medical devices enables innovative solutions for patient monitoring, drug administration, and disease diagnosis, driving market growth and diversification.

Cost-Effectiveness and Efficiency: The cost-effectiveness and efficiency of medical adhesives compared to traditional wound closure methods, such as sutures and staples, influence their adoption in clinical settings. Healthcare providers seek adhesive solutions that offer faster application, reduced procedure time, and improved patient outcomes, shaping market demand and pricing dynamics.

Market Competition and Innovation: The competitive landscape within the medical adhesives market, characterized by the presence of key players, market share distribution, and technological innovations, influences market dynamics. Manufacturers need to innovate, differentiate their offerings, and collaborate with healthcare providers to address unmet clinical needs and gain a competitive edge in the market.

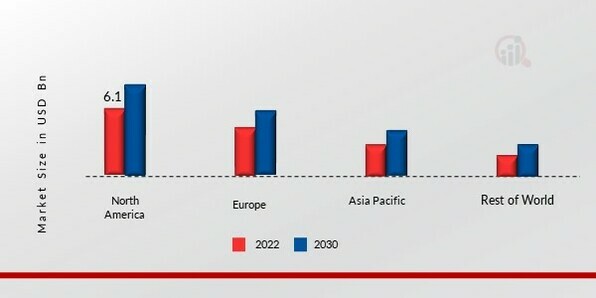

Global Healthcare Expenditure and Infrastructure: Global healthcare expenditure and infrastructure development influence the demand for medical adhesives in different regions. As countries invest in healthcare infrastructure development and healthcare access improves, the demand for medical adhesives for surgical procedures and wound care management grows, driving market expansion opportunities.

Consumer Awareness and Preference for Advanced Wound Care: Increasing consumer awareness of wound care options and preferences for advanced wound care products drive the demand for medical adhesives. Patients seek adhesive solutions that offer faster healing, reduced scarring, and improved comfort, influencing market trends and product development.

Source: Secondary Research, Primary Research, Market Research Future Database, and Analyst Review

Source: Secondary Research, Primary Research, Market Research Future Database, and Analyst Review

Leave a Comment