Market Trends

Introduction

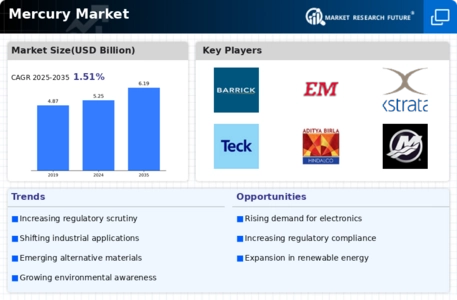

The Mercury Market will undergo a great change in 2024, due to the confluence of macro-economic factors. Technological developments are reshaping the extraction and processing of mercury, leading to increased efficiency and productivity. In parallel, the regulatory framework is becoming increasingly stringent worldwide, with stricter policies to reduce emissions and promote the use of safer alternatives. The behaviour of consumers is also changing, with a greater demand for products that are environmentally friendly. These trends are of strategic importance for the market, as they will not only drive operational changes, but also offer opportunities for innovation and differentiation in an increasingly regulated environment.

Top Trends

-

Increased Regulatory Scrutiny

Fortunately, governments have been tightening the restrictions on mercury emissions, and the European Union’s Mercury Regulation is a good example. In 2023, the European Union reported that the total mercury emissions from the region had dropped by 15 percent. This trend is forcing companies to invest in cleaner technology, which is affecting their costs. However, as the regulations evolve, they will face higher penalties for noncompliance, which will in turn force them to think of even more ways to reduce emissions. -

Shift Towards Sustainable Mining Practices

The mining companies are adopting more and more sustainable practices to mitigate their impact on the environment. For example, Barrick Gold has committed to reducing its carbon footprint by 30 per cent by 2030. This trend is bolstered by the growing demand for sustainable products. Seventy per cent of consumers are prepared to pay more for sustainable products. The result for the mining companies is higher initial costs but potentially longer-term savings and greater customer loyalty. -

Technological Advancements in Mercury Recovery

In the United States, mercury recovery methods are being developed. A recent study shows that it is possible to extract up to 95% of the mercury from the waste water. This is not only more efficient, but reduces contamination of the environment. In the future, the cost of the technology will be lowered and the company's profits increased by the use of these methods. -

Growing Demand in Electronics Manufacturing

The sphere of electricity and electrical equipment is the most important source of demand for mercury. It is used mainly in the manufacture of fluorescent lamps and batteries. In 2023, the demand for mercury in the field of electrical equipment increased by 10 percent, mainly due to the growth in the use of LEDs. This trend led manufacturers to seek substitute materials, which may change the existing production chain. Quick adaptation of the market may give companies a competitive advantage. -

Emerging Markets for Mercury Applications

In the developing countries, the use of mercury in a variety of applications, including artisanal gold mining, is growing. There are estimates that there are more than 15 million people involved in this activity and that they use a considerable amount of mercury. This situation creates a health risk for the environment, which international organizations have recognized and which have been working to eliminate. In the future, the regulatory pressure on these markets may increase, and they may be forced to adopt safer alternatives. -

Focus on Mercury Waste Management

It is for this reason that the Minamata Convention on Mercury and other initiatives have gained ground. In 2023, a hundred and twenty countries had committed to reducing their mercury waste, and a twenty per cent increase in the amount of mercury that could be recycled was recorded. This trend has led companies to invest in waste-management technology that can be used to improve their operational efficiency. It is possible that future regulations on waste disposal will have an effect on the way companies operate. -

Investment in Research and Development

The use of mercury in industry is in decline. The industry is investing more and more in R & D to develop safer substitutes. For example, Teck Resources has allocated considerable funds to research into mercury-free processes. The trend is based on a combination of regulatory pressure and consumers' demand for safer products. The potential shift in the product line could be a major impact. The companies that are innovating will have the opportunity to develop new markets. -

Collaboration for Environmental Solutions

The leaders of industry are forming associations to fight together against the pollution of mercury. In this way, a kind of partnership is being established between the different parties. In 2023, the association of associations had reduced the discharge of mercury by a quarter in the participating regions. This trend strengthens the social responsibility of the companies and can lead to the development of shared technology that benefits all parties. -

Increased Public Awareness and Advocacy

The public is more and more aware of the dangers of methylmercury, and the media are playing an increasingly important role. Surveys show that about 60 percent of consumers are better informed about the health effects of methylmercury. This development is also reflected in the transparency of companies and their suppliers in their production and procurement. In the long run, the demand for mercury-free products will increase, and the manufacturing process will change. -

Integration of Circular Economy Principles

The mercury market is witnessing a shift towards the principles of the circular economy, which emphasizes the reuse and recyclability of the product. The companies are examining how to recover mercury from end-of-life products. Studies show that a reduction in new demand for mercury of up to 30 percent can be achieved through this process. This trend is reflected in a change in the business model, whereby companies seek to minimize waste and optimize the use of resources. This may result in the emergence of new business models that are based on the principles of sustainability.

Conclusion: Navigating the Mercury Market Landscape

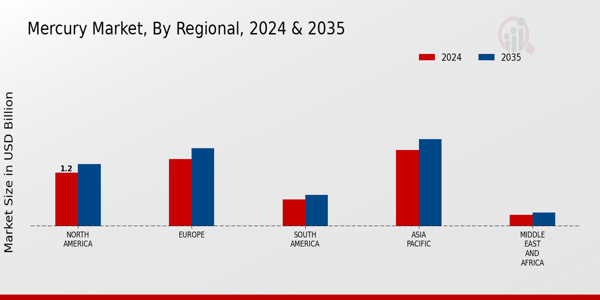

It is evident from our analysis of the Mercury Market in 2024 that the competition is highly fragmented, with both the old and the new players vying for a share of the market. Region-wise trends are pointing towards a shift towards automation and green technology, thereby requiring the players to adapt their strategies accordingly. The players with a long history are concentrating on building their reputations, whereas the new players are focusing on innovation and flexibility to capture niche market opportunities. Artificial intelligence and automation are the keys to gaining a foothold in the market. The Mercury Market is highly regulated, and the players need to not only respond to the changing demands of the consumers, but also to the changing regulatory requirements.

Leave a Comment