Mobile Emission Catalysts Market Trends

Mobile Emission Catalysts Market Research Report Information By Metal Type (Palladium, Platinum, Rhodium And Others), By Technology (Three-Way Conversion Catalyst, Four-Way Conversion Catalyst, Diesel Oxidation Catalyst, Catalyzed Soot Filter, Selective Catalytic Reduction, Lean GDI Catalyst, Electrically Heated Catalytic Converter), By Vehicle Type (Light-Duty Vehicles, Heavy-Duty Diesel, Natu...

Market Summary

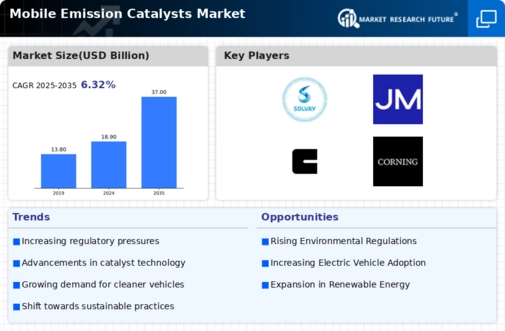

The Global Mobile Emission Catalysts Market is projected to grow from 18.87 USD Billion in 2024 to 37.04 USD Billion by 2035, reflecting a robust growth trajectory.

Key Market Trends & Highlights

Mobile Emission Catalysts Key Trends and Highlights

- The market is expected to experience a compound annual growth rate of 6.32 percent from 2025 to 2035.

- By 2035, the market valuation is anticipated to reach 37.0 USD Billion, indicating substantial expansion.

- in 2024, the market is valued at 18.87 USD Billion, laying a strong foundation for future growth.

- Growing adoption of emission control technologies due to stringent environmental regulations is a major market driver.

Market Size & Forecast

| 2024 Market Size | 18.87 (USD Billion) |

| 2035 Market Size | 37.04 (USD Billion) |

| CAGR (2025-2035) | 6.32% |

| Largest Regional Market Share in 2024 | latin_america) |

Major Players

BASF SE (Germany), Solvay (Belgium), Johnson Matthey (UK), Clariant (Switzerland), Umicore AG & Co. KG (Belgium), Cataler Corporation (Japan), Corning Incorporated (US), Heraeus Holding (Germany), N.E. CHEMCAT (Japan), Zeolyst International, Inc (US)

Market Trends

Rising emission standards are driving market growth

Market CAGR for mobile emission catalysts is being driven by the increasing emission standards. The market for mobile emission catalysts is expanding rapidly as emission laws become more stringent. The governments of several nations are establishing rigorous emission rules to decrease hazardous emissions from automobiles, which is boosting demand for mobile emission catalysts. Mobile emission catalysts are used in automobiles to limit the emission of hazardous gases such as carbon monoxide, hydrocarbons, and nitrogen oxides.

The growing popularity of electric and hybrid vehicles is also driving demand for mobile emission catalysts, as these vehicles generate hazardous gases during the combustion process. The growing awareness of the adverse impacts of air pollution on human health is also propelling the growth of the mobile emission catalysts market. Mobile emission catalysts are used to limit the emission of hazardous gases from automobiles, hence improving air quality. Increased investments in research and development operations to create better mobile emission catalysts are also propelling the market forward.

Market participants are concentrating their efforts on creating mobile emission catalysts that are more efficient and can lower dangerous gas emissions from automobiles to a larger extent. As a result, the increasing stringency of emission standards is propelling the growth of the mobile emission catalysts market.

The rising demand for electric vehicles in emerging economies like as China and India is expected to open up attractive potential for mobile emission catalysts market participants.

The ongoing transition towards stricter emission regulations is likely to drive innovation and demand in the mobile emission catalysts sector, as manufacturers seek to enhance vehicle efficiency and reduce environmental impact.

U.S. Environmental Protection Agency (EPA)

Mobile Emission Catalysts Market Market Drivers

Regulatory Compliance

The Global Mobile Emission Catalysts Market Industry is significantly influenced by stringent environmental regulations aimed at reducing vehicular emissions. Governments worldwide are implementing increasingly rigorous standards, such as the Euro 6 and Tier 3 regulations, which mandate lower nitrogen oxides and particulate matter emissions. This regulatory landscape compels automotive manufacturers to integrate advanced emission control technologies, including mobile emission catalysts, into their vehicles. As a result, the market is projected to reach 18.9 USD Billion in 2024, reflecting the growing demand for compliance-driven solutions that enhance vehicle performance while adhering to environmental standards.

Market Segment Insights

Mobile Emission Catalysts Metal Type Insights

The Mobile Emission Catalysts Market segmentation, based on metal type includes palladium, platinum, rhodium and others. The palladium segment dominates the mobile emission catalysts market, because of its strong catalytic characteristics and great effectiveness in decreasing hazardous gas emissions from cars. Palladium-based catalysts are widely employed in the automotive sector because they effectively minimize the emission of hazardous gases such as carbon monoxide, hydrocarbons, and nitrogen oxides. The rising demand for palladium-based catalysts in the automobile industry is propelling the palladium segment of the mobile emission catalysts market forward.

Furthermore, the increasing use of electric and hybrid vehicles in many nations is boosting demand for palladium-based catalysts, which are used in the production of fuel cells, which are used in electric and hybrid vehicles.

Figure1: Mobile Emission Catalysts Market, by Metal Type, 2022 & 2032 (USD Billion)

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Mobile Emission Catalysts Technology Insights

The Mobile Emission Catalysts Market segmentation, based on technology, includes three-way conversion catalyst, four-way conversion catalyst, diesel oxidation catalyst, catalyzed soot filter, selective catalytic reduction, lean GDI catalyst, electrically heated catalytic converter and others. During the predicted time, selective catalytic reduction is expected to expand the fastest and have the largest demand. Industry has a high level of acceptance for mobile emission catalysts. SCR technology is far less expensive than other product types, and this, combined with new technologies, is enticing manufacturers to engage in the sector. When compared to other segments, the SCR system is more cost effective.

Furthermore, with the increased use in multiple industries and the cost-effective nature of SCR, the market for mobile emission catalysts around the world is predicted to expand steadily.

Mobile Emission Catalysts Vehicle Type Insights

The Mobile Emission Catalysts Market segmentation, based on vehicle type includes light-duty vehicles, heavy-duty diesel, natural gas vehicles, motorcycles, utility engines, and others. The light-duty vehicles category is the fastest growing segment in the mobile emission catalysts industry, due to the increasing demand for light-duty automobiles in many regions. Increased population, urbanization, and economic expansion in various nations are driving demand for light-duty cars, which in turn is boosting need for mobile emission catalysts. Furthermore, governments in several countries are imposing tight emission restrictions for light-duty vehicles in order to limit hazardous emissions from vehicles.

The growing awareness of the adverse impacts of air pollution on human health is also boosting demand for mobile emission catalysts in the Light-Duty Vehicles market.

Get more detailed insights about Mobile Emission Catalysts Market Research Report—Global Forecast till 2032

Regional Insights

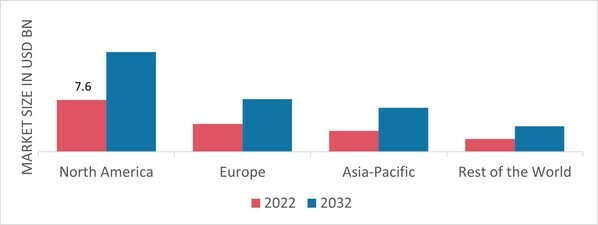

By region, the study provides the market insights into North America, Europe, Asia-Pacific and Rest of the World. North America is the industry leader in mobile emission catalysts, because of the region's government's rigorous pollution regulations. To prevent harmful emissions from vehicles, the United States and Canada have enacted severe emission rules. The region's growing awareness of the adverse impacts of air pollution on human health is also boosting demand for mobile emission catalysts. Furthermore, the region's increasing usage of electric and hybrid vehicles is propelling the expansion of the mobile emission catalysts market.

Further, the major countries studiedin the market reportare The US, Canada, German, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure2: MOBILE EMISSION CATALYSTS MARKET SHARE BY REGION 2022 (USD Billion)

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Europe Mobile Emission Catalysts Market accounts for the second-largest market share due to the presence of a high number of car manufacturers in the region. Further, the German Mobile Emission Catalysts Market held the largest market share, and the UK Mobile Emission Catalysts Market was the fastest growing market in the European region.

The Asia-Pacific Mobile Emission Catalysts Market is expected to grow at the fastest CAGR from 2023 to 2032. This is due to the increased demand for autos in the region. Moreover, China’s Mobile Emission Catalysts Market held the largest market share, and the Indian Mobile Emission Catalysts Market was the fastest growing market in the Asia-Pacific region.

Key Players and Competitive Insights

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the Mobile Emission Catalysts Market, grow even more. Market participants are also undertaking a variety of strategic activities to expand their footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, Mobile Emission Catalysts industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the Mobile Emission Catalysts industry to benefit clients and increase the market sector. In recent years, the Mobile Emission Catalysts industry has offered some of the most significant advantages to medicine. Major players in the Mobile Emission Catalysts Market, including Cataler Corporation (Japan), Corning Incorporated (US), Heraeus Holding (Germany), N.E. CHEMCAT (Japan), Zeolyst International, Inc (US) and others, are attempting to increase market demand by investing in research and development operations.

Corning Incorporated is a multinational technology corporation based in the United States that specializes in specialized glass, ceramics, and related materials and technologies, including advanced optics, principally for industrial and scientific purposes. Corning Glass Works was the company's name until 1989. Corning sold the Corning Consumer Products Company division (now known as Corelle Brands) to Borden in 1998, divesting its consumer product lines (including CorningWare and Visions Pyroceram-based cookware, Corelle Vitrelle tableware, and Pyrex glass bakeware). In 2019, Corning Incorporated has introduced a novel mobile emissions catalyst system for gasoline engines.

The new method is intended to lower nitrogen oxide and hydrocarbon emissions from gasoline engines.

Tenneco (previously Tenneco Automotive and initially Tennessee Gas Transmission Company) is a maker of automotive components as well as aftermarket ride control and emissions solutions. It is a Fortune 500 corporation that was publicly traded on the New York Stock Exchange from November 1999 until it was taken private by Apollo Management in November 2022. Tenneco is based in Northville, Michigan. In 2019, Tenneco Inc. has announced the purchase of Federal-Mogul LLC, a prominent supplier of mobile emissions control technologies. Tenneco's position in the mobile emissions control industry is projected to improve as a result of the acquisition.

Key Companies in the Mobile Emission Catalysts Market market include

Industry Developments

In August 2021, BASF SE has introduced a new mobile emissions catalytic system for gasoline engines. The new method is intended to lower nitrogen oxide and hydrocarbon emissions from gasoline engines.

In July 2020, Johnson Matthey Plc has introduced a new mobile emissions catalyst system for diesel engines. The new technology is intended to lower nitrogen oxide and particulate matter emissions from diesel engines.

In November 2019, Umicore SA has introduced a novel mobile emissions catalyst system for gasoline engines. The new method is intended to lower nitrogen oxide and hydrocarbon emissions from gasoline engines.

Future Outlook

Mobile Emission Catalysts Market Future Outlook

The Mobile Emission Catalysts Market is projected to grow at a 6.32% CAGR from 2025 to 2035, driven by stringent emission regulations, technological advancements, and increasing demand for cleaner vehicles.

New opportunities lie in:

- Invest in R&D for next-generation catalysts to enhance efficiency and reduce costs.

- Expand partnerships with automotive manufacturers to integrate advanced emission solutions.

- Leverage digital technologies for real-time monitoring and optimization of catalyst performance.

By 2035, the Mobile Emission Catalysts Market is expected to be robust, reflecting substantial growth and innovation.

Market Segmentation

Vehicle Type Outlook

- Light-Duty Vehicles

- Heavy-Duty Diesel

- Natural Gas Vehicles

- Motorcycles

- Utility Engines

- Others

Mobile Emission Catalysts Regional Outlook

- US

- Canada

Mobile Emission Catalysts Market By Metal Type Outlook

- Palladium

- Platinum

- Rhodium

- Others

Mobile Emission Catalysts Market By Technology Outlook

- Three-Way Conversion Catalyst

- Four-Way Conversion Catalyst

- Diesel Oxidation Catalyst

- Catalyzed Soot Filter

- Selective Catalytic Reduction

- Lean GDI Catalyst

- Electrically Heated Catalytic Converter

- Others

Mobile Emission Catalysts Market By Vehicle Type Outlook

- Light-Duty Vehicles

- Heavy-Duty Diesel

- Natural Gas Vehicles

- Motorcycles

- Utility Engines

- Others

Report Scope

| Report Attribute/Metric | Details |

| Market Size 2024 | USD 18.87 Billion |

| Market Size 2035 | 37.04 (Value (USD Billion)) |

| Compound Annual Growth Rate (CAGR) | 6.32% (2025 - 2035) |

| Base Year | 2024 |

| Market Forecast Period | 2025 - 2035 |

| Historical Data | 2018- 2022 |

| Market Forecast Units | Value (USD Billion) |

| Report Coverage | Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | Metal Type, Technology, Vehicle Type and Region |

| Geographies Covered | North America, Europe, AsiaPacific, and the Rest of the World |

| Countries Covered | The US, Canada, German, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

| Key Companies Profiled | BASF SE (Germany), Solvay (Belgium), Johnson Matthey (UK), Clariant (Switzerland), Umicore AG & Co. KG (Belgium), Cataler Corporation (Japan), Corning Incorporated (US), Heraeus Holding (Germany), N.E. CHEMCAT (Japan), Zeolyst International, Inc (US) |

| Key Market Opportunities | New emission limitations have been introduced by the laws on emission limit standards Euro 5 and 6 for lightweight passenger and commercial vehicles. In addition, |

| Key Market Dynamics | Growing awareness about energy conservation, as well as a requirement for efficient internal combustion engines, are driving market expansion. |

| Market Size 2025 | 20.06 (Value (USD Billion)) |

Market Highlights

Author

Latest Comments

This is a great article! Really helped me understand the topic better.

Thanks for sharing this. I’ve bookmarked it for later reference.

FAQs

How much is the Mobile Emission Catalysts Market?

Mobile Emission Catalysts Market size was valued at USD 18.87 Billion in 2024

What is the growth rate of the Mobile Emission Catalysts Market?

Mobile Emission Catalysts Market is projected to grow at a CAGR of 6.32% during the forecast period, 2025-2035

Which region held the largest market share in the Mobile Emission Catalysts Market?

North America had the largest share in the Mobile Emission Catalysts Market.

Who are the key players in the Mobile Emission Catalysts Market?

The key players in the Mobile Emission Catalysts Market are Cataler Corporation (Japan), Corning Incorporated (US), Heraeus Holding (Germany), N.E. CHEMCAT (Japan), Zeolyst International, Inc (US).

Which Metal Type led the Mobile Emission Catalysts Market?

The palladium category dominated the Mobile Emission Catalysts Market in 2022.

Which Technology had the largest market share in the Mobile Emission Catalysts Market?

The selective catalytic reduction had the largest share in the Mobile Emission Catalysts Market.

-

Table of Contents

-

Executive Summary 19

- GLOBAL MOBILE EMISSION CATALYSTS MARKET, BY METAL TYPE 21

- GLOBAL MOBILE EMISSION CATALYSTS MARKET, BY TECHNOLOGY 22

- GLOBAL MOBILE EMISSION CATALYSTS MARKET, BY VEHICLE TYPE 23

- GLOBAL MOBILE EMISSION CATALYSTS MARKET, BY REGION 24

-

Market Introduction 25

- DEFINITION 25

- Scope of the Study 25

- MARKET STRUCTURE 25

-

Research Methodology 26

- RESEARCH PROCESS 26

- PRIMARY RESEARCH 27

- SECONDARY RESEARCH 28

- MARKET SIZE ESTIMATION 29

- FORECAST MODEL 30

- LIST OF ASSUMPTIONS & LIMITATIONS 30

-

MARKET DYNAMICS 31

- INTRODUCTION 31

-

DRIVERS 32

- STRINGENT EMISSION NORMS AND REGULATIONS TO BOOST THE MARKET 32

- INCREASING SALES & PRODUCTION OF PASSENGER CARS 34

- DRIVERS IMPACT ANALYSIS 35

-

RESTRAINTS 36

- GROWING DEMAND FOR ELECTRIC VEHICLES IN THE MARKET 36

- RESTRAINTS IMPACT ANALYSIS 36

-

OPPORTUNITIES 37

- FOCUS ON PRODUCT INNOVATION AND NOVEL TECHNOLOGY DEVELOPMENT 37

- EXPANDING AUTOMOTIVE INDUSTRY IN LATIN AMERICA AND THE MIDDLE EAST 37

-

CHALLENGES 38

- FLUCTUATING AND HIGH RAW MATERIAL PRICES 38

-

MARKET FACTOR ANALYSIS 40

-

SUPPLY CHAIN ANALYSIS 40

- RAW MATERIALS SUPPLIERS 41

- MOBILE EMISSION CATALYST MANUFACTURERS 41

- DISTRIBUTION CHANNELS 41

- END USERS 41

-

PORTER’S FIVE FORCES MODEL 42

- THREAT OF NEW ENTRANTS 42

- BARGAINING POWER OF SUPPLIERS 43

- THREAT OF SUBSTITUTES 43

- BARGAINING POWER OF BUYERS 43

- INTENSITY OF RIVALRY 43

- GLOBAL MOBILE EMISSION CATALYST MARKET, PRICING ANALYSIS 43

-

IMPACT OF COVID 19 OUTBREAK ON GLOBAL MOBILE EMISSION CATALYST MARKET 44

- PRODUCTION SCENARIO 44

- IMPACT ON SUPPLY CHAIN 44

- MAJOR POLICIES BY VARIOUS COUNTRIES 45

-

SUPPLY CHAIN ANALYSIS 40

-

GLOBAL MOBILE EMISSION CATALYSTS MARKET, BY METAL TYPE 49

- INTRODUCTION 49

- PALLADIUM 51

- RHODIUM 52

- PLATINUM 53

- OTHERS 55

-

GLOBAL MOBILE EMISSION CATALYSTS MARKET, BY TECHNOLOGY 56

- INTRODUCTION 56

- DIESEL OXIDATION CATALYSTS (DOC) 58

- DIESEL PARTICULATE FILTERS (DPF) 59

- THREE-WAY CONVERSION CATALYSTS (TWC) 61

- FOUR-WAY CONVERSION CATALYSTS (FWC) 63

- LEAN GDI CATALYSTS (LGC) 64

- ELECTRICALLY HEATED CATALYTIC CONVERTER (E-CAT) 65

- OTHERS 66

-

GLOBAL MOBILE EMISSION CATALYSTS MARKET, BY VEHICLE TYPE 67

- INTRODUCTION 67

- LIGHT-DUTY VEHICLES 69

- HEAVY-DUTY VEHICLES 70

- NATURAL GAS VEHICLES 71

- MOTORCYCLES 73

- OTHERS 74

-

GLOBAL MOBILE EMISSION CATALYSTS MARKET, BY REGION 75

- INTRODUCTION 75

-

NORTH AMERICA 81

- US 85

- CANADA 88

-

EUROPE 91

- GERMANY 95

- FRANCE 98

- SPAIN 101

- UK 104

- RUSSIA 107

- ITALY 110

- REST OF EUROPE 113

-

ASIA-PACIFIC 116

- CHINA 120

- JAPAN 123

- INDIA 126

- SOUTH KOREA 129

- AUSTRALIA & NEW ZEALAND 132

- REST OF ASIA-PACIFIC 135

-

LATIN AMERICA 138

- BRAZIL 142

- MEXICO 145

- ARGENTINA 148

- REST OF LATIN AMERICA 151

-

MIDDLE EAST & AFRICA 154

- GCC 158

- SOUTH AFRICA 161

- REST OF THE MIDDLE EAST AND AFRICA 164

-

BENELUX 167

- BELGIUM 171

- NETHERLANDS 174

- LUXEMBOURG 177

-

-

Competitive Landscape 180

- INTRODUCTION 180

- MARKET STRATEGY ANALYSIS 180

- KEY DEVELOPMENTS & GROWTH STRATEGIES 181

- COMPETITIVE BENCHMARKING 183

-

COMPANY PROFILES 184

-

BASF SE 184

- COMPANY OVERVIEW 184

- FINANCIAL OVERVIEW 185

- PRODUCTS OFFERED 186

- KEY DEVELOPMENTS 187

- SWOT ANALYSIS 188

- KEY STRATEGIES 188

-

SOLVAY 189

- COMPANY OVERVIEW 189

- FINANCIAL OVERVIEW 190

- PRODUCTS OFFERED 191

- KEY DEVELOPMENTS 191

- SWOT ANALYSIS 191

- KEY STRATEGIES 192

-

JOHNSON MATTHEY 193

- COMPANY OVERVIEW 193

- FINANCIAL OVERVIEW 194

- PRODUCTS OFFERED 194

- KEY DEVELOPMENTS 195

- SWOT ANALYSIS 195

- KEY STRATEGIES 195

-

CLARIANT 196

- COMPANY OVERVIEW 196

- FINANCIAL OVERVIEW 197

- PRODUCTS OFFERED 198

- KEY DEVELOPMENTS 198

- SWOT ANALYSIS 199

- KEY STRATEGIES 199

-

UMICORE 200

- COMPANY OVERVIEW 200

- FINANCIAL OVERVIEW 201

- PRODUCTS OFFERED 202

- KEY DEVELOPMENTS 202

- SWOT ANALYSIS 203

- KEY STRATEGIES 203

-

CATALER CORPORATION 204

- COMPANY OVERVIEW 204

- FINANCIAL OVERVIEW 205

- PRODUCTS OFFERED 206

- KEY DEVELOPMENTS 206

- SWOT ANALYSIS 207

- KEY STRATEGIES 207

-

CORNING INCORPORATED 208

- COMPANY OVERVIEW 208

- FINANCIAL OVERVIEW 209

- PRODUCTS OFFERED 210

- KEY DEVELOPMENTS 210

- SWOT ANALYSIS 211

- KEY STRATEGY 211

-

HERAEUS HOLDING 212

- COMPANY OVERVIEW 212

- FINANCIAL OVERVIEW 213

- PRODUCTS OFFERED 213

- KEY DEVELOPMENTS 214

- SWOT ANALYSIS 214

- KEY STRATEGIES 214

-

TENNECO INC. 215

- COMPANY OVERVIEW 215

- FINANCIAL OVERVIEW 216

- PRODUCTS OFFERED 217

- KEY DEVELOPMENTS 217

- SWOT ANALYSIS 217

- KEY STRATEGIES 218

-

N.E. CHEMCAT 219

- COMPANY OVERVIEW 219

- FINANCIAL OVERVIEW 219

- PRODUCTS OFFERED 219

- KEY DEVELOPMENTS 219

- SWOT ANALYSIS 220

- KEY STRATEGIES 220

-

ZEOLYST INTERNATIONAL 221

- COMPANY OVERVIEW 221

- FINANCIAL OVERVIEW 221

- PRODUCTS OFFERED 221

- KEY DEVELOPMENTS 221

- SWOT ANALYSIS 222

- KEY STRATEGIES 222

-

BASF SE 184

-

List of Tables and Figures

- LIST OF TABLES

- TABLE 1 LIST OF ASSUMPTIONS & LIMITATIONS 30

- TABLE 2 GLOBAL MOBILE EMISSION CATALYST MARKET, PRICING ANALYSIS (USD/GM) 43

- TABLE 3 GLOBAL MOBILE EMISSION CATALYSTS MARKET, BY METAL TYPE, 2023-2032 (USD MILLION) 49

- TABLE 4 GLOBAL MOBILE EMISSION CATALYSTS MARKET, BY METAL TYPE, 2023-2032 (TONS) 50

- TABLE 5 GLOBAL MOBILE EMISSION CATALYSTS MARKET FOR PALLADIUM, BY REGION, 2023-2032(USD MILLION) 51

- TABLE 6 GLOBAL MOBILE EMISSION CATALYSTS MARKET FOR PALLADIUM, BY REGION, 2023-2032 (TONS) 51

- TABLE 7 GLOBAL MOBILE EMISSION CATALYSTS MARKET FOR RHODIUM, BY REGION, 2023-2032 (USD MILLION) 52

- TABLE 8 GLOBAL MOBILE EMISSION CATALYSTS MARKET FOR RHODIUM, BY REGION, 2023-2032 (TONS) 52

- TABLE 9 GLOBAL MOBILE EMISSION CATALYSTS MARKET FOR PLATINUM, BY REGION, 2023-2032(USD MILLION) 53

- TABLE 10 GLOBAL MOBILE EMISSION CATALYSTS MARKET FOR PLATINUM, BY REGION, 2023-2032 (TONS) 54

- TABLE 11 GLOBAL MOBILE EMISSION CATALYSTS MARKET FOR OTHERS, BY REGION, 2023-2032 (USD MILLION) 55

- TABLE 12 GLOBAL MOBILE EMISSION CATALYSTS MARKET FOR OTHERS, BY REGION, 2023-2032 (TONS) 55

- TABLE 13 GLOBAL MOBILE EMISSION CATALYSTS MARKET, BY TECHNOLOGY, 2023-2032 (USD MILLION) 56

- TABLE 14 GLOBAL MOBILE EMISSION CATALYSTS MARKET, BY TECHNOLOGY, 2023-2032 (TONS) 57

- TABLE 15 GLOBAL MOBILE EMISSION CATALYSTS MARKET FOR DIESEL OXIDATION CATALYSTS (DOC), BY REGION, 2023-2032 (USD MILLION) 58

- TABLE 16 GLOBAL MOBILE EMISSION CATALYSTS MARKET FOR DIESEL OXIDATION CATALYSTS (DOC), BY REGION, 2023-2032 (TONS) 58

- TABLE 17 GLOBAL MOBILE EMISSION CATALYSTS MARKET FOR DIESEL PARTICULATE FILTERS (DPF), BY REGION, 2023-2032 (USD MILLION) 59

- TABLE 18 GLOBAL MOBILE EMISSION CATALYSTS MARKET FOR DIESEL PARTICULATE FILTERS (DPF), BY REGION, 2023-2032 (TONS) 60

- TABLE 19 GLOBAL MOBILE EMISSION CATALYSTS MARKET FOR THREE-WAY CONVERSION CATALYSTS (TWC),BY REGION, 2023-2032 (USD MILLION) 61

- TABLE 20 GLOBAL MOBILE EMISSION CATALYSTS MARKET FOR THREE-WAY CONVERSION CATALYSTS (TWC),BY REGION, 2023-2032 (TONS) 62

- TABLE 21 GLOBAL MOBILE EMISSION CATALYSTS MARKET FOR FOUR-WAY CONVERSION CATALYSTS (FWC),BY REGION, 2023-2032 (USD MILLION) 63

- TABLE 22 GLOBAL MOBILE EMISSION CATALYSTS MARKET FOR FOUR-WAY CONVERSION CATALYSTS (FWC),BY REGION, 2023-2032 (TONS) 63

- TABLE 23 GLOBAL MOBILE EMISSION CATALYSTS MARKET FOR LEAN GDI CATALYSTS (LGC), BY REGION,2023-2032 (USD MILLION) 64

- TABLE 24 GLOBAL MOBILE EMISSION CATALYSTS MARKET FOR LEAN GDI CATALYSTS (LGC), BY REGION,2023-2032 (TONS) 64

- TABLE 25 GLOBAL MOBILE EMISSION CATALYSTS MARKET FOR ELECTRICALLY HEATED CATALYTIC CONVERTER (E-CAT), BY REGION, 2023-2032 (USD MILLION) 65

- TABLE 26 GLOBAL MOBILE EMISSION CATALYSTS MARKET FOR ELECTRICALLY HEATED CATALYTIC CONVERTER (E-CAT), BY REGION, 2023-2032 (TONS) 65

- TABLE 27 GLOBAL MOBILE EMISSION CATALYSTS MARKET FOR OTHERS, BY REGION, 2023-2032 (USD MILLION) 66

- TABLE 28 GLOBAL MOBILE EMISSION CATALYSTS MARKET FOR OTHERS, BY REGION, 2023-2032 (TONS) 66

- TABLE 29 GLOBAL MOBILE EMISSION CATALYSTS MARKET, BY VEHICLE TYPE, 2023-2032 (USD MILLION) 67

- TABLE 30 GLOBAL MOBILE EMISSION CATALYSTS MARKET, BY VEHICLE TYPE, 2023-2032 (TONS) 68

- TABLE 31 GLOBAL MOBILE EMISSION CATALYSTS MARKET FOR LIGHT-DUTY VEHICLES, BY REGION, 2023-2032 (USD MILLION) 69

- TABLE 32 GLOBAL MOBILE EMISSION CATALYSTS MARKET FOR LIGHT-DUTY VEHICLES, BY REGION,2023-2032 (TONS) 69

- TABLE 33 GLOBAL MOBILE EMISSION CATALYSTS MARKET FOR HEAVY-DUTY VEHICLES, BY REGION, 2023-2032 (USD MILLION) 70

- TABLE 34 GLOBAL MOBILE EMISSION CATALYSTS MARKET FOR HEAVY-DUTY VEHICLES, BY REGION, 2023-2032 (TONS) 70

- TABLE 35 GLOBAL MOBILE EMISSION CATALYSTS MARKET FOR NATURAL GAS VEHICLES, BY REGION, 2023-2032 (USD MILLION) 71

- TABLE 36 GLOBAL MOBILE EMISSION CATALYSTS MARKET FOR NATURAL GAS VEHICLES, BY REGION, 2023-2032 (TONS) 72

- TABLE 37 GLOBAL MOBILE EMISSION CATALYSTS MARKET FOR MOTORCYCLES, BY REGION, 2023-2032(USD MILLION) 73

- TABLE 38 GLOBAL MOBILE EMISSION CATALYSTS MARKET FOR MOTORCYCLES, BY REGION, 2023-2032 (TONS) 73

- TABLE 39 GLOBAL MOBILE EMISSION CATALYSTS MARKET FOR OTHERS, BY REGION, 2023-2032 (USD MILLION) 74

- TABLE 40 GLOBAL MOBILE EMISSION CATALYSTS MARKET FOR OTHERS, BY REGION, 2023-2032 (TONS) 74

- TABLE 41 GLOBAL MOBILE EMISSION CATALYSTS MARKET, BY REGION, 2023-2032 (USD MILLION) 76

- TABLE 42 GLOBAL MOBILE EMISSION CATALYSTS MARKET, BY REGION, 2023-2032 (TONS) 77

- TABLE 43 GLOBAL MOBILE EMISSION CATALYSTS MARKET, BY METAL TYPE, 2023-2032 (USD MILLION) 78

- TABLE 44 GLOBAL MOBILE EMISSION CATALYSTS MARKET, BY METAL TYPE, 2023-2032 (TONS) 78

- TABLE 45 GLOBAL MOBILE EMISSION CATALYSTS MARKET, BY TECHNOLOGY, 2023-2032 (USD MILLION) 79

- TABLE 46 GLOBAL MOBILE EMISSION CATALYSTS MARKET, BY TECHNOLOGY, 2023-2032 (TONS) 79

- TABLE 47 GLOBAL MOBILE EMISSION CATALYSTS MARKET, BY VEHICLE TYPE, 2023-2032 (USD MILLION) 80

- TABLE 48 GLOBAL MOBILE EMISSION CATALYSTS MARKET, BY VEHICLE TYPE, 2023-2032 (TONS) 80

- TABLE 49 NORTH AMERICA MOBILE EMISSION CATALYSTS MARKET, BY COUNTRY, 2023-2032 (USD MILLION) 81

- TABLE 50 NORTH AMERICA MOBILE EMISSION CATALYSTS MARKET, BY COUNTRY, 2023-2032 (TONS) 81

- TABLE 51 NORTH AMERICA MOBILE EMISSION CATALYSTS MARKET, BY METAL TYPE, 2023-2032 (USD MILLION) 81

- TABLE 52 NORTH AMERICA MOBILE EMISSION CATALYSTS MARKET, BY METAL TYPE, 2023-2032 (TONS) 82

- TABLE 53 NORTH AMERICA MOBILE EMISSION CATALYSTS MARKET, BY TECHNOLOGY, 2023-2032(USD MILLION) 82

- TABLE 54 NORTH AMERICA MOBILE EMISSION CATALYSTS MARKET, BY TECHNOLOGY, 2023-2032 (TONS) 83

- TABLE 55 NORTH AMERICA MOBILE EMISSION CATALYSTS MARKET, BY VEHICLE TYPE, 2023-2032(USD MILLION) 83

- TABLE 56 NORTH AMERICA MOBILE EMISSION CATALYSTS MARKET, BY VEHICLE TYPE, 2023-2032 (TONS) 84

- TABLE 57 US MOBILE EMISSION CATALYSTS MARKET, BY METAL TYPE, 2023-2032 (USD MILLION) 85

- TABLE 58 US MOBILE EMISSION CATALYSTS MARKET, BY METAL TYPE, 2023-2032 (TONS) 85

- TABLE 59 US MOBILE EMISSION CATALYSTS MARKET, BY TECHNOLOGY, 2023-2032 (USD MILLION) 86

- TABLE 60 US MOBILE EMISSION CATALYSTS MARKET, BY TECHNOLOGY, 2023-2032 (TONS) 86

- TABLE 61 US MOBILE EMISSION CATALYSTS MARKET, BY VEHICLE TYPE, 2023-2032 (USD MILLION) 87

- TABLE 62 US MOBILE EMISSION CATALYSTS MARKET, BY VEHICLE TYPE, 2023-2032 (TONS) 87

- TABLE 63 CANADA MOBILE EMISSION CATALYSTS MARKET, BY METAL TYPE, 2023-2032 (USD MILLION) 88

- TABLE 64 CANADA MOBILE EMISSION CATALYSTS MARKET, BY METAL TYPE, 2023-2032 (TONS) 88

- TABLE 65 CANADA MOBILE EMISSION CATALYSTS MARKET, BY TECHNOLOGY, 2023-2032 (USD MILLION) 89

- TABLE 66 CANADA MOBILE EMISSION CATALYSTS MARKET, BY TECHNOLOGY, 2023-2032 (TONS) 89

- TABLE 67 CANADA MOBILE EMISSION CATALYSTS MARKET, BY VEHICLE TYPE, 2023-2032 (USD MILLION) 90

- TABLE 68 CANADA MOBILE EMISSION CATALYSTS MARKET, BY VEHICLE TYPE, 2023-2032 (TONS) 90

- TABLE 69 EUROPE MOBILE EMISSION CATALYSTS MARKET, BY COUNTRY, 2023-2032 (USD MILLION) 91

- TABLE 70 EUROPE MOBILE EMISSION CATALYSTS MARKET, BY COUNTRY, 2023-2032 (TONS) 91

- TABLE 71 EUROPE MOBILE EMISSION CATALYSTS MARKET, BY METAL TYPE, 2023-2032 (USD MILLION) 92

- TABLE 72 EUROPE MOBILE EMISSION CATALYSTS MARKET, BY METAL TYPE, 2023-2032 (TONS) 92

- TABLE 73 EUROPE MOBILE EMISSION CATALYSTS MARKET, BY TECHNOLOGY, 2023-2032 (USD MILLION) 93

- TABLE 74 EUROPE MOBILE EMISSION CATALYSTS MARKET, BY TECHNOLOGY, 2023-2032 (TONS) 93

- TABLE 75 EUROPE MOBILE EMISSION CATALYSTS MARKET, BY VEHICLE TYPE, 2023-2032 (USD MILLION) 94

- TABLE 76 EUROPE MOBILE EMISSION CATALYSTS MARKET, BY VEHICLE TYPE, 2023-2032 (TONS) 94

- TABLE 77 GERMANY MOBILE EMISSION CATALYSTS MARKET, BY METAL TYPE, 2023-2032 (USD MILLION) 95

- TABLE 78 GERMANY MOBILE EMISSION CATALYSTS MARKET, BY METAL TYPE, 2023-2032 (TONS) 95

- TABLE 79 GERMANY MOBILE EMISSION CATALYSTS MARKET, BY TECHNOLOGY, 2023-2032 (USD MILLION) 96

- TABLE 80 GERMANY MOBILE EMISSION CATALYSTS MARKET, BY TECHNOLOGY, 2023-2032 (TONS) 96

- TABLE 81 GERMANY MOBILE EMISSION CATALYSTS MARKET, BY VEHICLE TYPE, 2023-2032 (USD MILLION) 97

- TABLE 82 GERMANY MOBILE EMISSION CATALYSTS MARKET, BY VEHICLE TYPE, 2023-2032 (TONS) 97

- TABLE 83 FRANCE MOBILE EMISSION CATALYSTS MARKET, BY METAL TYPE, 2023-2032 (USD MILLION) 98

- TABLE 84 FRANCE MOBILE EMISSION CATALYSTS MARKET, BY METAL TYPE, 2023-2032 (TONS) 98

- TABLE 85 FRANCE MOBILE EMISSION CATALYSTS MARKET, BY TECHNOLOGY, 2023-2032 (USD MILLION) 99

- TABLE 86 FRANCE MOBILE EMISSION CATALYSTS MARKET, BY TECHNOLOGY, 2023-2032 (TONS) 99

- TABLE 87 FRANCE MOBILE EMISSION CATALYSTS MARKET, BY VEHICLE TYPE, 2023-2032 (USD MILLION) 100

- TABLE 88 FRANCE MOBILE EMISSION CATALYSTS MARKET, BY VEHICLE TYPE, 2023-2032 (TONS) 100

- TABLE 89 SPAIN MOBILE EMISSION CATALYSTS MARKET, BY METAL TYPE, 2023-2032 (USD MILLION) 101

- TABLE 90 SPAIN MOBILE EMISSION CATALYSTS MARKET, BY METAL TYPE, 2023-2032 (TONS) 101

- TABLE 91 SPAIN MOBILE EMISSION CATALYSTS MARKET, BY TECHNOLOGY, 2023-2032 (USD MILLION) 102

- TABLE 92 SPAIN MOBILE EMISSION CATALYSTS MARKET, BY TECHNOLOGY, 2023-2032 (TONS) 102

- TABLE 93 SPAIN MOBILE EMISSION CATALYSTS MARKET, BY VEHICLE TYPE, 2023-2032 (USD MILLION) 103

- TABLE 94 SPAIN MOBILE EMISSION CATALYSTS MARKET, BY VEHICLE TYPE, 2023-2032 (TONS) 103

- TABLE 95 UK MOBILE EMISSION CATALYSTS MARKET, BY METAL TYPE, 2023-2032 (USD MILLION) 104

- TABLE 96 UK MOBILE EMISSION CATALYSTS MARKET, BY METAL TYPE, 2023-2032 (TONS) 104

- TABLE 97 UK MOBILE EMISSION CATALYSTS MARKET, BY TECHNOLOGY, 2023-2032 (USD MILLION) 105

- TABLE 98 UK MOBILE EMISSION CATALYSTS MARKET, BY TECHNOLOGY, 2023-2032 (TONS) 105

- TABLE 99 UK MOBILE EMISSION CATALYSTS MARKET, BY VEHICLE TYPE, 2023-2032 (USD MILLION) 106

- TABLE 100 UK MOBILE EMISSION CATALYSTS MARKET, BY VEHICLE TYPE, 2023-2032 (TONS) 106

- TABLE 101 RUSSIA MOBILE EMISSION CATALYSTS MARKET, BY METAL TYPE, 2023-2032 (USD MILLION) 107

- TABLE 102 RUSSIA MOBILE EMISSION CATALYSTS MARKET, BY METAL TYPE, 2023-2032 (TONS) 107

- TABLE 103 RUSSIA MOBILE EMISSION CATALYSTS MARKET, BY TECHNOLOGY, 2023-2032 (USD MILLION) 108

- TABLE 104 RUSSIA MOBILE EMISSION CATALYSTS MARKET, BY TECHNOLOGY, 2023-2032 (TONS) 108

- TABLE 105 RUSSIA MOBILE EMISSION CATALYSTS MARKET, BY VEHICLE TYPE, 2023-2032 (USD MILLION) 109

- TABLE 106 RUSSIA MOBILE EMISSION CATALYSTS MARKET, BY VEHICLE TYPE, 2023-2032 (TONS) 109

- TABLE 107 ITALY MOBILE EMISSION CATALYSTS MARKET, BY METAL TYPE, 2023-2032 (USD MILLION) 110

- TABLE 108 ITALY MOBILE EMISSION CATALYSTS MARKET, BY METAL TYPE, 2023-2032 (TONS) 110

- TABLE 109 ITALY MOBILE EMISSION CATALYSTS MARKET, BY TECHNOLOGY, 2023-2032 (USD MILLION) 111

- TABLE 110 ITALY MOBILE EMISSION CATALYSTS MARKET, BY TECHNOLOGY, 2023-2032 (TONS) 111

- TABLE 111 ITALY MOBILE EMISSION CATALYSTS MARKET, BY VEHICLE TYPE, 2023-2032 (USD MILLION) 112

- TABLE 112 ITALY MOBILE EMISSION CATALYSTS MARKET, BY VEHICLE TYPE, 2023-2032 (TONS) 112

- TABLE 113 REST OF EUROPE MOBILE EMISSION CATALYSTS MARKET, BY METAL TYPE, 2023-2032 (USD MILLION) 113

- TABLE 114 REST OF EUROPE MOBILE EMISSION CATALYSTS MARKET, BY METAL TYPE, 2023-2032 (TONS) 113

- TABLE 115 REST OF EUROPE MOBILE EMISSION CATALYSTS MARKET, BY TECHNOLOGY, 2023-2032(USD MILLION) 114

- TABLE 116 REST OF EUROPE MOBILE EMISSION CATALYSTS MARKET, BY TECHNOLOGY, 2023-2032 (TONS) 114

- TABLE 117 REST OF EUROPE MOBILE EMISSION CATALYSTS MARKET, BY VEHICLE TYPE, 2023-2032(USD MILLION) 115

- TABLE 118 REST OF EUROPE MOBILE EMISSION CATALYSTS MARKET, BY VEHICLE TYPE, 2023-2032 (TONS) 115

- TABLE 119 ASIA-PACIFIC MOBILE EMISSION CATALYSTS MARKET, BY COUNTRY, 2023-2032 (USD MILLION) 116

- TABLE 120 ASIA-PACIFIC MOBILE EMISSION CATALYSTS MARKET, BY COUNTRY, 2023-2032 (TONS) 116

- TABLE 121 ASIA-PACIFIC MOBILE EMISSION CATALYSTS MARKET, BY METAL TYPE, 2023-2032 (USD MILLION) 117

- TABLE 122 ASIA-PACIFIC MOBILE EMISSION CATALYSTS MARKET, BY METAL TYPE, 2023-2032 (TONS) 117

- TABLE 123 ASIA-PACIFIC MOBILE EMISSION CATALYSTS MARKET, BY TECHNOLOGY, 2023-2032 (USD MILLION) 118

- TABLE 124 ASIA-PACIFIC MOBILE EMISSION CATALYSTS MARKET, BY TECHNOLOGY, 2023-2032 (TONS) 118

- TABLE 125 ASIA-PACIFIC MOBILE EMISSION CATALYSTS MARKET, BY VEHICLE TYPE, 2023-2032 (USD MILLION) 119

- TABLE 126 ASIA-PACIFIC MOBILE EMISSION CATALYSTS MARKET, BY VEHICLE TYPE, 2023-2032 (TONS) 119

- TABLE 127 CHINA MOBILE EMISSION CATALYSTS MARKET, BY METAL TYPE, 2023-2032 (USD MILLION) 120

- TABLE 128 CHINA MOBILE EMISSION CATALYSTS MARKET, BY METAL TYPE, 2023-2032 (TONS) 120

- TABLE 129 CHINA MOBILE EMISSION CATALYSTS MARKET, BY TECHNOLOGY, 2023-2032 (USD MILLION) 121

- TABLE 130 CHINA MOBILE EMISSION CATALYSTS MARKET, BY TECHNOLOGY, 2023-2032 (TONS) 121

- TABLE 131 CHINA MOBILE EMISSION CATALYSTS MARKET, BY VEHICLE TYPE, 2023-2032 (USD MILLION) 122

- TABLE 132 CHINA MOBILE EMISSION CATALYSTS MARKET, BY VEHICLE TYPE, 2023-2032 (TONS) 122

- TABLE 133 JAPAN MOBILE EMISSION CATALYSTS MARKET, BY METAL TYPE, 2023-2032 (USD MILLION) 123

- TABLE 134 JAPAN MOBILE EMISSION CATALYSTS MARKET, BY METAL TYPE, 2023-2032 (TONS) 123

- TABLE 135 JAPAN MOBILE EMISSION CATALYSTS MARKET, BY TECHNOLOGY, 2023-2032 (USD MILLION) 124

- TABLE 136 JAPAN MOBILE EMISSION CATALYSTS MARKET, BY TECHNOLOGY, 2023-2032 (TONS) 124

- TABLE 137 JAPAN MOBILE EMISSION CATALYSTS MARKET, BY VEHICLE TYPE, 2023-2032 (USD MILLION) 125

- TABLE 138 JAPAN MOBILE EMISSION CATALYSTS MARKET, BY VEHICLE TYPE, 2023-2032 (TONS) 125

- TABLE 139 INDIA MOBILE EMISSION CATALYSTS MARKET, BY METAL TYPE, 2023-2032 (USD MILLION) 126

- TABLE 140 INDIA MOBILE EMISSION CATALYSTS MARKET, BY METAL TYPE, 2023-2032 (TONS) 126

- TABLE 141 INDIA MOBILE EMISSION CATALYSTS MARKET, BY TECHNOLOGY, 2023-2032 (USD MILLION) 127

- TABLE 142 INDIA MOBILE EMISSION CATALYSTS MARKET, BY TECHNOLOGY, 2023-2032 (TONS) 127

- TABLE 143 INDIA MOBILE EMISSION CATALYSTS MARKET, BY VEHICLE TYPE, 2023-2032 (USD MILLION) 128

- TABLE 144 INDIA MOBILE EMISSION CATALYSTS MARKET, BY VEHICLE TYPE, 2023-2032 (TONS) 128

- TABLE 145 SOUTH KOREA MOBILE EMISSION CATALYSTS MARKET, BY METAL TYPE, 2023-2032 (USD MILLION) 129

- TABLE 146 SOUTH KOREA MOBILE EMISSION CATALYSTS MARKET, BY METAL TYPE, 2023-2032 (TONS) 129

- TABLE 147 SOUTH KOREA MOBILE EMISSION CATALYSTS MARKET, BY TECHNOLOGY, 2023-2032(USD MILLION) 130

- TABLE 148 SOUTH KOREA MOBILE EMISSION CATALYSTS MARKET, BY TECHNOLOGY, 2023-2032 (TONS) 130

- TABLE 149 SOUTH KOREA MOBILE EMISSION CATALYSTS MARKET, BY VEHICLE TYPE, 2023-2032 (USD MILLION) 131

- TABLE 150 SOUTH KOREA MOBILE EMISSION CATALYSTS MARKET, BY VEHICLE TYPE, 2023-2032 (TONS) 131

- TABLE 151 AUSTRALIA & NEW ZEALAND MOBILE EMISSION CATALYSTS MARKET, BY METAL TYPE, 2023-2032 (USD MILLION) 132

- TABLE 152 AUSTRALIA & NEW ZEALAND MOBILE EMISSION CATALYSTS MARKET, BY METAL TYPE, 2023-2032 (TONS) 132

- TABLE 153 AUSTRALIA & NEW ZEALAND MOBILE EMISSION CATALYSTS MARKET, BY TECHNOLOGY, 2023-2032(USD MILLION) 133

- TABLE 154 AUSTRALIA & NEW ZEALAND MOBILE EMISSION CATALYSTS MARKET, BY TECHNOLOGY, 2023-2032 (TONS) 133

- TABLE 155 AUSTRALIA & NEW ZEALAND MOBILE EMISSION CATALYSTS MARKET, BY VEHICLE TYPE, 2023-2032 (USD MILLION) 134

- TABLE 156 AUSTRALIA & NEW ZEALAND MOBILE EMISSION CATALYSTS MARKET, BY VEHICLE TYPE, 2023-2032 (TONS) 134

- TABLE 157 REST OF ASIA-PACIFIC MOBILE EMISSION CATALYSTS MARKET, BY METAL TYPE, 2023-2032(USD MILLION) 135

- TABLE 158 REST OF ASIA-PACIFIC MOBILE EMISSION CATALYSTS MARKET, BY METAL TYPE, 2023-2032 (TONS) 135

- TABLE 159 REST OF ASIA-PACIFIC MOBILE EMISSION CATALYSTS MARKET, BY TECHNOLOGY, 2023-2032(USD MILLION) 136

- TABLE 160 REST OF ASIA-PACIFIC MOBILE EMISSION CATALYSTS MARKET, BY TECHNOLOGY, 2023-2032 (TONS) 136

- TABLE 161 REST OF ASIA-PACIFIC MOBILE EMISSION CATALYSTS MARKET, BY VEHICLE TYPE, 2023-2032(USD MILLION) 137

- TABLE 162 REST OF ASIA-PACIFIC MOBILE EMISSION CATALYSTS MARKET, BY VEHICLE TYPE, 2023-2032 (TONS) 137

- TABLE 163 LATIN AMERICA MOBILE EMISSION CATALYSTS MARKET, BY COUNTRY, 2023-2032 (USD MILLION) 138

- TABLE 164 LATIN AMERICA MOBILE EMISSION CATALYSTS MARKET, BY COUNTRY, 2023-2032 (TONS) 138

- TABLE 165 LATIN AMERICA MOBILE EMISSION CATALYSTS MARKET, BY METAL TYPE, 2023-2032 (USD MILLION) 139

- TABLE 166 LATIN AMERICA MOBILE EMISSION CATALYSTS MARKET, BY METAL TYPE, 2023-2032 (TONS) 139

- TABLE 167 LATIN AMERICA MOBILE EMISSION CATALYSTS MARKET, BY TECHNOLOGY, 2023-2032(USD MILLION) 140

- TABLE 168 LATIN AMERICA MOBILE EMISSION CATALYSTS MARKET, BY TECHNOLOGY, 2023-2032 (TONS) 140

- TABLE 169 LATIN AMERICA MOBILE EMISSION CATALYSTS MARKET, BY VEHICLE TYPE, 2023-2032 (USD MILLION) 141

- TABLE 170 LATIN AMERICA MOBILE EMISSION CATALYSTS MARKET, BY VEHICLE TYPE, 2023-2032 (TONS) 141

- TABLE 171 BRAZIL MOBILE EMISSION CATALYSTS MARKET, BY METAL TYPE, 2023-2032 (USD MILLION) 142

- TABLE 172 BRAZIL MOBILE EMISSION CATALYSTS MARKET, BY METAL TYPE, 2023-2032 (TONS) 142

- TABLE 173 BRAZIL MOBILE EMISSION CATALYSTS MARKET, BY TECHNOLOGY, 2023-2032 (USD MILLION) 143

- TABLE 174 BRAZIL MOBILE EMISSION CATALYSTS MARKET, BY TECHNOLOGY, 2023-2032 (TONS) 143

- TABLE 175 BRAZIL MOBILE EMISSION CATALYSTS MARKET, BY VEHICLE TYPE, 2023-2032 (USD MILLION) 144

- TABLE 176 BRAZIL MOBILE EMISSION CATALYSTS MARKET, BY VEHICLE TYPE, 2023-2032 (TONS) 144

- TABLE 177 MEXICO MOBILE EMISSION CATALYSTS MARKET, BY METAL TYPE, 2023-2032 (USD MILLION) 145

- TABLE 178 MEXICO MOBILE EMISSION CATALYSTS MARKET, BY METAL TYPE, 2023-2032 (TONS) 145

- TABLE 179 MEXICO MOBILE EMISSION CATALYSTS MARKET, BY TECHNOLOGY, 2023-2032 (USD MILLION) 146

- TABLE 180 MEXICO MOBILE EMISSION CATALYSTS MARKET, BY TECHNOLOGY, 2023-2032 (TONS) 146

- TABLE 181 MEXICO MOBILE EMISSION CATALYSTS MARKET, BY VEHICLE TYPE, 2023-2032 (USD MILLION) 147

- TABLE 182 MEXICO MOBILE EMISSION CATALYSTS MARKET, BY VEHICLE TYPE, 2023-2032 (TONS) 147

- TABLE 183 ARGENTINA MOBILE EMISSION CATALYSTS MARKET, BY METAL TYPE, 2023-2032 (USD MILLION) 148

- TABLE 184 ARGENTINA MOBILE EMISSION CATALYSTS MARKET, BY METAL TYPE, 2023-2032 (TONS) 148

- TABLE 185 ARGENTINA MOBILE EMISSION CATALYSTS MARKET, BY TECHNOLOGY, 2023-2032 (USD MILLION) 149

- TABLE 186 ARGENTINA MOBILE EMISSION CATALYSTS MARKET, BY TECHNOLOGY, 2023-2032 (TONS) 149

- TABLE 187 ARGENTINA MOBILE EMISSION CATALYSTS MARKET, BY VEHICLE TYPE, 2023-2032 (USD MILLION) 150

- TABLE 188 ARGENTINA MOBILE EMISSION CATALYSTS MARKET, BY VEHICLE TYPE, 2023-2032 (TONS) 150

- TABLE 189 REST OF LATIN AMERICA MOBILE EMISSION CATALYSTS MARKET, BY METAL TYPE, 2023-2032 (USD MILLION) 151

- TABLE 190 REST OF LATIN AMERICA MOBILE EMISSION CATALYSTS MARKET, BY METAL TYPE, 2023-2032 (TONS) 151

- TABLE 191 REST OF LATIN AMERICA MOBILE EMISSION CATALYSTS MARKET, BY TECHNOLOGY, 2023-2032(USD MILLION) 152

- TABLE 192 REST OF LATIN AMERICA MOBILE EMISSION CATALYSTS MARKET, BY TECHNOLOGY, 2023-2032 (TONS) 152

- TABLE 193 REST OF LATIN AMERICA MOBILE EMISSION CATALYSTS MARKET, BY VEHICLE TYPE, 2023-2032 (USD MILLION) 153

- TABLE 194 REST OF LATIN AMERICA MOBILE EMISSION CATALYSTS MARKET, BY VEHICLE TYPE, 2023-2032 (TONS) 153

- TABLE 195 MIDDLE EAST & AFRICA MOBILE EMISSION CATALYSTS MARKET, BY COUNTRY, 2023-2032(USD MILLION) 154

- TABLE 196 MIDDLE EAST & AFRICA MOBILE EMISSION CATALYSTS MARKET, BY COUNTRY, 2023-2032 (TONS) 154

- TABLE 197 MIDDLE EAST & AFRICA MOBILE EMISSION CATALYSTS MARKET, BY METAL TYPE, 2023-2032(USD MILLION) 155

- TABLE 198 MIDDLE EAST & AFRICA MOBILE EMISSION CATALYSTS MARKET, BY METAL TYPE, 2023-2032 (TONS) 155

- TABLE 199 MIDDLE EAST & AFRICA MOBILE EMISSION CATALYSTS MARKET, BY TECHNOLOGY, 2023-2032(USD MILLION) 156

- TABLE 200 MIDDLE EAST & AFRICA MOBILE EMISSION CATALYSTS MARKET, BY TECHNOLOGY, 2023-2032 (TONS) 156

- TABLE 201 MIDDLE EAST & AFRICA MOBILE EMISSION CATALYSTS MARKET, BY VEHICLE TYPE, 2023-2032 (USD MILLION) 157

- TABLE 202 MIDDLE EAST & AFRICA MOBILE EMISSION CATALYSTS MARKET, BY VEHICLE TYPE, 2023-2032 (TONS) 157

- TABLE 203 GCC MOBILE EMISSION CATALYSTS MARKET, BY METAL TYPE, 2023-2032 (USD MILLION) 158

- TABLE 204 GCC MOBILE EMISSION CATALYSTS MARKET, BY METAL TYPE, 2023-2032 (TONS) 158

- TABLE 205 GCC MOBILE EMISSION CATALYSTS MARKET, BY TECHNOLOGY, 2023-2032 (USD MILLION) 159

- TABLE 206 GCC MOBILE EMISSION CATALYSTS MARKET, BY TECHNOLOGY, 2023-2032 (TONS) 159

- TABLE 207 GCC MOBILE EMISSION CATALYSTS MARKET, BY VEHICLE TYPE, 2023-2032 (USD MILLION) 160

- TABLE 208 GCC MOBILE EMISSION CATALYSTS MARKET, BY VEHICLE TYPE, 2023-2032 (TONS) 160

- TABLE 209 SOUTH AFRICA MOBILE EMISSION CATALYSTS MARKET, BY METAL TYPE, 2023-2032 (USD MILLION) 161

- TABLE 210 SOUTH AFRICA MOBILE EMISSION CATALYSTS MARKET, BY METAL TYPE, 2023-2032 (TONS) 161

- TABLE 211 SOUTH AFRICA MOBILE EMISSION CATALYSTS MARKET, BY TECHNOLOGY, 2023-2032(USD MILLION) 162

- TABLE 212 SOUTH AFRICA MOBILE EMISSION CATALYSTS MARKET, BY TECHNOLOGY, 2023-2032 (TONS) 162

- TABLE 213 SOUTH AFRICA MOBILE EMISSION CATALYSTS MARKET, BY VEHICLE TYPE, 2023-2032 (USD MILLION) 163

- TABLE 214 SOUTH AFRICA MOBILE EMISSION CATALYSTS MARKET, BY VEHICLE TYPE, 2023-2032 (TONS) 163

- TABLE 215 REST OF THE MIDDLE EAST & AFRICA MOBILE EMISSION CATALYSTS MARKET, BY METAL TYPE,2023-2032 (USD MILLION) 164

- TABLE 216 REST OF THE MIDDLE EAST & AFRICA MOBILE EMISSION CATALYSTS MARKET, BY METAL TYPE,2023-2032 (TONS) 164

- TABLE 217 REST OF THE MIDDLE EAST & AFRICA MOBILE EMISSION CATALYSTS MARKET, BY TECHNOLOGY,2023-2032 (USD MILLION) 165

- TABLE 218 REST OF THE MIDDLE EAST & AFRICA MOBILE EMISSION CATALYSTS MARKET, BY TECHNOLOGY,2023-2032 (TONS) 165

- TABLE 219 REST OF THE MIDDLE EAST & AFRICA MOBILE EMISSION CATALYSTS MARKET, BY VEHICLE TYPE, 2023-2032 (USD MILLION) 166

- TABLE 220 REST OF THE MIDDLE EAST & AFRICA MOBILE EMISSION CATALYSTS MARKET, BY VEHICLE TYPE, 2023-2032 (TONS) 166

- TABLE 221 BENELUX MOBILE EMISSION CATALYSTS MARKET, BY COUNTRY, 2023-2032 (USD MILLION) 167

- TABLE 222 BENELUX MOBILE EMISSION CATALYSTS MARKET, BY COUNTRY, 2023-2032 (TONS) 167

- TABLE 223 BENELUX MOBILE EMISSION CATALYSTS MARKET, BY METAL TYPE, 2023-2032 (USD MILLION) 168

- TABLE 224 BENELUX MOBILE EMISSION CATALYSTS MARKET, BY METAL TYPE, 2023-2032 (TONS) 168

- TABLE 225 BENELUX MOBILE EMISSION CATALYSTS MARKET, BY TECHNOLOGY, 2023-2032 (USD MILLION) 169

- TABLE 226 BENELUX MOBILE EMISSION CATALYSTS MARKET, BY TECHNOLOGY, 2023-2032 (TONS) 169

- TABLE 227 BENELUX MOBILE EMISSION CATALYSTS MARKET, BY VEHICLE TYPE, 2023-2032 (USD MILLION) 170

- TABLE 228 BENELUX MOBILE EMISSION CATALYSTS MARKET, BY VEHICLE TYPE, 2023-2032 (TONS) 170

- TABLE 229 BELGIUM MOBILE EMISSION CATALYSTS MARKET, BY METAL TYPE, 2023-2032 (USD MILLION) 171

- TABLE 230 BELGIUM MOBILE EMISSION CATALYSTS MARKET, BY METAL TYPE, 2023-2032 (TONS) 171

- TABLE 231 BELGIUM MOBILE EMISSION CATALYSTS MARKET, BY TECHNOLOGY, 2023-2032 (USD MILLION) 172

- TABLE 232 BELGIUM MOBILE EMISSION CATALYSTS MARKET, BY TECHNOLOGY, 2023-2032 (TONS) 172

- TABLE 233 BELGIUM MOBILE EMISSION CATALYSTS MARKET, BY VEHICLE TYPE, 2023-2032 (USD MILLION) 173

- TABLE 234 BELGIUM MOBILE EMISSION CATALYSTS MARKET, BY VEHICLE TYPE, 2023-2032 (TONS) 173

- TABLE 235 NETHERLANDS MOBILE EMISSION CATALYSTS MARKET, BY METAL TYPE, 2023-2032 (USD MILLION) 174

- TABLE 236 NETHERLANDS MOBILE EMISSION CATALYSTS MARKET, BY METAL TYPE, 2023-2032 (TONS) 174

- TABLE 237 NETHERLANDS MOBILE EMISSION CATALYSTS MARKET, BY TECHNOLOGY, 2023-2032 (USD MILLION) 175

- TABLE 238 NETHERLANDS MOBILE EMISSION CATALYSTS MARKET, BY TECHNOLOGY, 2023-2032 (TONS) 175

- TABLE 239 NETHERLANDS MOBILE EMISSION CATALYSTS MARKET, BY VEHICLE TYPE, 2023-2032 (USD MILLION) 176

- TABLE 240 NETHERLANDS MOBILE EMISSION CATALYSTS MARKET, BY VEHICLE TYPE, 2023-2032 (TONS) 176

- TABLE 241 LUXEMBOURG MOBILE EMISSION CATALYSTS MARKET, BY METAL TYPE, 2023-2032 (USD MILLION) 177

- TABLE 242 LUXEMBOURG MOBILE EMISSION CATALYSTS MARKET, BY METAL TYPE, 2023-2032 (TONS) 177

- TABLE 243 LUXEMBOURG MOBILE EMISSION CATALYSTS MARKET, BY TECHNOLOGY, 2023-2032 (USD MILLION) 178

- TABLE 244 LUXEMBOURG MOBILE EMISSION CATALYSTS MARKET, BY TECHNOLOGY, 2023-2032 (TONS) 178

- TABLE 245 LUXEMBOURG MOBILE EMISSION CATALYSTS MARKET, BY VEHICLE TYPE, 2023-2032 (USD MILLION) 179

- TABLE 246 LUXEMBOURG MOBILE EMISSION CATALYSTS MARKET, BY VEHICLE TYPE, 2023-2032 (TONS) 179

- TABLE 247 BASF SE: PRODUCTS OFFERED 186

- TABLE 248 BASF SE: KEY DEVELOPMENTS 187

- TABLE 249 SOLVAY: PRODUCTS OFFERED 191

- TABLE 250 JOHNSON MATTHEY: PRODUCTS OFFERED 194

- TABLE 251 CLARIANT: PRODUCTS OFFERED 198

- TABLE 252 CLARIANT: KEY DEVELOPMENTS 198

- TABLE 253 UMICORE: PRODUCTS OFFERED 202

- TABLE 254 UMICORE: KEY DEVELOPMENTS 202

- TABLE 255 CATALER CORPORATION: PRODUCTS OFFERED 206

- TABLE 256 CORNING INCORPORATED: PRODUCTS OFFERED 210

- TABLE 257 CORNING INCORPORATED: KEY DEVELOPMENTS 210

- TABLE 258 HERAEUS HOLDING: PRODUCTS OFFERED 213

- TABLE 259 TENNECO INC.: PRODUCTS OFFERED 217

- TABLE 260 N.E. CHEMCAT: PRODUCTS OFFERED 219

- TABLE 261 ZEOLYST INTERNATIONAL: PRODUCTS OFFERED 221 LIST OF FIGURES

- FIGURE 1 MARKET SYNOPSIS 20

- FIGURE 2 GLOBAL MOBILE EMISSION CATALYSTS MARKET ANALYSIS, BY METAL TYPE 21

- FIGURE 3 GLOBAL MOBILE EMISSION CATALYSTS MARKET ANALYSIS, BY TECHNOLOGY 22

- FIGURE 4 GLOBAL MOBILE EMISSION CATALYSTS MARKET ANALYSIS, BY VEHICLE TYPE 23

- FIGURE 5 GLOBAL MOBILE EMISSION CATALYSTS MARKET ANALYSIS, BY REGION 24

- FIGURE 6 GLOBAL MOBILE EMISSION CATALYSTS MARKET: STRUCTURE 25

- FIGURE 7 RESEARCH PROCESS 26

- FIGURE 8

Mobile Emission Catalysts Market By Metal Type Outlook (USD Billion, 2018-2032)

- Palladium

- Platinum

- Rhodium

- Others

Mobile Emission Catalysts Market By Technology Outlook (USD Billion, 2018-2032)

- Three-Way Conversion Catalyst

- Four-Way Conversion Catalyst

- Diesel Oxidation Catalyst

- Catalyzed Soot Filter

- Selective Catalytic Reduction

- Lean GDI Catalyst

- Electrically Heated Catalytic Converter

- Others

Mobile Emission Catalysts Market By Vehicle Type Outlook (USD Billion, 2018-2032)

- Light-Duty Vehicles

- Heavy-Duty Diesel

- Natural Gas Vehicles

- Motorcycles

- Utility Engines

- Others

Mobile Emission Catalysts Market Regional Outlook (USD Billion, 2018-2032)

North America Outlook (USD Billion, 2018-2032)

North America Mobile Emission Catalysts Market By Metal Type

- Palladium

- Platinum

- Rhodium

- Others

North America Mobile Emission Catalysts Market Technology

- Three-Way Conversion Catalyst

- Four-Way Conversion Catalyst

- Diesel Oxidation Catalyst

- Catalyzed Soot Filter

- Selective Catalytic Reduction

- Lean GDI Catalyst

- Electrically Heated Catalytic Converter

- Others

North America Mobile Emission Catalysts Market By Vehicle Type

- Light-Duty Vehicles

- Heavy-Duty Diesel

- Natural Gas Vehicles

- Motorcycles

- Utility Engines

- Others

US Outlook (USD Billion, 2018-2032)

US Mobile Emission Catalysts Market By Metal Type

- Palladium

- Platinum

- Rhodium

- Others

US Mobile Emission Catalysts Market Technology

- Three-Way Conversion Catalyst

- Four-Way Conversion Catalyst

- Diesel Oxidation Catalyst

- Catalyzed Soot Filter

- Selective Catalytic Reduction

- Lean GDI Catalyst

- Electrically Heated Catalytic Converter

- Others

US Mobile Emission Catalysts Market By Vehicle Type

- Light-Duty Vehicles

- Heavy-Duty Diesel

- Natural Gas Vehicles

- Motorcycles

- Utility Engines

- Others

CANADA Outlook (USD Billion, 2018-2032)

CANADA Mobile Emission Catalysts Market By Metal Type

- Palladium

- Platinum

- Rhodium

- Others

CANADA Mobile Emission Catalysts Market Technology

- Three-Way Conversion Catalyst

- Four-Way Conversion Catalyst

- Diesel Oxidation Catalyst

- Catalyzed Soot Filter

- Selective Catalytic Reduction

- Lean GDI Catalyst

- Electrically Heated Catalytic Converter

- Others

CANADA Mobile Emission Catalysts Market By Vehicle Type

- Light-Duty Vehicles

- Heavy-Duty Diesel

- Natural Gas Vehicles

- Motorcycles

- Utility Engines

- Others

Europe Outlook (USD Billion, 2018-2032)

Europe Mobile Emission Catalysts Market By Metal Type

- Palladium

- Platinum

- Rhodium

- Others

Europe Mobile Emission Catalysts Market Technology

- Three-Way Conversion Catalyst

- Four-Way Conversion Catalyst

- Diesel Oxidation Catalyst

- Catalyzed Soot Filter

- Selective Catalytic Reduction

- Lean GDI Catalyst

- Electrically Heated Catalytic Converter

- Others

Europe Mobile Emission Catalysts Market By Vehicle Type

- Light-Duty Vehicles

- Heavy-Duty Diesel

- Natural Gas Vehicles

- Motorcycles

- Utility Engines

- Others

Germany Outlook (USD Billion, 2018-2032)

Germany Mobile Emission Catalysts Market By Metal Type

- Palladium

- Platinum

- Rhodium

- Others

Germany Mobile Emission Catalysts Market Technology

- Three-Way Conversion Catalyst

- Four-Way Conversion Catalyst

- Diesel Oxidation Catalyst

- Catalyzed Soot Filter

- Selective Catalytic Reduction

- Lean GDI Catalyst

- Electrically Heated Catalytic Converter

- Others

Germany Mobile Emission Catalysts Market By Vehicle Type

- Light-Duty Vehicles

- Heavy-Duty Diesel

- Natural Gas Vehicles

- Motorcycles

- Utility Engines

- Others

France Outlook (USD Billion, 2018-2032)

France Mobile Emission Catalysts Market By Metal Type

- Palladium

- Platinum

- Rhodium

- Others

France Mobile Emission Catalysts Market Technology

- Three-Way Conversion Catalyst

- Four-Way Conversion Catalyst

- Diesel Oxidation Catalyst

- Catalyzed Soot Filter

- Selective Catalytic Reduction

- Lean GDI Catalyst

- Electrically Heated Catalytic Converter

- Others

France Mobile Emission Catalysts Market By Vehicle Type

- Light-Duty Vehicles

- Heavy-Duty Diesel

- Natural Gas Vehicles

- Motorcycles

- Utility Engines

- Others

UK Outlook (USD Billion, 2018-2032)

UK Mobile Emission Catalysts Market By Metal Type

- Palladium

- Platinum

- Rhodium

- Others

UK Mobile Emission Catalysts Market Technology

- Three-Way Conversion Catalyst

- Four-Way Conversion Catalyst

- Diesel Oxidation Catalyst

- Catalyzed Soot Filter

- Selective Catalytic Reduction

- Lean GDI Catalyst

- Electrically Heated Catalytic Converter

- Others

UK Mobile Emission Catalysts Market By Vehicle Type

- Light-Duty Vehicles

- Heavy-Duty Diesel

- Natural Gas Vehicles

- Motorcycles

- Utility Engines

- Others

ITALY Outlook (USD Billion, 2018-2032)

ITALY Mobile Emission Catalysts Market By Metal Type

- Palladium

- Platinum

- Rhodium

- Others

ITALY Mobile Emission Catalysts Market Technology

- Three-Way Conversion Catalyst

- Four-Way Conversion Catalyst

- Diesel Oxidation Catalyst

- Catalyzed Soot Filter

- Selective Catalytic Reduction

- Lean GDI Catalyst

- Electrically Heated Catalytic Converter

- Others

ITALY Mobile Emission Catalysts Market By Vehicle Type

- Light-Duty Vehicles

- Heavy-Duty Diesel

- Natural Gas Vehicles

- Motorcycles

- Utility Engines

- Others

SPAIN Outlook (USD Billion, 2018-2032)

Spain Mobile Emission Catalysts Market By Metal Type

- Palladium

- Platinum

- Rhodium

- Others

Spain Mobile Emission Catalysts Market Technology

- Three-Way Conversion Catalyst

- Four-Way Conversion Catalyst

- Diesel Oxidation Catalyst

- Catalyzed Soot Filter

- Selective Catalytic Reduction

- Lean GDI Catalyst

- Electrically Heated Catalytic Converter

- Others

Spain Mobile Emission Catalysts Market By Vehicle Type

- Light-Duty Vehicles

- Heavy-Duty Diesel

- Natural Gas Vehicles

- Motorcycles

- Utility Engines

- Others

Rest Of Europe Outlook (USD Billion, 2018-2032)

Rest Of Europe Mobile Emission Catalysts Market By Metal Type

- Palladium

- Platinum

- Rhodium

- Others

REST OF EUROPE Mobile Emission Catalysts Market Technology

- Three-Way Conversion Catalyst

- Four-Way Conversion Catalyst

- Diesel Oxidation Catalyst

- Catalyzed Soot Filter

- Selective Catalytic Reduction

- Lean GDI Catalyst

- Electrically Heated Catalytic Converter

- Others

REST OF EUROPE Mobile Emission Catalysts Market By Vehicle Type

- Light-Duty Vehicles

- Heavy-Duty Diesel

- Natural Gas Vehicles

- Motorcycles

- Utility Engines

- Others

Asia-Pacific Outlook (USD Billion, 2018-2032)

Asia-Pacific Mobile Emission Catalysts Market By Metal Type

- Palladium

- Platinum

- Rhodium

- Others

Asia-Pacific Mobile Emission Catalysts Market Technology

- Three-Way Conversion Catalyst

- Four-Way Conversion Catalyst

- Diesel Oxidation Catalyst

- Catalyzed Soot Filter

- Selective Catalytic Reduction

- Lean GDI Catalyst

- Electrically Heated Catalytic Converter

- Others

Asia-Pacific Mobile Emission Catalysts Market By Vehicle Type

- Light-Duty Vehicles

- Heavy-Duty Diesel

- Natural Gas Vehicles

- Motorcycles

- Utility Engines

- Others

China Outlook (USD Billion, 2018-2032)

China Mobile Emission Catalysts Market By Metal Type

- Palladium

- Platinum

- Rhodium

- Others

China Mobile Emission Catalysts Market Technology

- Three-Way Conversion Catalyst

- Four-Way Conversion Catalyst

- Diesel Oxidation Catalyst

- Catalyzed Soot Filter

- Selective Catalytic Reduction

- Lean GDI Catalyst

- Electrically Heated Catalytic Converter

- Others

China Mobile Emission Catalysts Market By Vehicle Type

- Light-Duty Vehicles

- Heavy-Duty Diesel

- Natural Gas Vehicles

- Motorcycles

- Utility Engines

- Others

Japan Outlook (USD Billion, 2018-2032)

Japan Mobile Emission Catalysts Market By Metal Type

- Palladium

- Platinum

- Rhodium

- Others

Japan Mobile Emission Catalysts Market Technology

- Three-Way Conversion Catalyst

- Four-Way Conversion Catalyst

- Diesel Oxidation Catalyst

- Catalyzed Soot Filter

- Selective Catalytic Reduction

- Lean GDI Catalyst

- Electrically Heated Catalytic Converter

- Others

Japan Mobile Emission Catalysts Market By Vehicle Type

- Light-Duty Vehicles

- Heavy-Duty Diesel

- Natural Gas Vehicles

- Motorcycles

- Utility Engines

- Others

India Outlook (USD Billion, 2018-2032)

India Mobile Emission Catalysts Market By Metal Type

- Palladium

- Platinum

- Rhodium

- Others

India Mobile Emission Catalysts Market Technology

- Three-Way Conversion Catalyst

- Four-Way Conversion Catalyst

- Diesel Oxidation Catalyst

- Catalyzed Soot Filter

- Selective Catalytic Reduction

- Lean GDI Catalyst

- Electrically Heated Catalytic Converter

- Others

India Mobile Emission Catalysts Market By Vehicle Type

- Light-Duty Vehicles

- Heavy-Duty Diesel

- Natural Gas Vehicles

- Motorcycles

- Utility Engines

- Others

Australia Outlook (USD Billion, 2018-2032)

Australia Mobile Emission Catalysts Market By Metal Type

- Palladium

- Platinum

- Rhodium

- Others

Australia Mobile Emission Catalysts Market Technology

- Three-Way Conversion Catalyst

- Four-Way Conversion Catalyst

- Diesel Oxidation Catalyst

- Catalyzed Soot Filter

- Selective Catalytic Reduction

- Lean GDI Catalyst

- Electrically Heated Catalytic Converter

- Others

Australia Mobile Emission Catalysts Market By Vehicle Type

- Light-Duty Vehicles

- Heavy-Duty Diesel

- Natural Gas Vehicles

- Motorcycles

- Utility Engines

- Others

Rest of Asia-Pacific Outlook (USD Billion, 2018-2032)

Rest of Asia-Pacific Mobile Emission Catalysts Market By Metal Type

- Palladium

- Platinum

- Rhodium

- Others

Rest of Asia-Pacific Mobile Emission Catalysts Market Technology

- Three-Way Conversion Catalyst

- Four-Way Conversion Catalyst

- Diesel Oxidation Catalyst

- Catalyzed Soot Filter

- Selective Catalytic Reduction

- Lean GDI Catalyst

- Electrically Heated Catalytic Converter

- Others

Rest of Asia-Pacific Mobile Emission Catalysts Market By Vehicle Type

- Light-Duty Vehicles

- Heavy-Duty Diesel

- Natural Gas Vehicles

- Motorcycles

- Utility Engines

- Others

Rest of the World Outlook (USD Billion, 2018-2032)

Rest of the World Mobile Emission Catalysts Market By Metal Type

- Palladium

- Platinum

- Rhodium

- Others

Rest of the World Mobile Emission Catalysts Market Technology

- Three-Way Conversion Catalyst

- Four-Way Conversion Catalyst

- Diesel Oxidation Catalyst

- Catalyzed Soot Filter

- Selective Catalytic Reduction

- Lean GDI Catalyst

- Electrically Heated Catalytic Converter

- Others

Rest of the World Mobile Emission Catalysts Market By Vehicle Type

- Light-Duty Vehicles

- Heavy-Duty Diesel

- Natural Gas Vehicles

- Motorcycles

- Utility Engines

- Others

Middle East Outlook (USD Billion, 2018-2032)

Middle East Mobile Emission Catalysts Market By Metal Type

- Palladium

- Platinum

- Rhodium

- Others

Middle East Mobile Emission Catalysts Market Technology

- Three-Way Conversion Catalyst

- Four-Way Conversion Catalyst

- Diesel Oxidation Catalyst

- Catalyzed Soot Filter

- Selective Catalytic Reduction

- Lean GDI Catalyst

- Electrically Heated Catalytic Converter

- Others

Middle East Mobile Emission Catalysts Market By Vehicle Type

- Light-Duty Vehicles

- Heavy-Duty Diesel

- Natural Gas Vehicles

- Motorcycles

- Utility Engines

- Others

Africa Outlook (USD Billion, 2018-2032)

Africa Mobile Emission Catalysts Market By Metal Type

- Palladium

- Platinum

- Rhodium

- Others

Africa Mobile Emission Catalysts Market Technology

- Three-Way Conversion Catalyst

- Four-Way Conversion Catalyst

- Diesel Oxidation Catalyst

- Catalyzed Soot Filter

- Selective Catalytic Reduction

- Lean GDI Catalyst

- Electrically Heated Catalytic Converter

- Others

Africa Mobile Emission Catalysts Market By Vehicle Type

- Light-Duty Vehicles

- Heavy-Duty Diesel

- Natural Gas Vehicles

- Motorcycles

- Utility Engines

- Others

Latin America Outlook (USD Billion, 2018-2032)

Latin America Mobile Emission Catalysts Market By Metal Type

- Palladium

- Platinum

- Rhodium

- Others

Latin America Mobile Emission Catalysts Market Technology

- Three-Way Conversion Catalyst

- Four-Way Conversion Catalyst

- Diesel Oxidation Catalyst

- Catalyzed Soot Filter

- Selective Catalytic Reduction

- Lean GDI Catalyst

- Electrically Heated Catalytic Converter

- Others

Latin America Mobile Emission Catalysts Market By Vehicle Type

- Light-Duty Vehicles

- Heavy-Duty Diesel

- Natural Gas Vehicles

- Motorcycles

- Utility Engines

- Others

Free Sample Request

Kindly complete the form below to receive a free sample of this Report

Customer Strories

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

Leave a Comment