North America & GCC HVAC Insulation Market Analysis

North America & GCC HVAC Insulation Market Research Report - By Type (Wraps, Tapes, Fatty And Adhesives & Sealants), Application (Institutional, Hospitals, Office Buildings, Malls, Airports, Food & Beverages, Residential Buildings, General Commercial, Warehouses, And Lodging), And Countries - Forecast Till 2035

Market Summary

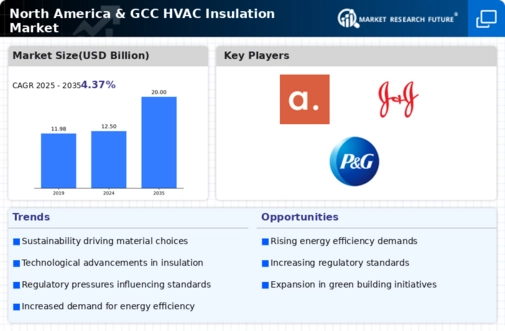

The North America and GCC HVAC insulation market is projected to grow from 12.5 USD Billion in 2024 to 20 USD Billion by 2035.

Key Market Trends & Highlights

North America & GCC HVAC Insulation Key Trends and Highlights

- The market is expected to experience a compound annual growth rate (CAGR) of 4.37 percent from 2025 to 2035.

- By 2035, the market valuation is anticipated to reach 20 USD Billion, indicating robust growth potential.

- In 2024, the market is valued at 12.5 USD Billion, reflecting a strong foundation for future expansion.

- Growing adoption of energy-efficient insulation materials due to increasing energy conservation regulations is a major market driver.

Market Size & Forecast

| 2024 Market Size | 12.5 (USD Billion) |

| 2035 Market Size | 20 (USD Billion) |

| CAGR (2025 - 2035) | 4.37% |

| Largest Regional Market Share in 2024 | -) |

Major Players

Apple Inc (US), Microsoft Corp (US), Amazon.com Inc (US), Alphabet Inc (US), Berkshire Hathaway Inc (US), Tesla Inc (US), Meta Platforms Inc (US), Johnson & Johnson (US), Visa Inc (US), Procter & Gamble Co (US)

Market Trends

The ongoing emphasis on energy efficiency and sustainability within the construction sector appears to drive a notable increase in the adoption of advanced HVAC insulation materials across North America and the GCC region.

U.S. Department of Energy

North America & GCC HVAC Insulation Market Market Drivers

Market Growth Projections

The Global North America and GCC HVAC Insulation Market Industry is projected to experience substantial growth over the next decade. With a market size expected to reach 12.5 USD Billion in 2024 and 20 USD Billion by 2035, the industry is poised for a robust expansion. The anticipated CAGR of 4.37% from 2025 to 2035 indicates a steady increase in demand for HVAC insulation products. This growth is driven by various factors, including rising energy efficiency standards, increased construction activities, and a growing emphasis on environmental sustainability. As the market evolves, it is likely to present new opportunities for manufacturers and stakeholders.

Growing Construction Activities

The Global North America and GCC HVAC Insulation Market Industry is significantly influenced by the ongoing expansion of construction activities. In North America, the construction sector is projected to grow steadily, driven by both residential and commercial projects. Similarly, the GCC region is witnessing a construction boom, particularly in countries like Saudi Arabia and the UAE, where mega projects are underway. This surge in construction is likely to increase the demand for HVAC insulation, as it is essential for maintaining indoor climate control and energy efficiency. The market is anticipated to reach 20 USD Billion by 2035, reflecting the robust growth in construction.

Government Incentives and Rebates

The Global North America and GCC HVAC Insulation Market Industry is positively impacted by various government incentives and rebate programs aimed at promoting energy-efficient upgrades. In North America, federal and state governments offer financial incentives for homeowners and businesses to invest in insulation improvements. Similarly, GCC countries are introducing initiatives to encourage energy conservation, which includes subsidies for insulation materials. These financial incentives lower the upfront costs associated with HVAC insulation installation, making it more accessible to a broader audience. As these programs gain traction, they are likely to stimulate demand within the market, contributing to its overall growth.

Rising Energy Efficiency Standards

The Global North America and GCC HVAC Insulation Market Industry is experiencing a surge in demand driven by increasing energy efficiency standards. Governments in both regions are implementing stringent regulations aimed at reducing energy consumption in buildings. For instance, the U.S. Department of Energy has set ambitious targets for energy efficiency, which necessitates the use of high-performance insulation materials. This trend is expected to contribute to the market's growth, with projections indicating a market size of 12.5 USD Billion in 2024. As energy efficiency becomes a priority, HVAC insulation plays a crucial role in achieving compliance with these standards.

Increased Awareness of Environmental Impact

The Global North America and GCC HVAC Insulation Market Industry is benefiting from a heightened awareness of environmental sustainability. Consumers and businesses alike are increasingly recognizing the importance of reducing carbon footprints and energy consumption. This shift in mindset is driving the adoption of eco-friendly insulation materials, which not only enhance energy efficiency but also contribute to environmental conservation. As a result, manufacturers are focusing on developing sustainable insulation solutions, which is likely to bolster market growth. The CAGR of 4.37% from 2025 to 2035 indicates a sustained interest in environmentally responsible products within the HVAC insulation sector.

Technological Advancements in Insulation Materials

The Global North America and GCC HVAC Insulation Market Industry is witnessing rapid advancements in insulation technologies. Innovations such as reflective insulation, spray foam, and advanced fiberglass materials are enhancing the performance and efficiency of HVAC systems. These technological improvements not only improve thermal performance but also reduce installation times and costs. As manufacturers continue to invest in research and development, the availability of high-performance insulation products is expected to increase. This trend is likely to attract more consumers, further driving the market's growth in the coming years, as energy efficiency becomes a critical factor in HVAC system design.

Market Segment Insights

Regional Insights

Key Companies in the North America & GCC HVAC Insulation Market market include

Industry Developments

- In 2014, a new plant with an annual production capacity of 45 kilotons had been set up in Turkey by Knauf Insulation for providing various expansion opportunities for companies in Turkey as well as in its neighboring countries.

- In 2016, for increasing the production capacity up to 100 kilotons per year, Saint-Gobain had increased its share in the ISOROC subsidiary that is used to increase to increasing acoustic insulation revenue along with its thermal insulation revenue from Eastern and Central European regions.

- In 2027, a new facility has been set up in Mississippi (North America) that has been started by Rockwool International for producing new stone wool acoustic ceiling products. Owing to cater to the increasing need demand for acoustic insulation in the North America region company has invested about 40 million for 130,000 square foot construction sites.

- A non-combustible thermal insulation solution for square and rectangle exterior ducts, namely product, has been introduced by Stone wool insulation specialist ROCKWOOL Ltd. for minimizing the risk of fire in the buildings.

- It has been observed that the HVAC insulation market helps in lowering the global problem of air pollution and warming, which provides various opportunities for its growth during the forecasted period.

Future Outlook

North America & GCC HVAC Insulation Market Future Outlook

The North America & GCC HVAC Insulation Market is projected to grow at a 4.37% CAGR from 2024 to 2035, driven by energy efficiency regulations, technological advancements, and increasing construction activities.

New opportunities lie in:

- Develop eco-friendly insulation materials to meet sustainability demands.

- Leverage smart technology integration for enhanced HVAC system efficiency.

- Expand into emerging markets with tailored insulation solutions for local climates.

By 2035, the market is expected to exhibit robust growth, reflecting evolving industry standards and consumer preferences.

Market Segmentation

Report Overview

Market Segmentation

- In 2014, a new plant with an annual production capacity of 45 kilotons had been set up in Turkey by Knauf Insulation for providing various expansion opportunities for companies in Turkey as well as in its neighboring countries.

- In 2016, for increasing the production capacity up to 100 kilotons per year, Saint-Gobain had increased its share in the ISOROC subsidiary that is used to increase to increasing acoustic insulation revenue along with its thermal insulation revenue from Eastern and Central European regions.

- In 2027, a new facility has been set up in Mississippi (North America) that has been started by Rockwool International for producing new stone wool acoustic ceiling products. Owing to cater to the increasing need demand for acoustic insulation in the North America region company has invested about 40 million for 130,000 square foot construction sites.

- A non-combustible thermal insulation solution for square and rectangle exterior ducts, namely product, has been introduced by Stone wool insulation specialist ROCKWOOL Ltd. for minimizing the risk of fire in the buildings.

- It has been observed that the HVAC insulation market helps in lowering the global problem of air pollution and warming, which provides various opportunities for its growth during the forecasted period.

Report Scope

| Report Attribute/Metric | Details |

| Market Size | 2032 : USD 955 million |

| CAGR | 6.2%(2024–2032) |

| Base Year | 2023 |

| Forecast Period | 2024 to 2032 |

| Historical Data | 2019 & 2020 |

| Forecast Units | Value (USD Million) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | By Type, Application and Countries |

| Geographies Covered | North America region, Asia-Pacific region, Europe region, Latin America region |

| Key Vendors | Design Polymerics, Duro Dyne, Elgen Manufacturing, CL Ward and Family, Ductmate, Hardcadt (Carlisle),Polymer Adhesives, RCD Corporation, ITW Polymers Sealants North America, Henkel Corporation, Pidilite Industries Ltd., Bostik (ARKEMA GROUP), XCHEM international L.L.C., Delmon |

| Key Market Opportunities | Owing to an increase in uncertainty in weather changes which is a global problem. |

| Key Market Drivers | Increasing at an alarming rate owing to increasing expenditure on infrastructure during the forecast period. |

Market Highlights

Author

Latest Comments

This is a great article! Really helped me understand the topic better.

Thanks for sharing this. I’ve bookmarked it for later reference.

FAQs

What is the expected market hike rate in North America and the GCC HVAC insulation market in the global market?

It is expected that North America and GCC HVAC insulation market will grow at a high CAGR of 6.2% in the global market.

What is the expected market value in North America and the GCC HVAC insulation market in the global market during the augur period from 2017 to 2024?

It is expected that the North America and GCC HVAC insulation market will account for the market value of USD 955 million during the forecasted period from 2024 to 2032.

In the global market, how are North America and GCC HVAC insulation market has been divided based on the application segment?

The North America and GCC HVAC insulation market in the global market based on the application segment have been divided into lodging, warehouses, general commercial, residential buildings, food and beverages, airports, malls, office buildings, hospitals, institutions.

-

List of Tables and Figures

- TABLE 1 NORTH

- AMERICA & GCC INSULATION WRAPS PRICING FORECAST, 2020-2027(USD/SQUARE METER)

- 35

- TABLE 2 NORTH AMERICA & GCC INSULATION WRAPS PRICING FORECAST,

- 2020-2027(USD/SQUARE METER) 35

- TABLE 3 NORTH AMERICA & GCC INSULATION

- ADHESIVES & SEALANTS PRICING FORECAST, 2020-2027(USD/KT) 35

- TABLE

- 4 NORTH AMERICA & GCC HVAC INSULATION WRAPS & TAPES MARKET, BY TYPE, 2020-2027(USD

- MILLION) 37

- TABLE 5 NORTH AMERICA & GCC HVAC INSULATION MARKET, BY

- WRAPS & TAPES, 2020-2027(MILLION SQ. METERS) 38

- TABLE 6 NORTH AMERICA

- & GCC HVAC INSULATION MARKET FOR WRAPS, 2020-2027(USD MILLION) 38

- TABLE

- 7 NORTH AMERICA & GCC HVAC INSULATION MARKET FOR WRAPS, 2020-2027(MILLION SQ.

- METERS) 39

- TABLE 8 NORTH AMERICA & GCC HVAC INSULATION MARKET FOR

- TAPES, 2020-2027(USD MILLION) 39

- TABLE 9 NORTH AMERICA & GCC HVAC

- INSULATION MARKET FOR TAPES, 2020-2027(MILLION SQ. METERS) 40

- TABLE 10

- NORTH AMERICA & GCC HVAC INSULATION MARKET, BY APPLICATION, 2020-2027(USD MILLION)

- 43

- TABLE 11 NORTH AMERICA & GCC HVAC INSULATION MARKET, BY APPLICATION,

- 2020-2027(MILLION SQ. METERS) 44

- TABLE 12 NORTH AMERICA & GCC HVAC

- INSULATION MARKET, BY REGION, 2020-2027(USD MILLION) 46

- TABLE 13 NORTH

- AMERICA & GCC HVAC INSULATION MARKET, BY REGION, 2020-2027(MILLION SQ. METERS)

- 47

- TABLE 14 NORTH AMERICA HVAC WRAPS & INSULATION MARKET, BY COUNTRY,

- 2020-2027(USD MILLION) 49

- TABLE 15 NORTH AMERICA HVAC WRAPS & INSULATION

- MARKET, BY COUNTRY, 2020-2027(MILLION SQ. METERS) 49

- TABLE 16 NORTH AMERICA

- HVAC WRAPS & INSULATION MARKET, BY TYPE, 2020-2027(USD MILLION) 49

- TABLE

- 17 NORTH AMERICA HVAC WRAPS & INSULATION MARKET, BY TYPE, 2020-2027(MILLION

- SQ. METERS) 50

- TABLE 18 NORTH AMERICA HVAC WRAPS & INSULATION MARKET,

- BY WRAPS, 2020-2027(USD MILLION) 50

- TABLE 19 NORTH AMERICA HVAC WRAPS

- & INSULATION MARKET, BY WRAPS, 2020-2027(MILLION SQ. METERS) 50

- TABLE

- 20 NORTH AMERICA HVAC WRAPS & INSULATION MARKET, BY TAPES, 2020-2027(USD MILLION)

- 51

- TABLE 21 NORTH AMERICA HVAC WRAPS & INSULATION MARKET, BY TAPES,

- 2020-2027(MILLION SQ. METERS) 51

- TABLE 22 NORTH AMERICA HVAC WRAPS &

- INSULATION MARKET, BY APPLICATION, 2020-2027(USD MILLION) 52

- TABLE 23

- NORTH AMERICA HVAC WRAPS & INSULATION MARKET, BY APPLICATION, 2020-2027(MILLION

- SQ. METERS) 52

- TABLE 24 U.S HVAC WRAPS & INSULATION MARKET, BY TYPE,

- 2020-2027(USD MILLION) 53

- TABLE 25 U.S HVAC WRAPS & INSULATION MARKET,

- BY TYPE, 2020-2027(MILLION SQ. METERS) 53

- TABLE 26 U.S HVAC WRAPS &

- INSULATION MARKET, BY WRAPS, 2020-2027(USD MILLION) 53

- TABLE 27 U.S HVAC

- WRAPS & INSULATION MARKET, BY WRAPS, 2020-2027(MILLION SQ. METERS) 53

- TABLE

- 28 U.S HVAC WRAPS & INSULATION MARKET, BY TAPES, 2020-2027(USD MILLION) 54

- TABLE

- 29 U.S HVAC WRAPS & INSULATION MARKET, BY TAPES, 2020-2027(MILLION SQ. METERS)

- 55

- TABLE 30 U.S HVAC WRAPS & INSULATION MARKET, BY APPLICATION, 2020-2027(USD

- MILLION) 55

- TABLE 31 U.S HVAC WRAPS & INSULATION MARKET, BY APPLICATION,

- 2020-2027(MILLION SQ. METERS) 56

- TABLE 32 CANADA HVAC WRAPS & INSULATION

- MARKET, BY TYPE, 2020-2027(USD MILLION) 56

- TABLE 33 CANADA HVAC WRAPS

- & INSULATION MARKET, BY TYPE, 2020-2027(MILLION SQ. METERS) 56

- TABLE

- 34 CANADA HVAC WRAPS & INSULATION MARKET, BY WRAPS, 2020-2027(USD MILLION) 56

- TABLE

- 35 CANADA HVAC WRAPS & INSULATION MARKET, BY WRAPS, 2020-2027(MILLION SQ. METERS)

- 57

- TABLE 36 CANADA HVAC WRAPS & INSULATION MARKET, BY TAPES, 2020-2027(USD

- MILLION) 57

- TABLE 37 CANADA HVAC WRAPS & INSULATION MARKET, BY TAPES,

- 2020-2027(USD MILLION) 58

- TABLE 38 CANADA HVAC WRAPS & INSULATION

- MARKET, BY APPLICATION, 2020-2027(USD MILLION) 58

- TABLE 39 CANADA HVAC

- WRAPS & INSULATION MARKET, BY APPLICATION, 2020-2027(MILLION SQ. METERS) 59

- TABLE

- 40 GCC HVAC WRAPS & INSULATION MARKET, BY COUNTRY, 2020-2027(USD MILLION) 61

- TABLE

- 41 GCC HVAC WRAPS & INSULATION MARKET, BY COUNTRY, 2020-2027(MILLION SQ. METERS)

- 61

- TABLE 42 GCC HVAC WRAPS & INSULATION MARKET, BY TYPE, 2020-2027(USD

- MILLION) 62

- TABLE 43 GCC HVAC WRAPS & INSULATION MARKET, BY TYPE,

- 2020-2027(MILLION SQ. METERS) 62

- TABLE 44 GCC HVAC WRAPS & INSULATION

- MARKET, BY WRAPS, 2020-2027(USD MILLION) 62

- TABLE 45 GCC HVAC WRAPS &

- INSULATION MARKET, BY WRAPS, 2020-2027(MILLION SQ. METERS) 63

- TABLE 46

- GCC HVAC WRAPS & INSULATION MARKET, BY TAPES, 2020-2027(USD MILLION) 63

- TABLE

- 47 GCC HVAC WRAPS & INSULATION MARKET, BY TAPES, 2020-2027(MILLION SQ. METERS)

- 64

- TABLE 48 GCC HVAC WRAPS & INSULATION MARKET, BY APPLICATION, 2020-2027(USD

- MILLION) 64

- TABLE 49 GCC HVAC WRAPS & INSULATION MARKET, BY APPLICATION,

- 2020-2027(MILLION SQ. METERS) 65

- TABLE 50 SAUDI ARABIA HVAC WRAPS &

- INSULATION MARKET, BY TYPE, 2020-2027(USD MILLION) 65

- TABLE 51 SAUDI ARABIA

- HVAC WRAPS & INSULATION MARKET, BY TYPE, 2020-2027(MILLION SQ. METERS) 65

- TABLE

- 52 SAUDI ARABIA HVAC WRAPS & INSULATION MARKET, BY WRAPS, 2020-2027(USD MILLION)

- 66

- TABLE 53 SAUDI ARABIA HVAC WRAPS & INSULATION MARKET, BY WRAPS,

- 2020-2027(MILLION SQ. METERS) 66

- TABLE 54 SAUDI ARABIA HVAC WRAPS &

- INSULATION MARKET, BY TAPES, 2020-2027(USD MILLION) 66

- TABLE 55 SAUDI

- ARABIA HVAC WRAPS & INSULATION MARKET, BY TAPES, 2020-2027(MILLION SQ. METERS)

- 67

- TABLE 56 SAUDI ARABIA HVAC WRAPS & INSULATION MARKET, BY APPLICATION,

- 2020-2027(USD MILLION) 67

- TABLE 57 SAUDI ARABIA HVAC WRAPS & INSULATION

- MARKET, BY APPLICATION, 2020-2027(MILLION SQ. METERS) 68

- TABLE 58 UAE

- HVAC WRAPS & INSULATION MARKET, BY TYPE, 2020-2027(USD MILLION) 68

- TABLE

- 59 UAE HVAC WRAPS & INSULATION MARKET, BY TYPE, 2020-2027(MILLION SQ. METERS)

- 68

- TABLE 60 UAE HVAC WRAPS & INSULATION MARKET, BY WRAPS, 2020-2027(USD

- MILLION) 69

- TABLE 61 UAE HVAC WRAPS & INSULATION MARKET, BY WRAPS,

- 2020-2027(MILLION SQ. METERS) 69

- TABLE 62 UAE HVAC WRAPS & INSULATION

- MARKET, BY TAPES, 2020-2027(USD MILLION) 69

- TABLE 63 UAE HVAC WRAPS &

- INSULATION MARKET, BY TAPES, 2020-2027(MILLION SQ. METERS) 70

- TABLE 64

- UAE HVAC WRAPS & INSULATION MARKET, BY APPLICATION, 2020-2027(USD MILLION) 70

- TABLE

- 65 UAE HVAC WRAPS & INSULATION MARKET, BY APPLICATION, 2020-2027(MILLION SQ.

- METERS) 71

- TABLE 66 QATAR HVAC WRAPS & INSULATION MARKET, BY TYPE,

- 2020-2027(USD MILLION) 71

- TABLE 67 QATAR HVAC WRAPS & INSULATION MARKET,

- BY TYPE, 2020-2027(MILLION SQ. METERS) 71

- TABLE 68 QATAR HVAC WRAPS &

- INSULATION MARKET, BY WRAPS, 2020-2027(USD MILLION) 72

- TABLE 69 QATAR

- HVAC WRAPS & INSULATION MARKET, BY WRAPS, 2020-2027(MILLION SQ. METERS) 72

- TABLE

- 70 QATAR HVAC WRAPS & INSULATION MARKET, BY TAPES, 2020-2027(USD MILLION) 72

- TABLE

- 71 QATAR HVAC WRAPS & INSULATION MARKET, BY TAPES, 2020-2027(MILLION SQ. METERS)

- 73

- TABLE 72 QATAR HVAC WRAPS & INSULATION MARKET, BY APPLICATION,

- 2020-2027(USD MILLION) 73

- TABLE 73 QATAR HVAC WRAPS & INSULATION MARKET,

- BY APPLICATION, 2020-2027(MILLION SQ. METERS) 74

- TABLE 74 KUWAIT HVAC

- WRAPS & INSULATION MARKET, BY TYPE, 2020-2027(USD MILLION) 74

- TABLE

- 75 KUWAIT HVAC WRAPS & INSULATION MARKET, BY TYPE, 2020-2027(MILLION SQ. METERS)

- 74

- TABLE 76 KUWAIT HVAC WRAPS & INSULATION MARKET, BY WRAPS, 2020-2027(USD

- MILLION) 75

- TABLE 77 KUWAIT HVAC WRAPS & INSULATION MARKET, BY WRAPS,

- 2020-2027(MILLION SQ. METERS) 75

- TABLE 78 KUWAIT HVAC WRAPS & INSULATION

- MARKET, BY TAPES, 2020-2027(USD MILLION) 75

- TABLE 79 KUWAIT HVAC WRAPS

- & INSULATION MARKET, BY TAPES, 2020-2027(MILLION SQ. METERS) 76

- TABLE

- 80 KUWAIT HVAC WRAPS & INSULATION MARKET, BY APPLICATION, 2020-2027(USD MILLION)

- 76

- TABLE 81 KUWAIT HVAC WRAPS & INSULATION MARKET, BY APPLICATION,

- 2020-2027(MILLION SQ. METERS) 77

- TABLE 82 OMAN HVAC WRAPS & INSULATION

- MARKET, BY TYPE, 2020-2027(USD MILLION) 77

- TABLE 83 OMAN HVAC WRAPS &

- INSULATION MARKET, BY TYPE, 2020-2027(MILLION SQ. METERS) 77

- TABLE 84

- OMAN HVAC WRAPS & INSULATION MARKET, BY WRAPS, 2020-2027(USD MILLION) 78

- TABLE

- 85 OMAN HVAC WRAPS & INSULATION MARKET, BY WRAPS, 2020-2027(MILLION SQ. METERS)

- 78

- TABLE 86 OMAN HVAC WRAPS & INSULATION MARKET, BY TAPES, 2020-2027(USD

- MILLION) 78

- TABLE 87 OMAN HVAC WRAPS & INSULATION MARKET, BY TAPES,

- 2020-2027(MILLION SQ. METERS) 79

- TABLE 88 OMAN HVAC WRAPS & INSULATION

- MARKET, BY APPLICATION, 2020-2027(USD MILLION) 79

- TABLE 89 OMAN HVAC WRAPS

- & INSULATION MARKET, BY APPLICATION, 2020-2027(MILLION SQ. METERS) 80

- TABLE

- 90 BAHRAIN HVAC WRAPS & INSULATION MARKET, BY TYPE, 2020-2027(USD MILLION) 80

- TABLE

- 91 BAHRAIN HVAC WRAPS & INSULATION MARKET, BY TYPE, 2020-2027(MILLION SQ. METERS)

- 80

- TABLE 92 BAHRAIN HVAC WRAPS & INSULATION MARKET, BY WRAPS, 2020-2027(USD

- MILLION) 81

- TABLE 93 BAHRAIN HVAC WRAPS & INSULATION MARKET, BY WRAPS,

- 2020-2027(MILLION SQ. METERS) 81

- TABLE 94 BAHRAIN HVAC WRAPS & INSULATION

- MARKET, BY TAPES, 2020-2027(USD MILLION) 81

- TABLE 95 BAHRAIN HVAC WRAPS

- & INSULATION MARKET, BY TAPES, 2020-2027(MILLION SQ. METERS) 82

- TABLE

- 96 BAHRAIN HVAC WRAPS & INSULATION MARKET, BY APPLICATION, 2020-2027(USD MILLION)

- 82

- TABLE 97 BAHRAIN HVAC WRAPS & INSULATION MARKET, BY APPLICATION,

- 2020-2027(MILLION SQ. METERS) 83

- TABLE 98 NORTH AMERICA & GCC HVAC

- INSULATION ADHESIVES & SEALANTS MARKET, BY TYPE, 2020-2027(USD MILLION) 85

- TABLE

- 99 NORTH AMERICA & GCC HVAC INSULATION MARKET, BY ADHESIVES & SEALANTS,

- 2020-2027(KT) 86

- TABLE 100 NORTH AMERICA & GCC HVAC INSULATION ADHESIVES

- & SEALANTS MARKET, BY APPLICATION, 2020-2027(USD MILLION) 88

- TABLE

- 101 NORTH AMERICA & GCC HVAC INSULATION ADHESIVES & SEALANTS MARKET, BY

- APPLICATION, 2020-2027(KT) 90

- TABLE 102 NORTH AMERICA & GCC HVAC INSULATION

- ADHESIVES & SEALANTS MARKET, BY REGION, 2020-2027(USD MILLION) 92

- TABLE

- 103 NORTH AMERICA & GCC HVAC INSULATION ADHESIVES & SEALANTS MARKET, BY

- REGION, 2020-2027(KT) 93

- TABLE 104 NORTH AMERICA HVAC INSULATION ADHESIVES

- & SEALANTS MARKET, BY COUNTRY, 2020-2027(USD MILLION) 95

- TABLE 105

- NORTH AMERICA HVAC INSULATION ADHESIVES & SEALANTS MARKET, BY COUNTRY, 2020-2027(KT)

- 95

- TABLE 106 NORTH AMERICA HVAC INSULATION ADHESIVES & SEALANTS MARKET,

- BY TYPE, 2020-2027(USD MILLION) 95

- TABLE 107 NORTH AMERICA HVAC INSULATION

- ADHESIVES & SEALANTS MARKET, BY TYPE, 2020-2027(KT) 96

- TABLE 108 NORTH

- AMERICA HVAC INSULATION ADHESIVES & SEALANTS MARKET, BY APPLICATION, 2020-2027(USD

- MILLION) 96

- TABLE 109 NORTH AMERICA HVAC INSULATION ADHESIVES & SEALANTS

- MARKET, BY APPLICATION, 2020-2027(KT) 97

- TABLE 110 US HVAC INSULATION

- ADHESIVES & SEALANTS MARKET, BY TYPE, 2020-2027(USD MILLION) 97

- TABLE

- 111 US HVAC INSULATION ADHESIVES & SEALANTS MARKET, BY TYPE, 2020-2027(KT) 98

- TABLE

- 112 US HVAC INSULATION ADHESIVES & SEALANTS MARKET, BY APPLICATION, 2020-2027(USD

- MILLION) 98

- TABLE 113 US HVAC INSULATION ADHESIVES & SEALANTS MARKET,

- BY APPLICATION, 2020-2027(KT) 99

- TABLE 114 CANADA HVAC INSULATION ADHESIVES

- & SEALANTS MARKET, BY TYPE, 2020-2027(USD MILLION) 99

- TABLE 115 CANADA

- HVAC INSULATION ADHESIVES & SEALANTS MARKET, BY TYPE, 2020-2027(KT) 100

- TABLE

- 116 CANADA HVAC INSULATION ADHESIVES & SEALANTS MARKET, BY APPLICATION, 2020-2027(USD

- MILLION) 100

- TABLE 117 CANADA HVAC INSULATION ADHESIVES & SEALANTS

- MARKET, BY APPLICATION, 2020-2027(KT) 101

- TABLE 118 GCC HVAC INSULATION

- ADHESIVES & SEALANTS MARKET, BY COUNTRY, 2020-2027(USD MILLION) 103

- TABLE

- 119 GCC HVAC INSULATION ADHESIVES & SEALANTS MARKET, BY COUNTRY, 2020-2027(KT)

- 103

- TABLE 120 GCC HVAC INSULATION ADHESIVES & SEALANTS MARKET, BY

- TYPE, 2020-2027(USD MILLION) 103

- TABLE 121 GCC HVAC INSULATION ADHESIVES

- & SEALANTS MARKET, BY TYPE, 2020-2027(KT) 104

- TABLE 122 GCC HVAC INSULATION

- ADHESIVES & SEALANTS MARKET, BY APPLICATION, 2020-2027(USD MILLION) 104

- TABLE

- 123 GCC HVAC INSULATION ADHESIVES & SEALANTS MARKET, BY APPLICATION, 2020-2027(KT)

- 105

- TABLE 124 SAUDI ARABIA HVAC INSULATION ADHESIVES & SEALANTS MARKET,

- BY TYPE, 2020-2027(USD MILLION) 105

- TABLE 125 SAUDI ARABIA HVAC INSULATION

- ADHESIVES & SEALANTS MARKET, BY TYPE, 2020-2027(KT) 106

- TABLE 126

- SAUDI ARABIA HVAC INSULATION ADHESIVES & SEALANTS MARKET, BY APPLICATION, 2020-2027(USD

- MILLION) 106

- TABLE 127 SAUDI ARABIA HVAC INSULATION ADHESIVES & SEALANTS

- MARKET, BY APPLICATION, 2020-2027(KT) 107

- TABLE 128 UAE HVAC INSULATION

- ADHESIVES & SEALANTS MARKET, BY TYPE, 2020-2027(USD MILLION) 107

- TABLE

- 129 UAE HVAC INSULATION ADHESIVES & SEALANTS MARKET, BY TYPE, 2020-2027(KT)

- 108

- TABLE 130 UAE HVAC INSULATION ADHESIVES & SEALANTS MARKET, BY

- APPLICATION, 2020-2027(USD MILLION) 108

- TABLE 131 UAE HVAC INSULATION

- ADHESIVES & SEALANTS MARKET, BY APPLICATION, 2020-2027(KT) 109

- TABLE

- 132 QATAR HVAC INSULATION ADHESIVES & SEALANTS MARKET, BY TYPE, 2020-2027(USD

- MILLION) 109

- TABLE 133 QATAR HVAC INSULATION ADHESIVES & SEALANTS

- MARKET, BY TYPE, 2020-2027(KT) 110

- TABLE 134 QATAR HVAC INSULATION ADHESIVES

- & SEALANTS MARKET, BY APPLICATION, 2020-2027(USD MILLION) 110

- TABLE

- 135 QATAR HVAC INSULATION ADHESIVES & SEALANTS MARKET, BY APPLICATION, 2020-2027(KT)

- 111

- TABLE 136 KUWAIT HVAC INSULATION ADHESIVES & SEALANTS MARKET,

- BY TYPE, 2020-2027(USD MILLION) 111

- TABLE 137 KUWAIT HVAC INSULATION ADHESIVES

- & SEALANTS MARKET, BY TYPE, 2020-2027(KT) 112

- TABLE 138 KUWAIT HVAC

- INSULATION ADHESIVES & SEALANTS MARKET, BY APPLICATION, 2020-2027(USD MILLION)

- 112

- TABLE 139 KUWAIT HVAC INSULATION ADHESIVES & SEALANTS MARKET,

- BY APPLICATION, 2020-2027(KT) 113

- TABLE 140 OMAN HVAC INSULATION ADHESIVES

- & SEALANTS MARKET, BY TYPE, 2020-2027(USD MILLION) 113

- TABLE 141 OMAN

- HVAC INSULATION ADHESIVES & SEALANTS MARKET, BY TYPE, 2020-2027(KT) 114

- TABLE

- 142 OMAN HVAC INSULATION ADHESIVES & SEALANTS MARKET, BY APPLICATION, 2020-2027(USD

- MILLION) 114

- TABLE 143 OMAN HVAC INSULATION ADHESIVES & SEALANTS MARKET,

- BY APPLICATION, 2020-2027(KT) 115

- TABLE 144 BAHRAIN HVAC INSULATION ADHESIVES

- & SEALANTS MARKET, BY TYPE, 2020-2027(USD MILLION) 115

- TABLE 145 BAHRAIN

- HVAC INSULATION ADHESIVES & SEALANTS MARKET, BY TYPE, 2020-2027(KT) 116

- TABLE

- 146 BAHRAIN HVAC INSULATION ADHESIVES & SEALANTS MARKET, BY APPLICATION, 2020-2027(USD

- MILLION) 116

- TABLE 147 BAHRAIN HVAC INSULATION ADHESIVES & SEALANTS

- MARKET, BY APPLICATION, 2020-2027(KT) 117

- TABLE 148 KEY DEVELOPMENTS 119

- 15

-

List of Tables and Figures

- FIGURE 1 TOP DOWN & BOTTOMUP APPROACH 23

- FIGURE

- 2 FORECAST MODEL 24

- FIGURE 3 DROT ANALYSIS OF NORTH AMERICA & GCC

- HVAC INSULATION MARKET 26

- FIGURE 4 SUPPLY CHAIN ANALYSIS 33

- FIGURE

- 5 NORTH AMERICA & GCC HVAC INSULATION WRAPS & TAPES MARKET, BY TYPE, 2020-2027(USD

- MILLION) 37

- FIGURE 6 NORTH AMERICA & GCC HVAC INSULATION WRAPS &

- TAPES MARKET, BY TYPE, 2020-2027(MILLION SQ. METERS) 38

- FIGURE 7 NORTH

- AMERICA & GCC HVAC INSULATION WRAPS & TAPES MARKET, BY APPLICATION, 2020-2027(USD

- MILLION) 42

- FIGURE 8 NORTH AMERICA & GCC HVAC INSULATION MARKET, BY

- APPLICATION, 2020-2027(MILLION SQ. METERS) 43

- FIGURE 9 NORTH AMERICA &

- GCC HVAC INSULATION MARKET, BY REGION, 2020-2027(USD MILLION) 46

- FIGURE

- 10 NORTH AMERICA & GCC HVAC INSULATION MARKET, BY REGION, 2020-2027(MILLION

- SQ. METERS) 47

- FIGURE 11 NORTH AMERICA & GCC HVAC INSULATION ADHESIVES

- & SEALANTS MARKET, BY TYPE, 2020-2027(USD MILLION) 85

- FIGURE 12 NORTH

- AMERICA & GCC HVAC INSULATION ADHESIVES & SEALANTS MARKET, BY TYPE, 2020-2027(KT)

- 86

- FIGURE 13 NORTH AMERICA & GCC HVAC INSULATION ADHESIVES & SEALANTS

- MARKET, BY APPLICATION, 2020-2027(USD MILLION) 88

- FIGURE 14 NORTH AMERICA

- & GCC HVAC INSULATION ADHESIVES & SEALANTS MARKET, BY APPLICATION, 2020-2027(KT)

- 90

- FIGURE 15 NORTH AMERICA & GCC HVAC INSULATION ADHESIVES & SEALANTS

- MARKET, BY REGION, 2020-2027(USD MILLION) 92

- FIGURE 16 NORTH AMERICA &

- GCC HVAC INSULATION ADHESIVES & SEALANTS MARKET, BY REGION, 2020-2027(KT) 92

- FIGURE

- 17 SWOT ANALYSIS 123

- FIGURE 18 SWOT ANALYSIS 125

- FIGURE 19 SWOT

- ANALYSIS 127

- FIGURE 20 SWOT ANALYSIS 129

- FIGURE 21 SWOT ANALYSIS

- 131

- FIGURE 22 SWOT ANALYSIS 133

- FIGURE 23 SWOT ANALYSIS 135

- FIGURE

- 24 SWOT ANALYSIS 137

- FIGURE 25 SWOT ANALYSIS 139

- FIGURE 26 SWOT

- ANALYSIS 141

- FIGURE 27 SWOT ANALYSIS 143

- FIGURE 28 SWOT ANALYSIS

- 145

- FIGURE 29 SWOT ANALYSIS 147

- FIGURE 30 SWOT ANALYSIS 149

- FIGURE

- 31 SWOT ANALYSIS 151

- FIGURE 32 SWOT ANALYSIS 153

North America & GCC HVAC Insulation Market Segmentation

Market Segmentation Overview

- Detailed segmentation data will be available in the full report

- Comprehensive analysis by multiple parameters

- Regional and country-level breakdowns

- Market size forecasts by segment

Free Sample Request

Kindly complete the form below to receive a free sample of this Report

Customer Strories

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

Leave a Comment