Market Trends

Introduction

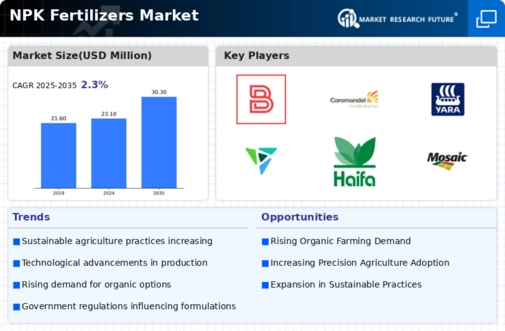

As we enter 2024, the NPK fertilizers market is poised for significant transformation driven by a confluence of macro factors. Technological advancements in precision agriculture and nutrient management are reshaping product formulations and application methods, enhancing efficiency and sustainability. Concurrently, regulatory pressures aimed at reducing environmental impact are prompting manufacturers to innovate and comply with stricter guidelines. Additionally, shifts in consumer behavior towards organic and sustainable farming practices are influencing demand for eco-friendly fertilizer options. These trends are strategically important for stakeholders, as they not only dictate competitive positioning but also align with broader agricultural sustainability goals.

Top Trends

-

Sustainability and Eco-Friendly Formulations

The demand for sustainable NPK fertilizers is rising, driven by environmental regulations and consumer preferences. Companies like Yara International are investing in eco-friendly production methods, reducing carbon footprints by up to 30%. Governments are incentivizing sustainable practices, leading to a shift in market dynamics. This trend is expected to enhance brand loyalty and open new market segments focused on organic farming. -

Precision Agriculture Integration

The integration of precision agriculture technologies is transforming NPK fertilizer application. Companies are leveraging data analytics and IoT to optimize fertilizer use, reducing waste by approximately 20%. This trend is supported by initiatives from agricultural ministries promoting smart farming. As precision agriculture becomes mainstream, it will likely lead to increased efficiency and higher crop yields. -

Enhanced Efficiency Products

There is a growing focus on developing enhanced efficiency fertilizers (EEFs) that improve nutrient uptake. For instance, BASF SE has introduced products that can increase nutrient use efficiency by 30%. This trend is driven by the need to maximize crop yields while minimizing environmental impact. The market is expected to see a rise in demand for EEFs as farmers seek cost-effective solutions. -

Digitalization in Fertilizer Management

Digital platforms for fertilizer management are gaining traction, allowing farmers to track and manage nutrient applications effectively. Companies like CF Industries are adopting digital tools that can improve decision-making processes by 25%. This trend is supported by government initiatives promoting digital agriculture. The future may see a more connected farming ecosystem, enhancing productivity. -

Regulatory Compliance and Safety Standards

Stricter regulatory frameworks are shaping the NPK fertilizer market, with a focus on safety and environmental impact. The Mosaic Company is adapting to these changes by reformulating products to meet new standards. Compliance is becoming a competitive advantage, as non-compliance can lead to significant penalties. This trend will likely drive innovation in product development and safety protocols. -

Biological NPK Fertilizers

The rise of biological NPK fertilizers is reshaping the market, with products that enhance soil health and promote sustainable farming. Companies like Haifa Group are investing in research to develop bio-based solutions that can improve nutrient availability. This trend is supported by increasing consumer demand for organic produce. The future may see a significant shift towards biological options as farmers seek sustainable alternatives. -

Global Supply Chain Resilience

The COVID-19 pandemic highlighted vulnerabilities in the global supply chain for NPK fertilizers. Companies are now focusing on building resilience through local sourcing and diversified supply chains. For example, Potash Corporation is exploring partnerships with local producers to mitigate risks. This trend is expected to lead to more stable pricing and availability in the market. -

Customized Fertilizer Solutions

There is an increasing demand for customized NPK fertilizer solutions tailored to specific crop needs. Coromandel International is leading this trend by offering bespoke formulations based on soil testing. This approach can enhance crop performance by up to 15%. As farmers seek to maximize yields, the market for customized solutions is likely to expand significantly. -

Investment in Research and Development

Investment in R&D for innovative NPK fertilizers is on the rise, with companies allocating significant budgets to develop new formulations. For instance, K + S Aktiengesellschaft has increased its R&D spending by 20% to enhance product efficacy. This trend is crucial for maintaining competitive advantage and meeting evolving agricultural demands. Future developments may lead to breakthroughs in nutrient delivery systems. -

Market Consolidation and Strategic Alliances

The NPK fertilizer market is witnessing consolidation as companies seek strategic alliances to enhance market presence. Recent mergers, such as those involving Borealis AG, are aimed at expanding product portfolios and geographic reach. This trend is likely to create a more competitive landscape, driving innovation and efficiency. Future consolidations may lead to fewer but stronger players in the market.

Conclusion: Navigating NPK Fertilizer Market Dynamics

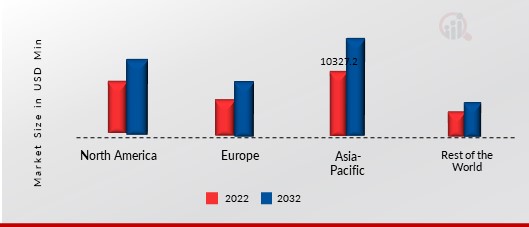

The NPK fertilizers market in 2024 is characterized by intense competitive dynamics and significant fragmentation, with both legacy and emerging players vying for market share. Regional trends indicate a growing emphasis on sustainability and eco-friendly practices, compelling vendors to innovate and adapt their product offerings. Legacy players are leveraging established distribution networks and brand loyalty, while emerging companies are focusing on advanced capabilities such as AI-driven precision agriculture and automation to enhance operational efficiency. As the market evolves, the ability to integrate sustainability, flexibility in product formulations, and technological advancements will be critical for vendors aiming to secure leadership positions. Decision-makers must prioritize these capabilities to navigate the complexities of the market and capitalize on emerging opportunities.

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Leave a Comment