Optical Lenses Size

Market Size Snapshot

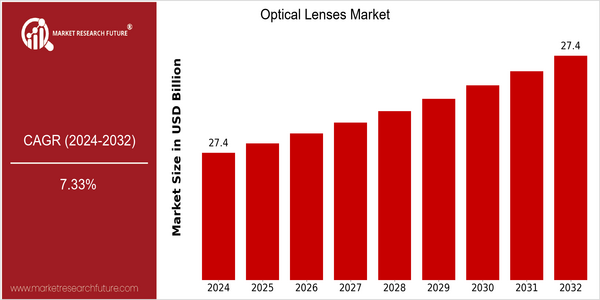

| Year | Value |

|---|---|

| 2024 | USD 27.4 Billion |

| 2032 | USD 27.4 Billion |

| CAGR (2023-2032) | 7.33 % |

Note – Market size depicts the revenue generated over the financial year

The market for optical lenses is undergoing a period of rapid expansion. In 2024, the market is valued at $27 billion and is expected to reach the same level in 2032. The market will grow at a CAGR of 7.3% from 2023 to 2032. This indicates a dynamic market, driven by evolving customer needs and technological developments. The market’s sustained size reflects the essential role that optical lenses play in our everyday lives and in our professional activities. The factors driving the market’s growth are the growing number of people with vision problems, the ageing of the population, and the increased use of advanced lens technology, such as anti-reflective coatings and blue light filters. Also contributing to the market’s expansion are developments in manufacturing and materials technology, such as the development of light, strong lens materials. Essilor-Luxottica, Zeiss and other major players are constantly investing in research and development, establishing strategic alliances and launching new products to meet the changing needs of the market.

Regional Market Size

Regional Deep Dive

The Optical Lenses Market is growing at a rapid pace across various regions, owing to the increasing demand for vision correction solutions, advancements in lens technology, and an increasing geriatric population. In North America, the market is characterized by high awareness among consumers and the presence of key players. In Europe, the market is characterized by the presence of new players, along with regulatory frameworks that promote sustainable practices. In the Asia-Pacific region, the market is characterized by rapid urbanization and increasing disposable income, which in turn has led to a rise in demand for optical lenses. In the Middle East and Africa, advanced lens technology is being gradually adopted. The Latin American market is growing, owing to increasing awareness and access to care.

Europe

- The European Union's regulations on environmental sustainability are pushing manufacturers to adopt eco-friendly materials and production processes, influencing the types of optical lenses being developed.

- Notable collaborations, such as between Zeiss and various tech firms, are focusing on integrating augmented reality features into lenses, catering to the growing demand for multifunctional eyewear.

Asia Pacific

- Rapid urbanization in countries like China and India is leading to increased screen time, which is driving the demand for blue light blocking lenses and other specialized optical products.

- Government initiatives in countries like Japan are promoting eye health awareness, resulting in higher adoption rates of corrective lenses among the population.

Latin America

- In Brazil, the government has launched programs to improve access to vision care, which is expected to boost the demand for optical lenses significantly.

- The rise of e-commerce platforms in Latin America is facilitating easier access to a variety of optical lenses, catering to a broader audience and enhancing market penetration.

North America

- The rise of telehealth services has led to increased consultations for vision-related issues, prompting a surge in demand for optical lenses, particularly in the online retail space.

- Companies like EssilorLuxottica and CooperVision are investing heavily in R&D to develop smart lenses that integrate technology for enhanced user experience, reflecting a trend towards innovation in the market.

Middle East And Africa

- The growing middle class in countries like the UAE is leading to increased spending on healthcare and eyewear, thus expanding the optical lenses market.

- Local manufacturers are emerging, such as Al Jaber Optical, which are focusing on providing affordable yet quality optical solutions tailored to regional preferences.

Did You Know?

“Approximately 2.7 billion people worldwide are estimated to need vision correction, yet only half of them have access to the necessary optical lenses.” — World Health Organization

Segmental Market Size

Optical Lenses Market is experiencing a stable growth, mainly due to the increasing demand for eyeglasses and the technological developments in the industry. Among the factors that will drive this market are the growing prevalence of myopia and presbyopia, which will lead to a growing demand for corrective eyewear. Also, the increasing use of digital devices has increased the awareness of eye health, which will further increase the demand for optical lenses. The market is in a mature stage, and the main players are EssilorLuxottica and J&J. The main applications of optical lenses are eyeglasses, sun glasses and specialized lenses for the use of digital devices. Among the notable trends that will accelerate the growth of this market are the increasing demand for sustainable materials in the production of optical lenses and the integration of smart technology such as blue light filters and anti-reflective coatings. Also, 3D printing and digital surfacing are reshaping the industry, increasing the degree of personalization and reducing the costs of production.

Future Outlook

The Optical Lenses Market is set for substantial growth between 2024 and 2032, with a projected CAGR of 7.33% from 2024 to 2032. This growth will increase the market value from $29 billion in 2024 to approximately $29 billion by 2032. The rising demand for vision correction and technological advances will drive this growth. The rising prevalence of vision-related disorders, especially among the aging population, and the growing use of digital devices, will boost the penetration of optical lenses in the developed regions, which is projected to reach over 60% by 2032, compared to the current 45.5%. Moreover, the development of smart lenses and improved coatings that enhance the performance and the life of lenses will alter the consumer preferences and drive the market growth. Also, the supportive government policies that encourage eye health awareness and increase the access to eye care will play a key role in the market growth. In addition, the integration of augmented and virtual reality with optical lenses will open new avenues for growth. This evolving market is ripe for investment and the opportunity to capitalize on the trends and meet the evolving needs of the consumers.

Leave a Comment