Increasing application in printing ink and paints &coatings industry

Organic pigments are utilized in a variety of applications, including printing inks and paints & coatings, which are likely to fuel market expansion during the projection period. Organic pigments are the most significant colorants in the

printing inks

business due to their variety, colors, and high performance. Organic pigments are extremely durable and resistant to fading and chemical reactions, making them excellent for use in printing. They are also quite versatile, as they may be used in a variety of printing procedures such as flexography, gravure, and screen printing. Organic pigments, in general, are an important component in the formulation of high-quality printing ink solutions. Furthermore, strict guidelines governing the use of printing inks in food packaging are driving demand for environmentally friendly organic pigments.

Food packaging safety has become a global issue, and concerned populations are becoming more conscious of the possible transfer of container color into food items. Organic pigments of high grade are color and viscosity stable. They are readily printable in a variety of mediums. Increased demand for a wide variety of FDA-approved pigments, such as yellow, green, and other coloring agents, is likely to fuel market growth during the projection period.

Surge in textile production in emerging economies

Organic dyes and organic pigments are increasingly being employed as textile colorants. Colorants utilized in various textile segments are primarily responsible for the high demand. With the increasing volume of the textile sector, there is a rising demand for coloring and dying the cloth, resulting in a strong market demand for pigments. Most pigments used in industry are organic molecules. Because of their exceptional light fastness, pigments are widely used for coloring fabrics such as cotton, wool, and other man-made fibres. They have no attraction for fibres and are attached to fabric with the assistance of resins.

However, demand is increasing due to people's increased awareness of the need for ecologically friendly products. In addition, we notice a trend towards high pigment concentration and brilliant aesthetics, which contributes to an increase in the need for organic pigments in the textile sector. As a result, we would see an enormous surge in demand for organic pigments in the textile industry. The textile sector is expanding rapidly in emerging economies, particularly in India, China, Mexico, and Brazil. According to the Indian Brand Equity Foundation (IBEF), the textile and apparel industry in India accounts for 13% of total industrial output.

India's textile and apparel exports (including handicrafts) were USD 44.4 billion in 2022, representing a 41% rise year on year. In 2022, readymade garment exports including cotton accessories were USD 6.19 billion. Industry is one of the most important and vital sectors of the economy. Various initiatives are also being launched to support and expand the Indian textile market. The Union Budget, which was released by the Textile Ministry and the finance minister, has given the industry a significant boost.

The government's plans to establish seven giant textile parks throughout India will not only provide job possibilities but also improve the MSME sector. An even larger plan, costing USD 1.4 billion, was unveiled, which will assist textile and apparel manufacturing facilities in realizing their capacity potential. These actions by the government are positive moves towards enabling the industry's growth.

According to a report by the Federation of Indian Chambers of Commerce and Industry (FICCI)-Wazir Advisors, the Indian textile and apparel market is expected to be worth USD 153 billion in 2021, with the domestic market accounting for USD 110 billion and exports accounting for USD 43 billion, with the Indian textile and apparel market having the potential to grow to USD 250 billion by 2025-26. With the textile sector in India predicted to develop dramatically, the market need for colorants is expected to rise, resulting in a rise in demand for organic pigments.

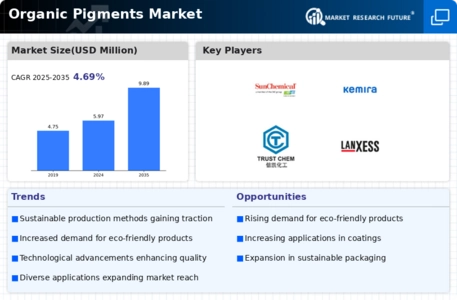

Development of low-VOC and eco-friendly products

With increasing consumer awareness of the environmental impacts of chemicals and the commitment of manufacturing companies to reduce their environmental impact and contribute to the sustainability goals set by governments at the national level and by companies themselves at the individual level, there is an increasing trend of development as well as demand for eco-friendly products in the global market. Consumer interest in environmentally friendly items has increased in recent years, owing to the trend towards all natural and environmentally friendly options.

This increased consumer preference is driving an increase in demand for low-VOC and environmentally friendly products in the organic pigments market. Organic pigments collected from animals and flowers contain a wide spectrum of deep colors, including rose, deep red carmine, and crimson, whereas synthetic organic pigments are generated from petroleum chemicals. They are often more powerful, brighter, and clearer than inorganic

pigments

, but not as light-resistant. They may be partly soluble in a variety of thermoplastics. Organic pigments are becoming increasingly popular because they may be utilized in a variety of applications, including food & beverages and the cosmetics sector, are ecologically benign, and are long-lasting. They are also increasingly being used to color polymers. The need for organic pigments has also increased due to the increasing importance of low-volatile organic compounds in goods such as paints & coatings, inks, and polymers.

As a result, inorganic pigments are increasingly being replaced by organic pigments, or they are used in combination to lessen the product's negative impact on the environment and humans. This practice is also projected to boost market potential for organic pigments. DayGlo's Elara Luxe pigment line is a cutting-edge choice for producers of makeup and personal beauty care items in 2023. A vital component of many cosmetic and personal beauty care goods, pigments are found in nail polishes, lipsticks, and eyeshadows, among other items.

Innovation in this field is more and more important as customer demand for products with sustainable and clean ingredients grows. One of the top manufacturers of organic and inorganic pigments as well as complete color solutions, The Heubach Group, introduced its new UltrazurTM product range in 2023. A new production plant at Heubach's Dahej, India, produces a range of Ultramarine Blue pigments in four colors ranging from greenish to reddish for a variety of standard and difficult applications.

With the introduction of its new product line, Licosperse, which features more environmentally friendly pigment preparations for polish applications, Clariant—one of the top producers of organic pigments and dyes worldwide—has increased its commitment to sustainability in 2021. The preparations are made without the use of dust, heavy metals, or resin, and are made from non-toxic raw materials to facilitate easy usage in the end user's industrial processes.

The increasing demand for environmentally friendly and sustainable products is driving the growth of the organic pigments market, as industries seek alternatives to synthetic dyes and pigments.

U.S. Environmental Protection Agency

Leave a Comment