-

EXECUTIVE SUMMARY

-

GLOBAL PACKAGING MATERIAL MARKET, BY MATERIAL

-

GLOBAL PACKAGING MATERIAL MARKET, BY PRODUCT

-

GLOBAL PACKAGING MATERIAL MARKET, BY LEVEL OF PACKAGING

-

GLOBAL PACKAGING MATERIAL MARKET, BY END USE INDUSTRY

-

MARKET INTRODUCTION

-

DEFINITION

-

SCOPE OF THE STUDY

-

RESEARCH OBJECTIVE

-

MARKET STRUCTURE

-

KEY BUYING CRITERIA

-

RESEARCH METHODOLOGY

-

RESEARCH PROCESS

-

PRIMARY RESEARCH

-

SECONDARY RESEARCH

-

MARKET SIZE ESTIMATION

-

TOP-DOWN AND BOTTOM-UP APPROACH

-

FORECAST MODEL

-

LIST OF ASSUMPTIONS

-

MARKET DYNAMICS

-

INTRODUCTION

-

DRIVERS:

- THE RISING DEMAND FOR PACKAGING SOLUTIONS IS BEING DRIVEN BY THE GROWTH OF EMERGING MARKETS IN DEVELOPING REGIONS

- THE GROWING EMPHASIS ON SUSTAINABILITY AND ENVIRONMENTALLY RESPONSIBLE PACKAGING SOLUTIONS IS FUELING THE EXPANSION OF THE PACKAGING MATERIAL INDUSTRY

-

MARKET RESTRAIN:

- SHORTAGE OF SKILLED LABOURS POSSES AS MARKET CHALLENGES

- IMPLEMENTING ANTI-COUNTERFEITING MEASURES WITHIN THE PACKAGING INDUSTRY CAN ENTAIL SUBSTANTIAL COST-RELATED HURDLES, THEREBY POSING A LIMITATION ON THE MARKET'S GROWTH POTENTIAL

-

OPPORTUNITY

- CONSUMERS ARE INCREASINGLY SEEKING PERSONALIZED AND CUSTOMIZED EXPERIENCES TOWARDS PACKING PRODUCTS

-

COVID-19 IMPACT ANALYSIS

- IMPACT ANALYSIS OF COVID 19 ON PACKAGING MATERIAL MARKET

- IMPACT ON OVERALL INDUSTRY

-

IMPACT ON THE SUPPLY CHAIN OF PACKAGING MATERIAL

-

IMPACT ON MARKET DEMAND

- IMPACT DUE TO RESTRICTION/LOCKDOWNS

- CONSUMER SENTIMENTS

- IMPACT ON PRICING

-

MARKET FACTOR ANALYSIS

-

SUPPLY CHAIN ANALYSIS

- RAW MATERIAL SUPPLY

- MANUFACTURE & ASSEMBLY

- SALES & DISTRIBUTION

- END USE

-

PORTER’S FIVE FORCE MODLE

- THREAT OF NEW ENTRY:

- BARGAINING POWER OF SUPPLIER:

- THREAT OF SUBSTITUTES

- BARGAINING POWER OF BUYERS

- INTENSITY OF RIVALRY

-

GLOBAL PACKAGING MATERIAL MARKET, BY MATERIAL

-

OVERVIEW

-

PAPER AND PAPERBOARD

-

RIGID PLASTICS

-

METAL

-

FLEXIBLE PLASTICS

-

GLASS

-

WOOD

-

OTHERS

-

GLOBAL PACKAGING MATERIAL MARKET, BY PRODUCT

-

OVERVIEW

-

CONTAINERS AND JARS

-

BAGS AND SACKS

-

POUCHES

-

CLOSURES AND LIDS

-

FILMS AND WRAPS

-

DRUMS & IBCS

-

BOXES & CARTONS

-

CRATES AND PALLETS

-

OTHERS

-

GLOBAL PACKAGING MATERIAL MARKET, BY LEVEL OF PACKAGING

-

OVERVIEW

-

PRIMARY PACKAGING

-

SECONDARY PACKAGING

-

TERTIARY PACKAGING

-

GLOBAL PACKAGING MATERIAL MARKET, BY END USE INDUSTRY

-

OVERVIEW

-

FOOD & BEVERAGES

-

PHARMACEUTICALS AND HEALTHCARE

-

PERSONAL CARE AND COSMETICS

-

AUTOMOTIVE

-

ELECTRICAL AND ELECTRONICS

-

CHEMICALS

-

HOUSEHOLD PRODUCTS

-

OTHERS

-

GLOBAL PACKAGING MATERIAL MARKET, BY REGION

-

OVERVIEW

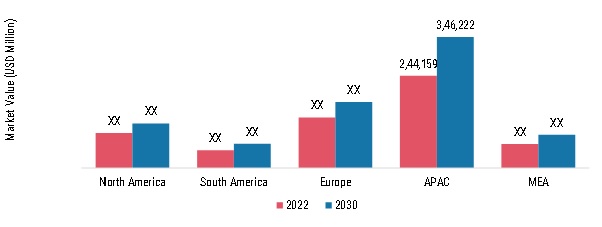

- GLOBAL PACKAGING MATERIAL MARKET, BY REGION, 2018–2030

-

NORTH AMERICA

- NORTH AMERICA: PACKAGING MATERIAL MARKET, BY COUNTRY, 2018–2030

- NORTH AMERICA: PACKAGING MATERIAL MARKET, BY MATERIAL, 2018–2030

- NORTH AMERICA: PACKAGING MATERIAL MARKET, BY PRODUCT, 2018–2030

- NORTH AMERICA: PACKAGING MATERIAL MARKET, BY LEVEL OF PACKAGING, 2018–2030

- NORTH AMERICA: PACKAGING MATERIAL MARKET, BY END USE INDUSTRY, 2018–2030

- USA: PACKAGING MATERIAL MARKET, BY MATERIAL, 2018–2030

- USA: PACKAGING MATERIAL MARKET, BY PRODUCT, 2018–2030

- USA: PACKAGING MATERIAL MARKET, BY LEVEL OF PACKAGING, 2018–2030

- USA: PACKAGING MATERIAL MARKET, BY END USE INDUSTRY, 2018–2030

- CANADA: PACKAGING MATERIAL MARKET, BY MATERIAL, 2018–2030

- CANADA: PACKAGING MATERIAL MARKET, BY PRODUCT, 2018–2030

- CANADA: PACKAGING MATERIAL MARKET, BY LEVEL OF PACKAGING, 2018–2030

- CANADA: PACKAGING MATERIAL MARKET, BY END USE INDUSTRY, 2018–2030

- MEXICO: PACKAGING MATERIAL MARKET, BY MATERIAL, 2018–2030

- MEXICO: PACKAGING MATERIAL MARKET, BY PRODUCT, 2018–2030

- MEXICO: PACKAGING MATERIAL MARKET, BY LEVEL OF PACKAGING, 2018–2030

- MEXICO: PACKAGING MATERIAL MARKET, BY END USE INDUSTRY, 2018–2030

-

SOUTH AMERICA

- SOUTH AMERICA: PACKAGING MATERIAL MARKET, BY COUNTRY, 2018–2030

- SOUTH AMERICA: PACKAGING MATERIAL MARKET, BY MATERIAL, 2018–2030

- SOUTH AMERICA: PACKAGING MATERIAL MARKET, BY PRODUCT, 2018–2030

- SOUTH AMERICA: PACKAGING MATERIAL MARKET, BY LEVEL OF PACKAGING, 2018–2030

- SOUTH AMERICA: PACKAGING MATERIAL MARKET, BY END USE INDUSTRY, 2018–2030

- BRAZIL: PACKAGING MATERIAL MARKET, BY MATERIAL, 2018–2030

- BRAZIL: PACKAGING MATERIAL MARKET, BY PRODUCT, 2018–2030

- BRAZIL: PACKAGING MATERIAL MARKET, BY LEVEL OF PACKAGING, 2018–2030

- BRAZIL: PACKAGING MATERIAL MARKET, BY END USE INDUSTRY, 2018–2030

- ARGENTINA: PACKAGING MATERIAL MARKET, BY MATERIAL, 2018–2030

- ARGENTINA: PACKAGING MATERIAL MARKET, BY PRODUCT, 2018–2030

- ARGENTINA: PACKAGING MATERIAL MARKET, BY LEVEL OF PACKAGING, 2018–2030

- ARGENTINA: PACKAGING MATERIAL MARKET, BY END USE INDUSTRY, 2018–2030

- REST OF SA: PACKAGING MATERIAL MARKET, BY MATERIAL, 2018–2030

- REST OF SA: PACKAGING MATERIAL MARKET, BY PRODUCT, 2018–2030

- REST OF SA: PACKAGING MATERIAL MARKET, BY LEVEL OF PACKAGING, 2018–2030

- REST OF SA: PACKAGING MATERIAL MARKET, BY END USE INDUSTRY, 2018–2030

-

EUROPE

- EUROPE: PACKAGING MATERIAL MARKET, BY COUNTRY, 2018–2030

- EUROPE: PACKAGING MATERIAL MARKET, BY MATERIAL, 2018–2030

- EUROPE: PACKAGING MATERIAL MARKET, BY PRODUCT, 2018–2030

- EUROPE: PACKAGING MATERIAL MARKET, BY LEVEL OF PACKAGING, 2018–2030

- EUROPE: PACKAGING MATERIAL MARKET, BY END USE INDUSTRY, 2018–2030

- GERMANY: PACKAGING MATERIAL MARKET, BY MATERIAL, 2018–2030

- GERMANY: PACKAGING MATERIAL MARKET, BY PRODUCT, 2018–2030

- GERMANY: PACKAGING MATERIAL MARKET, BY LEVEL OF PACKAGING, 2018–2030

- GERMANY: PACKAGING MATERIAL MARKET, BY END USE INDUSTRY, 2018–2030

- FRANCE: PACKAGING MATERIAL MARKET, BY MATERIAL, 2018–2030

- FRANCE: PACKAGING MATERIAL MARKET, BY PRODUCT, 2018–2030

- FRANCE: PACKAGING MATERIAL MARKET, BY LEVEL OF PACKAGING, 2018–2030

- FRANCE: PACKAGING MATERIAL MARKET, BY END USE INDUSTRY, 2018–2030

- UK: PACKAGING MATERIAL MARKET, BY MATERIAL, 2018–2030

- UK: PACKAGING MATERIAL MARKET, BY PRODUCT, 2018–2030

- UK: PACKAGING MATERIAL MARKET, BY LEVEL OF PACKAGING, 2018–2030

- UK: PACKAGING MATERIAL MARKET, BY END USE INDUSTRY, 2018–2030

- ITALY: PACKAGING MATERIAL MARKET, BY MATERIAL, 2018–2030

- ITALY: PACKAGING MATERIAL MARKET, BY PRODUCT, 2018–2030

- ITALY: PACKAGING MATERIAL MARKET, BY LEVEL OF PACKAGING, 2018–2030

- ITALY: PACKAGING MATERIAL MARKET, BY END USE INDUSTRY, 2018–2030

- REST OF EUROPE: PACKAGING MATERIAL MARKET, BY MATERIAL, 2018–2030

- REST OF EUROPE: PACKAGING MATERIAL MARKET, BY PRODUCT, 2018–2030

- REST OF EUROPE: PACKAGING MATERIAL MARKET, BY LEVEL OF PACKAGING, 2018–2030

- REST OF EUROPE: PACKAGING MATERIAL MARKET, BY END USE INDUSTRY, 2018–2030

-

ASIA PACIFIC

- ASIA PACIFIC: PACKAGING MATERIAL MARKET, BY COUNTRY, 2018–2030

- ASIA PACIFIC: PACKAGING MATERIAL MARKET, BY MATERIAL, 2018–2030

- ASIA PACIFIC: PACKAGING MATERIAL MARKET, BY PRODUCT, 2018–2030

- ASIA PACIFIC: PACKAGING MATERIAL MARKET, BY LEVEL OF PACKAGING, 2018–2030

- ASIA PACIFIC: PACKAGING MATERIAL MARKET, BY END USE INDUSTRY, 2018–2030

- CHINA: PACKAGING MATERIAL MARKET, BY MATERIAL, 2018–2030

- CHINA: PACKAGING MATERIAL MARKET, BY PRODUCT, 2018–2030

- CHINA: PACKAGING MATERIAL MARKET, BY LEVEL OF PACKAGING, 2018–2030

- CHINA: PACKAGING MATERIAL MARKET, BY END USE INDUSTRY, 2018–2030

- INDIA: PACKAGING MATERIAL MARKET, BY MATERIAL, 2018–2030

- INDIA: PACKAGING MATERIAL MARKET, BY PRODUCT, 2018–2030

- INDIA: PACKAGING MATERIAL MARKET, BY LEVEL OF PACKAGING, 2018–2030

- INDIA: PACKAGING MATERIAL MARKET, BY END USE INDUSTRY, 2018–2030

- JAPAN: PACKAGING MATERIAL MARKET, BY MATERIAL, 2018–2030

- JAPAN: PACKAGING MATERIAL MARKET, BY PRODUCT, 2018–2030

- JAPAN: PACKAGING MATERIAL MARKET, BY LEVEL OF PACKAGING, 2018–2030

- JAPAN: PACKAGING MATERIAL MARKET, BY END USE INDUSTRY, 2018–2030

- REST OF ASIA PACIFIC: PACKAGING MATERIAL MARKET, BY MATERIAL, 2018–2030

- REST OF ASIA PACIFIC: PACKAGING MATERIAL MARKET, BY PRODUCT, 2018–2030

- REST OF ASIA PACIFIC: PACKAGING MATERIAL MARKET, BY LEVEL OF PACKAGING, 2018–2030

- REST OF ASIA PACIFIC: PACKAGING MATERIAL MARKET, BY END USE INDUSTRY, 2018–2030

-

MIDDLE EAST & AFRICA

- MIDDLE EAST & AFRICA: PACKAGING MATERIAL MARKET, BY COUNTRY, 2018–2030

- MIDDLE EAST & AFRICA: PACKAGING MATERIAL MARKET, BY MATERIAL, 2018–2030

- MIDDLE EAST & AFRICA: PACKAGING MATERIAL MARKET, BY PRODUCT, 2018–2030

- MIDDLE EAST & AFRICA: PACKAGING MATERIAL MARKET, BY LEVEL OF PACKAGING, 2018–2030

- MIDDLE EAST & AFRICA: PACKAGING MATERIAL MARKET, BY END USE INDUSTRY, 2018–2030

- SAUDI ARABIA: PACKAGING MATERIAL MARKET, BY MATERIAL, 2018–2030

- SAUDI ARABIA: PACKAGING MATERIAL MARKET, BY PRODUCT, 2018–2030

- SAUDI ARABIA: PACKAGING MATERIAL MARKET, BY LEVEL OF PACKAGING, 2018–2030

- SAUDI ARABIA: PACKAGING MATERIAL MARKET, BY END USE INDUSTRY, 2018–2030

- UAE: PACKAGING MATERIAL MARKET, BY MATERIAL, 2018–2030

- UAE: PACKAGING MATERIAL MARKET, BY PRODUCT, 2018–2030

- UAE: PACKAGING MATERIAL MARKET, BY LEVEL OF PACKAGING, 2018–2030

- UAE: PACKAGING MATERIAL MARKET, BY END USE INDUSTRY, 2018–2030

- SOUTH AFRICA: PACKAGING MATERIAL MARKET, BY MATERIAL, 2018–2030

- SOUTH AFRICA: PACKAGING MATERIAL MARKET, BY PRODUCT, 2018–2030

- SOUTH AFRICA: PACKAGING MATERIAL MARKET, BY LEVEL OF PACKAGING, 2018–2030

- SOUTH AFRICA: PACKAGING MATERIAL MARKET, BY END USE INDUSTRY, 2018–2030

- REST OF MIDDLE EAST & AFRICA: PACKAGING MATERIAL MARKET, BY MATERIAL, 2018–2030

- REST OF MIDDLE EAST & AFRICA: PACKAGING MATERIAL MARKET, BY PRODUCT, 2018–2030

- REST OF MIDDLE EAST & AFRICA: PACKAGING MATERIAL MARKET, BY LEVEL OF PACKAGING, 2018–2030

- REST OF MIDDLE EAST & AFRICA: PACKAGING MATERIAL MARKET, BY END USE INDUSTRY, 2018–2030

-

COMPETITIVE LANDSCAPE

-

INTRODUCTION

-

COMPETITIVE BENCHMARKING

-

MARKET SHARE ANALYSIS

-

KEY DEVELOPMENTS & GROWTH STRATEGIES

- PRODUCT LAUNCH

- ACQUISITION

- PARTNERSHIP

- EXPANSION

- CERTIFICATION

- INVESTMENT

- AWARD

- ANNOUNCEMENT

- INNOVATION

-

COMPANY PROFILES

-

AMCOR PLC

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS/SERVICES OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

MONDI PLC

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS/SERVICES OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

SEALED AIR CORPORATION

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

A-ROO COMPANY LLC

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

FLEXPAK SERVICES

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

AMERPLAST

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

AJOVER S.A.S.

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

OLIVER PACKAGING & EQUIPMENT COMPANY

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

3M

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

GRAHAM PACKAGING COMPANY

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

TETRA PAK GROUP

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

HONEYWELL INTERNATIONAL INC.

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

INTERNATIONAL PAPER

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

SONOCO PRODUCTS COMPANY

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

WESTROCK COMPANY

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

DS SMITH

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

BERRY GLOBAL

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

AVERY DENNISON CORPORATION

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

CCL INDUSTRIES INC

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

MAYR-MELNHOF KARTON AG

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

PROAMPAC

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

-

LIST OF TABLES

-

LIST OF ASSUMPTIONS

-

MIDDLE CLASS POPULATION

-

MIDDLE CLASS PEOPLE SPENDING

-

GLOBAL PACKAGING MATERIAL MARKET, BY MATERIAL, 2018–2030 (USD MILLION)

-

GLOBAL PACKAGING MATERIAL MARKET, BY PRODUCT, 2018–2030 (USD MILLION)

-

GLOBAL PACKAGING MATERIAL MARKET, BY LEVEL OF PACKAGING, 2018–2030 (USD MILLION)

-

GLOBAL PACKAGING MATERIAL MARKET, BY END USE INDUSTRY, 2018–2030 (USD MILLION)

-

GLOBAL PACKAGING MATERIAL MARKET, BY REGION, 2018–2030 (USD MILLION)

-

NORTH AMERICA: PACKAGING MATERIAL MARKET, BY COUNTRY, 2018–2030 (USD MILLION)

-

NORTH AMERICA: PACKAGING MATERIAL MARKET, BY MATERIAL, 2018–2030 (USD MILLION)

-

NORTH AMERICA: PACKAGING MATERIAL MARKET, BY PRODUCT, 2018–2030 (USD MILLION)

-

NORTH AMERICA PACKAGING MATERIAL MARKET, BY LEVEL OF PACKAGING, 2018–2030 (USD MILLION)

-

NORTH AMERICA PACKAGING MATERIAL MARKET, BY END USE INDUSTRY, 2018–2030 (USD MILLION)

-

USA: PACKAGING MATERIAL MARKET, BY MATERIAL, 2018–2030 (USD MILLION)

-

USA: PACKAGING MATERIAL MARKET, BY PRODUCT, 2018–2030 (USD MILLION)

-

USA PACKAGING MATERIAL MARKET, BY LEVEL OF PACKAGING, 2018–2030 (USD MILLION)

-

USA PACKAGING MATERIAL MARKET, BY END USE INDUSTRY, 2018–2030 (USD MILLION)

-

CANADA: PACKAGING MATERIAL MARKET, BY MATERIAL, 2018–2030 (USD MILLION)

-

CANADA: PACKAGING MATERIAL MARKET, BY PRODUCT, 2018–2030 (USD MILLION)

-

CANADA PACKAGING MATERIAL MARKET, BY LEVEL OF PACKAGING, 2018–2030 (USD MILLION)

-

CANADA PACKAGING MATERIAL MARKET, BY END USE INDUSTRY, 2018–2030 (USD MILLION)

-

MEXICO: PACKAGING MATERIAL MARKET, BY MATERIAL, 2018–2030 (USD MILLION)

-

MEXICO: PACKAGING MATERIAL MARKET, BY PRODUCT, 2018–2030 (USD MILLION)

-

MEXICO PACKAGING MATERIAL MARKET, BY LEVEL OF PACKAGING, 2018–2030 (USD MILLION)

-

MEXICO PACKAGING MATERIAL MARKET, BY END USE INDUSTRY, 2018–2030 (USD MILLION)

-

SOUTH AMERICA: PACKAGING MATERIAL MARKET, BY COUNTRY, 2018–2030 (USD MILLION)

-

SOUTH AMERICA: PACKAGING MATERIAL MARKET, BY MATERIAL, 2018–2030 (USD MILLION)

-

SOUTH AMERICA: PACKAGING MATERIAL MARKET, BY PRODUCT, 2018–2030 (USD MILLION)

-

SOUTH AMERICA PACKAGING MATERIAL MARKET, BY LEVEL OF PACKAGING, 2018–2030 (USD MILLION)

-

SOUTH AMERICA PACKAGING MATERIAL MARKET, BY END USE INDUSTRY, 2018–2030 (USD MILLION)

-

BRAZIL: PACKAGING MATERIAL MARKET, BY MATERIAL, 2018–2030 (USD MILLION)

-

BRAZIL: PACKAGING MATERIAL MARKET, BY PRODUCT, 2018–2030 (USD MILLION)

-

BRAZIL PACKAGING MATERIAL MARKET, BY LEVEL OF PACKAGING, 2018–2030 (USD MILLION)

-

BRAZIL PACKAGING MATERIAL MARKET, BY END USE INDUSTRY, 2018–2030 (USD MILLION)

-

ARGENTINA: PACKAGING MATERIAL MARKET, BY MATERIAL, 2018–2030 (USD MILLION)

-

ARGENTINA: PACKAGING MATERIAL MARKET, BY PRODUCT, 2018–2030 (USD MILLION)

-

ARGENTINA PACKAGING MATERIAL MARKET, BY LEVEL OF PACKAGING, 2018–2030 (USD MILLION)

-

ARGENTINA PACKAGING MATERIAL MARKET, BY END USE INDUSTRY, 2018–2030 (USD MILLION)

-

REST OF SA: PACKAGING MATERIAL MARKET, BY MATERIAL, 2018–2030 (USD MILLION)

-

REST OF SA: PACKAGING MATERIAL MARKET, BY PRODUCT, 2018–2030 (USD MILLION)

-

REST OF SA PACKAGING MATERIAL MARKET, BY LEVEL OF PACKAGING, 2018–2030 (USD MILLION)

-

REST OF SA PACKAGING MATERIAL MARKET, BY END USE INDUSTRY, 2018–2030 (USD MILLION)

-

EUROPE: PACKAGING MATERIAL MARKET, BY COUNTRY, 2018–2030 (USD MILLION)

-

EUROPE: PACKAGING MATERIAL MARKET, BY MATERIAL, 2018–2030 (USD MILLION)

-

EUROPE: PACKAGING MATERIAL MARKET, BY PRODUCT, 2018–2030 (USD MILLION)

-

EUROPE PACKAGING MATERIAL MARKET, BY LEVEL OF PACKAGING, 2018–2030 (USD MILLION)

-

EUROPE PACKAGING MATERIAL MARKET, BY END USE INDUSTRY, 2018–2030 (USD MILLION)

-

GERMANY: PACKAGING MATERIAL MARKET, BY MATERIAL, 2018–2030 (USD MILLION)

-

GERMANY: PACKAGING MATERIAL MARKET, BY PRODUCT, 2018–2030 (USD MILLION)

-

GERMANY PACKAGING MATERIAL MARKET, BY LEVEL OF PACKAGING, 2018–2030 (USD MILLION)

-

GERMANY PACKAGING MATERIAL MARKET, BY END USE INDUSTRY, 2018–2030 (USD MILLION)

-

FRANCE: PACKAGING MATERIAL MARKET, BY MATERIAL, 2018–2030 (USD MILLION)

-

FRANCE: PACKAGING MATERIAL MARKET, BY PRODUCT, 2018–2030 (USD MILLION)

-

FRANCE PACKAGING MATERIAL MARKET, BY LEVEL OF PACKAGING, 2018–2030 (USD MILLION)

-

FRANCE PACKAGING MATERIAL MARKET, BY END USE INDUSTRY, 2018–2030 (USD MILLION)

-

UK: PACKAGING MATERIAL MARKET, BY MATERIAL, 2018–2030 (USD MILLION)

-

UK: PACKAGING MATERIAL MARKET, BY PRODUCT, 2018–2030 (USD MILLION)

-

UK PACKAGING MATERIAL MARKET, BY LEVEL OF PACKAGING, 2018–2030 (USD MILLION)

-

UK PACKAGING MATERIAL MARKET, BY END USE INDUSTRY, 2018–2030 (USD MILLION)

-

ITALY: PACKAGING MATERIAL MARKET, BY MATERIAL, 2018–2030 (USD MILLION)

-

ITALY: PACKAGING MATERIAL MARKET, BY PRODUCT, 2018–2030 (USD MILLION)

-

ITALY PACKAGING MATERIAL MARKET, BY LEVEL OF PACKAGING, 2018–2030 (USD MILLION)

-

ITALY PACKAGING MATERIAL MARKET, BY END USE INDUSTRY, 2018–2030 (USD MILLION)

-

REST OF EUROPE: PACKAGING MATERIAL MARKET, BY MATERIAL, 2018–2030 (USD MILLION)

-

REST OF EUROPE: PACKAGING MATERIAL MARKET, BY PRODUCT, 2018–2030 (USD MILLION)

-

REST OF EUROPE PACKAGING MATERIAL MARKET, BY LEVEL OF PACKAGING, 2018–2030 (USD MILLION)

-

REST OF EUROPE PACKAGING MATERIAL MARKET, BY END USE INDUSTRY, 2018–2030 (USD MILLION)

-

ASIA PACIFIC: PACKAGING MATERIAL MARKET, BY COUNTRY, 2018–2030 (USD MILLION)

-

ASIA PACIFIC: PACKAGING MATERIAL MARKET, BY MATERIAL, 2018–2030 (USD MILLION)

-

ASIA PACIFIC: PACKAGING MATERIAL MARKET, BY PRODUCT, 2018–2030 (USD MILLION)

-

ASIA PACIFIC PACKAGING MATERIAL MARKET, BY LEVEL OF PACKAGING, 2018–2030 (USD MILLION)

-

ASIA PACIFIC PACKAGING MATERIAL MARKET, BY END USE INDUSTRY, 2018–2030 (USD MILLION)

-

CHINA: PACKAGING MATERIAL MARKET, BY MATERIAL, 2018–2030 (USD MILLION)

-

CHINA: PACKAGING MATERIAL MARKET, BY PRODUCT, 2018–2030 (USD MILLION)

-

CHINA PACKAGING MATERIAL MARKET, BY LEVEL OF PACKAGING, 2018–2030 (USD MILLION)

-

CHINA PACKAGING MATERIAL MARKET, BY END USE INDUSTRY, 2018–2030 (USD MILLION)

-

INDIA: PACKAGING MATERIAL MARKET, BY MATERIAL, 2018–2030 (USD MILLION)

-

INDIA: PACKAGING MATERIAL MARKET, BY PRODUCT, 2018–2030 (USD MILLION)

-

INDIA PACKAGING MATERIAL MARKET, BY LEVEL OF PACKAGING, 2018–2030 (USD MILLION)

-

INDIA PACKAGING MATERIAL MARKET, BY END USE INDUSTRY, 2018–2030 (USD MILLION)

-

JAPAN: PACKAGING MATERIAL MARKET, BY MATERIAL, 2018–2030 (USD MILLION)

-

JAPAN: PACKAGING MATERIAL MARKET, BY PRODUCT, 2018–2030 (USD MILLION)

-

JAPAN PACKAGING MATERIAL MARKET, BY LEVEL OF PACKAGING, 2018–2030 (USD MILLION)

-

JAPAN PACKAGING MATERIAL MARKET, BY END USE INDUSTRY, 2018–2030 (USD MILLION)

-

REST OF ASIA PACIFIC: PACKAGING MATERIAL MARKET, BY MATERIAL, 2018–2030 (USD MILLION)

-

REST OF ASIA PACIFIC: PACKAGING MATERIAL MARKET, BY PRODUCT, 2018–2030 (USD MILLION)

-

REST OF ASIA PACIFIC PACKAGING MATERIAL MARKET, BY LEVEL OF PACKAGING, 2018–2030 (USD MILLION)

-

REST OF ASIA PACIFIC PACKAGING MATERIAL MARKET, BY END USE INDUSTRY, 2018–2030 (USD MILLION)

-

MIDDLE EAST & AFRICA: PACKAGING MATERIAL MARKET, BY COUNTRY, 2018–2030 (USD MILLION)

-

MIDDLE EAST & AFRICA: PACKAGING MATERIAL MARKET, BY MATERIAL, 2018–2030 (USD MILLION)

-

MIDDLE EAST & AFRICA: PACKAGING MATERIAL MARKET, BY PRODUCT, 2018–2030 (USD MILLION)

-

MIDDLE EAST & AFRICA PACKAGING MATERIAL MARKET, BY LEVEL OF PACKAGING, 2018–2030 (USD MILLION)

-

MIDDLE EAST & AFRICA PACKAGING MATERIAL MARKET, BY END USE INDUSTRY, 2018–2030 (USD MILLION)

-

SAUDI ARABIA: PACKAGING MATERIAL MARKET, BY MATERIAL, 2018–2030 (USD MILLION)

-

SAUDI ARABIA: PACKAGING MATERIAL MARKET, BY PRODUCT, 2018–2030 (USD MILLION)

-

SAUDI ARABIA PACKAGING MATERIAL MARKET, BY LEVEL OF PACKAGING, 2018–2030 (USD MILLION)

-

SAUDI ARABIA PACKAGING MATERIAL MARKET, BY END USE INDUSTRY, 2018–2030 (USD MILLION)

-

UAE: PACKAGING MATERIAL MARKET, BY MATERIAL, 2018–2030 (USD MILLION)

-

UAE: PACKAGING MATERIAL MARKET, BY PRODUCT, 2018–2030 (USD MILLION)

-

UAE PACKAGING MATERIAL MARKET, BY LEVEL OF PACKAGING, 2018–2030 (USD MILLION)

-

UAE PACKAGING MATERIAL MARKET, BY END USE INDUSTRY, 2018–2030 (USD MILLION)

-

SOUTH AFRICA: PACKAGING MATERIAL MARKET, BY MATERIAL, 2018–2030 (USD MILLION)

-

SOUTH AFRICA: PACKAGING MATERIAL MARKET, BY PRODUCT, 2018–2030 (USD MILLION)

-

SOUTH AFRICA PACKAGING MATERIAL MARKET, BY LEVEL OF PACKAGING, 2018–2030 (USD MILLION)

-

SOUTH AFRICA PACKAGING MATERIAL MARKET, BY END USE INDUSTRY, 2018–2030 (USD MILLION)

-

REST OF MIDDLE EAST & AFRICA: PACKAGING MATERIAL MARKET, BY MATERIAL, 2018–2030 (USD MILLION)

-

REST OF MIDDLE EAST & AFRICA: PACKAGING MATERIAL MARKET, BY PRODUCT, 2018–2030 (USD MILLION)

-

REST OF MIDDLE EAST & AFRICA PACKAGING MATERIAL MARKET, BY LEVEL OF PACKAGING, 2018–2030 (USD MILLION)

-

REST OF MIDDLE EAST & AFRICA PACKAGING MATERIAL MARKET, BY END USE INDUSTRY, 2018–2030 (USD MILLION)

-

PRODUCT LAUNCH

-

ACQUISITION

-

PARTNERSHIP

-

EXPANSION

-

CERTIFICATION

-

INVESTMENT

-

AWARD

-

ANNOUNCEMENT

-

INNOVATION

-

AMCOR PLC: PRODUCTS/SERVICES OFFERED

-

AMCOR PLC: KEY DEVELOPMENTS

-

MONDI PLC: PRODUCTS OFFERED

-

MONDI PLC: KEY DEVELOPMENTS

-

SEALED AIR CORPORATION: PRODUCTS OFFERED

-

SEALED AIR CORPORATION: KEY DEVELOPMENTS

-

A-ROO COMPANY LLC: PRODUCTS OFFERED

-

A-ROO COMPANY LLC: KEY DEVELOPMENTS

-

FLEXPAK SERVICES: PRODUCTS OFFERED

-

FLEXPAK SERVICES: KEY DEVELOPMENTS

-

AMERPLAST: PRODUCTS OFFERED

-

AMERPLAST: KEY DEVELOPMENTS

-

AJOVER S.A.S.: PRODUCTS OFFERED

-

OLIVER PACKAGING & EQUIPMENT COMPANY: PRODUCTS OFFERED

-

3M: PRODUCTS OFFERED

-

3M: KEY DEVELOPMENTS

-

GRAHAM PACKAGING COMPANY: PRODUCTS OFFERED

-

GRAHAM PACKAGING COMPANY: KEY DEVELOPMENTS

-

TETRA PAK GROUP: PRODUCTS OFFERED

-

TETRA PAK GROUP: KEY DEVELOPMENTS

-

HONEYWELL INTERNATIONAL INC.: PRODUCTS OFFERED

-

HONEYWELL INTERNATIONAL INC.: KEY DEVELOPMENTS

-

INTERNATIONAL PAPER: PRODUCTS OFFERED

-

INTERNATIONAL PAPER: KEY DEVELOPMENTS

-

SONOCO PRODUCTS COMPANY: PRODUCTS OFFERED

-

SONOCO PRODUCTS COMPANY: KEY DEVELOPMENTS

-

WESTROCK COMPANY: PRODUCTS OFFERED

-

WESTROCK COMPANY: KEY DEVELOPMENTS

-

DS SMITH: PRODUCTS OFFERED

-

DS SMITH: KEY DEVELOPMENTS

-

BERRY GLOBAL: PRODUCTS OFFERED

-

BERRY GLOBAL: KEY DEVELOPMENTS

-

AVERY DENNISON CORPORATION: PRODUCTS OFFERED

-

AVERY DENNISON CORPORATION: KEY DEVELOPMENTS

-

CCL INDUSTRIES INC.: PRODUCTS OFFERED

-

CCL INDUSTRIES INC.: KEY DEVELOPMENTS

-

MAYR-MELNHOF KARTON AG.: PRODUCTS OFFERED

-

MAYR-MELNHOF KARTON AG.: KEY DEVELOPMENTS

-

PROAMPAC: PRODUCTS OFFERED

-

PROAMPAC: KEY DEVELOPMENTS

-

-

LIST OF FIGURES

-

MARKET SYNOPSIS

-

GLOBAL PACKAGING MATERIAL MARKET ANALYSIS, BY MATERIAL, 2022

-

GLOBAL PACKAGING MATERIAL MARKET ANALYSIS, BY PRODUCT, 2022

-

GLOBAL PACKAGING MATERIAL MARKET ANALYSIS, BY LEVEL OF PACKAGING, 2022

-

GLOBAL PACKAGING MATERIAL MARKET ANALYSIS, BY END USE INDUSTRY, 2022

-

GLOBAL PACKAGING MATERIAL MARKET: STRUCTURE

-

KEY BUYING CRITERIA FOR PACKAGING MATERIAL

-

RESEARCH PROCESS OF MRFR

-

SEVERITY OF SHORTAGES BY BROAD OCCUPATION GROUP, 2022 (EUROPE REGION)

-

SUPPLY CHAIN ANALYSIS: GLOBAL PACKAGING MATERIAL MARKET

-

GLOBAL PACKAGING MATERIAL MARKET, BY MATERIAL, 2022 (% SHARE)

-

GLOBAL PACKAGING MATERIAL MARKET, BY MATERIAL, 2018–2030 (USD MILLION)

-

GLOBAL PACKAGING MATERIAL MARKET, BY PRODUCT, 2022 (% SHARE)

-

GLOBAL PACKAGING MATERIAL MARKET, BY PRODUCT, 2018–2030 (USD MILLION)

-

GLOBAL PACKAGING MATERIAL MARKET, BY LEVEL OF PACKAGING, 2022 (% SHARE)

-

GLOBAL PACKAGING MATERIAL MARKET, BY LEVEL OF PACKAGING, 2018–2030 (USD MILLION)

-

GLOBAL PACKAGING MATERIAL MARKET, BY END USE INDUSTRY, 2022 (% SHARE)

-

GLOBAL PACKAGING MATERIAL MARKET, BY END USE INDUSTRY, 2018–2030 (USD MILLION)

-

GLOBAL PACKAGING MATERIAL MARKET, BY REGION, 2022 (% SHARE)

-

GLOBAL PACKAGING MATERIAL MARKET, BY REGION, 2018 TO 2030 (USD MILLION)

-

NORTH AMERICA: PACKAGING MATERIAL MARKET SHARE, BY COUNTRY, 2022 (% SHARE)

-

SOUTH AMERICA: PACKAGING MATERIAL MARKET SHARE, BY COUNTRY, 2022 (% SHARE)

-

EUROPE: PACKAGING MATERIAL MARKET SHARE, BY COUNTRY, 2022 (% SHARE)

-

ASIA PACIFIC: PACKAGING MATERIAL MARKET SHARE, BY COUNTRY, 2022 (% SHARE)

-

MIDDLE EAST & AFRICA: PACKAGING MATERIAL MARKET SHARE, BY COUNTRY, 2022 (% SHARE)

-

GLOBAL PACKAGING MATERIAL MARKET SHARE ANALYSIS, 2022 %

-

AMCOR PLC: FINANCIAL OVERVIEW SNAPSHOT

-

AMCOR PLC: SWOT ANALYSIS

-

MONDI PLC: FINANCIAL OVERVIEW SNAPSHOT

-

MONDI PLC: SWOT ANALYSIS

-

SEALED AIR CORPORATION: FINANCIAL OVERVIEW SNAPSHOT

-

SEALED AIR CORPORATION: SWOT ANALYSIS

-

A-ROO COMPANY LLC: SWOT ANALYSIS

-

FLEXPAK SERVICES: SWOT ANALYSIS

-

AMERPLAST: SWOT ANALYSIS

-

AJOVER S.A.S.: SWOT ANALYSIS

-

OLIVER PACKAGING & EQUIPMENT COMPANY: SWOT ANALYSIS

-

3M: FINANCIAL OVERVIEW SNAPSHOT

-

3M: SWOT ANALYSIS

-

GRAHAM PACKAGING COMPANY: SWOT ANALYSIS

-

TETRA PAK GROUP: FINANCIAL OVERVIEW SNAPSHOT

-

TETRA PAK GROUP: SWOT ANALYSIS

-

HONEYWELL INTERNATIONAL INC.: FINANCIAL OVERVIEW SNAPSHOT

-

HONEYWELL INTERNATIO

Leave a Comment