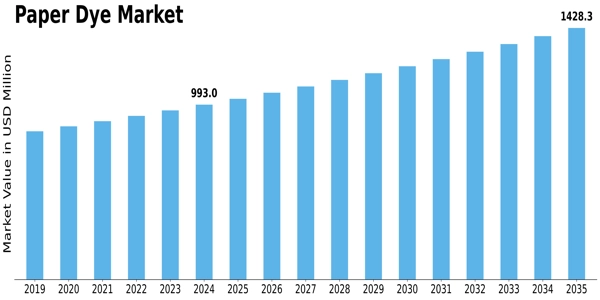

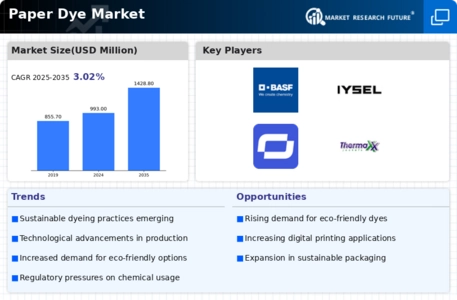

Market Growth Projections

The Global Paper Dye Market Industry is projected to experience substantial growth over the next decade. With a market value of 993.0 USD Million in 2024, the industry is expected to expand significantly, reaching an estimated 1428.8 USD Million by 2035. This growth trajectory indicates a compound annual growth rate (CAGR) of 3.36% from 2025 to 2035. Factors contributing to this growth include increasing demand for sustainable and specialty papers, advancements in dye production technologies, and heightened regulatory compliance. As these trends continue to evolve, the market is likely to witness a robust expansion, driven by both innovation and changing consumer preferences.

Sustainable Practices Driving Demand

The Global Paper Dye Market Industry is increasingly influenced by the shift towards sustainable practices. As environmental concerns gain prominence, manufacturers are adopting eco-friendly dyes derived from natural sources. This trend aligns with global initiatives aimed at reducing carbon footprints and promoting sustainability. For instance, companies are investing in plant-based dyes, which not only minimize environmental impact but also cater to consumer preferences for green products. The growing demand for sustainable packaging solutions further propels this market, as businesses seek to enhance their brand image while complying with regulatory standards. This shift is expected to contribute significantly to the market's growth trajectory.

Increasing Demand for Specialty Papers

The rising demand for specialty papers is a pivotal driver in the Global Paper Dye Market Industry. Specialty papers, which include products like coated papers, art papers, and packaging materials, require specific dye formulations to achieve desired aesthetics and performance. This trend is fueled by various sectors, including publishing, packaging, and stationery, which seek unique paper characteristics to differentiate their products. As consumer preferences evolve towards personalized and high-quality paper products, manufacturers are compelled to innovate and expand their dye offerings. This growing segment is anticipated to contribute to the market's expansion, with a projected CAGR of 3.36% from 2025 to 2035.

Market Dynamics and Competitive Landscape

The Global Paper Dye Market Industry is characterized by dynamic market conditions and a competitive landscape. Key players are continually adapting to changing consumer preferences and market demands, which influences their product offerings and pricing strategies. The competition among manufacturers fosters innovation, leading to the introduction of novel dye formulations and application techniques. Additionally, strategic partnerships and collaborations are becoming increasingly common as companies seek to enhance their market presence and expand their product lines. This competitive environment is likely to stimulate growth, with the market projected to reach 1428.8 USD Million by 2035, reflecting the industry's resilience and adaptability.

Regulatory Compliance and Safety Standards

Regulatory compliance and safety standards play a crucial role in shaping the Global Paper Dye Market Industry. Governments worldwide are implementing stringent regulations regarding the use of hazardous substances in dyes and chemicals. This regulatory landscape compels manufacturers to adopt safer alternatives and invest in research and development for compliant products. As a result, the market is witnessing a shift towards non-toxic and biodegradable dyes, which not only meet regulatory requirements but also align with consumer expectations for safety. This trend is expected to drive innovation and growth within the industry, as companies strive to enhance their product portfolios while adhering to safety standards.

Technological Advancements in Dye Production

Technological advancements are reshaping the Global Paper Dye Market Industry, enhancing production efficiency and dye quality. Innovations in dye formulation and application techniques enable manufacturers to produce a wider range of colors with improved performance characteristics. For example, the development of digital printing technologies allows for precise color matching and reduced waste, appealing to the growing customization trend in the paper industry. These advancements not only optimize resource utilization but also lower production costs, making high-quality dyes more accessible. As a result, the market is poised for growth, with projections indicating a market value of 993.0 USD Million in 2024.

Leave a Comment