-

EXECUTIVE SUMMARY 18

-

MARKET ATTRACTIVENESS

-

ANALYSIS 20

-

1.1.1

-

GLOBAL PEANUT FLAVOR MARKET, BY FLAVOR 21

-

GLOBAL PEANUT FLAVOR MARKET, BY PRODUCT 22

-

GLOBAL PEANUT FLAVOR

-

MARKET, BY APPLICATION 23

-

GLOBAL PEANUT FLAVOR MARKET, BY DISTRIBUTION CHANNEL 24

-

GLOBAL PEANUT FLAVOR

-

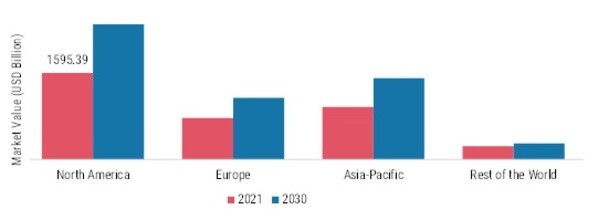

MARKET, BY REGION 25

-

1.1.6

-

GLOBAL PEANUT FLAVOURS MARKET, BY REGION 26

-

MARKET INTRODUCTION 27

-

DEFINITION 27

-

SCOPE OF THE STUDY 27

-

RESEARCH OBJECTIVE 27

-

MARKET STRUCTURE 28

-

KEY BUYING CRITERIA 29

-

RESEARCH METHODOLOGY 30

-

RESEARCH PROCESS 30

-

PRIMARY RESEARCH 31

-

SECONDARY RESEARCH 32

-

MARKET SIZE ESTIMATION 33

-

FORECAST MODEL 34

-

LIST OF ASSUMPTIONS & LIMITATIONS 35

-

MARKET DYNAMICS 36

-

INTRODUCTION 36

-

DRIVERS 37

- RISING DEMAND FOR

- EMERGING USE OF

- DRIVERS IMPACT ANALYSIS 38

-

PLANT-BASED FOODS 37

-

4.2.2

-

INCREASING INSTITUTIONAL RESEARCH FOR FLAVORING PRODUCTS ACROSS THE GLOBE 37

-

CHEMICAL-FREE INGREDIENTS IN THE FOOD INDUSTRY 37

-

RESTRAINTS 38

- INCIDENCE OF ALLERGIES

- RESTRAINTS IMPACT ANALYSIS 39

-

AND INTOLERANCE DUE TO PEANUT CONSUMPTION 38

-

OPPORTUNITIES 39

- PRODUCT LAUNCHES

-

AND INNOVATION 39

-

4.4.2

-

DEMAND FOR ORGANIC PEANUT FLAVOR PRODUCTS 39

-

CHALLENGES 40

- RISING INPUT COSTS IN PROCESSING PEANUT FLAVORS

- STRINGENT

-

40

-

GOVERNMENT REGULATIONS REGARDING FOOD ALLERGEN LABELING 40

-

MARKET FACTOR ANALYSIS 41

-

VALUE CHAIN ANALYSIS 41

- RAW MATERIAL PROCUREMENT 42

- PROCESSING 42

- PACKAGING 42

-

SUPPLY CHAIN ANALYSIS

-

43

-

PORTER’S

- BARGAINING POWER OF SUPPLIERS 45

- THREAT OF SUBSTITUTES 45

- BARGAINING POWER OF BUYERS

- INTENSITY

- IMPACT ON PRODUCTION 46

- IMPACT ON SUPPLY CHAIN 46

- IMPACT ON CONSUMER BUYING

-

FIVE FORCES MODEL 44

-

5.3.1

-

THREAT OF NEW ENTRANTS 44

-

45

-

OF RIVALRY 45

-

5.4

-

IMPACT OF COVID-19 ON THE GLOBAL PEANUT FLAVOR MARKET 46

-

BEHAVIOR 46

-

6

-

GLOBAL PEANUT FLAVOR MARKET, BY FLAVOR 47

-

OVERVIEW 47

- GLOBAL PEANUT FLAVOR MARKET ESTIMATES &

-

FORECAST, BY FLAVOR, 2022–2030 48

-

CHOCOLATE 48

- CHOCOLATE: MARKET ESTIMATES & FORECAST, BY REGION,

-

6.3

-

CARAMEL 49

-

6.3.1

-

CARAMEL: MARKET ESTIMATES & FORECAST, BY REGION, 2022–2030 49

-

OTHERS 49

- OTHERS: MARKET

-

ESTIMATES & FORECAST, BY REGION, 2022–2030 49

-

GLOBAL PEANUT FLAVOR MARKET, BY PRODUCT 50

-

OVERVIEW 50

- GLOBAL PEANUT FLAVOR

-

MARKET ESTIMATES & FORECAST, BY PRODUCT, 2022–2030 51

-

SNACKS 52

- SNACKS: MARKET ESTIMATES

-

& FORECAST, BY REGION, 2022–2030 52

-

BITES 53

- BITES: MARKET ESTIMATES & FORECAST, BY

-

REGION, 2022–2030 53

-

SPREADS 53

- SPREADS: MARKET ESTIMATES & FORECAST, BY REGION, 2022–2030

-

53

-

BISCUITS

- BISCUITS:

-

54

-

MARKET ESTIMATES & FORECAST, BY REGION, 2022–2030 54

-

TABLETS 55

- TABLETS: MARKET ESTIMATES

-

& FORECAST, BY REGION, 2022–2030 55

-

OTHERS 55

- OTHERS: MARKET ESTIMATES & FORECAST, BY

-

REGION, 2022–2030 55

-

GLOBAL PEANUT FLAVOR MARKET, BY APPLICATION 56

-

OVERVIEW 56

- GLOBAL PEANUT FLAVOR MARKET

-

ESTIMATES & FORECAST, BY APPLICATION, 2022–2030 57

-

BAKERY 57

- BAKERY: MARKET ESTIMATES & FORECAST, BY

-

REGION, 2022–2030 57

-

CONFECTIONARY 58

- CONFECTIONARY: MARKET ESTIMATES & FORECAST, BY REGION, 2022–2030

-

58

-

BUTTER

-

& SPREADS 59

-

8.4.1

-

BUTTER & SPREADS: MARKET ESTIMATES & FORECAST, BY REGION, 2022–2030

-

59

-

DAIRY

-

PRODUCTS 60

-

8.5.1

-

DAIRY PRODUCTS: MARKET ESTIMATES & FORECAST, BY REGION, 2022–2030 60

-

OTHERS 60

- OTHERS: MARKET

-

ESTIMATES & FORECAST, BY REGION, 2022–2030 60

-

GLOBAL PEANUT FLAVOR MARKET, BY DISTRIBUTION CHANNEL

-

61

-

OVERVIEW

- GLOBAL

-

61

-

PEANUT FLAVOR MARKET ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2022–2030

-

62

-

STORE-BASED

- STORE-BASED:

-

62

-

MARKET ESTIMATES & FORECAST, BY REGION, 2022–2030 62

-

NON-STORE-BASED 63

- NON-STORE-BASED:

-

MARKET ESTIMATES & FORECAST, BY REGION, 2022–2030 63

-

GLOBAL PEANUT FLAVOR MARKET,

-

BY REGION 64

-

10.1

-

OVERVIEW 64

-

10.2

-

NORTH AMERICA 66

-

10.2.1

-

US 68

-

10.2.2

-

CANADA 69

-

10.2.3

-

MEXICO 71

-

-

EUROPE 73

- GERMANY 75

- UK 76

- FRANCE 78

- SPAIN 79

- ITALY 80

- REST OF EUROPE

-

82

-

ASIA-PACIFIC

- JAPAN

- CHINA

- INDIA

- AUSTRALIA

-

84

-

87

-

88

-

90

-

& NEW ZEALAND 91

-

10.4.5

-

REST OF ASIA-PACIFIC 92

-

REST OF THE WORLD 94

- SOUTH AMERICA 96

- MIDDLE EAST 97

- AFRICA 99

-

GLOBAL PEANUT MARKET 101

-

COMPETITIVE LANDSCAPE 102

-

INTRODUCTION 102

- MARKET STRATEGY ANALYSIS 102

-

COMPETITIVE BENCHMARKING

- INDUSTRY EXPERIENCES 104

-

103

-

12.2.1

-

INTRODUCTION 103

-

12.2.2

-

PRODUCT PORTFOLIO 104

-

12.2.3

-

REGIONAL PRESENCE 104

-

12.2.4

-

STRATEGIC ALLIANCES 104

-

KEY DEVELOPMENTS & GROWTH STRATEGIES 104

- ACQUISITION 104

-

COMPANY PROFILES 105

-

FIRMENICH 105

- COMPANY OVERVIEW

- COMPANY OVERVIEW 108

- FINANCIAL OVERVIEW 108

- PRODUCTS OFFERED 108

- KEY DEVELOPMENTS 109

- SWOT ANALYSIS 109

- KEY STRATEGIES 109

-

105

-

13.1.2

-

FINANCIAL OVERVIEW 106

-

13.1.3

-

PRODUCTS OFFERED 106

-

13.1.4

-

KEY DEVELOPMENTS 107

-

13.1.5

-

SWOT ANALYSIS 107

-

13.1.6

-

KEY STRATEGIES 107

-

13.2

-

NATURE’S FLAVORS 108

-

ABELEI 110

- COMPANY OVERVIEW 110

- FINANCIAL OVERVIEW 110

- PRODUCTS OFFERED 110

- KEY DEVELOPMENTS 110

- SWOT ANALYSIS 111

- KEY STRATEGIES 111

-

S-WORLD FLAVOR & FRAGRANCES 112

- COMPANY OVERVIEW

- COMPANY OVERVIEW 114

- FINANCIAL OVERVIEW 114

- PRODUCTS OFFERED 114

- KEY DEVELOPMENTS 114

- SWOT ANALYSIS 115

- KEY STRATEGIES 115

-

112

-

13.4.2

-

FINANCIAL OVERVIEW 112

-

13.4.3

-

PRODUCTS OFFERED 112

-

13.4.4

-

KEY DEVELOPMENTS 112

-

13.4.5

-

SWOT ANALYSIS 113

-

13.4.6

-

KEY STRATEGIES 113

-

13.5

-

NORTHWESTERN EXTRACT 114

-

WEBER FLAVORS 116

- COMPANY OVERVIEW 116

- FINANCIAL OVERVIEW 116

- PRODUCTS OFFERED 116

- KEY DEVELOPMENTS 116

- KEY STRATEGIES 116

-

STRINGER FLAVOUR 117

- COMPANY OVERVIEW 117

- FINANCIAL OVERVIEW 117

- PRODUCTS OFFERED 117

- KEY DEVELOPMENTS 117

- KEY STRATEGIES 117

-

FLAVOURSOGOOD COMPANY 118

- COMPANY OVERVIEW 118

- FINANCIAL OVERVIEW

- COMPANY OVERVIEW 120

- FINANCIAL OVERVIEW 120

- PRODUCTS OFFERED 120

- KEY DEVELOPMENTS

-

118

-

13.8.3

-

PRODUCTS OFFERED 118

-

13.8.4

-

KEY DEVELOPMENTS 118

-

13.8.5

-

KEY STRATEGIES 118

-

13.9

-

LIONEL HITCHEN 119

-

13.9.1

-

COMPANY OVERVIEW 119

-

13.9.2

-

FINANCIAL OVERVIEW 119

-

13.9.3

-

PRODUCTS OFFERED 119

-

13.9.4

-

KEY DEVELOPMENTS 119

-

13.9.5

-

KEY STRATEGIES 119

-

13.10

-

FUXIONG FLAVORS & FRAGRANCES COMPANY 120

-

120

-

13.10.5

-

KEY STRATEGIES 120

-

14

-

COMPANY PROFILE FOR PEANUT MARKET 121

-

HAMPTON FARMS 121

- COMPANY OVERVIEW 121

- FINANCIAL OVERVIEW 121

- PRODUCTS OFFERED 121

- KEY DEVELOPMENTS 122

- SWOT ANALYSIS 122

- KEY STRATEGIES 122

-

VIRGINIA DINER 123

- COMPANY OVERVIEW 123

- FINANCIAL OVERVIEW 123

- PRODUCTS OFFERED 123

- KEY DEVELOPMENTS 123

- SWOT ANALYSIS 124

- KEY STRATEGIES 124

-

-

ARCHER-DANIELS-MIDLAND COMPANY (ADM) 125

- COMPANY OVERVIEW

- COMPANY OVERVIEW 129

- FINANCIAL OVERVIEW 129

- PRODUCTS OFFERED 129

- KEY DEVELOPMENTS 129

- SWOT ANALYSIS 130

- KEY STRATEGIES 130

-

125

-

14.3.2

-

FINANCIAL OVERVIEW 126

-

14.3.3

-

PRODUCTS OFFERED 127

-

14.3.4

-

KEY DEVELOPMENTS 127

-

14.3.5

-

SWOT ANALYSIS 128

-

14.3.6

-

KEY STRATEGIES 128

-

14.4

-

LONE TREE NUT COMPANY 129

-

STAR SNACKS 131

- COMPANY OVERVIEW 131

- FINANCIAL OVERVIEW 131

- PRODUCTS OFFERED 131

- KEY DEVELOPMENTS 131

- SWOT ANALYSIS 132

- KEY STRATEGIES 132

-

OLAM GROUP 133

- COMPANY OVERVIEW 133

- FINANCIAL OVERVIEW 133

- PRODUCTS OFFERED 134

- KEY DEVELOPMENTS 134

- SWOT ANALYSIS 135

- KEY STRATEGIES 135

-

THE GOOD SNACK COMPANY 136

- COMPANY OVERVIEW 136

- FINANCIAL OVERVIEW

-

136

-

14.7.3

-

PRODUCTS OFFERED 136

-

14.7.4

-

KEY DEVELOPMENTS 136

-

14.7.5

-

SWOT ANALYSIS 137

-

14.7.6

-

KEY STRATEGIES 137

-

15

-

REFERENCES 138

-

-

LIST OF OTHERS

-

PRIMARY INTERVIEWS

-

31

-

TABLE 2

-

LIST OF ASSUMPTIONS & LIMITATIONS 35

-

GLOBAL PEANUT FLAVOR MARKET ESTIMATES & FORECAST,

-

BY FLAVOR, 2022–2030 (EURO MILLION) 48

-

CHOCOLATE: MARKET ESTIMATES & FORECAST,

-

BY REGION, 2022–2030 (EURO MILLION) 48

-

CARAMEL: MARKET ESTIMATES & FORECAST,

-

BY REGION, 2022–2030 (EURO MILLION) 49

-

OTHERS: MARKET ESTIMATES & FORECAST,

-

BY REGION, 2022–2030 (EURO MILLION) 49

-

GLOBAL PEANUT FLAVOR MARKET ESTIMATES &

-

FORECAST, BY PRODUCT, 2022–2030 (EURO MILLION) 51

-

SNACKS: MARKET ESTIMATES & FORECAST,

-

BY REGION, 2022–2030 (EURO MILLION) 52

-

BITES: MARKET ESTIMATES & FORECAST, BY

-

REGION, 2022–2030 (EURO MILLION) 53

-

SPREADS: MARKET ESTIMATES & FORECAST,

-

BY REGION, 2022–2030 (EURO MILLION) 53

-

BISCUITS: MARKET ESTIMATES & FORECAST,

-

BY REGION, 2022–2030 (EURO MILLION) 54

-

TABLETS: MARKET ESTIMATES & FORECAST,

-

BY REGION, 2022–2030 (EURO MILLION) 55

-

OTHERS: MARKET ESTIMATES & FORECAST,

-

BY REGION, 2022–2030 (EURO MILLION) 55

-

GLOBAL PEANUT FLAVOR MARKET ESTIMATES &

-

FORECAST, BY APPLICATION, 2022–2030 (EURO MILLION) 57

-

BAKERY: MARKET ESTIMATES & FORECAST,

-

BY REGION, 2022–2030 (EURO MILLION) 57

-

CONFECTIONARY: MARKET ESTIMATES & FORECAST,

-

BY REGION, 2022–2030 (EURO MILLION) 58

-

BUTTER & SPREADS: MARKET ESTIMATES &

-

FORECAST, BY REGION, 2022–2030 (EURO MILLION) 59

-

DAIRY PRODUCTS: MARKET ESTIMATES & FORECAST,

-

BY REGION, 2022–2030 (EURO MILLION) 60

-

OTHERS: MARKET ESTIMATES & FORECAST,

-

BY REGION, 2022–2030 (EURO MILLION) 60

-

GLOBAL PEANUT FLAVOR MARKET ESTIMATES &

-

FORECAST, BY DISTRIBUTION CHANNEL, 2022–2030 (EURO MILLION) 62

-

STORE-BASED: MARKET

-

ESTIMATES & FORECAST, BY REGION, 2022–2030 (EURO MILLION) 62

-

NON-STORE-BASED:

-

MARKET ESTIMATES & FORECAST, BY REGION, 2022–2030 (EURO MILLION) 63

-

GLOBAL PEANUT

-

FLAVOR MARKET ESTIMATES & FORECAST, BY REGION, 2022–2030 (EURO MILLION)

-

65

-

TABLE 24

-

NORTH AMERICA: PEANUT FLAVOR MARKET ESTIMATES & FORECAST, BY COUNTRY, 2022–2030

-

(EURO MILLION) 66

-

TABLE

-

NORTH AMERICA: PEANUT FLAVOR MARKET, BY FLAVOR, 2022–2030 (EURO MILLION)

-

67

-

TABLE 26

-

NORTH AMERICA: PEANUT FLAVOR MARKET, BY PRODUCT, 2022–2030 (EURO MILLION)

-

67

-

TABLE 27

-

NORTH AMERICA: PEANUT FLAVOR MARKET, BY APPLICATION, 2022–2030 (EURO MILLION)

-

67

-

TABLE 28

-

NORTH AMERICA: PEANUT FLAVOR MARKET, BY DISTRIBUTION CHANNEL, 2022–2030 (EURO

-

MILLION) 68

-

TABLE

-

US: PEANUT FLAVOR MARKET, BY FLAVOR, 2022–2030 (EURO MILLION) 68

-

US: PEANUT FLAVOR

-

MARKET, BY PRODUCT, 2022–2030 (EURO MILLION) 68

-

US: PEANUT FLAVOR MARKET, BY APPLICATION,

-

US: PEANUT FLAVOR MARKET, BY DISTRIBUTION CHANNEL, 2022–2030

-

(EURO MILLION) 69

-

TABLE

-

CANADA: PEANUT FLAVOR MARKET, BY FLAVOR, 2022–2030 (EURO MILLION) 69

-

CANADA: PEANUT

-

FLAVOR MARKET, BY PRODUCT, 2022–2030 (EURO MILLION) 70

-

CANADA: PEANUT FLAVOR MARKET, BY APPLICATION,

-

CANADA: PEANUT FLAVOR MARKET, BY DISTRIBUTION CHANNEL, 2022–2030

-

(EURO MILLION) 70

-

TABLE

-

MEXICO: PEANUT FLAVOR MARKET, BY FLAVOR, 2022–2030 (EURO MILLION) 71

-

MEXICO: PEANUT

-

FLAVOR MARKET, BY PRODUCT, 2022–2030 (EURO MILLION) 71

-

MEXICO: PEANUT FLAVOR MARKET, BY APPLICATION,

-

MEXICO: PEANUT FLAVOR MARKET, BY DISTRIBUTION CHANNEL, 2022–2030

-

(EURO MILLION) 72

-

TABLE

-

EUROPE: PEANUT FLAVOR MARKET ESTIMATES & FORECAST, BY COUNTRY, 2022–2030

-

(EURO MILLION) 73

Leave a Comment