PET Bottle Recycling Market Share

PET Bottle Recycling Market Research Report Information by Recycling Process (Mechanical, Chemical), By Application (Beverages, Personal Care, Pharmaceuticals, Consumer Goods, Others), And By Region (North America, Europe, Asia-Pacific, And Rest Of The World) - Forecast Till 2035

Market Summary

As per Market Research Future Analysis, the Global PET Bottle Recycling Market was valued at USD 5.10 billion in 2024 and is projected to grow to USD 8.82 billion by 2035, with a CAGR of 5.10% from 2025 to 2035. The market is primarily driven by the increasing demand for recycled PET in the packaging industry, particularly in food and beverages. Government initiatives aimed at promoting sustainable practices in the textile industry further bolster market growth. The mechanical recycling process dominates the market, accounting for 69.07% of the share in 2021, while the beverages segment leads in application, holding 40.69% of the market share.

Key Market Trends & Highlights

Key trends influencing the PET Bottle Recycling Market include government initiatives and technological advancements.

- Government initiatives for the textile industry are enhancing the demand for recycled polyester staple fiber. The mechanical recycling segment is expected to register a CAGR of 5.68% during the forecast period. The beverages application segment is projected to grow at a CAGR of 5.97%, driven by increased demand in packaging. North America accounted for 34.47% of the market share in 2021, with a projected CAGR of 5.04%.

Market Size & Forecast

| 2024 Market Size | USD 5.10 Billion |

| 2035 Market Size | USD 8.82 Billion |

| CAGR (2024-2035) | 5.10% |

| Largest Regional Market Share in 2021 | North America |

Major Players

<p>Indorama Ventures Public Company Limited, Plastipak Holdings, Inc., Schoeller Group, PFR Nord GmbH, PolyQuest, Phoenix Technologies, UltrePET, LLC, Krones AG, Sieu Japan Co., Ltd., Vanden Global Ltd.</p>

Market Trends

INCREASING GOVERNMENT INITIATIVES FOR THE TEXTILE INDUSTRY

PET/Polyester trash and previously used PET bottles are used to create recycled polyester staple fiber, a synthetic man-made fiber. It is utilized as a polyfill to stuff cushions, pillows, soft toys, and blankets as well as in the non-woven carpet, wadding, and filtration sectors. It is also employed in the production of geotextiles and yarn. Premium pillows, cushions, and blankets are made with hollow polyester staple fiber because it has exceptional durability capabilities. Recycling PET bottles and other PET waste is crucial to keeping the environment clean.

In the textile industry, PSF from PET Recycled Bottles composed of purified terephthalic acid, monoethylene glycol chips and other materials are employed in fabric manufacturing to enhance its durability. Federal governments across the globe are taking initiatives to promote the textile industry's development overall and sustainable growth, modernization, value addition, and export growth. The European Union's 2030 Vision for Textiles plan, for instance, intends to increase the textile industry's environmental friendliness, competitiveness, and resilience to global shocks.

The federal governments of African countries have also launched a number of initiatives to build new textile factories across the continent in order to increase textile production in the region.These programs aim to increase textile and garment production in Africa by 2030. Moreover, in India, The National Technical Textiles Mission (NTTM) and SAMARTH (Skill Development & Capacity Building) programs were started by the Indian government to improve the skills of weavers and craftsmen and enhance the skills of jobless youth in the textile industry.

Additionally, the Union Finance Ministry has been asked to maintain the current excise duty cost advantage of recycled PSF relative to virgin PSF while finalizing the GST rates. This request comes from the All India Recycled Fibre & Yarn Manufacturers Association, which represents 35 recycled polyester staple fiber (PSF) producers in India. This factor has ultimately enhanced driving the growth of the PET Bottle Recycling Market revenue.

<p>The increasing emphasis on sustainability and circular economy principles is driving innovations in PET bottle recycling technologies, which are essential for reducing plastic waste and enhancing resource efficiency.</p>

U.S. Environmental Protection Agency (EPA)

PET Bottle Recycling Market Market Drivers

Market Growth Projections

The Global PET Bottle Recycling Market Industry is poised for substantial growth, with projections indicating a market size of 8.82 USD Billion by 2035. This anticipated growth is underpinned by various factors, including increasing environmental awareness, regulatory support, and technological advancements. The market is expected to experience a CAGR of 5.11% from 2025 to 2035, reflecting the industry's resilience and adaptability in the face of evolving consumer preferences and regulatory landscapes. These projections highlight the potential for continued investment and innovation within the PET bottle recycling sector, positioning it as a critical component of the global sustainability agenda.

Growing Environmental Awareness

The Global PET Bottle Recycling Market Industry is witnessing a surge in environmental consciousness among consumers and businesses alike. As awareness of plastic pollution escalates, stakeholders are increasingly motivated to adopt sustainable practices. This shift is evidenced by initiatives aimed at reducing plastic waste and promoting recycling. For instance, various countries have implemented stringent regulations to curb single-use plastics, thereby enhancing the demand for recycled PET bottles. This growing environmental awareness is projected to contribute significantly to the market, with a valuation of 5.1 USD Billion in 2024, reflecting the industry's potential for growth.

Regulatory Support and Policies

Government policies play a crucial role in shaping the Global PET Bottle Recycling Market Industry. Numerous nations are enacting legislation that mandates recycling and sets ambitious targets for waste reduction. For example, the European Union has established directives that require member states to recycle at least 90 percent of PET bottles by 2029. Such regulatory frameworks not only incentivize recycling initiatives but also foster investments in recycling infrastructure. This supportive environment is likely to propel the market forward, with projections indicating a market size of 8.82 USD Billion by 2035, demonstrating the impact of regulatory measures on industry growth.

Consumer Preference for Sustainable Products

Consumer preferences are shifting towards sustainable products, significantly influencing the Global PET Bottle Recycling Market Industry. As consumers become more environmentally conscious, they actively seek products made from recycled materials. This trend is evident in the beverage industry, where brands are increasingly using recycled PET for their bottles. Companies that prioritize sustainability in their product offerings are likely to gain a competitive edge in the market. This consumer-driven demand for sustainable products is expected to further stimulate the growth of the PET recycling market, aligning with the broader movement towards environmental responsibility.

Rising Demand for Recycled PET in Manufacturing

The demand for recycled PET (rPET) in various manufacturing sectors is a significant driver of the Global PET Bottle Recycling Market Industry. Industries such as textiles, automotive, and packaging are increasingly incorporating rPET into their products, driven by sustainability goals and consumer preferences. For example, major brands are committing to using a higher percentage of recycled materials in their packaging to meet consumer expectations for eco-friendly products. This trend is likely to bolster the market, as the integration of rPET into manufacturing processes not only supports recycling efforts but also contributes to a circular economy.

Technological Advancements in Recycling Processes

Innovations in recycling technology are transforming the Global PET Bottle Recycling Market Industry. Advanced sorting and processing technologies enhance the efficiency of recycling operations, allowing for higher recovery rates of PET materials. For instance, the adoption of AI-driven sorting systems has shown promise in improving the accuracy of material separation, thereby increasing the quality of recycled PET. These technological advancements not only streamline operations but also reduce costs associated with recycling. As the industry embraces these innovations, the market is expected to grow at a CAGR of 5.11% from 2025 to 2035, reflecting the potential for enhanced recycling capabilities.

Market Segment Insights

PET Bottle Recycling Market by Recycling Process Insights

<p>The PET Bottle Recycling Market segmentation, based on Recycling Process, includes mechanical and chemical. The mechanical segment accounted for a larger market share of 69.07% in 2021, with a market value of USD 3,007.4 million; it is expected to register a higher CAGR of 5.68% during the forecast period in respect to the PET Bottle Recycling Market revenue. The starting stage of PET recycling involves the collection of bottles, which are primarily procured from curbsides. Collected plastic containers are delivered to a material recovery facility (MRF) or a plastics intermediate processing facility (IPC) to begin the recycling process.</p>

<p>MRFs integrate collected recyclables and separate them into respective material categories. In the reclaiming process, the impure material passes through a series of sorting and cleaning stages to separate required <a href="https://www.marketresearchfuture.com/reports/plastic-strapping-material-market-37375">plastic material</a> from others. The material derived from processing is known as clean flake. The clean flake or pellet is then processed into fiber, sheet, or compounded pellet and finally sold to end users for manufacturing new products.</p>

<p>November 2022: Plastipak announced the opening of its 5th recycling plant in Toledo, Spain, with a capacity of 20,000 tons of food-grade recycled pellets, which will help them eliminate resin transport-related emissions as the plant is located close to its existing preform manufacturing unit. The facility will recycle and produce PET flakes into food-grade PET (rPET) pellets suitable for use in preforms, bottles and containers for various end-use applications. The plant is equipped with advanced energy technologies and equipment which include 1800 photovoltaic solar panels to save up to 443 tons of CO2 per year.</p>

PET Bottle Recycling Market by Application Insights

<p>The PET Bottle Recycling Market segmentation, based on application, has been segmented into beverages, personal care, pharmaceutical, consumer goods, and others. The beverages segment accounted for the largest market share of 40.69% in 2021, with a market value of USD 1,771.74 million; it is expected to register a CAGR of 5.97% during the forecast period. The personal care segment accounted for the second largest market share in 2021, valued at USD 1,499.31 million; it is projected to exhibit a CAGR of 5.42% during the forecast period.</p>

<p>PET resin is primarily used to manufacture beverage bottles, with an estimated 90%–95% of all PET resin utilized for this application. The PET Bottle Recycling Market is expected to witness impressive growth due to the increase in demand in the packaging industry. Hence, the beverages application segment is expected to register the highest CAGR of 5.97% during the forecast period.</p>

<p>January 2022: Plastipak has expanded its recycling facility at Bascharage, Luxembourg by 136%. The recycling facility, which is adjacent to Plastipak's flagship preform and container manufacturing facility, converts washed rPET flakes from post-consumer bottles into food-grade recycled PET (rPET) pellets. Its rPET is converted into new preforms and containers at the Bascharage facility, which primarily serves the German and Benelux food and beverage markets.</p>

Get more detailed insights about PET Bottle Recycling Market Research Report - Global Forecast To 2032

Regional Insights

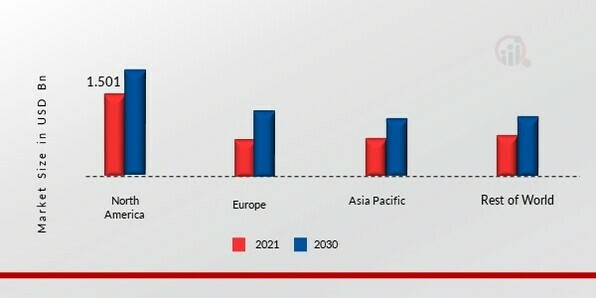

By Region, the PET Bottle Recycling Market has been segmented into North America, Europe, Asia-Pacific and Rest of the world. The North America segment accounted for the largest market share of 34.47% in 2021, with a market value of USD 1,501.00 million; it is expected to register a CAGR of 5.04% during the forecast period. The Europe segment accounted for the second largest market share in 2021, valued at USD 1,242.89 million; it is projected to exhibit a CAGR of 4.93% during the forecast period. Followed by the Asia-Pacific segment, which is expected to register a CAGR of 6.32%.

Further, the major countries studied are: The U.S, Canada, Mexico, Germany, France, UK, Spain, China, Japan, India, South America, Africa, and Middle East.

Figure 3: PET Bottle Recycling Market SHARE BY REGION 2021 (%)

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

North America PET bottle recycling market accounts for the largest market share and is expected to grow by a CAGR of 5.04%. One of the biggest marketplaces for PET bottle recycling worldwide is North America, which is followed by Europe. Significant product advances, the industrialization of PET recycling in the region, and the active involvement of the U.S., Mexico, and Canadian markets all contribute to the region's success. To sustain customer applications, suppliers are utilizing various material combinations.

Further, the US PET bottle recycling market dominated the regional PET bottle recycling market and will expect to grow by a CAGR of 5.31%, and the Canada PET bottle recycling market is expected to grow by a CAGR of 4.68% in North America region. For instance, US PET bottle recycling market is a major contributor in the regional PET bottle recycling market, Leading manufacturers and large companies driving the PET bottle recycling market in North America. The PET bottle recycling market is currently being driven by several factors.

The Europe PET bottle recycling Market is expected to grow at a CAGR of 4.93% from 2024 to 2030, due to the PET bottle recycling market currently being driven by several factors. Additionally, companies in this region are now adopting advanced machinery, which is coupled with the rise in the need for supply chain integration. This is driving the manufacturers towards automation solutions because of their ability to interact with the stakeholders and the optimization of complicated logistics schedules.

Moreover, Germany PET bottle recycling market held the largest market share, and the Spain PET bottle recycling market was the fastest growing market in the Europe region.

Key Players and Competitive Insights

Major market players are spending a lot of money on R&D to increase their product lines, which will help the PET bottle recycling market grow even more. Market participants are also taking a range of strategic initiatives to grow their worldwide footprint, including new product launches, contractual agreements, mergers and acquisitions, increased investments, and collaboration with other organizations. Competitors in the PET bottle recycling industry must offer cost-effective items to expand and survive in an increasingly competitive and rising market environment.

One of the primary business strategies adopted by manufacturers in the global PET bottle recycling industry to benefit clients and expand the PET bottle recycling market sector is to manufacture locally to reduce operating costs. The leading players, as mentioned above, are dominating the market due to their advanced product offerings, high industry experience, and geographic reach. These players may establish their presence worldwide through strategic partnerships and acquisitions during the forecast period. Players with access to better technologies can develop unique and innovative products and solutions, which could render the competitors’ offerings obsolete.

The competitive environment in the market is likely to intensify further due to technological advancements.

Indorama Ventures Public Company Limited (Indorama Ventures) is one of the leading PET manufacturers across the globe. It operates through three business segments: feedstock, PET, and fibers. The product offering of the company includes- recycled products, feedstock, PET, fibers, and packaging. It is one of the key players in polyesters fiber production in Thailand. Its recycled PET is primarily used as a raw material in the production of bottles, sheets, films, fibers, filaments, and other specialty products. The company's resins are used to make one out of every five PET bottles in the world.

Its PET resins are used in the packaging of beverages, food, pharmaceuticals, household goods, and industrial products. It is a global PET manufacturer, with 18 production plants spread across 11 countries and four continents. The company's subsidiaries include Auriga Polymers Inc., FiberVisions, L.P, Indorama Ventures Global Services Ltd., and Indorama Holdings Ltd.

Krones AG is a wholly owned subsidiary of Krones Group. Krones AG is engaged in developing and manufacturing machines, complete lines for recycled bottles, cans and related packaging, process technology, and intralogistics. It also offers IT solutions for the food and beverage industries. It offers process technology, dairy products, filling and packaging lines, intralogistics, IT solutions, and PET recycling systems. It primarily caters to the beverages industry. It works on two modules for PET recycling systems: the washing module and the decontamination module.

The company owns more than 5,000 patents; it also invested approximately USD 194 million in research and development activities in 2017. The company has a presence in the US and has bases in Germany, China, India, South Africa, UAE, and the UK. Its major production facility is located at Debrecen, Hungary.

Key Companies in the PET Bottle Recycling Market market include

Industry Developments

November 2022 Plastipak announced the opening of its 5th recycling plant in Toledo, Spain, with a capacity of 20,000 tons of food-grade recycled pellets, which will help them eliminate resin transport-related emissions as the plant is located close to its existing preform manufacturing unit. The facility will recycle and produce PET flakes into food-grade PET (rPET) pellets suitable for use in preforms, bottles and containers for various end-use applications. The plant is equipped with advanced energy technologies and equipments which include 1800 photovoltic solar panels to save upto 443 tons of CO2 per year.

October 2021 PolyQuest formed Renuva Plastics LLC a wholly owned subsidiary of PolyQuest dba Faith Group USA which acquired the USA division of Faith Group Company. The Faith Group is a premier distributor of post-industrial thermoplastics (especially PET). The acquisition has given PolyQuest significant access to virgin, post-industrial and post-consumer products through applications consuming resin such as bottle, sheet, film, textile staple fiber, textile filament, BCF, strapping, etc.

August 2020 Indorama Ventures acquired a 100% equity stake in industrie Maurizio Peruzzo Polowat spóka z ograniczonoci (IMP Polowat), which consists of two production sites in poland, bielsko-biala and leczyca. IMP Polowat recycles pet flakes and pellets from post-consumer PET. This facility provides an appealing recycling platform for IVL in eastern Europe, opening new opportunities to meet the growing demand for recycled PET and more sustainable packaging solutions.

Future Outlook

PET Bottle Recycling Market Future Outlook

<p>The PET Bottle Recycling Market is projected to grow at a 5.10% CAGR from 2025 to 2035, driven by increasing environmental regulations, consumer awareness, and technological advancements in recycling processes.</p>

New opportunities lie in:

- <p>Develop advanced sorting technologies to enhance recycling efficiency and reduce contamination. Invest in partnerships with beverage companies for closed-loop recycling initiatives. Explore innovative biodegradable alternatives to PET to capture emerging market segments.</p>

<p>By 2035, the PET Bottle Recycling Market is expected to be robust, reflecting substantial growth and innovation.</p>

Market Segmentation

PET Bottle Recycling Market Regional Outlook

- {"North America"=>["US"

- "Canada"

- "Mexico"]}

- {"Europe"=>["Germany"

- "France"

- "UK"

- "Spain"

- "Rest of Europe"]}

- {"Asia-Pacific"=>["China"

- "Japan"

- "India"

- "Rest of Asia -Pacific"]}

- {"Rest of the World"=>["Middle East & Africa"

- "South America"]}

PET Bottle Recycling Market Application Outlook (USD Million, 2018-2030)

- Beverages

- Personal Care

- Pharmaceuticals

- Consumer goods

- Others

PET Bottle Recycling Market Recycling Process Outlook (USD Million, 2018-2030)

- Mechanical

- Chemical

Report Scope

| Attribute/Metric | Details |

| Market Size 2024 | USD 5.1 billion |

| Market Size 2035 | 8.82 |

| Compound Annual Growth Rate (CAGR) | 5.10% (2025 - 2035) |

| Base Year | 2024 |

| Forecast Period | 2025 - 2035 |

| Historical Data | 2018 & 2020 |

| Forecast Units | Value (USD Billion) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | Recycling Process, Application, and Region |

| Geographies Covered | North America, Europe, Asia Pacific, and Rest of the World. |

| Countries Covered | The U.S, Canada, Mexico, Germany, France, UK, Spain, China, Japan, India, South America, and Middle East & Africa. |

| Key Companies Profiled | Indorama Ventures Public Company Limited (Indorama Ventures), Krones AG, Plastipak Holdings, Inc. (Plastipak), Schoeller Group, PFR Nord GmbH, PolyQuest, Phoenix Technologies, UltrePET, LLC (UltrePET), Sieu Japan Co., Ltd. (Seiu Japan), and Vanden Global Ltd. (Vanden). |

| Key Market Opportunities | Designing of PET Bottle to Facilitate Recycling |

| Key Market Dynamics | Use of PET Bottles in the Packaging Industry increasing government initiatives for the Textile Industry |

| Market Size 2025 | 5.36 |

Market Highlights

Author

Latest Comments

This is a great article! Really helped me understand the topic better.

Thanks for sharing this. I’ve bookmarked it for later reference.

FAQs

How much is the PET Bottle Recycling Market?

PET Bottle Recycling Market worth USD 7.6 billion by 2032

What are the key driving factors for the growth of the PET Bottle Recycling Market?

Use of PET Bottles in the Packaging Industry and increasing government initiatives for the Textile Industry are the key driving factor for the growth of the PET Bottle Recycling Market.

What is the growth rate of the PET Bottle Recycling Market?

PET Bottle Recycling Market grows at a CAGR of 5.10% during the forecast year.

Which region held the largest market share in the PET Bottle Recycling Market?

North America held the largest market share in the PET Bottle Recycling Market.

Who are the key players in the PET Bottle Recycling Market?

Indorama Ventures Public Company Limited (Indorama Ventures), Krones AG, Plastipak Holdings, Inc. (Plastipak), Schoeller Group, PFR Nord GmbH, PolyQuest, Phoenix Technologies, UltrePET, LLC (UltrePET), Sieu Japan Co., Ltd. (Seiu Japan), and Vanden Global Ltd. (Vanden), and other are the key players.

-

--- "Table of Contents

-

Executive Summary

-

MARKET ATTRACTIVENESS ANALYSIS

- GLOBAL PET BOTTLE RECYCLING MARKET, BY RECYCLING PROCESS

- GLOBAL PET BOTTLE RECYCLING MARKET, BYAPPLICATION

- GLOBAL PET BOTTLE RECYCLING MARKET, BY REGION

-

MARKET ATTRACTIVENESS ANALYSIS

-

Market Introduction

- DEFINITION

- Scope of the Study

- MARKET STRUCTURE

- KEY BUILDING CRITERIA

-

Research Methodology

- RESEARCH PROCESS

- PRIMARY RESEARCH

- SECONDARY RESEARCH

- MARKET SIZE ESTIMATION

- TOP-DOWN AND Bottom-up Approach

- FORECAST MODEL

- LIST OF ASSUMPTIONS

-

MARKET DYNAMICS

- INTRODUCTION

-

DRIVERS

- USE OF PET BOTTLES IN THE PACKAGING INDUSTRY

- INCREASING GOVERNMENT INITIATIVES FOR THE TEXTILE INDUSTRY

- DRIVERS IMPACT ANALYSIS

-

RESTRAINT

- HIGH COST AND SLOW RECYCLING OF PET BOTTLES

-

OPPORTUNITIES

- DESIGNING OF PET BOTTLE TO FACILITATE RECYCLING

-

MARKET FACTOR ANALYSIS

-

SUPPLY CHAIN ANALYSIS

- RAW MATERIAL SUPPLIERS

- FLAKE MANUFACTURERS

- DISTRIBUTION & SALES

- END-USERS

-

PORTER’S FIVE FORCES MODEL

- THREAT OF NEW ENTRANTS

- BARGAINING POWER OF SUPPLIERS

- BARGAINING POWER OF BUYERS

- THREAT OF SUBSTITUTES

- INTENSITY OF RIVALRY

-

IMPACT OF COVID 19 OUTBREAK ON THE PET BOTTLE RECYCLING MARKET

- IMPACT OF COVID-19 ON THE SUPPLY CHAIN OF PET BOTTLE RECYCLING

- IMPACT OF COVID-19 ON PET BOTTLE RECYCLING END-USE INDUSTRY

-

SUPPLY CHAIN ANALYSIS

-

GLOBALPET BOTTLE RECYCLING MARKET, BY RECYCLING PROCESS

-

OVERVIEW

- PET BOTTLE RECYCLING: MARKET ESTIMATES & FORECAST BY RECYCLING PROCESS, 2019–2030

-

MECHANICAL

- MECHANICAL: MARKET ESTIMATES & FORECAST BY REGION,2019–2030

-

CHEMICAL

- CHEMICAL: MARKET ESTIMATES & FORECAST BY REGION,2019–2030

-

OVERVIEW

-

GLOBALPET BOTTLE RECYCLING MARKET, BY APPLICATION

-

OVERVIEW

- PET BOTTLE RECYCLING: MARKET ESTIMATES & FORECAST BY APPLICATION, 2019–2030

-

BEVERAGES

- BEVERAGES: MARKET ESTIMATES & FORECAST BY REGION,2019–2030

-

PERSONAL CARE

- PERSONAL CARE: MARKET ESTIMATES & FORECAST BY REGION,2019–2030

-

PHARMACEUTICAL

- PHARMACEUTICAL: MARKET ESTIMATES & FORECAST BY REGION,2019–2030

-

CONSUMER GOODS

- CONSUMER GOODS: MARKET ESTIMATES & FORECAST BY REGION,2019–2030

-

OTHERS

- OTHERS: MARKET ESTIMATES & FORECAST BY REGION,2019–2030

-

OVERVIEW

-

GLOBAL PET BOTTLE RECYCLING MARKET, BY REGION

- OVERVIEW

-

NORTH AMERICA

- US

- CANADA

- MEXICO

-

EUROPE

- GERMANY

- UK

- FRANCE

- SPAIN

- REST OF EUROPE

-

ASIA PACIFIC

- CHINA

- JAPAN

- INDIA

- REST OF ASIA-PACIFIC

-

REST OF THE WORLD

- MIDDLE EAST & AFRICA

- SOUTH AMERICA

-

Competitive Landscape

- COMPETITIVE ANALYSIS

- RECENT DEVELOPMENTS, MERGERS/ACQUISITIONS

- MARKET STRATEGY ANALYSIS

- MARKET SHARE ANALYSIS

- MAJOR GROWTH STRATEGY IN THE GLOBAL PET BOTTLE RECYCLING MARKET

- COMPETITIVE BENCHMARKING

-

COMPANY PROFILES

-

INDORAMA VENTURES PUBLIC COMPANY LIMITED

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

KRONES AG

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCT OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGIES

-

PLASTIPAK HOLDINGS, INC.

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS/SERVICES OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGY

-

SCHOELLER GROUP

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCT/SERVICES OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGY

-

PFR NORD GMBH

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS/SERVICES OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGY

-

POLYQUEST

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS/SERVICES OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGY

-

PHOENIX TECHNOLOGIES

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS/SERVICES OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGY

-

ULTREPET, LLC

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS/SERVICES OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGY

-

SEIU JAPAN CO., LTD.

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS/SERVICES OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGY

-

VANDEN GLOBAL LTD.

- COMPANY OVERVIEW

- FINANCIAL OVERVIEW

- PRODUCTS/SERVICES OFFERED

- KEY DEVELOPMENTS

- SWOT ANALYSIS

- KEY STRATEGY

-

INDORAMA VENTURES PUBLIC COMPANY LIMITED

-

APPENDIXES

- REFERENCES

- RELATED REPORTS

-

List of Tables and Figures

- LIST OF TABLES

- TABLE 1 LIST OF ASSUMPTIONS & LIMITATIONS

- TABLE 2 PET BOTTLE RECYCLING MARKET ESTIMATES & FORECAST, BY RECYCLING PROCESS, 2019–2030 (USD MILLION)

- TABLE 3 MECHANICAL MARKET ESTIMATES & FORECAST, BY REGION, 2019–2030 (USD MILLION)

- TABLE 4 CHEMICAL MARKET ESTIMATES & FORECAST, BY REGION, 2019–2030 (USD MILLION)

- TABLE 5 PET BOTTLE RECYCLING MARKET ESTIMATES & FORECAST, BY APPLICATION, 2019–2030 (USD MILLION)

- TABLE 6 BEVERAGES MARKET ESTIMATES & FORECAST, BY REGION, 2019–2030 (USD MILLION)

- TABLE 7 PERSONAL CARE MARKET ESTIMATES & FORECAST, BY REGION, 2019–2030 (USD MILLION)

- TABLE 8 PHARMACEUTICAL MARKET ESTIMATES & FORECAST, BY REGION, 2019–2030 (USD MILLION)

- TABLE 9 CONSUMER GOODS MARKET ESTIMATES & FORECAST, BY REGION, 2019–2030 (USD MILLION)

- TABLE 10 OTHERS MARKET ESTIMATES & FORECAST, BY REGION, 2019–2030 (USD MILLION)

- TABLE 11 GLOBAL PET BOTTLE RECYCLING MARKET, BY REGION, 2019–2030 (USD MILLION)

- TABLE 12 NORTH AMERICA: PET BOTTLE RECYCLING MARKET, BY COUNTRY, 2019–2030 (USD MILLION)

- TABLE 13 NORTH AMERICA: PET BOTTLE RECYCLING MARKET, BY RECYCLING PROCESS, 2019–2030 (USD MILLION)

- TABLE 14 NORTH AMERICA: PET BOTTLE RECYCLING MARKET, BY APPLICATION, 2019–2030 (USD MILLION)

- TABLE 15 US: PET BOTTLE RECYCLING MARKET, BY RECYCLING PROCESS, 2019–2030 (USD MILLION)

- TABLE 16 US: PET BOTTLE RECYCLING MARKET, BY APPLICATION, 2019–2030 (USD MILLION)

- TABLE 17 CANADA: PET BOTTLE RECYCLING MARKET, BY RECYCLING PROCESS, 2019–2030 (USD MILLION)

- TABLE 18 CANADA: PET BOTTLE RECYCLING MARKET, BY APPLICATION, 2019–2030 (USD MILLION)

- TABLE 19 MEXICO: PET BOTTLE RECYCLING MARKET, BY RECYCLING PROCESS, 2019–2030 (USD MILLION)

- TABLE 20 MEXICO: PET BOTTLE RECYCLING MARKET, BY APPLICATION, 2019–2030 (USD MILLION)

- TABLE 21 EUROPE: PET BOTTLE RECYCLING MARKET, BY COUNTRY, 2019–2030 (USD MILLION)

- TABLE 22 EUROPE: PET BOTTLE RECYCLING MARKET, BY RECYCLING PROCESS, 2019–2030 (USD MILLION)

- TABLE 23 EUROPE: PET BOTTLE RECYCLING MARKET, BY APPLICATION, 2019–2030 (USD MILLION)

- TABLE 24 GERMANY: PET BOTTLE RECYCLING MARKET, BY RECYCLING PROCESS, 2019–2030 (USD MILLION)

- TABLE 25 GERMANY: PET BOTTLE RECYCLING MARKET, BY APPLICATION, 2019–2030 (USD MILLION)

- TABLE 26 UK: PET BOTTLE RECYCLING MARKET, BY RECYCLING PROCESS, 2019–2030 (USD MILLION)

- TABLE 27 UK: PET BOTTLE RECYCLING MARKET, BY APPLICATION, 2019–2030 (USD MILLION)

- TABLE 28 FRANCE: PET BOTTLE RECYCLING MARKET, BY RECYCLING PROCESS, 2019–2030 (USD MILLION)

- TABLE 29 FRANCE: PET BOTTLE RECYCLING MARKET, BY APPLICATION, 2019–2030 (USD MILLION)

- TABLE 30 SPAIN: PET BOTTLE RECYCLING MARKET, BY RECYCLING PROCESS, 2019–2030 (USD MILLION)

- TABLE 31 SPAIN: PET BOTTLE RECYCLING MARKET, BY APPLICATION, 2019–2030 (USD MILLION)

- TABLE 32 REST OF EUROPE: PET BOTTLE RECYCLING MARKET, BY RECYCLING PROCESS, 2019–2030 (USD MILLION)

- TABLE 33 REST OF EUROPE: PET BOTTLE RECYCLING MARKET, BY APPLICATION, 2019–2030 (USD MILLION)

- TABLE 34 ASIA-PACIFIC: PET BOTTLE RECYCLING MARKET, BY COUNTRY, 2019–2030 (USD MILLION)

- TABLE 35 ASIA PACIFIC: PET BOTTLE RECYCLING MARKET, BY RECYCLING PROCESS, 2019–2030 (USD MILLION)

- TABLE 36 ASIA PACIFIC: PET BOTTLE RECYCLING MARKET, BY APPLICATION, 2019–2030 (USD MILLION)

- TABLE 37 CHINA: PET BOTTLE RECYCLING MARKET, BY RECYCLING PROCESS, 2019–2030 (USD MILLION)

- TABLE 38 CHINA: PET BOTTLE RECYCLING MARKET, BY APPLICATION, 2019–2030 (USD MILLION)

- TABLE 39 JAPAN: PET BOTTLE RECYCLING MARKET, BY RECYCLING PROCESS, 2019–2030 (USD MILLION)

- TABLE 40 JAPAN: PET BOTTLE RECYCLING MARKET, BY APPLICATION, 2019–2030 (USD MILLION)

- TABLE 41 INDIA: PET BOTTLE RECYCLING MARKET, BY RECYCLING PROCESS, 2019–2030 (USD MILLION)

- TABLE 42 INDIA: PET BOTTLE RECYCLING MARKET, BY APPLICATION, 2019–2030 (USD MILLION)

- TABLE 43 REST OF ASIA-PACIFIC: PET BOTTLE RECYCLING MARKET, BY RECYCLING PROCESS, 2019–2030 (USD MILLION)

- TABLE 44 REST OF ASIA-PACIFIC: PET BOTTLE RECYCLING MARKET, BY APPLICATION, 2019–2030 (USD MILLION)

- TABLE 45 REST OF THE WORLD: PET BOTTLE RECYCLING MARKET, BY COUNTRY, 2019–2030 (USD MILLION)

- TABLE 46 REST OF THE WORLD: PET BOTTLE RECYCLING MARKET, BY RECYCLING PROCESS, 2019–2030 (USD MILLION)

- TABLE 47 REST OF THE WORLD: PET BOTTLE RECYCLING MARKET, BY APPLICATION, 2019–2030 (USD MILLION)

- TABLE 48 MIDDLE EAST & AFRICA: PET BOTTLE RECYCLING MARKET, BY RECYCLING PROCESS, 2019–2030 (USD MILLION)

- TABLE 49 MIDDLE EAST & AFRICA: PET BOTTLE RECYCLING MARKET, BY APPLICATION, 2019–2030 (USD MILLION)

- TABLE 50 SOUTH AMERICA: PET BOTTLE RECYCLING MARKET, BY RECYCLING PROCESS, 2019–2030 (USD MILLION)

- TABLE 51 SOUTH AMERICA: PET BOTTLE RECYCLING MARKET, BY APPLICATION, 2019–2030 (USD MILLION)

- TABLE 52 RECENT DEVELOPMENTS, MERGERS/ACQUISITIONS

- TABLE 53 INDORAMA VENTURES: PRODUCTS OFFERED

- TABLE 54 INDORAMA VENTURES: KEY DEVELOPMENT

- TABLE 55 KRONES AG: PRODUCT OFFERED

- TABLE 56 PLASTIPAK HOLDINGS, INC.: PRODUCTS/SERVICES OFFERED

- TABLE 57 PLASTIPAK HOLDINGS, INC.: KEY DEVELOPMENTS

- TABLE 58 SCHOELLER GROUP: PRODUCTS/SERVICES OFFERED

- TABLE 59 PFR NORD GMBH: PRODUCTS/SERVICES OFFERED

- TABLE 60 POLYQUEST: PRODUCTS/SERVICES OFFERED

- TABLE 61 POLYQUEST: KEY DEVELOPMENTS

- TABLE 62 PHOENIX TECHNOLOGIES.: PRODUCTS/SERVICES OFFERED

- TABLE 63 ULTREPET, LLC: PRODUCTS/SERVICES OFFERED

- TABLE 64 SIEU JAPAN CO., LTD.: PRODUCTS/SERVICES OFFERED

- TABLE 65 VANDEN GLOBAL LTD.: PRODUCTS/SERVICES OFFERED LIST OF FIGURES

- FIGURE 1 MARKET SYNOPSIS

- FIGURE 2 GLOBAL PET BOTTLE RECYCLING MARKET ANALYSIS BY RECYCLING PROCESS

- FIGURE 3 GLOBAL PET BOTTLE RECYCLING MARKET ANALYSIS BY APPLICATION

- FIGURE 4 GLOBAL PET BOTTLE RECYCLING MARKET ATTRACTIVENESS ANALYSIS BY REGION

- FIGURE 5 PET BOTTLE RECYCLING MARKET: MARKET STRUCTURE

- FIGURE 6 RESEARCH PROCESS OF MRFR

- FIGURE 7 MARKET DYNAMICS OVERVIEW

- FIGURE 8 ANNUAL PRODUCTION OF PLASTIC WORLDWIDE FROM 2015 TO 2021 (MILLION METRIC TONS)

- FIGURE 9 DRIVERS IMPACT ANALYSIS

- FIGURE 10 RESTRAINTS IMPACT ANALYSIS

- FIGURE 11 SUPPLY CHAIN ANALYSIS OF THE GLOBAL PET BOTTLE RECYCLING MARKET

- FIGURE 12 Porter's Five Forces Analysis OF THE GLOBAL PET BOTTLE RECYCLING MARKET

- FIGURE 13 GLOBAL PET BOTTLE RECYCLING MARKET, BY RECYCLING PROCESS, 2019 TO 2030 (USD MILLION)

- FIGURE 14 GLOBAL PET BOTTLE RECYCLING MARKET, BY APPLICATION, 2019 TO 2030 (USD MILLION)

- FIGURE 15 GLOBAL PET BOTTLE RECYCLING MARKET, BY REGION, 2019–2030 (USD MILLION)

- FIGURE 16 MARKET SHARE ANALYSIS, 2021 (%)

- FIGURE 17 MAJOR GROWTH STRATEGY

- FIGURE 18 COMPETITIVE BENCHMARKING

- FIGURE 19 INDORAMA VENTURES: FINANCIAL OVERVIEW SNAPSHOT

- FIGURE 20 INDORAMA VENTURES: SWOT ANALYSIS

- FIGURE 21 KRONES AG: FINANCIAL OVERVIEW SNAPSHOT

- FIGURE 22 KRONES AG: SWOT ANALYSIS

- FIGURE 23 PLASTIPAK HOLDINGS, INC.: SWOT ANALYSIS

- FIGURE 24 SCHOELLER GROUP: SWOT ANALYSIS

- FIGURE 25 PFR NORD GMBH: SWOT ANALYSIS

- FIGURE 26 POLYQUEST: SWOT ANALYSIS

- FIGURE 27 PHOENIX TECHNOLOGIES: SWOT ANALYSIS

- FIGURE 28 ULTREPET, LLC: SWOT ANALYSIS

- FIGURE 29 SIEU JAPAN CO., LTD.: SWOT ANALYSIS

- FIGURE 30 VANDEN GLOBAL LTD.: SWOT ANALYSIS"

Global PET Bottle Recycling Market Recycling Process Outlook (USD Million, 2019-2030)

Mechanical

Chemical

Global PET Bottle Recycling Market Application Outlook (USD Million, 2019-2030)

Beverages

Personal Care

Pharmaceuticals

Consumer goods

Others

Global PET Bottle Recycling Regional Outlook (USD Million, 2019-2030)

North America Outlook (USD Million, 2019-2030)

Mechanical

Chemical

North America Global PET Bottle Recycling by ApplicationBeverages

Personal Care

Pharmaceuticals

Consumer goods

Others

US Outlook (USD Million, 2019-2030)

Mechanical

Chemical

US Global PET Bottle Recycling by ApplicationBeverages

Personal Care

Pharmaceuticals

Consumer goods

Others

Canada Outlook (USD Million, 2019-2030)

Mechanical

Chemical

Canada Global PET Bottle Recycling by ApplicationBeverages

Personal Care

Pharmaceuticals

Consumer goods

Others

Mexico Outlook (USD Million, 2019-2030)

Mechanical

Chemical

Mexico Global PET Bottle Recycling by ApplicationBeverages

Personal Care

Pharmaceuticals

Consumer goods

Others

Europe Outlook (USD Million, 2019-2030)

Europe Outlook (USD Million, 2019-2030)

Mechanical

Chemical

Europe Global PET Bottle Recycling by ApplicationBeverages

Personal Care

Pharmaceuticals

Consumer goods

Others

Germany Outlook (USD Million, 2019-2030)

Mechanical

Chemical

Germany Global PET Bottle Recycling by ApplicationBeverages

Personal Care

Pharmaceuticals

Consumer goods

Others

UK Outlook (USD Million, 2019-2030)

Mechanical

Chemical

UK Global PET Bottle Recycling by ApplicationBeverages

Personal Care

Pharmaceuticals

Consumer goods

Others

France Outlook (USD Million, 2019-2030)

Mechanical

Chemical

France Global PET Bottle Recycling by ApplicationBeverages

Personal Care

Pharmaceuticals

Consumer goods

Others

Spain Outlook (USD Million, 2019-2030)

Mechanical

Chemical

Spain Global PET Bottle Recycling by ApplicationBeverages

Personal Care

Pharmaceuticals

Consumer goods

Others

Rest of Europe Outlook (USD Million, 2019-2030)

Mechanical

Chemical

Rest of Europe Global PET Bottle Recycling by ApplicationBeverages

Personal Care

Pharmaceuticals

Consumer goods

Others

Asia-Pacific Outlook (USD Million, 2019-2030)

Mechanical

Chemical

Asia-Pacific Global PET Bottle Recycling by ApplicationBeverages

Personal Care

Pharmaceuticals

Consumer goods

Others

China Outlook (USD Million, 2019-2030)

Mechanical

Chemical

China Global PET Bottle Recycling by ApplicationBeverages

Personal Care

Pharmaceuticals

Consumer goods

Others

India Outlook (USD Million, 2019-2030)

Mechanical

Chemical

India Global PET Bottle Recycling by ApplicationBeverages

Personal Care

Pharmaceuticals

Consumer goods

Others

Japan Outlook (USD Million, 2019-2030)

Mechanical

Chemical

Japan Global PET Bottle Recycling by ApplicationBeverages

Personal Care

Pharmaceuticals

Consumer goods

Others

Rest of Asia-Pacific Outlook (USD Million, 2019-2030)

Mechanical

Chemical

Rest of Asia-Pacific Global PET Bottle Recycling by ApplicationBeverages

Personal Care

Pharmaceuticals

Consumer goods

Others

Rest of World Outlook (USD Million, 2019-2030)

Rest of the World Outlook (USD Million, 2019-2030)

Mechanical

Chemical

Rest of the World Global PET Bottle Recycling by ApplicationBeverages

Personal Care

Pharmaceuticals

Consumer goods

Others

Middle East & Africa Outlook (USD Million, 2019-2030)

Mechanical

Chemical

Middle East & Africa Global PET Bottle Recycling by ApplicationBeverages

Personal Care

Pharmaceuticals

Consumer goods

Others

South America Outlook (USD Million, 2019-2030)

Mechanical

Chemical

South America Global PET Bottle Recycling by ApplicationBeverages

Personal Care

Pharmaceuticals

Consumer goods

Others

Free Sample Request

Kindly complete the form below to receive a free sample of this Report

Customer Strories

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

Leave a Comment