Pharmaceutical Packaging Size

Market Size Snapshot

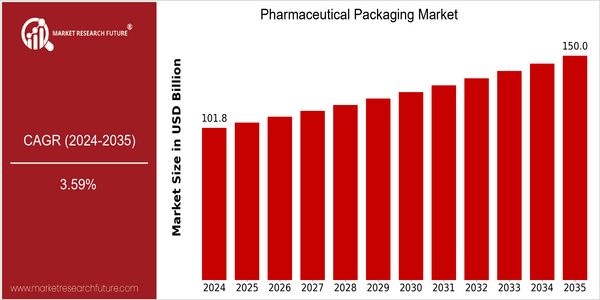

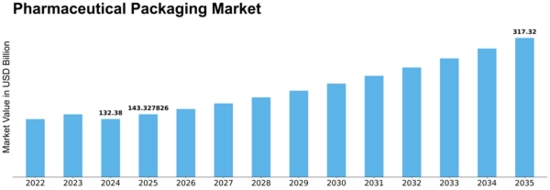

| Year | Value |

|---|---|

| 2024 | USD 101.75 Billion |

| 2035 | USD 150.0 Billion |

| CAGR (2025-2035) | 3.59 % |

Note – Market size depicts the revenue generated over the financial year

The global pharmaceuticals packaging market is expected to grow significantly, with a current market size of US$101.75 billion in 2024, and is expected to reach US$150.0 billion by 2035. CAGR: 3.59% from 2025 to 2035. The driving force for the development of the market is the increasing demand for advanced packaging solutions that can guarantee the safety and efficacy of medicines, as well as the increasing prevalence of chronic diseases that require more sophisticated pharmaceutical products. The development of new materials and processes for pharmaceutical packaging also promotes the growth of the market. In addition, smart packaging technology, which can monitor the conditions of medicines and display them in real time, is becoming more and more popular. The companies that lead the trend are Amcor, West Pharmaceutical Services and Gerresheimer. The leading companies have established a series of strategic alliances and made a series of strategic investments to further develop their products. For example, Amcor has teamed up with pharmaceutical companies to develop sustainable packaging solutions, which reflects the trend of sustainable development in the industry, which will further promote the development of the market.

Regional Market Size

Regional Deep Dive

The pharmaceutical packaging market is growing significantly across all regions, owing to the increasing demand for advanced packaging solutions that ensure drug safety, efficacy, and compliance with regulatory standards. In North America, the pharmaceutical packaging market is characterized by a strong focus on innovation and sustainability, with companies investing in smart packaging technology and environment-friendly materials. In Europe, the regulatory framework has a strong influence on the standards for pharmaceutical packaging. The Asia-Pacific region is a rapidly expanding market, with the growing pharmaceutical industry and the rising expenditure on healthcare. The Middle East and Africa region is characterized by the lack of a regulatory framework and the need for improving the healthcare system. In Latin America, the demand for packaging solutions that meet local requirements is growing, owing to the increasing demand for drugs and the rising middle class.

Europe

- The European Medicines Agency (EMA) has implemented stricter regulations on serialization and traceability, leading to increased investments in tamper-evident and anti-counterfeiting packaging solutions by firms like Schott AG and Stora Enso.

- The rise of personalized medicine in Europe is pushing pharmaceutical companies to adopt flexible packaging solutions that can accommodate small batch sizes and customized dosages, fostering innovation in the sector.

Asia Pacific

- China's National Medical Products Administration (NMPA) has introduced new regulations aimed at improving packaging standards, which is encouraging local manufacturers to enhance their capabilities and invest in advanced technologies.

- The growing trend of e-commerce in India is driving demand for innovative packaging solutions that ensure product integrity during transit, with companies like Huhtamaki and Uflex Limited leading the charge.

Latin America

- Brazil's National Health Surveillance Agency (ANVISA) has introduced new guidelines for pharmaceutical packaging that emphasize child safety and tamper evidence, prompting local manufacturers to adapt their products accordingly.

- The increasing prevalence of chronic diseases in Latin America is driving demand for packaging solutions that facilitate medication adherence, with companies like Grupo Phoenix and CCL Industries focusing on user-friendly designs.

North America

- The U.S. Food and Drug Administration (FDA) has introduced new guidelines for packaging materials to enhance drug safety, prompting companies like Amcor and West Pharmaceutical Services to innovate their product lines.

- Sustainability is a major trend, with companies such as Pfizer and Johnson & Johnson committing to reducing plastic waste in their packaging, which is expected to drive the adoption of biodegradable and recyclable materials.

Middle East And Africa

- The African Medicines Regulatory Harmonization (AMRH) initiative is working to standardize packaging regulations across member states, which is expected to streamline processes and improve market access for pharmaceutical companies.

- In the UAE, the government is promoting the use of smart packaging technologies to enhance drug traceability and safety, with local firms collaborating with international partners to develop these solutions.

Did You Know?

“Approximately 30% of all pharmaceutical products are estimated to be affected by counterfeiting, making secure packaging solutions critical in the fight against this global issue.” — World Health Organization (WHO)

Segmental Market Size

The pharmaceutical packaging market is experiencing steady growth, as a result of the increasing demand for safety and adherence in the delivery of pharmaceutical products. Among the major driving forces for this market are the increasing stringency of regulations in the field of patient safety and the rising demand for easy-to-use packaging solutions that enhance medication adherence. The development of new materials and designs is also encouraging innovation in the pharmaceutical packaging market. In the market for pharmaceutical packaging, the process of adopting advanced solutions is already well underway, with companies such as Amcor and West Pharmaceutical Services taking the lead in introducing smart packaging solutions. The most important pharmaceutical packaging applications are blisters, vials, and prefilled syringes, which play a critical role in ensuring the safety and quality of the products. In addition, the need for tamper-evident and sustainable packaging solutions has increased as a result of the COV19 influenza pandemic. The serialization and traceability requirements imposed by the governments are also boosting the market. The use of RFID and IoT is transforming the pharmaceutical packaging market, as it increases supply-chain transparency and improves patient engagement.

Future Outlook

The pharmaceutical packaging market is expected to grow from $101.75 billion to $155 billion, with a CAGR of 3.59%. This growth is mainly due to the growing demand for advanced packaging solutions to ensure drug safety, effectiveness, and compliance. The pharmaceutical industry is growing due to the aging of the population and the increase in the prevalence of chronic diseases. Therefore, the need for advanced packaging solutions that meet the regulatory requirements and the expectations of consumers is growing. By 2035, smart packaging solutions, including RFID and QR codes, will account for over 30% of the market, which will facilitate the tracking and authentication of pharmaceutical products. In addition, the use of sustainable materials and the development of child-resistant and tamper-resistant packages will also contribute to the development of the pharmaceutical packaging market. The demand for sustainable and safe materials will also be driven by the upcoming regulatory requirements. In addition, the growth of e-commerce in the pharmaceutical industry will require packaging solutions that can ensure the integrity of the product during transportation, which will lead to an increase in the investment in the development of robust packages. The pharmaceutical packaging market will change significantly, driven by innovation, regulatory changes, and changing consumer preferences, and will become an important part of the broader health system.

Leave a Comment