Polyurethane Elastomers Market Share

Polyurethane Elastomers Market Research Report Information by Type (Thermoset PU Elastomers and Thermoplastic PU Elastomers), End-Use Industry (Footwear, Automotive, Machinery, Building & Construction and Medical), Region (North America, Europe, Asia-Pacific, Latin America and the Middle East & Africa) - Forecast till 2035

Market Summary

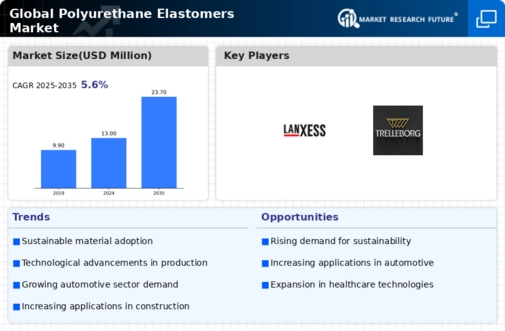

As per Market Research Future Analysis, the global polyurethane elastomers market, valued at approximately USD 13 billion in 2024, is projected to grow at a CAGR of about 5.60% from 2024 to 2032. The market is driven by high demand in the footwear industry, particularly due to the athleisure trend, and the automotive sector's need for lightweight materials. Polyurethane elastomers are primarily used in footwear, automotive components, and various industrial applications, with thermosetting elastomers dominating the market. Asia-Pacific is the leading region, holding over 50% market share in 2018, driven by increased consumer spending and a growing automotive industry. Key players include Tosoh Corporation, Dow, BASF SE, and Covestro AG.

Key Market Trends & Highlights

The polyurethane elastomers market is witnessing significant growth driven by various factors.

- Market Valuation in 2024: USD 13 billion.

- Projected CAGR from 2024 to 2032: 5.60%.

- Asia-Pacific market share in 2018: over 50%.

- Key growth driver: High demand in the footwear industry.

Market Size & Forecast

| Market Size in 2024 | USD 13 billion |

| Projected CAGR | 5.60% |

| Largest Regional Market Share in 2018 | Asia-Pacific |

| Key Growth Driver | Footwear Industry Demand |

Major Players

Tosoh Corporation (Japan), Dow (US), BASF SE (Germany), Covestro AG (Germany), Huntsman International LLC (US), LANXESS (Germany), The Lubrizol Corporation (US), Trelleborg (Sweden), Herikon (The Netherlands), Argonics, Inc (US), VCM Polyurethanes Pvt. Ltd (India)

Market Trends

The demand for polyurethane elastomers is expected to rise due to their versatility and performance in various applications, particularly in automotive and construction sectors.

U.S. Department of Commerce

Polyurethane Elastomers Market Market Drivers

Market Trends and Projections

The Global Polyurethane Elastomers Market Industry is poised for substantial growth, with projections indicating a market value of 13 USD Billion in 2024 and an anticipated increase to 23.7 USD Billion by 2035. The compound annual growth rate is expected to be 5.6% from 2025 to 2035, reflecting the industry's resilience and adaptability. Key trends influencing this growth include advancements in technology, increasing demand from various sectors, and a heightened focus on sustainability. These factors collectively shape the future landscape of the polyurethane elastomers market.

Increasing Focus on Sustainability

Sustainability is becoming a central theme within the Global Polyurethane Elastomers Market Industry, as manufacturers seek to minimize environmental impact. The shift towards eco-friendly materials, including bio-based polyurethane elastomers, aligns with global sustainability goals and consumer preferences. This trend is particularly evident in industries such as packaging and automotive, where companies are increasingly adopting sustainable practices. As awareness of environmental issues grows, the demand for sustainable polyurethane elastomers is expected to rise, further propelling market growth and encouraging innovation in material development.

Rising Demand in Automotive Sector

The Global Polyurethane Elastomers Market Industry experiences a notable surge in demand from the automotive sector, driven by the need for lightweight and durable materials. Polyurethane elastomers are increasingly utilized in various automotive applications, including seals, gaskets, and interior components. This trend is expected to contribute significantly to the market's growth, with projections indicating a market value of 13 USD Billion in 2024. As automotive manufacturers prioritize fuel efficiency and performance, the adoption of polyurethane elastomers is likely to expand, thereby enhancing the overall market landscape.

Growth in Construction Applications

The construction industry plays a pivotal role in the expansion of the Global Polyurethane Elastomers Market Industry. These materials are favored for their excellent mechanical properties and resistance to environmental factors, making them ideal for applications such as flooring, insulation, and coatings. The increasing focus on sustainable building practices and energy-efficient materials further propels the demand for polyurethane elastomers. As the construction sector continues to evolve, the market is projected to reach 23.7 USD Billion by 2035, reflecting a robust growth trajectory driven by innovative applications and regulatory support.

Expanding Applications in Healthcare

The healthcare sector is emerging as a significant driver for the Global Polyurethane Elastomers Market Industry, with applications ranging from medical devices to prosthetics. Polyurethane elastomers are valued for their biocompatibility, flexibility, and durability, making them suitable for various healthcare applications. The increasing demand for advanced medical technologies and devices is likely to boost the market, as manufacturers seek high-performance materials that meet stringent regulatory standards. This trend indicates a promising future for polyurethane elastomers in healthcare, contributing to the overall market growth.

Technological Advancements in Production

Technological advancements in the production of polyurethane elastomers are transforming the Global Polyurethane Elastomers Market Industry. Innovations in manufacturing processes, such as improved polymerization techniques and the development of bio-based alternatives, enhance the performance and sustainability of these materials. These advancements not only increase efficiency but also reduce production costs, making polyurethane elastomers more accessible to various industries. As a result, the market is likely to witness a compound annual growth rate of 5.6% from 2025 to 2035, indicating a strong potential for growth driven by continuous innovation.

Market Segment Insights

Regional Insights

Key Companies in the Polyurethane Elastomers Market market include

Industry Developments

October 2023: a Seoul private equity firm, Glenwood Private Equity, acquired 100% of SKC’s shares in SK pucore, a producer of poliurethanes. Accordingly, the petrochemical subsidiary of SKC was sold to another private equity firm at KRW 410.3 billion (USD 304.1 million) with an aim to focus on semiconductor and EV battery materials that will drive the PU elastomers market.

August 2023: Covestro AG has started manufacturing polyurethane elastomer systems in its new plant in Shanghai. The investment is undisclosed (in the double-digit EUR Million range). This is part of a series investments in elastomers raw materials made by the company over the past years with plants located in Thailand and Spain.

July 2023: Nordmann announced selling polyurethane elastomers produced by Era Polymers from Australia across Germany, Belgium, Holland, Italy, Finland, Sweden and Switzerland. The latter is specialized in developing and producing prepolymer systems for polyurethane elastomers production for the automotive sector, which has spread over six production sites where its capacity reaches more than 400 thousand tons per year.

In November 2021, Covestro AG intends to build a new plant for PU elastomer systems in Shanghai to meet growing global demand, especially coming from the APAC region. The German supplier’s facility will be part of the integrated site worth EUR 3.5 billion euros located in Shanghai, due to become operational at the beginning of the year two thousand twenty-three.

Intended Audience

- Polyurethane elastomers manufacturers

- Traders and distributors of polyurethane elastomers

- Research and development institutes

- Potential investors

- End users

- Nationalized laboratories

Future Outlook

Polyurethane Elastomers Market Future Outlook

The Global Polyurethane Elastomers Market is projected to grow at a 5.6% CAGR from 2024 to 2035, driven by advancements in automotive applications, increasing demand for lightweight materials, and innovations in sustainable production processes.

New opportunities lie in:

- Develop bio-based polyurethane elastomers to meet rising sustainability demands.

- Invest in R&D for high-performance elastomers in automotive and aerospace sectors.

- Expand into emerging markets with tailored solutions for local industries.

By 2035, the market is expected to achieve substantial growth, reflecting evolving consumer preferences and technological advancements.

Market Segmentation

Report Scope

| Attribute/Metric | Details |

| Market Size | 13 Billion |

| CAGR | 5.60% (2024-2032 ) |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020 |

| Forecast Units | Value (USD Billion) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | Type and End-Use Industry |

| Geographies Covered | North America, Europe, Asia-Pacific, and Rest of the World (RoW) |

| Key Vendors | BASF SE (Germany), Bayer Materialscience (Germany), Bsw Gmbh (Germany), The Dow Chemical Company (U.S.), DuPont (U.S.), Lyondellbasell Industries N.V. (Netherlands), 3M (U.S.), KINGFA SCI. &TECH. CO., LTD. (China), Accella Polyurethane Systems (U.S.), and P+S Polyurethan-Elastomere GmbH & Co. KG (Germany) |

| Key Market Opportunities | High demand for polyurethane elastomers in the footwear industry |

| Key Market Drivers | Increasing active and fitness conscious among the consumers has given rise to the athleisure movement The active consumers are gravitating towards shoes that fit for every occasion |

Market Highlights

Author

Latest Comments

This is a great article! Really helped me understand the topic better.

Thanks for sharing this. I’ve bookmarked it for later reference.

FAQs

With what CAGR, the polyurethane elastomers market is projected to grow during the forecast period of 2022-2030?

Polyurethane elastomers market has the chance to showcase a 5.60% CAGR during the forecast period covering 2024-2032.

What was the estimated valuation of the polyurethane elastomers market valuation in 2018?

The estimated valuation of the polyurethane elastomers market was USD 20.9 Billion

Which industry can transform the outcome of the polyurethane elastomers market?

The automotive sector can change the global polyurethane elastomers market as the use of the component is picking up speed.

What trend could prove advantageous for the polyurethane elastomers market?

The inclusion of bio-friendly components can be trendy for the polyurethane elastomers market.

Which region has the upper hand in the polyurethane elastomers market?

The Asia Pacific market has control of the polyurethane elastomers market.

-

Table of Contents

-

1 Executive Summary

-

2 Market Introduction

- Market Definition

- Scope of the Study

- Assumptions & Limitations

- Market Structure

- Key Takeaways

-

3 Market Insights

-

4 Research Methodology

- Research Process

- Primary Research

- Secondary Research

- Market Size Estimation

- Forecast Model

-

5 Market Dynamics

- Introduction

- Drivers

- Restraints

- Opportunities

- Challenges

- Trends

-

6 Market Factor Analysis

-

Supply Chain Analysis

- Raw Material Suppliers

- Manufacturers/Producers

- Distributors/Retailers/Wholesalers/E-Commerce Merchants

- End-Users

-

Porter’s Five Forces Analysis

- Threat of New Entrants

- Intensity of Competitive Rivalry

- Threat of Substitutes

- Bargaining Power of Suppliers

- Bargaining Power of Buyers

- Pricing Analysis

-

Supply Chain Analysis

-

Global Polyurethane Elastomers Market, by Type

- Introduction

-

Thermoset PU Elastomers

- Market Estimates & Forecast, 2020-2027

- Market Estimates & Forecast, by Region, 2020-2027

- Thermoplastic PU Elastomers

-

7.3.1 Market Estimates & Forecast, 2020-2027

- Market Estimates & Forecast, by Region, 2020-2027

-

Global Polyurethane Elastomers Market, by End-Use Industry

- Introduction

-

Footwear

- Market Estimates & Forecast, 2020-2027

- Market Estimates & Forecast, by Region, 2020-2027

-

Automotive

- Market Estimates & Forecast, 2020-2027

- Market Estimates & Forecast, by Region, 2020-2027

-

Machinery

- Market Estimates & Forecast, 2020-2027

- Market Estimates & Forecast, by Region, 2020-2027

-

Building & Construction

- Market Estimates & Forecast, 2020-2027

- Market Estimates & Forecast, by Region, 2020-2027

-

Medical

- Market Estimates & Forecast, 2020-2027

- Market Estimates & Forecast, by Region, 2020-2027

-

Others

- Market Estimates & Forecast, 2020-2027

- Market Estimates & Forecast, by Region, 2020-2027

-

Global Polyurethane Elastomers Market, by Region

- Introduction

-

North America

- Market Estimates & Forecast, 2020-2027

- Market Estimates & Forecast, by Type, 2020-2027

- Market Estimates & Forecast, by End-Use Industry, 2020-2027

- US

- Canada

-

Europe

- Market Estimates & Forecast, 2020-2027

- Market Estimates & Forecast, by Type, 2020-2027

- Market Estimates & Forecast, by End-Use Industry, 2020-2027

- Germany

- France

- Italy

- Spain

- UK

- Russia

- Poland

-

Asia-Pacific

- Market Estimates & Forecast, 2020-2027

- Market Estimates & Forecast, by Type, 2020-2027

- Market Estimates & Forecast, by End-Use Industry, 2020-2027

- China

-

9.4.5 India

-

Market Estimates & Forecast, 2020-2027

- Market Estimates & Forecast, by Type, 2020-2027

- Japan

- Australia & New Zealand

- Indonesia

- Rest of Asia-Pacific

-

Middle East & Africa

- Market Estimates & Forecast, 2020-2027

- Market Estimates & Forecast, by Type, 2020-2027

- Market Estimates & Forecast, by End-Use Industry, 2020-2027

- Turkey

- Israel

- South Africa

- GCC

- Rest of the Middle East & Africa

-

Latin America

- Market Estimates & Forecast, 2020-2027

- Market Estimates & Forecast, by Type, 2020-2027

- Market Estimates & Forecast, by End-Use Industry, 2020-2027

- Brazil

- Argentina

- Mexico

- Rest of Latin America

-

Market Estimates & Forecast, 2020-2027

-

Competitive Landscape

- Introduction

-

10.2 Market Strategy Analysis

- Key Development Analysis

-

(Expansions/Mergers & Acquisitions/Joint Ventures/New Product Developments/Agreements/Investments)

-

Company Profiles

-

BASF SE

- Company Overview

- Financial Overview

- Product/Business Segment Overview

- Key Developments

- SWOT Analysis

- Key Strategies

-

BASF SE

-

11.2 Tosoh Corporation

-

Company Overview

- Financial Overview

- Product/Business Segment Overview

- Key Developments

- SWOT Analysis

- Key Strategies

-

Dow

- Company Overview

- Financial Overview

- Product/Business Segment Overview

- Key Developments

- SWOT Analysis

- Key Strategies

-

Company Overview

-

11.4 Huntsman International LLC

-

Company Overview

- Financial Overview

- Product/Business Segment Overview

- Key Developments

- SWOT Analysis

- Key Strategies

-

Covestro AG

- Company Overview

- Financial Overview

- Product/Business Segment Overview

- Key Developments

- SWOT Analysis

- Key Strategies

-

LANXESS

- Company Overview

- Financial Overview

- Product/Business Segment Overview

- Key Developments

- SWOT Analysis

- Key Strategies

-

The Lubrizol Corporation

- Company Overview

- Financial Overview

- Product/Business Segment Overview

- Key Developments

- SWOT Analysis

- Key Strategies

-

Trelleborg

- Company Overview

- Financial Overview

- Product/Business Segment Overview

- Key Developments

- SWOT Analysis

- Key Strategies

-

Company Overview

-

11.9 Herikon

-

Company Overview

- Financial Overview

- Product/Business Segment Overview

- Key Developments

- SWOT Analysis

- Key Strategies

-

Company Overview

-

11.10 Argonics, Inc

-

Company Overview

- Financial Overview

- Product/Business Segment Overview

- Key Developments

- SWOT Analysis

- Key Strategies

-

Company Overview

-

11.11 VCM Polyurethanes Pvt. Ltd

-

Company Overview

- Financial Overview

- Product/Business Segment Overview

- Key Developments

- SWOT Analysis

- Key Strategies

-

Company Overview

-

12. Appendix

-

-

List of Tables and Figures

- LIST OF TABLES

- Table 1 Global Polyurethane Elastomers Market, by Region, 2020-2027

- Table 2 North America: Polyurethane Elastomers Market, by Country, 2020-2027

- Table 3 Europe: Polyurethane Elastomers Market, by Country, 2020-2027

- Table 4 Asia-Pacific: Polyurethane Elastomers Market, by Country, 2020-2027

- Table 5 Middle East & Africa: Polyurethane Elastomers Market, by Country, 2020-2027

- Table 6 Latin America: Polyurethane Elastomers Market, by Country, 2020-2027

- Table 7 Global Polyurethane Elastomers Market, for Type, by Region, 2020-2027

- Table 8 North America: Polyurethane Elastomers Market, for Type, by Country, 2020-2027

- Table 9 Europe: Polyurethane Elastomers Market, for Type, by Country, 2020-2027

- Table 10 Asia-Pacific: Polyurethane Elastomers Market, for Type, by Country, 2020-2027

- Table 11 Middle East & Africa: Polyurethane Elastomers Market, for Type, by Country, 2020-2027

- Table 12 Latin America: Polyurethane Elastomers Market, for Type, by Country, 2020-2027

- Table 13 Global Polyurethane Elastomers Market, for End-Use Industry, by Region, 2020-2027

- Table 14 North America: Polyurethane Elastomers Market, for End-Use Industry, by Country, 2020-2027

- Table 15 Europe: Polyurethane Elastomers Market, for End-Use Industry, by Country, 2020-2027

- Table 16 Asia-Pacific: Polyurethane Elastomers Market, for End-Use Industry, by Country, 2020-2027

- Table 17 Middle East & Africa: Polyurethane Elastomers Market, for End-Use Industry, by Country, 2020-2027

- Table 18 Latin America: Polyurethane Elastomers Market, for End-Use Industry, by Country, 2020-2027

- Table 19 Global Type Market, by Region, 2020-2027

- Table 20 Global End-Use Industry Market, by Region, 2020-2027

- Table 21 North America: Polyurethane Elastomers Market, by Country, 2020-2027

- Table 22 North America: Polyurethane Elastomers Market, by Type, 2020-2027

- Table 23 North America: Polyurethane Elastomers Market, by End-Use Industry, 2020-2027

- Table 24 Europe: Polyurethane Elastomers Market, by Country, 2020-2027

- Table 25 Europe: Polyurethane Elastomers Market, by Type, 2020-2027

- Table 26 Europe: Polyurethane Elastomers Market, by End-Use Industry, 2020-2027

- Table 27 Asia-Pacific: Polyurethane Elastomers Market, by Country, 2020-2027

- Table 28 Asia-Pacific: Polyurethane Elastomers Market, by Type, 2020-2027

- Table 29 Asia-Pacific: Polyurethane Elastomers Market, by End-Use Industry, 2020-2027

- Table 30 Middle East & Africa: Polyurethane Elastomers Market, by Country, 2020-2027

- Table 31 Middle East & Africa: Polyurethane Elastomers Market, by Type, 2020-2027

- Table 32 Middle East & Africa: Polyurethane Elastomers Market, by End-Use Industry, 2020-2027

- Table 33 Latin America: Polyurethane Elastomers Market, by Country, 2020-2027

- Table 34 Latin America: Polyurethane Elastomers Market, by Type, 2020-2027

- Table 35 Latin America: Polyurethane Elastomers Market, by End-Use Industry, 2020-2027 LIST OF FIGURES

- FIGURE 1 Global Polyurethane Elastomers Market Segmentation

- FIGURE 2 Forecast Methodology

- FIGURE 3 Porter’s Five Forces Analysis of Global Polyurethane Elastomers Market

- FIGURE 4 Supply Chain Analysis of Global Polyurethane Elastomers Market

- FIGURE 5 Share of Polyurethane Elastomers Market, by Country, 2020 (%)

- FIGURE 6 Global Polyurethane Elastomers Market, 2020-2027

- FIGURE 7 Sub-Segments of Type

- FIGURE 8 Global Polyurethane Elastomers Market Size, by Type, 2020 (%)

- FIGURE 9 Share of Global Polyurethane Elastomers Market, by Type, 2020-2027

- FIGURE 10 Sub-Segments of End-Use Industry

- FIGURE 11 Global Polyurethane Elastomers Market Size, by End-Use Industry, 2020 (%)

- FIGURE 12 Share of Global Polyurethane Elastomers Market, by End-Use Industry, 2020-2027

Polyurethane Elastomers Market Segmentation

Market Segmentation Overview

- Detailed segmentation data will be available in the full report

- Comprehensive analysis by multiple parameters

- Regional and country-level breakdowns

- Market size forecasts by segment

Free Sample Request

Kindly complete the form below to receive a free sample of this Report

Customer Strories

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

Leave a Comment