Market Share

Introduction: Navigating the Competitive Landscape of Pressure Sensitive Adhesives

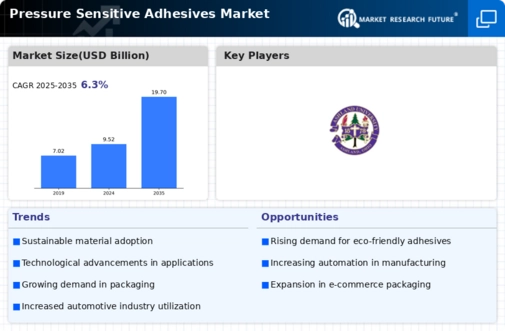

The pressure-sensitive adhesives market is going through a period of transformation. The market is being transformed by the rapid adoption of new technology and by changing customer expectations in terms of performance and sustainability. This is resulting in a high degree of competition among the key players in the market. The pressure-sensitive adhesives market is being transformed by the adoption of IoT-based manufacturing and the use of AI for product development. The market is being transformed by a growing trend towards green building, which is driving established suppliers to develop green solutions. New entrants are introducing novel adhesives that target specific applications. The pressure-sensitive adhesives market is being transformed by the increasing importance of regional markets, especially in Asia-Pacific and North America. This is resulting in a shift towards a strategy of local production and supply chain optimisation in order to meet the rising demand for custom-made solutions. The pressure-sensitive adhesives market is being transformed by the use of bio-based raw materials and the increasing importance of food-grade adhesives. The pressure-sensitive adhesives market is being transformed by the emergence of new market players, especially in Asia-Pacific and North America.

Competitive Positioning

Full-Suite Integrators

These vendors offer comprehensive solutions across various adhesive applications, leveraging extensive product portfolios.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| 3M | Innovative adhesive technologies | Pressure sensitive adhesives | Global |

| Avery Dennison Corporation | Strong brand recognition and innovation | Labeling and packaging adhesives | Global |

| Henkel AG & Company KGaA | Diverse product range and sustainability focus | Industrial adhesives | Global |

| Tesa S.E. | High-performance adhesive solutions | Self-adhesive products | Global |

Specialized Technology Vendors

These vendors focus on niche markets or specific adhesive technologies, providing tailored solutions.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Nitto Denko Corporation | Advanced material technology | Specialty adhesive tapes | Asia, North America |

| Lintec Corporation | High-quality label and packaging solutions | Pressure sensitive labels | Asia, Europe |

| Collanos Adhesives AG | Innovative adhesive formulations | Specialty adhesives | Europe |

Infrastructure & Equipment Providers

These vendors supply the necessary equipment and materials for adhesive application and production.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Intertape Polymer Group, Inc. | Wide range of packaging solutions | Adhesive tapes and films | North America |

| The DOW Chemical Company | Chemical innovation and sustainability | Adhesive raw materials | Global |

| B. Fuller Company | Custom adhesive solutions | Industrial adhesives | North America, Europe |

| Sika AG | Construction and industrial adhesive expertise | Construction adhesives | Global |

| Jonson Tapes Limited | Specialized tape solutions | Adhesive tapes | Asia, Europe |

| Reflex Labels Ltd. | Custom label solutions | Label adhesives | Europe |

Emerging Players & Regional Champions

- Adhesive Technologies, a German company, manufactures pressure-sensitive adhesives for automobile and electrical applications. It recently won a contract with a major automobile manufacturer for the supply of a new generation of green adhesives, thus taking on the established suppliers.

- Avery Dennison (USA): A wide range of pressure-sensitive adhesive products, such as special films and labels, have been added to the product line. The company has also expanded its production capacity in Asia to meet growing demand, thereby complementing its existing product line and providing greater supply efficiency and availability.

- Sika AG, Switzerland, is known for its adhesives in the construction and automobile industries. In the recent past it has been involved in a major green building project, and has thus become a challenger to the traditional adhesives industry.

- Scapa Group (UK) specializes in medical and industrial pressure-sensitive tapes, and recently launched a new line of hypoallergenic medical tapes. The company complements the offerings of the established companies by supplying niche products to the niche market.

Regional Trends: In 2023, the trend towards eco-friendliness and the green solution will continue in the pressure-sensitive adhesives market, especially in Europe and North America. In this case, companies will increasingly use advanced bio-based adhesives and smart adhesives. Also, the Asia-Pacific region will see a large growth in the pressure-sensitive adhesives market, which is due to the rapid development of industrialization and the increasing demand for packaging solutions, resulting in the intensification of competition between local and foreign players.

Collaborations & M&A Movements

- Henkel and 3M entered into a partnership to develop innovative pressure-sensitive adhesive solutions aimed at the automotive sector, enhancing their competitive positioning in a growing market segment.

- Avery Dennison acquired the adhesive division of UPM Raflatac to expand its product portfolio and strengthen its market share in sustainable adhesive solutions amidst increasing regulatory pressures for eco-friendly products.

- Bostik and Sika formed a collaboration to create advanced adhesive technologies for construction applications, aiming to leverage each other's strengths to capture a larger share of the booming construction market.

Competitive Summary Table

| Capability | Leading Players | Remarks |

|---|---|---|

| Adhesive Performance | 3M, Henkel, Avery Dennison | The 3M Company is known for its adhesives, which have a reputation for strength and endurance, particularly in the field of automobiles and electrical appliances. The Henkel Company has a large range of high-quality adhesives for various industries, including the packaging and construction industries. The Avery Company makes sustainable adhesives that are based on biodegradable materials and thereby improve performance while reducing the negative impact on the environment. |

| Sustainability | BASF, Dow, Sika | In recent years BASF has made great strides in the development of eco-friendly adhesives, with a focus on reducing VOC emissions. With the development of water-based, low-emission adhesives, Dow is pursuing its commitment to sustainable development. Sika is well known for its sustainable building solutions, including pressure-sensitive adhesives that meet the most demanding of standards. |

| Customization and Versatility | Scotch Adhesives, Momentive, H.B. Fuller | Scotch Adhesives offers a wide range of custom-made adhesive solutions adapted to the needs of the customer, especially in the consumer goods sector. In the field of silicones, Momentive is a specialist in the development of versatile adhesives for various applications, especially in the field of car and electronics. H.B. Fuller is known for its ability to develop special adhesives for special customer requirements in various industries. |

| Technological Innovation | Henkel, 3M, Sika | The development of new adhesives is one of the most important areas of investment for Henkel. 3M is a company that is constantly innovating in the field of adhesives, and has achieved great progress in the field of bonding technology, such as the medically advanced pressure-sensitive adhesives. Sika has invested in digital technology to improve the quality and efficiency of its adhesives production. |

| Market Reach and Distribution | Avery Dennison, BASF, H.B. Fuller | The Avery Dennison distribution network ensures the efficient delivery of its products in various markets. It is also possible to ensure the availability of BASF's adhesives solutions around the world with the help of the BASF distribution network. HB. Fuller has developed its distribution network in emerging markets and increased its distribution capabilities to meet the growing demand for its products. |

Conclusion: Navigating Competitive Waters in Adhesives

Competition is strong in the pressure-sensitive adhesives market in 2023, and the market is highly fragmented, with both incumbents and new entrants vying for market share. Strategically, suppliers are focusing on Asia-Pacific and North America. The established players are relying on their distribution networks and brand loyalty, while the new entrants are focusing on innovation and sustainability to capture niches. The ability to integrate advanced capabilities such as AI, automation and flexibility into the production process will be critical to success in this market. Suppliers must ensure that they are able to meet evolving customer preferences in a rapidly changing market.

Leave a Comment