-

Executive Summary

-

Introduction

-

Definition

-

Scope Of The Study

- Research Objective

- Assumption

- Limitations

-

Market Structure

-

Research Methodology

-

Introduction

-

Primary Research

-

Secondary Research

-

Secondary Research

-

Market Dynamics

-

Introduction 21

- Drivers 21

- Functional Properties

- Advancement In Technology

- Restraints

- Opportunities

- Challenges

-

Market Trends

-

Trends In Supply/Production

-

Trends In Demand/Consumption By Function

-

Emerging Markets (Supply & Demand)

-

Emerging Markets For Proteins

-

Introduction

-

Trend In Protein Concentrates And Textured Protein Substances Exports And Imports

- Trend In Protein Concentrates And Textured Protein Substances Exports

- Trend In Protein Concentrates And Textured Protein Substances Imports

-

Innovations In Products/Process In Proteins

-

Macroeconomic Indicator Analysis For Top Protein Ingredient Market

- Pestle Analysis-U.S.

- Pestle Analysis-U.K.

- Pestle Analysis-India

- Pestle Analysis-China

-

Market Factor Analysis

-

Value Chain Analysis

-

Porter’s Five Forces

- Bargaining Power Of Suppliers

- Threat Of New Entrants

- Bargaining Power Of Buyers

- Threat Of Substitutes

- Competitive Rivalry Between Existing Players

-

Supply Chain Analysis

-

Global Protein Ingredients Market- By Feedstock

-

Global Protein Ingredient Market- By Soy

-

Global Protein Ingredient Market- By Wheat

-

Global Protein Ingredient Market- By Pea

-

Global Protein Ingredient Market- By Canola

-

Global Protein Ingredient Market- By Whey

-

Global Protein Ingredient Market- By Milk

-

Global Protein Ingredient Market- By Casein

-

Global Protein Ingredient Market- By Egg

-

Global Protein Ingredient Market- By Beef

-

Global Protein Ingredient Market- By Pork

-

Global Protein Ingredient Market- By Other Ingredients

-

Global Protein Ingredients Market- By Form

-

Introduction

-

Global Protein Powder Market- By Powder

-

Global Protein Powder Market- By Bars

-

Global Protein Powder Market- By Ready To Drink

-

Global Protein Powder Market- By Capsules & Tablets

-

Global Protein Powder Market- By Other Forms

-

Global Protein Ingredients Market- By Application

-

Introduction

-

Global Protein Powder Market- By Functional Foods

-

Global Protein Powder Market- By Sports Nutrition

-

Global Protein Powder Market- By Meat Additives

-

Global Protein Powder Market- By Confectionery & Other Food Products

-

Global Protein Powder Market- By Pharmaceuticals

-

Global Protein Powder Market- By Other Applications

-

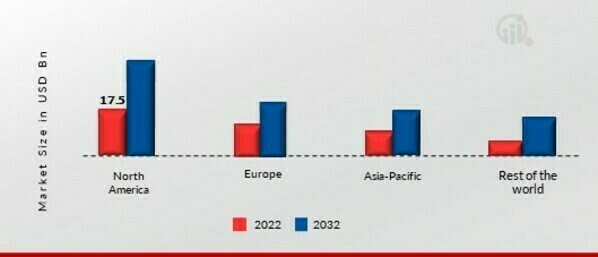

Global Protein Ingredients Market- By Region

-

Introduction

-

NORTH AMERICA PROTEIN INGREDIENTS MARKET, BY COUNTRY

-

NORTH AMERICA PROTEIN INGREDIENTS MARKET, BY FEEDSTOCK

-

NORTH AMERICA PROTEIN INGREDIENTS MARKET, BY FORM

-

NORTH AMERICA PROTEIN INGREDIENTS MARKET, BY APPLICATION

-

U.S. PROTEIN INGREDIENTS MARKET, BY FEEDSTOCK

-

U.S. PROTEIN INGREDIENTS MARKET, BY FORM

-

U.S. PROTEIN INGREDIENTS MARKET, BY APPLICATION

-

CANADA PROTEIN INGREDIENTS MARKET, BY FEEDSTOCK

-

CANADA PROTEIN INGREDIENTS MARKET, BY FORM

-

CANADA PROTEIN INGREDIENTS MARKET, BY APPLICATION

-

MEXICO PROTEIN INGREDIENTS MARKET, BY FEEDSTOCK

-

MEXICO PROTEIN INGREDIENTS MARKET, BY FORM

-

MEXICO PROTEIN INGREDIENTS MARKET, BY APPLICATION

-

Introduction

-

EUROPE PROTEIN INGREDIENTS MARKET

-

EUROPE PROTEIN INGREDIENTS MARKET BY COUNTRY

-

EUROPE PROTEIN INGREDIENTS MARKET BY FEEDSTOCK

-

EUROPE PROTEIN INGREDIENTS BY FORM

-

EUROPE PROTEIN INGREDIENTS BY APPLICATION

-

FRANCE PROTEIN INGREDIENTS BY FEEDSTOCK

-

FRANCE PROTEIN INGREDIENTS BY FORM

-

FRANCE PROTEIN INGREDIENTS BY APPLICATION

-

U.K. PROTEIN INGREDIENTS BY FEEDSTOCK

-

U.K. PROTEIN INGREDIENTS BY FORM

-

U.K. PROTEIN INGREDIENTS BY APPLICATION

-

FRANCE PROTEIN INGREDIENTS BY FEEDSTOCK

-

FRANCE PROTEIN INGREDIENTS BY FORM

-

FRANCE PROTEIN INGREDIENTS BY APPLICATION

-

ITALY PROTEIN INGREDIENTS BY FEEDSTOCK

-

ITALY PROTEIN INGREDIENTS BY FORM

-

ITALY PROTEIN INGREDIENTS BY APPLICATION

-

RUSSIA PROTEIN INGREDIENTS BY FEEDSTOCK

-

RUSSIA PROTEIN INGREDIENTS BY FORM

-

RUSSIA PROTEIN INGREDIENTS BY APPLICATION

-

REST OF EUROPE PROTEIN INGREDIENTS BY FEEDSTOCK

-

REST OF EUROPE PROTEIN INGREDIENTS BY FORM

-

REST OF EUROPE PROTEIN INGREDIENTS BY APPLICATION

-

Introduction

-

ASIA PACIFIC PROTEIN INGREDIENTS MARKET BY COUNTRY

-

ASIA PACIFIC PROTEIN INGREDIENTS MARKET BY FEEDSTOCK

-

ASIA PACIFIC PROTEIN INGREDIENTS MARKET BY FORM

-

ASIA PACIFIC PROTEIN INGREDIENTS MARKET BY APPLICATION

-

CHINA PROTEIN INGREDIENTS MARKET BY FEEDTSOCK

-

CHINA PROTEIN INGREDIENTS MARKET BY FORM

-

CHINA PROTEIN INGREDIENTS MARKET BY APPLICATION

-

THAILAND PROTEIN INGREDIENTS MARKET BY FEEDSTOCK

-

THAILAND PROTEIN INGREDIENTS MARKET BY FORM

-

THAILAND PROTEIN INGREDIENTS MARKET BY APPLICATION

-

INDIA PROTEIN INGREDIENTS MARKET BY FEDSTOCK

-

INDIA PROTEIN INGREDIENTS MARKET BY FORM

-

INDIA PROTEIN INGREDIENTS MARKET BY APPLICATION

-

AUSTRALIA PROTEIN INGREDIENTS MARKET BY FEEDSTOCK

-

AUSTRALIA PROTEIN INGREDIENTS MARKET BY FORM

-

AUSTRALIA PROTEIN INGREDIENTS MARKET BY APPLICATION

-

REST OF ASIA PACIFIC PROTEIN INGREDIENTS MARKET BY FEEDSTOCK

-

REST OF ASIA PACIFIC PROTEIN INGREDIENTS MARKET BY FORM

-

REST OF ASIA PACIFIC PROTEIN INGREDIENTS MARKET BY APPLICATION

-

REST OF THE WORLD PROTEIN INGREDIENTS MARKET BY COUNTRY

-

REST OF WORLD PROTEIN INGREDIENTS MARKET BY FEEDSTOCK

-

REST OF WORLD PROTEIN INGREDIENTS MARKET BY FORM

-

REST OF WORLD PROTEIN INGREDIENTS MARKET BY APPLICATION

-

BRAZIL PROTEIN INGREDIENTS MARKET BY FEEDSTOCK

-

BRAZIL PROTEIN INGREDIENTS MARKET BY FORM

-

BRAZIL PROTEIN INGREDIENTS MARKET BY APPLICATION

-

EGYPT PROTEIN INGREDIENTS MARKET BY FEEDSTOCK

-

EGYPT PROTEIN INGREDIENTS MARKET BY FORM

-

EGYPT PROTEIN INGREDIENTS MARKET BY APPLICATION

-

SOUTH AFRICA PROTEIN INGREDIENTS BY FEEDSTOCK

-

SOUTH AFRICA PROTEIN INGREDIENTS BY FORM

-

SOUTH AFRICA PROTEIN INGREDIENTS BY APPLICATION

-

OTHERS PROTEIN INGREDIENTS BY FEEDSTOCK

-

OTHERS PROTEIN INGREDIENTS BY FORM

-

OTHERS PROTEIN INGREDIENTS BY APPLICATION

-

Competitive Landscape

-

Introduction

-

Strategies Adopted By Key Players

-

Capacity Analysis-By Company

-

Product Analysis-By Company

-

Price Analysis- By Company

-

Company Profile

-

Archer Daniels Midland Company

- COMPANY OVERVIEW

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- SWOT Analysis

-

SOLAE

- COMPANY OVERVIEW

- Financial Analysis:

- Product Portfolio:

- Recent Developments

- SWOT Analysis

-

Shandong Yuwang Industrial Co., Ltd.

- COMPANY OVERVIEW

- Financial Analysis:

- Product Portfolio:

- Recent Developments

- SWOT Analysis

-

Shandong Sinoglory Health Food Co., Ltd

- COMPANY OVERVIEW

- Product Portfolio:

- Recent Developments:

- SWOT Analysis

-

Gushen Biological Technology Group Co.,Ltd

- COMPANY OVERVIEW

- Financial Analysis:

- Product Portfolio:

- Recent Developments:

-

Solbar

- COMPANY OVERVIEW

- FINANCIAL ANANYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

-

NUTRIPEA

- COMPANY OVERVIEW

- Financial Analysis:

- Product Portfolio:

- Recent Developments:

-

Harbin Hi-Tech Soybean Food Co.,Ltd

- COMPANY OVERVIEW

- Financial Analysis:

- Product Portfolio:

- Recent Developments:

-

Linyi Shansong Biological PRODUCTS CO LTD

- COMPANY OVERVIEW

- Financial Analysis:

- Product Portfolio:

- Recent Developments:

-

Crown Protein

- COMPANY OVERVIEW

- Financial Analysis:

- Product Portfolio:

- Recent Developments:

-

-

List Of Tables

-

INNOVATIONS IN PRODUCTS/PROCESS IN PROTEINS 29

-

PESTLE ANALYSIS-U.S. 33

-

PESTLE ANALYSIS- U.K. 35

-

PESTLE ANALYSIS-INDIA 36

-

PESTLE ANALYSIS-CHINA 37

-

GLOBAL PROTEIN INGREDIENTS MARKET, BY FEEDSTOCK, (2023–2032), KILO TONS 47

-

GLOBAL PROTEIN INGREDIENTS MARKET, BY SOY, (2023–2032), KILO TONS 48

-

GLOBAL PROTEIN INGREDIENTS MARKET, BY WHEAT, (2023–2032), KILO TONS 48

-

GLOBAL PROTEIN INGREDIENTS MARKET, BY PEA, (2023–2032), KILO TONS 49

-

GLOBAL PROTEIN INGREDIENTS MARKET, BY CANOLA, (2023–2032), KILO TONS 50

-

GLOBAL PROTEIN INGREDIENTS MARKET, BY WHEY, (2023–2032), KILO TONS 50

-

GLOBAL PROTEIN INGREDIENTS MARKET, BY MILK, (2023–2032), KILO TONS 51

-

GLOBAL PROTEIN INGREDIENTS MARKET, BY CASEIN, (2023–2032), KILO TONS 52

-

GLOBAL PROTEIN INGREDIENTS MARKET, BY EGG, (2023–2032), KILO TONS 52

-

GLOBAL PROTEIN INGREDIENTS MARKET, BY BEEF, (2023–2032), KILO TONS 53

-

GLOBAL PROTEIN INGREDIENTS MARKET, BY PORK, (2023–2032), KILO TONS 54

-

GLOBAL PROTEIN INGREDIENTS MARKET, BY OTHER SOURCES, (2023–2032), KILO TONS 54

-

GLOBAL PROTEIN INGREDIENTS MARKET, BY FORM, (2023–2032), KILO TONS 58

-

GLOBAL PROTEIN INGREDIENTS MARKET, BY POWDER, (2023–2032), KILO TONS 58

-

GLOBAL PROTEIN INGREDIENTS MARKET, BY BARS, (2023–2032), KILO TONS 59

-

GLOBAL PROTEIN INGREDIENTS MARKET, BY READY TO DRINK, (2023–2032), KILO TONS 60

-

GLOBAL PROTEIN INGREDIENTS MARKET, BY CAPSULES & TABLETS, (2023–2032), KILO TONS 60

-

GLOBAL PROTEIN INGREDIENTS MARKET, BY OTHER FORMS, (2023–2032), KILO TONS 61

-

GLOBAL PROTEIN INGREDIENTS MARKET, BY APPLICATION, (2023–2032), KILO TONS 64

-

GLOBAL PROTEIN INGREDIENTS MARKET, BY FUNCTIONAL FOODS, (2023–2032), KILO TONS 64

-

GLOBAL PROTEIN INGREDIENTS MARKET, BY SPORTS NUTRITION, (2023–2032), KILO TONS 65

-

GLOBAL PROTEIN INGREDIENTS MARKET, BY MEAT ADDITIVES, (2023–2032), KILO TONS 66

-

GLOBAL PROTEIN INGREDIENTS MARKET, BY CONFECTIONERY & OTHER FOOD PRODUCTS, (2023–2032), KILO TONS 66

-

GLOBAL PROTEIN INGREDIENTS MARKET, BY PHARMACEUTICALS, (2023–2032), KILO TONS 67

-

GLOBAL PROTEIN INGREDIENTS MARKET, BY OTHER APPLICATIONS, (2023–2032), KILO TONS 68

-

NORTH AMERICA PROTEIN INGREDIENTS MARKET SHARE, (2023–2032), KILO TONS, BY COUNTRY 71

-

NORTH AMERICA PROTEIN INGREDIENTS MARKET SHARE, (2023–2032), KILO TONS, BY FEEDSTOCK 72

-

NORTH AMERICA PROTEIN INGREDIENTS MARKET SHARE, (2023–2032), KILO TONS, BY FORM 73

-

NORTH AMERICA PROTEIN INGREDIENTS MARKET SHARE, (2023–2032), KILO TONS, BY APPLICATION 73

-

U.S. PROTEIN INGREDIENTS MARKET SHARE, (2023–2032), KILO TONS, BY FEEDSTOCK 74

-

U.S. PROTEIN INGREDIENTS MARKET SHARE, (2023–2032), KILO TONS, BY FORM 75

-

U.S. PROTEIN INGREDIENTS MARKET SHARE, (2023–2032), KILO TONS, BY APPLICATION 75

-

CANADA PROTEIN INGREDIENTS MARKET SHARE, (2023–2032), KILO TONS, BY TYPE 76

-

CANADA PROTEIN INGREDIENTS MARKET SHARE, (2023–2032), KILO TONS, BY FORM 77

-

CANADA PROTEIN INGREDIENTS MARKET SHARE, (2023–2032), KILO TONS, BY APPLICATION 77

-

MEXICO PROTEIN INGREDIENTS MARKET SHARE, (2023–2032), KILO TONS, BY FEEDSTOCK 78

-

MEXICO PROTEIN INGREDIENTS MARKET SHARE, (2023–2032), KILO TONS, BY FORM 78

-

MEXICO PROTEIN INGREDIENTS MARKET SHARE, (2023–2032), KILO TONS, BY APPLICATION 79

-

EUROPE PROTEIN INGREDIENTS MARKET SHARE, (2023–2032), KILO TONS, BY COUNTRY 81

-

EUROPE PROTEIN INGREDIENTS MARKET SHARE, (2023–2032), KILO TONS, BY FEEDSTOCK 82

-

EUROPE PROTEIN INGREDIENTS MARKET SHARE, (2023–2032), KILO TONS, BY FORM 83

-

EUROPE PROTEIN INGREDIENTS MARKET SHARE, (2023–2032), KILO TONS, BY APPLICATION 83

-

GERMANY PROTEIN INGREDIENTS MARKET SHARE, (2023–2032), KILO TONS, BY FEEDSTOCK 84

-

Plant Protein

Animal/Dairy Proteins

Microbe Protein

Others

Protein Ingredients Application Outlook (USD Billion, 2018-2032)

Food & Beverages

Infant Formulations

Clinical Nutrition

Animal Feed

Others

North America Protein Ingredients by ProductPlant Protein

Animal/Dairy Proteins

Microbe Protein

Others

North America Protein Ingredients by ApplicationFood & Beverages

Infant Formulations

Clinical Nutrition

Animal Feed

Others

US Protein Ingredients by ProductPlant Protein

Animal/Dairy Proteins

Microbe Protein

Others

US Protein Ingredients by ApplicationFood & Beverages

Infant Formulations

Clinical Nutrition

Animal Feed

Others

CANADA Protein Ingredients by ProductPlant Protein

Animal/Dairy Proteins

Microbe Protein

Others

CANADA Protein Ingredients by ApplicationFood & Beverages

Infant Formulations

Clinical Nutrition

Animal Feed

Others

Europe Protein Ingredients by ProductPlant Protein

Animal/Dairy Proteins

Microbe Protein

Others

Europe Protein Ingredients by ApplicationFood & Beverages

Infant Formulations

Clinical Nutrition

Animal Feed

Others

Germany Outlook (USD Billion, 2018-2032)

Germany Protein Ingredients by ProductPlant Protein

Animal/Dairy Proteins

Microbe Protein

Others

Germany Protein Ingredients by ApplicationFood & Beverages

Infant Formulations

Clinical Nutrition

Animal Feed

Others

France Protein Ingredients by ProductPlant Protein

Animal/Dairy Proteins

Microbe Protein

Others

France Protein Ingredients by ApplicationFood & Beverages

Infant Formulations

Clinical Nutrition

Animal Feed

Others

UK Protein Ingredients by ProductPlant Protein

Animal/Dairy Proteins

Microbe Protein

Others

UK Protein Ingredients by ApplicationFood & Beverages

Infant Formulations

Clinical Nutrition

Animal Feed

Others

ITALY Protein Ingredients by ProductPlant Protein

Animal/Dairy Proteins

Microbe Protein

Others

ITALY Protein Ingredients by ApplicationFood & Beverages

Infant Formulations

Clinical Nutrition

Animal Feed

Others

Spain Protein Ingredients by ProductPlant Protein

Animal/Dairy Proteins

Microbe Protein

Others

Spain Protein Ingredients by ApplicationFood & Beverages

Infant Formulations

Clinical Nutrition

Animal Feed

Others

Rest Of Europe Protein Ingredients by ProductPlant Protein

Animal/Dairy Proteins

Microbe Protein

Others

REST OF EUROPE Protein Ingredients by ApplicationFood & Beverages

Infant Formulations

Clinical Nutrition

Animal Feed

Others

Asia-Pacific Protein Ingredients by ProductPlant Protein

Animal/Dairy Proteins

Microbe Protein

Others

Asia-Pacific Protein Ingredients by ApplicationFood & Beverages

Infant Formulations

Clinical Nutrition

Animal Feed

Others

China Protein Ingredients by ProductPlant Protein

Animal/Dairy Proteins

Microbe Protein

Others

China Protein Ingredients by ApplicationFood & Beverages

Infant Formulations

Clinical Nutrition

Animal Feed

Others

Japan Protein Ingredients by ProductPlant Protein

Animal/Dairy Proteins

Microbe Protein

Others

Japan Protein Ingredients by ApplicationFood & Beverages

Infant Formulations

Clinical Nutrition

Animal Feed

Others

India Protein Ingredients by ProductPlant Protein

Animal/Dairy Proteins

Microbe Protein

Others

India Protein Ingredients by ApplicationFood & Beverages

Infant Formulations

Clinical Nutrition

Animal Feed

Others

Australia Protein Ingredients by ProductPlant Protein

Animal/Dairy Proteins

Microbe Protein

Others

Australia Protein Ingredients by ApplicationFood & Beverages

Infant Formulations

Clinical Nutrition

Animal Feed

Others

Rest of Asia-Pacific Protein Ingredients by ProductPlant Protein

Animal/Dairy Proteins

Microbe Protein

Others

Rest of Asia-Pacific Protein Ingredients by ApplicationFood & Beverages

Infant Formulations

Clinical Nutrition

Animal Feed

Others

Rest of the World Protein Ingredients by ProductPlant Protein

Animal/Dairy Proteins

Microbe Protein

Others

Rest of the World Protein Ingredients by ApplicationFood & Beverages

Infant Formulations

Clinical Nutrition

Animal Feed

Others

Middle East Protein Ingredients by ProductPlant Protein

Animal/Dairy Proteins

Microbe Protein

Others

Middle East Protein Ingredients by ApplicationFood & Beverages

Infant Formulations

Clinical Nutrition

Animal Feed

Others

Africa Protein Ingredients by ProductPlant Protein

Animal/Dairy Proteins

Microbe Protein

Others

Africa Protein Ingredients by ApplicationFood & Beverages

Infant Formulations

Clinical Nutrition

Animal Feed

Others

Latin America Protein Ingredients by ProductPlant Protein

Animal/Dairy Proteins

Microbe Protein

Others

Latin America Protein Ingredients by ApplicationFood & Beverages

Infant Formulations

Clinical Nutrition

Animal Feed

Others

Leave a Comment