Pulses Ingredients Market Share

Pulses Ingredients Market Research Report: Information By Type (Pulses Flours, Pulses Starch, Pulses Proteins, and Others), By Source (Lentils, Peas, Beans, Chickpeas, and Others), By Application (Food & Beverage, Animal Feed, and Others), And By Region (Asia-Pacific, Europe, North America, And Rest Of The World) –Market Forecast Till 2035

Market Summary

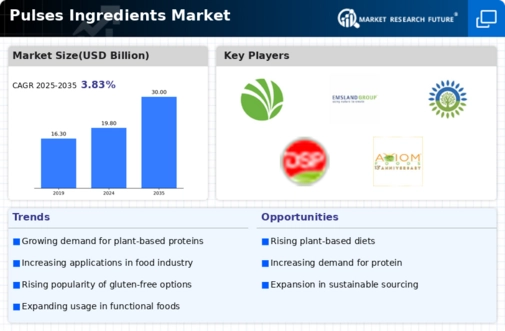

The Global Pulses Ingredients Market is projected to grow from 19.80 USD Billion in 2024 to 29.94 USD Billion by 2035.

Key Market Trends & Highlights

Pulses Ingredients Key Trends and Highlights

- The market is expected to achieve a compound annual growth rate of 3.85 percent from 2025 to 2035. By 2035, the market valuation is anticipated to reach 30.0 USD Billion, indicating robust growth. in 2024, the market is valued at 19.80 USD Billion, reflecting a strong foundation for future expansion. Growing adoption of plant-based diets due to increasing health consciousness is a major market driver.

Market Size & Forecast

| 2024 Market Size | 19.80 (USD Billion) |

| 2035 Market Size | 29.94 (USD Billion) |

| CAGR (2025-2035) | 3.83% |

| Largest Regional Market Share in 2024 | latin_america) |

Major Players

<p>Ingredion Incorporated (US), Roquette Frères (France), Emsland Group (Germany), The Scoular Company (US), Archer Daniels Midland Company (US), SunOpta Inc. (Canada), Diefenbaker Spice & Pulses (Canada), Axiom Foods Inc. (US), Cosucra Groupe Warcoing SA (Belgium), Dakota Dry Bean (US)</p>

Market Trends

The increasing need for pulse starch in various food and industrial uses drives market growth.

Pulse starch can be used to gel, texturize, bind, coat, thicken, and make films, among other things. It has been utilized in various food applications, including pasta and noodles, pastry, confectionery, soups and sauces, and meat and poultry because of its multi-functionality. Additionally, it is frequently used as a binding agent in the production of vermicelli. Due to its variety of uses and affordability, pulse starch is also a possible alternative for other starches in food and beverage applications.

The Saskatchewan Agriculture Ministry and the MOA announced USD 2.07 million in funding for research exploring new possibilities for starches from pulse crops, which is being directed by the University of Saskatchewan in 2021. The study aimed to improve seed starch isolation and understand the processes involved in converting pulse starches into products with additional value. Thus, driving the pulse ingredients market revenue.

An increase in the creation of processed and convenience foods is driving the need for ingredients made from pulses. India and China are two emerging economies in the Asia Pacific region growing quickly. Additionally, the Asia-Pacific area offers lower production and processing costs. High demand and cheap production costs are two important characteristics that will help suppliers and manufacturers of pulse ingredients target the pulse ingredients industry.

The rise in demand for convenience and ready-to-eat foods has been influenced by several factors, including the growing number of working women and nuclear families, an improved standard of living, and changing lifestyles. The growing desire for snacks drives the market for RTE & bakery items, soups, and snacks made from pulse ingredients. Busier lives have boosted the need for on-the-go products to reduce the time spent preparing meals. Demand for healthier products with pulse components also rises due to the demand for these products.

<p>The increasing consumer demand for plant-based proteins is reshaping the landscape of the pulses ingredients market, highlighting their potential as a sustainable alternative in food production.</p>

United States Department of Agriculture (USDA)

Pulses Ingredients Market Market Drivers

Rising Health Consciousness

The Global Pulses Ingredients Market Industry is experiencing a surge in demand driven by increasing health consciousness among consumers. Pulses are recognized for their high protein content, fiber, and essential nutrients, making them a preferred choice for health-oriented diets. As more individuals seek plant-based alternatives to meat, the market for pulses is projected to reach 19.8 USD Billion in 2024. This trend is further supported by various health organizations advocating for the inclusion of pulses in daily diets, which enhances their visibility and acceptance in mainstream food products.

Government Support and Initiatives

Government initiatives aimed at promoting pulse cultivation and consumption are significantly influencing the Global Pulses Ingredients Market Industry. Various countries are implementing policies to support farmers in pulse production, recognizing the crop's nutritional benefits and environmental advantages. These initiatives often include financial incentives, research funding, and educational programs to raise awareness about pulses. Such support is likely to enhance production capabilities and expand market reach, thereby contributing to the anticipated growth of the market to 30.0 USD Billion by 2035, as governments prioritize food security and sustainable agriculture.

Market Trends and Growth Projections

Diverse Applications in Food Products

The versatility of pulses is a key driver for the Global Pulses Ingredients Market Industry. Pulses can be utilized in various food applications, including snacks, baked goods, and meat alternatives. This adaptability allows manufacturers to innovate and create new products that cater to diverse consumer preferences. As the market evolves, the incorporation of pulses into gluten-free and high-protein products is becoming increasingly popular. This trend is likely to contribute to a compound annual growth rate of 3.85% from 2025 to 2035, reflecting the growing acceptance of pulses in mainstream food categories.

Growing Vegan and Vegetarian Population

The increasing number of individuals adopting vegan and vegetarian lifestyles is a substantial driver for the Global Pulses Ingredients Market Industry. As more consumers seek plant-based diets for ethical, health, or environmental reasons, the demand for pulse-based products is on the rise. This demographic shift is reflected in the market's projected growth, reaching 19.8 USD Billion in 2024. The rise of plant-based protein products, including meat substitutes made from pulses, indicates a significant shift in consumer preferences, further solidifying the role of pulses in modern diets.

Sustainability and Environmental Concerns

Sustainability plays a pivotal role in the growth of the Global Pulses Ingredients Market Industry. Pulses are known for their low environmental impact compared to animal protein sources, as they require less water and land for cultivation. This aligns with the global shift towards sustainable food systems, prompting food manufacturers to incorporate pulses into their products. The market is expected to grow significantly, with projections indicating a value of 30.0 USD Billion by 2035. This growth reflects a broader commitment to reducing carbon footprints and promoting eco-friendly agricultural practices.

Market Segment Insights

Pulses Ingredients Type Insights

<p>Based on the type, the pulses ingredients market segmentation includes pulses flours, pulses starch, pulse proteins, and others. The increasing need for animal-based protein is predicted to impact the environment, including the emission of greenhouse gases and the requirement for fresh water. These factors will lead to the developing of current protein sources and other alternative sources that are more sustainably produced for direct human consumption.</p>

Pulses Ingredients Source Insights

<p>Based on the source, the pulses ingredients market segmentation includes lentils, peas, beans, chickpeas, etc. The chickpeas dominated the market, accounting for 45% of market revenue (8.2 Billion). Zinc, iron, phosphorus, and magnesium are minerals in peas that support good health. Due to their high fiber content, they are also believed to help lower cholesterol and maintain blood sugar levels. Pea components, including pea proteins, <a href="https://www.marketresearchfuture.com/reports/pea-starch-market-6736">pea starches</a>, pea flours, and pulse powders, are used as main ingredients in various foods, including sauces, soups, baked goods, and other foods.</p>

Pulses Ingredients Application Insights

<p>Based on application, the pulses ingredients market segmentation includes food & beverage, animal feed, others. The food & beverages category generated the most income (53%). Pulse starch can be used to gel, texturize, bind, coat, thicken, and create films. Due to its versatility, it has been used in various food applications, including meat and poultry, soups and sauces, pastry, confectionery, and pasta and noodles. Additionally, it is frequently employed in producing vermicelli as a binding agent. Pulse starch is also a potential substitute for other starches in F&B applications due to its accessibility and range of uses.</p>

<p>Figure 1: Pulses Ingredients Market, by Application, 2022 & 2032 (USD Billion)</p>

<p>Source: Secondary Research, Primary Research, Market Research Future Database, and Analyst Review</p>

Get more detailed insights about Pulses Ingredients Market Research Report – Global Forecast till 2032

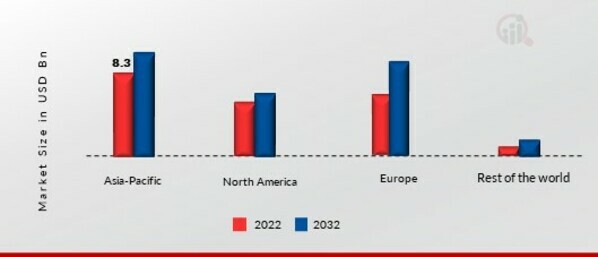

Regional Insights

By region, the study provides market insights into North America, Asia-Pacific, Europe, and the Rest of the World. The Asia Pacific pulse ingredients market, will dominate this market. Due to its sizable elderly population, Japan is another prospective market for pulse components. This is anticipated to increase demand for food products with added protein, increasing demand for pulse components. Due to its vast population and movement towards plant-based components, the Asia Pacific region is predicted to have a significant demand for pulse ingredients in the upcoming years.

Further, the major countries studied in the market report are The US, German, France, the UK, Italy, Canada, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure 2: PULSES INGREDIENTS MARKET SHARE BY REGION 2022 (USD Billion)

Source: Secondary Research, Primary Research, Market Research Future Database, and Analyst Review

Europe's pulses ingredients market accounts for the second-largest market share due to the increasing product innovation in the region. Further, the German pulses ingredients market held the largest market share, and the UK was the fastest-growing market in the European region.

The North American pulses ingredients Market is expected to grow at the fastest CAGR from 2023 to 2032. This is brought on by rising per capita disposable income, increased awareness of a healthy lifestyle, and good nutrition. Moreover, US’s pulses ingredients market held the largest market share, and the Canadian pulses ingredients market was the fastest-growing market in the North American region.

Key Players and Competitive Insights

Leading industry companies are making significant R&D investments to diversify their product offerings, which will spur further expansion of the market for pulses ingredients. Market participants also engage in various strategic actions to increase their worldwide footprint. Important market developments include introducing new products, increased investments, contractual agreements, mergers and acquisitions, and collaboration with other organizations. The pulse ingredient sector must provide affordable products to grow and thrive in a more cutthroat and competitive market environment.

One of the main business strategies manufacturers use in the worldwide pulses ingredients industry to benefit customers and expand the market sector is local manufacturing to reduce operational costs. The pulses ingredients sector has recently provided some of the most important medicinal benefits. Major players in the pulses ingredients market, including Ingredion Incorporated (US), Roquette Frères (France), Emsland Group (Germany), The Scoular Company (US), Archer Daniels Midland Company (US), SunOpta Inc. (Canada), Diefenbaker Spice & Pulses (Canada), and others are attempting to increase market demand by investing in research and development operations.

Based in Westchester, Illinois, Ingredion Incorporated is an American company that provides ingredients for food and beverages. It primarily produces starches, non-GMO sweeteners, stevia, and pea protein. The business produces ingredients for food, beverage, brewing, pharmaceutical, and many other industrial sectors using maize, tapioca, potatoes, plant-based stevia, cereals, fruits, gums, and other vegetables. It serves consumers in more than 120 countries and employs roughly 12,000 people across 44 locations. Ingredion was ranked second in 2021 by FoodTalks in the Top 50 Sweetener Companies list and the Modified Starch category of the Food Thickener Companies list.

The starch taken from corn, wheat, potatoes and peas is used by Roquette, a family-owned business headquartered in France, to make more than 650 by-products. Roquette, established in 1933 and headquartered in Lestrem, France, by the brothers Dominique and Germain Roquette, has developed into the fourth-largest producer of starch in the world and the leader in starch manufacturing in Europe. Additionally, it is the world's top polyol producer, with molecules generated from dietary ingredients. More than 8,360 people work for Roquette worldwide, and the company generated more than 2,5 billion euros in revenue in 2011.

Key Companies in the Pulses Ingredients Market market include

Industry Developments

- Q2 2024: Ingredion opens new pulse-based protein facility in Nebraska Ingredion announced the opening of a new manufacturing facility in Nebraska dedicated to producing pulse-based protein ingredients, aiming to meet rising demand for plant-based foods.

- Q1 2024: AGT Food and Ingredients partners with Beyond Meat for pea protein supply AGT Food and Ingredients entered a multi-year partnership with Beyond Meat to supply pea protein, strengthening its position in the pulse ingredients market and supporting Beyond Meat’s product expansion.

- Q2 2024: Cargill launches new chickpea flour ingredient for bakery sector Cargill introduced a new chickpea flour ingredient targeting the bakery industry, expanding its portfolio of pulse-based products for food manufacturers.

- Q3 2024: Roquette announces $50M investment in Canadian pea processing plant Roquette revealed a $50 million investment to expand its pea processing facility in Manitoba, Canada, aiming to increase production capacity for pulse-derived ingredients.

- Q2 2024: Bühler and Givaudan form joint venture for pulse ingredient innovation Bühler and Givaudan established a joint venture focused on developing innovative pulse-based ingredients for the food industry, combining expertise in processing and flavor technology.

- Q1 2025: Ingredion appoints new VP of Pulse Ingredients Division Ingredion announced the appointment of Dr. Lisa Chen as Vice President of its Pulse Ingredients Division, signaling a strategic focus on plant-based ingredient innovation.

- Q2 2025: Puris secures $30M funding round to expand pea protein production Puris completed a $30 million funding round to scale up its pea protein production facilities, responding to increased demand from food manufacturers for pulse-based ingredients.

- Q3 2024: ADM launches lentil protein concentrate for sports nutrition market ADM introduced a new lentil protein concentrate designed for sports nutrition products, expanding its pulse ingredient offerings to meet consumer demand for plant-based protein.

- Q2 2024: AGT Food and Ingredients wins major contract with European food manufacturer AGT Food and Ingredients secured a multi-year contract to supply pulse ingredients to a leading European food manufacturer, strengthening its international market presence.

- Q1 2025: Roquette receives regulatory approval for new pea protein isolate in Japan Roquette obtained regulatory approval from Japanese authorities for its new pea protein isolate, enabling expanded sales in the Asia-Pacific region.

- Q2 2025: Cargill acquires minority stake in pulse ingredient startup NutriPulse Cargill acquired a minority stake in NutriPulse, a startup specializing in innovative pulse-based ingredients, to accelerate product development and market reach.

- Q3 2024: Bühler opens new R&D center for pulse ingredient technology in Switzerland Bühler inaugurated a new research and development center in Switzerland focused on advancing pulse ingredient processing technologies for global food applications.

Future Outlook

Pulses Ingredients Market Future Outlook

<p>The Pulses Ingredients Market is projected to grow at 3.83% CAGR from 2025 to 2035, driven by rising health consciousness, plant-based diets, and sustainable agriculture practices.</p>

New opportunities lie in:

- <p>Develop innovative pulse-based protein products for the growing vegan market. Invest in sustainable farming technologies to enhance pulse yield and quality. Expand distribution channels to emerging markets with increasing demand for healthy ingredients.</p>

<p>By 2035, the Pulses Ingredients Market is expected to achieve robust growth, reflecting evolving consumer preferences and sustainability trends.</p>

Market Segmentation

Pulses Ingredients Sou Outlook

- Lentils

- Peas

- Beans

- Chickpeas

- Others

Pulses Ingredients Type Outlook

- Pulses Flours

- Pulses Starch

- Pulses Proteins

- Others

Pulses Ingredients Regional Outlook

- {"North America"=>["US"

- "Canada"

- "Europe"

- "Germany"

- "France"

- "UK"

- "Italy"

- "Spain"

- "Rest of Europe"]}

- {"Asia-Pacific"=>["China"

- "Japan"

- "India"

- "Australia"

- "South Korea"

- "Rest of Asia-Pacific"]}

- {"Rest of the World"=>["Middle East"

- "Africa"

- "Latin America"]}

Pulses Ingredients Application Outlook

- Food & Beverage

- Animal Feed

- Others

Report Scope

| Report Attribute/Metric | Details |

| Market Size 2024 | USD 19.8 Billion |

| Market Size 2035 | 29.94 (Value (USD Billion)) |

| Compound Annual Growth Rate (CAGR) | 3.83% (2025 - 2035) |

| Base Year | 2024 |

| Market Forecast Period | 2025 - 2035 |

| Historical Data | 2018- 2022 |

| Market Forecast Units | Value (USD Billion) |

| Report Coverage | Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | Source, Type, Application, and Region |

| Geographies Covered | North America, Europe, Asia Pacific, and the Rest of the World |

| Countries Covered | The US, Canada, German, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

| Key Companies Profiled | Ingredion Incorporated (US), Roquette Frères (France), Emsland Group (Germany), The Scoular Company (US), Archer Daniels Midland Company (US), SunOpta Inc. (Canada), Diefenbaker Spice & Pulses (Canada), and others |

| Key Market Opportunities | The high protein profile of pulse ingredients increases their popularity as a healthy option. |

| Key Market Dynamics | Increased health consciousness among consumers drives market growth |

| Market Size 2025 | 20.56 (Value (USD Billion)) |

Market Highlights

Author

Latest Comments

This is a great article! Really helped me understand the topic better.

Thanks for sharing this. I’ve bookmarked it for later reference.

FAQs

How much is the pulses ingredients market?

The pulses ingredients market size was valued at USD 19.8 Billion in 2024.

What is the growth rate of the pulses ingredients market?

The market is projected to grow at a CAGR of 3.83% during the forecast period, 2024-2032.

Which region held the largest market share in the pulses ingredients market?

Asia Pacific had the largest share of the market

Who are the key players in the pulses ingredients market?

The key players in the market are Ingredion Incorporated (US), Roquette Frères (France), Emsland Group (Germany), The Scoular Company (US), Archer Daniels Midland Company (US), SunOpta Inc. (Canada), and others.

Which type led the pulses ingredients market?

The pulse protein category dominated the market in 2023.

Which application segment had the largest market share in the pulses ingredients market?

Food & Beverages had the largest share of the market.

-

--- 'Table of Contents

-

Executive Summary

-

Scope of the Report

- Market Definition

-

Scope of the Study

- Research Objectives

- Assumptions & Limitations

- Market Structure

-

Market Research Methodology

- Research Process

- Secondary Research

- Primary Research

- Forecast Model

-

Market Landscape

-

Supply Chain Analysis

- Source Suppliers

- Manufacturers/Producers

- Distributors/Retailers/Wholesalers/E-Commerce

- End Users

-

Porter’s Five Forces Analysis

- Threat of New Entrants

- Bargaining Power of Buyers

- Bargaining Power of Suppliers

- Threat of Substitutes

- Internal Rivalry

-

Supply Chain Analysis

-

Market Dynamics of Global Pulses Ingredients Market

- Introduction

- Drivers

- Restraints

- Opportunities

- Challenges

-

Global Pulses Ingredients Market, by Type

- Introduction

-

Pulse Flours

- Market Estimates & Forecast, 2023–2032

- Market Estimates & Forecast, by Region, 2023–2032

-

Pulse Starch

- Market Estimates & Forecast, 2023–2032

- Market Estimates & Forecast, by Region, 2023–2032

-

Pulse Proteins

- Market Estimates & Forecast, 2023–2032

- Market Estimates & Forecast, by Region, 2023–2032

-

Others

- Market Estimates & Forecast, 2023–2032

- Market Estimates & Forecast, by Region, 2023–2032

-

Global Pulses Ingredients Market, by Source

- Introduction

-

Lentils

- Market Estimates & Forecast, 2023–2032

- Market Estimates & Forecast, by Region, 2023–2032

-

Peas

- Market Estimates & Forecast, 2023–2032

- Market Estimates & Forecast, by Region, 2023–2032

-

Beans

- Market Estimates & Forecast, 2023–2032

- Market Estimates & Forecast, by Region, 2023–2032

-

Chickpeas

- Market Estimates & Forecast, 2023–2032

- Market Estimates & Forecast, by Region, 2023–2032

-

Others

- Market Estimates & Forecast, 2023–2032

- Market Estimates & Forecast, by Region, 2023–2032

-

Global Pulses Ingredients Market, by Application

- Introduction

-

Food & Beverage

- Market Estimates & Forecast, 2023–2032

- Market Estimates & Forecast, by Region, 2023–2032

- Bakery & Confectionery

- Sauces, Dressings, and Spreads

- RTE & RTC Foods

- Others

-

Animal Feed

- Market Estimates & Forecast, 2023–2032

- Market Estimates & Forecast, by Region, 2023–2032

-

Others

- Market Estimates & Forecast, 2023–2032

- Market Estimates & Forecast, by Region, 2023–2032

-

Global Pulses Ingredients Market, by Region

- Introduction

-

North America

- Market Estimates & Forecast, 2023–2032

- Market Estimates & Forecast, by Type, 2023–2032

- Market Estimates & Forecast, by Source, 2023–2032

- Market Estimates & Forecast, by Application, 2023–2032

- US

- Canada

- Mexico

-

Europe

- Market Estimates & Forecast, 2023–2032

- Market Estimates & Forecast, by Type, 2023–2032

- Market Estimates & Forecast, by Application, 2023–2032

- Germany

- France

- Italy

- Spain

- Rest of Europe

-

Asia-Pacific

- Market Estimates & Forecast, 2023–2032

- Market Estimates & Forecast, by Type, 2023–2032

- Market Estimates & Forecast, by Source, 2023–2032

- Market Estimates & Forecast, by Application, 2023–2032

- China

- India

- Japan

- Australia & New Zealand

- Rest of Asia-Pacific

-

Rest of the World (RoW)

- Market Estimates & Forecast, 2023–2032

- Market Estimates & Forecast, by Type, 2023–2032

- Market Estimates & Forecast, by Source, 2023–2032

- Market Estimates & Forecast, by Application, 2023–2032

- South America

- Middle East

- Africa

-

Company Landscape

- Market Strategy

- Key Development Analysis

-

(Expansions/Mergers and Acquisitions/Joint Ventures/New Product Developments/Agreements/Investments

-

Company Profiles

-

Ingredion Incorporated

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Strategy

- Key Developments

- SWOT Analysis

-

Roquette Frères

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Strategy

- Key Developments

- SWOT Analysis

-

Emsland Group

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Strategy

- Key Developments

- SWOT Analysis

-

The Scoular Company

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Strategy

- Key Developments

- SWOT Analysis

-

Archer Daniels Midland Company

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Strategy

- Key Developments

- SWOT Analysis

-

SunOpta Inc.

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Strategy

- Key Developments

- SWOT Analysis

-

Diefenbaker Spice & Pulse

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Strategy

- Key Developments

- SWOT Analysis

-

Axiom Foods Inc.

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Strategy

- Key Developments

- SWOT Analysis

-

Cosucra Groupe Warcoing SA

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Strategy

- Key Developments

- SWOT Analysis

-

Dakota Dry Bean

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Strategy

- Key Developments

- SWOT Analysis

-

Ingredion Incorporated

-

Conclusion

-

-

List of Tables and Figures

- LIST OF TABLES

- Table 1 Global Pulses Ingredients Market, by Region, 2023–2032 (USD Million)

- Table 2 Global Pulses Ingredients Market, by Type, 2023–2032 (USD Million)

- Table 3 Global Pulses Ingredients Market, by Source, 2023–2032 (USD Million)

- Table 4 Global Pulses Ingredients Market, by Application, 2023–2032 (USD Million)

- Table 5 North America: Pulses Ingredients Market, by Country, 2023–2032 (USD Million)

- Table 6 North America: Pulses Ingredients Market, by Type, 2023–2032 (USD Million)

- Table 7 North America: Pulses Ingredients Market, by Source, 2023–2032 (USD Million)

- Table 8 North America: Pulses Ingredients Market, by Application, 2023–2032 (USD Million)

- Table 9 US: Pulses Ingredients Market, by Type, 2023–2032 (USD Million)

- Table 10 US: Pulses Ingredients Market, by Source, 2023–2032 (USD Million)

- Table 11 US: Pulses Ingredients Market, by Application, 2023–2032 (USD Million)

- Table 12 Canada: Pulses Ingredients Market, by Type, 2023–2032 (USD Million)

- Table 13 Canada: Pulses Ingredients Market, by Source, 2023–2032 (USD Million)

- Table 14 Canada: Pulses Ingredients Market, by Application, 2023–2032 (USD Million)

- Table 15 Mexico: Pulses Ingredients Market, by Type, 2023–2032 (USD Million)

- Table 16 Mexico: Pulses Ingredients Market, by Source, 2023–2032 (USD Million)

- Table 17 Mexico: Pulses Ingredients Market, by Application, 2023–2032 (USD Million)

- Table 18 Europe: Pulses Ingredients Market, by Country, 2023–2032 (USD Million)

- Table 19 Europe: Pulses Ingredients Market, by Type, 2023–2032 (USD Million)

- Table 20 Europe: Pulses Ingredients Market, by Source, 2023–2032 (USD Million)

- Table 21 Europe: Pulses Ingredients Market, by Application, 2023–2032 (USD Million)

- Table 22 Germany: Pulses Ingredients Market, by Type, 2023–2032 (USD Million)

- Table 23 Germany: Pulses Ingredients Market, by Source, 2023–2032 (USD Million)

- Table 24 Germany: Pulses Ingredients Market, by Application, 2023–2032 (USD Million)

- Table 25 France: Pulses Ingredients Market, by Type, 2023–2032 (USD Million)

- Table 26 France: Pulses Ingredients Market, by Source, 2023–2032 (USD Million)

- Table 27 France: Pulses Ingredients Market, by Application, 2023–2032 (USD Million)

- Table 28 Italy: Pulses Ingredients Market, by Type, 2023–2032 (USD Million)

- Table 29 Italy: Pulses Ingredients Market, by Source, 2023–2032 (USD Million)

- Table 30 Italy: Pulses Ingredients Market, by Application, 2023–2032 (USD Million)

- Table 31 Spain: Pulses Ingredients Market, by Type, 2023–2032 (USD Million)

- Table 32 Spain: Pulses Ingredients Market, by Source, 2023–2032 (USD Million)

- Table 33 Spain: Pulses Ingredients Market, by Application, 2023–2032 (USD Million)

- Table 34 UK: Pulses Ingredients Market, by Type, 2023–2032 (USD Million)

- Table 35 UK: Pulses Ingredients Market, by Source, 2023–2032 (USD Million)

- Table 36 UK: Pulses Ingredients Market, by Application, 2023–2032 (USD Million)

- Table 37 Rest of Europe: Pulses Ingredients Market, by Type, 2023–2032 (USD Million)

- Table 38 Rest of Europe: Pulses Ingredients Market, by Source, 2023–2032 (USD Million)

- Table 39 Rest of Europe: Pulses Ingredients Market, by Application, 2023–2032 (USD Million)

- Table 40 Asia-Pacific: Pulses Ingredients Market, by Country, 2023–2032 (USD Million)

- Table 41 Asia-Pacific: Pulses Ingredients Market, by Type, 2023–2032 (USD Million)

- Table 42 Asia-Pacific: Pulses Ingredients Market, by Source, 2023–2032 (USD Million)

- Table 43 Asia-Pacific: Pulses Ingredients Market, by Application, 2023–2032 (USD Million)

- Table 44 China: Pulses Ingredients Market, by Type, 2023–2032 (USD Million)

- Table 45 China: Pulses Ingredients Market, by Source, 2023–2032 (USD Million)

- Table 46 China: Pulses Ingredients Market, by Application, 2023–2032 (USD Million)

- Table 47 India: Pulses Ingredients Market, by Type, 2023–2032 (USD Million)

- Table 48 India: Pulses Ingredients Market, by Source, 2023–2032 (USD Million)

- Table 49 India: Pulses Ingredients Market, by Application, 2023–2032 (USD Million)

- Table 50 Japan: Pulses Ingredients Market, by Type, 2023–2032 (USD Million)

- Table 51 Japan: Pulses Ingredients Market, by Source, 2023–2032 (USD Million)

- Table 52 Japan: Pulses Ingredients Market, by Application, 2023–2032 (USD Million)

- Table 53 Rest of Asia-Pacific: Pulses Ingredients Market, by Type, 2023–2032 (USD Million)

- Table 54 Rest of Asia-Pacific: Pulses Ingredients Market, by Source, 2023–2032 (USD Million)

- Table 55 Rest of Asia-Pacific: Pulses Ingredients Market, by Application, 2023–2032 (USD Million)

- Table 56 Rest of the World (RoW): Pulses Ingredients Market, by Country, 2023–2032 (USD Million)

- Table 57 Rest of the World (RoW): Pulses Ingredients Market, by Type, 2023–2032 (USD Million)

- Table 58 Rest of the World (RoW): Pulses Ingredients Market, by Source, 2023–2032 (USD Million)

- Table 59 Rest of the World (RoW): Pulses Ingredients Market, by Application, 2023–2032 (USD Million)

- Table 60 South America: Pulses Ingredients Market, by Type, 2023–2032 (USD Million)

- Table 61 South America: Pulses Ingredients Market, by Source, 2023–2032 (USD Million)

- Table 62 South America: Pulses Ingredients Market, by Application, 2023–2032 (USD Million)

- Table 63 Middle East: Pulses Ingredients Market, by Type, 2023–2032 (USD Million)

- Table 64 Middle East: Pulses Ingredients Market, by Source, 2023–2032 (USD Million)

- Table 65 Middle East: Pulses Ingredients Market, by Application, 2023–2032 (USD Million)

- Table 66 Africa: Pulses Ingredients Market, by Type, 2023–2032 (USD Million)

- Table 67 Africa: Pulses Ingredients Market, by Source, 2023–2032 (USD Million)

- Table 68 Africa: Pulses Ingredients Market, by Application, 2023–2032 (USD Million) LIST OF FIGURES

- FIGURE 1 Global Pulses Ingredients Market Segmentation

- FIGURE 2 Forecast Research Methodology

- FIGURE 3 Five Forces Analysis of the Global Pulses Ingredients Market

- FIGURE 4 Value Chain of the Global Pulses Ingredients Market

- FIGURE 5 Share of the Global Pulses Ingredients Market in 2023, by Country (%)

- FIGURE 6 Global Pulses Ingredients Market, by Region, 2023–2032,

- FIGURE 7 Global Pulses Ingredients Market Size, by Type, 2023

- FIGURE 8 Share of Global Pulses Ingredients Market, by Type, 2023–2032 (%)

- FIGURE 9 Global Pulses Ingredients Market Size, by Source, 2023

- FIGURE 10 Share of Global Pulses Ingredients Market, by Source, 2023–2032 (%)

- FIGURE 11 Global Pulses Ingredients Market Size, by Application, 2023

- FIGURE 12 Share of Global Pulses Ingredients Market, by Application, 2023–2032 (%)'

Market Segmentation

Pulses Ingredients Market Type Outlook (USD Billion, 2018-2032)

- Pulses Flours

- Pulses Starch

- Pulses Proteins

- Others

Pulses Ingredients Market Source Outlook (USD Billion, 2018-2032)

- Lentils

- Peas

- Beans

- Chickpeas

- Others

Pulses Ingredients Market Application Outlook (USD Billion, 2018-2032)

- Food & Beverage

- Animal Feed

- Others

Pulses Ingredients Market Regional Outlook (USD Billion, 2018-2032)

- North America Outlook (USD Billion, 2018-2032)

- North America Pulses Ingredients Market by Type

- Pulses Flours

- Pulses Starch

- Pulses Proteins

- Others

- North America Pulses Ingredients Market by Source

- Lentils

- Peas

- Beans

- Chickpeas

- Others

- North America Pulses Ingredients Market by Application

- Food & Beverage

- Animal Feed

- Others

- US Outlook (USD Billion, 2018-2032)

- US Pulses Ingredients Market by Type

- Pulses Flours

- Pulses Starch

- Pulses Proteins

- Others

- US Pulses Ingredients Market by Source

- Lentils

- Peas

- Beans

- Chickpeas

- Others

- US Pulses Ingredients Market by Application

- Food & Beverage

- Animal Feed

- Others

- CANADA Outlook (USD Billion, 2018-2032)

- CANADA Pulses Ingredients Market by Type

- Pulses Flours

- Pulses Starch

- Pulses Proteins

- Others

- CANADA Pulses Ingredients Market by Source

- Lentils

- Peas

- Beans

- Chickpeas

- Others

- CANADA Pulses Ingredients Market by Application

- Food & Beverage

- Animal Feed

- Others

- Europe Outlook (USD Billion, 2018-2032)

- Europe Pulses Ingredients Market by Type

- Pulses Flours

- Pulses Starch

- Pulses Proteins

- Others

- Europe Pulses Ingredients Market by Source

- Lentils

- Peas

- Beans

- Chickpeas

- Others

- Europe Pulses Ingredients Market by Application

- Food & Beverage

- Animal Feed

- Others

- Germany Outlook (USD Billion, 2018-2032)

- Germany Pulses Ingredients Market by Type

- Pulses Flours

- Pulses Starch

- Pulses Proteins

- Others

- Germany Pulses Ingredients Market by Source

- Lentils

- Peas

- Beans

- Chickpeas

- Others

- Germany Pulses Ingredients Market by Application

- Food & Beverage

- Animal Feed

- Others

- France Outlook (USD Billion, 2018-2032)

- France Pulses Ingredients Market by Type

- Pulses Flours

- Pulses Starch

- Pulses Proteins

- Others

- France Pulses Ingredients Market by Source

- Lentils

- Peas

- Beans

- Chickpeas

- Others

- France Pulses Ingredients Market by Application

- Food & Beverage

- Animal Feed

- Others

- UK Outlook (USD Billion, 2018-2032)

- UK Pulses Ingredients Market by Type

- Pulses Flours

- Pulses Starch

- Pulses Proteins

- Others

- UK Pulses Ingredients Market by Source

- Lentils

- Peas

- Beans

- Chickpeas

- Others

- UK Pulses Ingredients Market by Application

- Food & Beverage

- Animal Feed

- Others

- ITALY Outlook (USD Billion, 2018-2032)

- ITALY Pulses Ingredients Market by Type

- Pulses Flours

- Pulses Starch

- Pulses Proteins

- Others

- ITALY Pulses Ingredients Market by Source

- Lentils

- Peas

- Beans

- Chickpeas

- Others

- ITALY Pulses Ingredients Market by Application

- Food & Beverage

- Animal Feed

- Others

- SPAIN Outlook (USD Billion, 2018-2032)

- Spain Pulses Ingredients Market by Type

- Pulses Flours

- Pulses Starch

- Pulses Proteins

- Others

- Spain Pulses Ingredients Market by Source

- Lentils

- Peas

- Beans

- Chickpeas

- Others

- Spain Pulses Ingredients Market by Application

- Food & Beverage

- Animal Feed

- Others

- Rest Of Europe Outlook (USD Billion, 2018-2032)

- Rest Of Europe Pulses Ingredients Market by Type

- Pulses Flours

- Pulses Starch

- Pulses Proteins

- Others

- REST OF EUROPE Pulses Ingredients Market by Source

- Lentils

- Peas

- Beans

- Chickpeas

- Others

- REST OF EUROPE Pulses Ingredients Market by Application

- Food & Beverage

- Animal Feed

- Others

- Asia-Pacific Outlook (USD Billion, 2018-2032)

- Asia-Pacific Pulses Ingredients Market by Type

- Pulses Flours

- Pulses Starch

- Pulses Proteins

- Others

- Asia-Pacific Pulses Ingredients Market by Source

- Lentils

- Peas

- Beans

- Chickpeas

- Others

- Asia-Pacific Pulses Ingredients Market by Application

- Food & Beverage

- Animal Feed

- Others

- China Outlook (USD Billion, 2018-2032)

- China Pulses Ingredients Market by Type

- Pulses Flours

- Pulses Starch

- Pulses Proteins

- Others

- China Pulses Ingredients Market by Source

- Lentils

- Peas

- Beans

- Chickpeas

- Others

- China Pulses Ingredients Market by Application

- Food & Beverage

- Animal Feed

- Others

- Japan Outlook (USD Billion, 2018-2032)

- Japan Pulses Ingredients Market by Type

- Pulses Flours

- Pulses Starch

- Pulses Proteins

- Others

- Japan Pulses Ingredients Market by Source

- Lentils

- Peas

- Beans

- Chickpeas

- Others

- Japan Pulses Ingredients Market by Application

- Food & Beverage

- Animal Feed

- Others

- India Outlook (USD Billion, 2018-2032)

- India Pulses Ingredients Market by Type

- Pulses Flours

- Pulses Starch

- Pulses Proteins

- Others

- India Pulses Ingredients Market by Source

- Lentils

- Peas

- Beans

- Chickpeas

- Others

- India Pulses Ingredients Market by Application

- Food & Beverage

- Animal Feed

- Others

- Australia Outlook (USD Billion, 2018-2032)

- Australia Pulses Ingredients Market by Type

- Pulses Flours

- Pulses Starch

- Pulses Proteins

- Others

- Australia Pulses Ingredients Market by Source

- Lentils

- Peas

- Beans

- Chickpeas

- Others

- Australia Pulses Ingredients Market by Application

- Food & Beverage

- Animal Feed

- Others

- Rest of Asia-Pacific Outlook (USD Billion, 2018-2032)

- Rest of Asia-Pacific Pulses Ingredients Market by Type

- Pulses Flours

- Pulses Starch

- Pulses Proteins

- Others

- Rest of Asia-Pacific Pulses Ingredients Market by Source

- Lentils

- Peas

- Beans

- Chickpeas

- Others

- Rest of Asia-Pacific Pulses Ingredients Market by Application

- Food & Beverage

- Animal Feed

- Others

- Rest of the World Outlook (USD Billion, 2018-2032)

- Rest of the World Pulses Ingredients Market by Type

- Pulses Flours

- Pulses Starch

- Pulses Proteins

- Others

- Rest of the World Pulses Ingredients Market by Source

- Lentils

- Peas

- Beans

- Chickpeas

- Others

- Rest of the World Pulses Ingredients Market by Application

- Food & Beverage

- Animal Feed

- Others

- Middle East Outlook (USD Billion, 2018-2032)

- Middle East Pulses Ingredients Market by Type

- Pulses Flours

- Pulses Starch

- Pulses Proteins

- Others

- Middle East Pulses Ingredients Market by Source

- Lentils

- Peas

- Beans

- Chickpeas

- Others

- Middle East Pulses Ingredients Market by Application

- Food & Beverage

- Animal Feed

- Others

- Africa Outlook (USD Billion, 2018-2032)

- Africa Pulses Ingredients Market by Type

- Pulses Flours

- Pulses Starch

- Pulses Proteins

- Others

- Africa Pulses Ingredients Market by Source

- Lentils

- Peas

- Beans

- Chickpeas

- Others

- Africa Pulses Ingredients Market by Application

- Food & Beverage

- Animal Feed

- Others

- Latin America Outlook (USD Billion, 2018-2032)

- Latin America Pulses Ingredients Market by Type

- Pulses Flours

- Pulses Starch

- Pulses Proteins

- Others

- Latin America Pulses Ingredients Market by Source

- Lentils

- Peas

- Beans

- Chickpeas

- Others

- Latin America Pulses Ingredients Market by Application

- Food & Beverage

- Animal Feed

- Others

- Rest of the World Pulses Ingredients Market by Type

- Asia-Pacific Pulses Ingredients Market by Type

- Europe Pulses Ingredients Market by Type

- North America Pulses Ingredients Market by Type

Free Sample Request

Kindly complete the form below to receive a free sample of this Report

Customer Strories

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

Leave a Comment