-

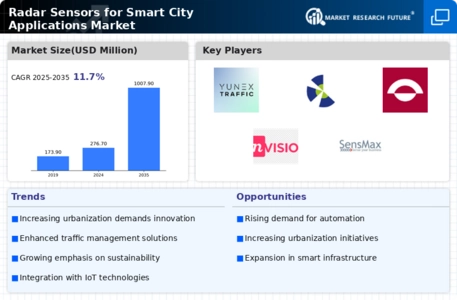

EXECUTIVE SUMMARY

-

Market Attractiveness Analysis

- Global Radar Sensors for Smart City Applications Market, By Type

-

1.1.2.

-

Global Radar Sensors for Smart City Applications Market, By Frequency

-

1.1.3.

-

Global Radar Sensors for Smart City Applications Market, By Application

-

1.1.4.

-

Global Radar Sensors for Smart City Applications Market, By Region

-

MARKET

-

INTRODUCTION

-

Definition

-

Scope of the Study

-

Market

-

Structure

-

Key Buying Criteria

-

Macro Factor Indicator Analysis

-

RESEARCH METHODOLOGY

-

Research Process

-

Primary Research

-

Secondary Research

-

Market Size Estimation

-

Forecast Model

-

List of Assumptions

-

MARKET DYNAMICS

-

Introduction

- Government initiatives towards smart cities infrastructure

- Privacy concerns associated with cameras propelling the demand for radar

- Advantages of radar sensors such as long-range detection, distance

- Rising importance

- Increasing population

- Drivers

-

4.2.

-

Drivers

-

sensors

-

and velocity detection, and weather-proof features

-

of data for effective operations of smart cities

-

and urbanization propelling the demand for advanced technologies

-

Impact Analysis

-

Restraints

- Restraint 1

- Restraints

-

Impact Analysis

-

Opportunities

- Advancements in Human-Computer

- Brain-computer Interfaces (BCIs) based on electroencephalography

-

Interaction (HCI)

-

(EEG) in video games

-

Challenges

- Technological advancements

- Developments of high-resolution radar sensors that

-

in the radar sensors

-

can track multiple objects

-

Impact of COVID-19

- Impact on semiconductor

- Impact on smart cities

- Impact on radar sensors

- YOY Growth 2020-2022

-

industry

-

manufacturing & Frequency

-

MARKET FACTOR

-

ANALYSIS

-

Value Chain Analysis/Supply Chain Analysis

-

Porter’s

-

Five Forces Model

-

Bargaining Power of Suppliers

-

Bargaining Power

-

of Buyers

-

Threat of New Entrants

-

Threat of Substitutes

-

5.7.

-

Intensity of Rivalry

-

GLOBAL RADAR SENSORS FOR SMART CITY APPLICATIONS MARKET,

-

BY TYPE

-

Introduction

-

Ground Radar Sensors

-

Overhead

-

Radar Sensors

-

GLOBAL RADAR SENSORS FOR SMART CITY APPLICATIONS MARKET, BY

-

FREQUENCY

-

Introduction

-

24 GHz

-

10.5 GHz

-

Others

-

GLOBAL RADAR SENSORS FOR SMART CITY APPLICATIONS MARKET, BY APPLICATION

-

Introduction

-

Traffic Monitoring

-

Pedestrian (Crowd) Monitoring

-

GLOBAL RADAR SENSORS FOR SMART CITY APPLICATIONS MARKET SIZE ESTIMATION &

-

FORECAST, BY REGION

-

Introduction

-

North America

- Market

- Market Estimates &

- Market Estimates & Forecast, by Frequency,

- Market Estimates & Forecast, by Application, 2018-2032

- US

-

Estimates & Forecast, by Country, 2018-2032

-

Forecast, by Type, 2018-2032

-

9.2.5.3.

-

Market Estimates & Forecast, by Application, 2018-2032

-

Estimates & Forecast, by Frequency, 2018-2032

-

& Forecast, by Application, 2018-2032

-

Estimates & Forecast, by Type, 2018-2032

-

Forecast, by Frequency, 2018-2032

-

by Application, 2018-2032

-

by Country, 2018-2032

-

Estimates & Forecast, by Application, 2018-2032

-

9.3.5.1.

-

Canada

-

Market Estimates & Forecast, by Type, 2018-2032

-

Market

-

Market Estimates

-

Mexico

-

Market

-

Market Estimates &

-

Market Estimates & Forecast,

-

Europe

- Market Estimates & Forecast,

- Market Estimates & Forecast, by Type, 2018-2032

- Market Estimates & Forecast, by Frequency, 2018-2032

- Market

- UK

-

Market Estimates & Forecast, by Type, 2018-2032

-

& Forecast, by Frequency, 2018-2032

-

by Application, 2018-2032

-

Forecast, by Type, 2018-2032

-

9.3.7.3.

-

Market Estimates

-

Market Estimates & Forecast,

-

Germany

-

Market Estimates &

-

Market Estimates & Forecast, by Frequency,

-

Market Estimates & Forecast, by Application, 2018-2032

-

France

-

Market Estimates & Forecast, by Type, 2018-2032

-

Market Estimates & Forecast, by Frequency, 2018-2032

-

Market Estimates & Forecast, by Application, 2018-2032

-

Estimates & Forecast, by Frequency, 2018-2032

-

& Forecast, by Application, 2018-2032

-

Estimates & Forecast, by Country, 2018-2032

-

Forecast, by Type, 2018-2032

-

9.4.5.3.

-

Rest of Europe

-

Market Estimates & Forecast, by Type, 2018-2032

-

Market

-

Market Estimates

-

Asia-Pacific

- Market

- Market Estimates &

- Market Estimates & Forecast, by Frequency,

- Market Estimates & Forecast, by Application, 2018-2032

- China

-

Market Estimates & Forecast, by Application, 2018-2032

-

Estimates & Forecast, by Frequency, 2018-2032

-

& Forecast, by Application, 2018-2032

-

Estimates & Forecast, by Type, 2018-2032

-

Forecast, by Frequency, 2018-2032

-

by Application, 2018-2032

-

Estimates & Forecast, by Type, 2018-2032

-

Forecast, by Frequency, 2018-2032

-

by Application, 2018-2032

-

Estimates & Forecast, by Type, 2018-2032

-

Forecast, by Frequency, 2018-2032

-

Application, 2018-2032

-

Forecast, by Type, 2018-2032

-

Japan

-

Market Estimates & Forecast, by Type, 2018-2032

-

Market

-

Market Estimates

-

India

-

Market

-

Market Estimates &

-

Market Estimates & Forecast,

-

Rest of Asia-Pacific

-

Market

-

Market Estimates &

-

Market Estimates & Forecast,

-

Middle East & Africa

- Market

- Market Estimates &

- Market Estimates & Forecast, by

-

South America

- Market Estimates &

- Market Estimates & Forecast, by Frequency,

- Market Estimates & Forecast, by Application, 2018-2032

-

COMPETITIVE LANDSCAPE

-

Introduction

-

Key Developments

-

& Growth Strategies

-

Competitor Benchmarking

-

Vendor Share

-

Analysis, 2021(% Share)

-

COMPANY PROFILES

-

Yunex Traffic

- Financial Overview

- Products/Solutions/Services

- Key Developments

- Swot Analysis

-

11.1.1.

-

Company Overview

-

Offered

-

Kymati

- Company Overview

- Financial Overview

- Key Developments

- Swot

-

GmbH

-

11.2.3.

-

Products/Solutions/Services Offered

-

Analysis

-

Icoms Detections S.A.

- Company Overview

- Products/Solutions/Services Offered

- Swot Analysis

-

11.3.2.

-

Financial Overview

-

11.3.4.

-

Key Developments

-

AGD Systems

- Financial Overview

- Products/Solutions/Services

- Key Developments

- Swot Analysis

- Company Overview

- Financial Overview

- Key Developments

- Swot

-

11.4.1.

-

Company Overview

-

Offered

-

11.5.

-

Navtech Radar

-

11.5.3.

-

Products/Solutions/Services Offered

-

Analysis

-

Image Sensing Systems Inc. (ISS)

- Company Overview

- Financial Overview

- Products/Solutions/Services Offered

- Key Developments

- Swot Analysis

-

Invisens

- Financial Overview

- Products/Solutions/Services

- Key Developments

- Swot Analysis

-

11.7.1.

-

Company Overview

-

Offered

-

Staal

- Company Overview

- Financial Overview

- Products/Solutions/Services Offered

- Key Developments

-

Technologies BV

-

11.8.5.

-

Swot Analysis

-

Smart City NZ

- Company Overview

- Products/Solutions/Services Offered

- Swot Analysis

-

11.9.2.

-

Financial Overview

-

11.9.4.

-

Key Developments

-

Smart microwave sensors

- Company Overview

- Financial Overview

- Key Developments

-

GmbH

-

11.10.3.

-

Products/Solutions/Services Offered

-

11.10.5.

-

Swot Analysis

-

Innovative Radar Sensor Technology

- Company

- Financial Overview

- Products/Solutions/Services

- Key Developments

- Swot Analysis

-

Overview

-

Offered

-

SCAE

- Company Overview

- Financial Overview

- Key Developments

-

spa

-

11.12.3.

-

Products/Solutions/Services Offered

-

11.12.5.

-

Swot Analysis

-

Sensmax

- Company Overview

- Financial

- Products/Solutions/Services Offered

- Key Developments

- Swot Analysis

-

Overview

-

-

LIST OF TABLES

-

LIST

-

OF ASSUMPTIONS 23

-

GLOBAL RADAR SENSORS FOR SMART CITY APPLICATIONS

-

MARKET, BY TYPE, 2018–2030 (USD MILLION) 40

-

GLOBAL RADAR SENSORS

-

FOR SMART CITY APPLICATIONS MARKET, BY FREQUENCY, 2018–2030 (USD MILLION)

-

45

-

GLOBAL RADAR SENSORS FOR SMART CITY APPLICATIONS MARKET, BY APPLICATION,

-

GLOBAL RADAR SENSORS FOR SMART CITY

-

APPLICATIONS MARKET, BY REGION, 2018–2030 (USD MILLION) 52

-

NORTH

-

AMERICA: RADAR SENSORS FOR SMART CITY APPLICATIONS MARKET, BY COUNTRY, 2018–2030

-

(USD MILLION) 54

-

NORTH AMERICA: RADAR SENSORS FOR SMART CITY APPLICATIONS

-

MARKET, BY TYPE, 2018–2030 (USD MILLION) 54

-

NORTH AMERICA RADAR

-

SENSORS FOR SMART CITY APPLICATIONS MARKET, BY FREQUENCY, 2018–2030 (USD MILLION)

-

56

-

NORTH AMERICA: RADAR SENSORS FOR SMART CITY APPLICATIONS MARKET,

-

BY APPLICATION, 2018–2030 (USD MILLION) 56

-

US: RADAR SENSORS

-

FOR SMART CITY APPLICATIONS MARKET, BY TYPE, 2018–2030 (USD MILLION) 58

-

US RADAR SENSORS FOR SMART CITY APPLICATIONS MARKET, BY FREQUENCY, 2018–2030

-

(USD MILLION) 59

-

US: RADAR SENSORS FOR SMART CITY APPLICATIONS MARKET,

-

BY APPLICATION, 2018–2030 (USD MILLION) 59

-

CANADA: RADAR SENSORS

-

FOR SMART CITY APPLICATIONS MARKET, BY TYPE, 2018–2030 (USD MILLION) 61

-

CANADA RADAR SENSORS FOR SMART CITY APPLICATIONS MARKET, BY FREQUENCY,

-

CANADA: RADAR SENSORS FOR SMART CITY

-

APPLICATIONS MARKET, BY APPLICATION, 2018–2030 (USD MILLION) 63

-

TABLE

-

MEXICO: RADAR SENSORS FOR SMART CITY APPLICATIONS MARKET, BY TYPE, 2018–2030

-

(USD MILLION) 64

-

MEXICO: RADAR SENSORS FOR SMART CITY APPLICATIONS

-

MARKET, BY FREQUENCY, 2018–2030 (USD MILLION) 66

-

MEXICO: RADAR

-

SENSORS FOR SMART CITY APPLICATIONS MARKET, BY APPLICATION, 2018–2030 (USD

-

MILLION) 66

-

EUROPE: RADAR SENSORS FOR SMART CITY APPLICATIONS MARKET,

-

BY COUNTRY, 2018–2030 (USD MILLION) 70

-

EUROPE: RADAR SENSORS

-

FOR SMART CITY APPLICATIONS MARKET, BY TYPE, 2018–2030 (USD MILLION) 70

-

EUROPE: RADAR SENSORS FOR SMART CITY APPLICATIONS MARKET, BY FREQUENCY,

-

EUROPE: RADAR SENSORS FOR SMART CITY

-

APPLICATIONS MARKET, BY APPLICATION, 2018–2030 (USD MILLION) 72

-

TABLE

-

GERMANY: RADAR SENSORS FOR SMART CITY APPLICATIONS MARKET, BY TYPE, 2018–2030

-

(USD MILLION) 73

-

GERMANY: RADAR SENSORS FOR SMART CITY APPLICATIONS

-

MARKET, BY FREQUENCY, 2018–2030 (USD MILLION) 75

-

GERMANY: RADAR

-

SENSORS FOR SMART CITY APPLICATIONS MARKET, BY APPLICATION, 2018–2030 (USD

-

MILLION) 75

-

FRANCE: RADAR SENSORS FOR SMART CITY APPLICATIONS MARKET,

-

BY TYPE, 2018–2030 (USD MILLION) 77

-

FRANCE RADAR SENSORS FOR

-

SMART CITY APPLICATIONS MARKET, BY FREQUENCY, 2018–2030 (USD MILLION) 78

-

FRANCE: RADAR SENSORS FOR SMART CITY APPLICATIONS MARKET, BY APPLICATION,

-

UK: RADAR SENSORS FOR SMART CITY

-

APPLICATIONS MARKET, BY TYPE, 2018–2030 (USD MILLION) 80

-

UK:

-

RADAR SENSORS FOR SMART CITY APPLICATIONS MARKET, BY FREQUENCY, 2018–2030

-

(USD MILLION) 81

-

UK: RADAR SENSORS FOR SMART CITY APPLICATIONS MARKET,

-

BY APPLICATION, 2018–2030 (USD MILLION) 82

-

NORDICS: RADAR SENSORS

-

FOR SMART CITY APPLICATIONS MARKET, BY TYPE, 2018–2030 (USD MILLION) 83

-

NORDICS: RADAR SENSORS FOR SMART CITY APPLICATIONS MARKET, BY FREQUENCY,

-

NORDICS: RADAR SENSORS FOR SMART

-

CITY APPLICATIONS MARKET, BY APPLICATION, 2018–2030 (USD MILLION) 85

-

TABLE

-

BENELUX: RADAR SENSORS FOR SMART CITY APPLICATIONS MARKET, BY TYPE, 2018–2030

-

(USD MILLION) 87

-

BENELUX RADAR SENSORS FOR SMART CITY APPLICATIONS

-

MARKET, BY FREQUENCY, 2018–2030 (USD MILLION) 88

-

BENELUX: RADAR

-

SENSORS FOR SMART CITY APPLICATIONS MARKET, BY APPLICATION, 2018–2030 (USD

-

MILLION) 88

-

SPAIN: RADAR SENSORS FOR SMART CITY APPLICATIONS MARKET,

-

BY TYPE, 2018–2030 (USD MILLION) 90

-

SPAIN: RADAR SENSORS FOR

-

SMART CITY APPLICATIONS MARKET, BY FREQUENCY, 2018–2030 (USD MILLION) 91

-

SPAIN: RADAR SENSORS FOR SMART CITY APPLICATIONS MARKET, BY APPLICATION,

-

ITALY: RADAR SENSORS FOR SMART CITY

-

APPLICATIONS MARKET, BY TYPE, 2018–2030 (USD MILLION) 93

-

ITALY

-

RADAR SENSORS FOR SMART CITY APPLICATIONS MARKET, BY FREQUENCY, 2018–2030

-

(USD MILLION) 95

-

ITALY: RADAR SENSORS FOR SMART CITY APPLICATIONS

-

MARKET, BY APPLICATION, 2018–2030 (USD MILLION) 95

-

REST OF EUROPE:

-

RADAR SENSORS FOR SMART CITY APPLICATIONS MARKET, BY TYPE, 2018–2030 (USD

-

MILLION) 97

-

REST OF EUROPE: RADAR SENSORS FOR SMART CITY APPLICATIONS

-

MARKET, BY FREQUENCY, 2018–2030 (USD MILLION) 98

-

REST OF EUROPE:

-

RADAR SENSORS FOR SMART CITY APPLICATIONS MARKET, BY APPLICATION, 2018–2030

-

(USD MILLION) 98

-

ASIA-PACIFIC: RADAR SENSORS FOR SMART CITY APPLICATIONS

-

MARKET, BY COUNTRY, 2018–2030 (USD MILLION) 103

-

ASIA-PACIFIC:

-

RADAR SENSORS FOR SMART CITY APPLICATIONS MARKET, BY TYPE, 2018–2030 (USD

-

MILLION) 103

-

ASIA-PACIFIC RADAR SENSORS FOR SMART CITY APPLICATIONS

-

MARKET, BY FREQUENCY, 2018–2030 (USD MILLION) 104

-

ASIA-PACIFIC:

-

RADAR SENSORS FOR SMART CITY APPLICATIONS MARKET, BY APPLICATION, 2018–2030

-

(USD MILLION) 105

-

CHINA: RADAR SENSORS FOR SMART CITY APPLICATIONS

-

MARKET, BY TYPE, 2018–2030 (USD MILLION) 106

-

CHINA: RADAR SENSORS

-

FOR SMART CITY APPLICATIONS MARKET, BY FREQUENCY, 2018–2030 (USD MILLION)

-

108

-

CHINA: RADAR SENSORS FOR SMART CITY APPLICATIONS MARKET, BY APPLICATION,

-

JAPAN: RADAR SENSORS FOR SMART CITY

-

APPLICATIONS MARKET, BY TYPE, 2018–2030 (USD MILLION) 110

-

JAPAN

-

RADAR SENSORS FOR SMART CITY APPLICATIONS MARKET, BY FREQUENCY, 2018–2030

-

(USD MILLION) 111

-

JAPAN: RADAR SENSORS FOR SMART CITY APPLICATIONS

-

MARKET, BY APPLICATION, 2018–2030 (USD MILLION) 111

-

INDIA: RADAR

-

SENSORS FOR SMART CITY APPLICATIONS MARKET, BY TYPE, 2018–2030 (USD MILLION)

-

113

-

INDIA: RADAR SENSORS FOR SMART CITY APPLICATIONS MARKET, BY FREQUENCY,

-

INDIA: RADAR SENSORS FOR SMART CITY

-

APPLICATIONS MARKET, BY APPLICATION, 2018–2030 (USD MILLION) 115

-

TABLE

-

AUSTRALIA: RADAR SENSORS FOR SMART CITY APPLICATIONS MARKET, BY TYPE, 2018–2030

-

(USD MILLION) 116

-

AUSTRALIA: RADAR SENSORS FOR SMART CITY APPLICATIONS

-

MARKET, BY FREQUENCY, 2018–2030 (USD MILLION) 118

-

AUSTRALIA:

-

RADAR SENSORS FOR SMART CITY APPLICATIONS MARKET, BY APPLICATION, 2018–2030

-

(USD MILLION) 118

-

SOUTH KOREA: RADAR SENSORS FOR SMART CITY APPLICATIONS

-

MARKET, BY TYPE, 2018–2030 (USD MILLION) 120

-

SOUTH KOREA RADAR

-

SENSORS FOR SMART CITY APPLICATIONS MARKET, BY FREQUENCY, 2018–2030 (USD MILLION)

-

121

-

SOUTH KOREA: RADAR SENSORS FOR SMART CITY APPLICATIONS MARKET,

-

BY APPLICATION, 2018–2030 (USD MILLION) 121

-

SINGAPORE: RADAR

-

SENSORS FOR SMART CITY APPLICATIONS MARKET, BY TYPE, 2018–2030 (USD MILLION)

-

123

-

SINGAPORE: RADAR SENSORS FOR SMART CITY APPLICATIONS MARKET, BY

-

FREQUENCY, 2018–2030 (USD MILLION) 124

-

SINGAPORE: RADAR SENSORS

-

FOR SMART CITY APPLICATIONS MARKET, BY APPLICATION, 2018–2030 (USD MILLION)

-

125

-

REST OF ASIA-PACIFIC: RADAR SENSORS FOR SMART CITY APPLICATIONS

-

MARKET, BY TYPE, 2018–2030 (USD MILLION) 126

-

REST OF ASIA-PACIFIC:

-

RADAR SENSORS FOR SMART CITY APPLICATIONS MARKET, BY FREQUENCY, 2018–2030

-

(USD MILLION) 128

-

REST OF ASIA-PACIFIC: RADAR SENSORS FOR SMART CITY

-

APPLICATIONS MARKET, BY APPLICATION, 2018–2030 (USD MILLION) 128

-

TABLE

-

MIDDLE EAST & AFRICA: RADAR SENSORS FOR SMART CITY APPLICATIONS MARKET, BY

-

TYPE, 2018–2030 (USD MILLION) 130

-

MIDDLE EAST & AFRICA RADAR

-

SENSORS FOR SMART CITY APPLICATIONS MARKET, BY FREQUENCY, 2018–2030 (USD MILLION)

-

131

-

MIDDLE EAST & AFRICA: RADAR SENSORS FOR SMART CITY APPLICATIONS

-

MARKET, BY APPLICATION, 2018–2030 (USD MILLION) 132

-

SOUTH AMERICA:

-

RADAR SENSORS FOR SMART CITY APPLICATIONS MARKET, BY TYPE, 2018–2030 (USD

-

MILLION) 134

-

SOUTH AMERICA RADAR SENSORS FOR SMART CITY APPLICATIONS

-

MARKET, BY FREQUENCY, 2018–2030 (USD MILLION) 135

-

SOUTH AMERICA:

-

RADAR SENSORS FOR SMART CITY APPLICATIONS MARKET, BY APPLICATION, 2018–2030

-

(USD MILLION) 136

-

PARTNERSHIPS/AGREEMENTS/CONTRACTS/COLLABORATIONS

-

140

-

BUSINESS EXPANSIONS/ACQUISITIONS 142

-

PRODUCT LAUNCHES/DEVELOPMENTS

-

143

-

YUNEX TRAFFIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED 147

-

TABLE

-

YUNEX TRAFFIC: KEY DEVELOPMENTS 148

-

KYMATI GMBH: PRODUCTS/SOLUTIONS/SERVICES

-

OFFERED 151

-

KYMATI GMBH: KEY DEVELOPMENTS 152

-

ICOMS

-

DETECTIONS S.A.: PRODUCTS/SOLUTIONS/SERVICES OFFERED 154

-

ICOMS DETECTIONS

-

S.A.: KEY DEVELOPMENTS 155

-

AGD SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES

-

OFFERED 158

-

AGD SYSTEMS: KEY DEVELOPMENTS 159

-

NAVTECH

-

RADAR: PRODUCTS/SOLUTIONS/SERVICES OFFERED 162

-

NAVTECH RADAR: KEY

-

DEVELOPMENTS 163

-

IMAGE SENSING SYSTEMS INC. (ISS): PRODUCTS/SOLUTIONS/SERVICES

-

OFFERED 165

-

IMAGE SENSING SYSTEMS INC. (ISS): KEY DEVELOPMENTS 166

-

KASPERSKY LAB: PRODUCTS/SOLUTIONS/SERVICES OFFERED 167

-

TABLE 94

-

INVISENS: PRODUCTS/SOLUTIONS/SERVICES OFFERED 170

-

STAAL TECHNOLOGIES

-

BV: PRODUCTS/SOLUTIONS/SERVICES OFFERED 174

-

STAAL TECHNOLOGIES BV:

-

KEY DEVELOPMENTS 174

-

SMART CITY NZ: PRODUCTS/SOLUTIONS/SERVICES OFFERED

-

177

-

SMART CITY NZ: KEY DEVELOPMENTS 177

-

SMART MICROWAVE

-

SENSORS GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED 180

-

SMART MICROWAVE

-

SENSORS GMBH INC: PRODUCTS/SOLUTIONS/SERVICES OFFERED 184

-

SMART MICROWAVE

-

SENSORS GMBH INC: KEY DEVELOPMENTS 184

-

INNOVATIVE RADAR SENSOR TECHNOLOGY:

-

PRODUCTS/SOLUTIONS/SERVICES OFFERED 186

-

INNOVATIVE RADAR SENSOR TECHNOLOGY:

-

KEY DEVELOPMENTS 186

-

SCAE SPA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

-

188

-

SCAE SPA: PRODUCTS/SOLUTIONS/SERVICES OFFERED 188

-

TABLE

-

SENSMAX: PRODUCTS/SOLUTIONS/SERVICES OFFERED 190

-

SENSMAX: PRODUCTS/SOLUTIONS/SERVICES

-

OFFERED 190

-

SCADAFENCE: PRODUCTS/SOLUTIONS/SERVICES OFFERED 192

-

-

LIST OF FIGURES

-

MARKET SYNOPSIS 23

-

GLOBAL RADAR SENSORS FOR SMART CITY APPLICATIONS MARKET STRUCTURE 25

-

BOTTOM-UP AND TOP-DOWN APPROACHES 30

-

MARKET DYNAMICS ANALYSIS:

-

GLOBAL RADAR SENSORS FOR SMART CITY APPLICATIONS MARKET 32

-

DRIVERS

-

IMPACT ANALYSIS: GLOBAL OPERATIONAL TECHNOLOGY MARKET 34

-

RESTRAINTS

-

IMPACT ANALYSIS: GLOBAL OPERATIONAL TECHNOLOGY MARKET 35

-

VALUE CHAIN

-

ANALYSIS OF THE GLOBAL RADAR SENSORS FOR SMART CITY APPLICATIONS MARKET 37

-

FIGURE

-

PORTER’S FIVE FORCES ANALYSIS OF THE GLOBAL RADAR SENSORS FOR SMART CITY

-

APPLICATIONS MARKET 39

-

GLOBAL RADAR SENSORS FOR SMART CITY APPLICATIONS

-

MARKET, BY TYPE, 2021 (%) 41

-

GLOBAL RADAR SENSORS FOR SMART CITY

-

APPLICATIONS MARKET, BY TYPE, 2021 VS 2032 (USD MILLION) 41

-

GLOBAL

-

RADAR SENSORS FOR SMART CITY APPLICATIONS MARKET, BY FREQUENCY, 2021 (%) 46

-

FIGURE

-

GLOBAL RADAR SENSORS FOR SMART CITY APPLICATIONS MARKET, BY FREQUENCY, 2021 VS

-

GLOBAL RADAR SENSORS FOR SMART CITY APPLICATIONS

-

MARKET, BY APPLICATION, 2021 (%) 48

-

GLOBAL RADAR SENSORS FOR SMART

-

CITY APPLICATIONS MARKET, BY APPLICATION, 2021 VS 2032 (USD MILLION) 48

-

FIGURE

-

GLOBAL RADAR SENSORS FOR SMART CITY APPLICATIONS MARKET, BY REGION, 2021 (%)

-

53

-

RADAR SENSORS FOR SMART CITY APPLICATIONS MARKET, BY REGION, 2021

-

VS 2032 (USD MILLION) 54

-

NORTH AMERICA: RADAR SENSORS FOR SMART CITY

-

APPLICATIONS MARKET, BY COUNTRY, 2021 (%) 55

-

NORTH AMERICA: RADAR

-

SENSORS FOR SMART CITY APPLICATIONS MARKET, BY COUNTRY, 2021 VS 2032 (USD MILLION)

-

56

-

EUROPE: RADAR SENSORS FOR SMART CITY APPLICATIONS MARKET, BY COUNTRY,

-

EUROPE: RADAR SENSORS FOR SMART CITY APPLICATIONS MARKET,

-

BY COUNTRY, 2021 VS 2032 (USD MILLION) 71

-

ASIA-PACIFIC: RADAR SENSORS

-

FOR SMART CITY APPLICATIONS MARKET, BY COUNTRY, 2021 (%) 104

-

ASIA-PACIFIC:

-

RADAR SENSORS FOR SMART CITY APPLICATIONS MARKET, BY COUNTRY, 2021 VS 2032 (USD

-

MILLION) 104

-

GLOBAL OPERATIONAL TECHNOLOGY (OT) SECURITY MARKET:

-

COMPETITIVE BENCHMARKING 141

-

VENDOR SHARE ANALYSIS, 2021 (%) 142

-

YUNEX TRAFFIC: FINANCIAL OVERVIEW SNAPSHOT 149

-

YUNEX

-

TRAFFIC: SWOT ANALYSIS 150

-

KYMATI GMBH FINANCIAL OVERVIEW 150

-

KYMATI GMBH: SWOT ANALYSIS 154

-

ICOMS DETECTIONS S.A.:

-

FINANCIAL OVERVIEW SNAPSHOT 156

-

ICOMS DETECTIONS S.A.: SWOT ANALYSIS

-

158

-

AGD SYSTEMS: FINANCIAL OVERVIEW SNAPSHOT 160

-

AGD

-

SYSTEMS: SWOT ANALYSIS 162

-

NAVTECH RADAR: FINANCIAL OVERVIEW SNAPSHOT

-

164

-

NAVTECH RADAR: SWOT ANALYSIS 165

-

IMAGE SENSING

-

SYSTEMS INC. (ISS): FINANCIAL OVERVIEW SNAPSHOT 167

-

IMAGE SENSING

-

SYSTEMS INC. (ISS): SWOT ANALYSIS 168

-

INVISENS: FINANCIAL OVERVIEW

-

SNAPSHOT 171

-

INVISENS: SWOT ANALYSIS 172

-

STAAL TECHNOLOGIES

-

BV: FINANCIAL OVERVIEW SNAPSHOT 175

-

STAAL TECHNOLOGIES BV: SWOT ANALYSIS

-

177

-

SMART CITY NZ: FINANCIAL OVERVIEW SNAPSHOT 178

-

FIGURE 42

-

SMART CITY NZ: SWOT ANALYSIS 180

-

SMART MICROWAVE SENSORS GMBH: FINANCIAL

-

OVERVIEW SNAPSHOT 182

-

SMART MICROWAVE SENSORS GMBH: SWOT ANALYSIS

-

183

-

SMART MICROWAVE SENSORS GMBH: INC FINANCIAL OVERVIEW SNAPSHOT

-

185

-

SMART MICROWAVE SENSORS GMBH INC: SWOT ANALYSIS 187

-

FIGURE

-

INNOVATIVE RADAR SENSOR TECHNOLOGY: SWOT ANALYSIS 189

-

SCAE SPA:

-

SWOT ANALYSIS 191

-

SENSMAX: SWOT ANALYSIS 193

Leave a Comment