-

Executive Summary

-

Scope of the Report

-

Market Definition

-

Scope of the Study

- Research Objectives

- Assumptions & Limitations

-

Market Structure

-

Market

-

Research Methodology

-

Research Process

-

Secondary Research

-

Primary Research

-

Forecast Model

-

Market Landscape

-

4.1

-

Five Forces Analysis

-

of Buyers

-

Nickel Market

-

5

-

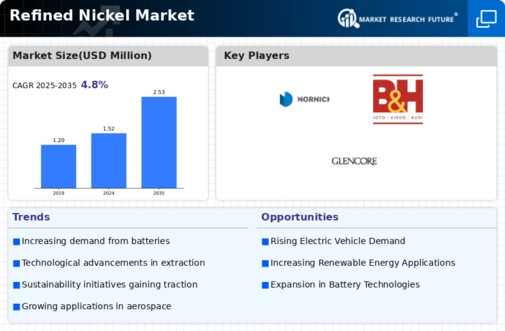

Industry Overview of Global Refined Nickel Market

-

5.2

-

Growth Drivers

-

Threat of New Entrants

-

Bargaining power

-

Bargaining power of Suppliers

-

Threat of Substitutes

-

Segment Rivalry

-

Value Chain/Supply Chain of Global Refined

-

Pricing Analysis, By Region

-

Trade Analysis4

-

Introduction

-

Impact Analysis

-

Market Challenges

-

Market

-

Trends

-

Introduction

-

Growth Trends

-

Impact Analysis

-

Global Refined Nickel Market, by Application

-

Introduction

- Market Estimates & Forecast, 2020–2027

-

7.2

-

Stainless Steel

-

7.2.2

-

Market Estimates & Forecast, by Region, 2020–2027

-

Non-Ferrous

- Market Estimates & Forecast, 2020–2027

- Market

-

Alloy

-

Estimates & Forecast, by Region, 2020–2027

-

Plating

- Market Estimates &

-

7.4.1

-

Market Estimates & Forecast, 2020–2027

-

Forecast, by Region, 2020–2027

-

Alloys & Steel Casting

- Market Estimates &

-

7.5.1

-

Market Estimates & Forecast, 2020–2027

-

Forecast, by Region, 2020–2027

-

Batteries

- Market Estimates

- Market Estimates & Forecast, by Region,

-

& Forecast, 2020–2027

-

Others

- Market Estimates & Forecast, 2020–2027

- Market Estimates & Forecast, by Region, 2020–2027

-

Global

-

Refined Nickel Market, by End-Use Industry

-

Introduction

-

Industrial

- Market Estimates & Forecast, 2020–2027

-

Machinery

-

8.2.2

-

Market Estimates & Forecast, by Region, 2020–2027

-

Metallurgy

- Market Estimates & Forecast, 2020–2027

- Market Estimates

-

& Forecast, by Region, 2020–2027

-

Automotive & Transportation

- Market Estimates & Forecast, 2020–2027

- Market Estimates

-

& Forecast, by Region, 2020–2027

-

Electronics

- Market

- Market Estimates & Forecast,

-

Estimates & Forecast, 2020–2027

-

by Region, 2020–2027

-

Others

- Market Estimates & Forecast,

- Market Estimates & Forecast, by Region, 2020–2027

-

Global Refined Nickel Market, by Region

-

Introduction

-

North

- Market Estimates & Forecast, 2020–2027

- Market

- Market Estimates

- US

- Canada

-

America

-

Estimates & Forecast, by Application, 2020–2027

-

& Forecast, by End-Use Industry, 2020–2027

-

9.2.4.1

-

Market Estimates & Forecast, 2020–2027

-

Forecast, by Application, 2020–2027

-

by End-Use Industry, 2020–2027

-

& Forecast, 2020–2027

-

Application, 2020–2027

-

Industry, 2020–2027

-

Europe

- Market Estimates & Forecast,

- Market Estimates & Forecast, by Application, 2020–2027

- Market Estimates & Forecast, by End-Use Industry, 2020–2027

- Germany

-

9.3.4.3

-

Market Estimates & Forecast, by End-Use Industry, 2020–2027

-

9.3.5.

-

France

-

9.3.5.2

-

Market Estimates & Forecast, 2020–2027

-

Market Estimates & Forecast, by Application, 2020–2027

-

Estimates & Forecast, by End-Use Industry, 2020–2027

-

& Forecast, by Application, 2020–2027

-

Forecast, by End-Use Industry, 2020–2027

-

Estimates & Forecast, 2020–2027

-

by Application, 2020–2027

-

End-Use Industry, 2020–2027

-

Forecast, 2020–2027

-

9.3.10.3

-

Market

-

Italy

-

Market Estimates & Forecast, 2020–2027

-

Market Estimates

-

Market Estimates &

-

Spain

-

Market

-

Market Estimates & Forecast,

-

Market Estimates & Forecast, by

-

UK

-

Market Estimates &

-

Market Estimates & Forecast, by Application,

-

Market Estimates & Forecast, by End-Use Industry,

-

Russia

-

Market Estimates & Forecast,

-

Market Estimates & Forecast, by Application, 2020–2027

-

Market Estimates & Forecast, by End-Use Industry, 2020–2027

-

Poland

-

Market Estimates & Forecast, 2020–2027

-

Market Estimates & Forecast, by Application, 2020–2027

-

Market Estimates & Forecast, by End-Use Industry, 2020–2027

-

Asia-Pacific

- Market Estimates & Forecast, 2020–2027

- Market Estimates

- Market Estimates &

- China

- India

- Japan

- Australia

-

& Forecast, by Application, 2020–2027

-

Forecast, by End-Use Industry, 2020–2027

-

Estimates & Forecast, 2020–2027

-

by Application, 2020–2027

-

End-Use Industry, 2020–2027

-

& Forecast, 2020–2027

-

Application, 2020–2027

-

Industry, 2020–2027

-

9.4.7.3

-

Market Estimates & Forecast, by End-Use Industry, 2020–2027

-

9.4.8

-

New Zealand

-

9.4.8.2

-

Market Estimates & Forecast, 2020–2027

-

Market Estimates & Forecast, by Application, 2020–2027

-

Estimates & Forecast, by End-Use Industry, 2020–2027

-

Asia-Pacific

-

9.4.9.2

-

Market

-

Rest of

-

Market Estimates & Forecast, 2020–2027

-

Market Estimates & Forecast, by Application, 2020–2027

-

Estimates & Forecast, by End-Use Industry, 2020–2027

-

& Africa

-

9.5.2

-

Market

-

Middle East

- Market Estimates & Forecast, 2020–2027

-

Market Estimates & Forecast, by Application, 2020–2027

-

Estimates & Forecast, by End-Use Industry, 2020–2027

-

& Forecast, by Application, 2020–2027

-

Forecast, by End-Use Industry, 2020–2027

-

Estimates & Forecast, 2020–2027

-

by Application, 2020–2027

-

End-Use Industry, 2020–2027

-

& Forecast, 2020–2027

-

Application, 2020–2027

-

Industry, 2020–2027

-

Forecast, 2020–2027

-

9.6.4.3

-

Market

-

Turkey

-

Market Estimates & Forecast, 2020–2027

-

Market Estimates

-

Market Estimates &

-

Israel

-

Market

-

Market Estimates & Forecast,

-

Market Estimates & Forecast, by

-

North Africa

-

Market Estimates

-

Market Estimates & Forecast, by

-

Market Estimates & Forecast, by End-Use

-

GCC

-

Market Estimates & Forecast,

-

Market Estimates & Forecast, by Application, 2020–2027

-

Market Estimates & Forecast, by End-Use Industry, 2020–2027

-

Rest of the Middle East & Africa

-

Market Estimates &

-

Market Estimates & Forecast, by Application,

-

Market Estimates & Forecast, by End-Use Industry,

-

Latin America

- Market Estimates & Forecast,

- Market Estimates & Forecast, by Application, 2020–2027

- Market Estimates & Forecast, by End-Use Industry, 2020–2027

- Brazil

-

Market Estimates & Forecast, by End-Use Industry, 2020–2027

-

9.6.5

-

Argentina

-

9.6.5.2

-

Market Estimates & Forecast, 2020–2027

-

Market Estimates & Forecast, by Application, 2020–2027

-

Estimates & Forecast, by End-Use Industry, 2020–2027

-

Estimates & Forecast, by Application, 2020–2027

-

& Forecast, by End-Use Industry, 2020–2027

-

Estimates & Forecast, by Application, 2020–2027

-

& Forecast, by End-Use Industry, 2020–2027

-

Market

-

Mexico

-

Market Estimates & Forecast, 2020–2027

-

Market

-

Market Estimates

-

Rest of Latin America

-

Market Estimates & Forecast, 2020–2027

-

Market

-

Market Estimates

-

Company Landscape

-

Company Profiles

-

Norilsk Nickel

- Company Overview

- Application/Business Segment Overview

- Financial Updates

- Key Developments

-

Vale

- Company Overview

- Financial Updates

-

11.2.2

-

Application/Business Segment Overview

-

11.2.4

-

Key Developments

-

BHP

- Company Overview

- Application/Business

- Financial Updates

- Key Developments

- Company Overview

- Financial Updates

-

Segment Overview

-

11.4

-

Jinchuan Group International Resources Co. Ltd

-

11.4.2

-

Application/Business Segment Overview

-

11.4.4

-

Key Developments

-

Sumitomo Metal Mining Co.

- Company Overview

- Application/Business Segment Overview

- Financial Updates

- Key Developments

-

Anglo American

- Company Overview

- Application/Business Segment Overview

- Financial Updates

- Key Developments

-

Ambatovy

- Company Overview

- Financial Updates

-

11.7.2

-

Application/Business Segment Overview

-

11.7.4

-

Key Developments

-

Sherritt International Corporation

- Company

- Application/Business Segment Overview

- Financial

- Key Developments

-

Overview

-

Updates

-

Minara Resources

- Company

- Application/Business Segment Overview

- Financial

- Key Developments

-

Overview

-

Updates

-

Glencore

- Company Overview

- Application/Business Segment Overview

- Financial Updates

- Key Developments

-

Conclusion

-

List of Tables

-

Table 2

-

Global Refined Nickel Market, by Region, 2020–2027

-

North America:

-

Refined Nickel Market, by Country, 2020–2027

-

Europe: Refined

-

Nickel Market, by Country, 2020–2027

-

Asia-Pacific: Refined Nickel

-

Market, by Country, 2020–2027

-

Middle East & Africa: Refined

-

Nickel Market, by Country, 2020–2027

-

Latin America: Refined Nickel

-

Market, by Country, 2020–2027

-

Global Refined Nickel Application

-

Market, by Region, 2020–2027

-

North America: Refined Nickel Application

-

Market, by Country, 2020–2027

-

Europe: Refined Nickel Application

-

Market, by Country, 2020–2027

-

Table11 Asia-Pacific: Refined Nickel Application

-

Market, by Country, 2020–2027

-

Table13 Middle East & Africa: Refined

-

Nickel Application Market, by Country, 2020–2027

-

Table12 Latin America:

-

Refined Nickel Application Market, by Country, 2020–2027

-

Table14 North

-

America: Refined Nickel End-Use Industry Market, by Country, 2020–2027

-

Table13 Europe: Refined Nickel End-Use Industry Market, by Country, 2020–2027

-

Table14 Asia-Pacific: Refined Nickel End-Use Industry Market, by Country, 2020–2027

-

Table16 Middle East & Africa: Refined Nickel End-Use Industry Market, by Country,

-

Table15 Latin America: Refined Nickel End-Use Industry Market,

-

by Country, 2020–2027

-

Table23 Global Application Market, by Region,

-

Table24 Global End-Use Industry Market, by Region, 2020–2027

-

Table25 North America: Refined Nickel Market, by Country, 2020–2027

-

Table26 North America: Refined Nickel Market, by Application, 2020–2027

-

Table27 North America: Refined Nickel Market, by End-Use Industry, 2020–2027

-

Table28 Europe: Refined Nickel Market, by Country, 2020–2027

-

Table29

-

Europe: Refined Nickel Market, by Application, 2020–2027

-

Table30 Europe:

-

Refined Nickel Market, by End-Use Industry, 2020–2027

-

Table31 Asia-Pacific:

-

Refined Nickel Market, by Country, 2020–2027

-

Table32 Asia-Pacific: Refined

-

Nickel Market, by Application, 2020–2027

-

Table33 Asia-Pacific: Refined

-

Nickel Market, by End-Use Industry, 2020–2027

-

Table36 Middle East &

-

Africa: Refined Nickel Market, by Country, 2020–2027

-

Table37 Middle

-

East & Africa Refined Nickel Market, by Application, 2020–2027

-

Table33

-

Middle East & Africa: Refined Nickel Market, by End-Use Industry, 2020–2027

-

Table34 Latin America: Refined Nickel Market, by Country, 2020–2027

-

Table35 Latin America Refined Nickel Market, by Application, 2020–2027

-

Table33 Latin America: Refined Nickel Market, by End-Use Industry, 2020–2027

-

List of Figures

-

Global Refined Nickel Market Segmentation

-

Forecast Methodology

-

Five Forces Analysis of Global Refined

-

Nickel Market

-

Value Chain of Global Refined Nickel Market

-

FIGURE

-

Share of Global Refined Nickel Market in 2020, by Country (%)

-

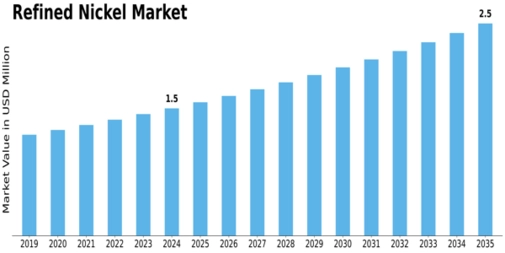

Global

-

Refined Nickel Market, 2020–2027,

-

Sub-Segments of Application,

-

Global Refined Nickel Market Size, by Application, 2020

-

FIGURE

-

Share of Global Refined Nickel Market, by Application, 2020–2027

-

FIGURE

-

Sub-Segments of End-Use Industry

-

Global Refined Nickel Market

-

Size, by End-Use Industry, 2020

-

Share of Global Refined Nickel Market,

-

by End-Use Industry, 2020–2027

Leave a Comment