Leading market players are investing heavily in research and development in order to expand their product lines, which will help the Retail Edge Computing market, grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, Retail Edge Computing Industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the global Retail Edge Computing Industry to benefit clients and increase the market Application. In recent years, the Retail Edge Computing Industry has offered some of the most significant advantages to medicine.

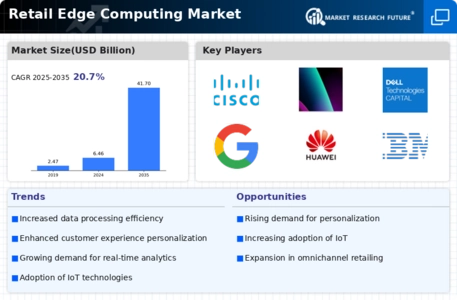

Major players in the Retail Edge Computing market, including Cisco, AWS, Dell Technologies, Google, HPE, Huawei, IBM, Intel, Litmus Automation, Microsoft, Nokia, ADLINK, Axellio, Capgemini, ClearBlade, Digi International, Fastly, StackPath, Vapor IO, GE Digital, Moxa, Sierra Wireless, Juniper Networks, EdgeConnex, Belden, Saguna Networks, Edge Intelligence, Edgeworx, Sunlight.io, Mutable, Hivecell, Section, and EdgeIQ, are attempting to increase market demand by investing in research and development operations.

IT infrastructure services are provided by Amazon Web Services, a cloud-based web platform. The business offers a range of services, including cloud computing, compute, networking, storage and content delivery, databases, analytics, application services, deployment and administration, mobile services, and investments, on a scalable cloud computing platform. In doing so, it makes it possible for e-commerce firms to launch and grow their cloud businesses while increasing their online sales.

Google LLC (Google), an affiliate of Alphabet Inc., provides online search and advertising services. The company's primary business segments include advertising, search, platforms and operating systems, enterprise products, and hardware. These are just a few of the products and services it provides: Google Search, Google Chrome, Google Docs, Google Calendar, Google Photos, Google Meet, Google Drive, Google Finance, Google Play Books, Google News, Google Earth, Google Ad Manager, Google Play, AdMob, Google Maps, AdSense, Gmail, Google Groups, and YouTube. The business has operations in the Americas, Europe, Asia-Pacific, Middle East, and Africa.

Google's main office is located in Mountain View, California, in the United States.

Leave a Comment