Retail Point of Sale Terminals Market Share

Retail Point of Sale Terminals Market Research Report: By Technology (Cloud-Based Systems, On-Premises Systems, Mobile Point of Sale, Self-Service Kiosks), By Component (Hardware, Software, Services), By End User (Retail, Hospitality, Healthcare, FoodBeverage), By Payment Method (Credit/Debit Card, Mobile Wallet, Contactless Payment, Cash) and By Regional (North America, Europe, South America, ...

Market Summary

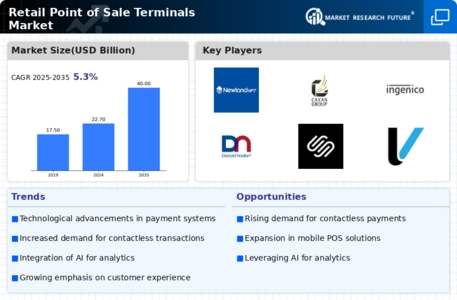

As per Market Research Future Analysis, the Retail Point of Sale Terminals Market was valued at 32.96 USD Billion in 2024 and is projected to reach 125.22 USD Billion by 2035, reflecting a compound annual growth rate (CAGR) of 5.3% from 2025 to 2035. The market is driven by the rising adoption of contactless payment solutions, technological advancements, and the growing e-commerce sector. Key players are innovating to enhance customer experiences and streamline operations, making this market highly competitive.

Key Market Trends & Highlights

The Retail Point of Sale Terminals Market is witnessing transformative trends driven by technology and consumer preferences.

- Cloud-Based Systems segment valued at 8.0 USD Billion in 2024, expected to grow to 15.0 USD Billion by 2035.

- Mobile Wallet transactions projected to reach 3.4 trillion USD by 2024, highlighting the shift towards contactless payments.

- North America market valued at 8.5 USD Billion in 2024, leading in technological adoption.

- E-commerce sales expected to exceed 6 trillion USD by 2024, driving demand for integrated POS systems.

Market Size & Forecast

| 2024 Market Size | USD 32.96 Billion |

| 2035 Market Size | USD 125.22 Billion |

| CAGR (2025-2035) | 12.90% |

| Largest Regional Market Share in 2024 | North America |

Major Players

Square, Fiserv, FIS, TouchBistro, Ingenico Group, NCR Corporation, SumUp, Diebold Nixdorf, PAX Technology, Clover Network, Lightspeed, Toast, PayPal Holdings, Verifone, Zebra Technologies

Market Trends

The Retail Point of Sale Terminals Market is experiencing significant trends that are reshaping its landscape. One of the key market drivers is the shift towards cashless transactions as consumers increasingly prefer digital payment methods over traditional cash. This trend is fueled by advancements in mobile payment technologies and the growing adoption of contactless payment systems, which enhance the customer experience by providing speed and convenience. Additionally, the rising demand for integrated payment solutions that combine hardware and software functionalities is gaining traction, as retailers seek to streamline operations and improve efficiency at the checkout process.

The growth of e-commerce and omnichannel retailing is two areas of the Retail Point of Sale Terminals Market that could be interesting to look into. As more people shop online, it is becoming clear that POS systems need to work well with online platforms. Retailers can take advantage of this chance by using systems that let them manage sales and inventory in both physical and online stores. This will help them reach a wider range of customers.

Also, new developments in data analytics are giving retailers new ways to learn about how customers act and what they like, which lets them create more personalized marketing plans.

Trends in recent times also indicate a growing focus on security features within POS systems. With the increasing threat of data breaches and cyberattacks, the implementation of robust security measures, including end-to-end encryption and compliance with global payment standards, is crucial. Retailers worldwide are prioritizing these security enhancements to protect sensitive customer information, further driving the demand for advanced POS solutions. Collectively, these trends are setting the foundation for the future development of the retail point of sale terminals market on a global scale.

The ongoing evolution of retail point of sale terminals reflects a growing emphasis on integrated payment solutions, enhancing customer experience and operational efficiency across diverse retail environments.

U.S. Department of Commerce

Retail Point of Sale Terminals Market Market Drivers

Regulatory Compliance

Regulatory compliance plays a crucial role in shaping the Global Retail Point of Sale Terminals Market Industry. Retailers are required to adhere to various regulations concerning data security and consumer protection. Compliance with standards such as the Payment Card Industry Data Security Standard (PCI DSS) is essential for safeguarding customer information during transactions. As regulations become more stringent, retailers are compelled to invest in advanced POS systems that ensure compliance and protect against data breaches. This focus on regulatory adherence is likely to drive market growth, as businesses prioritize secure and compliant payment solutions.

E-commerce Integration

The integration of e-commerce capabilities into the Global Retail Point of Sale Terminals Market Industry is a vital driver of growth. As online shopping continues to gain traction, retailers are increasingly seeking POS systems that can seamlessly connect in-store and online sales. This integration enables businesses to manage inventory more effectively and provide a unified customer experience across channels. For example, retailers utilizing omnichannel strategies report higher customer retention rates and increased sales. This trend is expected to contribute to a compound annual growth rate of 5.3% from 2025 to 2035, underscoring the importance of e-commerce integration in the retail sector.

Market Growth Projections

The Global Retail Point of Sale Terminals Market Industry is projected to experience substantial growth over the next decade. With a market size expected to reach 22.7 USD Billion in 2024 and further expand to 40 USD Billion by 2035, the industry is on a promising trajectory. The compound annual growth rate of 5.3% from 2025 to 2035 indicates a robust demand for innovative POS solutions. This growth is driven by various factors, including technological advancements, changing consumer behaviors, and the increasing importance of regulatory compliance. The market's expansion reflects the evolving landscape of retail and the critical role of POS systems in facilitating transactions.

Technological Advancements

The Global Retail Point of Sale Terminals Market Industry experiences a robust growth trajectory, primarily driven by rapid technological advancements. Innovations such as contactless payment systems, mobile POS solutions, and cloud-based software are revolutionizing the retail landscape. These technologies enhance transaction speed and security, appealing to both retailers and consumers. For instance, the integration of artificial intelligence in POS systems allows for personalized customer experiences and efficient inventory management. As a result, the market is projected to reach 22.7 USD Billion in 2024, reflecting a growing demand for sophisticated retail solutions.

Rising Consumer Expectations

In the Global Retail Point of Sale Terminals Market Industry, rising consumer expectations significantly influence market dynamics. Today's consumers demand seamless and efficient shopping experiences, prompting retailers to adopt advanced POS systems that facilitate quick transactions and enhanced customer service. Features such as mobile payment options and loyalty program integrations are becoming standard. Retailers that fail to meet these expectations risk losing market share. Consequently, the industry is poised for substantial growth, with projections indicating a market size of 40 USD Billion by 2035, driven by the need for improved customer engagement and satisfaction.

Market Expansion in Emerging Economies

The Global Retail Point of Sale Terminals Market Industry is witnessing significant expansion in emerging economies, where increasing urbanization and rising disposable incomes are driving retail growth. Countries in Asia-Pacific and Latin America are experiencing a surge in retail establishments, leading to heightened demand for efficient POS systems. For instance, the proliferation of small and medium-sized enterprises in these regions is creating opportunities for tailored POS solutions that cater to diverse business needs. This trend is expected to contribute to the overall market growth, as emerging economies adopt modern retail technologies to enhance operational efficiency.

Market Segment Insights

Retail Point of Sale Terminals Market Technology Insights

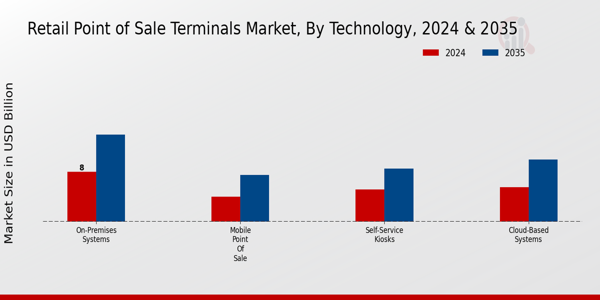

The Retail Point of Sale Terminals Market, particularly within the Technology segment, is witnessing substantial growth and evolution. By 2024, the overall market is valued at 22.66 USD Billion and is expected to continue this trajectory, reaching 40.0 USD billion by 2035. A key driving force behind this growth is the increasing demand for efficient and versatile payment solutions in the retail sector. The Technology segment is divided into various solutions, including Cloud-Based Systems, On-Premises Systems, Mobile Point of Sale (mPOS), and Self-Service Kiosks.

Among these, Cloud-Based Systems are projected to grow significantly from a valuation of 5.5 USD Billion in 2024 to 10.0 USD Billion in 2035, reflecting a shift towards more flexible, cost-efficient software solutions that aid retailers in managing transactions seamlessly over the internet. This adaptability and ease of integration with other technologies make Cloud-Based Systems a popular choice for retailers aiming to enhance operational efficiency and improve customer satisfaction.

On-Premises Systems hold a remarkable market presence, starting at a valuation of 8.0 USD Billion in 2024 and expected to expand to 14.0 USD Billion by 2035. This growth is primarily driven by brick-and-mortar establishments that prefer traditional systems with direct control over data and security protocols. However, this segment faces competition from the flexibility of cloud solutions. Mobile Point of Sale, with initial valuations of 4.0 USD Billion in 2024 and 7.5 USD Billion by 2035, is also becoming crucial as it allows retailers to conduct transactions anywhere on the sales floor, enhancing the shopping experience and driving sales.

This segment is especially significant in sectors like hospitality and retail, where mobility is key to upselling and facilitating customer interactions. Lastly, Self-Service Kiosks are valued at 5.16 USD Billion in 2024, projected to rise to 8.5 USD Billion by 2035, reflecting a trend toward enhanced customer autonomy in the purchasing process. With the growing acceptance of self-service options in retail, these kiosks not only optimize service time but also reduce labor costs, highlighting their importance as retailers seek to adapt to changing consumer preferences.

Overall, trends within the Retail Point of Sale Terminals Market indicate a movement towards more integrated, technology-driven solutions that respond to the evolving landscape of retail. With respective segment valuations reflecting significant opportunities, there is evident market growth potential driven by technological advancements and consumer demand for more efficient transactional processes. The ongoing adoption of these technologies, supported by key factors such as enhanced data security and operational flexibility, ensures that the Retail Point of Sale Terminals Market remains an area of vibrant activity and innovation.

Retail Point of Sale Terminals Market Component Insights

The Retail Point of Sale Terminals Market is projected to achieve a valuation of 22.66 USD Billion in 2024, with a consistent growth trajectory expected to reach 40.0 USD Billion by 2035. The market segmentation identifies key components such as Hardware, Software, and Services that play a critical role in shaping market dynamics. Hardware remains vital as it encompasses physical devices facilitating transactions, ensuring a seamless customer experience. Software solutions, encompassing payment processing and inventory management systems, are equally significant as they enhance operational efficiency.

Services, including maintenance and technical support, provide essential support to keep systems functioning effectively and cater to evolving customer needs. These components collectively present opportunities driven by trends such as the growing adoption of contactless payments and the rising integration of cloud-based technologies. However, challenges such as cybersecurity threats and the need for continuous innovation pose significant hurdles. The increasing demand for enhanced customer interactions and operational efficiencies continues to propel market growth in the Retail Point of Sale Terminals Market, presenting various opportunities aligned with consumer behavior shifts.

Retail Point of Sale Terminals Market End User Insights

The Retail Point of Sale Terminals Market is seeing significant growth, with a projected overall valuation of USD 22.66 billion in 2024. The market's End User segment comprises various industries, including Retail, Hospitality, Healthcare, and Food and Beverage, each playing a crucial role in driving market dynamics. The Retail sector utilizes point of sale terminals to enhance customer experience through efficient transactions, while the Hospitality industry relies on advanced systems for managing guest services and billing seamlessly. In Healthcare, these terminals facilitate the processing of payments and patient data management, showcasing their importance in improving operational efficiency.

The Food and Beverage sector significantly benefits from point of sale solutions for inventory management and customer interaction, enabling businesses to adapt to consumer behavior swiftly. The integration of technology in these sectors fosters demand, as businesses seek to improve transaction efficiency and enhance customer engagement. As the Retail Point of Sale Terminals Market evolves, the focus on delivering user-friendly and innovative solutions will continue to be pivotal in ensuring growth across all end user categories, supporting a diverse range of applications, and enhancing operational capabilities.

Retail Point of Sale Terminals Market Payment Method Insights

The Retail Point of Sale Terminals Market, valued at 22.66 billion USD in 2024, is significantly shaped by the Payment Method segment, which includes various transaction options such as Credit/Debit Cards, Mobile Wallets, Contactless Payments, and Cash. This segment is crucial as it reflects the evolving consumer preferences towards more convenient and secure payment methods. Credit and debit cards have been dominant in retail transactions, providing consumers with the flexibility to spend and manage their finances. Mobile wallets are gaining traction rapidly, driven by the increase in smartphone penetration and consumer interest in seamless transactions.

Contactless payments are also becoming increasingly popular, offering speed and efficiency, especially in high-traffic retail environments. Although cash remains a traditional method, its usage is declining as digital payments become more prevalent. The market growth is supported by technological advancements and consumer demand for enhanced payment experiences. However, challenges such as cybersecurity concerns and the need for infrastructure upgrades pose obstacles to market expansion. Overall, the diverse Payment Method segment is integral to the dynamics of the Retail Point of Sale Terminals Market, accommodating a wide range of consumer needs and preferences.

Get more detailed insights about Retail Point-of-Sale Terminals Market Research Report—Global Forecast till 2035

Regional Insights

The Retail Point of Sale Terminals Market demonstrates significant regional differentiation in its growth trajectory. North America commands a major share with a projected valuation of 8.8 USD Billion in 2024, escalating to 15.5 USD billion by 2035, showcasing its dominant position due to advanced technological adoption and a robust retail sector. Europe follows closely with a market value of 6.5 USD Billion in 2024, expected to reach 11.5 USD Billion in 2035, bolstered by extensive digital payment integrations.

The Asia Pacific region is emerging rapidly, starting at 3.5 USD Billion in 2024 and anticipated to climb to 6.5 USD billion by 2035, driven by increasing smartphone penetration and evolving consumer preferences towards cashless transactions.

South America and the Middle East, and Africa are comparatively smaller markets, valued at 2.0 USD Billion and 2.86 USD Billion in 2024, respectively, yet both regions are expected to grow steadily through rising retail activities. The Regional segmentation highlights variance in market dynamics, with North America and Europe significantly influencing the Retail Point of Sale Terminals Market revenue through advanced payment infrastructures, while Asia Pacific shows potential for increased market growth supported by changing consumer behavior.

Source: Primary Research, Secondary Research, MRFR Database, and Analyst Review

Key Players and Competitive Insights

The Retail Point of Sale Terminals Market has experienced significant growth and transformation as businesses increasingly embrace digital transactions and seek to enhance customer experiences. Competitive insights in this market highlight the diverse key players that are dominating the landscape, each contributing unique technological advancements and services aimed at improving payment efficiency and security. With the rise of e-commerce and the growing demand for contactless payment solutions, companies are investing in innovative technologies and strategic partnerships to capture a larger market share.

The competitive environment is driven by continuous development in software functionalities, integration capabilities, and compliance with evolving regulations, resulting in a dynamic marketplace that adapts to consumer preferences and technological progress.

Bluefin Payment Systems has established a robust presence in the Retail Point of Sale Terminals Market by focusing on providing secure payment solutions. The company prides itself on its unique offerings in encryption and tokenization technologies, which are geared towards protecting sensitive customer data. With a commitment to innovation, Bluefin has positioned itself as a leader in the cybersecurity realm within the payment processing sector. Its strengths lie in its sophisticated systems that ensure seamless integration with existing retail environments, enabling merchants to accept various payment types efficiently.

The brand's emphasis on security not only bolsters its reputation but also appeals to a broad spectrum of businesses seeking trustworthy alternatives in an increasingly digital landscape.

Newland Payment Technology has broadened its footprint in the Retail Point of Sale Terminals Market, delivering cutting-edge payment solutions that cater to diverse retail needs. The company is recognized for its extensive range of products, including handheld and countertop POS terminals, which combine user-friendly interfaces with advanced processing capabilities. Newland's strengths are reflected in its commitment to innovation and customer satisfaction, ensuring that its solutions remain relevant in a rapidly evolving market. The company's strategic focus on forging partnerships has facilitated its growth and enabled it to remain competitive.

Additionally, Newland actively engages in mergers and acquisitions to enhance its product offerings and market reach, focusing on integrating technologies that improve payment processing efficiency and customer engagement globally. With a solid market presence, Newland continues to cater to its clients with tailored solutions that support their unique operational needs while leveraging its technological expertise to drive growth in the retail sector.

Key Companies in the Retail Point of Sale Terminals Market market include

Industry Developments

Recent changes in the Global Retail Point of Sale (POS) Terminals Market have shown a lot of growth and new ideas, mostly because more people are using contactless payment methods and payment technologies are getting better. Ingenico Group and Verifone are two companies that have made big improvements to their products to better serve retail customers.

In September 2023, Fiserv (formerly First Data Corporation) announced upgrades to its Clover POS systems. These upgrades included new security features to help protect against fraud in retail transactions, which is becoming more and more important. In August 2023, Square also added new features to its hardware that were designed for small to medium-sized businesses.

In July 2023, NCR Corporation started NCR Voyix, a separate division that focuses on retail analytics and digital transformation. This was done to improve the company's position in the market.

The market value has grown a lot, with estimates showing that it has grown at a compound annual growth rate (CAGR) of more than 10% in recent years. This is mostly because more people are doing business online. The push for omnichannel retailing and easier payment processes has changed the way businesses work over the past two years. Companies like PAX Technology and Clover Network have put a lot of money into new ideas to make shopping better for customers on both physical and digital platforms.

Future Outlook

Retail Point of Sale Terminals Market Future Outlook

The Retail Point of Sale Terminals Market is projected to grow at a 12.90% CAGR from 2025 to 2035, driven by technological advancements, increasing digital payments, and enhanced customer experiences.

New opportunities lie in:

- Develop integrated POS solutions with AI for personalized customer engagement.

- Expand mobile POS systems to enhance transaction flexibility in retail environments.

- Leverage cloud-based POS systems for real-time data analytics and inventory management.

By 2035, the Retail Point of Sale Terminals Market is expected to achieve substantial growth, reflecting evolving consumer preferences and technological integration.

Market Segmentation

Retail Point of Sale Terminals Market End User Outlook

- Credit/Debit Card

- Mobile Wallet

- Contactless Payment

- Cash

Retail Point of Sale Terminals Market Regional Outlook

- North America

- Europe

- South America

- Asia Pacific

- Middle East and Africa

Retail Point of Sale Terminals Market Component Outlook

- Retail

- Hospitality

- Healthcare

- FoodBeverage

Retail Point of Sale Terminals Market Technology Outlook

- Hardware

- Software

- Services

Retail Point of Sale Terminals Market Payment Method Outlook

- North America

- Europe

- South America

- Asia Pacific

- Middle East and Africa

Report Scope

|

Report Attribute/Metric |

Details |

|

Market Size 2024 |

22.66 (USD Billion) |

|

Market Size 2035 |

125.22 (USD Billion) |

|

Compound Annual Growth Rate (CAGR) |

12.90% (2025 - 2035) |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

|

Base Year |

2024 |

|

Market Forecast Period |

2025 - 2035 |

|

Historical Data |

2019 - 2024 |

|

Market Forecast Units |

USD Billion |

|

Key Companies Profiled |

Bluefin Payment Systems, Newland Payment Technology, Cayan, Destiny Technologies, First Data Corporation, Ingenico Group, NCR Corporation, Total Merchant Services, Ingenico, Diebold Nixdorf, Square, Verifone, PAX Technology, Clover Network, Epson |

|

Segments Covered |

Technology, Component, End User, Payment Method, Regional |

|

Key Market Opportunities |

Mobile payment integration, Cloud-based solutions growth, Emerging markets expansion, AI-driven analytics adoption, Contactless payment preference |

|

Key Market Dynamics |

Growing e-commerce sales, increasing mobile payments, demand for contactless transactions, technological advancements, and integration with cloud solutions |

|

Countries Covered |

North America, Europe, APAC, South America, MEA |

| Market Size 2025 | 37.21 (USD Billion) |

Market Highlights

Author

Latest Comments

This is a great article! Really helped me understand the topic better.

Thanks for sharing this. I’ve bookmarked it for later reference.

FAQs

What is the projected value of the Retail Point of Sale Terminals Market by 2035?

The Retail Point of Sale Terminals Market is expected to be valued at 40.0 USD billion by the year 2035.

What was the market size of the Retail Point of Sale Terminals Market in 2024?

In 2024, the Retail Point of Sale Terminals Market was valued at 22.66 USD billion.

What is the expected CAGR for the Retail Point of Sale Terminals Market from 2025 to 2035?

The expected CAGR for the Retail Point of Sale Terminals Market from 2025 to 2035 is 5.3%.

Which region is expected to have the highest market value in 2035?

North America is projected to have the highest market value, estimated at 15.5 USD Billion in 2035.

What is the forecasted market size of Cloud-Based Systems in 2035?

The market size for Cloud-Based Systems is expected to reach 10.0 USD billion by 2035.

Who are some of the key players in the Retail Point of Sale Terminals Market?

Major players in the market include Ingenico Group, NCR Corporation, and Verifone, among others.

What is the expected market size for Self-Service Kiosks in 2024?

The market size for Self-Service Kiosks is projected to be 5.16 USD billion in 2024.

What market value is expected for On-Premises Systems in 2035?

On-Premises Systems are expected to reach a market value of 14.0 USD billion by 2035.

What is the anticipated growth of the Asia Pacific region by 2035?

The Asia Pacific region is anticipated to grow to a market value of 6.5 USD billion by 2035.

What is the market size projection for Mobile Point of Sale by 2035?

The market size for Mobile Point of Sale is projected to be 7.5 USD billion by the year 2035.

-

Table of Contents

-

Executive Summary

- Market Overview

- Key Findings

- Market Segmentation

- Competitive Landscape

- Challenges and Opportunities

- Future Outlook

-

Market Introduction

- Definition

-

Scope of the Study

- Research Objective

- Assumption

- Limitations

-

Research Methodology

- Overview

- Data Mining

- Secondary Research

-

Primary Research

- Primary Interviews and Information Gathering Process

- Breakdown of Primary Respondents

- Forecasting Model

-

Market Size Estimation

- Bottom-up Approach

- Top-Down Approach

- Data Triangulation

- Validation

-

MARKET DYNAMICS

- Overview

- Drivers

- Restraints

- Opportunities

-

MARKET FACTOR ANALYSIS

- Value chain Analysis

-

Porter's Five Forces Analysis

- Bargaining Power of Suppliers

- Bargaining Power of Buyers

- Threat of New Entrants

- Threat of Substitutes

- Intensity of Rivalry

-

COVID-19 Impact Analysis

- Market Impact Analysis

- Regional Impact

- Opportunity and Threat Analysis

-

RETAIL POINT OF SALE TERMINALS MARKET, BY TECHNOLOGY (USD BILLION)

- Cloud-Based Systems

- On-Premises Systems

- Mobile Point of Sale

- Self-Service Kiosks

-

RETAIL POINT OF SALE TERMINALS MARKET, BY COMPONENT (USD BILLION)

- Hardware

- Software

- Services

-

RETAIL POINT OF SALE TERMINALS MARKET, BY END USER (USD BILLION)

- Retail

- Hospitality

- Healthcare

- FoodBeverage

-

RETAIL POINT OF SALE TERMINALS MARKET, BY PAYMENT METHOD (USD BILLION)

- Credit/Debit Card

- Mobile Wallet

- Contactless Payment

- Cash

-

RETAIL POINT OF SALE TERMINALS MARKET, BY REGIONAL (USD BILLION)

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Russia

- Italy

- Spain

- Rest of Europe

-

APAC

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Indonesia

- Rest of APAC

-

South America

- Brazil

- Mexico

- Argentina

- Rest of South America

-

MEA

- GCC Countries

- South Africa

- Rest of MEA

-

North America

-

Competitive Landscape

- Overview

- Competitive Analysis

- Market share Analysis

- Major Growth Strategy in the Retail Point of Sale Terminals Market

- Competitive Benchmarking

- Leading Players in Terms of Number of Developments in the Retail Point of Sale Terminals Market

-

Key developments and growth strategies

- New Product Launch/Service Deployment

- Merger & Acquisitions

- Joint Ventures

-

Major Players Financial Matrix

- Sales and Operating Income

- Major Players R&D Expenditure. 2023

-

COMPANY PROFILES

-

Bluefin Payment Systems

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Newland Payment Technology

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Cayan

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Destiny Technologies

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

First Data Corporation

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Ingenico Group

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

NCR Corporation

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Total Merchant Services

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Ingenico

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Diebold Nixdorf

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Square

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Verifone

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

PAX Technology

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Clover Network

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Epson

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Bluefin Payment Systems

-

APPENDIX

- References

- Related Reports

-

List of Tables and Figures

- LIST OF TABLES

- TABLE 1. LIST OF ASSUMPTIONS

- TABLE 2. NORTH AMERICA RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY TECHNOLOGY, 2019-2035 (USD BILLIONS)

- TABLE 3. NORTH AMERICA RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY COMPONENT, 2019-2035 (USD BILLIONS)

- TABLE 4. NORTH AMERICA RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD BILLIONS)

- TABLE 5. NORTH AMERICA RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY PAYMENT METHOD, 2019-2035 (USD BILLIONS)

- TABLE 6. NORTH AMERICA RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 7. US RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY TECHNOLOGY, 2019-2035 (USD BILLIONS)

- TABLE 8. US RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY COMPONENT, 2019-2035 (USD BILLIONS)

- TABLE 9. US RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD BILLIONS)

- TABLE 10. US RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY PAYMENT METHOD, 2019-2035 (USD BILLIONS)

- TABLE 11. US RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 12. CANADA RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY TECHNOLOGY, 2019-2035 (USD BILLIONS)

- TABLE 13. CANADA RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY COMPONENT, 2019-2035 (USD BILLIONS)

- TABLE 14. CANADA RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD BILLIONS)

- TABLE 15. CANADA RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY PAYMENT METHOD, 2019-2035 (USD BILLIONS)

- TABLE 16. CANADA RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 17. EUROPE RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY TECHNOLOGY, 2019-2035 (USD BILLIONS)

- TABLE 18. EUROPE RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY COMPONENT, 2019-2035 (USD BILLIONS)

- TABLE 19. EUROPE RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD BILLIONS)

- TABLE 20. EUROPE RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY PAYMENT METHOD, 2019-2035 (USD BILLIONS)

- TABLE 21. EUROPE RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 22. GERMANY RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY TECHNOLOGY, 2019-2035 (USD BILLIONS)

- TABLE 23. GERMANY RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY COMPONENT, 2019-2035 (USD BILLIONS)

- TABLE 24. GERMANY RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD BILLIONS)

- TABLE 25. GERMANY RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY PAYMENT METHOD, 2019-2035 (USD BILLIONS)

- TABLE 26. GERMANY RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 27. UK RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY TECHNOLOGY, 2019-2035 (USD BILLIONS)

- TABLE 28. UK RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY COMPONENT, 2019-2035 (USD BILLIONS)

- TABLE 29. UK RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD BILLIONS)

- TABLE 30. UK RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY PAYMENT METHOD, 2019-2035 (USD BILLIONS)

- TABLE 31. UK RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 32. FRANCE RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY TECHNOLOGY, 2019-2035 (USD BILLIONS)

- TABLE 33. FRANCE RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY COMPONENT, 2019-2035 (USD BILLIONS)

- TABLE 34. FRANCE RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD BILLIONS)

- TABLE 35. FRANCE RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY PAYMENT METHOD, 2019-2035 (USD BILLIONS)

- TABLE 36. FRANCE RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 37. RUSSIA RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY TECHNOLOGY, 2019-2035 (USD BILLIONS)

- TABLE 38. RUSSIA RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY COMPONENT, 2019-2035 (USD BILLIONS)

- TABLE 39. RUSSIA RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD BILLIONS)

- TABLE 40. RUSSIA RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY PAYMENT METHOD, 2019-2035 (USD BILLIONS)

- TABLE 41. RUSSIA RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 42. ITALY RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY TECHNOLOGY, 2019-2035 (USD BILLIONS)

- TABLE 43. ITALY RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY COMPONENT, 2019-2035 (USD BILLIONS)

- TABLE 44. ITALY RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD BILLIONS)

- TABLE 45. ITALY RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY PAYMENT METHOD, 2019-2035 (USD BILLIONS)

- TABLE 46. ITALY RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 47. SPAIN RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY TECHNOLOGY, 2019-2035 (USD BILLIONS)

- TABLE 48. SPAIN RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY COMPONENT, 2019-2035 (USD BILLIONS)

- TABLE 49. SPAIN RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD BILLIONS)

- TABLE 50. SPAIN RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY PAYMENT METHOD, 2019-2035 (USD BILLIONS)

- TABLE 51. SPAIN RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 52. REST OF EUROPE RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY TECHNOLOGY, 2019-2035 (USD BILLIONS)

- TABLE 53. REST OF EUROPE RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY COMPONENT, 2019-2035 (USD BILLIONS)

- TABLE 54. REST OF EUROPE RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD BILLIONS)

- TABLE 55. REST OF EUROPE RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY PAYMENT METHOD, 2019-2035 (USD BILLIONS)

- TABLE 56. REST OF EUROPE RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 57. APAC RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY TECHNOLOGY, 2019-2035 (USD BILLIONS)

- TABLE 58. APAC RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY COMPONENT, 2019-2035 (USD BILLIONS)

- TABLE 59. APAC RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD BILLIONS)

- TABLE 60. APAC RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY PAYMENT METHOD, 2019-2035 (USD BILLIONS)

- TABLE 61. APAC RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 62. CHINA RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY TECHNOLOGY, 2019-2035 (USD BILLIONS)

- TABLE 63. CHINA RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY COMPONENT, 2019-2035 (USD BILLIONS)

- TABLE 64. CHINA RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD BILLIONS)

- TABLE 65. CHINA RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY PAYMENT METHOD, 2019-2035 (USD BILLIONS)

- TABLE 66. CHINA RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 67. INDIA RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY TECHNOLOGY, 2019-2035 (USD BILLIONS)

- TABLE 68. INDIA RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY COMPONENT, 2019-2035 (USD BILLIONS)

- TABLE 69. INDIA RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD BILLIONS)

- TABLE 70. INDIA RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY PAYMENT METHOD, 2019-2035 (USD BILLIONS)

- TABLE 71. INDIA RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 72. JAPAN RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY TECHNOLOGY, 2019-2035 (USD BILLIONS)

- TABLE 73. JAPAN RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY COMPONENT, 2019-2035 (USD BILLIONS)

- TABLE 74. JAPAN RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD BILLIONS)

- TABLE 75. JAPAN RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY PAYMENT METHOD, 2019-2035 (USD BILLIONS)

- TABLE 76. JAPAN RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 77. SOUTH KOREA RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY TECHNOLOGY, 2019-2035 (USD BILLIONS)

- TABLE 78. SOUTH KOREA RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY COMPONENT, 2019-2035 (USD BILLIONS)

- TABLE 79. SOUTH KOREA RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD BILLIONS)

- TABLE 80. SOUTH KOREA RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY PAYMENT METHOD, 2019-2035 (USD BILLIONS)

- TABLE 81. SOUTH KOREA RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 82. MALAYSIA RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY TECHNOLOGY, 2019-2035 (USD BILLIONS)

- TABLE 83. MALAYSIA RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY COMPONENT, 2019-2035 (USD BILLIONS)

- TABLE 84. MALAYSIA RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD BILLIONS)

- TABLE 85. MALAYSIA RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY PAYMENT METHOD, 2019-2035 (USD BILLIONS)

- TABLE 86. MALAYSIA RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 87. THAILAND RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY TECHNOLOGY, 2019-2035 (USD BILLIONS)

- TABLE 88. THAILAND RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY COMPONENT, 2019-2035 (USD BILLIONS)

- TABLE 89. THAILAND RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD BILLIONS)

- TABLE 90. THAILAND RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY PAYMENT METHOD, 2019-2035 (USD BILLIONS)

- TABLE 91. THAILAND RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 92. INDONESIA RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY TECHNOLOGY, 2019-2035 (USD BILLIONS)

- TABLE 93. INDONESIA RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY COMPONENT, 2019-2035 (USD BILLIONS)

- TABLE 94. INDONESIA RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD BILLIONS)

- TABLE 95. INDONESIA RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY PAYMENT METHOD, 2019-2035 (USD BILLIONS)

- TABLE 96. INDONESIA RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 97. REST OF APAC RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY TECHNOLOGY, 2019-2035 (USD BILLIONS)

- TABLE 98. REST OF APAC RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY COMPONENT, 2019-2035 (USD BILLIONS)

- TABLE 99. REST OF APAC RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD BILLIONS)

- TABLE 100. REST OF APAC RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY PAYMENT METHOD, 2019-2035 (USD BILLIONS)

- TABLE 101. REST OF APAC RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 102. SOUTH AMERICA RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY TECHNOLOGY, 2019-2035 (USD BILLIONS)

- TABLE 103. SOUTH AMERICA RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY COMPONENT, 2019-2035 (USD BILLIONS)

- TABLE 104. SOUTH AMERICA RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD BILLIONS)

- TABLE 105. SOUTH AMERICA RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY PAYMENT METHOD, 2019-2035 (USD BILLIONS)

- TABLE 106. SOUTH AMERICA RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 107. BRAZIL RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY TECHNOLOGY, 2019-2035 (USD BILLIONS)

- TABLE 108. BRAZIL RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY COMPONENT, 2019-2035 (USD BILLIONS)

- TABLE 109. BRAZIL RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD BILLIONS)

- TABLE 110. BRAZIL RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY PAYMENT METHOD, 2019-2035 (USD BILLIONS)

- TABLE 111. BRAZIL RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 112. MEXICO RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY TECHNOLOGY, 2019-2035 (USD BILLIONS)

- TABLE 113. MEXICO RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY COMPONENT, 2019-2035 (USD BILLIONS)

- TABLE 114. MEXICO RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD BILLIONS)

- TABLE 115. MEXICO RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY PAYMENT METHOD, 2019-2035 (USD BILLIONS)

- TABLE 116. MEXICO RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 117. ARGENTINA RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY TECHNOLOGY, 2019-2035 (USD BILLIONS)

- TABLE 118. ARGENTINA RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY COMPONENT, 2019-2035 (USD BILLIONS)

- TABLE 119. ARGENTINA RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD BILLIONS)

- TABLE 120. ARGENTINA RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY PAYMENT METHOD, 2019-2035 (USD BILLIONS)

- TABLE 121. ARGENTINA RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 122. REST OF SOUTH AMERICA RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY TECHNOLOGY, 2019-2035 (USD BILLIONS)

- TABLE 123. REST OF SOUTH AMERICA RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY COMPONENT, 2019-2035 (USD BILLIONS)

- TABLE 124. REST OF SOUTH AMERICA RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD BILLIONS)

- TABLE 125. REST OF SOUTH AMERICA RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY PAYMENT METHOD, 2019-2035 (USD BILLIONS)

- TABLE 126. REST OF SOUTH AMERICA RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 127. MEA RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY TECHNOLOGY, 2019-2035 (USD BILLIONS)

- TABLE 128. MEA RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY COMPONENT, 2019-2035 (USD BILLIONS)

- TABLE 129. MEA RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD BILLIONS)

- TABLE 130. MEA RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY PAYMENT METHOD, 2019-2035 (USD BILLIONS)

- TABLE 131. MEA RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 132. GCC COUNTRIES RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY TECHNOLOGY, 2019-2035 (USD BILLIONS)

- TABLE 133. GCC COUNTRIES RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY COMPONENT, 2019-2035 (USD BILLIONS)

- TABLE 134. GCC COUNTRIES RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD BILLIONS)

- TABLE 135. GCC COUNTRIES RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY PAYMENT METHOD, 2019-2035 (USD BILLIONS)

- TABLE 136. GCC COUNTRIES RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 137. SOUTH AFRICA RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY TECHNOLOGY, 2019-2035 (USD BILLIONS)

- TABLE 138. SOUTH AFRICA RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY COMPONENT, 2019-2035 (USD BILLIONS)

- TABLE 139. SOUTH AFRICA RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD BILLIONS)

- TABLE 140. SOUTH AFRICA RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY PAYMENT METHOD, 2019-2035 (USD BILLIONS)

- TABLE 141. SOUTH AFRICA RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 142. REST OF MEA RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY TECHNOLOGY, 2019-2035 (USD BILLIONS)

- TABLE 143. REST OF MEA RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY COMPONENT, 2019-2035 (USD BILLIONS)

- TABLE 144. REST OF MEA RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY END USER, 2019-2035 (USD BILLIONS)

- TABLE 145. REST OF MEA RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY PAYMENT METHOD, 2019-2035 (USD BILLIONS)

- TABLE 146. REST OF MEA RETAIL POINT OF SALE TERMINALS MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

- TABLE 147. PRODUCT LAUNCH/PRODUCT DEVELOPMENT/APPROVAL

- TABLE 148. ACQUISITION/PARTNERSHIP LIST OF FIGURES

- FIGURE 1. MARKET SYNOPSIS

- FIGURE 2. NORTH AMERICA RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS

- FIGURE 3. US RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY TECHNOLOGY

- FIGURE 4. US RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY COMPONENT

- FIGURE 5. US RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY END USER

- FIGURE 6. US RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY PAYMENT METHOD

- FIGURE 7. US RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY REGIONAL

- FIGURE 8. CANADA RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY TECHNOLOGY

- FIGURE 9. CANADA RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY COMPONENT

- FIGURE 10. CANADA RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY END USER

- FIGURE 11. CANADA RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY PAYMENT METHOD

- FIGURE 12. CANADA RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY REGIONAL

- FIGURE 13. EUROPE RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS

- FIGURE 14. GERMANY RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY TECHNOLOGY

- FIGURE 15. GERMANY RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY COMPONENT

- FIGURE 16. GERMANY RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY END USER

- FIGURE 17. GERMANY RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY PAYMENT METHOD

- FIGURE 18. GERMANY RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY REGIONAL

- FIGURE 19. UK RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY TECHNOLOGY

- FIGURE 20. UK RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY COMPONENT

- FIGURE 21. UK RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY END USER

- FIGURE 22. UK RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY PAYMENT METHOD

- FIGURE 23. UK RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY REGIONAL

- FIGURE 24. FRANCE RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY TECHNOLOGY

- FIGURE 25. FRANCE RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY COMPONENT

- FIGURE 26. FRANCE RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY END USER

- FIGURE 27. FRANCE RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY PAYMENT METHOD

- FIGURE 28. FRANCE RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY REGIONAL

- FIGURE 29. RUSSIA RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY TECHNOLOGY

- FIGURE 30. RUSSIA RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY COMPONENT

- FIGURE 31. RUSSIA RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY END USER

- FIGURE 32. RUSSIA RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY PAYMENT METHOD

- FIGURE 33. RUSSIA RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY REGIONAL

- FIGURE 34. ITALY RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY TECHNOLOGY

- FIGURE 35. ITALY RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY COMPONENT

- FIGURE 36. ITALY RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY END USER

- FIGURE 37. ITALY RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY PAYMENT METHOD

- FIGURE 38. ITALY RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY REGIONAL

- FIGURE 39. SPAIN RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY TECHNOLOGY

- FIGURE 40. SPAIN RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY COMPONENT

- FIGURE 41. SPAIN RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY END USER

- FIGURE 42. SPAIN RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY PAYMENT METHOD

- FIGURE 43. SPAIN RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY REGIONAL

- FIGURE 44. REST OF EUROPE RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY TECHNOLOGY

- FIGURE 45. REST OF EUROPE RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY COMPONENT

- FIGURE 46. REST OF EUROPE RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY END USER

- FIGURE 47. REST OF EUROPE RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY PAYMENT METHOD

- FIGURE 48. REST OF EUROPE RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY REGIONAL

- FIGURE 49. APAC RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS

- FIGURE 50. CHINA RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY TECHNOLOGY

- FIGURE 51. CHINA RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY COMPONENT

- FIGURE 52. CHINA RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY END USER

- FIGURE 53. CHINA RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY PAYMENT METHOD

- FIGURE 54. CHINA RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY REGIONAL

- FIGURE 55. INDIA RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY TECHNOLOGY

- FIGURE 56. INDIA RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY COMPONENT

- FIGURE 57. INDIA RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY END USER

- FIGURE 58. INDIA RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY PAYMENT METHOD

- FIGURE 59. INDIA RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY REGIONAL

- FIGURE 60. JAPAN RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY TECHNOLOGY

- FIGURE 61. JAPAN RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY COMPONENT

- FIGURE 62. JAPAN RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY END USER

- FIGURE 63. JAPAN RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY PAYMENT METHOD

- FIGURE 64. JAPAN RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY REGIONAL

- FIGURE 65. SOUTH KOREA RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY TECHNOLOGY

- FIGURE 66. SOUTH KOREA RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY COMPONENT

- FIGURE 67. SOUTH KOREA RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY END USER

- FIGURE 68. SOUTH KOREA RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY PAYMENT METHOD

- FIGURE 69. SOUTH KOREA RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY REGIONAL

- FIGURE 70. MALAYSIA RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY TECHNOLOGY

- FIGURE 71. MALAYSIA RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY COMPONENT

- FIGURE 72. MALAYSIA RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY END USER

- FIGURE 73. MALAYSIA RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY PAYMENT METHOD

- FIGURE 74. MALAYSIA RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY REGIONAL

- FIGURE 75. THAILAND RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY TECHNOLOGY

- FIGURE 76. THAILAND RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY COMPONENT

- FIGURE 77. THAILAND RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY END USER

- FIGURE 78. THAILAND RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY PAYMENT METHOD

- FIGURE 79. THAILAND RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY REGIONAL

- FIGURE 80. INDONESIA RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY TECHNOLOGY

- FIGURE 81. INDONESIA RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY COMPONENT

- FIGURE 82. INDONESIA RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY END USER

- FIGURE 83. INDONESIA RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY PAYMENT METHOD

- FIGURE 84. INDONESIA RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY REGIONAL

- FIGURE 85. REST OF APAC RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY TECHNOLOGY

- FIGURE 86. REST OF APAC RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY COMPONENT

- FIGURE 87. REST OF APAC RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY END USER

- FIGURE 88. REST OF APAC RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY PAYMENT METHOD

- FIGURE 89. REST OF APAC RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY REGIONAL

- FIGURE 90. SOUTH AMERICA RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS

- FIGURE 91. BRAZIL RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY TECHNOLOGY

- FIGURE 92. BRAZIL RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY COMPONENT

- FIGURE 93. BRAZIL RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY END USER

- FIGURE 94. BRAZIL RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY PAYMENT METHOD

- FIGURE 95. BRAZIL RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY REGIONAL

- FIGURE 96. MEXICO RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY TECHNOLOGY

- FIGURE 97. MEXICO RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY COMPONENT

- FIGURE 98. MEXICO RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY END USER

- FIGURE 99. MEXICO RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY PAYMENT METHOD

- FIGURE 100. MEXICO RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY REGIONAL

- FIGURE 101. ARGENTINA RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY TECHNOLOGY

- FIGURE 102. ARGENTINA RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY COMPONENT

- FIGURE 103. ARGENTINA RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY END USER

- FIGURE 104. ARGENTINA RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY PAYMENT METHOD

- FIGURE 105. ARGENTINA RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY REGIONAL

- FIGURE 106. REST OF SOUTH AMERICA RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY TECHNOLOGY

- FIGURE 107. REST OF SOUTH AMERICA RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY COMPONENT

- FIGURE 108. REST OF SOUTH AMERICA RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY END USER

- FIGURE 109. REST OF SOUTH AMERICA RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY PAYMENT METHOD

- FIGURE 110. REST OF SOUTH AMERICA RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY REGIONAL

- FIGURE 111. MEA RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS

- FIGURE 112. GCC COUNTRIES RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY TECHNOLOGY

- FIGURE 113. GCC COUNTRIES RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY COMPONENT

- FIGURE 114. GCC COUNTRIES RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY END USER

- FIGURE 115. GCC COUNTRIES RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY PAYMENT METHOD

- FIGURE 116. GCC COUNTRIES RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY REGIONAL

- FIGURE 117. SOUTH AFRICA RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY TECHNOLOGY

- FIGURE 118. SOUTH AFRICA RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY COMPONENT

- FIGURE 119. SOUTH AFRICA RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY END USER

- FIGURE 120. SOUTH AFRICA RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY PAYMENT METHOD

- FIGURE 121. SOUTH AFRICA RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY REGIONAL

- FIGURE 122. REST OF MEA RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY TECHNOLOGY

- FIGURE 123. REST OF MEA RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY COMPONENT

- FIGURE 124. REST OF MEA RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY END USER

- FIGURE 125. REST OF MEA RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY PAYMENT METHOD

- FIGURE 126. REST OF MEA RETAIL POINT OF SALE TERMINALS MARKET ANALYSIS BY REGIONAL

- FIGURE 127. KEY BUYING CRITERIA OF RETAIL POINT OF SALE TERMINALS MARKET

- FIGURE 128. RESEARCH PROCESS OF MRFR

- FIGURE 129. DRO ANALYSIS OF RETAIL POINT OF SALE TERMINALS MARKET

- FIGURE 130. DRIVERS IMPACT ANALYSIS: RETAIL POINT OF SALE TERMINALS MARKET

- FIGURE 131. RESTRAINTS IMPACT ANALYSIS: RETAIL POINT OF SALE TERMINALS MARKET

- FIGURE 132. SUPPLY / VALUE CHAIN: RETAIL POINT OF SALE TERMINALS MARKET

- FIGURE 133. RETAIL POINT OF SALE TERMINALS MARKET, BY TECHNOLOGY, 2025 (% SHARE)

- FIGURE 134. RETAIL POINT OF SALE TERMINALS MARKET, BY TECHNOLOGY, 2019 TO 2035 (USD Billions)

- FIGURE 135. RETAIL POINT OF SALE TERMINALS MARKET, BY COMPONENT, 2025 (% SHARE)

- FIGURE 136. RETAIL POINT OF SALE TERMINALS MARKET, BY COMPONENT, 2019 TO 2035 (USD Billions)

- FIGURE 137. RETAIL POINT OF SALE TERMINALS MARKET, BY END USER, 2025 (% SHARE)

- FIGURE 138. RETAIL POINT OF SALE TERMINALS MARKET, BY END USER, 2019 TO 2035 (USD Billions)

- FIGURE 139. RETAIL POINT OF SALE TERMINALS MARKET, BY PAYMENT METHOD, 2025 (% SHARE)

- FIGURE 140. RETAIL POINT OF SALE TERMINALS MARKET, BY PAYMENT METHOD, 2019 TO 2035 (USD Billions)

- FIGURE 141. RETAIL POINT OF SALE TERMINALS MARKET, BY REGIONAL, 2025 (% SHARE)

- FIGURE 142. RETAIL POINT OF SALE TERMINALS MARKET, BY REGIONAL, 2019 TO 2035 (USD Billions)

- FIGURE 143. BENCHMARKING OF MAJOR COMPETITORS

Retail Point of Sale Terminals Market Segmentation

- Retail Point of Sale Terminals Market By Technology (USD Billion, 2019-2035)

- Cloud-Based Systems

- On-Premises Systems

- Mobile Point of Sale

- Self-Service Kiosks

- Retail Point of Sale Terminals Market By Component (USD Billion, 2019-2035)

- Hardware

- Software

- Services

- Retail Point of Sale Terminals Market By End User (USD Billion, 2019-2035)

- Retail

- Hospitality

- Healthcare

- FoodBeverage

- Retail Point of Sale Terminals Market By Payment Method (USD Billion, 2019-2035)

- Credit/Debit Card

- Mobile Wallet

- Contactless Payment

- Cash

- Retail Point of Sale Terminals Market By Regional (USD Billion, 2019-2035)

- North America

- Europe

- South America

- Asia Pacific

- Middle East and Africa

Retail Point of Sale Terminals Market Regional Outlook (USD Billion, 2019-2035)

- North America Outlook (USD Billion, 2019-2035)

- North America Retail Point of Sale Terminals Market by Technology Type

- Cloud-Based Systems

- On-Premises Systems

- Mobile Point of Sale

- Self-Service Kiosks

- North America Retail Point of Sale Terminals Market by Component Type

- Hardware

- Software

- Services

- North America Retail Point of Sale Terminals Market by End User Type

- Retail

- Hospitality

- Healthcare

- FoodBeverage

- North America Retail Point of Sale Terminals Market by Payment Method Type

- Credit/Debit Card

- Mobile Wallet

- Contactless Payment

- Cash

- North America Retail Point of Sale Terminals Market by Regional Type

- US

- Canada

- US Outlook (USD Billion, 2019-2035)

- US Retail Point of Sale Terminals Market by Technology Type

- Cloud-Based Systems

- On-Premises Systems

- Mobile Point of Sale

- Self-Service Kiosks

- US Retail Point of Sale Terminals Market by Component Type

- Hardware

- Software

- Services

- US Retail Point of Sale Terminals Market by End User Type

- Retail

- Hospitality

- Healthcare

- FoodBeverage

- US Retail Point of Sale Terminals Market by Payment Method Type

- Credit/Debit Card

- Mobile Wallet

- Contactless Payment

- Cash

- CANADA Outlook (USD Billion, 2019-2035)

- CANADA Retail Point of Sale Terminals Market by Technology Type

- Cloud-Based Systems

- On-Premises Systems

- Mobile Point of Sale

- Self-Service Kiosks

- CANADA Retail Point of Sale Terminals Market by Component Type

- Hardware

- Software

- Services

- CANADA Retail Point of Sale Terminals Market by End User Type

- Retail

- Hospitality

- Healthcare

- FoodBeverage

- CANADA Retail Point of Sale Terminals Market by Payment Method Type

- Credit/Debit Card

- Mobile Wallet

- Contactless Payment

- Cash

- Europe Outlook (USD Billion, 2019-2035)

- Europe Retail Point of Sale Terminals Market by Technology Type

- Cloud-Based Systems

- On-Premises Systems

- Mobile Point of Sale

- Self-Service Kiosks

- Europe Retail Point of Sale Terminals Market by Component Type

- Hardware

- Software

- Services

- Europe Retail Point of Sale Terminals Market by End User Type

- Retail

- Hospitality

- Healthcare

- FoodBeverage

- Europe Retail Point of Sale Terminals Market by Payment Method Type

- Credit/Debit Card

- Mobile Wallet

- Contactless Payment

- Cash

- Europe Retail Point of Sale Terminals Market by Regional Type

- Germany

- UK

- France

- Russia

- Italy

- Spain

- Rest of Europe

- GERMANY Outlook (USD Billion, 2019-2035)

- GERMANY Retail Point of Sale Terminals Market by Technology Type

- Cloud-Based Systems

- On-Premises Systems

- Mobile Point of Sale

- Self-Service Kiosks

- GERMANY Retail Point of Sale Terminals Market by Component Type

- Hardware

- Software

- Services

- GERMANY Retail Point of Sale Terminals Market by End User Type

- Retail

- Hospitality

- Healthcare

- FoodBeverage

- GERMANY Retail Point of Sale Terminals Market by Payment Method Type

- Credit/Debit Card

- Mobile Wallet

- Contactless Payment

- Cash

- UK Outlook (USD Billion, 2019-2035)

- UK Retail Point of Sale Terminals Market by Technology Type

- Cloud-Based Systems

- On-Premises Systems

- Mobile Point of Sale

- Self-Service Kiosks

- UK Retail Point of Sale Terminals Market by Component Type

- Hardware

- Software

- Services

- UK Retail Point of Sale Terminals Market by End User Type

- Retail

- Hospitality

- Healthcare

- FoodBeverage

- UK Retail Point of Sale Terminals Market by Payment Method Type

- Credit/Debit Card

- Mobile Wallet

- Contactless Payment

- Cash

- FRANCE Outlook (USD Billion, 2019-2035)

- FRANCE Retail Point of Sale Terminals Market by Technology Type

- Cloud-Based Systems

- On-Premises Systems

- Mobile Point of Sale

- Self-Service Kiosks

- FRANCE Retail Point of Sale Terminals Market by Component Type

- Hardware

- Software

- Services

- FRANCE Retail Point of Sale Terminals Market by End User Type

- Retail

- Hospitality

- Healthcare

- FoodBeverage

- FRANCE Retail Point of Sale Terminals Market by Payment Method Type

- Credit/Debit Card

- Mobile Wallet

- Contactless Payment

- Cash

- RUSSIA Outlook (USD Billion, 2019-2035)

- RUSSIA Retail Point of Sale Terminals Market by Technology Type

- Cloud-Based Systems

- On-Premises Systems

- Mobile Point of Sale

- Self-Service Kiosks

- RUSSIA Retail Point of Sale Terminals Market by Component Type

- Hardware

- Software

- Services

- RUSSIA Retail Point of Sale Terminals Market by End User Type

- Retail

- Hospitality

- Healthcare

- FoodBeverage

- RUSSIA Retail Point of Sale Terminals Market by Payment Method Type

- Credit/Debit Card

- Mobile Wallet

- Contactless Payment

- Cash

- ITALY Outlook (USD Billion, 2019-2035)

- ITALY Retail Point of Sale Terminals Market by Technology Type

- Cloud-Based Systems

- On-Premises Systems

- Mobile Point of Sale

- Self-Service Kiosks

- ITALY Retail Point of Sale Terminals Market by Component Type

- Hardware

- Software

- Services

- ITALY Retail Point of Sale Terminals Market by End User Type

- Retail

- Hospitality

- Healthcare

- FoodBeverage

- ITALY Retail Point of Sale Terminals Market by Payment Method Type

- Credit/Debit Card

- Mobile Wallet

- Contactless Payment

- Cash

- SPAIN Outlook (USD Billion, 2019-2035)

- SPAIN Retail Point of Sale Terminals Market by Technology Type

- Cloud-Based Systems

- On-Premises Systems

- Mobile Point of Sale

- Self-Service Kiosks

- SPAIN Retail Point of Sale Terminals Market by Component Type

- Hardware

- Software

- Services

- SPAIN Retail Point of Sale Terminals Market by End User Type

- Retail

- Hospitality

- Healthcare

- FoodBeverage

- SPAIN Retail Point of Sale Terminals Market by Payment Method Type

- Credit/Debit Card

- Mobile Wallet

- Contactless Payment

- Cash

- REST OF EUROPE Outlook (USD Billion, 2019-2035)

- REST OF EUROPE Retail Point of Sale Terminals Market by Technology Type

- Cloud-Based Systems

- On-Premises Systems

- Mobile Point of Sale

- Self-Service Kiosks

- REST OF EUROPE Retail Point of Sale Terminals Market by Component Type

- Hardware

- Software

- Services

- REST OF EUROPE Retail Point of Sale Terminals Market by End User Type

- Retail

- Hospitality

- Healthcare

- FoodBeverage

- REST OF EUROPE Retail Point of Sale Terminals Market by Payment Method Type

- Credit/Debit Card

- Mobile Wallet

- Contactless Payment

- Cash

- APAC Outlook (USD Billion, 2019-2035)

- APAC Retail Point of Sale Terminals Market by Technology Type

- Cloud-Based Systems

- On-Premises Systems

- Mobile Point of Sale

- Self-Service Kiosks

- APAC Retail Point of Sale Terminals Market by Component Type

- Hardware

- Software

- Services

- APAC Retail Point of Sale Terminals Market by End User Type

- Retail

- Hospitality

- Healthcare

- FoodBeverage

- APAC Retail Point of Sale Terminals Market by Payment Method Type

- Credit/Debit Card

- Mobile Wallet

- Contactless Payment

- Cash

- APAC Retail Point of Sale Terminals Market by Regional Type

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Indonesia

- Rest of APAC

- CHINA Outlook (USD Billion, 2019-2035)

- CHINA Retail Point of Sale Terminals Market by Technology Type

- Cloud-Based Systems

- On-Premises Systems

- Mobile Point of Sale

- Self-Service Kiosks

- CHINA Retail Point of Sale Terminals Market by Component Type

- Hardware

- Software

- Services

- CHINA Retail Point of Sale Terminals Market by End User Type

- Retail

- Hospitality

- Healthcare

- FoodBeverage

- CHINA Retail Point of Sale Terminals Market by Payment Method Type

- Credit/Debit Card

- Mobile Wallet

- Contactless Payment

- Cash

- INDIA Outlook (USD Billion, 2019-2035)

- INDIA Retail Point of Sale Terminals Market by Technology Type

- Cloud-Based Systems

- On-Premises Systems

- Mobile Point of Sale

- Self-Service Kiosks

- INDIA Retail Point of Sale Terminals Market by Component Type

- Hardware

- Software

- Services

- INDIA Retail Point of Sale Terminals Market by End User Type

- Retail

- Hospitality

- Healthcare

- FoodBeverage

- INDIA Retail Point of Sale Terminals Market by Payment Method Type

- Credit/Debit Card

- Mobile Wallet

- Contactless Payment

- Cash

- JAPAN Outlook (USD Billion, 2019-2035)

- JAPAN Retail Point of Sale Terminals Market by Technology Type

- Cloud-Based Systems

- On-Premises Systems

- Mobile Point of Sale

- Self-Service Kiosks

- JAPAN Retail Point of Sale Terminals Market by Component Type

- Hardware

- Software

- Services

- JAPAN Retail Point of Sale Terminals Market by End User Type

- Retail

- Hospitality

- Healthcare

- FoodBeverage

- JAPAN Retail Point of Sale Terminals Market by Payment Method Type

- Credit/Debit Card

- Mobile Wallet

- Contactless Payment

- Cash

- SOUTH KOREA Outlook (USD Billion, 2019-2035)

- SOUTH KOREA Retail Point of Sale Terminals Market by Technology Type

- Cloud-Based Systems

- On-Premises Systems

- Mobile Point of Sale

- Self-Service Kiosks

- SOUTH KOREA Retail Point of Sale Terminals Market by Component Type

- Hardware

- Software

- Services

- SOUTH KOREA Retail Point of Sale Terminals Market by End User Type

- Retail

- Hospitality

- Healthcare

- FoodBeverage

- SOUTH KOREA Retail Point of Sale Terminals Market by Payment Method Type

- Credit/Debit Card

- Mobile Wallet

- Contactless Payment

- Cash

- MALAYSIA Outlook (USD Billion, 2019-2035)

- MALAYSIA Retail Point of Sale Terminals Market by Technology Type

- Cloud-Based Systems

- On-Premises Systems

- Mobile Point of Sale

- Self-Service Kiosks

- MALAYSIA Retail Point of Sale Terminals Market by Component Type

- Hardware

- Software

- Services

- MALAYSIA Retail Point of Sale Terminals Market by End User Type

- Retail

- Hospitality

- Healthcare

- FoodBeverage

- MALAYSIA Retail Point of Sale Terminals Market by Payment Method Type

- Credit/Debit Card

- Mobile Wallet

- Contactless Payment

- Cash

- THAILAND Outlook (USD Billion, 2019-2035)

- THAILAND Retail Point of Sale Terminals Market by Technology Type

- Cloud-Based Systems

- On-Premises Systems

- Mobile Point of Sale

- Self-Service Kiosks

- THAILAND Retail Point of Sale Terminals Market by Component Type

- Hardware

- Software

- Services

- THAILAND Retail Point of Sale Terminals Market by End User Type

- Retail

- Hospitality

- Healthcare

- FoodBeverage

- THAILAND Retail Point of Sale Terminals Market by Payment Method Type

- Credit/Debit Card

- Mobile Wallet

- Contactless Payment

- Cash

- INDONESIA Outlook (USD Billion, 2019-2035)

- INDONESIA Retail Point of Sale Terminals Market by Technology Type

- Cloud-Based Systems

- On-Premises Systems

- Mobile Point of Sale

- Self-Service Kiosks

- INDONESIA Retail Point of Sale Terminals Market by Component Type

- Hardware

- Software

- Services

- INDONESIA Retail Point of Sale Terminals Market by End User Type

- Retail

- Hospitality

- Healthcare

- FoodBeverage

- INDONESIA Retail Point of Sale Terminals Market by Payment Method Type

- Credit/Debit Card

- Mobile Wallet

- Contactless Payment

- Cash

- REST OF APAC Outlook (USD Billion, 2019-2035)

- REST OF APAC Retail Point of Sale Terminals Market by Technology Type

- Cloud-Based Systems

- On-Premises Systems

- Mobile Point of Sale

- Self-Service Kiosks

- REST OF APAC Retail Point of Sale Terminals Market by Component Type

- Hardware

- Software

- Services

- REST OF APAC Retail Point of Sale Terminals Market by End User Type

- Retail

- Hospitality

- Healthcare

- FoodBeverage

- REST OF APAC Retail Point of Sale Terminals Market by Payment Method Type

- Credit/Debit Card

- Mobile Wallet

- Contactless Payment

- Cash

- South America Outlook (USD Billion, 2019-2035)

- South America Retail Point of Sale Terminals Market by Technology Type

- Cloud-Based Systems

- On-Premises Systems

- Mobile Point of Sale

- Self-Service Kiosks

- South America Retail Point of Sale Terminals Market by Component Type

- Hardware

- Software

- Services

- South America Retail Point of Sale Terminals Market by End User Type

- Retail

- Hospitality

- Healthcare

- FoodBeverage