Rfid Tags Size

Market Size Snapshot

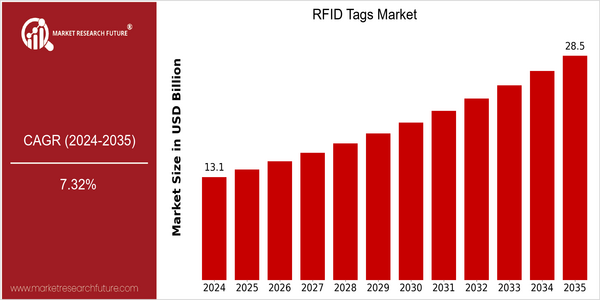

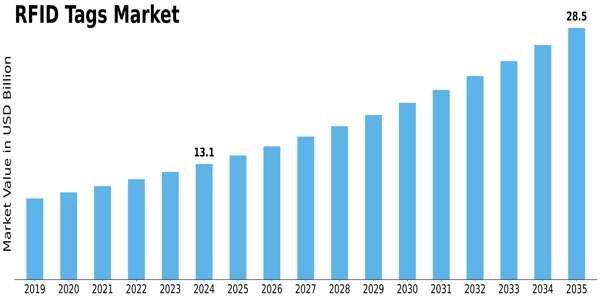

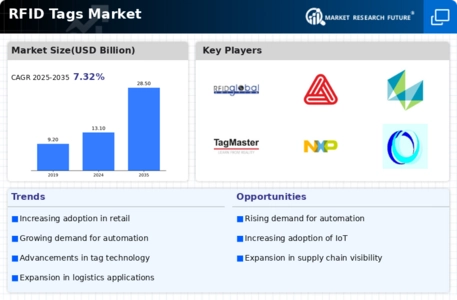

| Year | Value |

|---|---|

| 2024 | USD 13.1 Billion |

| 2035 | USD 28.5 Billion |

| CAGR (2025-2035) | 7.32 % |

Note – Market size depicts the revenue generated over the financial year

The RFID market is expected to reach $13.1 billion by 2024, and $28.4 billion by 2035. This is a CAGR of 7.32% from 2025 to 2035. The increasing use of RFID in various sectors, such as retail, health and logistics, is the main driving force. As the business efficiency and inventory management are expected to increase, the demand for RFID tags will increase, and the real-time tracking and data collection will be further enhanced. Furthermore, the integration of IoT with RFID and the development of more cost-effective and efficient tags will further promote the development of the RFID industry. The three major players in the industry, such as Zebra Technologies, Impinj, and NXP Semiconductors, are investing in research and development, establishing strategic alliances, and launching new products in order to obtain more market share. The recent supply chain collaborations show that the industry is committed to using technology to improve performance and customer satisfaction.

Regional Market Size

Regional Deep Dive

The RFID tag market is experiencing a significant growth in all regions. It is driven by technological advancements, increased adoption in the supply chain, and the need for enhanced inventory tracking. Each region is characterized by its own characteristics based on the local economic conditions, regulatory framework, and cultural factors. North America leads in terms of technological innovations and adoption, while Europe is more focused on regulatory compliance and long-term investment. The Asia-Pacific region is expanding rapidly, driven by the availability of manufacturers and a growing demand for products, while the Middle East and Africa are seeing increased investments in smart technology. Latin America is adopting RFID solutions slowly, mainly in retail and supply chain, as a result of increased efforts to optimize operations.

Europe

- The European Union's emphasis on sustainability has led to innovations in eco-friendly RFID tags, with companies like Smartrac and Avery Dennison developing biodegradable options to meet regulatory standards.

- The rise of Industry 4.0 initiatives in Germany is fostering the integration of RFID technology in manufacturing processes, enhancing automation and data collection capabilities.

Asia Pacific

- China's rapid industrialization and the government's support for smart manufacturing initiatives are propelling the demand for RFID tags, particularly in logistics and supply chain management.

- Japan is leading in the development of advanced RFID technologies, with companies like Sony and Hitachi investing in next-generation RFID solutions for various applications, including smart cities.

Latin America

- Brazil is emerging as a key player in the RFID market, with government initiatives aimed at modernizing logistics and supply chains, particularly in the agricultural sector.

- The retail industry in Mexico is beginning to adopt RFID technology to enhance customer experience and streamline operations, with companies like Chedraui leading the charge.

North America

- The U.S. is witnessing a surge in RFID adoption in the retail sector, with major companies like Walmart and Target implementing RFID systems to enhance inventory accuracy and reduce shrinkage.

- Recent regulatory changes, such as the FDA's push for RFID in pharmaceutical tracking, are driving demand for RFID tags in the healthcare sector, ensuring better traceability and compliance.

Middle East And Africa

- The UAE is investing heavily in smart city projects, with RFID technology being integrated into public transportation systems to improve efficiency and user experience.

- South Africa's retail sector is increasingly adopting RFID solutions to combat theft and improve inventory management, supported by initiatives from local retailers like Shoprite.

Did You Know?

“Approximately 70% of RFID tags are used in supply chain management, highlighting their critical role in enhancing operational efficiency.” — RFID Journal

Segmental Market Size

The RFID Tags Market is expected to grow at a CAGR of about 27% from 2017 to 2022, driven by the increasing demand for efficient inventory management and asset tracking in various industries. The key factors driving the growth of this segment include the increasing need for real-time data visibility and the growing automation of supply chain processes. The increasing regulatory compliances for tracking products in various industries such as food safety and pharmaceuticals are also driving the demand for RFID tags. The RFID tags market is currently in the process of implementation and deployment, with industry leaders such as Wal-Mart and Amazon deploying RFID solutions for improving their logistics and inventory management. The key applications of RFID tags include retail inventory management, asset tracking in the healthcare industry, and logistics in the manufacturing industry. The growing focus on reducing costs and the growing regulatory compliances for tracking products are also driving the growth of this segment. The Internet of Things (IoT) and big data are the key trends defining the evolution of the RFID tags market.

Future Outlook

- The market for RFID tags will be growing at a rapid pace from 2024 to 2035, with a CAGR of 7.32% from $13.1 billion to $28.7 billion. This is mainly due to the increasing use of RFID technology in various industries such as retail, logistics, health care, and manufacturing. In order to improve inventory management, supply chain efficiency, and customer experience, the use of RFID tags will continue to increase. In the long run, the penetration rate of RFID tags in the key industries will exceed 30%. The development of active and passive RFID tags with long read and write distances will also drive market growth. The combination of RFID with the Internet of Things and artificial intelligence will also create new applications and improve data analysis. The demand for RFID solutions will also be driven by the government's stricter traceability and transparency requirements. This will allow the RFID tag market to become an indispensable part of the modern business system, and innovation and efficiency will be promoted in various industries.

Leave a Comment