STD Testing Devices Market Share

STD Testing Devices Market Research Report By Type of Test (Serological Tests, Molecular Tests, Rapid Tests, Nucleic Acid Amplification Tests), By End User (Hospitals, Diagnostic Laboratories, Home Care Settings, Public Health Organizations), By Product Type (Test Kits, Equipment, Consumables), By Application (Chlamydia Testing, Gonorrhea Testing, Syphilis Testing, HIV Testing, Hepatitis Testin...

Market Summary

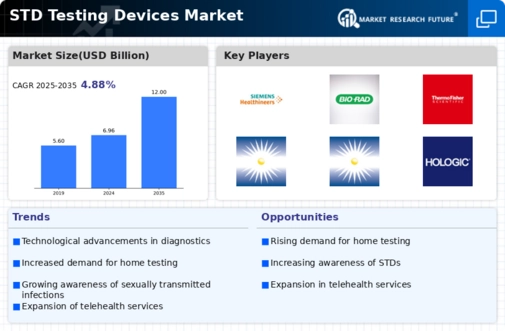

As per Market Research Future Analysis, the STD Testing Devices Market was valued at 6.46 USD Billion in 2022 and is projected to grow from 6.78 USD Billion in 2023 to 10.4 USD Billion by 2032, reflecting a CAGR of 4.88% from 2024 to 2032. The market is driven by rising awareness of sexual health, increasing prevalence of STDs, and technological advancements in testing devices.

Key Market Trends & Highlights

The STD Testing Devices Market is witnessing significant growth due to various factors.

- Rising prevalence of STDs drives demand for testing solutions, with millions diagnosed annually.

- Technological advancements, including point-of-care and home testing kits, enhance accessibility.

- Government initiatives promote awareness and testing, expanding market reach.

- Increased investment in R&D focuses on rapid tests and multi-pathogen detection devices.

Market Size & Forecast

| 2022 Market Size | USD 6.46 Billion |

| 2023 Market Size | USD 6.78 Billion |

| 2032 Market Size | USD 10.4 Billion |

| CAGR (2024-2032) | 4.88% |

| Largest Regional Market Share in 2023 | North America |

Major Players

Siemens Healthineers, Acon Laboratories, BioRad Laboratories, Thermo Fisher Scientific, Orasure Technologies, Genomica, Abbott Laboratories, BD, Hoffmann-La Roche, Hologic, Cepheid, Mayo Clinic Laboratories, MedMira

Market Trends

The STD Testing Devices Market is experiencing significant growth driven by rising awareness about sexual health and the increasing prevalence of sexually transmitted infections. Greater acceptance of sexual health discussions and improvements in healthcare infrastructure are leading more individuals to seek testing. Additionally, advancements in technology have resulted in more efficient and user-friendly testing devices, which are making testing more accessible and convenient. The growing emphasis on preventive healthcare, alongside initiatives aimed at reducing the stigma associated with STDs, further supports market expansion. Opportunities within this market are abundant, especially in emerging economies where healthcare access is improving.

It would be more beneficial to work with firms and government institutions as they can help encourage affordable testing means. They are also looking to manage their health from the privacy of their homes; this explains the trend for at-home testing solutions. Such testing also enables targets for new audiences including mobile testing kits that are directed towards such of these trends. The analysis made it possible to observe the trends that suggest a greater usage of telehealth services together with the platforms and applications that provide STD testing.

An increasing number of people now use virtual consultations, which allow for reporting of results online. This has made the process easier and also more effective as it is hassle-free and private.

This trend is supported by the rise of tech-savvy consumers who prefer digital solutions over traditional healthcare methods. Increased investment in research and development is also evident, with an emphasis on developing rapid tests and multi-pathogen detection devices that cater to varying demographic needs. As awareness continues to grow and technology evolves, the market for STD testing devices will likely expand further, presenting new avenues for growth and innovation.

The increasing prevalence of sexually transmitted diseases underscores the critical need for accessible and efficient testing devices, which may enhance early detection and treatment outcomes.

Centers for Disease Control and Prevention (CDC)

STD Testing Devices Market Market Drivers

Market Growth Projections

The Global STD Testing Devices Market Industry is projected to experience substantial growth in the coming years. With a market value of 6.96 USD Billion in 2024, it is anticipated to reach 12.0 USD Billion by 2035. This growth trajectory suggests a robust CAGR of 5.07% from 2025 to 2035, driven by various factors including technological advancements, increasing prevalence of STDs, and heightened awareness among the population. The market's expansion reflects the critical need for effective testing solutions and the ongoing efforts to improve public health outcomes globally.

Increasing Prevalence of STDs

The rising incidence of sexually transmitted diseases is a primary driver of the Global STD Testing Devices Market Industry. According to health statistics, millions of new STD cases are reported annually, highlighting the urgent need for effective testing solutions. This trend is particularly pronounced in regions with limited access to healthcare, where awareness and testing rates remain low. As the global population becomes more aware of STDs and their implications, the demand for testing devices is expected to surge. In 2024, the market is valued at 6.96 USD Billion, reflecting the growing recognition of the importance of early detection and treatment.

Growing Awareness and Education

The increasing awareness and education surrounding STDs play a crucial role in driving the Global STD Testing Devices Market Industry. Educational campaigns aimed at reducing stigma and promoting safe sexual practices have led to higher testing rates. Organizations and healthcare providers are actively working to inform the public about the importance of regular testing, particularly among high-risk groups. This heightened awareness is expected to contribute to a steady growth rate, with a projected CAGR of 5.07% from 2025 to 2035. As individuals become more informed about their sexual health, the demand for reliable testing devices is likely to increase.

Government Initiatives and Funding

Government initiatives aimed at combating STDs significantly influence the Global STD Testing Devices Market Industry. Many countries are implementing programs to increase awareness, promote testing, and provide funding for the development of testing technologies. For instance, public health campaigns often focus on high-risk populations, encouraging regular testing and treatment. These initiatives not only enhance public health outcomes but also stimulate market growth by increasing the demand for testing devices. As governments recognize the economic burden of untreated STDs, investments in testing infrastructure are likely to rise, further propelling the market forward.

Rising Demand for Home Testing Kits

The trend towards home testing kits is reshaping the Global STD Testing Devices Market Industry. With the convenience and privacy these kits offer, more individuals are opting for at-home testing solutions. This shift is particularly appealing to younger demographics who prioritize discretion and ease of use. As a result, manufacturers are increasingly focusing on developing user-friendly home testing devices that deliver accurate results. The growing acceptance of telehealth services further supports this trend, allowing individuals to consult healthcare professionals remotely. This evolving landscape is expected to drive market growth, as more consumers seek accessible testing options.

Technological Advancements in Testing Devices

Innovations in technology are transforming the Global STD Testing Devices Market Industry, leading to the development of more accurate, rapid, and user-friendly testing solutions. Recent advancements include the introduction of point-of-care testing devices that provide immediate results, thereby facilitating timely treatment. These devices often utilize advanced molecular techniques, enhancing sensitivity and specificity. As healthcare providers increasingly adopt these technologies, the market is poised for growth. By 2035, the market is projected to reach 12.0 USD Billion, driven by continuous improvements in testing methodologies and the increasing demand for convenient testing options.

Market Segment Insights

STD Testing Devices Market Type of Test Insights

The STD Testing Devices Market demonstrates diverse segmentation, particularly within the Type of Test category. In 2023, the market reached a substantial valuation of 6.78 USD Billion, with various testing types contributing significantly to this figure. Among these, Serological Tests led the charge, holding a valuation of 2.02 USD Billion, reflecting their prominence in diagnosing sexually transmitted diseases through antibody detection. This method is critical for understanding infection history and immunity, thus facilitating effective treatment strategies.

Following closely, Molecular Tests, valued at 1.67 USD Billion in the same year, utilize advanced techniques to identify pathogens' genetic material, offering precise results that are crucial in clinical decision-making. Rapid Tests also present an important player in this market with a 2023 valuation of 1.56 USD Billion, allowing for swift diagnoses that empower timely treatment decisions, which is vital in public health management. Meanwhile, Nucleic Acid Amplification Tests, at a value of 1.53 USD Billion, leverage sophisticated technology to enhance the detection of lower concentrations of pathogens, reinforcing their significance in scenarios where traditional methods may fall short.

The revenue breakdown for each type of test indicates that Serological Tests and Molecular Tests dominate the market, collectively accounting for a considerable share, while Rapid Tests and Nucleic Acid Amplification Tests play essential supportive roles. These metrics not only outline the current landscape but also highlight growth drivers such as technological advancements, increasing awareness, and subsequent demand for quicker and more reliable testing solutions. The ongoing global health initiatives aimed at controlling STDs further elevate the importance of these testing methods, presenting opportunities for expansion in the testing devices market.

However, challenges such as regulatory hurdles and variable insurance coverage may inhibit growth potential. Overall, understanding the STD Testing Devices Market segmentation showcases the vital roles these testing types play in enhancing public health efforts and controlling the spread of sexually transmitted infections globally.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

STD Testing Devices Market End User Insights

The STD Testing Devices Market is anticipated to witness significant growth in the End User segment from 2023, with a market value of 6.78 billion USD. This segment comprises various settings, including hospitals, diagnostic laboratories, home care settings, and public health organizations, each playing a critical role in enhancing disease detection and prevention efforts. Hospitals, often equipped with advanced technologies and specialists, represent a major holding in facilitating timely diagnoses and treatments, while diagnostic laboratories are essential for providing accurate test results, thereby significantly contributing to the STD Testing Devices Market revenue.

Home care settings have gained importance due to a rising trend in patient convenience, allowing individuals to access testing privately and with ease. Public health organizations are pivotal in driving awareness and accessibility, which enhances overall public health initiatives. As the market continues to evolve, trends such as technological advancements, increased patient engagement, and rising health awareness will serve as growth drivers, although challenges such as regulatory hurdles and market adoption will need to be addressed. The STD Testing Devices Market Statistics suggest a promising outlook for this segment as it adapts to meet emerging healthcare needs.

STD Testing Devices Market Product Type Insights

The STD Testing Devices Market is projected to reach a valuation of 6.78 billion USD in 2023, reflecting its growing importance in healthcare. The market exhibits various product types, prominently including Test Kits, Equipment, and Consumables. Test Kits are vital as they offer convenience and accessibility for patients, catering to the rising demand for at-home testing options. Equipment plays a significant role in clinical settings, enabling accurate and timely diagnosis, which is crucial for effective disease management. Consumables are essential, ensuring the smooth operability of testing devices and maintaining high standards of hygiene and reliability.

The trends driving growth in this market include heightened awareness about sexually transmitted diseases, increased funding for healthcare infrastructure, and the development of innovative testing solutions that enhance the accuracy and efficiency of diagnoses. However, challenges such as regulatory hurdles and the need for advanced technological integration persist. Despite these challenges, opportunities arise from the growing emphasis on preventive healthcare and increased investment in research and development within the STD Testing Devices Market industry. Overall, the market reflects robust potential as it aligns with global health improvement initiatives, ensuring widespread access to critical testing services.

In 2023, the STD Testing Devices Market is projected to be valued at 6.78 billion USD, showcasing a strong demand for diagnostic solutions in the healthcare sector. The market is structured around various applications such as Chlamydia Testing, Gonorrhea Testing, Syphilis Testing, HIV Testing, and Hepatitis Testing. Among these, HIV Testing captures significant attention, given the global emphasis on controlling the spread of HIV and the rising prevalence of sexually transmitted infections. Chlamydia and Gonorrhea Testing also hold a major share, driven by increasing awareness regarding sexual health and routine screening practices.

The demand for early detection and treatment solutions contributes to the notable growth in the market. Furthermore, Hepatitis Testing plays a critical role due to the rising incidence of Hepatitis B and C worldwide, emphasizing the need for effective testing devices. As the market continues to evolve, advancements in technology will likely further enhance the accuracy and efficiency of these testing devices, contributing to the overall growth and improvement of public health metrics.

Get more detailed insights about STD Testing Devices Market Research Report - Forecast till 2032

Regional Insights

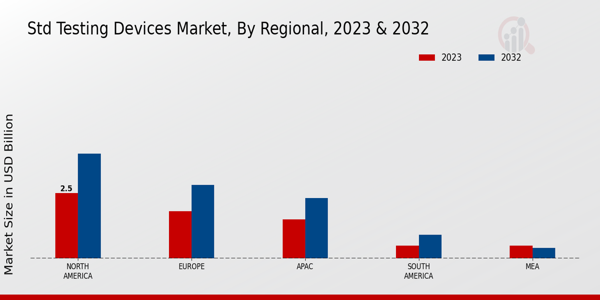

The STD Testing Devices Market revenue is experiencing steady growth across various regions, demonstrating distinct dynamics in each. In 2023, North America commands a significant share, valued at 2.5 USD Billion, reflecting its majority holding in the market due to advanced healthcare systems and increased awareness of sexually transmitted diseases. Europe follows with a valuation of 1.8 USD Billion, benefiting from stringent health regulations and a well-established healthcare infrastructure. The APAC region, valued at 1.5 USD Billion, is emerging as a significant player driven by increasing healthcare access and rising public health initiatives.

South America and MEA are comparatively smaller markets, valued at 0.5 USD Billion each in 2023; however, their growth potential should not be overlooked, with South America at 0.9 USD Billion and MEA at 0.4 USD Billion projected by 2032. These market dynamics are driven by factors like rising awareness, technological advancements, and changing lifestyles, while challenges related to accessibility and cultural stigma persist. The STD Testing Devices Market statistics suggest that each region possesses unique opportunities for growth, underscoring the importance of tailored strategies to address their specific needs.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

Key Players and Competitive Insights

The STD Testing Devices Market has witnessed significant growth due to increasing awareness about sexually transmitted diseases, advancements in technology, and governmental initiatives aimed at promoting sexual health. The competitive landscape of this market is characterized by the presence of several key players who are continuously innovating and enhancing their product offerings to meet the growing demand for efficient and accurate testing solutions. Competitive insights reveal that companies are focusing on differentiating their products by incorporating advanced technologies such as point-of-care testing, automation, and integrated software solutions.

Strategic collaborations and partnerships among various stakeholders, including healthcare providers, research organizations, and technological firms, have been pivotal in expanding market reach and improving service delivery. Furthermore, the shift towards personalized healthcare and telemedicine has driven companies to develop user-friendly and accessible testing devices catering to a wider consumer base. Siemens Healthineers stands out in the STD Testing Devices Market owing to its robust portfolio of innovative diagnostic solutions that enhance the accuracy and reliability of testing.

The company has made significant investments in research and development, facilitating the creation of advanced testing platforms that can detect multiple sexually transmitted infections with a single test. The strength of Siemens Healthineers lies in its strong global presence and established relationships with healthcare providers, enabling widespread distribution and accessibility of its devices. Their commitment to integrating digital solutions with traditional testing methods enhances operational efficiency, thus promoting effective disease management.

The company's ability to adapt to changing market dynamics and address specific health challenges by offering tailored solutions sets it apart from its competitors, solidifying its leadership position in the STD testing landscape. Acon Laboratories has carved a niche in the STD Testing Devices Market through its focus on rapid and efficient testing solutions. The company leverages its expertise in lateral flow technology to deliver products that provide quick results, catering to the growing demand for fast and accurate diagnostics in various settings, including clinics and at-home testing.

Acon Laboratories' strengths lie in its commitment to quality assurance and adherence to regulatory standards, ensuring that its devices consistently meet the necessary health requirements. The company's emphasis on user-centric design has made it a preferred choice for patients and healthcare providers alike, as its testing kits are intuitive and easy to use. Additionally, Acon Laboratories actively seeks to expand its product range and enhance its offerings by incorporating feedback from healthcare professionals and consumers, positioning itself as a responsive player ready to meet the evolving needs of the market.

Key Companies in the STD Testing Devices Market market include

Industry Developments

Recent developments in the STD Testing Devices Market have indicated significant growth, driven by increased awareness and demand for early detection of sexually transmitted diseases. Companies like Siemens Healthineers and Thermo Fisher Scientific are advancing their product lines to include more accurate and rapid testing options. Acon Laboratories and BioRad Laboratories are also focusing on innovative technologies to improve the efficiency of testing processes. Notably, Roche Holding, through its subsidiary F. Hoffmann-La Roche, has made strides in research and development to enhance testing accuracy.

Current affairs reflect a competitive landscape, with Hologic and Cepheid expanding their market reach and investing in partnerships to bolster their product offerings. Additionally, Abbott Laboratories has reported growth in market valuation due to new product launches and strategic marketing initiatives. In terms of mergers and acquisitions, OraSure Technologies and BD are actively pursuing collaborative opportunities to enhance their market presence. There is a growing shift towards integrated testing devices that combine various STI tests, aiming to streamline diagnosis and improve patient outcomes.

This trend signifies a robust interest in enhancing the overall capacity and capability within the STD testing devices market.

Future Outlook

STD Testing Devices Market Future Outlook

The Global STD Testing Devices Market is projected to grow at a 5.07% CAGR from 2024 to 2035, driven by technological advancements, increasing awareness, and rising prevalence of STDs.

New opportunities lie in:

- Develop mobile testing units to enhance accessibility in underserved regions.

- Invest in AI-driven diagnostics for faster and more accurate results.

- Create partnerships with telehealth platforms to integrate testing services.

By 2035, the market is expected to exhibit robust growth, reflecting advancements in testing technologies and increased public health initiatives.

Market Segmentation

STD Testing Devices Market End User Outlook

- Hospitals

- Diagnostic Laboratories

- Home Care Settings

- Public Health Organizations

STD Testing Devices Market Regional Outlook

- North America

- Europe

- South America

- Asia Pacific

- Middle East and Africa

STD Testing Devices Market Application Outlook

- Chlamydia Testing

- Gonorrhea Testing

- Syphilis Testing

- HIV Testing

- Hepatitis Testing

STD Testing Devices Market Product Type Outlook

- Test Kits

- Equipment

- Consumables

STD Testing Devices Market Type of Test Outlook

- Serological Tests

- Molecular Tests

- Rapid Tests

- Nucleic Acid Amplification Tests

Report Scope

| Report Attribute/Metric | Details |

| Market Size 2022 | 6.46 (USD Billion) |

| Market Size 2023 | 6.78 (USD Billion) |

| Market Size 2032 | 10.4 (USD Billion) |

| Compound Annual Growth Rate (CAGR) | 4.88% (2024 - 2032) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Base Year | 2023 |

| Market Forecast Period | 2024 - 2032 |

| Historical Data | 2019 - 2023 |

| Market Forecast Units | USD Billion |

| Key Companies Profiled | Siemens Healthineers, Acon Laboratories, BioRad Laboratories, Thermo Fisher Scientific, Orasure Technologies, Genomica, Abbott Laboratories, OraSure Technologies, BD, F. HoffmannLa Roche, Roche Holding, Hologic, Cepheid, Mayo Clinic Laboratories, MedMira |

| Segments Covered | Type of Test, End User, Product Type, Application, Regional |

| Key Market Opportunities | Increased demand for at-home testing, Rising prevalence of STDs globally, Technological advancements in testing devices, Growing awareness and education initiatives, Expansion of telehealth services for testing |

| Key Market Dynamics | Rising STD prevalence rates, Increased awareness and education, Technological advancements in testing, Growing demand for home testing, Government initiatives and funding |

| Countries Covered | North America, Europe, APAC, South America, MEA |

Market Highlights

Author

Latest Comments

This is a great article! Really helped me understand the topic better.

Thanks for sharing this. I’ve bookmarked it for later reference.

FAQs

What is the projected market size of the STD Testing Devices Market by 2032?

The STD Testing Devices Market is expected to reach a value of 10.4 USD Billion by the year 2032.

What was the market value of the STD Testing Devices Market in 2023?

In 2023, the STD Testing Devices Market was valued at 6.78 USD Billion.

What is the expected CAGR for the STD Testing Devices Market from 2024 to 2032?

The STD Testing Devices Market is anticipated to grow at a CAGR of 4.88% from 2024 to 2032.

Which region dominated the STD Testing Devices Market in 2023?

North America was the dominant region, valued at 2.5 USD Billion in 2023.

What will be the market value of Molecular Tests in the STD Testing Devices Market by 2032?

The market value of Molecular Tests is projected to reach 2.74 USD Billion by 2032.

Who are the key players in the STD Testing Devices Market?

Major players include Siemens Healthineers, Acon Laboratories, BioRad Laboratories, and Thermo Fisher Scientific.

What is the expected market value for Rapid Tests in 2032?

The market value for Rapid Tests is expected to be 2.4 USD Billion by 2032.

What is the projected market size for the European STD Testing Devices Market by 2032?

The European STD Testing Devices Market is expected to reach 2.8 USD Billion by 2032.

How much is the North American market valued in 2023?

The North American market for STD Testing Devices was valued at 2.5 USD Billion in 2023.

What will be the expected market size for Nucleic Acid Amplification Tests in 2032?

The expected market size for Nucleic Acid Amplification Tests is projected to be 2.19 USD Billion by 2032.

-

Table of Contents

-

Executive Summary

- Market Overview

- Key Findings

- Market Segmentation

- Competitive Landscape

- Challenges and Opportunities

- Future Outlook

-

Market Introduction

- Definition

-

Scope of the Study

- Research Objective

- Assumption

- Limitations

-

Research Methodology

- Overview

- Data Mining

- Secondary Research

-

Primary Research

- Primary Interviews and Information Gathering Process

- Breakdown of Primary Respondents

- Forecasting Model

-

Market Size Estimation

- Bottom-up Approach

- Top-Down Approach

- Data Triangulation

- Validation

-

MARKET DYNAMICS

- Overview

- Drivers

- Restraints

- Opportunities

-

MARKET FACTOR ANALYSIS

- Value chain Analysis

-

Porter's Five Forces Analysis

- Bargaining Power of Suppliers

- Bargaining Power of Buyers

- Threat of New Entrants

- Threat of Substitutes

- Intensity of Rivalry

-

COVID-19 Impact Analysis

- Market Impact Analysis

- Regional Impact

- Opportunity and Threat Analysis

-

STD TESTING DEVICES MARKET, BY TYPE OF TEST (USD BILLION)

- Serological Tests

- Molecular Tests

- Rapid Tests

- Nucleic Acid Amplification Tests

-

STD TESTING DEVICES MARKET, BY END USER (USD BILLION)

- Hospitals

- Diagnostic Laboratories

- Home Care Settings

- Public Health Organizations

-

STD TESTING DEVICES MARKET, BY PRODUCT TYPE (USD BILLION)

- Test Kits

- Equipment

- Consumables

-

STD TESTING DEVICES MARKET, BY APPLICATION (USD BILLION)

- Chlamydia Testing

- Gonorrhea Testing

- Syphilis Testing

- HIV Testing

- Hepatitis Testing

-

STD TESTING DEVICES MARKET, BY REGIONAL (USD BILLION)

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Russia

- Italy

- Spain

- Rest of Europe

-

APAC

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Indonesia

- Rest of APAC

-

South America

- Brazil

- Mexico

- Argentina

- Rest of South America

-

MEA

- GCC Countries

- South Africa

- Rest of MEA

-

North America

-

Competitive Landscape

- Overview

- Competitive Analysis

- Market share Analysis

- Major Growth Strategy in the STD Testing Devices Market

- Competitive Benchmarking

- Leading Players in Terms of Number of Developments in the STD Testing Devices Market

-

Key developments and growth strategies

- New Product Launch/Service Deployment

- Merger & Acquisitions

- Joint Ventures

-

Major Players Financial Matrix

- Sales and Operating Income

- Major Players R&D Expenditure. 2023

-

COMPANY PROFILES

-

Siemens Healthineers

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Acon Laboratories

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

BioRad Laboratories

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Thermo Fisher Scientific

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Orasure Technologies

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Genomica

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Abbott Laboratories

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

OraSure Technologies

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

BD

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

F. HoffmannLa Roche

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Roche Holding

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Hologic

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Cepheid

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Mayo Clinic Laboratories

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

MedMira

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Siemens Healthineers

-

APPENDIX

- References

- Related Reports

-

List of Tables and Figures

- LIST OF TABLES

- TABLE 1. LIST OF ASSUMPTIONS

- TABLE 2. NORTH AMERICA STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY TYPE OF TEST, 2019-2032 (USD BILLIONS)

- TABLE 3. NORTH AMERICA STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY END USER, 2019-2032 (USD BILLIONS)

- TABLE 4. NORTH AMERICA STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2032 (USD BILLIONS)

- TABLE 5. NORTH AMERICA STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2032 (USD BILLIONS)

- TABLE 6. NORTH AMERICA STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2032 (USD BILLIONS)

- TABLE 7. US STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY TYPE OF TEST, 2019-2032 (USD BILLIONS)

- TABLE 8. US STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY END USER, 2019-2032 (USD BILLIONS)

- TABLE 9. US STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2032 (USD BILLIONS)

- TABLE 10. US STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2032 (USD BILLIONS)

- TABLE 11. US STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2032 (USD BILLIONS)

- TABLE 12. CANADA STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY TYPE OF TEST, 2019-2032 (USD BILLIONS)

- TABLE 13. CANADA STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY END USER, 2019-2032 (USD BILLIONS)

- TABLE 14. CANADA STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2032 (USD BILLIONS)

- TABLE 15. CANADA STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2032 (USD BILLIONS)

- TABLE 16. CANADA STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2032 (USD BILLIONS)

- TABLE 17. EUROPE STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY TYPE OF TEST, 2019-2032 (USD BILLIONS)

- TABLE 18. EUROPE STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY END USER, 2019-2032 (USD BILLIONS)

- TABLE 19. EUROPE STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2032 (USD BILLIONS)

- TABLE 20. EUROPE STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2032 (USD BILLIONS)

- TABLE 21. EUROPE STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2032 (USD BILLIONS)

- TABLE 22. GERMANY STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY TYPE OF TEST, 2019-2032 (USD BILLIONS)

- TABLE 23. GERMANY STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY END USER, 2019-2032 (USD BILLIONS)

- TABLE 24. GERMANY STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2032 (USD BILLIONS)

- TABLE 25. GERMANY STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2032 (USD BILLIONS)

- TABLE 26. GERMANY STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2032 (USD BILLIONS)

- TABLE 27. UK STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY TYPE OF TEST, 2019-2032 (USD BILLIONS)

- TABLE 28. UK STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY END USER, 2019-2032 (USD BILLIONS)

- TABLE 29. UK STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2032 (USD BILLIONS)

- TABLE 30. UK STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2032 (USD BILLIONS)

- TABLE 31. UK STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2032 (USD BILLIONS)

- TABLE 32. FRANCE STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY TYPE OF TEST, 2019-2032 (USD BILLIONS)

- TABLE 33. FRANCE STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY END USER, 2019-2032 (USD BILLIONS)

- TABLE 34. FRANCE STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2032 (USD BILLIONS)

- TABLE 35. FRANCE STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2032 (USD BILLIONS)

- TABLE 36. FRANCE STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2032 (USD BILLIONS)

- TABLE 37. RUSSIA STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY TYPE OF TEST, 2019-2032 (USD BILLIONS)

- TABLE 38. RUSSIA STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY END USER, 2019-2032 (USD BILLIONS)

- TABLE 39. RUSSIA STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2032 (USD BILLIONS)

- TABLE 40. RUSSIA STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2032 (USD BILLIONS)

- TABLE 41. RUSSIA STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2032 (USD BILLIONS)

- TABLE 42. ITALY STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY TYPE OF TEST, 2019-2032 (USD BILLIONS)

- TABLE 43. ITALY STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY END USER, 2019-2032 (USD BILLIONS)

- TABLE 44. ITALY STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2032 (USD BILLIONS)

- TABLE 45. ITALY STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2032 (USD BILLIONS)

- TABLE 46. ITALY STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2032 (USD BILLIONS)

- TABLE 47. SPAIN STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY TYPE OF TEST, 2019-2032 (USD BILLIONS)

- TABLE 48. SPAIN STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY END USER, 2019-2032 (USD BILLIONS)

- TABLE 49. SPAIN STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2032 (USD BILLIONS)

- TABLE 50. SPAIN STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2032 (USD BILLIONS)

- TABLE 51. SPAIN STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2032 (USD BILLIONS)

- TABLE 52. REST OF EUROPE STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY TYPE OF TEST, 2019-2032 (USD BILLIONS)

- TABLE 53. REST OF EUROPE STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY END USER, 2019-2032 (USD BILLIONS)

- TABLE 54. REST OF EUROPE STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2032 (USD BILLIONS)

- TABLE 55. REST OF EUROPE STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2032 (USD BILLIONS)

- TABLE 56. REST OF EUROPE STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2032 (USD BILLIONS)

- TABLE 57. APAC STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY TYPE OF TEST, 2019-2032 (USD BILLIONS)

- TABLE 58. APAC STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY END USER, 2019-2032 (USD BILLIONS)

- TABLE 59. APAC STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2032 (USD BILLIONS)

- TABLE 60. APAC STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2032 (USD BILLIONS)

- TABLE 61. APAC STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2032 (USD BILLIONS)

- TABLE 62. CHINA STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY TYPE OF TEST, 2019-2032 (USD BILLIONS)

- TABLE 63. CHINA STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY END USER, 2019-2032 (USD BILLIONS)

- TABLE 64. CHINA STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2032 (USD BILLIONS)

- TABLE 65. CHINA STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2032 (USD BILLIONS)

- TABLE 66. CHINA STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2032 (USD BILLIONS)

- TABLE 67. INDIA STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY TYPE OF TEST, 2019-2032 (USD BILLIONS)

- TABLE 68. INDIA STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY END USER, 2019-2032 (USD BILLIONS)

- TABLE 69. INDIA STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2032 (USD BILLIONS)

- TABLE 70. INDIA STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2032 (USD BILLIONS)

- TABLE 71. INDIA STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2032 (USD BILLIONS)

- TABLE 72. JAPAN STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY TYPE OF TEST, 2019-2032 (USD BILLIONS)

- TABLE 73. JAPAN STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY END USER, 2019-2032 (USD BILLIONS)

- TABLE 74. JAPAN STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2032 (USD BILLIONS)

- TABLE 75. JAPAN STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2032 (USD BILLIONS)

- TABLE 76. JAPAN STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2032 (USD BILLIONS)

- TABLE 77. SOUTH KOREA STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY TYPE OF TEST, 2019-2032 (USD BILLIONS)

- TABLE 78. SOUTH KOREA STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY END USER, 2019-2032 (USD BILLIONS)

- TABLE 79. SOUTH KOREA STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2032 (USD BILLIONS)

- TABLE 80. SOUTH KOREA STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2032 (USD BILLIONS)

- TABLE 81. SOUTH KOREA STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2032 (USD BILLIONS)

- TABLE 82. MALAYSIA STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY TYPE OF TEST, 2019-2032 (USD BILLIONS)

- TABLE 83. MALAYSIA STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY END USER, 2019-2032 (USD BILLIONS)

- TABLE 84. MALAYSIA STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2032 (USD BILLIONS)

- TABLE 85. MALAYSIA STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2032 (USD BILLIONS)

- TABLE 86. MALAYSIA STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2032 (USD BILLIONS)

- TABLE 87. THAILAND STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY TYPE OF TEST, 2019-2032 (USD BILLIONS)

- TABLE 88. THAILAND STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY END USER, 2019-2032 (USD BILLIONS)

- TABLE 89. THAILAND STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2032 (USD BILLIONS)

- TABLE 90. THAILAND STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2032 (USD BILLIONS)

- TABLE 91. THAILAND STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2032 (USD BILLIONS)

- TABLE 92. INDONESIA STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY TYPE OF TEST, 2019-2032 (USD BILLIONS)

- TABLE 93. INDONESIA STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY END USER, 2019-2032 (USD BILLIONS)

- TABLE 94. INDONESIA STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2032 (USD BILLIONS)

- TABLE 95. INDONESIA STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2032 (USD BILLIONS)

- TABLE 96. INDONESIA STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2032 (USD BILLIONS)

- TABLE 97. REST OF APAC STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY TYPE OF TEST, 2019-2032 (USD BILLIONS)

- TABLE 98. REST OF APAC STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY END USER, 2019-2032 (USD BILLIONS)

- TABLE 99. REST OF APAC STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2032 (USD BILLIONS)

- TABLE 100. REST OF APAC STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2032 (USD BILLIONS)

- TABLE 101. REST OF APAC STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2032 (USD BILLIONS)

- TABLE 102. SOUTH AMERICA STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY TYPE OF TEST, 2019-2032 (USD BILLIONS)

- TABLE 103. SOUTH AMERICA STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY END USER, 2019-2032 (USD BILLIONS)

- TABLE 104. SOUTH AMERICA STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2032 (USD BILLIONS)

- TABLE 105. SOUTH AMERICA STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2032 (USD BILLIONS)

- TABLE 106. SOUTH AMERICA STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2032 (USD BILLIONS)

- TABLE 107. BRAZIL STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY TYPE OF TEST, 2019-2032 (USD BILLIONS)

- TABLE 108. BRAZIL STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY END USER, 2019-2032 (USD BILLIONS)

- TABLE 109. BRAZIL STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2032 (USD BILLIONS)

- TABLE 110. BRAZIL STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2032 (USD BILLIONS)

- TABLE 111. BRAZIL STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2032 (USD BILLIONS)

- TABLE 112. MEXICO STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY TYPE OF TEST, 2019-2032 (USD BILLIONS)

- TABLE 113. MEXICO STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY END USER, 2019-2032 (USD BILLIONS)

- TABLE 114. MEXICO STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2032 (USD BILLIONS)

- TABLE 115. MEXICO STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2032 (USD BILLIONS)

- TABLE 116. MEXICO STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2032 (USD BILLIONS)

- TABLE 117. ARGENTINA STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY TYPE OF TEST, 2019-2032 (USD BILLIONS)

- TABLE 118. ARGENTINA STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY END USER, 2019-2032 (USD BILLIONS)

- TABLE 119. ARGENTINA STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2032 (USD BILLIONS)

- TABLE 120. ARGENTINA STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2032 (USD BILLIONS)

- TABLE 121. ARGENTINA STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2032 (USD BILLIONS)

- TABLE 122. REST OF SOUTH AMERICA STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY TYPE OF TEST, 2019-2032 (USD BILLIONS)

- TABLE 123. REST OF SOUTH AMERICA STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY END USER, 2019-2032 (USD BILLIONS)

- TABLE 124. REST OF SOUTH AMERICA STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2032 (USD BILLIONS)

- TABLE 125. REST OF SOUTH AMERICA STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2032 (USD BILLIONS)

- TABLE 126. REST OF SOUTH AMERICA STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2032 (USD BILLIONS)

- TABLE 127. MEA STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY TYPE OF TEST, 2019-2032 (USD BILLIONS)

- TABLE 128. MEA STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY END USER, 2019-2032 (USD BILLIONS)

- TABLE 129. MEA STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2032 (USD BILLIONS)

- TABLE 130. MEA STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2032 (USD BILLIONS)

- TABLE 131. MEA STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2032 (USD BILLIONS)

- TABLE 132. GCC COUNTRIES STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY TYPE OF TEST, 2019-2032 (USD BILLIONS)

- TABLE 133. GCC COUNTRIES STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY END USER, 2019-2032 (USD BILLIONS)

- TABLE 134. GCC COUNTRIES STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2032 (USD BILLIONS)

- TABLE 135. GCC COUNTRIES STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2032 (USD BILLIONS)

- TABLE 136. GCC COUNTRIES STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2032 (USD BILLIONS)

- TABLE 137. SOUTH AFRICA STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY TYPE OF TEST, 2019-2032 (USD BILLIONS)

- TABLE 138. SOUTH AFRICA STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY END USER, 2019-2032 (USD BILLIONS)

- TABLE 139. SOUTH AFRICA STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2032 (USD BILLIONS)

- TABLE 140. SOUTH AFRICA STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2032 (USD BILLIONS)

- TABLE 141. SOUTH AFRICA STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2032 (USD BILLIONS)

- TABLE 142. REST OF MEA STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY TYPE OF TEST, 2019-2032 (USD BILLIONS)

- TABLE 143. REST OF MEA STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY END USER, 2019-2032 (USD BILLIONS)

- TABLE 144. REST OF MEA STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY PRODUCT TYPE, 2019-2032 (USD BILLIONS)

- TABLE 145. REST OF MEA STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2032 (USD BILLIONS)

- TABLE 146. REST OF MEA STD TESTING DEVICES MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2032 (USD BILLIONS)

- TABLE 147. PRODUCT LAUNCH/PRODUCT DEVELOPMENT/APPROVAL

- TABLE 148. ACQUISITION/PARTNERSHIP LIST OF FIGURES

- FIGURE 1. MARKET SYNOPSIS

- FIGURE 2. NORTH AMERICA STD TESTING DEVICES MARKET ANALYSIS

- FIGURE 3. US STD TESTING DEVICES MARKET ANALYSIS BY TYPE OF TEST

- FIGURE 4. US STD TESTING DEVICES MARKET ANALYSIS BY END USER

- FIGURE 5. US STD TESTING DEVICES MARKET ANALYSIS BY PRODUCT TYPE

- FIGURE 6. US STD TESTING DEVICES MARKET ANALYSIS BY APPLICATION

- FIGURE 7. US STD TESTING DEVICES MARKET ANALYSIS BY REGIONAL

- FIGURE 8. CANADA STD TESTING DEVICES MARKET ANALYSIS BY TYPE OF TEST

- FIGURE 9. CANADA STD TESTING DEVICES MARKET ANALYSIS BY END USER

- FIGURE 10. CANADA STD TESTING DEVICES MARKET ANALYSIS BY PRODUCT TYPE

- FIGURE 11. CANADA STD TESTING DEVICES MARKET ANALYSIS BY APPLICATION

- FIGURE 12. CANADA STD TESTING DEVICES MARKET ANALYSIS BY REGIONAL

- FIGURE 13. EUROPE STD TESTING DEVICES MARKET ANALYSIS

- FIGURE 14. GERMANY STD TESTING DEVICES MARKET ANALYSIS BY TYPE OF TEST

- FIGURE 15. GERMANY STD TESTING DEVICES MARKET ANALYSIS BY END USER

- FIGURE 16. GERMANY STD TESTING DEVICES MARKET ANALYSIS BY PRODUCT TYPE

- FIGURE 17. GERMANY STD TESTING DEVICES MARKET ANALYSIS BY APPLICATION

- FIGURE 18. GERMANY STD TESTING DEVICES MARKET ANALYSIS BY REGIONAL

- FIGURE 19. UK STD TESTING DEVICES MARKET ANALYSIS BY TYPE OF TEST

- FIGURE 20. UK STD TESTING DEVICES MARKET ANALYSIS BY END USER

- FIGURE 21. UK STD TESTING DEVICES MARKET ANALYSIS BY PRODUCT TYPE

- FIGURE 22. UK STD TESTING DEVICES MARKET ANALYSIS BY APPLICATION

- FIGURE 23. UK STD TESTING DEVICES MARKET ANALYSIS BY REGIONAL

- FIGURE 24. FRANCE STD TESTING DEVICES MARKET ANALYSIS BY TYPE OF TEST

- FIGURE 25. FRANCE STD TESTING DEVICES MARKET ANALYSIS BY END USER

- FIGURE 26. FRANCE STD TESTING DEVICES MARKET ANALYSIS BY PRODUCT TYPE

- FIGURE 27. FRANCE STD TESTING DEVICES MARKET ANALYSIS BY APPLICATION

- FIGURE 28. FRANCE STD TESTING DEVICES MARKET ANALYSIS BY REGIONAL

- FIGURE 29. RUSSIA STD TESTING DEVICES MARKET ANALYSIS BY TYPE OF TEST

- FIGURE 30. RUSSIA STD TESTING DEVICES MARKET ANALYSIS BY END USER

- FIGURE 31. RUSSIA STD TESTING DEVICES MARKET ANALYSIS BY PRODUCT TYPE

- FIGURE 32. RUSSIA STD TESTING DEVICES MARKET ANALYSIS BY APPLICATION

- FIGURE 33. RUSSIA STD TESTING DEVICES MARKET ANALYSIS BY REGIONAL

- FIGURE 34. ITALY STD TESTING DEVICES MARKET ANALYSIS BY TYPE OF TEST

- FIGURE 35. ITALY STD TESTING DEVICES MARKET ANALYSIS BY END USER

- FIGURE 36. ITALY STD TESTING DEVICES MARKET ANALYSIS BY PRODUCT TYPE

- FIGURE 37. ITALY STD TESTING DEVICES MARKET ANALYSIS BY APPLICATION

- FIGURE 38. ITALY STD TESTING DEVICES MARKET ANALYSIS BY REGIONAL

- FIGURE 39. SPAIN STD TESTING DEVICES MARKET ANALYSIS BY TYPE OF TEST

- FIGURE 40. SPAIN STD TESTING DEVICES MARKET ANALYSIS BY END USER

- FIGURE 41. SPAIN STD TESTING DEVICES MARKET ANALYSIS BY PRODUCT TYPE

- FIGURE 42. SPAIN STD TESTING DEVICES MARKET ANALYSIS BY APPLICATION

- FIGURE 43. SPAIN STD TESTING DEVICES MARKET ANALYSIS BY REGIONAL

- FIGURE 44. REST OF EUROPE STD TESTING DEVICES MARKET ANALYSIS BY TYPE OF TEST

- FIGURE 45. REST OF EUROPE STD TESTING DEVICES MARKET ANALYSIS BY END USER

- FIGURE 46. REST OF EUROPE STD TESTING DEVICES MARKET ANALYSIS BY PRODUCT TYPE

- FIGURE 47. REST OF EUROPE STD TESTING DEVICES MARKET ANALYSIS BY APPLICATION

- FIGURE 48. REST OF EUROPE STD TESTING DEVICES MARKET ANALYSIS BY REGIONAL

- FIGURE 49. APAC STD TESTING DEVICES MARKET ANALYSIS

- FIGURE 50. CHINA STD TESTING DEVICES MARKET ANALYSIS BY TYPE OF TEST

- FIGURE 51. CHINA STD TESTING DEVICES MARKET ANALYSIS BY END USER

- FIGURE 52. CHINA STD TESTING DEVICES MARKET ANALYSIS BY PRODUCT TYPE

- FIGURE 53. CHINA STD TESTING DEVICES MARKET ANALYSIS BY APPLICATION

- FIGURE 54. CHINA STD TESTING DEVICES MARKET ANALYSIS BY REGIONAL

- FIGURE 55. INDIA STD TESTING DEVICES MARKET ANALYSIS BY TYPE OF TEST

- FIGURE 56. INDIA STD TESTING DEVICES MARKET ANALYSIS BY END USER

- FIGURE 57. INDIA STD TESTING DEVICES MARKET ANALYSIS BY PRODUCT TYPE

- FIGURE 58. INDIA STD TESTING DEVICES MARKET ANALYSIS BY APPLICATION

- FIGURE 59. INDIA STD TESTING DEVICES MARKET ANALYSIS BY REGIONAL

- FIGURE 60. JAPAN STD TESTING DEVICES MARKET ANALYSIS BY TYPE OF TEST

- FIGURE 61. JAPAN STD TESTING DEVICES MARKET ANALYSIS BY END USER

- FIGURE 62. JAPAN STD TESTING DEVICES MARKET ANALYSIS BY PRODUCT TYPE

- FIGURE 63. JAPAN STD TESTING DEVICES MARKET ANALYSIS BY APPLICATION

- FIGURE 64. JAPAN STD TESTING DEVICES MARKET ANALYSIS BY REGIONAL

- FIGURE 65. SOUTH KOREA STD TESTING DEVICES MARKET ANALYSIS BY TYPE OF TEST

- FIGURE 66. SOUTH KOREA STD TESTING DEVICES MARKET ANALYSIS BY END USER

- FIGURE 67. SOUTH KOREA STD TESTING DEVICES MARKET ANALYSIS BY PRODUCT TYPE

- FIGURE 68. SOUTH KOREA STD TESTING DEVICES MARKET ANALYSIS BY APPLICATION

- FIGURE 69. SOUTH KOREA STD TESTING DEVICES MARKET ANALYSIS BY REGIONAL

- FIGURE 70. MALAYSIA STD TESTING DEVICES MARKET ANALYSIS BY TYPE OF TEST

- FIGURE 71. MALAYSIA STD TESTING DEVICES MARKET ANALYSIS BY END USER

- FIGURE 72. MALAYSIA STD TESTING DEVICES MARKET ANALYSIS BY PRODUCT TYPE

- FIGURE 73. MALAYSIA STD TESTING DEVICES MARKET ANALYSIS BY APPLICATION

- FIGURE 74. MALAYSIA STD TESTING DEVICES MARKET ANALYSIS BY REGIONAL

- FIGURE 75. THAILAND STD TESTING DEVICES MARKET ANALYSIS BY TYPE OF TEST

- FIGURE 76. THAILAND STD TESTING DEVICES MARKET ANALYSIS BY END USER

- FIGURE 77. THAILAND STD TESTING DEVICES MARKET ANALYSIS BY PRODUCT TYPE

- FIGURE 78. THAILAND STD TESTING DEVICES MARKET ANALYSIS BY APPLICATION

- FIGURE 79. THAILAND STD TESTING DEVICES MARKET ANALYSIS BY REGIONAL

- FIGURE 80. INDONESIA STD TESTING DEVICES MARKET ANALYSIS BY TYPE OF TEST

- FIGURE 81. INDONESIA STD TESTING DEVICES MARKET ANALYSIS BY END USER

- FIGURE 82. INDONESIA STD TESTING DEVICES MARKET ANALYSIS BY PRODUCT TYPE

- FIGURE 83. INDONESIA STD TESTING DEVICES MARKET ANALYSIS BY APPLICATION

- FIGURE 84. INDONESIA STD TESTING DEVICES MARKET ANALYSIS BY REGIONAL

- FIGURE 85. REST OF APAC STD TESTING DEVICES MARKET ANALYSIS BY TYPE OF TEST

- FIGURE 86. REST OF APAC STD TESTING DEVICES MARKET ANALYSIS BY END USER

- FIGURE 87. REST OF APAC STD TESTING DEVICES MARKET ANALYSIS BY PRODUCT TYPE

- FIGURE 88. REST OF APAC STD TESTING DEVICES MARKET ANALYSIS BY APPLICATION

- FIGURE 89. REST OF APAC STD TESTING DEVICES MARKET ANALYSIS BY REGIONAL

- FIGURE 90. SOUTH AMERICA STD TESTING DEVICES MARKET ANALYSIS

- FIGURE 91. BRAZIL STD TESTING DEVICES MARKET ANALYSIS BY TYPE OF TEST

- FIGURE 92. BRAZIL STD TESTING DEVICES MARKET ANALYSIS BY END USER

- FIGURE 93. BRAZIL STD TESTING DEVICES MARKET ANALYSIS BY PRODUCT TYPE

- FIGURE 94. BRAZIL STD TESTING DEVICES MARKET ANALYSIS BY APPLICATION

- FIGURE 95. BRAZIL STD TESTING DEVICES MARKET ANALYSIS BY REGIONAL

- FIGURE 96. MEXICO STD TESTING DEVICES MARKET ANALYSIS BY TYPE OF TEST

- FIGURE 97. MEXICO STD TESTING DEVICES MARKET ANALYSIS BY END USER

- FIGURE 98. MEXICO STD TESTING DEVICES MARKET ANALYSIS BY PRODUCT TYPE

- FIGURE 99. MEXICO STD TESTING DEVICES MARKET ANALYSIS BY APPLICATION

- FIGURE 100. MEXICO STD TESTING DEVICES MARKET ANALYSIS BY REGIONAL

- FIGURE 101. ARGENTINA STD TESTING DEVICES MARKET ANALYSIS BY TYPE OF TEST

- FIGURE 102. ARGENTINA STD TESTING DEVICES MARKET ANALYSIS BY END USER

- FIGURE 103. ARGENTINA STD TESTING DEVICES MARKET ANALYSIS BY PRODUCT TYPE

- FIGURE 104. ARGENTINA STD TESTING DEVICES MARKET ANALYSIS BY APPLICATION

- FIGURE 105. ARGENTINA STD TESTING DEVICES MARKET ANALYSIS BY REGIONAL

- FIGURE 106. REST OF SOUTH AMERICA STD TESTING DEVICES MARKET ANALYSIS BY TYPE OF TEST

- FIGURE 107. REST OF SOUTH AMERICA STD TESTING DEVICES MARKET ANALYSIS BY END USER

- FIGURE 108. REST OF SOUTH AMERICA STD TESTING DEVICES MARKET ANALYSIS BY PRODUCT TYPE

- FIGURE 109. REST OF SOUTH AMERICA STD TESTING DEVICES MARKET ANALYSIS BY APPLICATION

- FIGURE 110. REST OF SOUTH AMERICA STD TESTING DEVICES MARKET ANALYSIS BY REGIONAL

- FIGURE 111. MEA STD TESTING DEVICES MARKET ANALYSIS

- FIGURE 112. GCC COUNTRIES STD TESTING DEVICES MARKET ANALYSIS BY TYPE OF TEST

- FIGURE 113. GCC COUNTRIES STD TESTING DEVICES MARKET ANALYSIS BY END USER

- FIGURE 114. GCC COUNTRIES STD TESTING DEVICES MARKET ANALYSIS BY PRODUCT TYPE

- FIGURE 115. GCC COUNTRIES STD TESTING DEVICES MARKET ANALYSIS BY APPLICATION

- FIGURE 116. GCC COUNTRIES STD TESTING DEVICES MARKET ANALYSIS BY REGIONAL

- FIGURE 117. SOUTH AFRICA STD TESTING DEVICES MARKET ANALYSIS BY TYPE OF TEST

- FIGURE 118. SOUTH AFRICA STD TESTING DEVICES MARKET ANALYSIS BY END USER

- FIGURE 119. SOUTH AFRICA STD TESTING DEVICES MARKET ANALYSIS BY PRODUCT TYPE

- FIGURE 120. SOUTH AFRICA STD TESTING DEVICES MARKET ANALYSIS BY APPLICATION

- FIGURE 121. SOUTH AFRICA STD TESTING DEVICES MARKET ANALYSIS BY REGIONAL

- FIGURE 122. REST OF MEA STD TESTING DEVICES MARKET ANALYSIS BY TYPE OF TEST

- FIGURE 123. REST OF MEA STD TESTING DEVICES MARKET ANALYSIS BY END USER

- FIGURE 124. REST OF MEA STD TESTING DEVICES MARKET ANALYSIS BY PRODUCT TYPE

- FIGURE 125. REST OF MEA STD TESTING DEVICES MARKET ANALYSIS BY APPLICATION

- FIGURE 126. REST OF MEA STD TESTING DEVICES MARKET ANALYSIS BY REGIONAL

- FIGURE 127. KEY BUYING CRITERIA OF STD TESTING DEVICES MARKET

- FIGURE 128. RESEARCH PROCESS OF MRFR

- FIGURE 129. DRO ANALYSIS OF STD TESTING DEVICES MARKET

- FIGURE 130. DRIVERS IMPACT ANALYSIS: STD TESTING DEVICES MARKET

- FIGURE 131. RESTRAINTS IMPACT ANALYSIS: STD TESTING DEVICES MARKET

- FIGURE 132. SUPPLY / VALUE CHAIN: STD TESTING DEVICES MARKET

- FIGURE 133. STD TESTING DEVICES MARKET, BY TYPE OF TEST, 2024 (% SHARE)

- FIGURE 134. STD TESTING DEVICES MARKET, BY TYPE OF TEST, 2019 TO 2032 (USD Billions)

- FIGURE 135. STD TESTING DEVICES MARKET, BY END USER, 2024 (% SHARE)

- FIGURE 136. STD TESTING DEVICES MARKET, BY END USER, 2019 TO 2032 (USD Billions)

- FIGURE 137. STD TESTING DEVICES MARKET, BY PRODUCT TYPE, 2024 (% SHARE)

- FIGURE 138. STD TESTING DEVICES MARKET, BY PRODUCT TYPE, 2019 TO 2032 (USD Billions)

- FIGURE 139. STD TESTING DEVICES MARKET, BY APPLICATION, 2024 (% SHARE)

- FIGURE 140. STD TESTING DEVICES MARKET, BY APPLICATION, 2019 TO 2032 (USD Billions)

- FIGURE 141. STD TESTING DEVICES MARKET, BY REGIONAL, 2024 (% SHARE)

- FIGURE 142. STD TESTING DEVICES MARKET, BY REGIONAL, 2019 TO 2032 (USD Billions)

- FIGURE 143. BENCHMARKING OF MAJOR COMPETITORS

STD Testing Devices Market Segmentation

- STD Testing Devices Market By Type of Test (USD Billion, 2019-2032)

- Serological Tests

- Molecular Tests

- Rapid Tests

- Nucleic Acid Amplification Tests

- STD Testing Devices Market By End User (USD Billion, 2019-2032)

- Hospitals

- Diagnostic Laboratories

- Home Care Settings

- Public Health Organizations

- STD Testing Devices Market By Product Type (USD Billion, 2019-2032)

- Test Kits

- Equipment

- Consumables

- STD Testing Devices Market By Application (USD Billion, 2019-2032)

- Chlamydia Testing

- Gonorrhea Testing

- Syphilis Testing

- HIV Testing

- Hepatitis Testing

- STD Testing Devices Market By Regional (USD Billion, 2019-2032)

- North America

- Europe

- South America

- Asia Pacific

- Middle East and Africa

STD Testing Devices Market Regional Outlook (USD Billion, 2019-2032)

- North America Outlook (USD Billion, 2019-2032)

- North America STD Testing Devices Market by Type of Test Type

- Serological Tests

- Molecular Tests

- Rapid Tests

- Nucleic Acid Amplification Tests

- North America STD Testing Devices Market by End User Type

- Hospitals

- Diagnostic Laboratories

- Home Care Settings

- Public Health Organizations

- North America STD Testing Devices Market by Product Type

- Test Kits

- Equipment

- Consumables

- North America STD Testing Devices Market by Application Type

- Chlamydia Testing

- Gonorrhea Testing

- Syphilis Testing

- HIV Testing

- Hepatitis Testing

- North America STD Testing Devices Market by Regional Type

- US

- Canada

- US Outlook (USD Billion, 2019-2032)

- US STD Testing Devices Market by Type of Test Type

- Serological Tests

- Molecular Tests

- Rapid Tests

- Nucleic Acid Amplification Tests

- US STD Testing Devices Market by End User Type

- Hospitals

- Diagnostic Laboratories

- Home Care Settings

- Public Health Organizations

- US STD Testing Devices Market by Product Type

- Test Kits

- Equipment

- Consumables

- US STD Testing Devices Market by Application Type

- Chlamydia Testing

- Gonorrhea Testing

- Syphilis Testing

- HIV Testing

- Hepatitis Testing

- CANADA Outlook (USD Billion, 2019-2032)

- CANADA STD Testing Devices Market by Type of Test Type

- Serological Tests

- Molecular Tests

- Rapid Tests

- Nucleic Acid Amplification Tests

- CANADA STD Testing Devices Market by End User Type

- Hospitals

- Diagnostic Laboratories

- Home Care Settings

- Public Health Organizations

- CANADA STD Testing Devices Market by Product Type

- Test Kits

- Equipment

- Consumables

- CANADA STD Testing Devices Market by Application Type

- Chlamydia Testing

- Gonorrhea Testing

- Syphilis Testing

- HIV Testing

- Hepatitis Testing

- Europe Outlook (USD Billion, 2019-2032)

- Europe STD Testing Devices Market by Type of Test Type

- Serological Tests

- Molecular Tests

- Rapid Tests

- Nucleic Acid Amplification Tests

- Europe STD Testing Devices Market by End User Type

- Hospitals

- Diagnostic Laboratories

- Home Care Settings

- Public Health Organizations

- Europe STD Testing Devices Market by Product Type

- Test Kits

- Equipment

- Consumables

- Europe STD Testing Devices Market by Application Type

- Chlamydia Testing

- Gonorrhea Testing

- Syphilis Testing

- HIV Testing

- Hepatitis Testing

- Europe STD Testing Devices Market by Regional Type

- Germany

- UK

- France

- Russia

- Italy

- Spain

- Rest of Europe

- GERMANY Outlook (USD Billion, 2019-2032)

- GERMANY STD Testing Devices Market by Type of Test Type

- Serological Tests

- Molecular Tests

- Rapid Tests

- Nucleic Acid Amplification Tests

- GERMANY STD Testing Devices Market by End User Type

- Hospitals

- Diagnostic Laboratories

- Home Care Settings

- Public Health Organizations

- GERMANY STD Testing Devices Market by Product Type

- Test Kits

- Equipment

- Consumables

- GERMANY STD Testing Devices Market by Application Type

- Chlamydia Testing

- Gonorrhea Testing

- Syphilis Testing

- HIV Testing

- Hepatitis Testing

- UK Outlook (USD Billion, 2019-2032)

- UK STD Testing Devices Market by Type of Test Type

- Serological Tests

- Molecular Tests

- Rapid Tests

- Nucleic Acid Amplification Tests

- UK STD Testing Devices Market by End User Type

- Hospitals

- Diagnostic Laboratories

- Home Care Settings

- Public Health Organizations

- UK STD Testing Devices Market by Product Type

- Test Kits

- Equipment

- Consumables

- UK STD Testing Devices Market by Application Type

- Chlamydia Testing

- Gonorrhea Testing

- Syphilis Testing

- HIV Testing

- Hepatitis Testing

- FRANCE Outlook (USD Billion, 2019-2032)

- FRANCE STD Testing Devices Market by Type of Test Type

- Serological Tests

- Molecular Tests

- Rapid Tests

- Nucleic Acid Amplification Tests

- FRANCE STD Testing Devices Market by End User Type

- Hospitals

- Diagnostic Laboratories

- Home Care Settings

- Public Health Organizations

- FRANCE STD Testing Devices Market by Product Type

- Test Kits

- Equipment

- Consumables

- FRANCE STD Testing Devices Market by Application Type

- Chlamydia Testing

- Gonorrhea Testing

- Syphilis Testing

- HIV Testing

- Hepatitis Testing

- RUSSIA Outlook (USD Billion, 2019-2032)

- RUSSIA STD Testing Devices Market by Type of Test Type

- Serological Tests

- Molecular Tests

- Rapid Tests

- Nucleic Acid Amplification Tests

- RUSSIA STD Testing Devices Market by End User Type

- Hospitals

- Diagnostic Laboratories

- Home Care Settings

- Public Health Organizations

- RUSSIA STD Testing Devices Market by Product Type

- Test Kits

- Equipment

- Consumables

- RUSSIA STD Testing Devices Market by Application Type

- Chlamydia Testing

- Gonorrhea Testing

- Syphilis Testing

- HIV Testing

- Hepatitis Testing

- ITALY Outlook (USD Billion, 2019-2032)

- ITALY STD Testing Devices Market by Type of Test Type

- Serological Tests

- Molecular Tests

- Rapid Tests

- Nucleic Acid Amplification Tests

- ITALY STD Testing Devices Market by End User Type

- Hospitals

- Diagnostic Laboratories

- Home Care Settings

- Public Health Organizations

- ITALY STD Testing Devices Market by Product Type

- Test Kits

- Equipment

- Consumables

- ITALY STD Testing Devices Market by Application Type

- Chlamydia Testing

- Gonorrhea Testing

- Syphilis Testing

- HIV Testing

- Hepatitis Testing

- SPAIN Outlook (USD Billion, 2019-2032)

- SPAIN STD Testing Devices Market by Type of Test Type

- Serological Tests

- Molecular Tests

- Rapid Tests

- Nucleic Acid Amplification Tests

- SPAIN STD Testing Devices Market by End User Type

- Hospitals

- Diagnostic Laboratories

- Home Care Settings

- Public Health Organizations

- SPAIN STD Testing Devices Market by Product Type

- Test Kits

- Equipment

- Consumables

- SPAIN STD Testing Devices Market by Application Type

- Chlamydia Testing

- Gonorrhea Testing

- Syphilis Testing

- HIV Testing

- Hepatitis Testing

- REST OF EUROPE Outlook (USD Billion, 2019-2032)

- REST OF EUROPE STD Testing Devices Market by Type of Test Type

- Serological Tests

- Molecular Tests

- Rapid Tests

- Nucleic Acid Amplification Tests

- REST OF EUROPE STD Testing Devices Market by End User Type

- Hospitals

- Diagnostic Laboratories

- Home Care Settings

- Public Health Organizations

- REST OF EUROPE STD Testing Devices Market by Product Type

- Test Kits

- Equipment

- Consumables

- REST OF EUROPE STD Testing Devices Market by Application Type

- Chlamydia Testing

- Gonorrhea Testing

- Syphilis Testing

- HIV Testing

- Hepatitis Testing

- APAC Outlook (USD Billion, 2019-2032)

- APAC STD Testing Devices Market by Type of Test Type

- Serological Tests

- Molecular Tests

- Rapid Tests

- Nucleic Acid Amplification Tests

- APAC STD Testing Devices Market by End User Type

- Hospitals

- Diagnostic Laboratories

- Home Care Settings

- Public Health Organizations

- APAC STD Testing Devices Market by Product Type

- Test Kits

- Equipment

- Consumables

- APAC STD Testing Devices Market by Application Type

- Chlamydia Testing

- Gonorrhea Testing

- Syphilis Testing

- HIV Testing

- Hepatitis Testing

- APAC STD Testing Devices Market by Regional Type

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Indonesia

- Rest of APAC

- CHINA Outlook (USD Billion, 2019-2032)

- CHINA STD Testing Devices Market by Type of Test Type

- Serological Tests

- Molecular Tests

- Rapid Tests

- Nucleic Acid Amplification Tests

- CHINA STD Testing Devices Market by End User Type

- Hospitals

- Diagnostic Laboratories

- Home Care Settings

- Public Health Organizations

- CHINA STD Testing Devices Market by Product Type

- Test Kits

- Equipment

- Consumables

- CHINA STD Testing Devices Market by Application Type

- Chlamydia Testing

- Gonorrhea Testing

- Syphilis Testing

- HIV Testing

- Hepatitis Testing

- INDIA Outlook (USD Billion, 2019-2032)

- INDIA STD Testing Devices Market by Type of Test Type

- Serological Tests

- Molecular Tests

- Rapid Tests

- Nucleic Acid Amplification Tests

- INDIA STD Testing Devices Market by End User Type

- Hospitals

- Diagnostic Laboratories

- Home Care Settings

- Public Health Organizations

- INDIA STD Testing Devices Market by Product Type

- Test Kits

- Equipment

- Consumables

- INDIA STD Testing Devices Market by Application Type

- Chlamydia Testing

- Gonorrhea Testing

- Syphilis Testing

- HIV Testing

- Hepatitis Testing

- JAPAN Outlook (USD Billion, 2019-2032)

- JAPAN STD Testing Devices Market by Type of Test Type

- Serological Tests

- Molecular Tests

- Rapid Tests

- Nucleic Acid Amplification Tests

- JAPAN STD Testing Devices Market by End User Type

- Hospitals

- Diagnostic Laboratories

- Home Care Settings

- Public Health Organizations

- JAPAN STD Testing Devices Market by Product Type

- Test Kits

- Equipment

- Consumables

- JAPAN STD Testing Devices Market by Application Type

- Chlamydia Testing

- Gonorrhea Testing

- Syphilis Testing

- HIV Testing

- Hepatitis Testing

- SOUTH KOREA Outlook (USD Billion, 2019-2032)

- SOUTH KOREA STD Testing Devices Market by Type of Test Type

- Serological Tests

- Molecular Tests

- Rapid Tests

- Nucleic Acid Amplification Tests

- SOUTH KOREA STD Testing Devices Market by End User Type

- Hospitals

- Diagnostic Laboratories

- Home Care Settings

- Public Health Organizations

- SOUTH KOREA STD Testing Devices Market by Product Type

- Test Kits

- Equipment

- Consumables

- SOUTH KOREA STD Testing Devices Market by Application Type

- Chlamydia Testing

- Gonorrhea Testing

- Syphilis Testing

- HIV Testing

- Hepatitis Testing

- MALAYSIA Outlook (USD Billion, 2019-2032)

- MALAYSIA STD Testing Devices Market by Type of Test Type

- Serological Tests

- Molecular Tests

- Rapid Tests

- Nucleic Acid Amplification Tests

- MALAYSIA STD Testing Devices Market by End User Type

- Hospitals

- Diagnostic Laboratories

- Home Care Settings

- Public Health Organizations

- MALAYSIA STD Testing Devices Market by Product Type

- Test Kits

- Equipment

- Consumables

- MALAYSIA STD Testing Devices Market by Application Type

- Chlamydia Testing

- Gonorrhea Testing

- Syphilis Testing

- HIV Testing

- Hepatitis Testing

- THAILAND Outlook (USD Billion, 2019-2032)

- THAILAND STD Testing Devices Market by Type of Test Type

- Serological Tests

- Molecular Tests

- Rapid Tests

- Nucleic Acid Amplification Tests

- THAILAND STD Testing Devices Market by End User Type

- Hospitals

- Diagnostic Laboratories

- Home Care Settings

- Public Health Organizations

- THAILAND STD Testing Devices Market by Product Type

- Test Kits

- Equipment

- Consumables

- THAILAND STD Testing Devices Market by Application Type

- Chlamydia Testing

- Gonorrhea Testing

- Syphilis Testing

- HIV Testing

- Hepatitis Testing

- INDONESIA Outlook (USD Billion, 2019-2032)

- INDONESIA STD Testing Devices Market by Type of Test Type

- Serological Tests

- Molecular Tests

- Rapid Tests

- Nucleic Acid Amplification Tests

- INDONESIA STD Testing Devices Market by End User Type

- Hospitals

- Diagnostic Laboratories

- Home Care Settings

- Public Health Organizations

- INDONESIA STD Testing Devices Market by Product Type

- Test Kits

- Equipment

- Consumables

- INDONESIA STD Testing Devices Market by Application Type

- Chlamydia Testing

- Gonorrhea Testing

- Syphilis Testing

- HIV Testing

- Hepatitis Testing

- REST OF APAC Outlook (USD Billion, 2019-2032)

- REST OF APAC STD Testing Devices Market by Type of Test Type

- Serological Tests

- Molecular Tests

- Rapid Tests

- Nucleic Acid Amplification Tests

- REST OF APAC STD Testing Devices Market by End User Type

- Hospitals

- Diagnostic Laboratories

- Home Care Settings

- Public Health Organizations

- REST OF APAC STD Testing Devices Market by Product Type

- Test Kits

- Equipment

- Consumables

- REST OF APAC STD Testing Devices Market by Application Type

- Chlamydia Testing

- Gonorrhea Testing

- Syphilis Testing

- HIV Testing

- Hepatitis Testing

- South America Outlook (USD Billion, 2019-2032)

- South America STD Testing Devices Market by Type of Test Type

- Serological Tests

- Molecular Tests

- Rapid Tests

- Nucleic Acid Amplification Tests

- South America STD Testing Devices Market by End User Type

- Hospitals

- Diagnostic Laboratories

- Home Care Settings

- Public Health Organizations

- South America STD Testing Devices Market by Product Type

- Test Kits

- Equipment

- Consumables

- South America STD Testing Devices Market by Application Type

- Chlamydia Testing

- Gonorrhea Testing

- Syphilis Testing

- HIV Testing

- Hepatitis Testing

- South America STD Testing Devices Market by Regional Type

- Brazil

- Mexico

- Argentina

- Rest of South America

- BRAZIL Outlook (USD Billion, 2019-2032)

- BRAZIL STD Testing Devices Market by Type of Test Type

- Serological Tests

- Molecular Tests

- Rapid Tests

- Nucleic Acid Amplification Tests

- BRAZIL STD Testing Devices Market by End User Type

- Hospitals

- Diagnostic Laboratories

- Home Care Settings

- Public Health Organizations

- BRAZIL STD Testing Devices Market by Product Type

- Test Kits

- Equipment

- Consumables

- BRAZIL STD Testing Devices Market by Application Type

- Chlamydia Testing

- Gonorrhea Testing

- Syphilis Testing

- HIV Testing

- Hepatitis Testing

- MEXICO Outlook (USD Billion, 2019-2032)

- MEXICO STD Testing Devices Market by Type of Test Type

- Serological Tests

- Molecular Tests

- Rapid Tests

- Nucleic Acid Amplification Tests

- MEXICO STD Testing Devices Market by End User Type

- Hospitals

- Diagnostic Laboratories

- Home Care Settings

- Public Health Organizations

- MEXICO STD Testing Devices Market by Product Type

- Test Kits

- Equipment

- Consumables

- MEXICO STD Testing Devices Market by Application Type

- Chlamydia Testing

- Gonorrhea Testing

- Syphilis Testing

- HIV Testing

- Hepatitis Testing

- ARGENTINA Outlook (USD Billion, 2019-2032)

- ARGENTINA STD Testing Devices Market by Type of Test Type

- Serological Tests

- Molecular Tests

- Rapid Tests

- Nucleic Acid Amplification Tests

- ARGENTINA STD Testing Devices Market by End User Type

- Hospitals

- Diagnostic Laboratories

- Home Care Settings

- Public Health Organizations

- ARGENTINA STD Testing Devices Market by Product Type

- Test Kits

- Equipment

- Consumables

- ARGENTINA STD Testing Devices Market by Application Type

- Chlamydia Testing

- Gonorrhea Testing

- Syphilis Testing

- HIV Testing

- Hepatitis Testing

- REST OF SOUTH AMERICA Outlook (USD Billion, 2019-2032)

- REST OF SOUTH AMERICA STD Testing Devices Market by Type of Test Type

- Serological Tests

- Molecular Tests

- Rapid Tests

- Nucleic Acid Amplification Tests

- REST OF SOUTH AMERICA STD Testing Devices Market by End User Type

- Hospitals

- Diagnostic Laboratories

- Home Care Settings

- Public Health Organizations

- REST OF SOUTH AMERICA STD Testing Devices Market by Product Type

- Test Kits

- Equipment

- Consumables

- REST OF SOUTH AMERICA STD Testing Devices Market by Application Type

- Chlamydia Testing

- Gonorrhea Testing

- Syphilis Testing

- HIV Testing

- Hepatitis Testing

- MEA Outlook (USD Billion, 2019-2032)

- MEA STD Testing Devices Market by Type of Test Type

- Serological Tests

- Molecular Tests

- Rapid Tests