Market Share

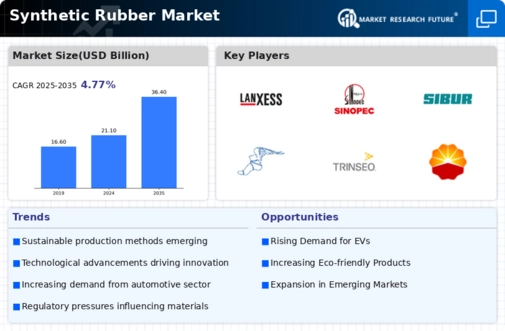

Synthetic Rubber Market Share Analysis

Market share positioning strategies in the Synthetic Rubber Market are critical for companies aiming to gain a competitive edge and maximize their presence in the industry. These strategies revolve around various approaches aimed at capturing a larger portion of the market and solidifying a company's position within it.

Rapid urbanization, growing demand for durable rubber, and continuous growth of automotive & transportation sector.

One key strategy employed by companies in the Synthetic Rubber Market is differentiation. This involves creating synthetic rubber products with unique features or attributes that set them apart from competitors. Whether it's superior durability, enhanced performance in specific applications, or environmentally friendly formulations, differentiation allows companies to carve out a niche for themselves within the market. By offering something that competitors don't or can't easily replicate, companies can attract customers looking for specialized solutions and build a loyal customer base.

Another important aspect of market share positioning is pricing strategy. Companies may choose to compete on price by offering synthetic rubber products at lower prices than their competitors. This can be particularly effective in price-sensitive markets or when targeting cost-conscious customers. However, it's essential to strike a balance between offering competitive prices and maintaining profitability. Some companies may opt for a premium pricing strategy, positioning their synthetic rubber products as high-quality, premium options for customers willing to pay a premium for superior performance or reliability.

In addition to differentiation and pricing strategies, effective marketing and branding play a crucial role in market share positioning. Building a strong brand identity and effectively communicating the value proposition of synthetic rubber products can help companies stand out in a crowded market. This may involve investing in advertising campaigns, participating in industry events and trade shows, or leveraging digital marketing channels to reach target customers. By building brand awareness and establishing a positive reputation, companies can increase demand for their products and gain market share over time.

Distribution and channel management also play a significant role in market share positioning within the Synthetic Rubber Market. Companies must ensure their products are readily available to customers through efficient distribution channels. This may involve partnering with distributors, wholesalers, or retailers to reach customers in different geographic regions or industry segments. By strategically managing their distribution channels, companies can expand their reach and accessibility, making it easier for customers to purchase their synthetic rubber products over those of competitors.

Furthermore, innovation and research & development (R&D) are essential for maintaining a competitive edge in the Synthetic Rubber Market. Companies that invest in R&D to develop new and improved synthetic rubber formulations or manufacturing processes can differentiate themselves from competitors and capture market share. Whether it's developing synthetic rubbers with enhanced performance characteristics, improved sustainability profiles, or reduced production costs, innovation allows companies to stay ahead of evolving customer needs and market trends.

Lastly, strategic partnerships and collaborations can be valuable for companies looking to strengthen their market share positioning. By partnering with other organizations, such as raw material suppliers, manufacturers, or research institutions, companies can leverage complementary strengths and resources to drive growth and innovation. Strategic partnerships can also help companies enter new markets or expand their product offerings, further solidifying their position within the Synthetic Rubber Market.

Leave a Comment