Market Share

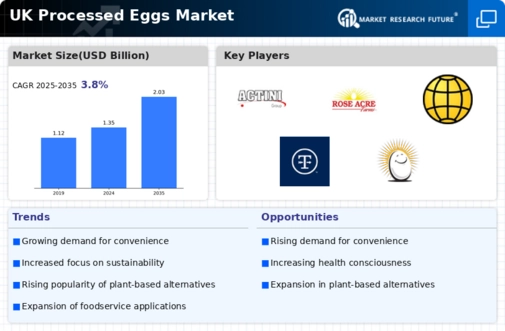

UK Processed Eggs Market Share Analysis

In the UK processed eggs market, strategic market share positioning is critical for brands aiming to thrive in this specialized industry. A prevalent approach involves differentiation through quality sourcing and processing methods. Brands often emphasize the use of fresh and high-quality eggs sourced from reliable suppliers. Employing advanced processing techniques, such as pasteurization, to ensure safety and extended shelf life further distinguishes brands in a market where consumers prioritize food safety and quality.

Effective branding plays a pivotal role in market share positioning within the processed eggs segment. Establishing a distinct brand identity, including recognizable logos, informative packaging, and transparent labeling, allows companies to create a lasting impression on consumers. Communicating the provenance of eggs, ethical sourcing practices, and nutritional information contributes to building trust with consumers, fostering brand loyalty, and ultimately influencing market share.

Innovation in product offerings is a significant factor in the processed eggs market. Brands often explore value-added options, such as pre-cooked or ready-to-use eggs, omelette mixes, and specialty blends. These innovations cater to the evolving needs of busy consumers seeking convenience in their meal preparation. Additionally, introducing flavored or seasoned processed eggs taps into culinary trends, offering variety and versatility to consumers and impacting market share by meeting their diverse preferences.

Strategic pricing is a key element in market share positioning within the UK processed eggs industry. Brands must strike a balance between offering competitive prices and emphasizing the quality and convenience associated with their products. Promotional discounts, bundle offers, and strategic partnerships with retailers can attract price-sensitive consumers while maintaining profitability and influencing market share in a competitive market.

Distribution channels are integral in determining market share within the processed eggs sector. Brands strategically collaborate with supermarkets, foodservice providers, and online platforms to ensure widespread availability. Effective distribution ensures that consumers can easily access and purchase their preferred processed egg brand, contributing to increased market share.

Health-conscious consumer trends have influenced the processed eggs market, leading to the development of specialty and health-oriented products. Brands that offer organic, free-range, or omega-3 enriched processed eggs cater to consumers seeking healthier alternatives. This strategic move aligns with the growing demand for nutrient-rich and ethically sourced food options, potentially expanding a brand's market share within health-conscious consumer demographics.

Digital marketing and social media engagement are essential tools for connecting with consumers in the processed eggs market. Brands utilize online platforms to showcase recipes, nutritional information, and cooking tips. Engaging content, influencer collaborations, and interactive campaigns can enhance brand visibility, influence consumer perceptions, and ultimately impact market share.

Sustainability practices are gaining importance in the food industry, and the processed eggs market is no exception. Brands that adopt eco-friendly packaging, implement waste reduction initiatives, and emphasize responsible sourcing contribute to a positive brand image. Sustainability efforts resonate with environmentally conscious consumers, potentially enhancing a brand's market share in a market where ethical and eco-friendly choices are increasingly valued.

Leave a Comment