Market Analysis

In-depth Analysis of UK Skincare Market Industry Landscape

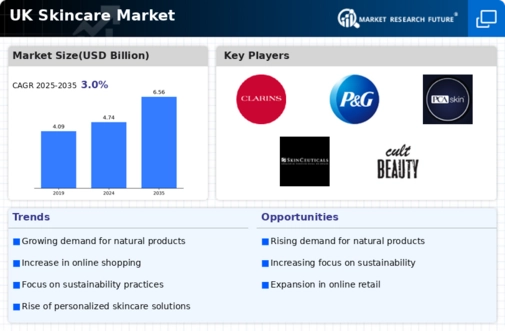

The United Kingdom's skincare market reflects a dynamic industry shaped by a combination of consumer preferences, technological advancements, and regulatory influences. The market dynamics are influenced by the British population's increasing awareness and emphasis on skincare routines, driven by a growing interest in health and wellness. Consumers are seeking products that not only cater to their skincare needs but also align with environmental and ethical considerations.

One of the notable trends in the UK skincare market is the rising demand for natural and sustainable products. Consumers are becoming more conscious of the ingredients used in skincare formulations and are actively seeking products that are free from harmful chemicals. This shift in consumer preferences has prompted skincare brands to adapt, with many introducing organic and eco-friendly lines. As a result, market dynamics are influenced by the competition among brands to align with the sustainability trend and meet the changing expectations of environmentally conscious consumers.

The technological landscape also plays a pivotal role in shaping the dynamics of the UK skincare market. Advancements in skincare technology, including the use of artificial intelligence, data analytics, and personalized skincare solutions, are gaining prominence. The integration of technology allows companies to offer customized products tailored to individual skin types and concerns. This trend not only enhances the overall consumer experience but also introduces a new dimension to the market dynamics, where innovation and tech-driven solutions become key differentiators for brands.

E-commerce has emerged as a significant factor influencing the market dynamics of the UK skincare industry. The convenience of online shopping, coupled with a wide range of product choices and access to reviews, has driven a substantial portion of skincare sales to digital platforms. As consumers increasingly turn to online channels for their skincare needs, traditional brick-and-mortar retailers are adapting their strategies to compete in this digital landscape. The e-commerce boom has redefined market dynamics, emphasizing the importance of a robust online presence, digital marketing strategies, and seamless customer experiences.

Regulatory factors also contribute to shaping the UK skincare market dynamics. Stringent regulations regarding product labeling, claims, and ingredient transparency influence how brands formulate, market, and sell their skincare products. The push for clean beauty and stricter regulations on certain ingredients have prompted companies to reformulate products to comply with evolving standards. This regulatory environment fosters a market where consumers can trust the efficacy and safety of skincare products, influencing purchasing decisions and overall market dynamics.

Cultural influences and changing beauty standards also impact the UK skincare market. The desire for a healthy and youthful appearance, coupled with the influence of social media and beauty trends, drives consumer preferences and product choices. Skincare routines are no longer just about addressing specific skin issues; they have become an integral part of self-care and lifestyle choices. As cultural norms and beauty ideals evolve, the market dynamics adapt to cater to the diverse needs and expectations of consumers.

Leave a Comment