Market Trends

Key Emerging Trends in the US Regenerative Medicine Market

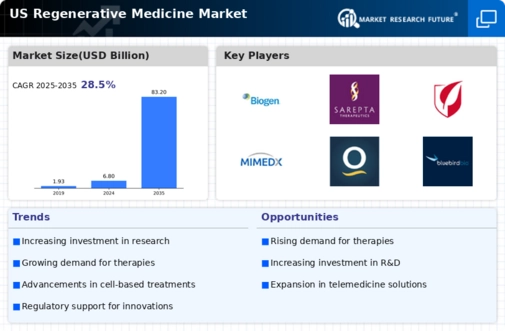

The field of regenerative medicine in the US has seen critical market patterns, mirroring a promising future for the industry. One of the key patterns molding the market is the rising predominance of persistent illnesses and degenerative circumstances. As the maturing population develops, so does the demand for imaginative therapies that can address ailments like osteoarthritis, cardiovascular illnesses, and neurodegenerative issues. This segment shift has energized a surge in innovative work exercises inside the regenerative medicine area, driving market growth. Another critical pattern is the raising interests in research and clinical preliminaries. Both public and confidential elements are emptying significant assets into investigating the capability of regenerative therapies. This increased interest is not just supporting the advancement of state-of-the-art medicines but at the same time is impelling joint efforts between research organizations, drug organizations, and biotechnology firms. Such organizations cultivate a cooperative climate, speeding up the interpretation of logical advances into practical business items. Furthermore, headways in foundational microorganism examination and quality therapy play had an urgent impact in forming the regenerative medicine landscape. Leap forwards in understanding cell systems and the capacity to control qualities have opened new roads for regenerative medicines. This has prompted the improvement of customized therapies tailored to individual patients, denoting a shift towards accuracy medicine inside the regenerative medicine market. As of late, administrative drives have additionally contributed fundamentally to market elements. Administrative bodies in the U.S., like the Food and Drug Administration (FDA), have shown an expanded readiness to smooth out the endorsement cycle for regenerative therapies, perceiving the potential advantages they offer. This has given a favorable climate to organizations to explore the administrative landscape, working with quicker market passage for novel regenerative medicines.

Leave a Comment