-

EXECUTIVE SUMMARY 17

-

MARKET INTRODUCTION 20

-

DEFINITION 20

-

SCOPE OF THE STUDY 20

-

RESEARCH OBJECTIVE 20

-

ARKET STRUCTURE 21

-

RESEARCH METHODOLOGY 22

-

OVERVIEW 22

-

DATA FLOW 24

- DATA MINING PROCESS 24

-

PURCHASED DATABASE: 25

-

SECONDARY SOURCES: 26

- SECONDARY RESEARCH DATA FLOW: 27

-

PRIMARY RESEARCH: 28

- PRIMARY RESEARCH DATA FLOW: 29

- PRIMARY RESEARCH: NUMBER OF INTERVIEWS CONDUCTED 30

- PRIMARY RESEARCH: REGIONAL COVERAGE 30

-

APPROACHES FOR MARKET SIZE ESTIMATION: 31

- CONSUMPTION & NET TRADE APPROACH 31

- REVENUE ANALYSIS APPROACH 31

-

DATA FORECASTING 32

- DATA FORECASTING TECHNIQUE 32

-

DATA MODELING 33

- MICROECONOMIC FACTOR ANALYSIS: 33

- DATA MODELING: 34

-

TEAMS AND ANALYST CONTRIBUTION 36

-

MARKET DYNAMICS 37

-

INTRODUCTION 37

-

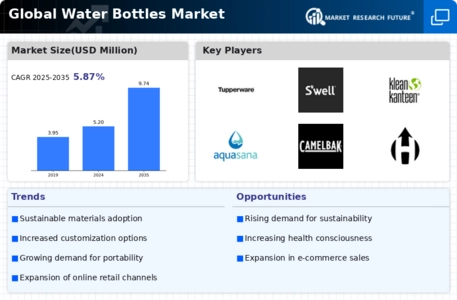

DRIVERS 38

- INCREASING AWARENESS FOR HEALTH AND WELLNESS 38

- DRIVING SUSTAINABLE SHIFTS IN THE WATER BOTTLE MARKET 38

- INTEGRATION OF SMART TECHNOLOGIES INTO WATER BOTTLE DESIGN 39

-

RESTRAINTS 40

- INCREASING ENVIRONMENTAL CONCERNS AND PLASTIC DISCERNMENT 40

-

OPPORTUNITY 42

- INNOVATION IN SUSTAINABLE MATERIALS 42

-

CHALLENGES 42

- RECYCLING INFRASTRUCTURE AND CONSUMER BEHAVIOR 42

-

TRENDS 43

- INCREASING DEMAND FOR CUSTOMIZATION AND PERSONALIZATION 43

-

TECHNOLOGY TRENDS 44

- INTEGRATION OF BLUETOOTH CONNECTIVITY 44

- INCORPORATION OF UV-C LIGHT PURIFICATION 45

-

IMPACT ANALYSIS OF COVID-19 46

- IMPACT ON OVERALL CONSUMER GOODS INDUSTRY 47

- IMPACT ON THE SUPPLY CHAIN OF WATER BOTTLE 48

- IMPACT ON MARKET DEMAND OF WATER BOTTLE 51

- IMPACT ON PRICING OF WATER BOTTLE 52

-

MARKET FACTOR ANALYSIS 53

-

VALUE CHAIN ANALYSIS 53

- RAW MATERIALS 53

- MANUFACTURING / PRODUCTION/ PROCESSING 54

- PACKING 54

- DISTRIBUTION 55

- END-USER 55

-

SUPPLY CHAIN ANALYSIS 56

- PARTICIPANTS (AT DIFFERENT NODES) 56

- INTEGRATION LEVELS 57

- KEY ISSUES ADDRESSED (KEY SUCCESS FACTORS) 57

-

PORTER’S FIVE FORCES MODEL 58

- BARGAINING POWER OF SUPPLIERS 58

- BARGAINING POWER OF BUYERS 59

- THREAT OF NEW ENTRANTS 59

- THREAT OF SUBSTITUTES 60

- INTENSITY OF RIVALRY 60

-

GLOBAL WATER BOTTLES MARKET, BY MATERIAL TYPE 62

-

INTRODUCTION 62

-

PLASTIC 63

-

STAINLESS STEEL 63

-

GLASS 64

-

OTHERS 65

-

GLOBAL WATER BOTTLES MARKET, BY PRODUCT TYPE 66

-

INTRODUCTION 66

-

INSULATED 67

-

NON-INSULATED 68

-

FILTER WATER BOTTLE 68

-

INFUSER WATER BOTTLE 69

-

OTHERS 69

-

GLOBAL WATER BOTTLES MARKET, BY DISTRIBUTION CHANNEL 71

-

INTRODUCTION 71

-

OFFLINE 72

-

ONLINE 73

-

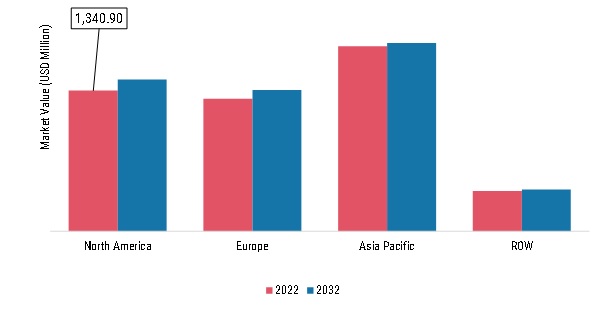

GLOBAL WATER BOTTLES MARKET, BY REGION 74

-

OVERVIEW 74

-

NORTH AMERICA 75

- US 78

- CANADA 79

- MEXICO 80

-

EUROPE 82

- GERMANY 85

- UK 86

- FRANCE 87

- SPAIN 88

- ITALY 89

- REST OF EUROPE 90

-

ASIA PACIFIC 91

- CHINA 94

- JAPAN 95

- INDIA 96

- AUSTRALIA 97

- SOUTH KOREA 98

- REST OF ASIA PACIFIC 99

-

ROW 100

- MIDDLE EAST 103

- AFRICA 104

- LATIN AMERICA 105

-

COMPETITIVE LANDSCAPE 107

-

INTRODUCTION 107

-

COMPETITION DASHBOARD 108

- PRODUCT PORTFOLIO 108

- REGIONAL PRESENCE 108

- STRATEGIC ALLIANCES 109

- INDUSTRY EXPERIENCES 109

-

MAJOR GROWTH STRATEGY IN THE GLOBAL WATER BOTTLE MARKET 109

-

KEY DEVELOPMENTS & GROWTH STRATEGIES 110

- NEW PRODUCT DEVELOPMENT 110

- MERGERS & ACQUISITIONS 111

- CONTRACTS & AGREEMENTS 111

- EXPANSIONS & INVESTMENTS 112

-

COMPANY PROFILES 113

-

SIGG SWITZERLAND BOTTLES AG 113

- COMPANY OVERVIEW 113

- PRODUCTS OFFERED 113

- SWOT ANALYSIS 116

- KEY STRATEGY 116

-

THERMOS L.L.C. 117

- COMPANY OVERVIEW 117

- PRODUCTS OFFERED 118

- SWOT ANALYSIS 119

- KEY STRATEGY 119

-

-

TUPPERWARE 120

- COMPANY OVERVIEW 120

- FINANCIAL OVERVIEW 121

- PRODUCTS OFFERED 122

- SWOT ANALYSIS 122

- KEY STRATEGY 123

-

CONTIGO BRANDS 124

- COMPANY OVERVIEW 124

- PRODUCTS OFFERED 124

- SWOT ANALYSIS 125

- KEY STRATEGY 126

-

S’WELL (A DIVISION OF LIFETIME BRANDS, INC). 127

- COMPANY OVERVIEW 127

- PRODUCTS OFFERED 128

- SWOT ANALYSIS 129

- KEY STRATEGY 129

-

KLEAN KANTEEN 130

- COMPANY OVERVIEW 130

- FINANCIAL OVERVIEW 130

- PRODUCTS OFFERED 130

- SWOT ANALYSIS 132

- KEY STRATEGY 132

-

AQUASANA, INC 133

- COMPANY OVERVIEW 133

- FINANCIAL OVERVIEW 133

- PRODUCTS OFFERED 133

- SWOT ANALYSIS 134

- KEY STRATEGY 134

-

CAMELBAK. 135

- COMPANY OVERVIEW 135

- FINANCIAL OVERVIEW 135

- PRODUCTS OFFERED 136

- SWOT ANALYSIS 137

- KEY STRATEGY 137

-

HYDAWAY 138

- COMPANY OVERVIEW 138

- FINANCIAL OVERVIEW 138

- PRODUCTS OFFERED 139

- SWOT ANALYSIS 139

- KEY STRATEGY 140

-

HAMILTON HOUSEWARES PVT. LTD 141

- COMPANY OVERVIEW 141

- PRODUCTS OFFERED 142

- SWOT ANALYSIS 142

- KEY STRATEGY 143

-

-

LIST OF TABLES

-

QFD MODELING FOR MARKET SHARE ASSESSMENT 34

-

GLOBAL WATER BOTTLES MARKET, BY MATERIAL TYPE, 2018-2032 (USD MILLION) 62

-

GLOBAL WATER BOTTLES MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION) 66

-

GLOBAL WATER BOTTLES MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION) 71

-

GLOBAL WATER BOTTLES MARKET, BY REGION, 2018-2032 (USD MILLION) 74

-

NORTH AMERICA WATER BOTTLES MARKET, BY COUNTRY, 2018-2032 (USD MILLION) 77

-

NORTH AMERICA WATER BOTTLES MARKET, BY MATERIAL TYPE, 2018-2032 (USD MILLION) 77

-

NORTH AMERICA WATER BOTTLES MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION) 78

-

NORTH AMERICA WATER BOTTLES MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION) 78

-

US WATER BOTTLES MARKET, BY MATERIAL TYPE, 2018-2032 (USD MILLION) 78

-

US WATER BOTTLES MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION) 79

-

US WATER BOTTLES MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION) 79

-

CANADA WATER BOTTLES MARKET, BY MATERIAL TYPE, 2018-2032 (USD MILLION) 79

-

CANADA WATER BOTTLES MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION) 80

-

CANADA WATER BOTTLES MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION) 80

-

MEXICO WATER BOTTLES MARKET, BY MATERIAL TYPE, 2018-2032 (USD MILLION) 80

-

MEXICO WATER BOTTLES MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION) 81

-

MEXICO WATER BOTTLES MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION) 81

-

EUROPE WATER BOTTLES MARKET, BY COUNTRY, 2018-2032 (USD MILLION) 83

-

EUROPE WATER BOTTLES MARKET, BY MATERIAL TYPE, 2018-2032 (USD MILLION) 84

-

EUROPE WATER BOTTLES MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION) 84

-

EUROPE WATER BOTTLES MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION) 84

-

GERMANY WATER BOTTLES MARKET, BY MATERIAL TYPE, 2018-2032 (USD MILLION) 85

-

GERMANY WATER BOTTLES MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION) 85

-

GERMANY WATER BOTTLES MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION) 85

-

UK WATER BOTTLES MARKET, BY MATERIAL TYPE, 2018-2032 (USD MILLION) 86

-

UK WATER BOTTLES MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION) 86

-

UK WATER BOTTLES MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION) 86

-

FRANCE WATER BOTTLES MARKET, BY MATERIAL TYPE, 2018-2032 (USD MILLION) 87

-

FRANCE WATER BOTTLES MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION) 87

-

FRANCE WATER BOTTLES MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION) 87

-

SPAIN WATER BOTTLES MARKET, BY MATERIAL TYPE, 2018-2032 (USD MILLION) 88

-

SPAIN WATER BOTTLES MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION) 88

-

SPAIN WATER BOTTLES MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION) 88

-

ITALY WATER BOTTLES MARKET, BY MATERIAL TYPE, 2018-2032 (USD MILLION) 89

-

ITALY WATER BOTTLES MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION) 89

-

ITALY WATER BOTTLES MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION) 89

-

REST OF EUROPE WATER BOTTLES MARKET, BY MATERIAL TYPE, 2018-2032 (USD MILLION) 90

-

REST OF EUROPE WATER BOTTLES MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION) 90

-

REST OF EUROPE WATER BOTTLES MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION) 90

-

ASIA PACIFIC WATER BOTTLES MARKET, BY COUNTRY, 2018-2032 (USD MILLION) 92

-

ASIA PACIFIC WATER BOTTLES MARKET, BY MATERIAL TYPE, 2018-2032 (USD MILLION) 93

-

ASIA PACIFIC WATER BOTTLES MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION) 93

-

ASIA PACIFIC WATER BOTTLES MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION) 93

-

CHINA WATER BOTTLES MARKET, BY MATERIAL TYPE, 2018-2032 (USD MILLION) 94

-

CHINA WATER BOTTLES MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION) 94

-

CHINA WATER BOTTLES MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION) 94

-

JAPAN WATER BOTTLES MARKET, BY MATERIAL TYPE, 2018-2032 (USD MILLION) 95

-

JAPAN WATER BOTTLES MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION) 95

-

JAPAN WATER BOTTLES MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION) 95

-

INDIA WATER BOTTLES MARKET, BY MATERIAL TYPE, 2018-2032 (USD MILLION) 96

-

INDIA WATER BOTTLES MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION) 96

-

INDIA WATER BOTTLES MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION) 96

-

AUSTRALIA WATER BOTTLES MARKET, BY MATERIAL TYPE, 2018-2032 (USD MILLION) 97

-

AUSTRALIA WATER BOTTLES MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION) 97

-

AUSTRALIA WATER BOTTLES MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION) 97

-

SOUTH KOREA WATER BOTTLES MARKET, BY MATERIAL TYPE, 2018-2032 (USD MILLION) 98

-

SOUTH KOREA WATER BOTTLES MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION) 98

-

SOUTH KOREA WATER BOTTLES MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION) 98

-

REST OF ASIA PACIFIC WATER BOTTLES MARKET, BY MATERIAL TYPE, 2018-2032 (USD MILLION) 99

-

REST OF ASIA PACIFIC WATER BOTTLES MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION) 99

-

REST OF ASIA PACIFIC WATER BOTTLES MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION) 99

-

ROW WATER BOTTLES MARKET, BY COUNTRY, 2018-2032 (USD MILLION) 102

-

ROW WATER BOTTLES MARKET, BY MATERIAL TYPE, 2018-2032 (USD MILLION) 102

-

ROW WATER BOTTLES MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION) 102

-

ROW WATER BOTTLES MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION) 103

-

MIDDLE EAST WATER BOTTLES MARKET, BY MATERIAL TYPE, 2018-2032 (USD MILLION) 103

-

MIDDLE EAST WATER BOTTLES MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION) 103

-

MIDDLE EAST WATER BOTTLES MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION) 104

-

AFRICA WATER BOTTLES MARKET, BY MATERIAL TYPE, 2018-2032 (USD MILLION) 104

-

AFRICA WATER BOTTLES MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION) 104

-

AFRICA WATER BOTTLES MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION) 105

-

LATIN AMERICA WATER BOTTLES MARKET, BY MATERIAL TYPE, 2018-2032 (USD MILLION) 105

-

LATIN AMERICA WATER BOTTLES MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION) 105

-

LATIN AMERICA WATER BOTTLES MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION) 106

-

NEW PRODUCT DEVELOPMENT 110

-

MERGERS & ACQUISITIONS 111

-

CONTRACTS & AGREEMENTS 111

-

EXPANSIONS & INVESTMENTS 112

-

SIGG SWITZERLAND BOTTLES AG: PRODUCTS OFFERED 113

-

THERMOS L.L.C.: PRODUCTS OFFERED 118

-

TUPPERWARE: PRODUCTS OFFERED 122

-

CONTIGO BRANDS: PRODUCTS OFFERED 124

-

S’WELL (A DIVISION OF LIFETIME BRANDS, INC). .: PRODUCTS OFFERED 128

-

KLEAN KANTEEN: PRODUCTS OFFERED 130

-

AQUASANA, INC: PRODUCTS OFFERED 133

-

CAMELBAK.: PRODUCTS OFFERED 136

-

HYDAWAY: PRODUCTS OFFERED 139

-

HAMILTON HOUSEWARES PVT. LTD: PRODUCTS OFFERED 142

-

-

LIST OF FIGURES

-

GLOBAL WATER BOTTLE MARKET: STRUCTURE 21

-

GLOBAL WATER BOTTLE MARKET: MARKET GROWTH FACTOR ANALYSIS (2022-2032) 37

-

DRIVER IMPACT ANALYSIS (2023-2032) 40

-

RESTRAINT IMPACT ANALYSIS (2022-2032) 41

-

VALUE CHAIN ANALYSIS: GLOBAL WATER BOTTLE MARKET 53

-

SUPPLY CHAIN ANALYSIS: GLOBAL WATER BOTTLE MARKET 5'

Leave a Comment