Zinc Stearate Size

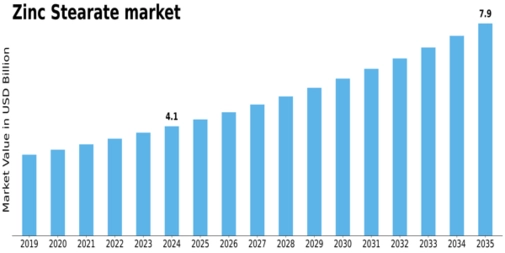

Zinc Stearate Market Growth Projections and Opportunities

The Zinc Stearate Market is influenced by various factors that collectively shape its dynamics. Stakeholders in the industry must grasp these key elements to navigate the market successfully and make informed decisions. Here's an exploration of the primary market factors in a concise, pointer format:

Plastic and Rubber Industries: The Zinc Stearate Market is closely tied to the plastic and rubber industries, where it serves as a crucial processing aid and release agent. The growth or contraction of these industries significantly impacts the overall demand for zinc stearate.

Construction Sector Growth: With applications in the construction industry as a lubricant and mold release agent, the Zinc Stearate Market is influenced by the expansion of construction activities globally. Increased construction projects contribute to a higher demand for zinc stearate in concrete and related applications.

Paints and Coatings Industry: Zinc stearate finds applications in the paints and coatings industry as a matting agent and flatting agent. The growth of this industry, driven by construction and automotive sectors, directly influences the demand for zinc stearate.

Pharmaceutical and Cosmetic Applications: The pharmaceutical and cosmetic industries utilize zinc stearate as a lubricant and glidant in the production of tablets and powders. The demand for pharmaceutical and cosmetic products contributes to the market's growth in these applications.

Rising Demand for PVC Products: Zinc stearate acts as a stabilizer and processing aid in the production of polyvinyl chloride (PVC) products. The increasing demand for PVC-based materials, especially in construction and packaging, positively affects the zinc stearate market.

Rubber Processing Aids: In the rubber industry, zinc stearate serves as a processing aid and release agent during manufacturing processes. The growth of the automotive sector, which extensively uses rubber components, influences the demand for zinc stearate.

Emulsion Stabilization in Cosmetics: Zinc stearate's role as an emulsion stabilizer in cosmetics contributes to its demand in this industry. The cosmetic sector's focus on stability and quality in product formulations impacts the market for zinc stearate in cosmetics.

Technological Advancements in Manufacturing: Ongoing advancements in manufacturing technologies contribute to the efficiency and quality of zinc stearate production. Manufacturers investing in research and development to improve manufacturing processes gain a competitive advantage.

Global Economic Conditions: Economic factors, including GDP growth, industrial output, and consumer spending, impact the demand for zinc stearate. Economic downturns may affect manufacturing activities and, consequently, the market negatively.

Regulatory Compliance: Adherence to regulatory standards, including those related to chemical safety and environmental impact, is crucial for zinc stearate manufacturers. Compliance with regulations such as REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) ensures market access.

Price and Availability of Raw Materials: The pricing and availability of raw materials, such as stearic acid, impact the production cost of zinc stearate. Fluctuations in raw material prices can influence overall pricing strategies and profitability for manufacturers.

Competitive Landscape: The Zinc Stearate Market is characterized by competition among key players. Factors such as product quality, pricing strategies, and the ability to meet diverse industry needs influence market share and success for individual companies.

Investments in Sustainable Practices: Growing environmental awareness prompts manufacturers to invest in sustainable practices. Zinc stearate formulations that align with eco-friendly and low-toxicity standards gain preference in the market.

End-User Preferences for High-Quality Additives: Industries using zinc stearate as an additive, such as plastics, rubber, and coatings, prefer high-quality products to enhance the performance of their final goods. Manufacturers producing superior-grade zinc stearate gain a competitive edge.

Leave a Comment