The global corporate tax services market was estimated at USD 68 billion. It is expected to reach USD 371 billion by 2023 with year-on-year growth rate of ~4-7%. Key factors influencing market growth include Tax reforms: BEPS and CbCR, OECD tax reforms, growth in tax compliance demand, due to evolving tax legislations, Technology adoption. Supply Landscape Categorization, By Service Line Corporate Tax Services Market Outlook Evolving tax landscape, due uncertainties involved in International Tax legislation, such like global minimum tax initiative, is expected to give boost to the tax compliance services; M&A, corporate restructuring, ESG strategies, etc., is expected to drive the demand for tax advisory services. The billing rates increased by 3-5 percent in 2021 and are expected to grow by 2–6 percent in 2022, due to rise in demand for both tax advisory and compliance services Inability to hire and retain experienced professionals (partner-level consultants) serves as a major growth constraint for tax industry globally, especially in advisory area Falling staff productivity levels, due to automation. Although, automation has expedited work, but tax firms are unable to use this additional capacity COVID-19, Russia-Ukraine Crisis, and Economic Headwinds Impact on Corporate Tax Services The impact of COVID on the tax market was considerably low due to various factors. The suppliers were able to offer tax services virtually without any hindrance, supply risk is low for corporate tax services. The demand for tax suppliers is increasing as clients are looking for a trusted advisor to track the tax developments happening across the globe. Complex tax regimes and increase in need for technology for tax reporting is resulting in clients looking for external support. Corporate Tax Services Pricing Insights Billing rates charged by accounting and tax firms may vary based on different factors, such as the relationship between client and supplier, tenure with the supplier, availability of consultants, leveragability, etc. In 2021, corporate tax billing rates increased marginally by 3-5 percent. Billing rates are expected to grow further in 2022 by 2-6 percent, mainly driven by a rapid rise in demand for both tax compliance and advisory services. Corporate Tax Services Supply Outlook From the supplier standpoint, Big Four firms command greater market share and have a strong foothold in the global tax services market. Availability of suppliers will not be an issue as accounting and tax firms are working remotely as well as adopting hybrid working patterns with the help of technologies to ensure continued services to the businesses. Suppliers are investing in cutting edge technology and upskilling resources to stay on top of the market and to offer comprehensive global solutions to clients. Regional Market Insights North America and Western Europe are the most mature markets for tax services, contributing to approximately 80 percent of the global tax services revenue. In North America, Global tax reforms, various new tax regulations by Biden government is expected to increase the complexity of reporting, resulting in increase in demand for tax compliance services Increase in demand for tax compliance and reporting services in Europe, mainly due to legislative amendments, such as VAT real-time reporting, requiring external support by companies to avoid penalties and double taxation. Changing tax laws, OECD’s ongoing Base Erosion and Profit Shifting (BEPS) project with new international tax rules for digital services is expected to increase the complexity of tax regimes across various countries in APAC region. Supplier Intelligence The category intelligence provides insights on key global, regional, and local players such as Deloitte, EY, KPMG and PwC among others. The tax services market is oligopolistic in nature, with the substantial market share owned by big four firms. Big four firms hold 65–75 percent of the market share across regions and are preferred by companies, due to their expertise and brand value. Many Tier 2 and niche firms are competing with the big four firms by offering tax services at lower costs.

1. Executive Summary

1.1. Supply Demand Outlook

1.2. Recommendations – Category Strategy Framework

1.3. Category Opportunities & Risks

1.4. Industry Best Practices

1.5. Impact of COVID-19 – Corporate Tax Services

1.6. Negotiation Levers

1.7. Talking Points: PP

2. Global Market Analysis

2.1. Global Corporate Tax Market Maturity, By Region

2.2. Global Corporate Tax Market Growth Trends, 2021

2.3. Global Corporate Tax Market Dynamics

2.3.1. Drivers

2.3.2. Constraints

3. RegionaL Market Analysis

3.1. North America Corporate Tax Market Size & CAGR, 2021

3.1.1. Current Trends

3.1.2. Growth Potential

3.1.3. Market Maturity Scenario

3.2. Europe, Middle East, Africa (EMEA) Corporate Tax Market Size & CAGR, 2021

3.2.1. Current Trends

3.2.2. Growth Potential

3.2.3. Market Maturity Scenario

3.3. Asia Pacific (APAC) Corporate Tax Market Size & CAGR, 2021

3.3.1. Current Trends

3.3.2. Growth Potential

3.3.3. Market Maturity Scenario

4. Industry Analysis

4.1. Global Corporate Tax Services Market - Procurement-Centric Five Forces Analysis

4.2. Tax Technology

5. Market Monitoring Insights

5.1. Cost Structure Analysis

5.2. Cost Drivers Analysis

5.3. Cost Analysis & Expected Savings

6. Billing Rate benchmarking

6.1. Overview

6.2. Corporate Tax Services Billing Rates: US

6.3. Corporate Tax Services Billing Rates: UK

6.4. Corporate Tax Services Billing Rates: Switzerland

6.5. Corporate Tax Services Billing Rates: Germany

6.6. Corporate Tax Services Billing Rates: Australia

6.7. Factors Affecting the Billing Rates

6.8. Billing Rates: Methodology

7. Corporate Tax Services Supply Analysis

7.1. Global Supplier List and Capabilities

7.2. Regional Supplier List and Capabilities (North America, Europe, Latin America, Middle East, Africa, APAC)

7.3. Country Specific Supplier List and Capabilities (US, UK, Switzerland, Germany, Australia)

8. Supplier Profiles and market share

9. COSt savings & negotiation opportunities

10. procurement best practices

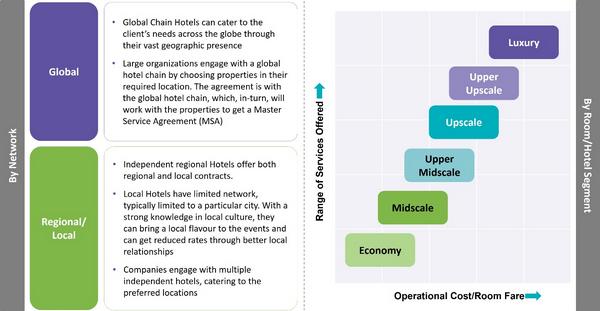

10.1. Sourcing Model Analysis

10.2. Engagement and Contract Models

10.3. Pricing Models

10.4. Key Performance Indicators (KPIs)

10.5. Ideal Resource/Personnel Mix for Tax advisory Engagements

11. COSt savings & negotiation opportunities

12. RFP/RFI Builder

13. Sustainability Initiatives by Accounting Firms