3d Printing Gases Size

3D Printing Gases Market Growth Projections and Opportunities

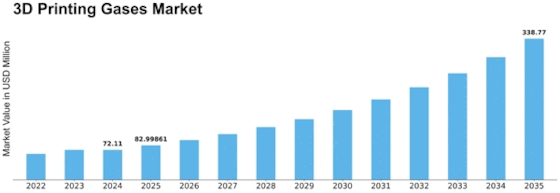

The 3D printing gases market is poised to experience a Compound Annual Growth Rate (CAGR) of 15.3% from 2022 to 2030. The driving force behind this growth is the escalating emphasis on integrating 3D printing techniques across the manufacturing sector, leading to an increased demand for 3D printing gases and fostering overall industry expansion. The surge in the adoption of 3D printing gases across industrialization, technological advancements, and the medical sector is anticipated to be pivotal in propelling the market during the forecast period. Notably, the substantial investment in Research and Development (R&D) activities related to 3D printing is a significant factor expected to boost the demand for 3D printing gases and drive market growth.

The rising demand for 3D printing gases spans various end-use industries, including design and manufacturing, healthcare, automotive, and more, contributing to the overall market growth. Additionally, the gas and oil sector's increasing adoption of 3D printing gases further augments market expansion. In key industries such as aerospace and healthcare, the need for inert gases is propelled by stringent high-tolerance standards. The market for 3D printing gases is now predominantly influenced by demands from sectors such as design, manufacturing, healthcare, consumer goods, automotive, aerospace, and defense.

Gases like nitrogen, argon, and various gas mixtures play a crucial role in creating inert ambient conditions that meet stringent criteria for material manufacturing. As a result, the primary driver for the 3D printing gases market is believed to be the manufacturing sector's demand. The continuous growth in the population of developing economies is expected to further accelerate the growth rate of the 3D printing gas market. However, the market's development faces constraints due to the escalating prices of gases like argon and nitrogen. Nevertheless, technological advancements and the pace of industrialization in emerging countries have led to increased usage of 3D printing gases in healthcare, design and manufacturing, automotive, consumer goods, education and research, as well as aerospace and military applications.

In terms of segmentation, the 3D printing market categorizes gases into argon, nitrogen, and gas mixtures. In 2021, the growth in the 3D printing gases market was notably pronounced in the argon category, driven by extensive applications in end-use industries like design and manufacturing and healthcare. The market further segments technology into stereolithography, laser sintering, poly-jet, material jetting, electron beam melting, and others. Stereolithography dominated the market in 2021 and is expected to maintain its dominance owing to its growing advantages and operational ease. The cooling and insulation functions segment differentiates the market, with insulation leading in 2021 due to the escalating demand for insulation in 3D gases. Finally, end-users are classified into automotive, aerospace and defense, and consumer products, with the automotive sector claiming a substantial market share in 2021 due to active technology adoption in various production processes associated with automotive production.

Leave a Comment